ETF market

QQQ July 14th 2025I failed to update my trade journal at the end of last week and am going to try to be better about it this week. I am going to try to keep these posts more brief so I can remain consistent and meet my goal of creating an accurate timeline of my trades. For this week, I am going in with a bullish bias, which is better supported on the PA for NASDAQ:QQQ instead of AMEX:SPY , so I will be trading it instead.

The price is currently down 0.60% overnight, which would take the price near the bottom of the range ($550), which is outside of the channel. In this flat structure, we will either see the price break up after a liquidity test (spring) or break down in a true bearish reversal.

+++++++++++++++++++++++++++

Neutral Analysis

Renko: As my main chart, Renko clearly shows both scenarios, illustrated by the solid white (bullish) line and the dotted (bearish) line. For the bullish idea, the price will find a significant number of buyers after a false breakout to the downside. I switched from Traditional box sizes to ATR (14) filtered, and as you can see, the automatic rally (AR) after the peak did not have a significant retracement. We did not see a retest of the upper part of the range that could be considered a secondary test (ST) until some time later and when it did, the price rose back to the peak, indicating that buyers still had strength. From there, the price has been chopping around in Phase B without making much progress to the downside, which it will most likely reach on Monday in the form of a gap down. Additionally, the rising channel that led to this pullback is also a strong pattern, so this pullback should be treated as possible re-accumulation. If the price fails to reenter the channel or reach the top after a breakout below the range, it will likely sell off from there.

200R Chart: The range chart also supports that the secondary test was the retest of the top of the channel, a potential sign of strength. The price is still way above the 200MA, so the uptrend appears strong. One important area to watch is the volume gap from $548-$549 on the volume profile. If bulls cannot defend the gap, that could be a potential sign of weakness.

500R Chart: I am including this chart because it does provide a reason to be cautious of a pullback, or even a reversal. The price is at the top of the channel that began on April 9th. The last time the price tested the upper boundary, it formed a temporary top and pulled back, which we could see play out again here. The volume candles also show significantly higher interest since May 13th. This could either be due to increased interest from buyers or the distribution of shares, requiring more effort to move the price higher.

Daily Chart: Here is another chart that suggests that the first movement that could be considered a secondary test was the retest of the top of the range. The price has been bouncing off monthly VWAP and Fisher Transform remains flat in the upper zone. We have not seen a bearish candle with intent on the daily chart. These have all been flat doji candles.

Options: For this section, I can’t provide a good analysis of on-the-money options since the price is likely to gap down. I’m including 7/15 $550p since the price will likely open around that level and will need to move below the strike to see the premium rise significantly. The price of this contract was in a larger descending channel and will need a strong break above the top ($2.15) in order to signal further downside for $QQQ. According to my options calculator, this would require the underlying price to drop below $551 for an extended period.

+++++++++++++++++++++++++++

Targets

Calls: Open at $549; Close at $557; Stop below $548

Puts: Open $550-$552; Close at $544.50; Stop above $555

$SPY: Composite Sub-Cycles (Recursive)Research Notes Documenting Commonality

I’ve identified several bar patterns that formed following significant historical declines. They share notable similarities, as if suggesting that the magnitude of past major moves sets the structure of subsequent groups of sub-cycles (which I call "building blocks" sometimes).

I placed them in respect to current scaling laws so the method of exclusion can be applied in order to familiarize with typical "terrain" of price dynamics at such phase. Documenting them because a direct study is the most effective approach to uncovering the essence of recursive patterns.

Some of the bar patterns are lowered to highlight temporal aspect which matters more than price scale.

ETHU: High-Conviction Setup with Clear Risk/Reward (3:1)Ethereum's leveraged ETF CBOE:ETHU just printed a clean technical structure, sitting right above cloud support with a clearly defined trade plan:

📊 Technical Breakdown

Ichimoku Cloud: Price is hugging the flat Kumo, signaling consolidation but not breakdown. The cloud acts as support here.

MACD: Bearish momentum is fading, showing histogram compression and potential reversal soon.

Price Action: Holding above key demand zone with a risk-defined low. Multiple higher lows show bulls are still defending this level.

Target: $81.32 (+54% upside)

Stop: $42.33 (-17% risk)

R/R: 3:1 — clean asymmetric setup

This is a textbook swing setup: if ETH bounces, ETHU could run hard due to the 2x leverage.

🧠 Macro Context

Ethereum looks coiled on higher timeframes. A breakout in ETH could fuel a sharp ETHU rally. Watch BTC/ETH correlation and altcoin sentiment.

