ETF market

QQQ: Expecting Bullish Continuation! Here is Why:

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy QQQ.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

SPY Massive Long! BUY!

My dear subscribers,

My technical analysis for SPY is below:

The price is coiling around a solid key level - 621.72

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 629.55

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Stock Allocation IdeasIf you're building a stock portfolio, how you allocate your money matters as much as what you buy. Here’s a practical, risk-aware approach for retail traders and investors:

1. Core and Satellite Approach

Core (60–70%): Stick with strong, stable companies—large-cap names with reliable earnings like AAPL, MSFT, or JNJ. These form the foundation of your portfolio.

Satellite (30–40%): Use this portion for high-potential ideas—growth stocks, emerging tech (like AI or EV), or small caps. Higher risk, but higher potential return.

2. Mix Between Defensive and Growth Stocks

In volatile markets, lean toward defensive sectors (healthcare, consumer staples, utilities).

In bull markets or improving conditions, increase exposure to growth sectors (tech, consumer discretionary).

3. Blend Growth and Value

Balance high-growth stocks with undervalued, stable companies.

When interest rates are high or inflation is rising, value stocks often perform better.

When rates fall or the economy picks up, growth stocks usually lead.

4. Don't Ignore International Exposure

While U.S. stocks are strong, consider adding 20–30% exposure to global markets (Europe, Japan, or select emerging markets).

5. Stay Disciplined with Rebalancing

Check your portfolio every 3 months.

Take profits where gains have outpaced, and reinvest in areas that are still fundamentally strong but lagging.

Final Tip: Focus on position sizing and risk management. You don’t need to hit every trade—preserving capital and staying in the game is the priority.

QQQ LEAP Trade Thesis – Aug 1, 2025

🧠 **QQQ LEAP Trade Thesis – Aug 1, 2025**

🎯 **Setup**: High-conviction LEAP PUT

📉 **Bias**: 🔻 *Moderate Bearish*

📆 Horizon: Long-Term (12+ months)

---

📊 **Multi-Model Intelligence Summary**

🧪 **Grok (xAI)**

• Monthly RSI = bearish 📉

• Trading near 52W highs = overvalued 💥

• Suggests: \$545 PUT

🧠 **Gemini (Google)**

• High conviction bearish

• Suggests: \$590 PUT (expensive premium)

🧬 **Claude (Anthropic)**

• RSI breakdown = confirmed weakness

• Recommends: \$530 PUT for max downside

🦾 **Meta (LLaMA)**

• Moving averages turning over

• Suggests: \$555 PUT – moderate confidence

🛰️ **DeepSeek**

• Long-term RSI confirms bearish drift

• Volatility ideal for LEAP entries

• Recommends: \$545 PUT

---

📍**MODEL CONSENSUS**

✅ Bearish trend across all models

✅ Favorable volatility (VIX ✅)

✅ Overvaluation = downside pressure

⚠️ Strike variance across models → we anchor at **\$545** for balance

---

💼 **TRADE SETUP (LEAP PUT)**

• 🔻 Direction: PUT (Short)

• 🎯 Strike: **\$545**

• 📆 Expiry: **2026-09-18** (413 days)

• 💰 Entry Price: **\$38.33**

• 🎯 Target: **\$76.66**

• 🛑 Stop: **\$24.91**

• ✅ Confidence: **75%**

• ⏰ Entry: Monday Open

• 📏 Size: 1 contract

---

📌 **Narrative**:

Every model says the same thing: RSI rollover, inflated price, and perfect LEAP conditions. Institutions are neutral → retail can front-run the decay. You don’t often get long-dated PUTs this clean.

🎯 Asymmetric risk/reward.

📉 Macro setup aligns.

🎯 Strong long-term positioning play.

---

🧠 Stay smart. Position early. Ride the macro shift.

🔔 Like + Follow for more AI-driven trade setups.

8/1/25 - $qqq - How i'm positioned 8/1/25 :: VROCKSTAR :: NASDAQ:QQQ

How i'm positioned

- 2x leverage on the whole book. 75% at risk so 150% gross

- so 25% powder

47% obtc

30% nxt (12.5% leaps)

36% deck (ST and leaps for 6.5%)

27% lulu (ST gas for 1% lol!)

8% mstr (ST gas for 80 bps lol!)

5% gme (ST gas for 40 bps!)

5% ses (covered with calls at 1 strike already)

be well. let's attack monday.

if we dip monday i think >50% chance that's the low

if we don't, i think >30% chance we go higher

so i'm bidding this selectively w balance of ST gas and high conviction plays.

V

SPY: I think dollar milkshake is brewing, buying for long term📉 SPY Daily Breakdown – Aug 1, 2025 | VolanX Observations

🧠 Bot failed today, but the market taught more than any trade could have. Sitting out gave me the clarity to reassess structure and edge.

🔍 Market Structure Update:

Gap Down from Premium Zone: Today’s price action rejected the weak high and created a clean daily gap — signaling potential distribution at the top.

ORB (15-min) marked and ready: Likely to be retested on Monday. If price rallies into this zone and rejects, that’s where I’ll look for short entries.

Friday Bearish Close Rule: Statistically, when Friday closes red with strong momentum, Monday tends to follow — especially after a gap-down open.

🧭 Big Picture Outlook:

Liquidity Zones Below:

600 → First institutional reaction zone.

580 → Deeper demand and equilibrium area from previous consolidation.

Dollar Milkshake Brewing: Strong USD thesis could pressure equities short-term. This aligns with potential flow into defensives and out of high beta.

Long-Term Bias: Watching for deep discounts. If price moves into high-value demand zones, I’ll accumulate for the long haul — buying fear when it's priced in.

📌 What I’m Watching Next Week:

Monday open – will we see Gap & Go or a Gap Fill + Fade?

Reaction to ORB zone.

Volatility behavior and volume footprint in the first 90 minutes.

🔻 No trades today due to a bot error, but ironically, that gave me better vision. Sometimes, the best trades are the ones you don’t take.

VolanX Protocol engaged. Standing by.

Rates Coming Down?TLT could be a great trade here. I'm seeing signs that the low could be in. The RSI is coiling up and piercing the downtrend. We are also climbing above the 21 Week Moving average, which is has been firm resistance since the rate hiking cycle.

Bond yields are tanking, employment is weakening, pressure is building on rate cuts from the highest level. TLT could be a beneficiary.

Not financial advice, do what's best for you.

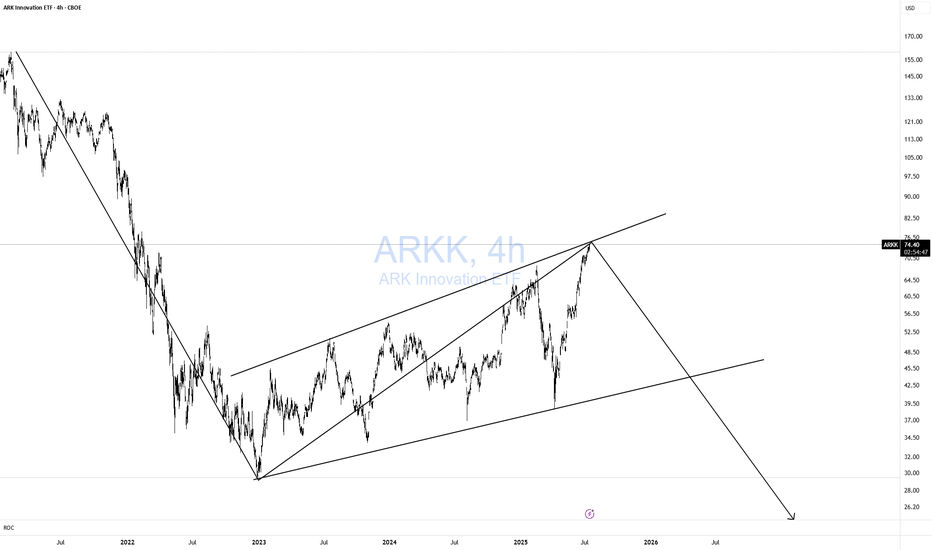

ARKK DOOMED!Classic 123 wave move down! As I like to say Short when no one else is looking! Not when everyone is looking. TOO LATE!

Simple but very effective pattern with excellent risk-reward. Remember, I am a macro trader, so don't expect to see a return on this investment tomorrow.

I won't get into the macro stuff.

#QQQ Weekly Chart – Technical Breakdown As of August 1, 2025QQQ Weekly Chart – Technical Breakdown

🧠 Key Observations

Bearish Weekly Rejection

A red candle at the recent high ($574.63) suggests buyers are taking profits.

Short-term reversal likely in play.

First Reaction Zone:

0.236 Fib at $533.87 is the first potential bounce zone.

Aligned with:

Fair Value Gap (FVG)

Upper range of the Weekly Order Block (OB)

Deeper Demand Zone:

If $533 fails, the Weekly Order Block becomes critical.

That zone stretches down toward $520–$508 (Fib 0.382).

Strong historical reaction area — may attract long setups if macro aligns.

RSI Divergence Risk:

RSI shows some signs of flattening.

Still above 59, so momentum is intact — but weakening.

📉 Pullback Path (Base Scenario):

Potential move to $533 → $520, consolidating inside the order block

From there, bullish continuation back toward $575+

Invalidated below $500, where structure breaks

📈 Mid-Term Bullish Bias Intact

Strong uptrend, higher lows still in place

Any dip into the OB + FVG zone = buy-the-dip opportunity.

Quantum's Missed IWM Short 8/1/25Well had a moment where I backed out of a A+++ setup. IWM had a ton of -gex pull down to 206. Would have been a massive short to end the week. I canceled my order instantly for no reason at all and missed it. Overall had a great day but this is what separates the elite from the average trader. Will work on this next week.

Opening (IRA): SMH September 19th 260 Covered Call... for a 253.21 debit.

Comments: One of the higher IV ETF's at the top of my board. Selling the -75 delta call against shares to emulate the delta metrics of a 25 delta short put, but with the built-in defense of the short call.

Metrics:

Break Even/Buying Power Effect: 253.21

Max Profit: 6.79 ($679)

ROC at Max: 2.68%

50% Max: 3.39 ($339)

ROC at 50% Max: 1.34%

Why NQ is probably tanking big timeIn this weekly chart, we see QQQ, which represents the Nasdaq.

As we can see, it had a hell of a run up.

Too far too fast IMO, and it reached the stretch level at the Upper Medianline Parallel.

The natural move is now to let go, take a breath and trade down to center again, which is the Centerline.

After all the most major and most important earnings results are over, and Funds have pumped up their gains through manipulative Options plays, it's time to reap what they have planted and book the gains.

It's all in line with, all moves are at the point, and everything is showing in a simple chart.

Unless price is opening and closing outside of the U-MLH, it's time to load the Boat and sail to the South.

Vanguard Australian Shares Index ETF (VAS) Vanguard Australian Shares Index ETF (VAS)

EFT Info :

Vanguard Australian Shares Index ETF (VAS) is an investment fund traded on the Australian stock exchange that allows investors to buy shares in approximately 300 of Australia's largest companies with a single purchase.

Chart Analysis

The Monthly zone is promising, entry is at 87.54 however thats the lowest timeframe i could use here.

Conc:

1.As this is monthly timeframe movement is in months and hence the long wait.

2. The zone is risky and would require a confirmation kind of trade to get into

Prop:

The Vanguard is well established and an entry would not require a target as its a wait and hold

S&P 500 Futures – Trendline Breach + AI Forecast Signals Major C📉 S&P 500 Futures – Trendline Breach + AI Forecast Signals Major Correction

VolanX Risk Engine Flags High Probability Downside

🧠 Narrative:

Markets have enjoyed a powerful uptrend off the March lows, but the structure is showing signs of exhaustion.

The ascending trendline—untouched for over two months—has now been breached.

Fibonacci levels cluster below current price, with critical demand at:

6319.25 (immediate test zone)

6179.25 (0.618 retrace)

5964.75 (macro support / VolanX institutional target)

Meanwhile, VolanX Protocol's predictive engine has shifted to a "Strong Sell" with a projected correction path clearly outlined. The 30-day price forecast (shown in red) leans toward a mean reversion toward 5842.12 by late August.

📊 Institutional Trade Plan (VolanX DSS):

Entry Zone: 6360-6380 (Confirmed breakdown retest)

Target 1: 6179.25

Target 2: 5964.75

Final Target: 5842.12

Invalidation: Close above 6480 (new highs with strength)

🔎 Risk/Reward: 3.4+

📈 Trend Deviation: 7.4%

📉 Bearish Conviction: 84.1%

📌 Key Insights:

Breakdown below trendline confirms shift in control to bears

Institutional models anticipate volatility-led selloff

Major liquidity rests below 6200 and 5960 zones

This is not the time to chase highs—risk is asymmetric

🔮 VolanX Opinion:

“Volatility expansion is near. Institutional capital is likely rotating out of risk. The squeeze has passed; now the trapdoor may open.”

This is where preparation outperforms prediction. Execute with risk logic, not emotion.

📚 #SNP500 #ESFutures #SPX #MacroTrading #SmartMoney #InstitutionalFlow #TrendReversal #Volatility #LiquiditySweep #FibonacciLevels #VolanX #AITrading #EminiFutures #WaverVanir #QuantStrategy #TechnicalAnalysis #Forecast #TradingView

$SPY: Mapping Scenarios🏛️ Research Notes

Fractal Corridors

Shows recursive formations which indicates a full fractal cycle.

The angles of decline are parallel which is important for potential buildup.

To map a cycle we'd need to apply fib channel to the opposite direction In a way this should be sufficient to cover the scenarios of nearest future if we were to use bar patterns to validate a structure.

These are examples of historic progressions with similar growth patterns (composite sub-cycles):

This explains most elements present in interactive chart.

$UVXY Signaling Trouble — $SPY Could Drop 10%+ In this video, I discuss why August/September could bring serious downside for the market, despite my long-term bullish stance.

Right now, SPY is trading around $632, but I have a downside target of $573 in the short term. If we get volume beneath $573 — especially a break below the daily EMA — SPY could drop quickly, with a potential fall all the way to $480 in the coming weeks/months.

At the same time, UVXY is signaling a correction for the overall market after rallying from the low's of April. I have a target of $30 and when UVXY starts to move, it often reflects sharp market corrections — and the setup is beginning to mirror that now.

Despite this short-term bearish outlook, I want to make it clear: I am very bullish long term. Any 10–20% correction will be a major buying opportunity for me. I'm watching key levels closely and preparing to take advantage when the market overreacts.

Nightly $SPY / $SPX Scenarios for August 1, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 1, 2025 🔮

🌍 Market-Moving News 🌍

📦 U.S. Imposes New Tariffs as Deadline Passes

Fresh tariffs rolled out on August 1 hitting major exporters: 25% on Indian goods, 20% on Taiwan, 19% on Thailand, and 15% on South Korea. Canadas tariff elevated to 35%, though Mexico got extra negotiation time. Global equity markets slipped modestly, led by declines in Asia-Pacific regions. AMEX:SPY futures also eased on mounting geopolitical and trade pressures.

🏦 Fed Uncertainty Mounts Despite Calm GDP

Despite robust Q2 GDP growth and a hold on interest rates this week, Fed Chair Jerome Powell faced growing unrest. Comments acknowledged downside labor risk amid trade uncertainty—investors are now assigning just a 39% chance of a rate cut in September.

📊 Key Data Releases & Events 📊

📅 Friday, August 1:

8:30 AM ET – Nonfarm Payrolls (July):

Payrolls rose by 106,000, less than June’s 147,000 but still positive. Wage growth slowed, easing inflation concerns slightly.

8:30 AM ET – Unemployment Rate:

Unemployment ticked up to 4.2%, from 4.1% in June—reflecting modest labor softness.

8:30 AM ET – Average Hourly Earnings (MoM):

Wages rose +0.2%, down from +0.4% in June, signaling wage pressure easing.

⚠️ Disclaimer:

This information is provided for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #jobs #Fed #tariffs #inflation #technicalanalysis