Gold - The clear top formation!🪙Gold ( TVC:GOLD ) just created a top formation:

🔎Analysis summary:

Over the past four months, Gold has overall been moving sideways. Following a previous blow-off rally of about +25%, this cycle is very similar to the 2008 bullish cycle. Bulls are starting to slow down which will most likely result in the creation of at least a short term top formation.

📝Levels to watch:

$3.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader

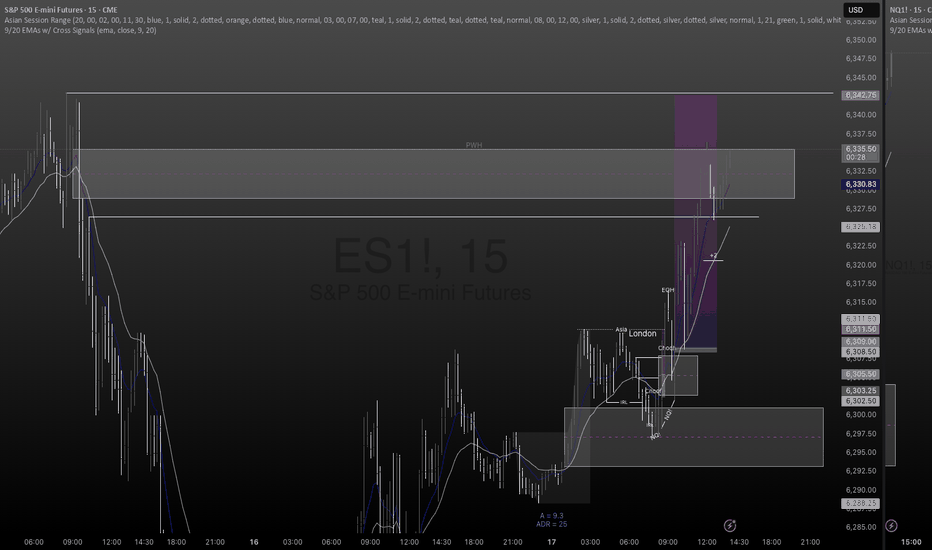

Futures market

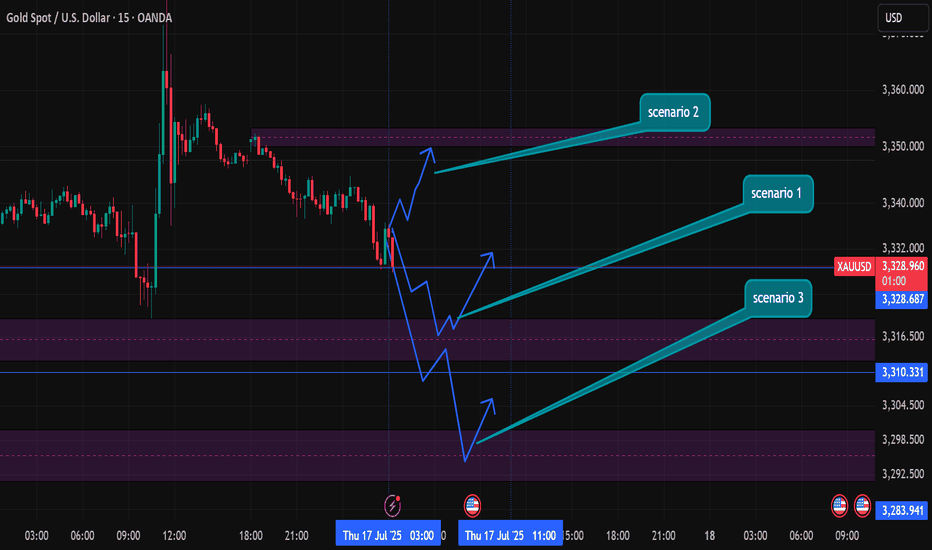

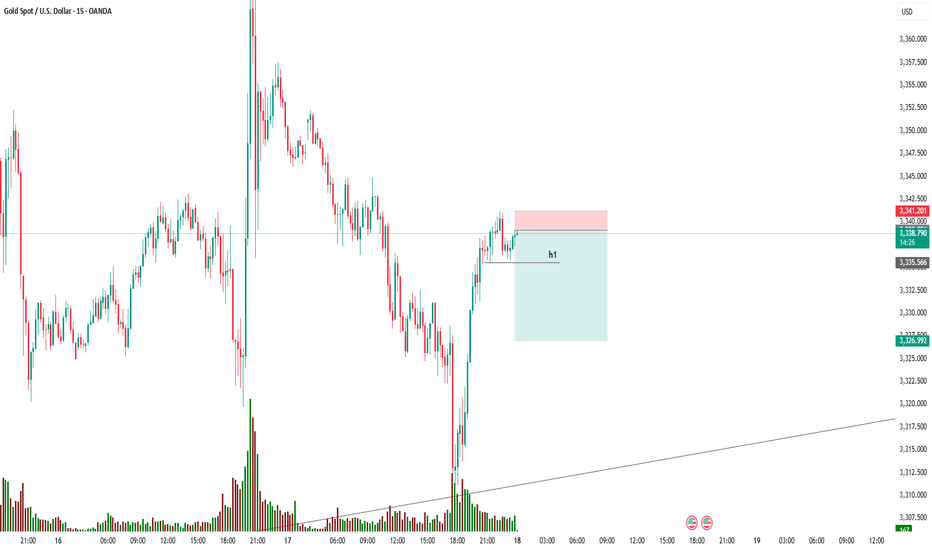

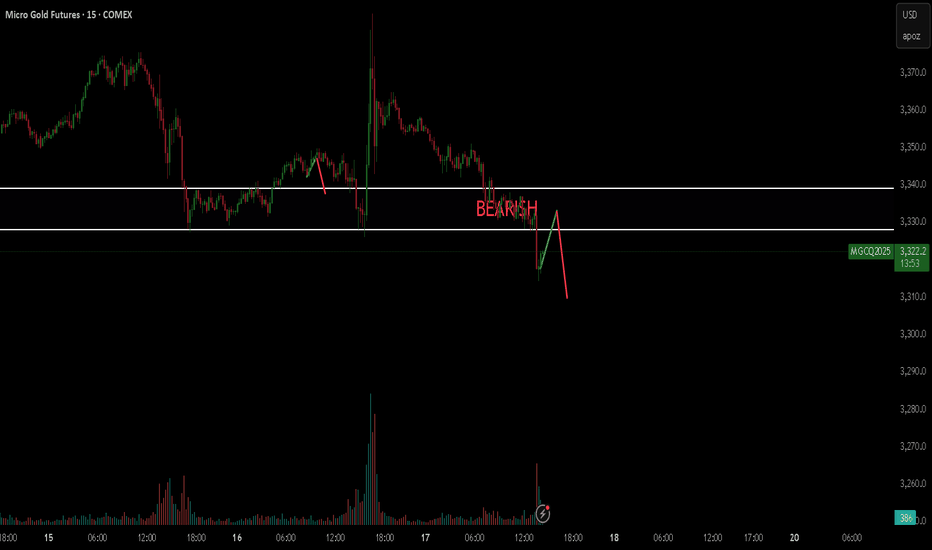

gold daily bias today (17th july 2025)Daily remains bullish within a bullish BOS. 4H structure confirms the same — only reacting if price invalidates the bullish setup.

For BUYS (Scenario 1 – Deep Retracement Buy):

1️⃣ Price retests the 3320.651 – 3311.381 zone.

2️⃣ Form a 1/3M bullish CHOCH with a body candle close.

3️⃣ Retest the level and BUY toward 3349.077.

