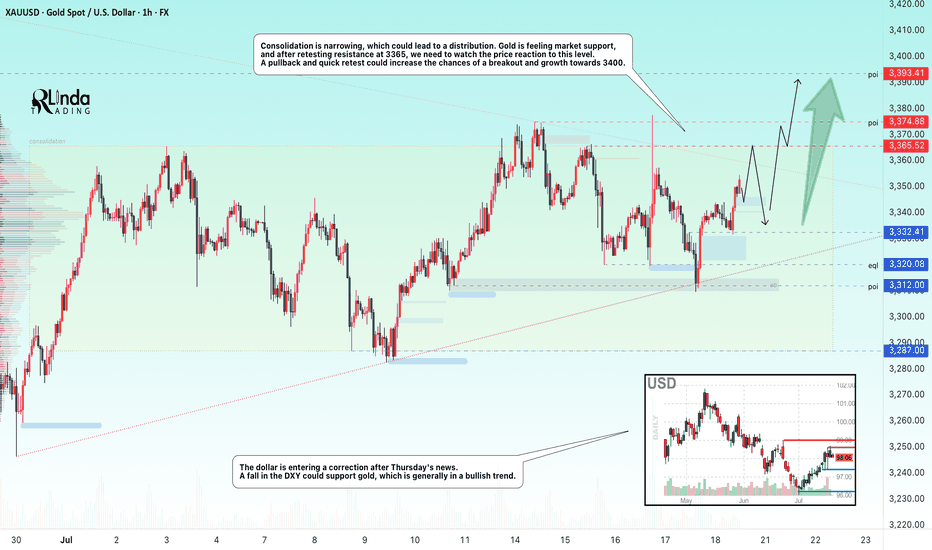

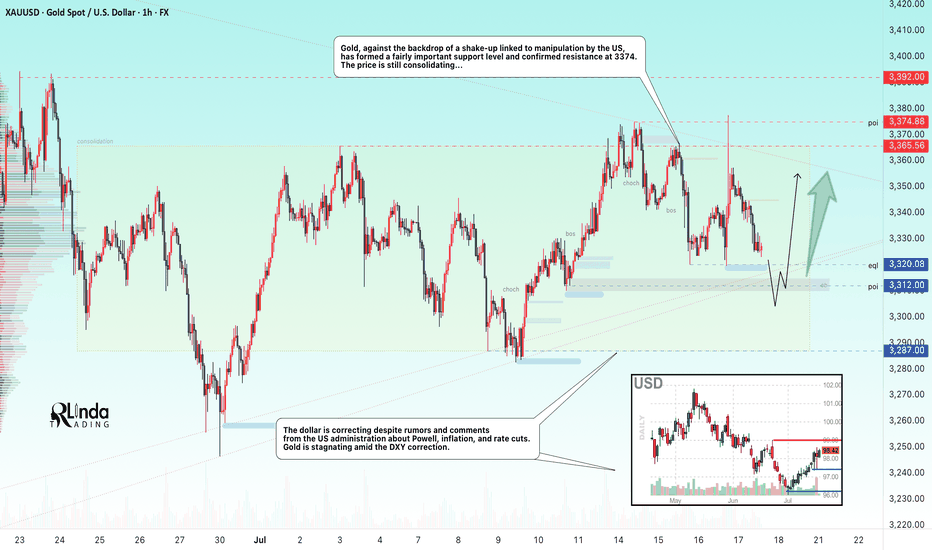

GOLD → Retest of consolidation resistance. Chances of a breakoutFX:XAUUSD bounces off support at 3312, forming a false breakdown at 3320. The price is heading towards consolidation resistance. The chances of continued growth are increasing...

Gold rebounded from its low amid statements by Fed member Waller about a possible rate cut in July. However, strong US sales and labor market data strengthened the dollar and held back XAU/USD growth. Despite statements by some Fed members about maintaining a tight policy, traders continue to expect rate cuts before the end of the year. The focus is on new economic data that could affect the dollar and gold prices.

Technically, consolidation is narrowing, which could lead to distribution. Gold is feeling market support, and after retesting resistance at 3365, we need to watch the price reaction to the level. A pullback and quick retest could increase the chances of a breakout and growth to 3400.

Resistance levels: 3365, 3375

Support levels: 3332, 3320, 3312

There is a high probability that there will be an attempt to break through the consolidation resistance amid expectations of a rate cut. This phase may be accompanied by either a correction to retest and return for a breakout, or a breakout and consolidation of the price above the level. Today, Friday, I expect a retest and correction, as there may not be enough local potential for a breakout of this level, and the price has already lost some of its momentum since the opening of the session...

Best regards, Linda!

Futures market

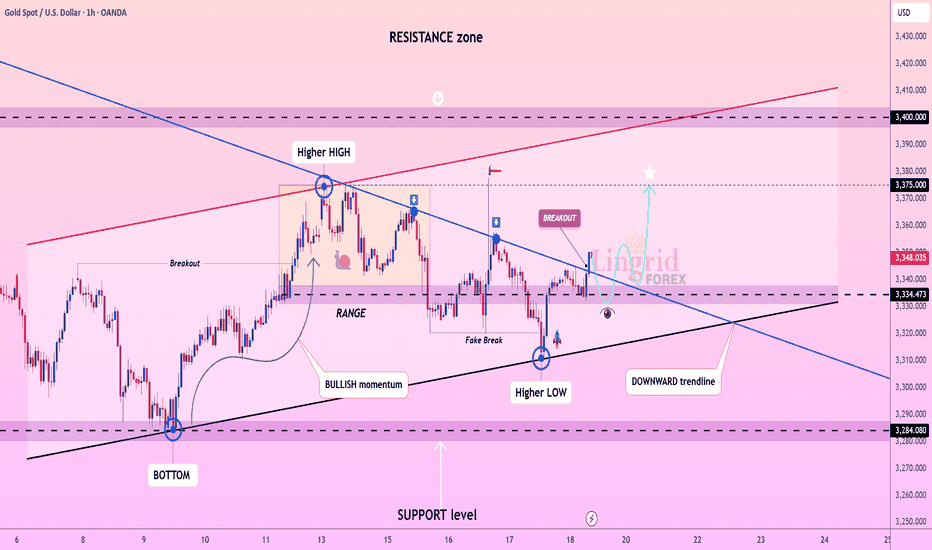

Lingrid | GOLD Broke Corrective Dynamic Resistance OANDA:XAUUSD rebounded off the key support near 3334, forming a higher low and breaking above the descending trendline. This breakout confirms bullish intent, supported by prior accumulation in the range and fake breakdown traps. Price is now retesting the breakout zone and is expected to launch toward 3375 and possibly higher. The structure favors a bullish continuation pattern supported by confluence of trendlines and rising momentum.

