NEVER GO FULL..... GOLD EUPHORIAGOLD EUPHORIA HAS GONE FULL CYCLE — AND THAT MAKES ME NERVOUS

There was a time not too long ago when uttering the word gold in financial circles would elicit smirks, eye-rolls, or worse — instant dismissal. Between 2014 and 2019, the mere suggestion of accumulating physical bullion or positioning in junior miners like GDXJ was treated as a form of ideological extremism. You were either a doomsday prepper, a Ron Paul groupie, or a relic yourself — a “pet rock” clinger, waiting for a catastrophe that the Fed’s digital printing press would forever keep at bay.

But fast-forward to mid-2025, and gold isn’t just back — it’s fashionable. That should terrify you.

Suddenly, everyone sees it. Systemic fragility. Fiscal nihilism. The slow, nauseating decay of the dollar’s purchasing power. Even the “trust-the-Fed” technocrats and QE-forever interventionists are parroting the same doomsday lingo they spent a decade mocking. Now, they’re loading up on precious metals, layering macro doom threads on Twitter, and waxing poetic about Bretton Woods III. The same institutions that branded you a lunatic for shorting the Treasury complex in 2020 are now publishing breathless gold forecasts and endorsing BRICS currency chatter like it’s gospel.

When the gold trade starts getting consensus nods from CNBC anchors and Brookings fellows, something has changed. And not for the better.

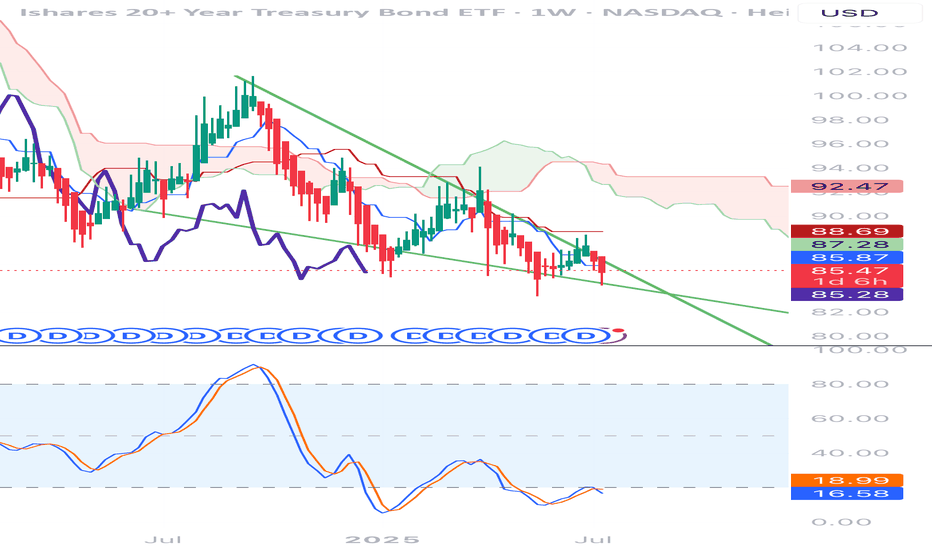

Take a look at the VanEck Junior Gold Miners ETF (GDXJ) — the quintessential proxy for speculative precious metals froth. From its late-2024 bottom near $40, it rocketed to over $72 by June 2025 — a near-80% vertical melt-up in seven months. The volume on that ascent was substantial, no doubt, but what’s come since is even more telling. We’ve now got three weeks of topping candles, declining volume, and a weekly close this Friday at $66.19, down nearly 4% on the week. Support at $65 is teetering, and the next real floor sits closer to $60 — the prior breakout zone.

Technically, it smells like distribution. Psychologically, it reeks of complacency.

Call it the Minsky moment of the gold trade. Stability breeds instability. And nothing screams instability like a former pariah asset becoming a near-universal safe haven consensus play, right as speculative capital piles in at nosebleed valuations.

This isn’t a call on gold’s long-term validity — far from it. The monetary rot is real. The fiat debasement is mathematically terminal. And the entire global sovereign debt pile is one rate shock away from implosion. But markets don’t move in straight lines. Especially not when everyone is suddenly on the same side of the boat, citing the same macro talking points they ridiculed five years ago.

I’ve been here before. I remember accumulating metal when it was hated — not merely unloved, but reviled. Back when CPI read 0.2% and the Fed pretended it could tighten. Back when nobody knew what an SDR was and gold bugs were caricatured as paranoid survivalists waiting for a return to the gold standard. That was value. That was accumulation.

What we have now is a FOMO-soaked crescendo, where even the Keynesians are starting to sound like Austrian-school newsletter writers.

So yes, I’ve sold into this rally — at least the speculative tranche. I’ve taken gains in miners, trimmed the GDXJ fat, and built a list of bear-side entries for what I think is the inevitable correction. Because when the least-likely characters start echoing your thesis word-for-word, it’s time to reassess your positioning.

This doesn’t mean the dollar survives. It doesn’t mean the Fed has regained credibility. It simply means markets are reflexive — they overshoot in both directions. And when the gold trade becomes saturated with latecomers who believe the dollar dies tomorrow and the DXY is going to 40 in a straight line, the odds of a savage retracement increase tenfold.

I remain a long-term gold bull. But right now? The fever is high. The crowd is euphoric. And in markets, that’s when gravity tends to do its finest work.

Chart Notes:

Weekly candle closed at $66.19, down -3.85%.

Resistance: $72.00.

Immediate support: $65.00.

Stronger support zone: $60–61.

Weekly volume: 16.86M, with signs of declining momentum.

ETF market

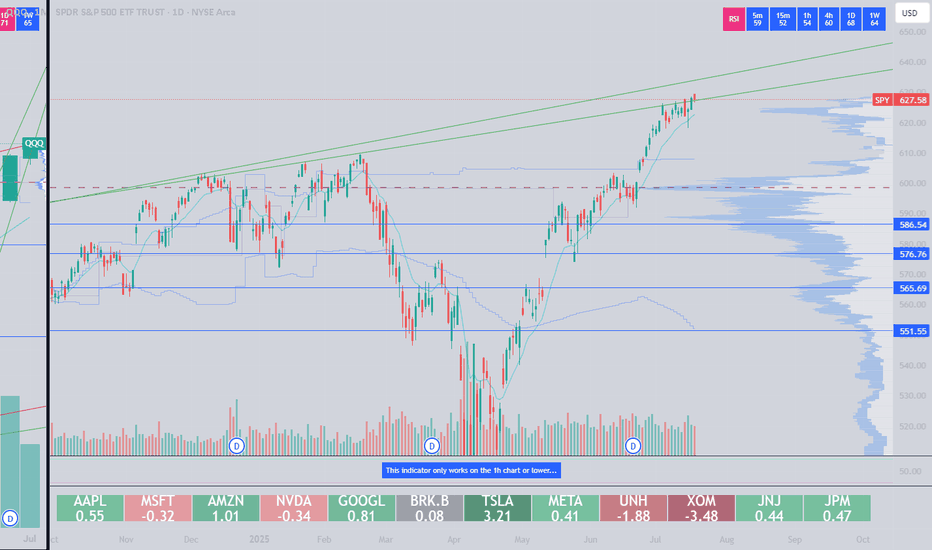

SPY: Market of Sellers

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to sell SPY.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

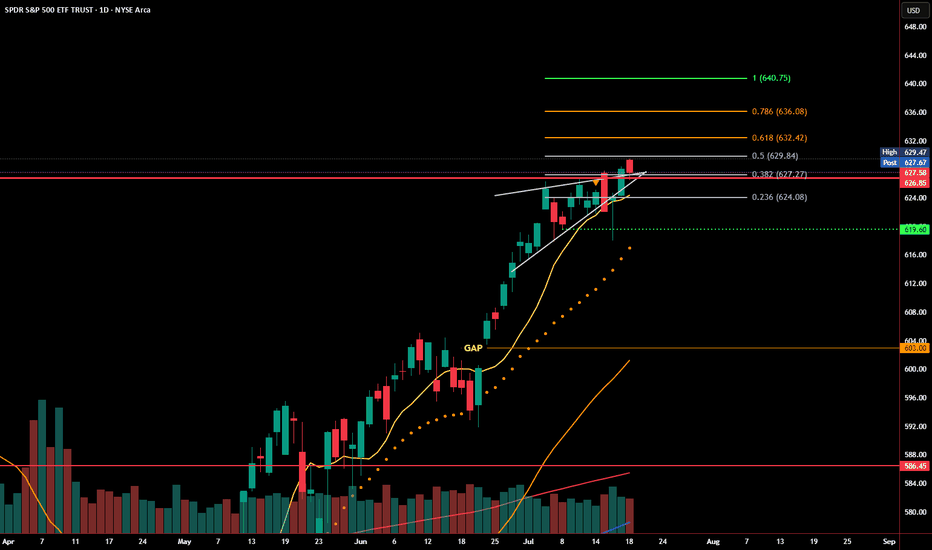

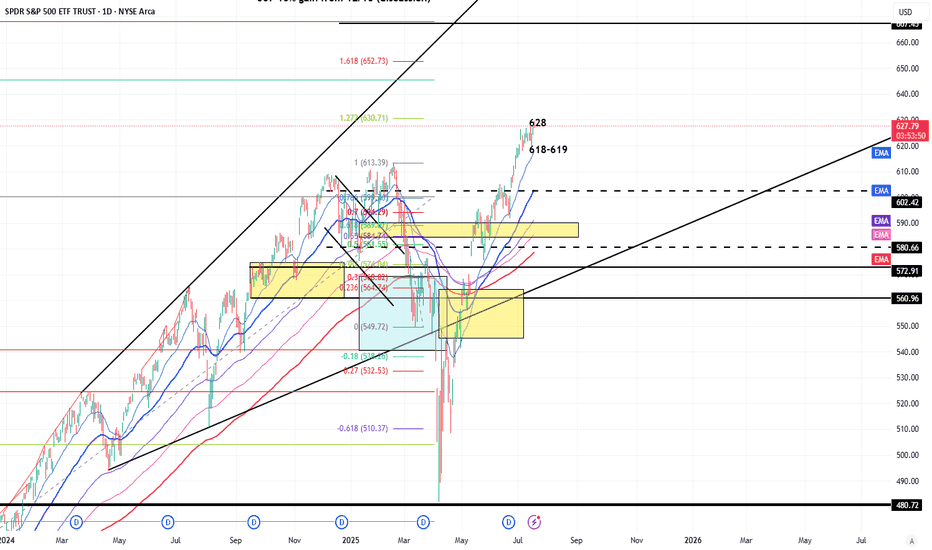

SPY Reclaims Rising Wedge Support - Bear Trap or Breakout Setup?SPY dropped below its rising wedge earlier this week, but that move may have been a bear trap. Price quickly reversed, reclaiming the wedge trendline and closing just below a key Fibonacci level at 629.84.

Buyers stepped in aggressively near the 0.382 and 0.236 retracement zones, defending short-term support. The bounce came on increased volume, signaling strength behind the recovery. Momentum remains intact as long as SPY holds above 626.

Now, bulls need to confirm with a breakout above 629.84–631.96 to open the door to the next levels at 635.63 and 640.30. Failure to break through could lead to another rejection and revisit lower support zones.

Levels to watch:

Support: 626.64, 623.62, 619.60

Resistance: 629.84, 631.96, 635.63

SPY is at a decision point. Reclaiming wedge support is a bullish signal, but bulls need follow-through to avoid another fakeout in the opposite direction.

Earnings Heat Up - 6300 and 6200 SPX Key Levels RemainMarket Update

SPX Key Levels

-SPX poked 6300 Tuesday, Thursday, and poked higher Friday (but settled back to 6300)

-6200 support remains a key level

-6050/6000/5800 next floor levels, I'll be looking for dips

I can see the market slowly (and I mean SLOWLY) grinding higher but preparing for a

reasonable seasonal selloff through end of July into end of September window

July 28-August 1 is a monster week in the markets

-Megacap Earnings (MAG7 Tue/Wed/Thu)

-Wed July 30 - FOMC (Pause expected but Powell's Press Conference is important)

-Friday August 1 - Non-Farm Payroll, Tariff Deadline

I'm hitting fresh YTD highs so I'm not complaining about this melt-up and grind, I'm simply wanting to allocate positions and add to my positions at better levels and with a slightly

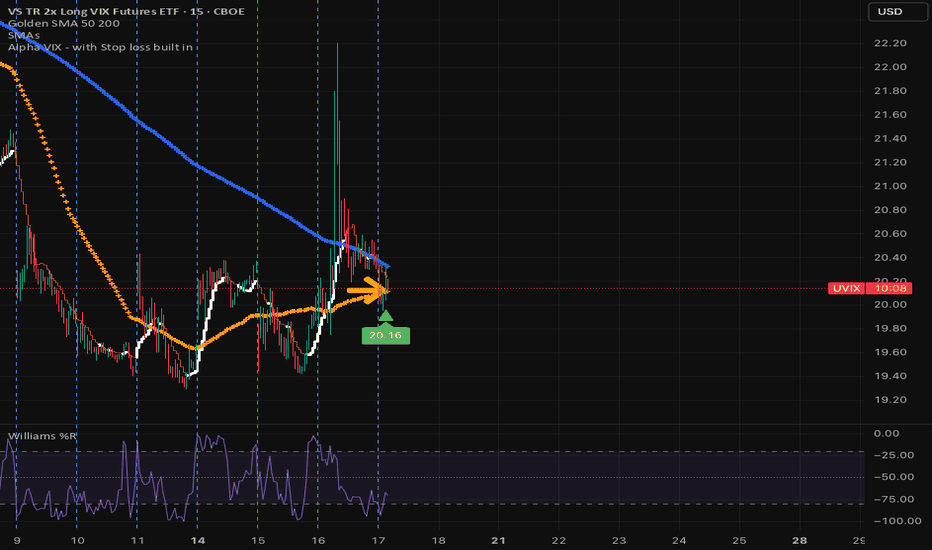

higher VIX to help take advantage of the expected move being greater than the actual move

Have a great weekend and thank you watching!!!

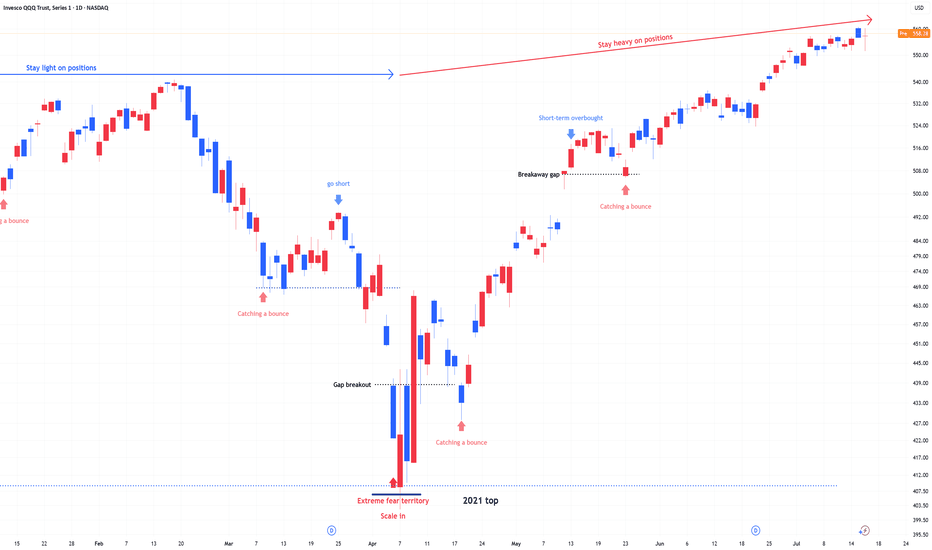

QQQ : Stay Heavy on Positions1) April Fear & Buy Signals

In early April, the Nasdaq 100 experienced a sharp sell-off, triggering extreme fear sentiment across the market.

At that point, scale-in buy signals appeared—classic "buy the fear" conditions.

2) Current Market State: No More Fear, but Watching

Since then, the market has stabilized.

The fear has disappeared, but we are still in a wait-and-see mode as traders assess the next move.

Momentum is holding, but participation remains cautious.

3) Stay Heavy on Positions

Despite short-term uncertainty, I’m maintaining an overweight position on the Nasdaq 100.

As long as we don’t see a major breakdown, the bias remains bullish.

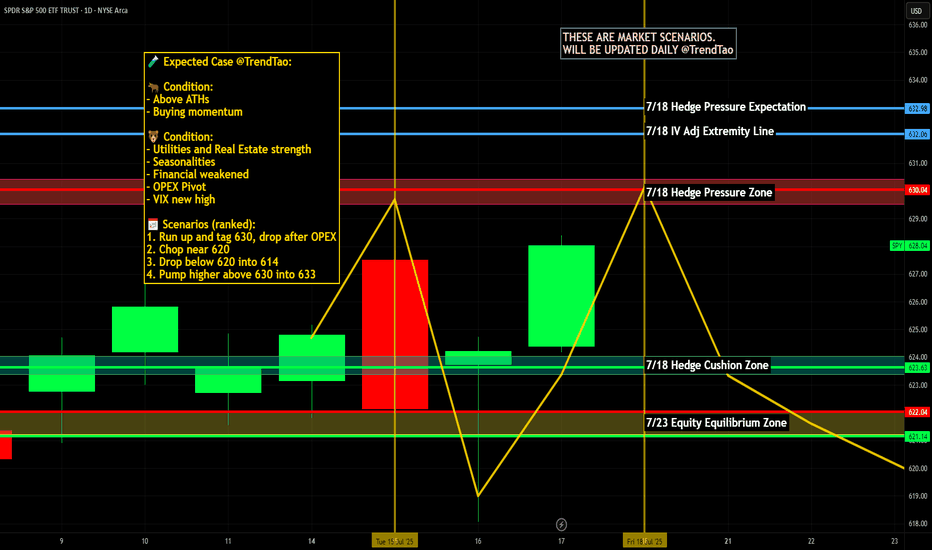

Nightly $SPY / $SPX Scenarios for July 19, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 19, 2025 🔮

🌍 Market-Moving News 🌍

🏢 U.S. Corp Buybacks Set to Propel Stocks

Citadel Securities expects U.S. companies to repurchase roughly $1 trillion of stock in 2025. With the blackout period ending in August, buybacks—historically strong in July, the stock market’s best month—could bolster valuations

⚖️ Fed Independence Debate Intensifies

President Trump’s continued criticism of Chair Powell has already weakened confidence in Federal Reserve autonomy. The fallout shows up in a weaker dollar, elevated Treasury yields, and rising inflation expectations—though stocks have remained resilient

🇺🇸 Immigration Rollback Sparks Economic Concern

The rescinding of Temporary Protected Status for ~900,000 immigrants could remove up to 1.1 million workers from the labor force. Analysts warn of potential stagflation risks, with GDP growth potentially down 0.3–0.4 percentage points and labor-market tightening ahead

💵 Massive T-Bill Issuance Incoming

Following the debt-ceiling deal, the Treasury plans over $1 trillion in T-bill issuance in the next 18 months. Money-market funds are expected to absorb much of it, influencing short-term rates and cash-market dynamics

📊 Key Data Releases & Events 📊

📅 Friday, July 19:

8:30 AM ET – Initial Jobless Claims

Weekly figure on new unemployment filings—a real-time indicator of labor-market resilience.

8:30 AM ET – Existing Home Sales (June)

Measures signed contracts on previously owned homes; key for gauging housing-market health.

All Day Events:

Ongoing corporate buybacks entering open window

Treasury auctions and T-bill issuance updates

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #monetarypolicy #debt #housing #labor #technicalanalysis

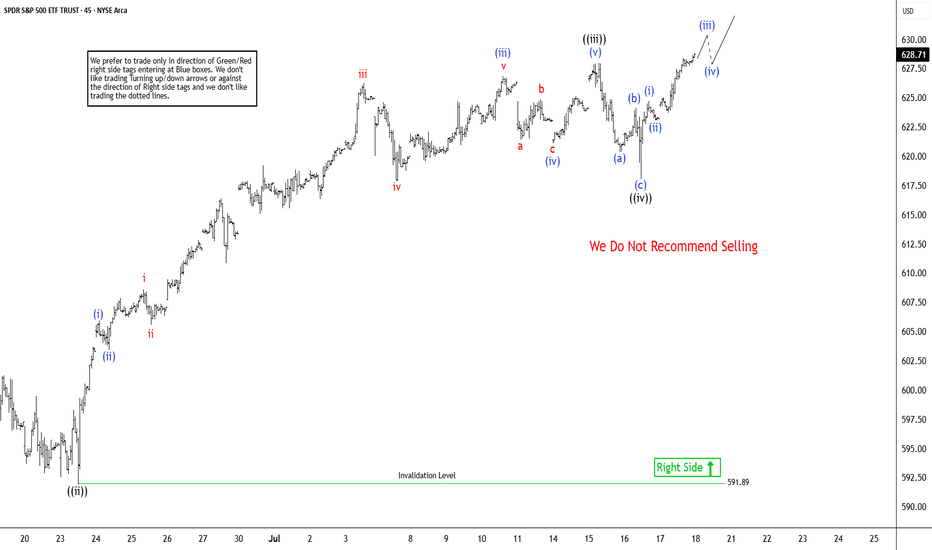

Elliott Wave Analysis: SPY Poised To Extend Higher In Bullish SeElliott Wave sequence in SPY (S&P 500 ETF) suggest bullish sequence in progress started from 4.07.2025 low. It expects two or few more highs to extend the impulse sequence from April-2025, while dips remain above 6.23.2025 low. SPY ended the daily corrective pullback in 3 swings at 480 low on 4.07.2025 low from February-2025 peak. Above there, it favors upside in bullish impulse sequence as broke above February-2025 high. Currently, it favors wave 3 of (1) & expect one more push higher from 7.16.2025 low in to 630.31 – 651.1 area before correcting in wave 4. In 4-hour, it placed 1 at 596.05 high, 2 at 573.26 low as shallow connector & extend higher in 3. Within 3, it placed ((i)) at 606.40 high, ((ii)) at 591.89 low, ((iii)) at 627.97 high & ((iv)) at 618.05 low.

In 1-hour above ((ii)) low of 591.89 low, it ended (i) at 605.96 high, (ii) at 603.17 low, (iii) at 626.87 high as extended move, (iv) at 620 low & (v) as ((iii)) at 627.97 high. Wave ((iv)) ended in 3 swing pullback as shallow connector slightly below 0.236 Fibonacci retracement of ((iii)). Within ((iii)), it ended (a) at 619.8 low, (b) at 624.12 high & (c) at 618.05 low on 7.16.2025 low (this week). Above there, it favors rally in ((v)) of 3 targeting in to 630.31 – 651.1 area before correcting in 4. Within ((v)), it placed (i) at 624.73 high, (ii) at 623.08 low & favors upside in (iii) of ((v)). We like to buy the pullback in clear 3, 7 or 11 swings correction at extreme area in 4 and later in (2) pullback, once finished (1) in 5 swings.

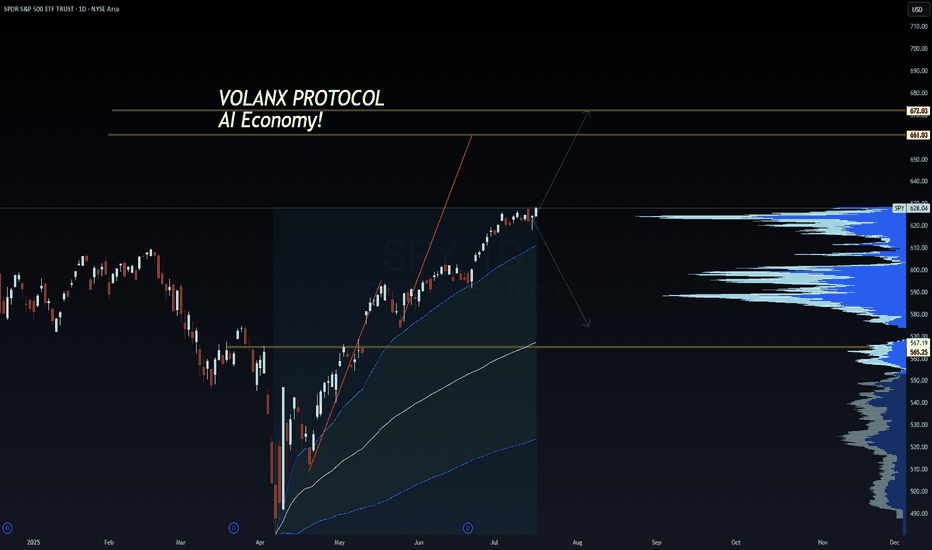

SPY 628 – Compression Before Expansion | VolanX Protocol Engaged🧠 SPY 628 – Compression Before Expansion | VolanX Protocol Engaged

📅 July 17, 2025

🔍 SPY (S&P 500 ETF Trust) | 1D Chart

📍 Current Price: 628.04

📈 Chart Thesis by: WaverVanir International LLC

🔗 Powered by VolanX Protocol

🌐 Macro Overview:

The market stands at a critical inflection point, with bulls and bears both pressing their narrative:

The Fed is expected to cut rates in September, with soft CPI and decelerating labor trends justifying a pivot.

Earnings season is bifurcated: Mega-cap tech is leading, while cyclicals are faltering. This raises the risk of a short-term rally masking deeper fragility.

Global macro risks – including rising geopolitical stress in the Asia-Pacific region and commodity volatility – increase the odds of a tail event.

📊 Technical Outlook:

SPY is now hugging a major supply zone near 628 with price stalling for multiple sessions. This area marks a compressed equilibrium where volatility is likely to expand soon. Key technicals:

Rejection candles suggest seller presence near 630.

Price is overextended but remains above all major EMAs.

Breakdown zone sits at 565, which aligns with prior resistance and a major volume shelf.

No current bearish divergence on RSI or MACD, but momentum is flat.

🎯 VolanX Probabilistic Bias:

The system currently anticipates three paths:

Bullish breakout toward 660–675 if the Fed confirms a dovish stance and tech continues to lead.

Neutral grind in the 600–615 zone if macro remains balanced and earnings don’t surprise.

Bearish breakdown to 565 or lower if macro stress emerges or dollar strength accelerates.

🛠️ Options Strategy Highlights:

Bullish Trade Idea: Buy 630C / Sell 660C (30–45 DTE) – Low cost, targets breakout above resistance.

Bearish Trade Idea: Buy 620P / Sell 565P – High R/R play into macro unwind.

Both are defined-risk strategies, ideal in volatile inflection zones like this.

⚠️ VolanX Note:

This is a classic binary event structure forming under institutional watch. DSS scans show compression is now mature. Whichever side confirms will likely trigger a large move, not a drift.

Let the narrative confirm the signal.

⚠️ This post is for informational and educational use only. Not financial advice.

#SPY #VolanX #MacroTrading #OptionsFlow #WaverVanir #FOMC #AIeconomy #LiquidityWave #TradingSignals

Chart Pattern Analysis Of YINN

From K1 to K5,

It is a small scale consolidation or a bullish triangle pattern.

The supply pressure is decreasing too.

It seems that K6 or K7 will break up or fall down.

If the following candles close upon K3 or K4,

It is likely that another bull run will start here to test 77USD area.

On the other hand,

If the following candles close below the neck line,

The risk will sharply increase.