For BUYS (Scenario 2 – Intraday Structure Flip):

1️⃣ Price forms a 15M bullish CHOCH with body candle close.

2️⃣ Retest the 15M BOS using a 2/3M bullish CHOCH.

3️⃣ Confirm the retest and BUY toward 3349.077.

For SELLS (Scenario 3 – BOS Break + Shift):

1️⃣ Break below 3320.651 – 3311.381 with a strong 1H momentum candle.

2️⃣ Pull back to the broken zone.

3️⃣ Form a 1/3M bearish CHOCH after retest and SELL toward 3298.508.

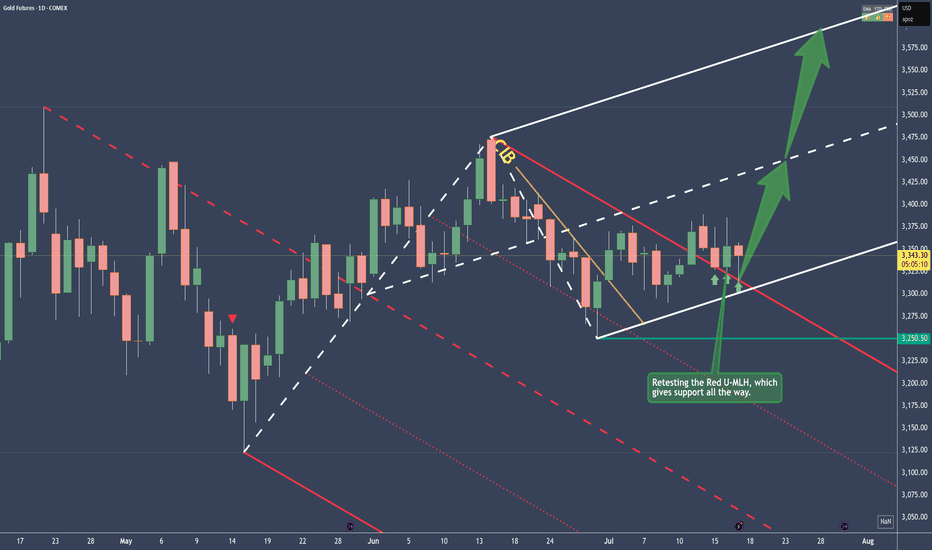

Gold - Bullish and here's whyPrice traveled within the Red Fork, until it broke the CIB Line, which is indicating a Change In Behavior.

From there on, sideways action, until the break of the Red U-MLH happened.

After the close above the Red U-MLH, price has tested it the 3rd time now. At the time of writing, the Bar looks like a PinBar. So it has good sepparation from the bottom, or a long Down-Wick. That's indicates good strenght.

To me this looks like a good long trade, but as everytime, play it save and don't let greed eat your brain ;-)