📉 Key Levels

Buy trigger: Break and hold above 3350

Buy zone: 3335–3345

Target: 3375 short-term, with potential to 3400

Invalidation: Drop below 3320 support line

💡 Risks

Another fake breakout followed by strong rejection

Resistance at 3375 acting as a supply wall

Low volume on breakout can cause reversal

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Gold 30Min Engaged ( Bearish Reversal Entry Detected ) what do you think before Price Move , GOLD Bullish or Bearish & why ?

lets spread the Knowledge

➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bearish Reversal : 3339 Zone

🩸 Bullish Reversal : 3311Zone

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

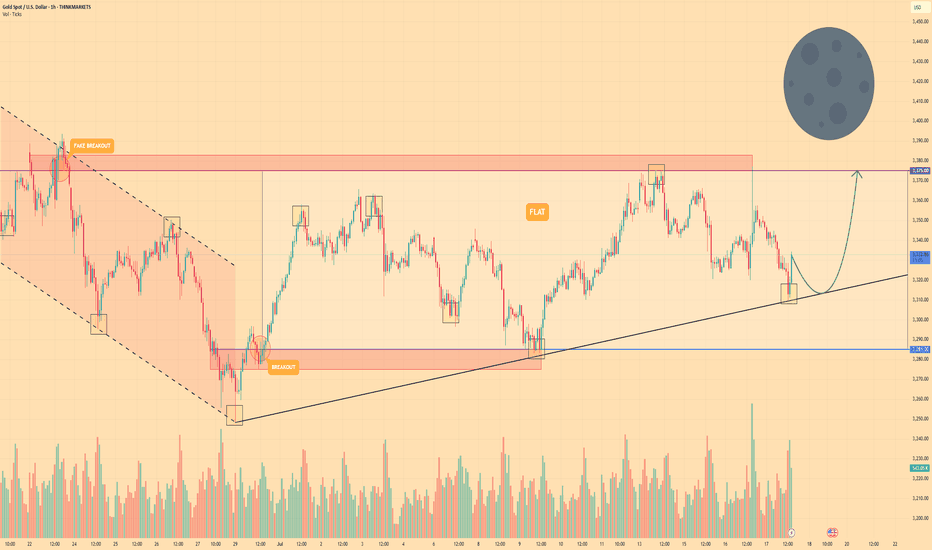

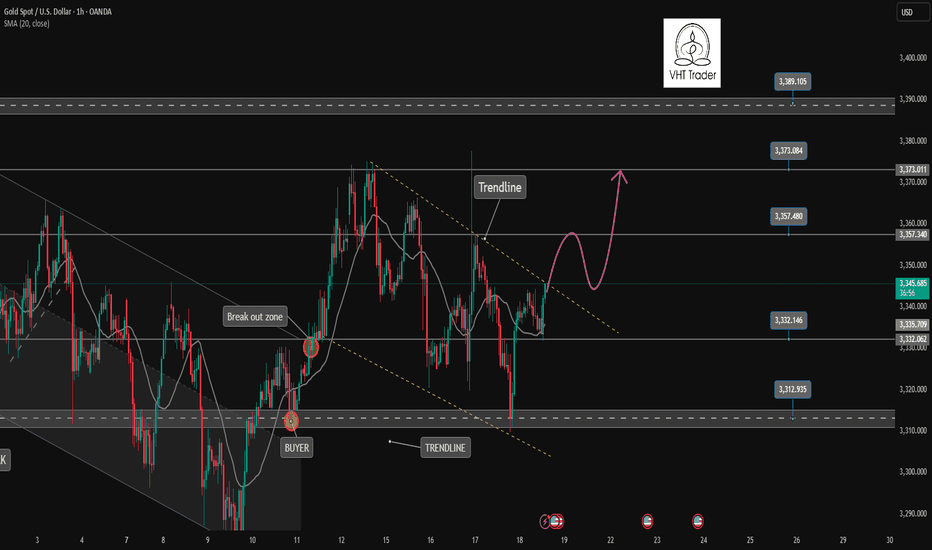

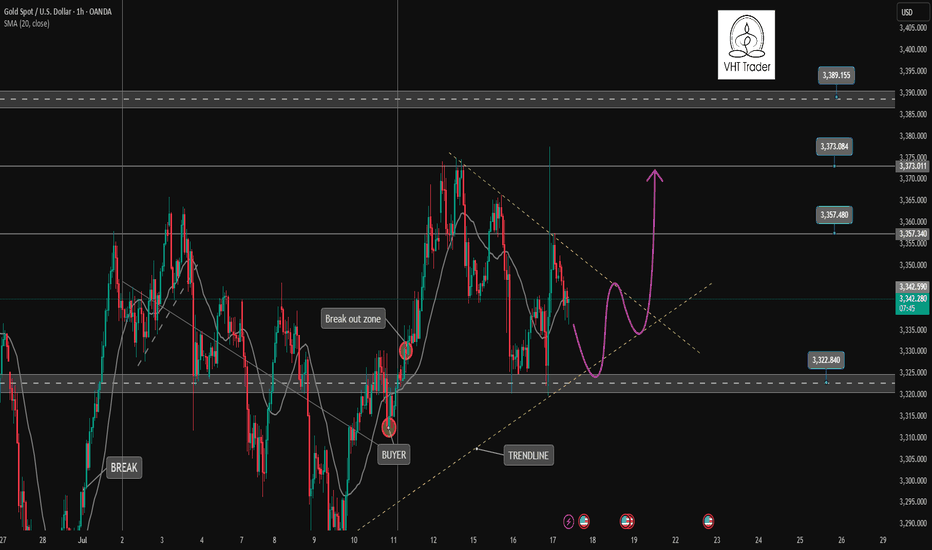

GOLD - Price may bounce up to $3375 level from support lineHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Initially, the price action was confined within a descending channel before a decisive bullish breakout occurred.

This first breakout triggered a strong upward impulse, setting the stage for the current market structure.

The price is now consolidating in a wide flat range, bounded by support near the $3285 level and resistance at $3375.

An ascending support line is providing dynamic support within this consolidation pattern, indicating underlying buying pressure.

I expect a brief retest of this support line, which should act as a launchpad for the price to move higher.

The primary target for this long setup is the $3375 resistance level, marking the top of the current flat range.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

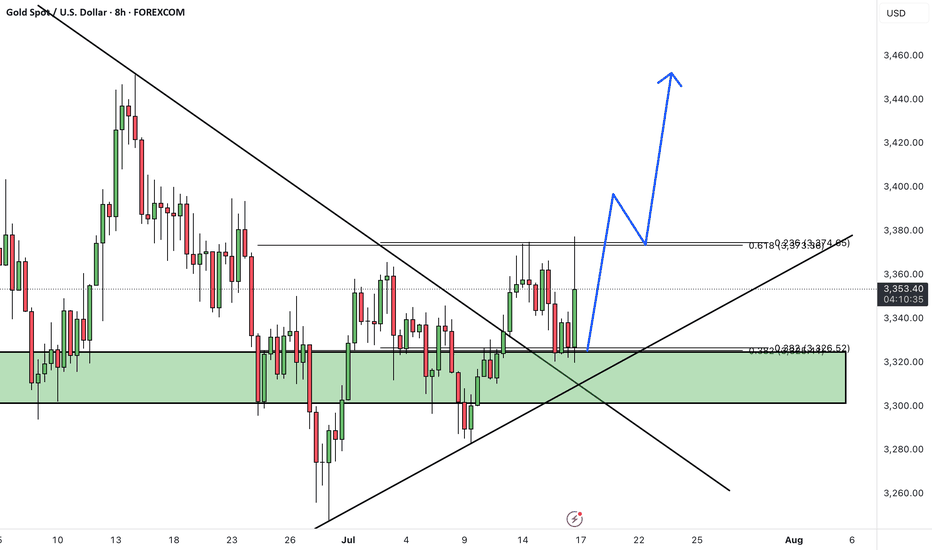

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Gold has broken above its descending trendline and completed a successful pullback to the breakout level. Now, the price appears ready to resume its upward move, but it's still facing resistance near the $3375 level.

We expect another attempt to break through the $3375 resistance zone.

A confirmed breakout above this area would open the path toward higher targets and potentially trigger strong bullish momentum.

As long as price holds above the broken trendline and key support zone, the overall bias remains bullish.

Don’t forget to like and share your thoughts in the comments! ❤️

GOLD NEXT MOVE (expecting a bullish move)(18-07-2025)Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (18-07-2025)

Current price- 3350

"if Price stays above 3330, then next target is 3360, 3378 and 3407 and below that 3310 and 3280 ".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk more than 1% of principal to follow any position.

Support us by liking and sharing the post.

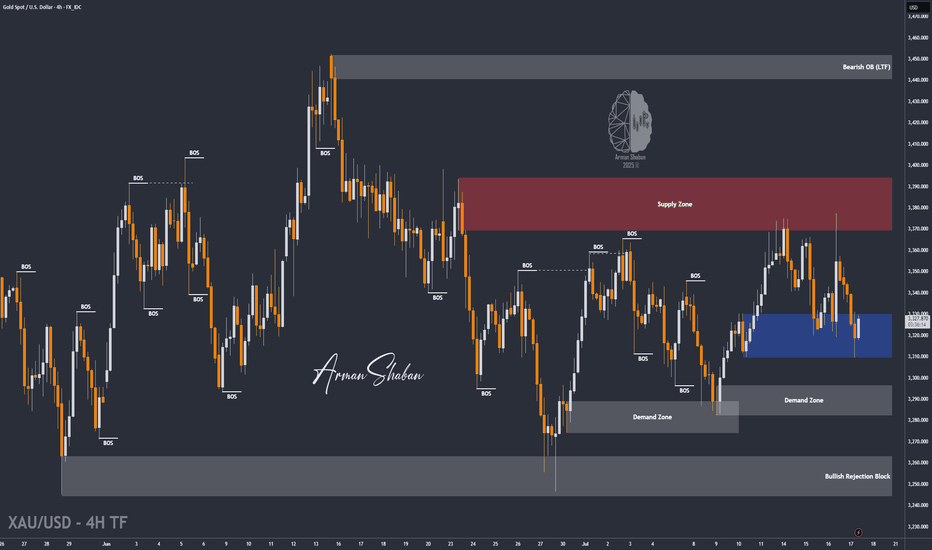

XAU/USD | First LONG to $3345, Then a Potential DROP Below $3300By analyzing the gold chart on the 4-hour timeframe, we can see that last night the price first tapped into the $3340 level, showing an initial push up to $3352. However, the drop intensified soon after, breaking the $3340 resistance and, according to the second scenario, falling to $3310. Upon reaching this key demand level, buying pressure kicked in, pushing the price back up to $3325. Now, the key question is whether gold can hold the $3310 support. If this level holds, we can expect a rise toward $3331 as the first target and $3345 as the second. After this move, a rejection from the $3345 area could trigger another drop, possibly pushing gold below $3300. So, first LONG, then SHORT!

THE LATEST VIDEO ANALYSIS :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

GOLD ROUTE MAP UPDATEHey Everyone,

End of week update following up on yesterday’s 1H chart outlook.

✅ 3353 was hit and respected to the pip, just as we mapped out and highlighted yesterday.

We saw the EMA5 cross and lock above 3328, confirming continuation.

The market respected structure beautifully

Rejections gave us clean dip buying entries

EMA5 methodology guided our execution

High probability Goldturn levels played out exactly as planned

Our discipline and patience were rewarded, yet again. Another strong end to the week.

We will now come back Sunday with a full multi timeframe analysis to prepare for next week’s setups, including updated views on the higher timeframes, EMA alignments, and structure expectations going forward.

Thanks again for all your likes, comments, and follows.

Wishing you all a fantastic weekend!!

Mr Gold

GoldViewFX

Double Top + Zigzag Complete: Are Bears About to Take Over Gold?Yesterday, the financial markets in general, including Gold ( OANDA:XAUUSD ) , acted like a roller coaster after the news of Powell's dismissal . After this news was denied , Gold returned to its main trend, which I published in my previous idea .

Gold is currently re-attacking the Support line , Support zone($3,326-$3,325) and 50_SMA(Daily) .

In terms of classic technical analysis , it seems that gold has formed a Double Top Pattern for support breakdowns, where a Support line breakdown can also be accompanied by a neckline breakdown .

From the perspective of Elliott Wave theory , it seems that Gold has managed to complete the Zigzag Correction(ABC/5-3-5) , and we should wait for the next bearish waves .

I expect Gold to break its supports and move towards $3,290 ; support breaks are best done with high momentum . An important price that can change the direction of Gold's downside is $3,350 .

Note: If Gold breaks the Resistance lines and forms an hourly candle above $3,351(Stop Loss (SL)), we can expect further Gold gains.

Gold Analyze (XAUUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

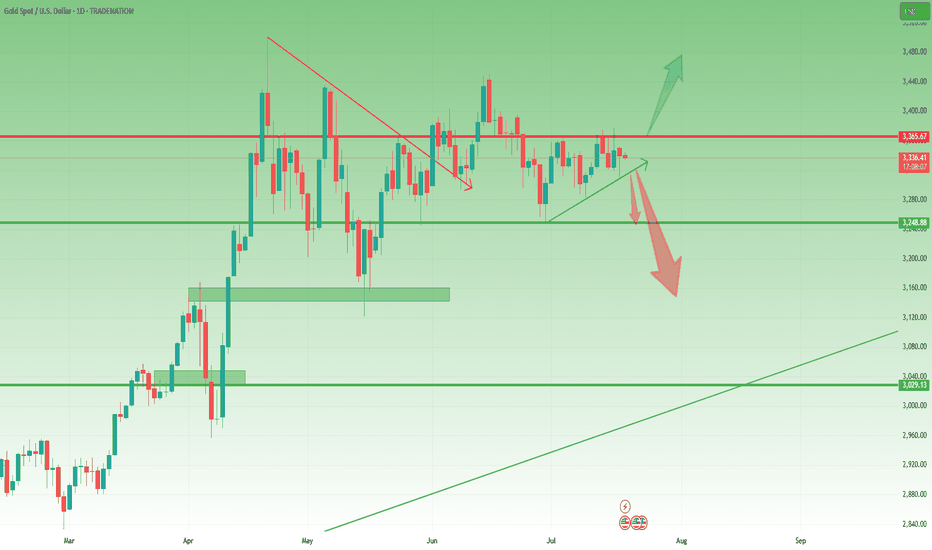

Gold- Still needs to resolve the range🔸 Still Rangebound, But Not for Long

In yesterday’s analysis, I mentioned that two scenarios are in play for Gold:

1. Bullish above 3375

2. Bearish under 3320

Throughout the session, price action leaned toward the bearish side, and I aligned with that by opening a short position. It ended with a minor loss — just 50 pips, which is negligible considering I'm looking for a potential 1,000 pip move in the bigger picture.

________________________________________

🔍 What's Next?

As the title says, Gold still needs to resolve the current range before a clear directional move unfolds.

The same key levels discussed yesterday remain valid and relevant.

And since it’s Friday, today’s daily and weekly candle close will be critical in shaping expectations for next week.

________________________________________

📈 Bullish Case: Close Above 3360

• A daily/weekly close around 3360 would bring strong pressure on the 3375 resistance.

• That could lead to a bullish breakout from the ascending triangle pattern.

• It would also leave behind a bullish weekly pin bar (last week was a bullish pin bar too).

• This scenario would bring 3450 into focus — with 3500 and even a new ATH on the table in the coming weeks.

________________________________________

📉 Bearish Case: Close Near 3300

• A close near 3300 would signal a failed rally attempt

• That would expose 3250 support short term, and 3150 medium term.

________________________________________

🧭 Final Thoughts

At the moment, I’m flat and waiting for clearer confirmation later in the day.

The next move big will be defined by the weekly close — it’s as simple as that.

P.S.: It’s just a hunch , but I’m still leaning toward a break under 3300 as the next major move.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

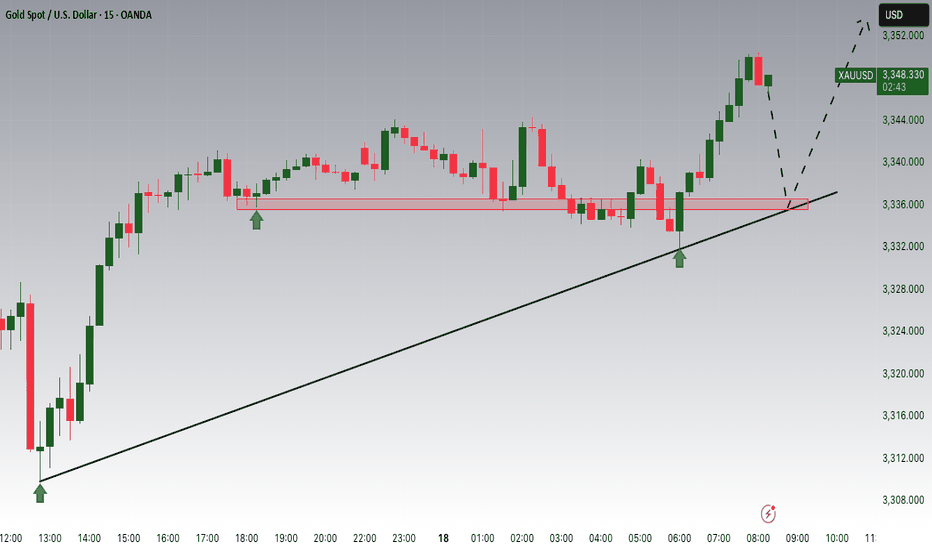

GOLD → The triangle is contracting. Retest of support...FX:XAUUSD tested a local high of 3375 but quickly returned to consolidation. The reason is manipulation by the US administration related to Powell, inflation, and interest rates...

Demand for gold has risen sharply amid global risks: Trump's aggressive tariff plans, strong inflation, and uncertainty about the Fed's actions have increased interest in defensive assets. Despite the temporary strengthening of the dollar, gold remains a popular hedging instrument. Technical analysis also points to a bullish outlook. However, growth potential is limited until the Fed clarifies its interest rate policy

Technically, on the D1 chart, it is clear that the price is consolidating, with the range continuing to narrow. Due to the bullish factors listed above, we can expect growth to continue. However, it is difficult to say where and when the growth will begin due to the uncertainty factor. All attention is on the support at 3320-3312, the triangle support, as well as the consolidation support at 3287.

Resistance levels: 3365, 3375

Support levels: 3320, 3312, 3287

Since the opening of the session, the price has spent part of its daily range, so there may not be enough potential for the decline to continue. A false breakdown of support and consolidation of the price above the key zone may attract buyers, which will trigger growth towards resistance.

Best regards, R. Linda!

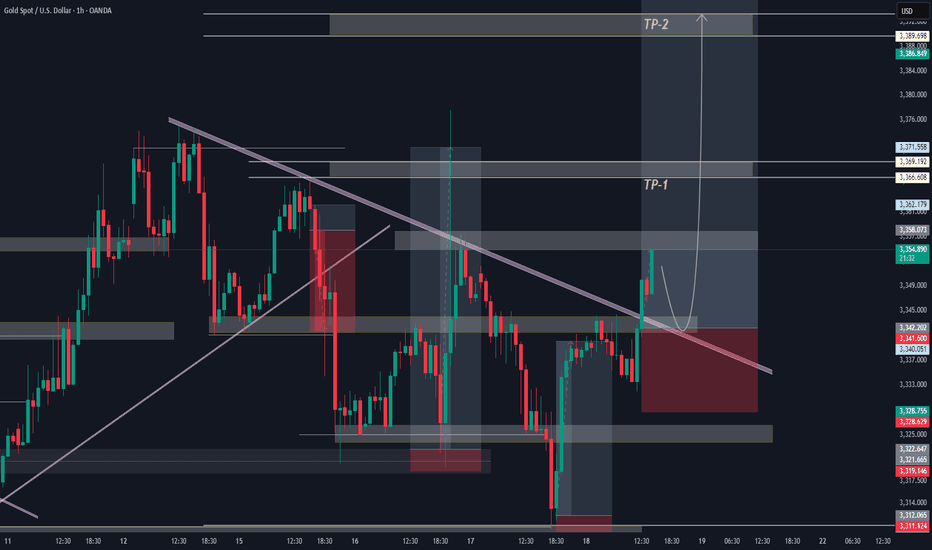

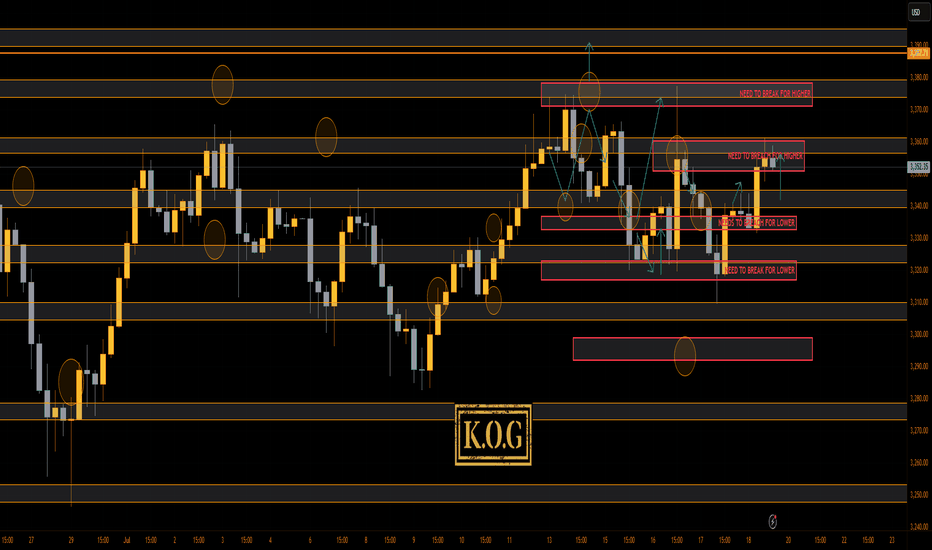

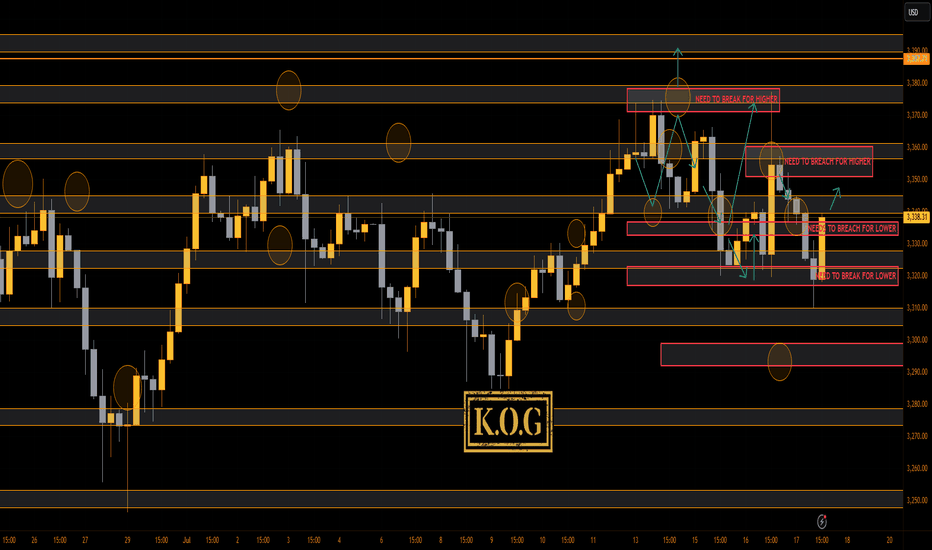

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

What a week on the markets with our KOG report plan working well, the red boxes moving with price, the Excalibur targets being completed and then most of the bias level targets completing as well.

Have a look at Sundays report and compare the move and levels shared, you'll see how well we've managed to track this. Only thing we haven't got (yet) is that curve ball, so let's see how we close today and open on Sunday.

For now, support below is at the 3340 level with resistance 3370. We may just see a late session move here so play caution.

KOG’s bias for the week:

Bullish above 3350 with targets above 3360✅, 3373✅, 3375✅ and 3383 for now

Bearish below 3350 with targets below 3340,✅ 3335✅, 3329✅, 3320✅ and 3310✅ for now

RED BOX TARGETS:

Break above 3365 for 3372✅, 3375✅, 3382, 3390 and 3406 in extension of the move

Break below 3350 for 3340✅, 3335✅, 3329✅, 3322✅ and 3310✅ in extension of the move

Wishing you all a great weekend and we'll see you on Sunday for the KOG Report. Please do take some time to hit the boost button, it's very much appreciated.

As always, trade safe.

KOG

Gold breaks trendline and returns to uptrend. BUY NOW!✏️ OANDA:XAUUSD A deep sweep to 3310 and bounce back to the trading range. Gold is reacting at the Trendline around the price zone of 3344. This is an important price zone that if broken will return to the uptrend and head towards 3373 soon. 3332 plays an important role in the current bullish wave structure, which is a suitable SL placement point for BUY signals.

📉 Key Levels

Support: 3332-3312

Resistance: 3344-3357-3373-3389

BUY trigger: Break and trading above Resistance 3344 (trendline, top uptrend wave 1)

BUY DCA trigger: Break Resistance 3353

Target 3373

Leave your comments on the idea. I am happy to read your views.

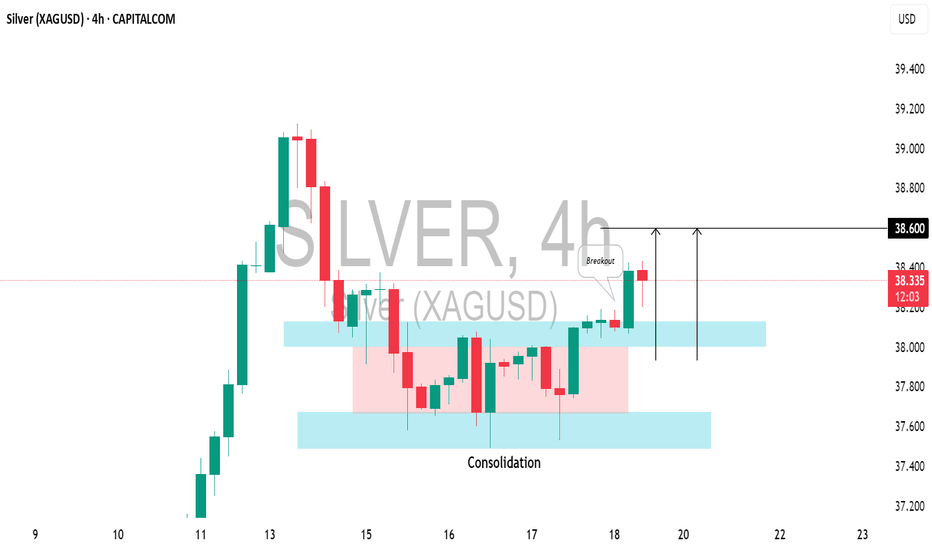

SILVER (XAGUSD): Bullish Move ConfirmedIt appears that the local correction on 📈SILVER has completed, and the pair is shifting back to a bullish trend.

Today's US economic data caused the pair to break through a resistance level within a narrow consolidation range on the 4-hour chart.

The price is expected to rise to the 38.60 level.

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Nice! Our idea from yesterday worked well giving the short trade into the level we wanted, to then break below the bias level and give us our 2 Gold Excalibur targets and 1 of our red box targets shared with the wider community. We suggested our traders watch the level of 3310 for a potential RIP, and that's exactly what we got upside.

Now, we have support at the 3330-27 level and resistance above at 3340-3. We have a red box above as well so we'll be waiting to see if the close is significant enough for us to target higher tomorrow! For now, keep an eye on the retracement into the 3335-2 level initially.

RED BOXES:

Break above 3335 for 3341, 3355, 3362, 3370 and 3376 in extension of the move

Break below 3320 for 3310✅, 3304, 3297 and 3294 in extension of the move

As always, trade safe.

KOG

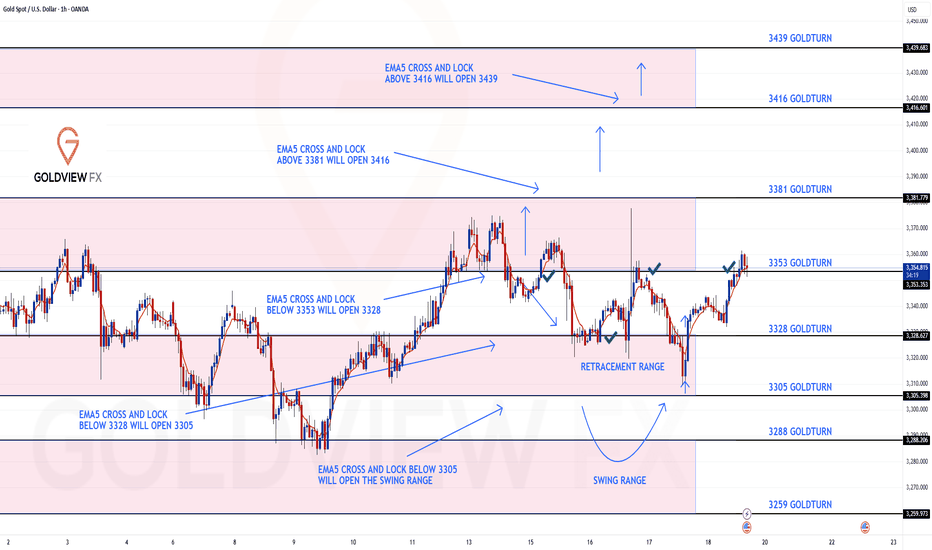

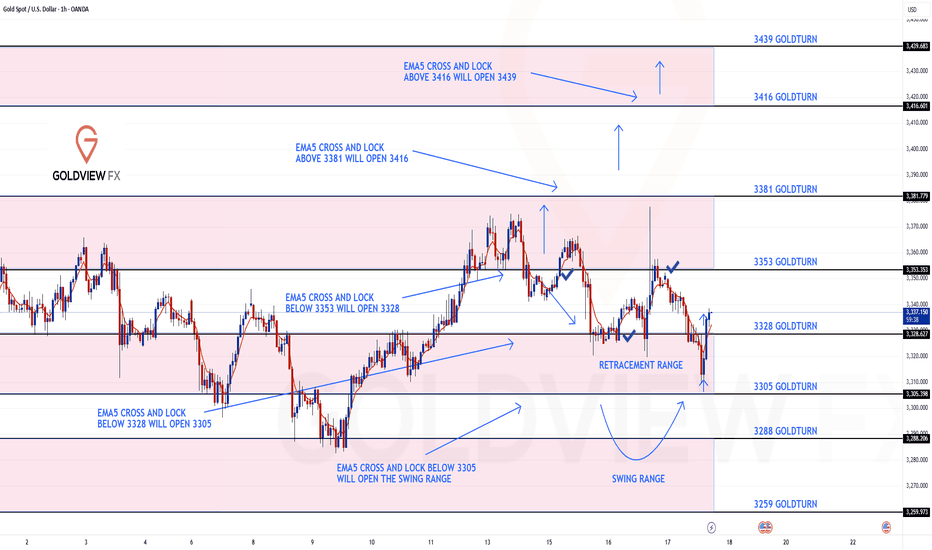

GOLD ROUTE MAP UPDATEHey Everyone,

Quick follow-up on yesterday’s 1H chart update

After hitting 3353, we did not see an EMA5 cross and lock above this level. That lack of confirmation was key and it validated a rejection right at 3353, leading to another drop into the retracement zone.

As per plan, that retracement provided yet another clean bounce, perfectly in line with our dip buying strategy.

We are once again looking toward 3353, and just like before, we will be closely watching for an EMA5 cross and lock confirmation to validate any continuation.

This kind of movement continues to confirm the power of patience, structure, and disciplined execution. No chasing just clean planned executions with high probability setups based on our EMA5 methodology.

We’re also still watching the 3381 gap a key magnet above, and a level we’ve been tracking since the Monday outlook. The roadmap remains unchanged. We’re trading the structure, managing risk, and letting confirmations guide the execution.

Updated Reminder of Key Levels:

BULLISH TARGET

3381

EMA5 CROSS & LOCK ABOVE 3381 opens

3416

EMA5 CROSS & LOCK ABOVE 3416 opens

3439

BEARISH TARGETS

3353 ✅ HIT

EMA5 CROSS & LOCK BELOW 3353 opens

3328 ✅ HIT

EMA5 CROSS & LOCK BELOW 3328 opens

3305

EMA5 CROSS & LOCK BELOW 3305 opens Swing Range:

3288

3259

As always, we’ll continue monitoring and sharing updates, as price reacts around these zones. Thank you all for the continued support, your likes, comments, and follows are genuinely appreciated!

Mr Gold

GoldViewFX

Gold returns to Sideway range waiting for new momentumOANDA:XAUUSD A sweep of liquidity back to the 3377 zone and then back into the triangle trading range. Currently, the market will wait for new momentum for the next trend. If the 3322 zone is still holding, the uptrend to 3400 is still there. This is an important price zone in today's trading day.

📉 Key Levels

BUY Trigger: rejection 3323 with bullrish confirmation

Target: 3373

SELL Trigger: Break and trading Bellow support 3321

Target: 3285

Leave your comments on the idea. I am happy to read your views.

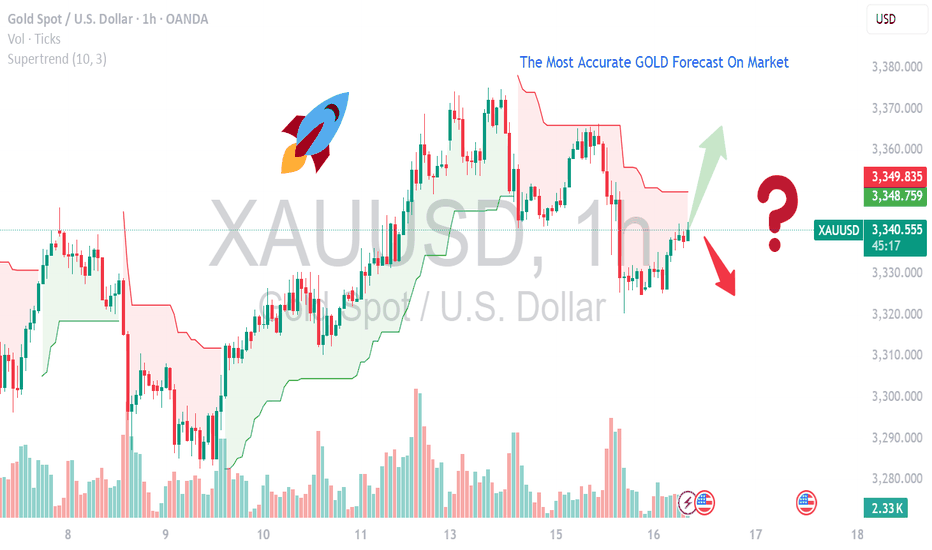

MOST ACCURATE XAUUSD GOLD FORECAST ANALYSIS MARKETCurrent Setup & Technical Outlook

Consolidation & Pennant Formation: Gold is building a bullish pennant and trading above its 50‑day MA — a classic continuation pattern suggesting a breakout toward new highs if momentum resumes .

Key Levels:

Support: $3,330–3,340 — confirmed by multiple technical sources .

Resistance/Breakout Zone: $3,360–3,375 — clearing this could trigger a rally toward $3,400+ .

Upside Targets: $3,390, then possibly $3,500–$3,535 per weekly forecast .

Alternate Bearish Scenario: A failure around the 0.618 Fibonacci resistance (~$3,374) and overbought RSI could spark a pullback to $3,356 or lower .

---

🧠 Fundamental Drivers

Inflation & U.S. Macro Data: Market awaits June CPI/PPI and Fed commentary — cooler inflation could boost gold via dovish expectations, while hotter data may strengthen the USD and weigh on bullion .

Geopolitical & Safe-Haven Demand: Trade tensions (e.g., tariffs) are keeping gold elevated near $3,350–$3,360 .

Central Bank & Real Yields Watch: Continued gold purchases and lower real rates are supportive, although mid-term easing in risks (like global trade) could curb momentum .

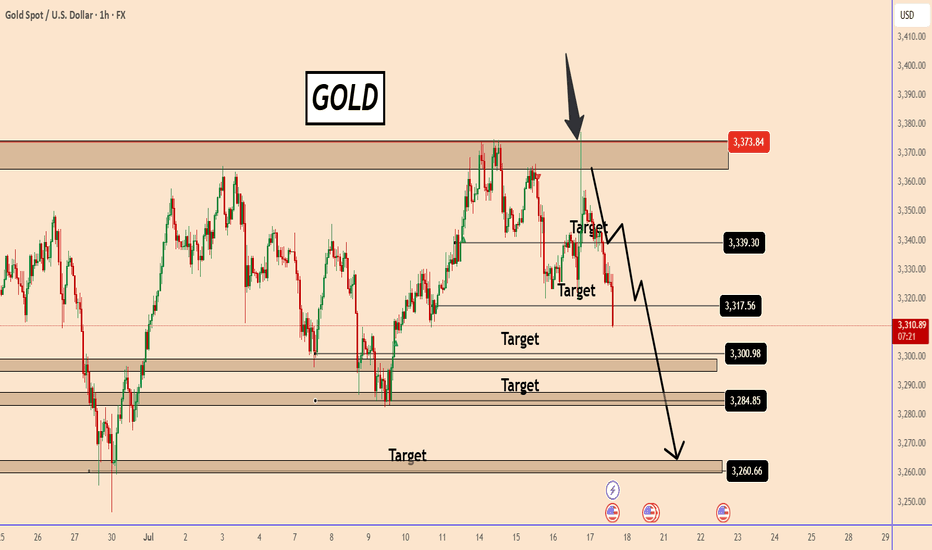

GOLD: Continues to respect our bearish scenarioGOLD: Continues to respect our bearish scenario

Yesterday we had a bad joke from Trump and the price tested again a very strong resistance area located near 3378.

As you can see from the chart, the sell-off happened quickly and was just a sell-off in a deep pullback.

Today, the price was struggling to find a clear direction, but after Trump said he had no plans to fire the Federal Reserve's Powell, the market calmed down easily.

The price fell from another strong support area earlier today after the US printed strong Retail Sales data for June of 0.6% versus an estimate of 0.1%.

The chances of further declines, as I explained earlier, are increasing further and it could even reach 3260, it seems.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

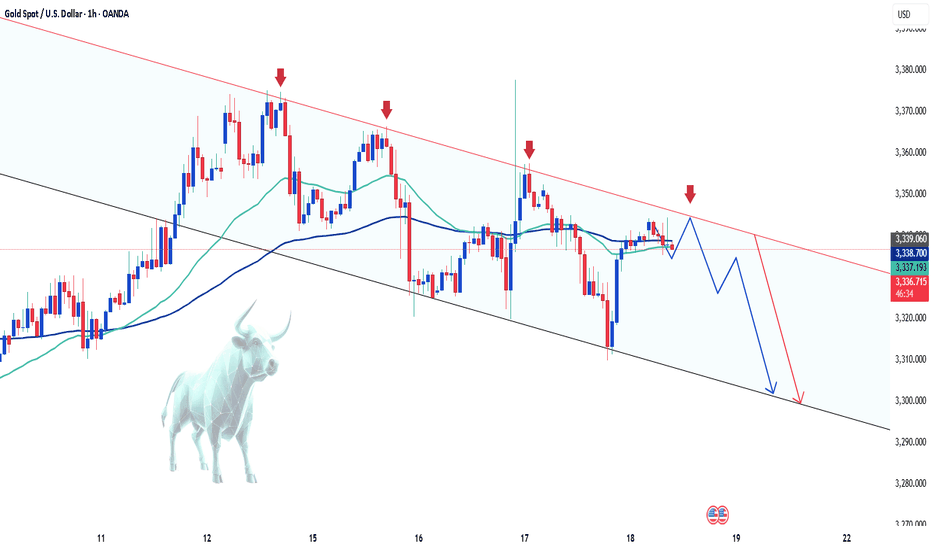

Gold's Short-Term Decline: What's Next?Hello everyone, what do you think about gold?

Today, gold continues its short-term downtrend. After new data was released at the end of yesterday’s trading session, the USD rose by 0.3%, and U.S. Treasury yields also increased, reducing the appeal of gold. Additionally, the latest unemployment claims data shows improvement in the U.S. economy, which has contributed to the drop in the precious metal.

As of writing, gold is trading around the EMA 34, 89 levels at 3,336 USD. With the recent news, the market is expected to maintain its current stance throughout the day, as no new significant updates are expected.

From a technical standpoint, the downtrend remains in place, with prices continuing to be capped below the trendline. The series of lower highs and lows could likely lead XAUUSD to test lower levels, with the possibility of reaching the 3,300 USD mark.

What do you think about the price of gold today? Let us know in the comments!

