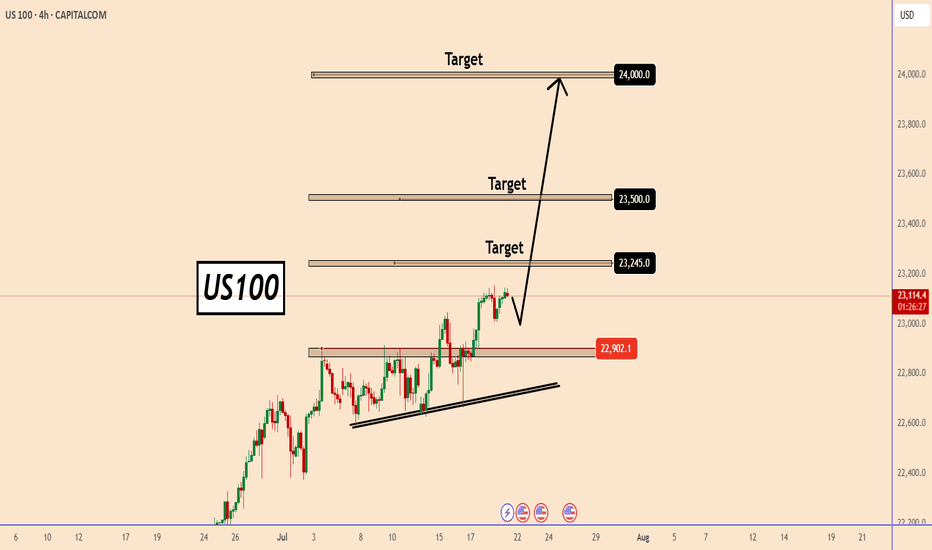

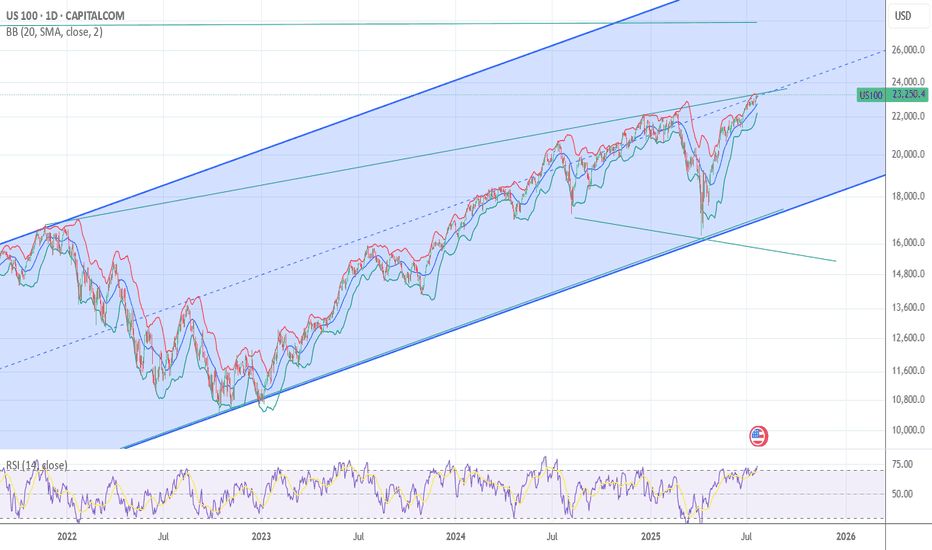

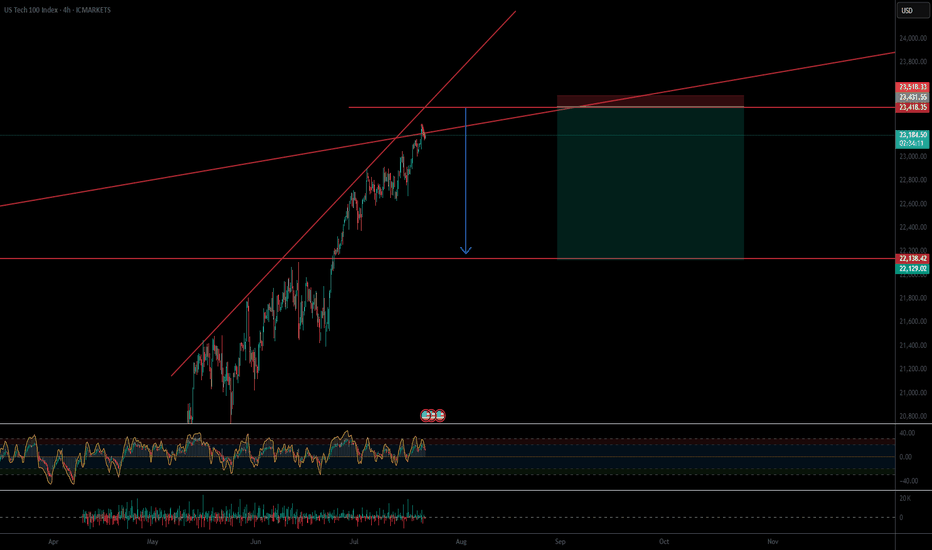

US100 continues to be in a clear uptrend.US100 continues to be in a clear uptrend.

After the price managed to break above 22900, we can see a strong bullish price action. The price increased by almost 2% in just 3 days and the volume still looks high.

There is a high possibility that even if US100 makes a small correction, it could rise further to 24000, as shown in the chart.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Market indices

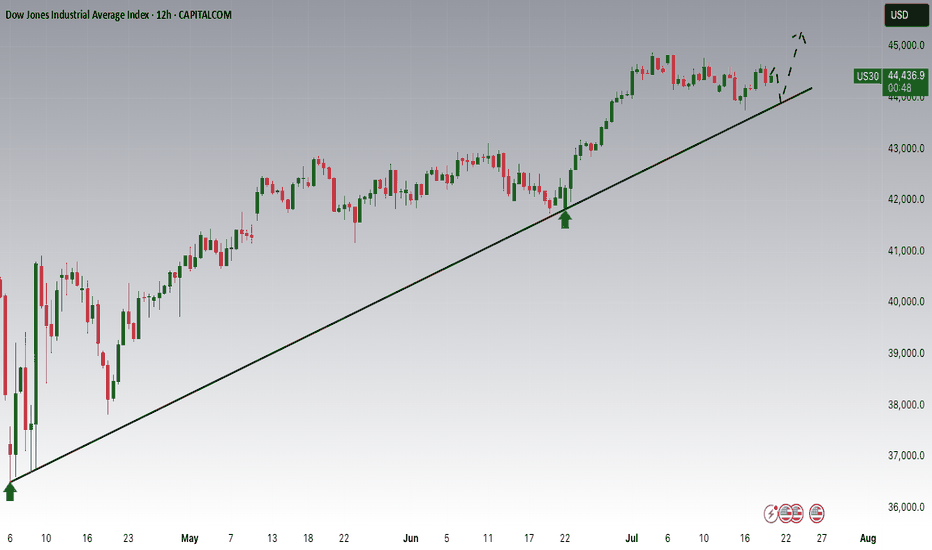

Dow Jones is Nearing an Important Support!!Hey Traders, in today's trading session we are monitoring US30 for a buying opportunity around 43,950 zone, Dow Jones is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 43,950 support and resistance area.

Trade safe, Joe.

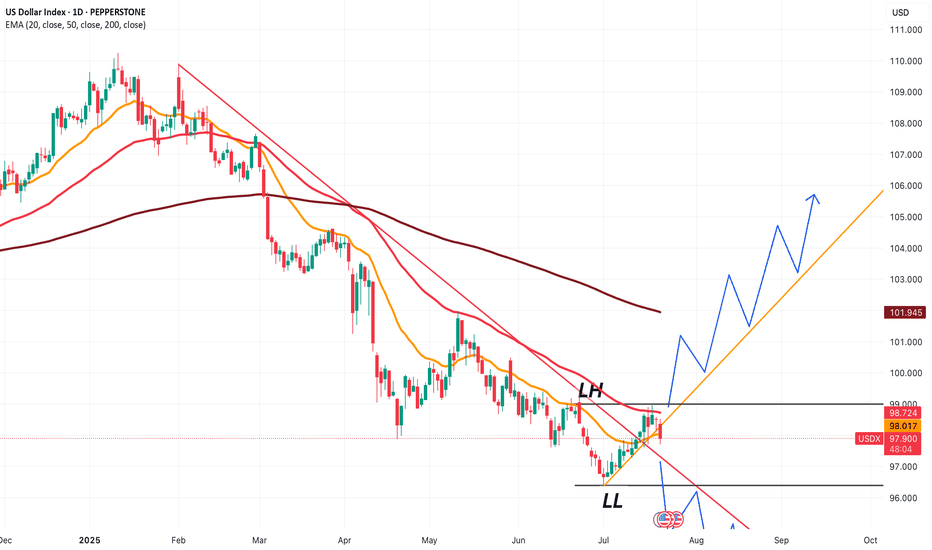

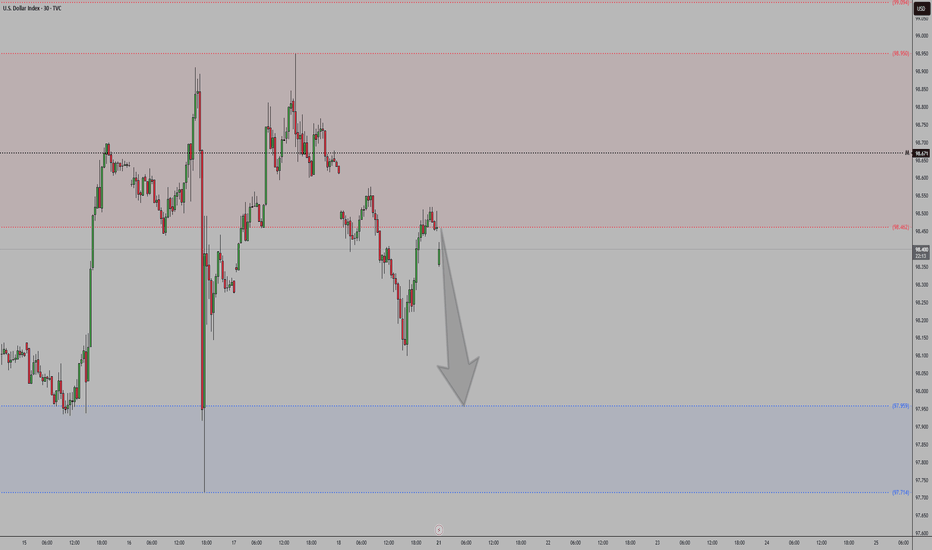

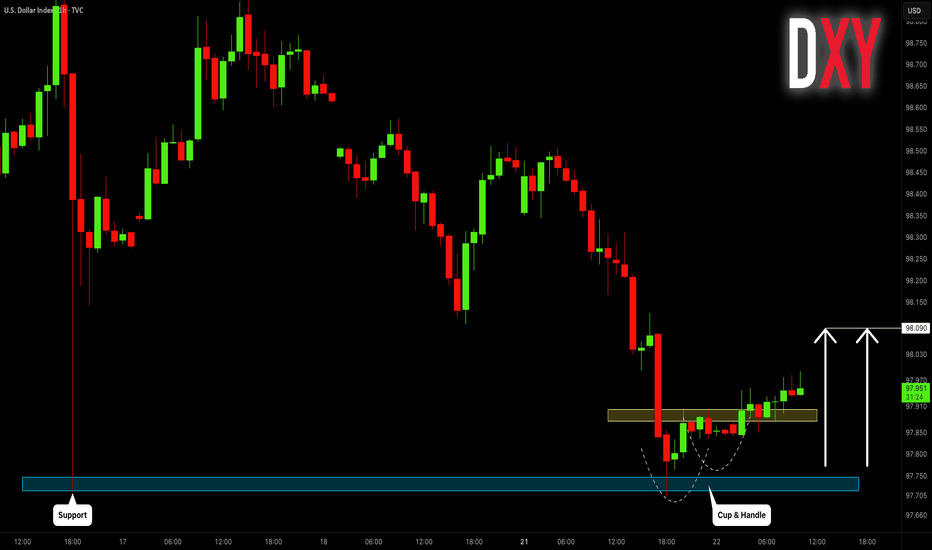

USDX at a crucial price point, which will decide trendThe next few candles for USDX price will be extremely important to understand where the dollar index is headed.

Based on that, we'll be able to choose 'which' Forex pairs we can trade, and more importantly 'how' we can trade them.

If price starts to follow the green line, and takes out 99.000, we'll be in an uptrend.

If price goes back to the red line and eventually goes below 96.400, we'll be in a downtrend.

Hopefully price won't consolidate too much, and trend in a particular direction.

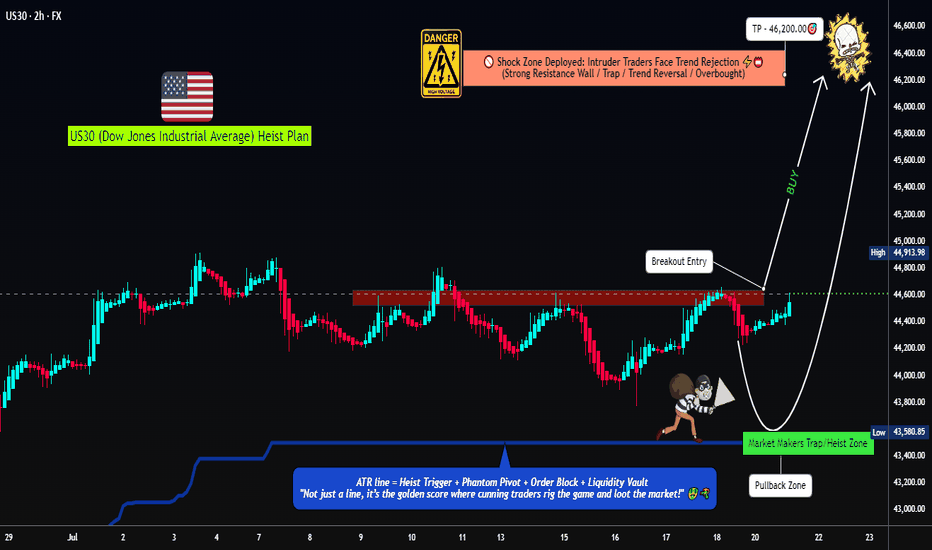

US30 Robbery Blueprint: Breakout, Pullback, Escape Setup💎 Dow Jones Robbery Blueprint: The US30 Vault Crack Plan 💎

(Maximized for reach — within TradingView title limit)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Robbers & Money Movers 🕵️♂️💰🚨

This ain't your average analysis — it’s a Thief Trader-style 🔥tactical mission🔥 aimed at the mighty "US30/DJI" (Dow Jones Industrial Average). We're talkin' about a precision heist with a full blueprint: entry zones, trap setups, and escape exits. Read carefully — this ain’t for the faint-hearted traders! 🧠🦾

🧠 Entry Zones (The Break-In) 📈

🛠 ENTRY 1: Crack the wall near 44700.00 – that’s the resistance gate. Wait for confirmation.

🎯 ENTRY 2: Sneak in at the Market Makers’ Trap around 43500.00 – a dirty zone where retailers get baited. Perfect time to strike long!

🧱 DCA/Layering strategy recommended. Stack those buy orders like a thief layering explosives on a safe. 💣💸

🛑 Risk Levels (Escape Routes/Stop Loss)

🔊 "Listen up, vault raiders! Never drop your SL until breakout is confirmed. If you jump early, you might land in a bear trap! 🪤"

🔐 Stop Zones (Based on Strategy):

📌 Swing Buy SL (2H TF): Place at 44100.00 for the stealth buy.

🏦 Institutional SL (Swing Zone): Drop it around 43000.00

🔐 Max Risk SL (3H TF): If you're deep, your last stand is at 39200.00

☝️ SL depends on your position sizing, number of entries, and risk appetite. Trade like a thief, not a gambler.

🎯 Heist Target (Profit Exit)

🏁 Escape Point: 46200.00 — or exit before heat rises! Don’t be greedy. Rob and vanish. 💨💰

🔥 Market Mood: Why the Heist Is On

"US30/DJI" is bullish AF — thanks to:

📊 Macro-Economic Wind at Our Back

📈 Institutional momentum

📰 Strong sentiment and intermarket flows

Check your chart radar: Fundamentals + technicals aligning = green light for robbery! 🟢

⚠️ Tactical Reminder: News Can Jam the Plan

📵 Avoid new entries during major economic releases

🛡 Use trailing SLs to protect running trades

Stay alert, stay alive. 💡

❤️ Support the Robbery Crew

Hit that 💥BOOST💥 — your love fuels our next mission.

Join us and ride daily heist plans with Thief Trading Style 🏴☠️🚀💰

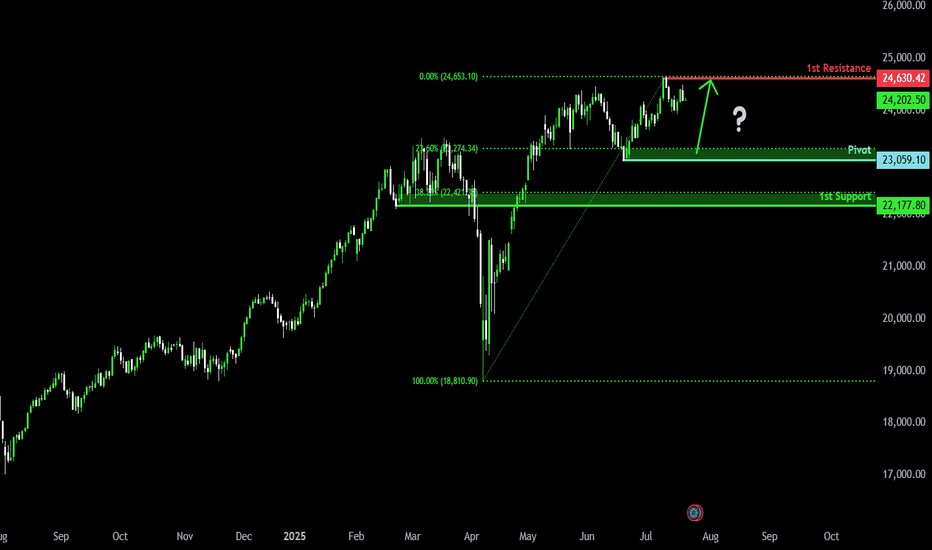

Bullish momentum to extend?DAX40 (DE40) is falling towards the pivot which has been identified as a pullback support and could bounce to the pullback resistance.

Pivot: 23,059.10

1st Support: 22,177.80

1st Resistance: 24,630.42

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

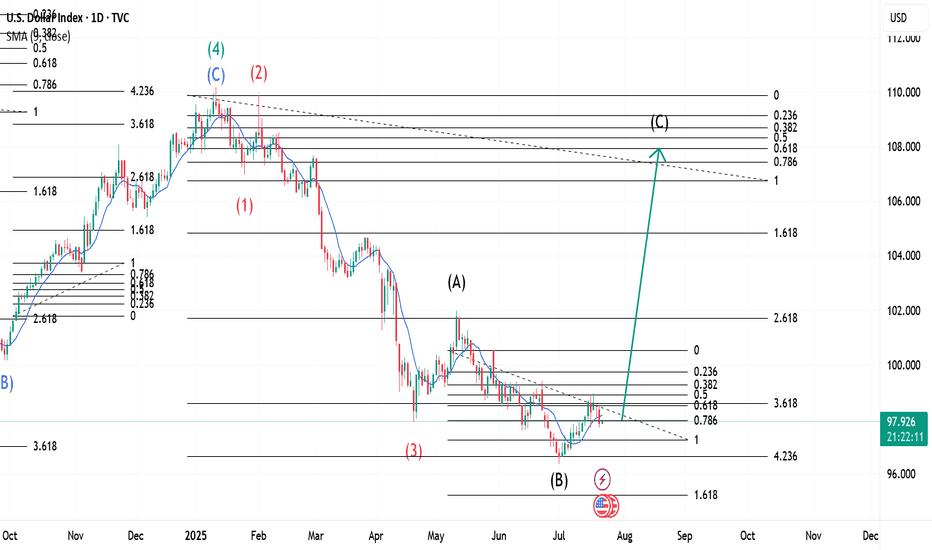

The $ Index ~ Elliott Wave Theory in real time.This is an update of a previously uploaded Dollar index Chart. Analysis remains the same and a confirmation at its current location would trigger continuation of the upward move as analysed on the first chart I had posted. Theoretically, the pullback on Monday, 21st July 2025 could be our Wave 2 with Wave 1 being on Thursday, 17th July 2025.

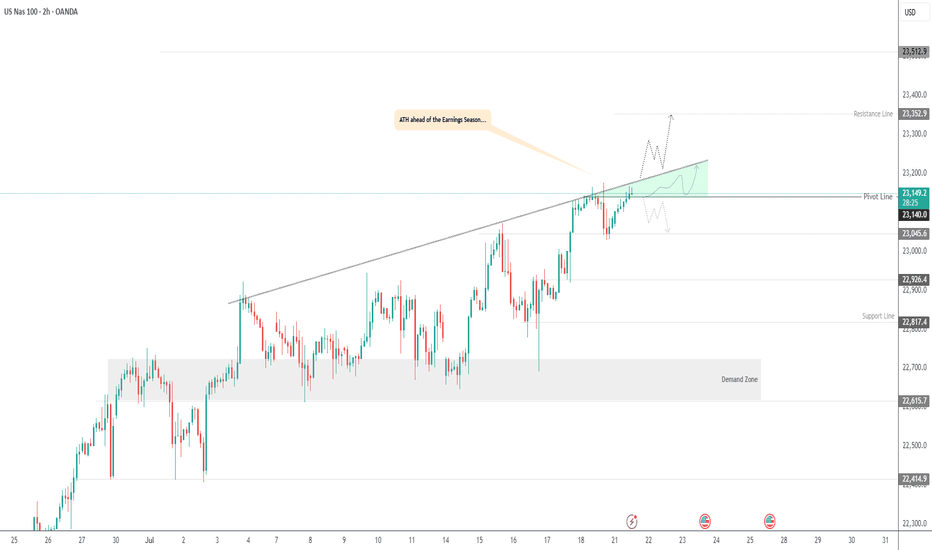

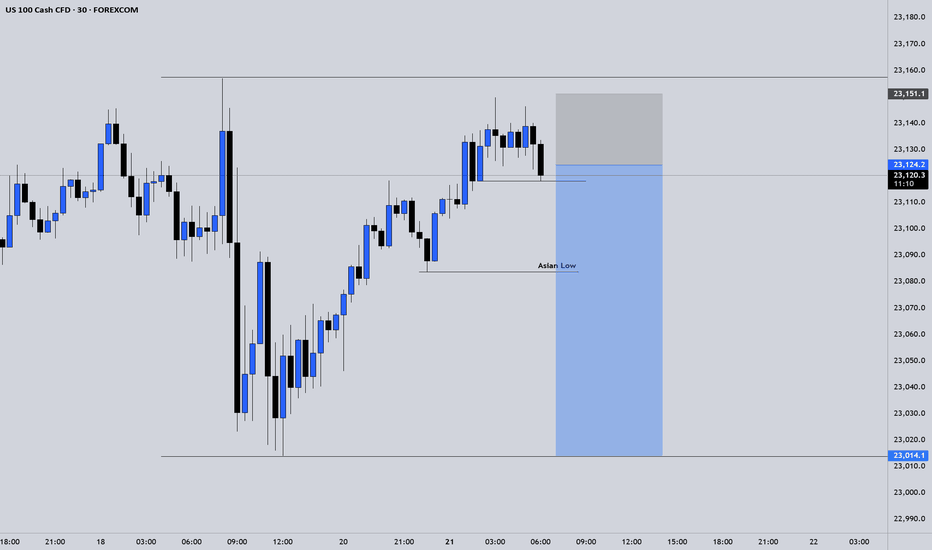

USNAS100 | Bullish Setup Ahead of Tech Earnings & Trade RiskUSNAS100 | Bullish Setup Ahead of Tech Earnings & Trade Risk

U.S. equity markets are entering a pivotal week with big-tech earnings and renewed focus on Trump’s proposed trade tariffs. Both the S&P 500 and Nasdaq are hovering near record highs, but new catalysts are required for continuation.

Technical Outlook:

The price has stabilized above 23140, breaking the pivot and confirming bullish momentum. As long as the price holds above this level, the trend remains bullish, especially if it breaks the green triangle resistance structure.

A sustained move above 23140 opens the path toward 23250 and 23350, with further extension possible to 23510.

However, a 4H close below 23140 may activate a bearish correction toward 23045, and possibly deeper toward 22920 and 22820.

Resistance Levels: 23250 · 23350 · 23510

Support Levels: 23045 · 22920 · 22820

Bias: Bullish above 23140

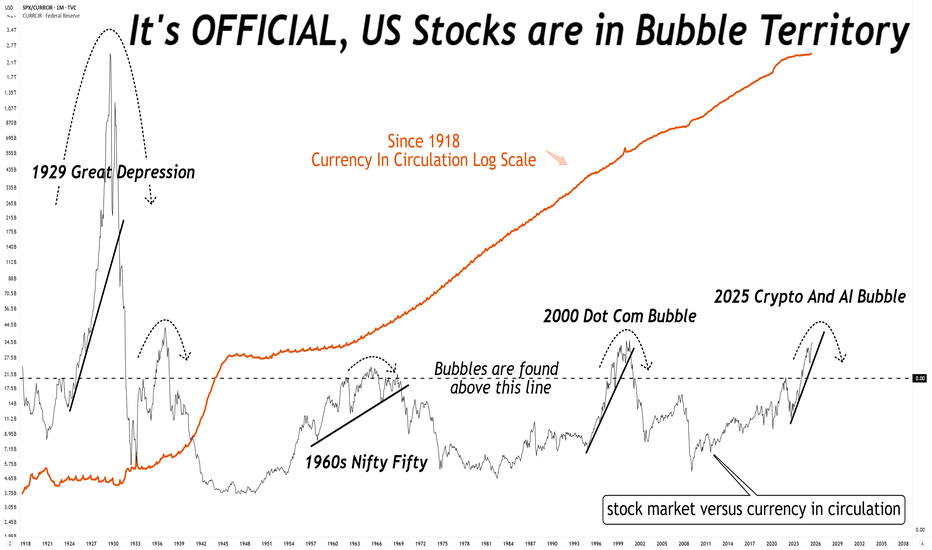

I am 100 % short spy and qqq I am BULLISH DXY the chart posted is now setup for the cycle top On several cycles and we have just popped the Shiller p/e above 3866 second highest reading ever . Cycle are into a peak that was due 7/5 to 7/14 So why are we now turning down .? wait the energy from one of the largest solar storms is the time for the transition it is also a new moon . my spirals have called for the top as it did in 12/5 and 2/17 . I see a min drop of over 8 and could see well over 11.8 within the next 90 days . best of trades WAVETIMER

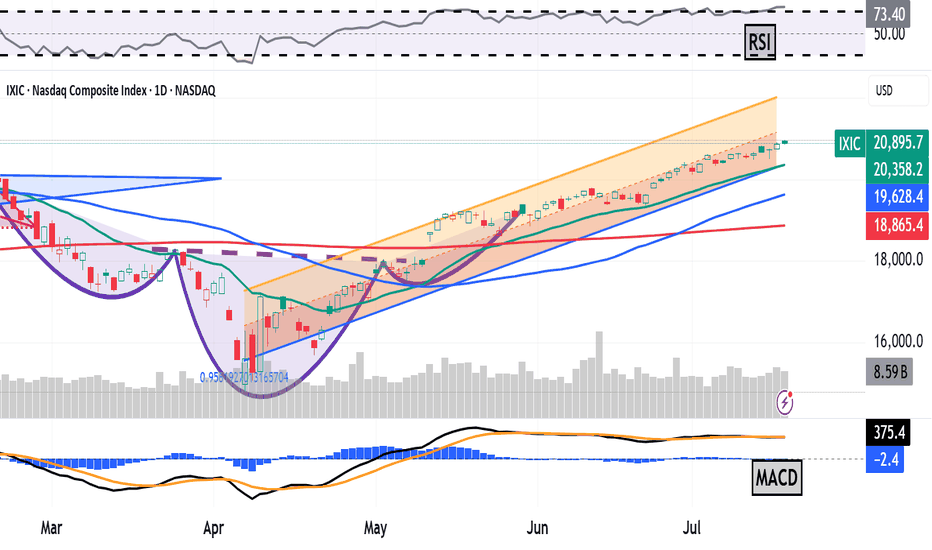

The Nasdaq Composite Is at a Record. What Does Its Chart Say?The Nasdaq Composite NASDAQ:IXIC has set multiple new all-time highs in recent weeks, but what does its chart say might happen next?

Let's check it out, starting with the IXIC's year-to-date chart as of Thursday afternoon:

Readers will note that the Nasdaq Composite bottomed out on April 7, shortly after President Donald Trump's "Liberation Day" tariff announcement.

However, the index, which consists of more than 2,500 companies listed on the Nasdaq Stock Market, has pretty much been in rally mode ever since. Can that continue?

Well, the chart above shows what's known as an "inverted head-and-shoulders" pattern of bullish reversal, marked with purple curving lines.

This pattern's "neckline" (denoted by the dotted purple line above) illustrates a pivot at just about 18,029 vs. the record 20,895.66 that the Nasdaq Composite closed at on Friday.

Readers will see that this neckline acted sort of like a springboard when it was triggered back on May 12.

The Nasdaq Comp also took back its 21-day Exponential Moving Average (or "EMA, marked with a green line) in late-ish April, then its 50-day Simple Moving Average (or "SMA," marked with a blue line) on April 30. This presumably forced portfolio managers to increase their long-side exposure.

Next, the Nasdaq Comp retook the even-more-important 200-day SMA (the red line above) during the index's May 12 breakout.

Readers will also see that the index benefited algorithmically in late June what's called a "golden cross." That occurs when a stock's 50-day SMA crosses above its rising 200-day SMA.

Meanwhile, a Raff Regression model (shaded in orange and tan at the chart's right) shows that Nasdaq Composite has stayed with the uptrend in place since its April bottom. And as an old Wall Street saying goes: "The trend is your friend."

Net result: Here we are in mid-to-late July and the index is still trading at or near all-time record highs.

Will it be smooth sailing from here?

Well, there's a lot to consider before saying that. First, second-quarter earnings season has just started, and how it plays out could heavily impact the Nasdaq Composite.

Second, the war of wills between Trump and Federal Reserve Chairman Jerome Powell seems to be a growing issue. And while tariffs have yet to noticeably slow down corporate margins, impact inflation or damage labor markets, there's no way to know if we're out of the woods there.

Meanwhile, the Nasdaq Composite is also facing some less-rosy technical indicators.

For example, the index's Relative Strength Index (the gray line at the chart's top) is now in technically overbought territory. That doesn't necessarily mean the index will sell off from here, but it does mean that investors should be more alert to that possibility.

Also note that the Nasdaq Composite's Moving Average Convergence Divergence indicator (or "MACD," marked with blue bars and gold and black lines at the chart's bottom) is flashing some mixed signals.

The histogram of the 9-day EMA (the blue bars) is running below the zero-bound, which is typically a short-term bearish sign.

That said, the 12-day EMA (the black line) and 26-day EMA (the gold line) are both running well above zero, which is technically positive.

However, while the two lines have been running together for about six weeks now, should the 26-day line cross above the 12-day one, that would historically represent another bearish signal for the Nasdaq Composite.

Add it all up and the Nasdaq Comp's technical picture looks bullish in historical terms.

The above chart appears to signal not long-term weakness, but potential opportunities in both the short- and medium-term future.

That's probably going to remain true until it isn't, right?

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle had no position in Nasdaq Composite-related ETFs or mutual funds at the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

NIFTY SUPPORT & RESISTANCE ZONES FOR 22-07-2025Nifty Support & Resistance Zones for Tomorrow 22-07-2025

Based on price cluster analysis and recent market structure, the following key support and resistance levels have been identified for the upcoming session:

Resistance Zones:

25438.25 – 25454.15

25363.45 – 25374.55

25257.60 – 25287.05

25178.00 – 25194.70

25089.70 – 25111.15

Support Zones:

25012.50 – 25030.00

24901.90 – 24931.35

24800.00 – 24825.50

24725.20 – 24733.20

24642.45 – 24651.20

These levels are derived from high-probability zones where price has shown repeated interaction in the recent past. Watch how Nifty reacts at these zones for potential breakout, reversal, or pullback setups.

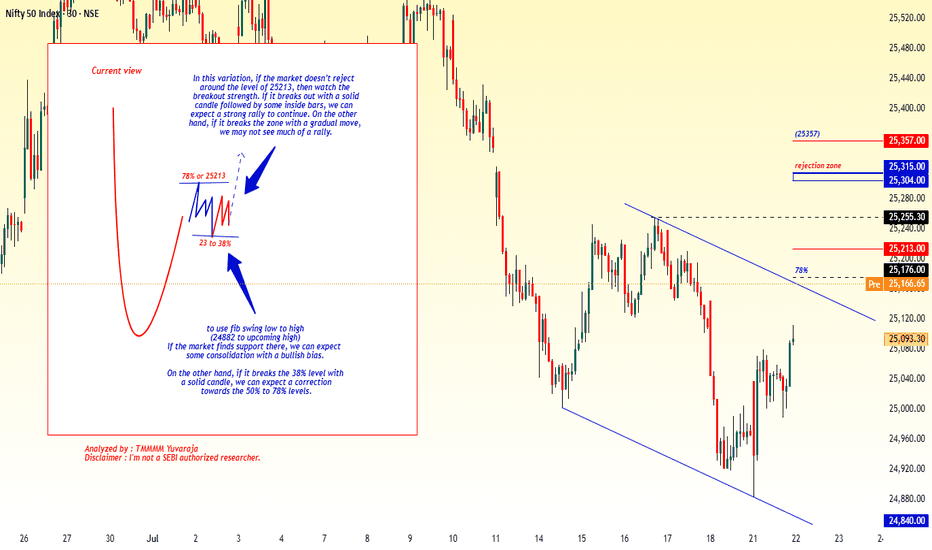

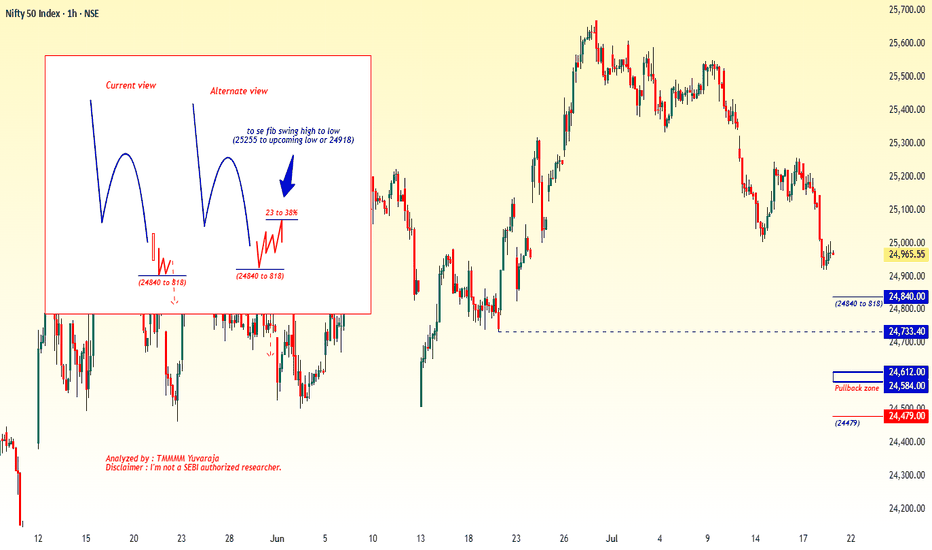

#Nifty directions and levels for July 22nd:Good morning, friends! 🌞

Here are the market directions and levels for July 22nd:

The global market shows no major changes and continues to maintain a moderately bearish sentiment.

Meanwhile, the local market is exhibiting a moderately bullish tone. Today, Gift Nifty indicates a gap-up opening of around 100 points.

What can we expect today?

In the previous session, both Nifty and Bank Nifty experienced a pullback and managed to sustain it. However, structurally, the trend remains bearish in the lower time frame. So, how should we interpret this sentiment?

1, Since there’s no clear direction, if the market faces rejection initially, we can expect minor consolidation within the 38% Fibonacci range.

2, On the other hand, if it sustains the gap-up and breaks the immediate resistance with a solid structure, we can follow the direction for further upside.

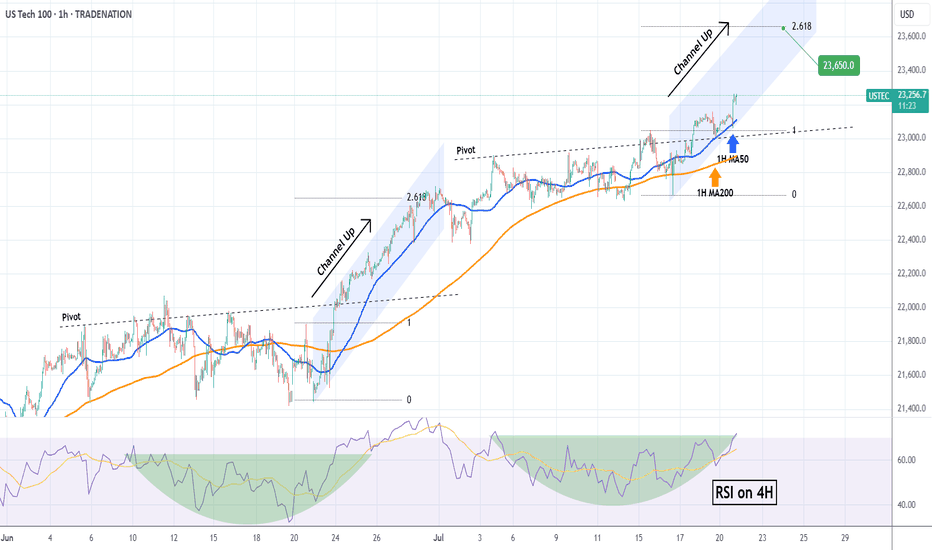

NASDAQ Rebounding on its 1H MA50.Nasdaq (NDX) rebounded today on its 1H MA50 (blue trend-line), third time since Friday's and Thursday's bounce. A Channel Up is emerging and based on the 4H RSI it is a medium-term bullish reversal off the Pivot trend-line, similar to June 20 - 30.

As you can see, that Channel Up targeted the 2.618 Fibonacci extension before breaking below the 1H MA50 to start a lengthy consolidation. Based on that, we are targeting 23650 (Fib 2.618 ext) on the short-term.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

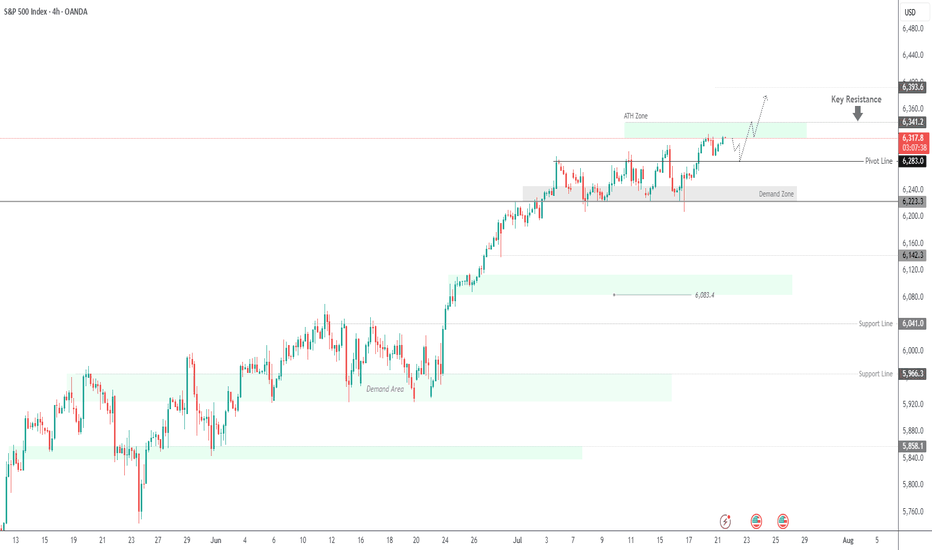

SPX500 Near ATH | Earnings Week Could Fuel Next MoveSPX500 | Weekly Outlook

The S&P 500 continues its bullish run, trading at record highs as investors await a critical week of tech earnings. Reports from Alphabet and Tesla could be key in justifying the lofty valuations driven by the AI boom.

Technical Outlook:

The price is expected to consolidate between 6341 and 6283 before any decisive move. A short-term bearish correction may occur initially, but if the price holds above the support zone, a push toward a new ATH at 6341 is likely. A breakout above this level could extend gains toward 6375 and 6393.

However, a break below 6283 would indicate weakness, potentially driving the price toward the demand zone near 6250 and 6224.

Support: 6283 · 6250 · 6224

Resistance: 6341 · 6375 · 6393

KOG - US30US30

Looking at this we have a clean reversal in play suggesting we’re going to get lower order regions before a potential RIP. The red boxes have been added and may give us opportunities to capture the tap and bounces on the smaller TFs.

If we can support lower, we could very well see this push up into the ideal target level we have illustrated.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

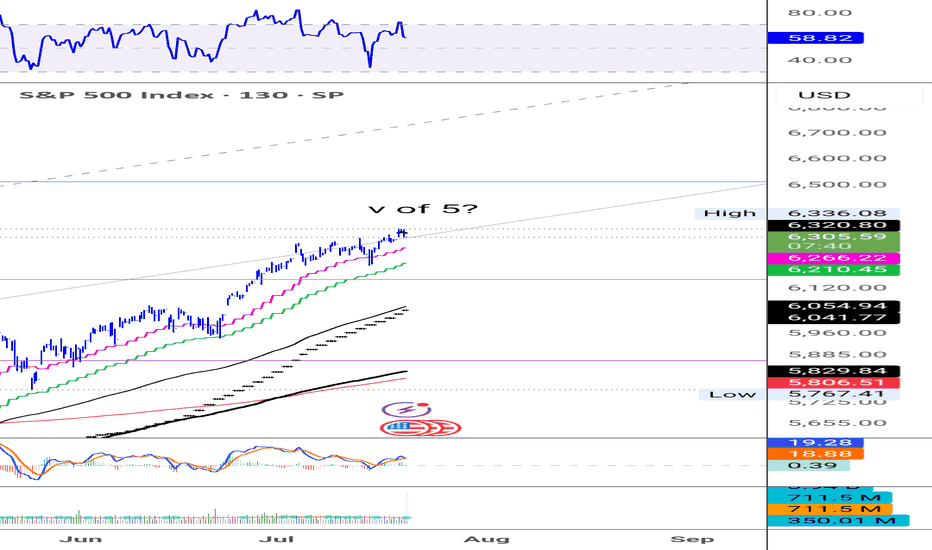

SPX - Time for a correction? To make it very simple,

Prices have been going up very nicely those last few weeks and months.

Everyone is happy but as we know that can't last.

NASDAQ:OPEN seems to be the latest pump and dump and it's just another sign of a coming correction imho.

Most stocks I've been following have reached resistance zone, levels where profit taking is very likely.

$S&P500 seems to have made a fifth wave, RSI divergence is present and confirming that.

It's difficult to pinpoint the exact top of course so I'm giving myself some leeway and use a small 1% stop loss in this case.

#Nifty directions and levels for July 21st:Good morning, friends! 🌞

Here are the market directions and levels for July 21st:

The global market shows no major changes and continues to maintain a moderately bearish sentiment.

Meanwhile, the local market is exhibiting a bearish tone. Today, Gift Nifty indicates a neutral to slightly gap-down start,

around 30 points negative.

What can we expect today?

In the previous session, both Nifty and Bank Nifty fell sharply. Structurally, the trend remains negative.

However, due to major firms' results, we might see some volatility in the first half, possibly leading to initial speculation.

That said, as per the structure my expectation is a continuation of the correction that's my current view

The alternate view is If the market takes an initial pullback, we could see a 23–38% retracement in the minor swing. Even in this scenario, the bias remains bearish unless the 38% Fibonacci level is broken.

A break above 38% could extend the pullback toward the 50–78% levels.

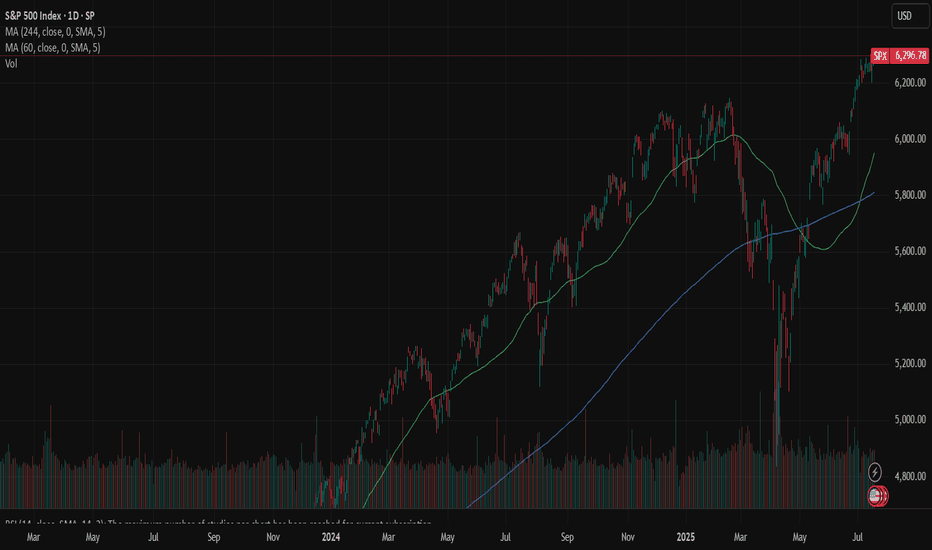

SPX: Banks beat, stocks peakThe US equity markets remained relatively resilient this week, despite ongoing concerns about trade policy developments. After last week’s slight retreat from its all-time high, the S&P 500 resumed its upward momentum early in the week, continuing to hover near record levels. The index reached a new highest level of 6,315 on Friday before pulling back slightly, closing the week at 6.296.

Bank earrings were in focus of investors during the previous week. Overall, Q2 reports from major U.S. banks showed resilience — better-than-expected earnings, strong interest income, and robust capital actions. So far, the finance sector has seen Q2 earnings rise around 13% y/y and 3,4% revenue growth. In addition, a stress test posted by Fed underpin confidence as all major banks, including JPMorgan and Citi showing resilience also under potential stress conditions. However, both bankers and investors held a cautious tone on macro/public policy risk.

Investors' confidence was additionally boosted by better than expected US macro data posted during the previous week. The inflation rate in June was 0,3% for the month and 2,7% on a yearly basis. At the same time, retail sales beat market expectations with an increase of 0,6% in June. As per analysts reports, currently 27 stocks included in the S&P 500 are trading at the all time highest levels. The ADM company, which is well known for producing Coca Cola, had a drop in the value of shares of 2% after the US President requested from the company to use real cane sugar in their popular drink.

From July 23st a composition of companies included in the S&P 500 index will be changed. A crypto company Block will be included, while the company Hess will be excluded from the index. Shares of the Blok surged by 10% on Friday, after the release of the news.

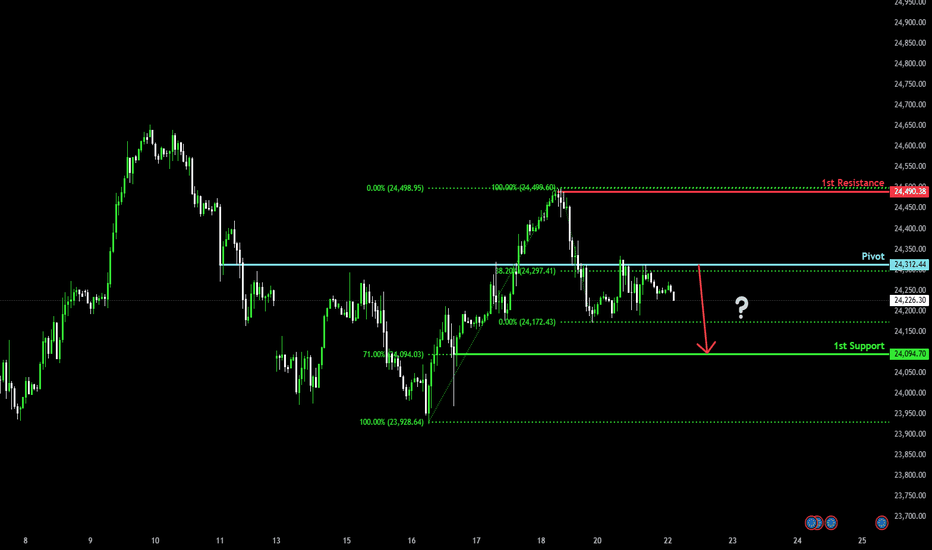

Bearish drop?DAX40 (DE40) has rejected off the pivot and could drop to the 1st support.

Pivot: 24,312.44

1st Support: 24,094.70

1st Resistance: 24,490.38

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.