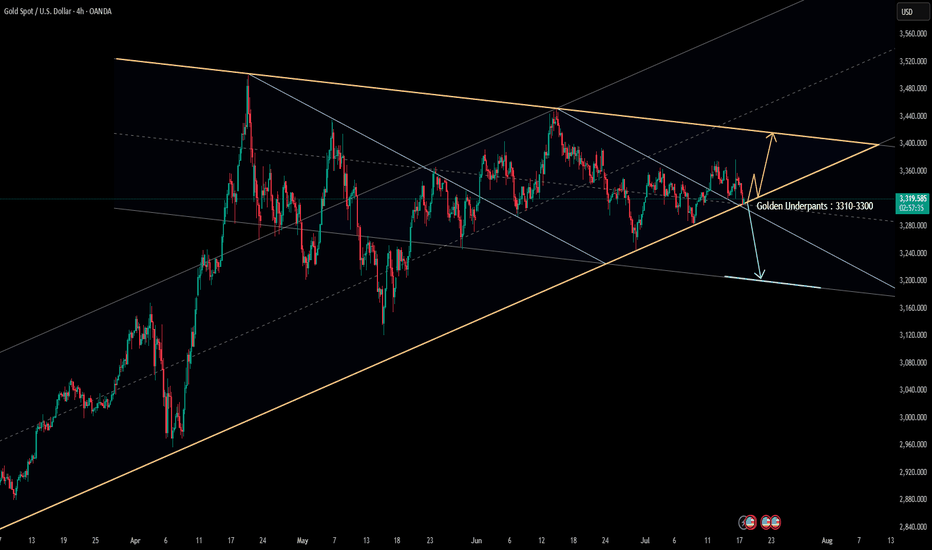

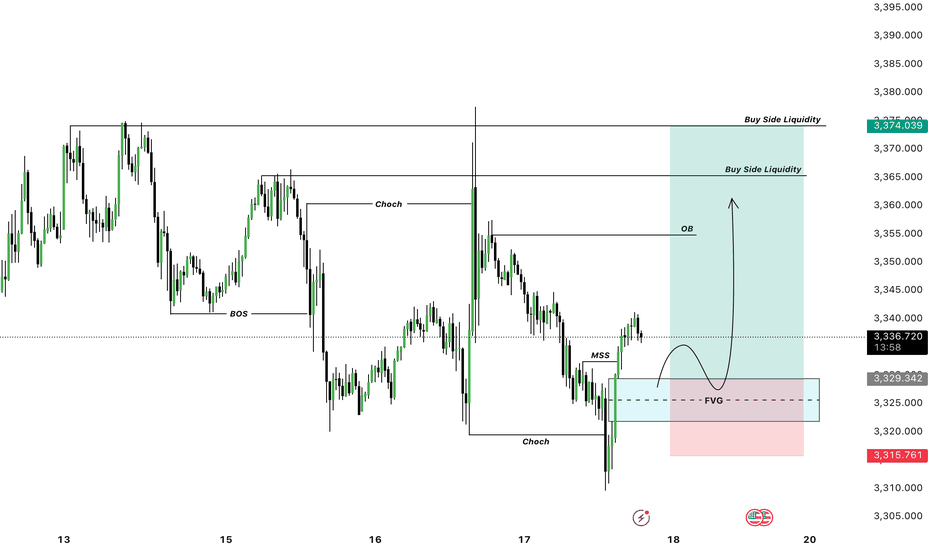

gold heading back to retest 3450gold heading back to retest 3450

so what happened to gold yesterday?

unemployment claims suppose to be that USD is strong however after the news effect the bull run started again.

technical basis is that H4 last structure was broken up and the day before happens to be a spike from 3320 to 3377. which indicate there are buyers in the market only that we will be caught off-guard most of the time. likewise yesterday. new gave a technical that m30/h1 broke down of current market structure whereby 3326-3328 was suppose to be a support before becomes resistance but bull came in with surprise again pushes price to break even 3341 resistance.

after analyzing no wonder as fibo golden ratio is sitting at 3310 and that was a good point of interest to buy and hold for 1st destination would be at 3365-3378 and 3414-3427 and lastly to retest 3450 as well as weekly broke trendline to see if there's true seller to push price for a proper correction of the year or back to ATH which usually new ATH happens in July often for the past 5years.

Gold underwear: 3300-3310Gold underwear: 3300-3310

As shown in the figure:

Today, the gold price is once again facing the test of the 3300-3310 support level

As today's title: Gold price underwear is coming

A new round of long-short battle is about to break out

As early as next week, there is a high probability that a historic market will be ushered in.

From the macro structure, the gold price has reached the end of the shock, and the long and short sides are currently in serious disagreement.

Surging stalemate range: 3310-3375

As of now, the gold price: 3315-3320 range shock

The next strategy is very clear:

1: As long as the gold price is above 3310, it is the best range for bottom-fishing and long, and the stop loss is set at 3300-3295.

2: Once it breaks through 3310, bulls need to be cautious and be alert to the possibility of a sharp decline. As long as the gold price stabilizes below 3300, it can be directly transferred to short-term trading, and the stop loss is set at 3310-3315.

I prefer to follow the big trend and see it as a strategy to buy at a low price.

Buy: 3310-3315

Stop loss: 3300-3295

Target: 3350-3375

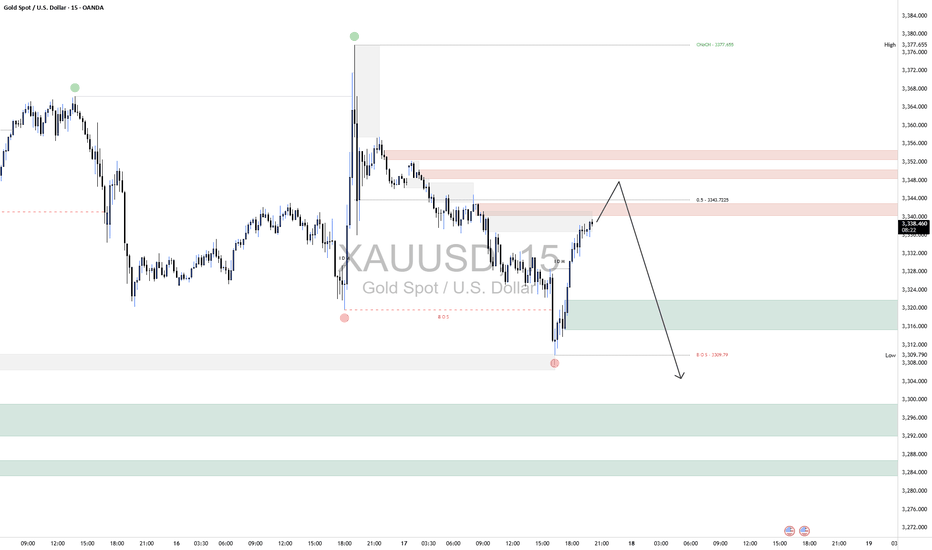

3340-3300: Lock in the buy high and sell low in this area!Under the influence of unemployment benefits and zero monthly sales data, gold fell sharply in the short term, but it did not effectively fall below 3310 during multiple tests, effectively curbing the further downward space of the shorts. Multiple structural supports are also concentrated in the 3310-3300 area, so as long as gold does not fall below this area, gold bulls still have the potential to rebound.

However, for the current gold market, it may be difficult to see a unilateral trend in the short term. After experiencing discontinuous surges and plunges, gold may focus on consolidation and repair, and the consolidation range may be limited to the 3340-3300 area.

So for short-term trading, first of all, I advocate going long on gold in the 3320-3310 area, and expect gold to rebound and reach the 3330-3340 area;

If gold reaches the 3335-3345 area as expected, we can start to consider shorting gold, and expect gold to step back to the 3320-3310 area during the shock and rectification process.

