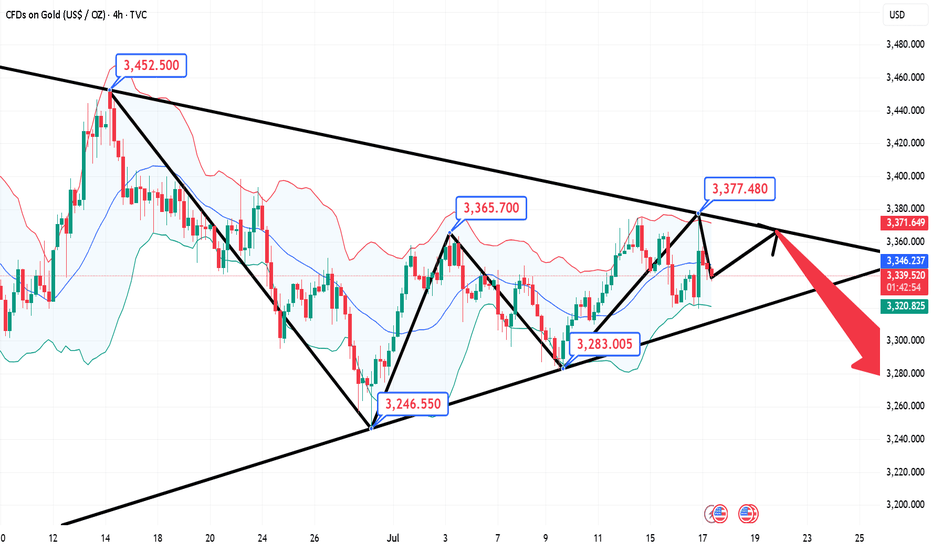

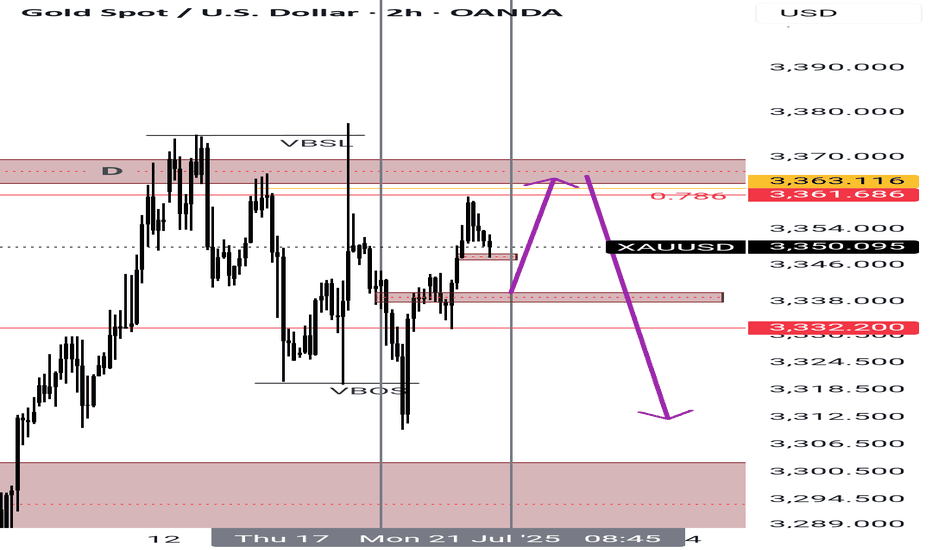

Analysis of 7.17 Gold Operation: Buy High and Sell LowYesterday, the trend of gold in the first half was quite regular. The rebound in the Japanese session was under pressure, and the European session continued to fall back to test the 3320 mark. The key here has been repeatedly emphasized yesterday. The gold market in the second half was more exciting. First, the news was released that Trump was ready to draft the dismissal of the Federal Reserve Chairman. Gold directly rose by 50 US dollars and broke through the recent high of 3375. Then he said that he had no intention of dismissing the Federal Reserve Chairman. Gold rushed up and fell back by 40 US dollars. The daily line finally closed with an inverted hammer pattern with a very long upper shadow line.

After the end of this pattern, today's market is still bearish. If the market is extremely weak, it will continue to fall below 3358. Pay attention to the attack and defense of the 3320 mark below. If it falls below, it will open the downward space to test the 3300 mark. During the day, we will temporarily set the small range of 3320-3358 to run, sell high and buy low, and retreat to 3325. One low long, defend yesterday's low, look up to 3335, 3342, 3358, and then reverse high.