📌 Are you long ETH or ETHU right now? Would you take this setup or wait for confirmation? Drop your thoughts below.

#ETHU #Ethereum #CryptoETF #Ichimoku #SwingTrading #Altcoins #TechnicalAnalysis #TradingSetup

SPY Daily Chart – Rising Wedge at Resistance, RSI Near OverboughSPY continues to push higher, but today's candle reinforces a cautious tone as we approach a key inflection point.

The chart is currently forming a rising wedge pattern — historically a bearish structure that often precedes downside breaks, especially when forming after a strong upside move. Price is hugging the upper boundary of the wedge, with multiple failed breakout attempts near 626.87, which is acting as strong resistance.

The RSI sits at 68.59, just below the 70 overbought threshold. While this confirms strong bullish momentum, it also signals that the move may be getting stretched. A rejection here or a lower high on RSI while price continues higher could form a bearish divergence, a classic early reversal signal.

Volume remains moderate (~51.85M), and the candles have tightened — suggesting indecision. The rising wedge’s lower trendline and the short-term moving average (likely the 8 or 10 EMA) are immediate support. A break below these levels would shift the bias more clearly to the downside.

Key levels to watch:

Resistance: 626.87 (wedge top)

Support: rising wedge lower boundary and EMA (around 620–622)

RSI: break below 65 or a confirmed divergence would increase bearish risk

If the wedge breaks down with a drop in RSI and a flip in momentum indicators (such as Parabolic SAR), it may open the door for a pullback toward previous support zones near 603 or even 592.63.

No confirmation yet, but the risk-reward here starts to shift away from chasing longs. Caution is warranted.

Nightly $SPY / $SPX Scenarios for July 15, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 15, 2025 🔮

🌍 Market-Moving News 🌍

📦 Dow Futures Dip on New Tariff Announcements

President Trump announced new 30% tariffs on EU and Mexico, with additional duties on Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos, and Myanmar starting August 1. Dow, S&P, and Nasdaq futures each slipped ~0.3% as markets assess inflation risk ahead of key CPI data this week

📈 Tech & AI Stocks Lead Despite Tariffs

Stocks like Circle (+9.3%), CoreWeave (+5.2%), Palantir (+5%), Roblox (+5.8%), and Shopify (+4.1%) surged, showcasing sector resilience amid broader tariff fears

⚠️ Deutsche Bank Warns of Summer Volatility

With thin market liquidity and rising geopolitical tension (tariff deadline Aug 1), Deutsche Bank flags summer as a period prone to sudden corrections

📊 Key Data Releases & Events 📊

📅 Tuesday, July 15:

8:30 AM ET – CPI (June)

Core CPI is projected at +0.3% MoM (2.7% YoY) and headline CPI +0.3% MoM—signs tariff effects may be feeding into prices

8:30 AM ET – Core CPI (June)

Expected to come in around 3.0% YoY.

8:30 AM ET – Empire State Manufacturing Survey (July)

Forecast: –7.8 (less negative than June’s –16.0) — a modest sign of stabilizing factory conditions

Fed Speakers Throughout the Day

Watch for commentary from Fed officials (Michael Barr, Barkin, Collins, Logan) for fresh insights on inflation and monetary policy

⚠️ Market Interpretation:

Inflation Watch: A hotter-than-expected CPI could delay anticipated rate cuts and lift yields. A pick-up in core CPI above 3% would be a red flag.

Growth Signals: A less-negative Empire State reading may suggest improving industrial momentum but still signals contraction.

Political Risk: Tariff escalation could shift investor appetite, even if markets right now are focusing on broader macro narratives.

Volatility Setup: The combination of thin liquidity, tariff uncertainty, and critical data makes for a potentially choppy week.

📌 #trading #stockmarket #economy #inflation #tariffs #Fed #CPI #manufacturing #technicalanalysis

QQQ watch $556.31 above 552.96 below: Break of either should RUNQQQ (Nasdaq) has flown off the bottom like a rocket.

Now up against a Golden Genesis fib at $556.31.

Local support fib from bottom is below at $552.96.

Break of either should result in a strong next leg.

Next decent support below is at $54.51-541.58

============================================

.