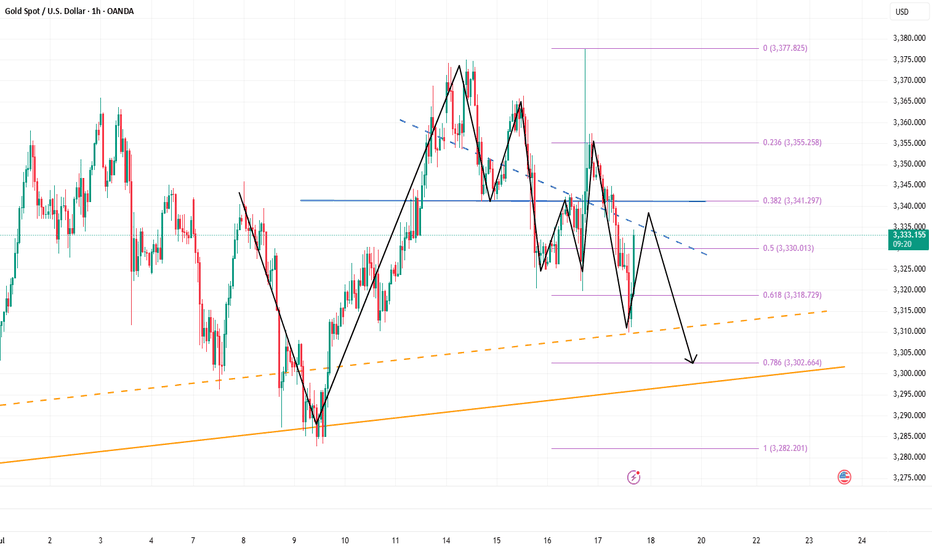

Xausd techinical analysis.The chart you've shared is a 1-hour Gold (XAU/USD) price analysis showing a potential bullish reversal pattern with some key technical features:

🔍 Key Observations:

1. Falling Wedge Pattern (Bullish Reversal)

The pink trendlines indicate a falling wedge — a bullish reversal pattern.

Price has broken out above the wedge, indicating potential upward momentum.

2. Order Blocks (O.B)

Marked at both the bottom (support) and top (resistance).

The lower O.B near 3310 acted as strong demand/support.

The upper O.B near 3350 could be the next key resistance.

3. FVG (Fair Value Gap)

Labeled in red — indicates an imbalance that price often comes back to fill.

This has already happened, which may have fueled the bounce.

4. Fibonacci Level

0.618 Fibonacci retracement line (blue) acted as a

XAUUSDXAU/USD, the trading pair for gold (XAU) against the US dollar (USD), reflects the value of one ounce of gold in dollars. When traders short XAU/USD, they anticipate a decline in gold prices relative to the dollar—often due to stronger U.S. economic data, rising interest rates, or reduced geopolitical tensions, which boost the dollar’s appeal over gold. This pair is sensitive to inflation, Federal Reserve policies, and global risk sentiment, making it a key instrument for both hedging and speculation in volatile markets.

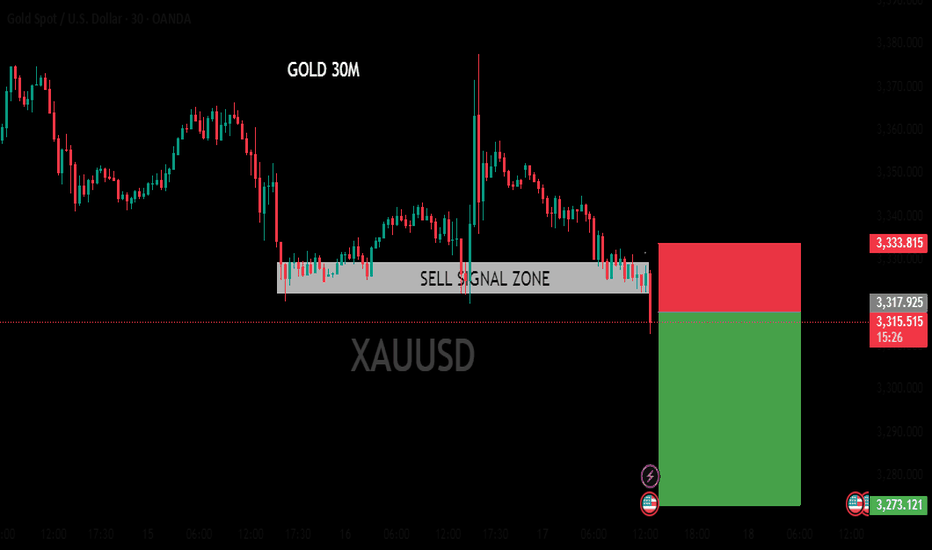

gold 30m bearish analysis The chart appears to be a candlestick chart, which is commonly used in financial markets to display price movements over time. The chart is labeled "GOLD 30M" at the top, indicating that it is showing the price of gold over a 30-minute time frame. The chart has a downward trend, with the price of gold decreasing over time. A white box in the center of the chart contains the text "SELL SIGNAL ZONE". This suggests that the chart is being used to identify potential selling opportunities in the gold market.

XAUUSD critical area, both sides are possiblecorrection waves are always complicated and messy often changes direction too often, goes up and down in a wide range either triangle, wedge or some sort of zigzag, internal waves usually goes as abc, wxy, wxyxz type of correction waves and it may seem like ended many times in the subwaves. so often confused with many other ideas. i believe correction continues yet criticals levles to watch 3307-3419 brake side will determen the future of gold.

my 3250 target already achieved but i expect another one, shor term targets 3250-3205 mid term targets 3119-3070-3050

daily candle body above 3420 invalidates short ideas.

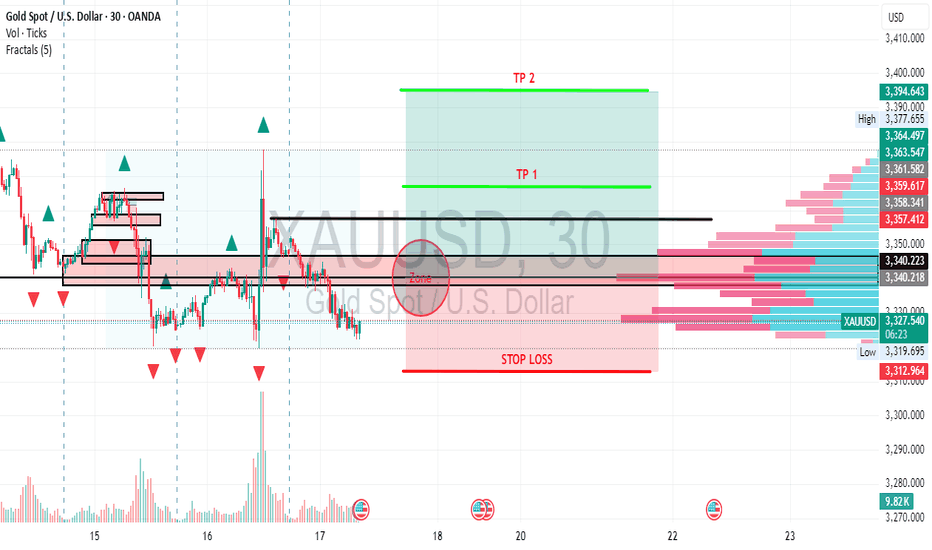

Title: Gold (XAU/USD) Reversal Zone Trade Plan – 30M Analysis🔍

Chart Description & Full Breakdown

This 30-minute chart of XAU/USD outlines a potential bullish reversal trade from a key demand zone, identified by volume profile and historical price reaction. The analysis is built on confluence between price structure, volume imbalance, and risk-reward alignment.

📈

Analysis Summary:

🔴

Zone Highlight:

Marked Zone is a clear liquidity sweep / demand block between $3,319 – $3,340.

Price is hovering just below POC (Point of Control), where the most volume has transacted.

This area acted as prior support multiple times and is likely to draw in buyers again.

🛑

Stop Loss:

Set below the last major swing low: $3,312.

Beneath the volume gap and right under the high-volume support shelf, protecting against downside flushes.

🟢

Take Profit Levels:

TP1: $3,357 – First key volume shelf and local resistance.

TP2: $3,394 – Near-term swing high and high-volume node on the upper side.

🎯

Strategy & Meaning Behind It:

You’re playing a retest of the previous demand zone, paired with a low-risk reversal idea.

Why this works:

Strong bullish imbalance on the left of the chart.

Consolidation broke down but failed to follow through aggressively.

Buyers showed volume on recent touches of the zone.

Multiple timeframe confluence from the broader bullish setup.

💡

Execution Plan:

Entry: As close to $3,323 – $3,330 as possible.

Stop Loss: Tight below $3,312 to protect capital.

Target Profit Zones: Use volume profile to take partials at TP1 and let runners go to TP2. @BandMangfo

ALUMINIUM: Selling opportunity following trendline breakALUMINIUM climbed a steep uptrend but it might meets its end with this recent break through this rising trendline. When price respects a trendline repeatedly, it becomes significant, its break indicating either a potential reversal or major pause in the trend. The candlestick that broke the trendline signals the first hint of structural change.

After breaking, price traced backward to retest the trendline. The retest manifested as a cluster of candles with wicks testing the former trendline but failing to reclaim it. That failure to reclaim, might signal seller conviction and transformation of market structure. But it would need additional confirmation to confirm the signal.

Ideally, what I look for in retests is to be met with a confirming candle, typically a bearish engulfing or marubozu closing below the trendline. This would confirm the sellers have taken over and validate the change from uptrend to potential downtrend or consolidation phase.

If I were to take a side here, I would choose more downside, but again only price action should determine next move.

However, if price breaks back above the trendline with conviction, especially engulfing the retest, it would invalidate the bearish scenario, suggesting that the uptrend may resume with fresh momentum.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

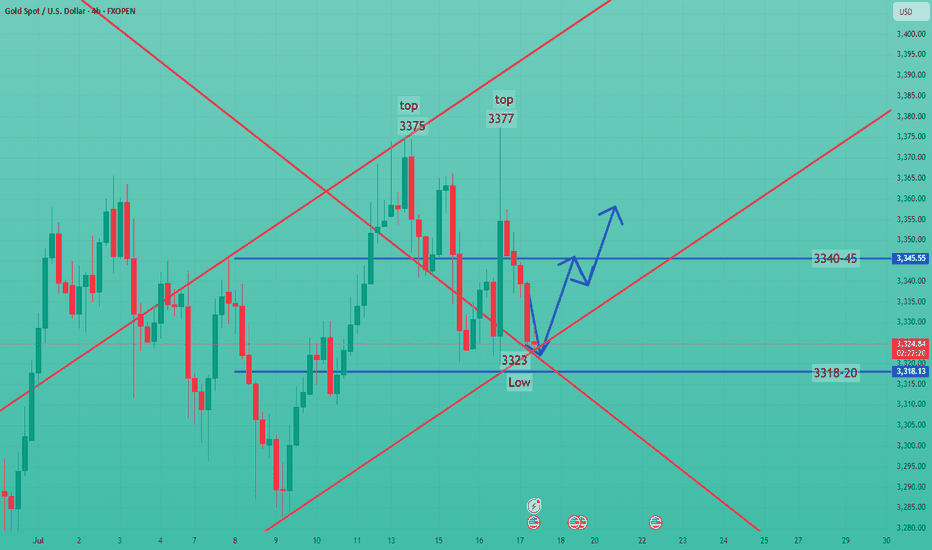

Continue to go long after bottoming outYesterday, the Trump and Powell incident caused gold to rise strongly to around 3377. The rise in gold was only short-lived. In the end, gold closed positively on the daily line, but it closed with a super long upper shadow line. In the end, the gold price quickly rose and broke through the 3377 mark, but fell back under pressure and closed in a volatile market. The daily K-line closed high and fell back in a volatile market. Although the overall gold price repeatedly fluctuated and washed out under the stimulation of news, it ultimately failed to break through the recent large box oscillation range. Today we continue to pay attention to the support line of 3318-25 below, and we will continue to go long if it falls back!

From the 4-hour analysis, the short-term support below continues to focus on around 3318-25, the short-term suppression above focuses on the 3340-45 line, and the key pressure above focuses on the 3380 line. Relying on this range as a whole, the main tone of high-altitude and low-multiple cycles remains unchanged. In the middle position, watch more and do less, be cautious in chasing orders, and wait patiently for key points to enter the market.

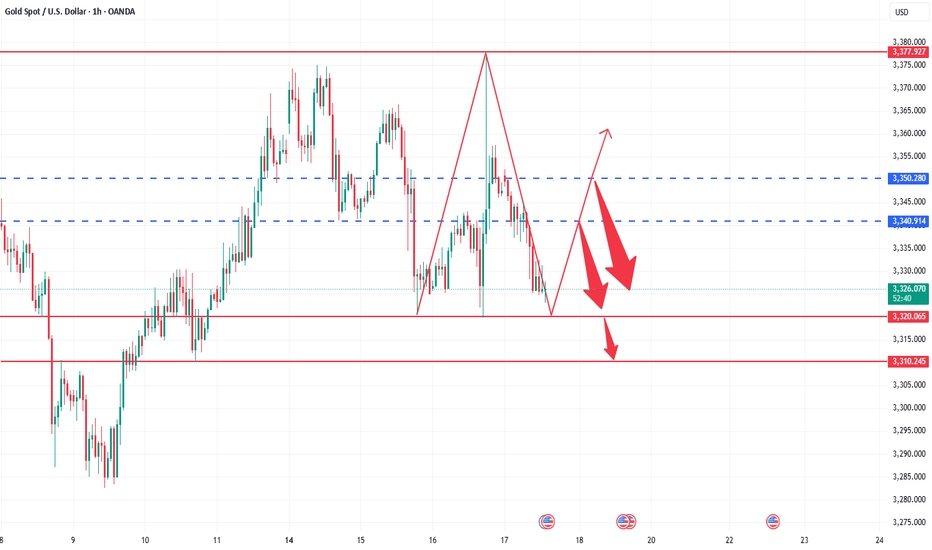

XAUUSD Short📈 Scenario Forecast:

Bias: Bearish

Expected Path:

Price to move into the 3340–3352 supply zone.

Rejection expected from this area.

Downside targets are 3315, followed by 3290s, depending on how price interacts with intermediate demand.

This aligns with a classic pullback-to-supply-and-drop setup based on smart money concepts and supply/demand dynamics.

Your Key Zones ("Borders"):

🔴 Supply Zones (Short Bias Areas):

Primary Supply: 3340–3352

This zone is well-placed, capturing imbalance and previous distribution. It’s situated right at the 50% equilibrium level of the last bearish leg (as shown by your 0.5 line at 3340.72), and likely to act as the rejection point for the next bearish leg.

If price prints a lower high or bearish confirmation candle within this zone, it supports the bearish continuation thesis.

🟢 Demand Zones (Target Areas):

First Demand Zone: 3315–3309

This zone represents the prior BOS and recent swing low. It's the first level where we may see a temporary pause or reaction before continuation. It's an ideal short-term target for traders entering from the supply zone above.

Secondary Demand Zone: 3292–3286

A deeper institutional demand block. If bearish pressure remains strong, price could be drawn here for a liquidity sweep before a higher-timeframe reversal or bounce.

Gold----Sell near 3357, target 3330---3320Gold market analysis:

Yesterday's gold daily Asian session was still a normal shock drop. We sold at 3340 and 3341 twice to 3322 to make all profits. 3320 is the previous low point and the moving average support position. This position is also a strong support today. Yesterday, the Trump and Powell incidents made gold strongly rise to around 3377. In addition, the Middle East bully bombed Syria again, which is also the main reason for the surge in gold. However, the fundamentals are only short-lived. In the end, the gold daily line closed positive, but closed with a super long upper shadow line. Selling is still not dead. Today's gold buying and selling have opportunities, and the possibility of a direct decline is small. I estimate that the Asian session will be repaired, and our ideas for buying and selling in the Asian session can be intercepted. If it breaks 3320, consider chasing and selling again, which means that selling has started again.

The highest rebound in the Asian session was around 3352, and the highest position in 1 hour was around 3357. Today's small suppression in the white session is 3357. The following support focuses on two positions, one is 3320, and the other is 3330. I estimate that the fluctuation range of the Asian session is 3320-3357. Let's observe and wait for the position in the Asian session.

Pressure 3352 and 3357, strong pressure 3366, support 3320 and 3330, and the watershed of strength and weakness in the market is 3350.

Fundamental analysis:

Trump's dissatisfaction with Powell has not been a day or two, and the conflict is inevitable. The impact on gold is also short-term. Yesterday's pull-up and dive is a case in point.

Operation suggestion:

Gold----Sell near 3357, target 3330---3320

Report - 17 jully, 2025Executive Notes – Summary

Tariffs Bring In $50bn+ for U.S.: Global partners mostly restrained; only China and Canada retaliated. EU delays action until Aug 1. → Bullish short-term for USD revenue and equities tied to U.S. industrial base; long-term inflation risk rising.

Trump vs Powell (Fed Chair): Trump floated firing Powell; market volatility followed. Odds hit 40%, fell after walk-back. → Bearish for DXY, bullish for XAUUSD and risk hedges.

China-Japan Espionage Flashpoint: Japanese executive jailed. U.S. and Japanese corporates face higher operational risk. → Negative FDI outlook for China, positive momentum for India, Vietnam.

EU–Mercosur Trade Deal at Risk: France demands safeguards on beef, sugar, poultry. Deal approval hinges on political concessions. → Watch agri-commodities (softs), BRL, and EU agri-lobby impacts.

ASML Profit Warning: Trump tariff fears cloud 2026 chip industry outlook; shares drop 11%. → Bearish on EU semis, capital goods.

Nvidia China Deal Revival: U.S. set to grant export licenses for AI GPUs; H20 shipments may resume. → Bullish for China AI adoption and semis; BABA, BIDU, NVDA in rebound territory.

Goldman & JPM Rally on IB Recovery: M&A/IPO flows return; +26% YoY IB fees. → Signals CEO confidence; bullish for dealmakers and sector ETFs (KCE, XLF).

Subsea Cable Ban on China: FCC to block Chinese tech in U.S.-linked subsea networks. → Signals rising digital Cold War; tech supply chains shifting westward.