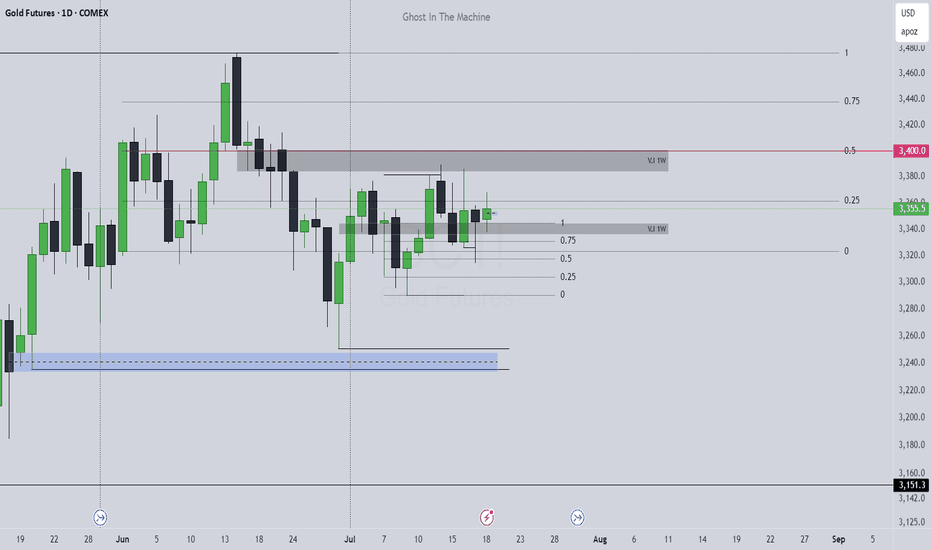

Futures market

Gold price moves sideways above 3320⭐️GOLDEN INFORMATION:

Gold prices advanced during the North American session, gaining 0.78%, supported by headlines suggesting US President Donald Trump had discussed firing Federal Reserve (Fed) Chair Jerome Powell. Although Trump later denied the reports, calling it “highly unlikely” unless fraud was involved, the speculation lifted demand for the precious metal. At the time of writing, XAU/USD is trading around $3,348, after briefly reaching a daily high of $3,377 following Trump-related headlines.

According to Bloomberg, Trump floated the idea during a meeting with GOP lawmakers focused on cryptocurrency regulation, noting that most attendees reportedly supported Powell’s removal.

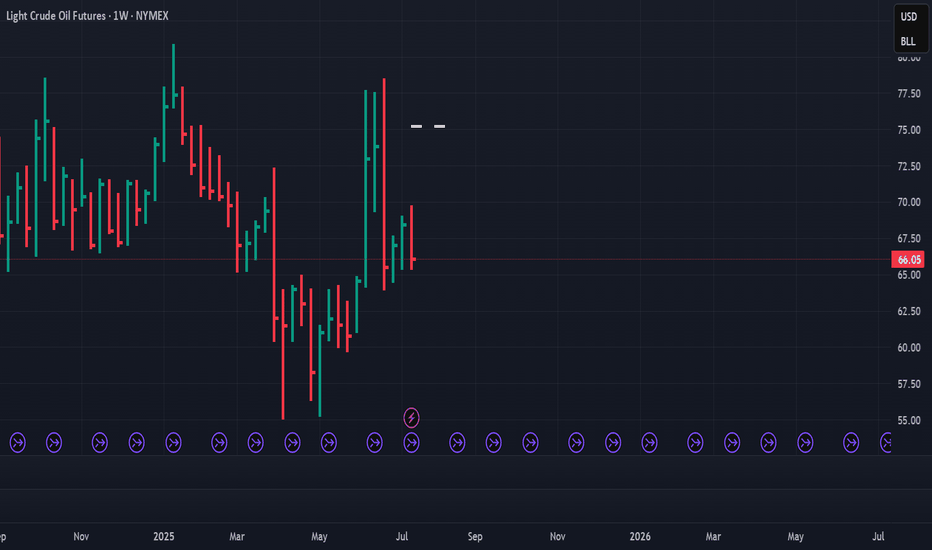

Beyond political drama, softer US economic data and ongoing geopolitical tensions also underpinned gold’s gains. The latest US Producer Price Index (PPI) came in below expectations but remained above the Fed’s 2% inflation target. Meanwhile, Israeli airstrikes in Syria helped limit downside pressure on bullion, though Gold’s upside remained capped below the $3,400 level following the recent US consumer inflation report.

⭐️Personal comments NOVA:

Gold price moves sideways in the price range of 3306 - 3380, accumulating and waiting for information on US tariffs and interest rates