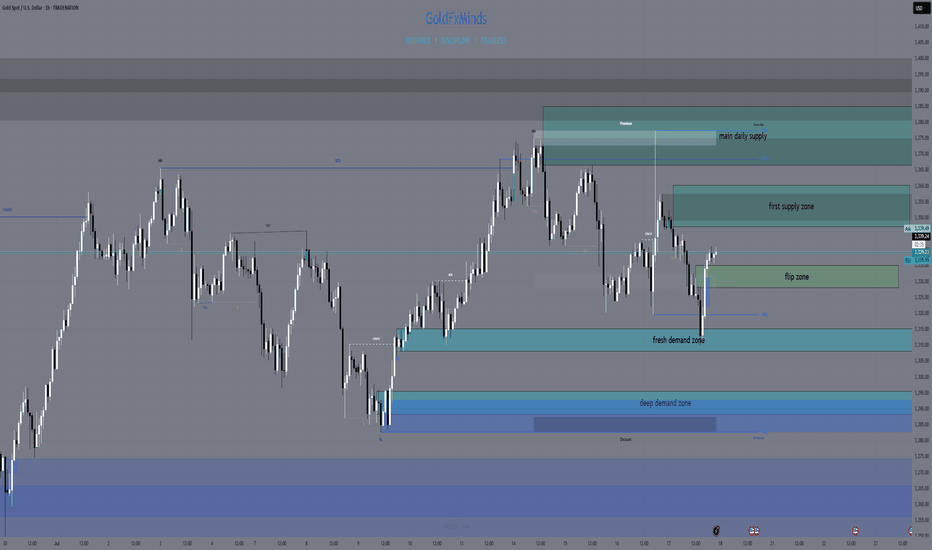

XAUUSD Daily Sniper Plan – July 17-18, 2025Hello traders!

After yesterday’s high-volatility trap and NY session recovery, we now stand at a major structural junction. Buyers reclaimed 3310–3314 with precision, but price is pressing into multi-timeframe supply. Let’s break it down clearly

🔸 HTF Bias

Daily Bias: Bullish correction inside a larger range. Demand at 3310–3305 was swept and respected, but supply at 3347–3360 caps upside.

H4 Bias: Bullish flow into supply. Structure printed clean HLs from 3295–3310. However, current zone is full of short-term profit-taking risk.

H1 Bias: Bullish short-term trend. Price built higher lows from 3310, but now sits at 3340–3347 — reactive zone where momentum could fade if no breakout.

🔸 Key Structural Zones (with role)

🔺 Supply Zones (Above Price):

3347–3360 (D1/H4/H1 Supply)

🔹 Multi-timeframe confluence

🔹 Previous reaction + NY trap zone

🔹 Expect heavy rejection or false breakout wicks

3366–3385 (D1 Supply)

🔹 Final liquidity shelf for buyers

🔹 Only valid if 3347 breaks clean

🔹 Longs must wait for confirmation after breakout

⚔️ Decision Zones (Middle):

3335–3328 (Intraday Flip Zone)

🔹 M15-M30 structure control

🔹 Buyers can reload here on clean bounce

🔹 If price closes below, opens door for bearish momentum

🔻 Demand Zones (Below Price):

3314–3310 (H1/H4 Demand – Key Buy Area)

🔹 Institutional demand origin

🔹 Price tapped, swept, and reclaimed

🔹 Ideal sniper buys only on retest with bullish M15 BOS

3305–3295 (Deep Reversal Demand)

🔹 Extreme discount

🔹 Valid only if 3310 fails

🔹 High RR buys if liquidity sweep appears

🔸 Sniper Battle Plan 🎯

Scenario 1 – Fade from 3347–3360:

🔹 If rejection signs (M15 FVG + RSI divergence), short toward 3335, 3314

🔹 Only enter if NY open confirms exhaustion

Scenario 2 – Pullback to 3335–3328:

🔹 Ideal quick buys on bounce with confirmation

🔹 Watch for BOS on LTF for sniper entry

Today’s zones require real discipline: no rush, no panic — just clear steps, sharp entries, and clean rejections or retests. You already saw what 3310–3305 reacted. The next move? You plan it. You take it. You own it.

✨ Which zone are you watching for your next move?

Drop a comment, leave a 🚀🚀🚀and follow for more sniper-level clarity — every single day.

Let’s keep mastering this market. Together.

Disclosure: All plans are built on Trade Nation live feed. Educational only.

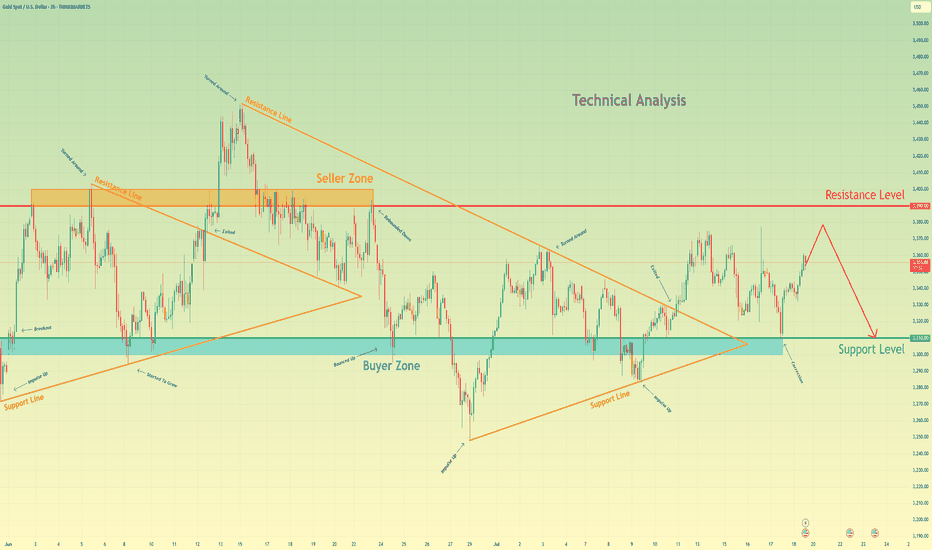

Gold may rise a little and then drop to support levelHello traders, I want share with you my opinion about Gold. Initially, gold was trading within a large consolidating pennant, showing both upward and downward impulses as it moved between the converging trend lines. The price eventually saw a breakout from this pattern, followed by a strong impulse up, but this momentum stalled as it approached the major horizontal resistance level at 3390. This level, which corresponds with the upper seller zone, has proven to be a significant barrier for buyers, rejecting the price and confirming a strong seller presence in that area. Currently, the market is in a corrective phase after being rejected from the highs. The price is drifting upwards once again in what appears to be a final retest of the aforementioned seller zone. This slow upward movement lacks the impulsive strength of the previous trend, suggesting that buyers are losing control and sellers are preparing to defend the 3390 resistance level once more. I expect this corrective move to fail upon reaching the seller zone around 3390. After this retest, I anticipate a sharp reversal and the beginning of a new downward trend. The logical target for this move is the major support level at 3310, an area that has historically acted as a strong buyer zone. That is why my TP is set at 3310. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.