Germany’s Allianz CEO Sounds Alarm: Warns of fiscal collapse by 2035 if welfare spending not reformed. → Supports hard-asset thesis; bearish EU fiscal stability perception.

Crypto Week & Stablecoin Push: Cantor-led SPAC to buy $4B BTC; U.S. fast-tracking stablecoin rules. → Bullish BTC, USDT dominance, and crypto-native banking platforms.

Full Strategic Macro & Market Analysis

President Trump’s aggressive tariff policy is achieving both economic and political outcomes ahead of the election: $64 billion in Q2 customs revenues and symbolic victory over hesitant global peers. According to Treasury data, tariffs have surged income by over $47 billion YoY. This influx comes with asymmetric retaliation: only China and Canada have meaningfully responded. The EU, under pressure from France’s agricultural bloc, has paused countermeasures, awaiting August 1 negotiations.

The market's muted reaction reflects the novelty of tariffs being treated as quasi-fiscal tools. Yet, the Yale Budget Lab’s finding of a 20.6% effective average tariff — the highest since 1910 — is an inflationary wildcard. UBS projects that core goods prices may push CPI above 2.3% until 2027 without policy reversal, eroding real incomes and squeezing margins across consumer sectors. As noted by Fed officials like John Williams, tariffs alone are lifting inflation by a full percentage point over the next 12 months.

At the same time, Trump’s remarks about firing Fed Chair Powell jolted Treasury and currency markets. The DXY fell nearly 0.9% intraday, while 2-year U.S. yields dropped to 3.90%, pricing in a potentially more dovish successor. This political volatility amplified market preference for inflation hedges and high-quality equity earnings.

Assets:

XAUUSD (Gold):

Trump’s Fed confrontation, rising CPI prints, and global legal-institutional instability support continued gold upside. Technical momentum remains bullish. If DXY dips below 103 and Powell uncertainty rises, gold could retest $2,450.

S&P 500 & Dow Jones:

Rotation continues. Industrials and financials (e.g., Goldman Sachs, JPMorgan) gain from tariff-driven reshoring and M&A revival. However, semis and global tech face drag from ASML warnings and U.S.–China tech decoupling. Dow holds better given dividend strength, but risk spikes if Powell is removed or tariffs push inflation past 3%.

USDJPY:

USD weakening bias persists on Fed risk, though yen gains are capped by geopolitical risk in Asia (e.g., Chinese jet near Japan, espionage cases) and Japan’s sluggish growth. A move toward 152 is possible if Powell exits or the Fed pivots dovishly.

DXY (Dollar Index):

Trump’s instability narrative, threats to Fed credibility, and rising CPI are weighing on the dollar. Watch for a decisive breakdown below 103, especially if ECB/BoE turn hawkish or U.S. deficit headlines worsen.

Crude Oil (WTI):

Supported by strong commodity complex (steel, copper, aluminum all up), tariffs on inputs, and stable OPEC+. Bullish bias into Q3, with demand steady and risk premia rising from China tensions and Middle East unrest.

Macro Risks

Fed Politicization: Powell’s premature dismissal could unravel market confidence in the U.S. rate regime. Bonds and USD would sell off; capital flight risk rises.

Persistent Inflation: Tariffs risk pushing CPI above 3% in 2025. Long-end yields will respond faster than the Fed.

Tech War Escalation: Subsea cable bans, Huawei exclusion, and AI chip controls could trigger further retaliation from China.

EU-Mercosur Breakdown: French farming veto could stall EU diversification efforts and strengthen protectionist politics in Europe.

Emerging Opportunities

U.S. Banks and Dealmakers: Goldman Sachs and JPMorgan gains point to a rebound in capital markets activity. KCE ETF, GS, and MS are prime exposure vehicles.

AI-Semiconductor Complex (Selective): Nvidia’s China deal reversal allows for a tactical rebound in NVDA, BIDU, BABA, despite broader export controls.

Bitcoin Accumulation Wave: Trump-aligned SPACs (Cantor Equity Partners 1, BSTR Holdings) are spearheading institutional BTC acquisition. Stablecoin legislation expected to favor U.S. dollar dominance.

Dividend-Centric Strategies: Payout increases from industrials (Costamare, ILPT) outnumber dividend cuts. Defensive dividend plays are outperforming growth narratives in volatile macro backdrops.

Possibilities:

XAUUSD (Gold)

Short-Term (1–4 weeks): Likely to stay elevated or push higher amid Fed independence concerns and strong CPI tailwinds. A sustained move above $2,400 opens a path to $2,450–2,480, especially if Powell’s status deteriorates or the DXY breaks 103.

Medium-Term (3–6 months): Remains supported by structural inflation and global de-dollarization themes (e.g., stablecoins, geopolitical risk in Asia, digital infrastructure war). Positioning may increase if the Fed turns more political.

S&P 500

Short-Term: High volatility. Earnings remain solid, especially in financials and industrials, but valuation compression risk persists if long-end rates stay above 5%. Potential 1–2% pullbacks on Powell uncertainty.

Medium-Term: Rotation-led upside possible if Fed stability is restored. But if tariffs worsen CPI and margins compress, we could see a multi-month consolidation. AI and industrial resilience may cap downside.

USDJPY

Short-Term: Expected to test downside near 152. Japanese yen gaining haven demand, and dovish Fed risk undermines USD strength. If risk sentiment worsens (China, Powell), JPY outperforms.

Medium-Term: Neutral-to-bearish. If the Fed resumes cuts or dollar confidence erodes, USDJPY could move sub-150. BOJ remains dovish, limiting gains beyond that.

DXY (US Dollar Index)

Short-Term: Under pressure. If Powell's removal gains traction or more tariffs fuel CPI, DXY may decisively lose 103 support. Temporary rebounds on safe-haven flows possible.

Medium-Term: Bearish bias forming. Stablecoin growth, Trump-led policy volatility, and global diversification efforts (e.g., EU trade deals) weigh on demand for USD assets.

Crude Oil (WTI)

Short-Term: Bullish tone holds. Supply-side support from OPEC+, tariffs lifting input costs, and solid U.S. industrial activity. Potential retest of $85/bbl.

Medium-Term: Risk of higher volatility. If global growth slows (China contraction or Fed missteps), oil could retreat to mid-$70s. But inflationary pressure remains net supportive.

Dow Jones Industrial Average

Short-Term: Outperforming due to resilient bank earnings, dividend momentum, and defensive bias. Likely to remain range-bound with modest upward drift unless Powell is ousted.

Medium-Term: Cautiously bullish. Dividend themes remain strong, and industrials benefit from tariff protection. But inflation and long-duration debt concerns could cap gains.

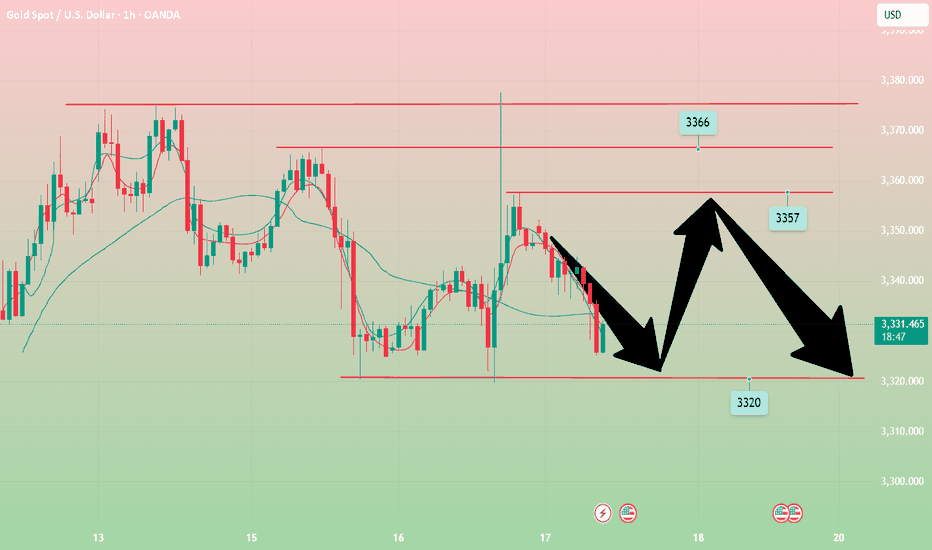

Today’s main strategy: bulls take the lead, followed by bears!Yesterday, gold maintained a range of fluctuations. The game between bulls and bears was fierce but failed to break the current structure. The overall trend is not clear for the time being. From a fundamental perspective, risk aversion still dominates market expectations, which makes the gold trend lack a directional breakthrough. However, we need to be vigilant that the main funds may force the gold price to fall through extreme suppression in the future. From the 4-hour cycle, gold has been under pressure near the upper track of 3377 and has fallen continuously. It has fallen below the middle track support and touched the lower track. The current price is temporarily supported near the lower track, but the overall situation is still in a wide range of fluctuations. The trend has not yet formed. The short-term strength of the US dollar also suppresses the gold rebound. The current bulls and bears are anxious, and the key support and resistance have not been effectively broken. Currently, pay attention to the effectiveness of the support in the 3325-3320 area. If it pulls back to this area, you can consider a short-term long layout, and the target is the 3340-3350 range above. If it rebounds to this area, you can choose to stop profit and go short at the right time, and the target is the lower track area. If the downward momentum is strong, it may fall below yesterday's low to form a continuous decline.

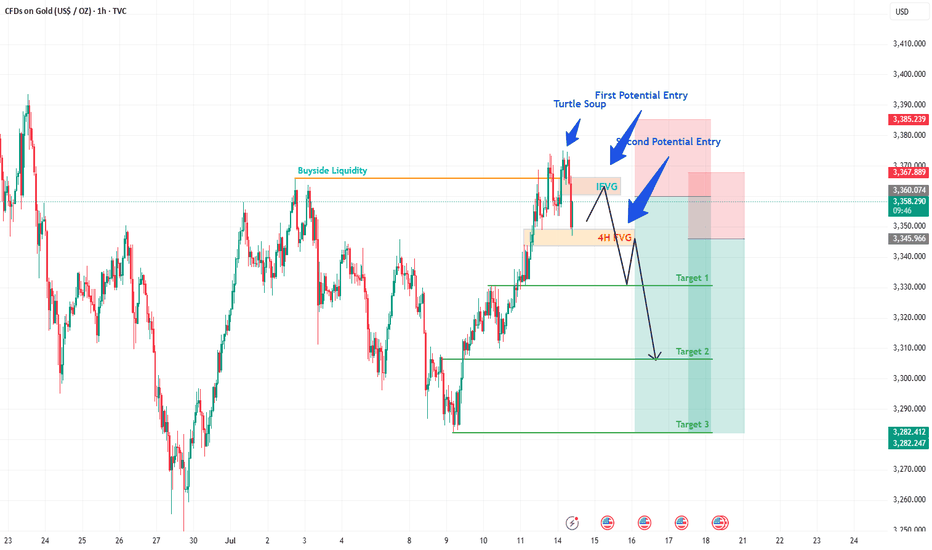

XAUUSD (GOLD) POTENTIAL SELL IDEAGold after hitting 3500 level, has kind of been ranging between 3200 and 3450 level. As we can say that Monday as start of the week has taken a Buyside Liquidity maybe making it high of the week which we will know as the market unfolds itself.

A FVG was formed on 1H before the Buyside was taken and after taking BSL, price sliced through FVG making it IFVG, we can expect Gold to give us a sell trade as it enters this IFVG which will be our first potential entry, placing SL slightly above Buyside Liquidity level.

If our first entry is successful, we can see a second entry when the price slices through the 4h FVG as marked, making it again an IFVG targeting the levels as highlighted on the chart.

FIRST POTENTIAL ENTRY:

Sell @ 3360-3365

Stop loss = 3385

Take Profit = 3335 (Target 1), 3310 (Target 2), 3390 (Target 3)

SECOND POTENTIAL ENTRY:

Sell @ 3340-3345

Stop loss = 3367

Take Profit = 3335 (Target 1), 3310 (Target 2), 3390 (Target 3)