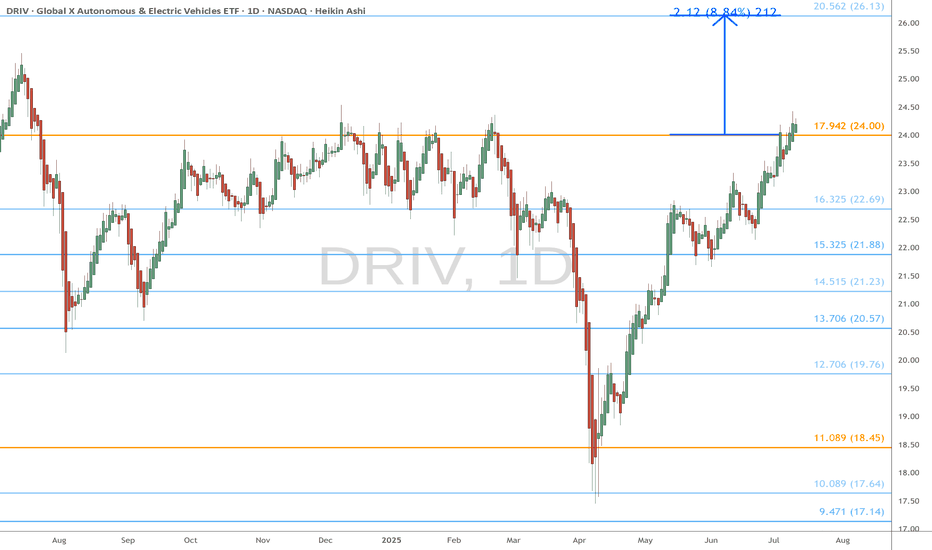

DRIV eyes on $24.00: Golden Genesis fib holding orbit over 3 yrsDRIV is once again testing the Golden Genesis at $24.00

Ultra High Gravity fib has held it in orbit for over 3 years.

Break and Retest should start the next Leg with vigor.

Looking for a Retest entry to pop to $26.13 minimum.

==================================================

.

BTCI – setting up for a breakout?What is CBOE:BTCI ?

BTCI is the NEOS Bitcoin High Income ETF – a covered-call ETF designed to provide exposure to Bitcoin price trends with monthly income. The fund uses options strategies to generate consistent yields while holding Bitcoin futures and related instruments.

💰 Annual dividend yield: approx. 18%, paid monthly

📆 Ideal for income-focused investors who still want crypto exposure without direct volatility.

CBOE:BTCI Current price: $59.64

Strong volume is building up (green arrow), and the stochastic oscillator shows bullish momentum returning.

Price is consolidating just under the resistance at $60.90–61.75, with a potential upside of +13.2%, targeting the $67.09 zone.

📈 If volume holds and breaks above $61.75, the move toward the target becomes likely.

🟩 Key support: $58.07 / $55.75

Chart Pattern Analysis Of AGQ

From K1 to K6,

It is a strong bullish three methods pattern,

It close upon the neck line of a potential bullish triangle.

It seems that the market will keep accelerating here.

So, I bought a small portion of AGQ at 55.35USD.

It is more and more clearly that the expensive metal such as Gold \Copper \ Ag is in the strong bullish market.

I will keep to buy in if the following candle fall to test 52.8USD area.

Long-55/Stop-50/Target-72

Long-52.8/Stop-50/Target-72

Global X Uranium ETF: Positioned for Growth Amid Rising Nuclear Current Price: $37.51

Direction: LONG

Targets:

- T1 = $39.00

- T2 = $40.50

Stop Levels:

- S1 = $36.50

- S2 = $35.75

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Global X Uranium ETF.

**Key Insights:**

The Global X Uranium ETF (URA) is strategically positioned to benefit from renewed interest in nuclear energy as a critical solution for low-carbon energy goals. With nuclear power gaining traction globally as a stable and clean energy source, demand for uranium—the primary input for nuclear reactors—is projected to rise significantly. Recent price action shows the ETF consolidating in a pivotal range, indicating investor positioning ahead of a potential breakout, as bullish trends dominate sector sentiment.

One of the key factors supporting URA's potential is the structural supply deficit in the uranium market. This imbalance has been exacerbated by declining production in recent years, matched against increasing demand fueled by energy diversification strategies around the world. The ETF's portfolio composition, focusing on uranium miners and producers, offers direct exposure to this secular growth trend.

**Recent Performance:**

URA has displayed resilience above the $35 level over the last few weeks, consolidating gains amid temporary pullbacks in commodity markets. Despite some volatility in broader markets, the ETF has maintained a consistent upward trajectory, reflecting strong investor confidence in the uranium sector's long-term prospects. A recent test of the $37.50 level indicates strengthening support zones that could propel future moves higher.