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3381- 3379 SL 3386

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3306-$3304 SL $3299

TP1: $3318

TP2: $3330

TP3: $3343

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

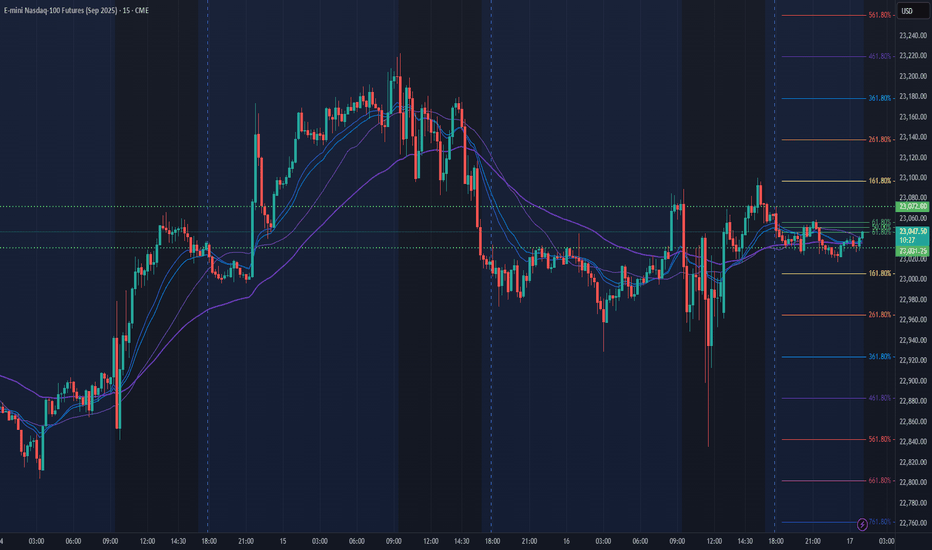

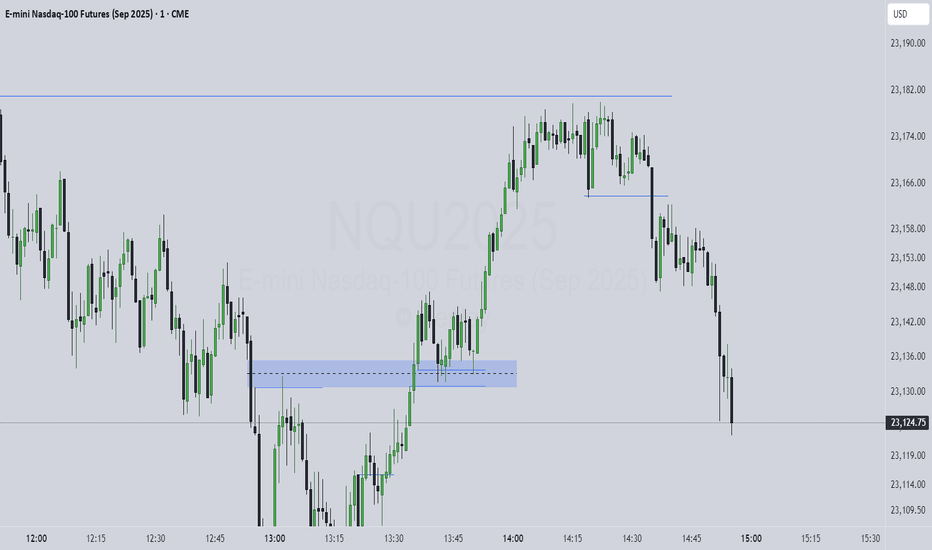

NQ Power Range Report with FIB Ext - 7/17/2025 SessionCME_MINI:NQU2025

- PR High: 23072.00

- PR Low: 23031.25

- NZ Spread: 91.25

Key scheduled economic events:

08:30 | Initial Jobless Claims

- Retail Sales (Core|MoM)

- Philadelphia Fed Manufacturing Index

Session Open Stats (As of 12:35 AM 7/17)

- Session Open ATR: 274.88

- Volume: 18K

- Open Int: 268K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

To fade all time highs or not?Not trying to fade ATH run but the SSL in this daily range looks too obvious to me. Super premium.

Price was in a consolidation July 7th - 14th. Took external range high today. I really could see shorts playing out if theres a intraweek reversal confirmed after purging the ERH.

Would need to see 1h CISD confirm intraweek reversal to the downside then trade the daily continuation lower targeting 22,779, 22,578 & EQ of the range at 22,370. Also, the daily BISI that needs sellside delivery.

CPI scheduled this week. PPI following.

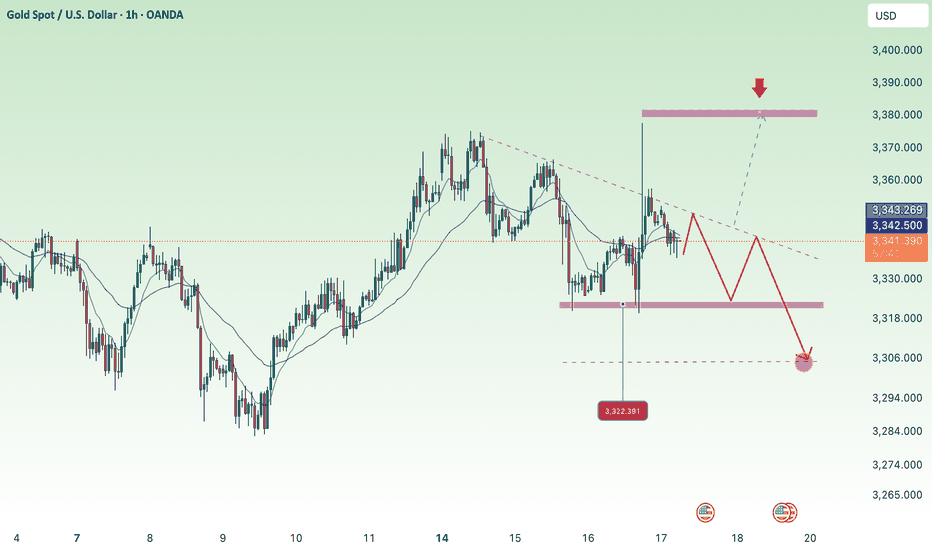

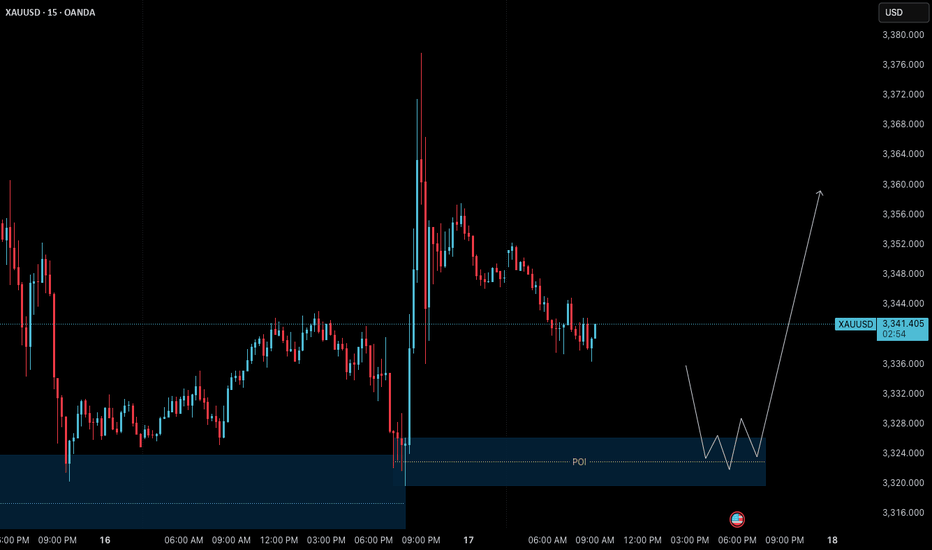

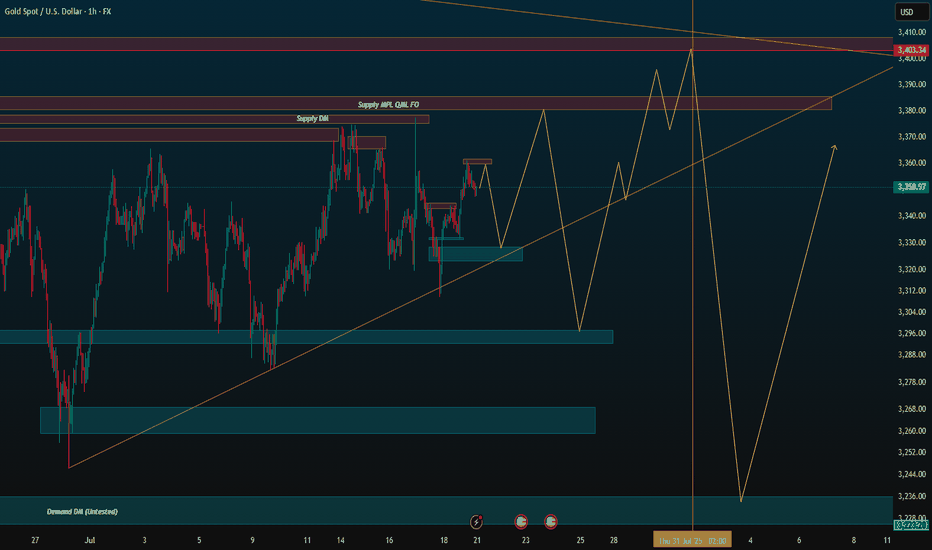

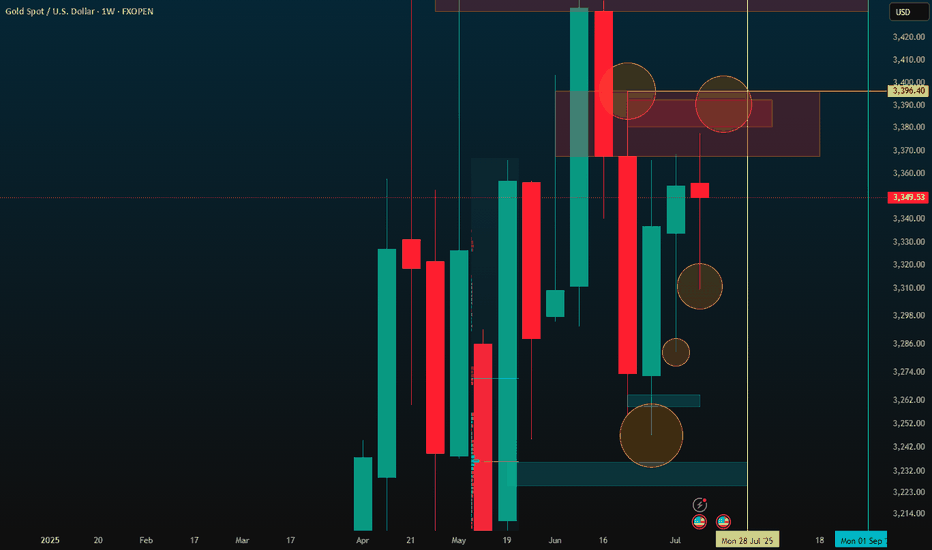

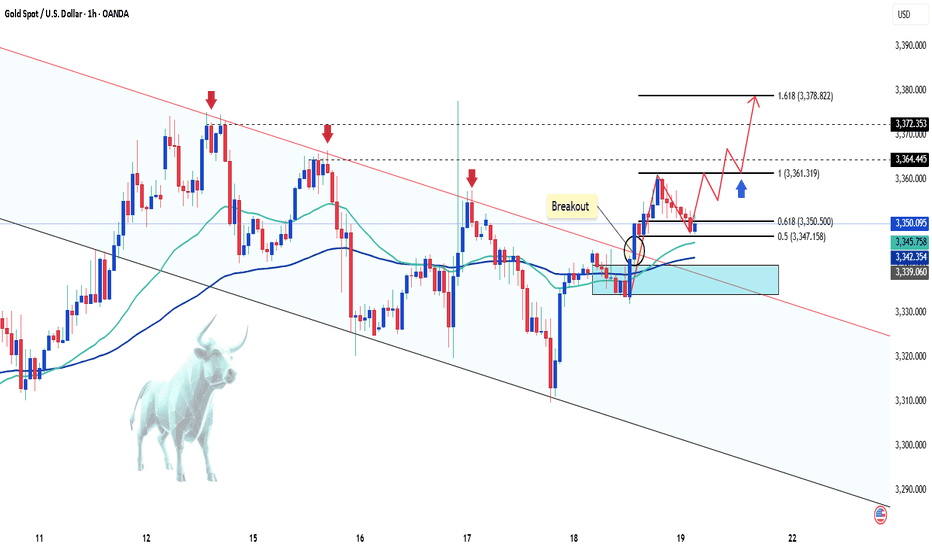

Gold (XAUUSD) – 17 July Analysis | Demand Zone in Play🟢 Gold (XAUUSD) – 17 July Analysis | Demand Zone in Play

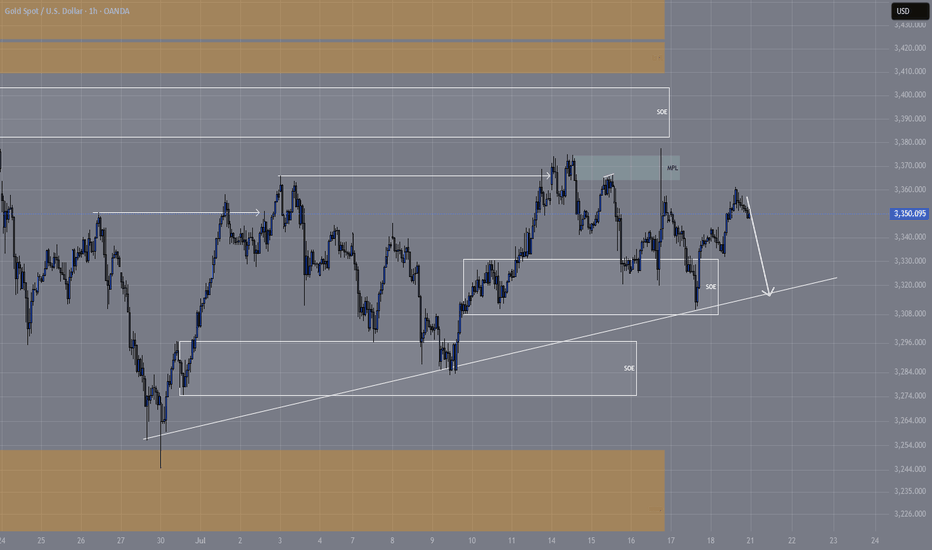

Gold continues to follow the bullish structure we’ve been tracking in our recent posts. Yesterday's news-driven price action pushed the market to a new swing high near 3377.600 , confirming strength in higher timeframes. Now, price is currently in a retracement/pullback phase , pulling back toward a key intraday demand zone at 3326–3320 — offering potential opportunity for the next leg upward.

🔍 Where Are We Now?

The market is currently pulling back toward a key M15 demand zone: 3326–3320 . This level also aligns with a higher timeframe order block on the H4, making it a critical confluence area for structure-based traders.

This 3326–3320 zone is crucial because:

→ It’s a fresh M15 demand zone inside a higher timeframe bullish structure

→ It aligns with the H4 OB that previously acted as a launchpad

→ The overall trend remains bullish unless this zone is decisively broken

If the zone holds and we get LTF confirmation (such as M1 internal structure shift + micro-BoS), it may present a high-probability long setup.

⚙️ Structure Summary:

✅ H4: Bullish continuation structure with recent higher high

✅ M15: Pullback within bullish order flow

✅ M1 (for entry): Awaiting ChoCH + BoS as entry trigger inside POI

📌 Trade Setup Plan (upon confirmation):

→ Entry: From 3326–3320 demand zone

→ Stop Loss: 40 pips below entry

→ Take Profit: 120 pips (targeting new HH based on H4 projection)

→ Risk-to-Reward Ratio: 1:3

🧠 Key Trading Insight:

We never predict — we prepare .

We don’t chase price — we position with confirmation .

Discipline means waiting for price to invite us in , not entering just because a level looks attractive.

📈 Summary & Expectations:

➡️ Price is retracing into a structurally significant demand zone

➡️ Market bias remains bullish unless this zone fails

➡️ If the zone holds with valid M1 confirmation, we’ll consider a long setup targeting a new high

➡️ No confirmation = no trade. Patience > prediction.

📘 Shared by @ChartIsMirror

This analysis is part of our ongoing structure-based approach to trading Gold. All entries are derived from pure price action, multi-timeframe structure alignment, and trader discipline — as taught in our book:

“The Chart Is the Mirror: Mastering Gold with Structure, Stillness, and Price Action”

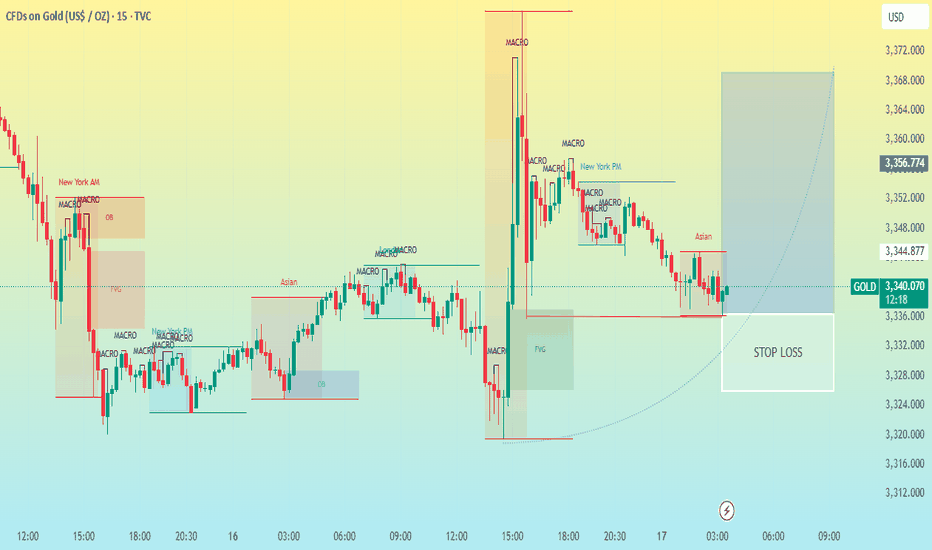

Gold (XAU/USD) 15-minute CHART PATTERNThis is a 15-minute chart of Gold (XAU/USD) with multiple trading concepts annotated. Here are the key elements:

Macro Levels: Several points are marked “MACRO,” likely denoting key market structure levels or significant order blocks.

Order Blocks (OB): Highlighted areas like the orange and blue boxes represent order blocks, potential zones where institutional buying or selling occurred.

Fair Value Gaps (FVG): The green and light red shaded areas signify imbalance zones in price action, where price may revisit to "fill" these gaps.

Sessions: "New York AM/PM" and "Asian" sessions are marked, showing session-based price behavior.

Stop Loss and Target Area: A clear buy setup is illustrated, with a stop-loss below the recent lows (around 3,330) and a projected upward price movement towards 3,360–3,370.

Interpretation:

This chart indicates a potential bullish setup from the current 3

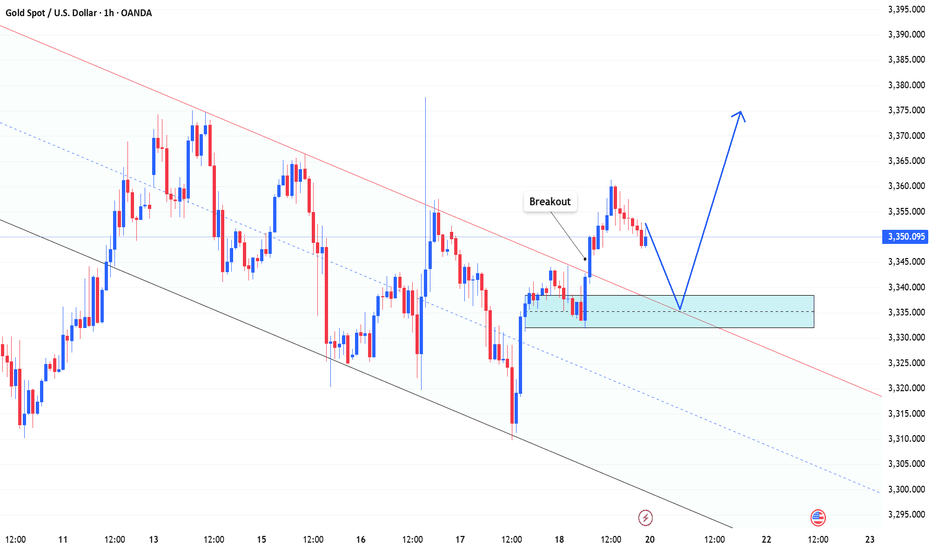

Gold 1H - Retest of channel & support zone at 3340After breaking out of the falling channel, gold is currently retesting its upper boundary — now acting as support. The 3340 zone is particularly important as it aligns with the 0.618 Fibonacci level and high volume node on the visible range volume profile. The price action suggests a potential bullish rejection from this area. With both the 50 and 200 EMA below price on the 1H, the short-term trend remains bullish. The 4H trendline further supports this setup. RSI is cooling off near the neutral zone, leaving room for another leg higher toward the 3377 resistance zone. If 3340 fails, 3324 (0.786 Fibo) becomes the next line of defense. Until then, the structure remains bullish following the successful breakout and retest of the channel.

Step-By-Step Guide to Building a Winning Gold Trading Strategy

In the today's article, I will teach you how to create your first profitable gold trading strategy from scratch.

Step 1: Choose the type of analysis

The type of analysis defines your view on the market.

With technical analysis you rely on patterns, statistical data, technical indicators, etc. for making trading decisions.

Fundamental analysis focuses on factors that drive the prices of gold such as micro and macroeconomics, news and geopolitics.

A combination of technical and fundamental analysis implies the application of both methods.

For the sake of the example, we will choose pure technical approach.

Step 2: Specify the area of analysis

Technical and fundamental analysis are complex and multilayered subjects. That is why it is crucially important to choose the exact concepts and techniques that you will apply in gold trading.

For example, with a technical analysis, you can trade harmonic patterns, or apply a combination of key levels and technical indicators.

With fundamental analysis, you can build your trading strategy around trading the economic calendar or important news releases.

Here we will choose support & resistance levels and smart money concepts.

Step 3: Select a trading time frame

Your trading time frame will define your trading style. Focusing on hourly time frame, for example, you will primarily catch the intraday moves, while a daily time frame analysis will help you to spot the swing moves.

You can also apply the combination of several time frames.

We will choose the combination of a daily and an hourly time frames.

Step 4: Define your trading zones

By a trading zone, I mean an area or a level on a price chart from where you will look for trading opportunities.

For example, a technical indicator trader may apply moving average as the trading point.

For the sake of the example, we will choose support and resistance levels on a daily time frame as our trading areas.

Step 5: Choose confirmations

Confirmation is your entry reason . It is the set of conditions that indicates a highly probable projected outcome.

For an economic calendar traders, the increasing CPI (inflation) figures can be a solid reason to open a long position on Gold.

Our confirmation will be a local change of character on an hourly time frame.

Step 6: Define your stop loss placement, entry and target selection and desired reward to risk ratio

You should know exactly where should be your entry point, where will be your stop loss and where should be the target.

We will open a trading position immediately after a confirmed change of character, stop loss will lie below the lows if we buy or above the highs if we sell.

Target will be the next daily structure.

Minimal reward to risk ration should be 1.5.

Step 7: Define Your Lot Size and Risk Per Trade

You should have precise rules for the calculation of a lot size for each trade.

For our example, we will strictly risk 1% of our trading deposit per trade.

Step 8: Set trade management rules

When the trade is active, trade management rules define your action:

for example, whether you strictly wait for tp or sl, or you apply a trailing stop loss.

In our strategy, we will move stop loss to entry 10 minutes ahead of the release of the US news in the economic calendar.

Step 9: Back test your strategy

Study the historical data and back test at least 50 trading setups that meet your strategy criteria.

Make sure that the strategy has a positive win rate.

Step 10: Try a trading strategy on a demo account

Spend at least a month on demo account and make sure that you obtain positive overall results.

If you see consistent profits on a demo account, it is the signal for you that your strategy is ready , and it's time to start trading on a real account.

In case of negative results, modify your trading conditions and back test them again, or build a new strategy from scratch.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

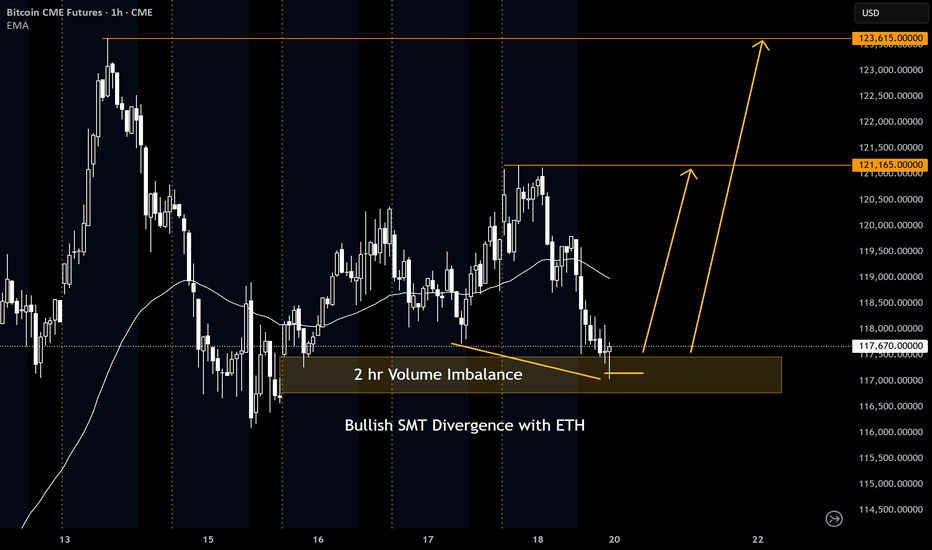

BTC Futures hitting ATH again???? Hmm....Looking at BTC futures, we have some bullish divergence with ETH. We also have a liquidity sweep into a 2 hr volume imbalance.

I will be looking at two areas to target. The first area is at 121,165 at the previous high and the second area is at 123,615 where the ATH will be broken.

Lets drop down to the 5 minute timeframe and wait for an FVG entry.

Let me know what you guys think.

Gold rebounds above $3,350 amid global tensions and Fed watchGold wrapped up Friday’s session with a gentle but notable recovery, reaching the 3,350 dollar mark and climbing over 100 pips by the end of the day. This rebound stands out as a positive signal amid a market environment filled with rising uncertainty.

The primary drivers behind gold’s strength include a weakening US Dollar, escalating geopolitical tensions, and a surge in demand for safe-haven assets. Additionally, recent economic data suggests that the US economy remains fundamentally stable, leading investors to believe that the Federal Reserve may refrain from rushing into monetary easing.

Looking ahead, growing expectations of the Fed beginning its rate-cutting cycle in late 2025 and into 2026 are creating a solid base for gold to continue its upward momentum. In a low interest rate environment, non-yielding assets like gold tend to perform better, especially during times of economic turbulence and heightened risk aversion among investors.

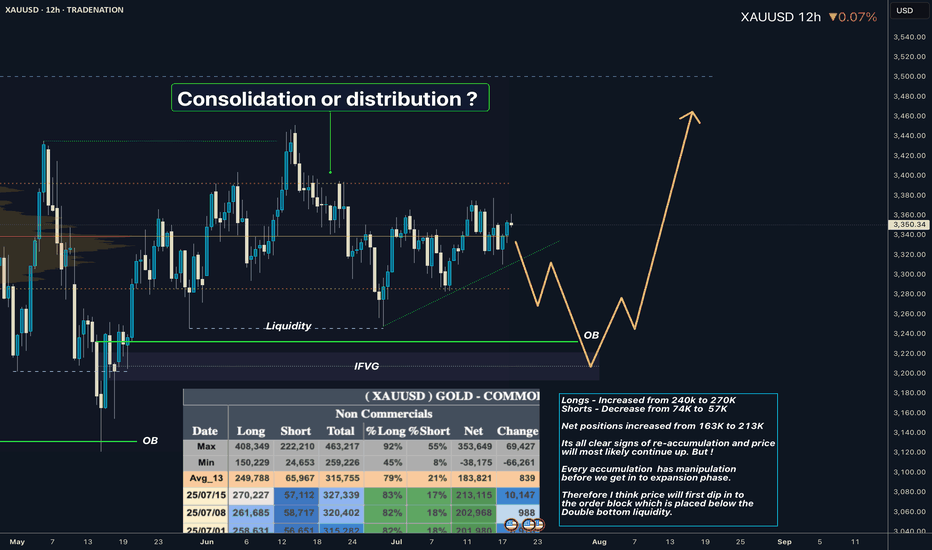

XAUUSD I Whats playing out in the range? COT overviewHey what up traders welcome to the COT data and Liquidity report. It's always good to go with those who move the market here is what I see in their cards. I share my COT - order flow views every weekend.

🎯 Non Commercials added significant longs and closed shorts at the same time. So for that reason I see the highs as a liquidity for their longs profits taking.

📍Please be aware that institutions report data to the SEC on Tuesdays and data are reported on Fridays - so again we as retail traders have disadvantage, but there is possibility to read between the lines. Remember in the report is what they want you to see, that's why mostly price reverse on Wednesday after the report so their cards are hidden as long as possible. However if the trend is running you can read it and use for your advantage.

💊 Tip

if the level has confluence with the high volume on COT it can be strong support / Resistance.

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

Gold Sees Mild Increase as USD WeakensGold ended Friday's session with a slight increase, regaining the 3350 USD level and recovering over 100 pips by the end of the day.

The weakening of the US Dollar (USD) allowed XAU/USD to rise modestly. Concerns about US President Donald Trump's erratic trade policies and their potential impact on the global economy further supported the precious metal.

In the short term, the technical chart shows gold breaking out of the downward channel and starting an upward wave. The price is currently adjusting at 3350 USD, which coincides with the 0.618 Fibonacci retracement level and the EMA zone, suggesting the potential for further price increases from this level, with targets towards key resistance levels.

Key resistance levels: 3160, 3172, and 3378 USD.

Support zones: 3350, 3340, 3331 USD.

ID: 2025 - 0084.16.2025

Trade #8 of 2025 executed. So simple, yet far from easy...

Trade entry at 93 DTE (days to expiration).

The last few weeks have been quite challenging, mostly due to increase volatility (3rd highest expansion in history), as well as widening bid/ask spreads. This trade idea will dovetail with trade id: 006 to balance delta without incurring more slippage due to spreads. This trade will hold to expiration without any adjustments until the final 30 days of trade life.

Happy Trading!

-kevin