Long-41.6/Stop-39.9/Target-77

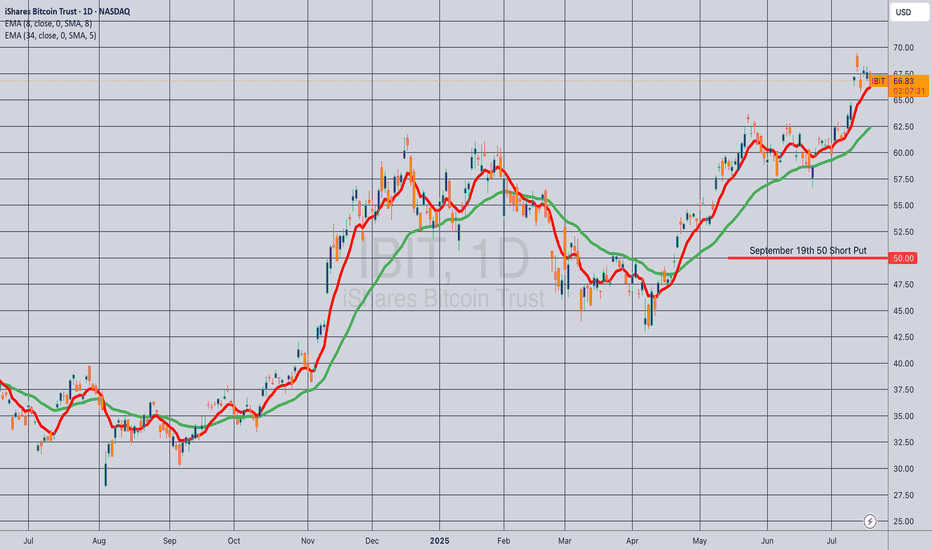

XRPT- Hope high can its go?So this ETF is Double Leveraged on the price movement from XRP(Crypto). For me this means that it doesn’t fit my normal trading /investment style of buy and hold.Had to go to Chat GPT to help me out with this play.

I used Fib Retrace to get an idea of pricing that the equity could potentially reach. These key areas are highlighted in green boxes.

Here its suggestion which makes sense to me.

Trading XRPT (the 2x leveraged XRP ETF from 21Shares) requires a slightly different approach than a regular spot ETF — due to its daily leverage reset, higher volatility, and decay risk over time.

Here’s how I suggest you trade it, JP:

⸻

🧭 1. Know What You’re Trading

• XRPT = 2x Daily Exposure to XRP

• Aims to return 2x the daily price movement of XRP, not over weeks or months.

• NOT for long-term holding

• Due to volatility drag and compounding effects, it can underperform XRP over time even if XRP trends upward.

• Great for short-term swing trades, momentum plays, or technical breakouts.

⸻

🧠 2. Use These Rules to Trade XRPT Effectively

✅ ENTRY STRATEGY

• Use 4H or Daily Wyckoff Analysis on XRP/USD (not XRPT) to gauge trend.

• Only trade XRPT when XRP is in:

• Phase C spring (reversal setup)

• Phase D markup (confirmed breakout)

• Watch ETH/BTC and BTC dominance as extra confirmation (alt season indicator).

Component

Strategy

Timeframe

1–10 days swing (max), or intraday momentum

Entry Trigger

Breakout from triangle / range on XRP chart, not XRPT

Stop Loss

7–12% under entry (wider than normal due to leverage)

Target Zones

+15% to +30% depending on structure

Position Size

Smaller than usual — start with ½ or ⅓ of normal size

Exit Trigger

RSI overbought on 4H/daily or reversal candle on XRP

🚨 RISK MANAGEMENT FOR XRPT

• Don’t hold during chop – consolidation kills leverage

• Don’t hold during corrections – 2x loss = faster drawdown

• Set hard stops — this isn’t one to “just watch”

• No overnight holds unless it’s a clear uptrend with volume

⸻

📌 3. Example Trade Setup (Fictional)

• XRP breaks out of an ascending triangle at $0.52

• You see strong RSI + Volume

• Target: $0.58–$0.62

• You enter XRPT around $10.00

• Stop loss around $9.10

• Sell at $11.50–$12.00 for 15–20% gain

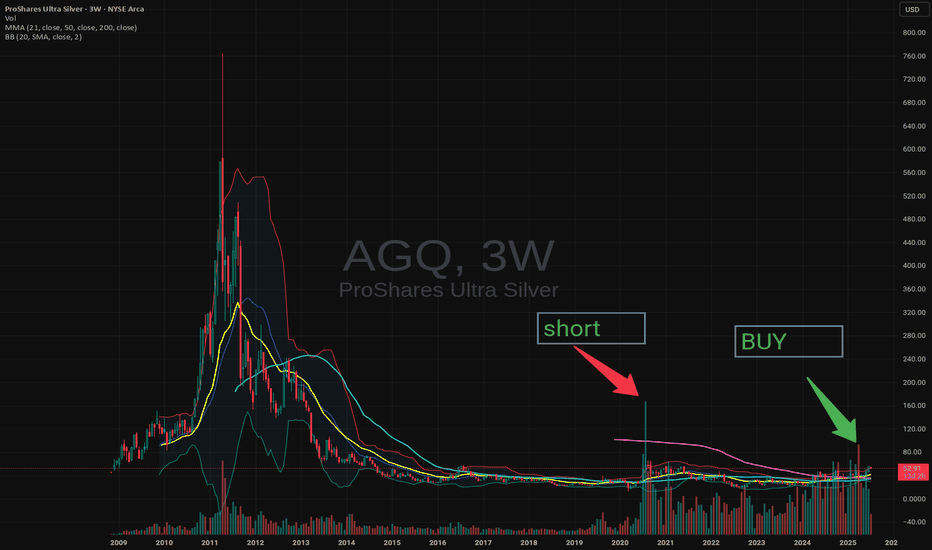

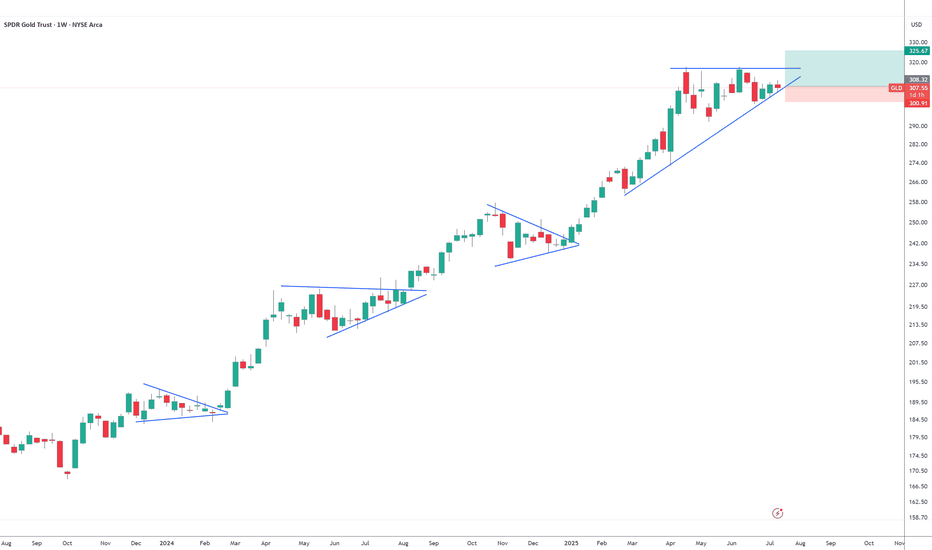

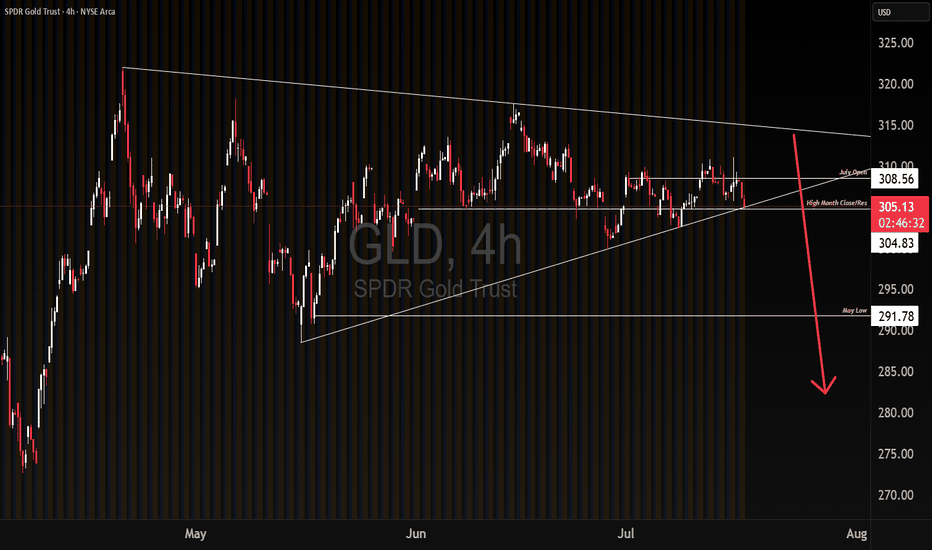

GLD potential break downWe could be experiencing a break down on GLD based on capital outflows, going into riskier markets. If this larger time frame range break down holds, and we get continuation lower on downside momentum, we get a measured move target of May's low. Will be watching to see if the breakdown is a bear trap first. If it is not a bear trap, I will buy OTM Jan 26 puts. Targeting May's low