**Expert Analysis:**

Professional analysts remain broadly optimistic about URA's potential, citing technical indicators and macroeconomic drivers backing its growth. Key resistance is identified at $39 and subsequently $40.50—levels that could trigger a sustained rally if breached. Technical support at $35.75 provides a risk-managed floor for traders, ensuring balanced positioning in case of short-term retracements. Furthermore, fundamental analysts highlight the operational leverage of uranium miners as the underlying commodity's price continues to recover.

**News Impact:**

Global energy policies emphasizing carbon neutrality have thrown a spotlight on nuclear power as a viable alternative to fossil fuels. Recent government commitments to expand nuclear capacity globally reinforce the bullish narrative for uranium demand. In addition, supply-side constraints due to limited mining activity and geopolitical factors are likely to sustain upward pressure on uranium prices, translating to healthy returns for URA investors.

**Trading Recommendation:**

Investors should consider a long position in URA, taking advantage of its exposure to a sector positioned for significant growth. Current technical levels suggest a bullish breakout toward $39 and $40.50, while stop levels at $36.50 and $35.75 ensure disciplined downside protection. As nuclear energy gains momentum in the global transition to sustainable energy, URA represents an attractive opportunity to capitalize on this transformative trend.

XLB eyes on $85: Proven Support zone to End Bounce or to Break?XLB has recovered the tariff tantrum dumps.

But struggling against a proven resistance zone.

Dip is likely, Break-n-Retest means Strong bull.

$84.61-85.24 (red) is the exact zone of concern.

$79.66-80.27 (green) is first strong support below.

$71.71-72.23 (Gold) a double golden major support.

=============================================

Weekly $SPY / $SPX Scenarios for July 14–18, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 14–18, 2025 🔮

🌍 Market-Moving News 🌍

⚖️ Powell Faces ‘Epic’ Trade‑Inflation Dilemma

Former Fed economists warn Chair Powell is navigating nearly unprecedented terrain: tariffs are pushing up prices even as the labor market cools. Striking a balance between inflation control and growth support remains a formidable challenge

📊 Tariff‑Driven Inflation May Peak This Week

June’s CPI is expected to show a 0.3% month-on-month increase, potentially lifting core inflation to ~2.7%—its highest level in 18 months. These data will heavily influence the Fed’s decision-making process

🏦 Big Bank Earnings Kick Off

Earnings season begins with JPMorgan ( NYSE:JPM ), Goldman Sachs ( NYSE:GS ), Wells Fargo ( NYSE:WFC ), and Citigroup ($C) reporting. Strong results could offset trade and inflation anxieties; expect volatility in financials

📈 Goldman Sees Broader S&P Rally

Goldman Sachs projects the S&P 500 to climb roughly 11% to 6,900 by mid‑2026, underpinned by firm earnings and expected Fed rate cuts. But warns that breadth remains narrow, increasing downside risk without robust participation

⚠️ Summer Volatility Risk Lingers

Deutsche Bank warns that summer’s low liquidity and the looming Aug 1 tariff re‑imposition deadline may spark sudden market turbulence—even amid bullish sentiment

📊 Key Data Releases & Events 📊

📅 Monday, July 14

Quiet start—markets digest back-to-back CPI, tariffs, and clearing post‑earnings.

📅 Tuesday, July 15

8:30 AM ET – Consumer Price Index (June)

Watch for potential tariff impact in CPI; core inflation data are crucial.

8:30 AM ET – Core CPI (June)

10:00 AM ET – Empire State Manufacturing Survey (July)

Early view on Northeast factory trends.

📅 Wednesday, July 16

8:30 AM ET – Producer Price Index (June)

Wholesale inflation signals to validate CPI trends.

10:00 AM ET – Housing Starts & Building Permits (June)

📅 Thursday, July 17

8:30 AM ET – Initial & Continuing Jobless Claims

A gauge on labor-market resilience amid talks of cooling.

📅 Friday, July 18

10:00 AM ET – Federal Reserve Beige Book Release

Fed’s regional economic snapshot ahead of next FOMC.

⚠️ Disclaimer:

This is for educational/informational use only—not financial advice. Consult a licensed professional before investing.

📌 #trading #stockmarket #economy #tariffs #inflation #earnings #Fed #CPI #technicalanalysis

QQQ What Next? SELL!

My dear followers,

I analysed this chart on QQQ and concluded the following:

The market is trading on 554.20 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 540.50

Safe Stop Loss - 560.82

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK