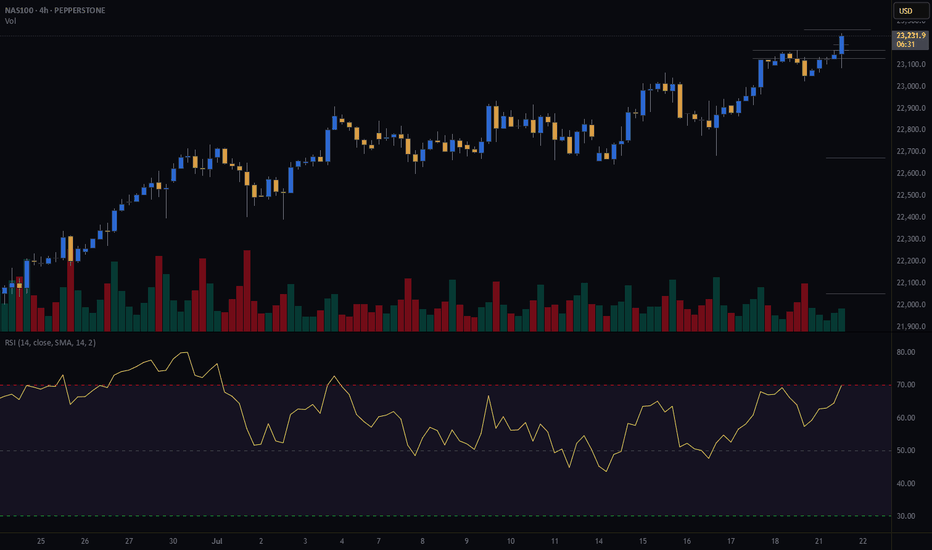

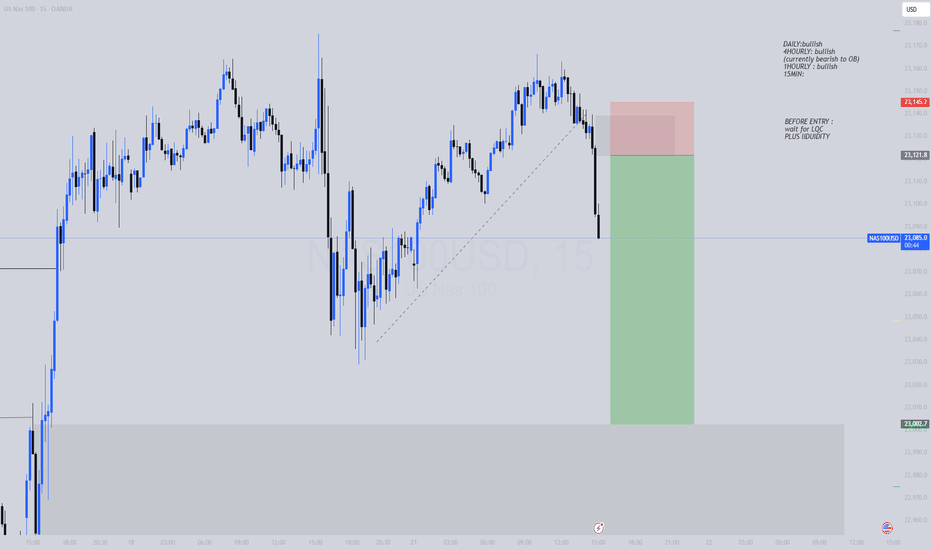

#NDQ - Monthly Targets: 23721.73 or 21387.86?Date: 03-07-2025

#NDQ - Current Price: 22641.89

Pivot Point: 22554.80 Support: 22276.15 Resistance: 22835.11

Upside Targets:

Target 1: 23028.36

Target 2: 23221.62

Target 3: 23471.67

Target 4: 23721.73

Downside Targets:

Target 1: 22082.06

Target 2: 21887.98

Target 3: 21637.92

Target 4: 21387.86

Market indices

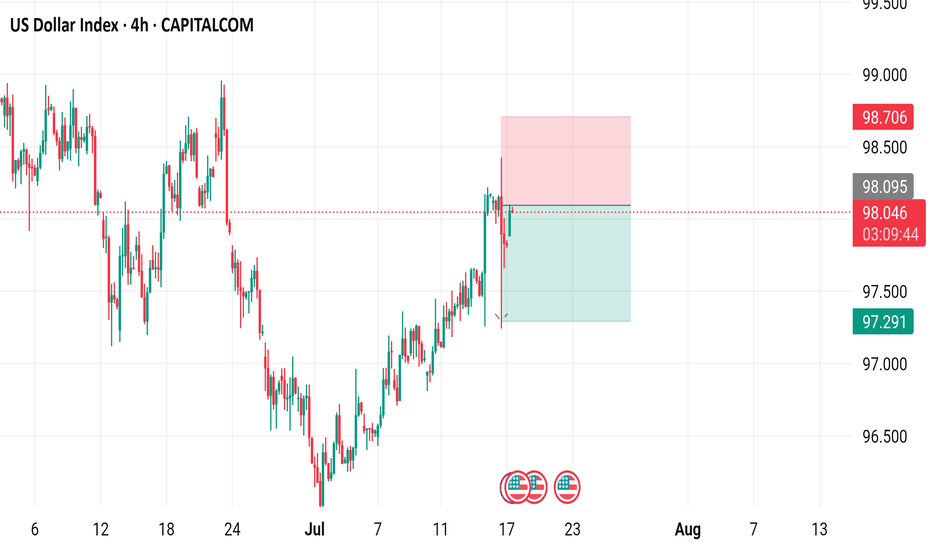

U.S. Dollar (DXY) bearish?Will dollar continue its bearish momentum or will it reverse?

Technical Summary

DXY remains in a firm bearish trend, having dropped around 11% this year. The setup is formed by a chain of lower highs and lower lows, confirming an unrelenting downtrend.

Support Level: ~97.70

Resistance Zone: 98.55–98.80

Long-Term Outlook: Bearish, unless a clear break and close over the resistance zone on the daily or weekly timeframe.

Technically, the momentum indicators remain weak, and the failure to sustain rallies above the 99.00 level also contributes to downward pressure further. The market is now consolidating within a narrow range after steep selling, which suggests probable continuation if macro catalysts are favourable.

Fundamental and Sentiment Drivers

Several macroeconomic and geopolitical drivers are underpinning the weakening of the U.S. dollar:

Federal Reserve Uncertainty:

Speculation over the ultimate fate of Federal Reserve Chairman Jerome Powell under political pressure from the executive branch has severely undermined investor confidence in the central bank’s independence. This has been manifested in increased volatility and bearish pressure on the dollar.

Trade Policy and Tariff Risks:

Ongoing trade tensions, including the possibility of sweeping tariffs (15–20%) on Chinese and European Union goods, have created a risk premium on valuations of the U.S. dollar. Market players still fear retaliation and its effects on trade stability in the world.

Fiscal Position and Credit Ratings:

The US fiscal deficit, which is approaching 7% of GDP, and recent credit rating downgrades to its outlook, have set alarms ringing regarding the structure. These fiscal developments have eroded the popularity of the US dollar as a safe-haven asset, particularly with foreign investors.

Global Monetary Landscape:

With European Central Bank and Bank of Japan maintaining policy guidance tight, and Federal Reserve already indicating that direction for a rate cut in Q4 2025 is being eyed, the falling rate differentials still maintain pressure on the dollar.

Market Outlook: Week of July 21–25, 2025

Major Geopolitical and Economic Events:

DATE : Ongoing

EVENT : U.S.- EU & U.S. — China Trade Negotiations.

MARKET RELEVANCE : High

Resolution or escalation will directly impact USD demand.

DATE : Mid-week

EVENT : Federal Reserve Speeches (including Powell)

MARKET RELEVANCE : High

Monetary policy guidance and institutional stability.

DATE : July 24–25

EVENT : Jobless Claims, Flash PMIs, New Home Sales, Durable Goods Orders

MARKET RELEVANCE : Medium–High

Labour market data, housing data, and production activity have the potential to shift rate expectations and dollar sentiment ahead of the FOMC and PCE releases.

Strategic Implications

Outlook: DXY remains structurally bearish in the short to medium term. Additional weakness below 98.80 and sustained closes below 97.70 would reassert downward momentum, risking a further retracement to the 96.00-95.50 region.

Possible Bullish Reversal Triggers:

A conclusive resolution to U.S. trade negotiations.

Unexpectedly solid economic data (particularly core inflation or employment).

Hawkish Fed commentary supporting policy tightening expectations.

Last thoughts

The U.S. Dollar Index is currently at structurally weak technical and fundamental foundations. Absent a sudden reversal of the monetary policy message or geopolitical resolution, the path of least resistance appears to remain to the lower side. Market participants need to pay special attention to upcoming economic data releases, central bank rhetoric, and trading news because any one of them could be a pivotal driver of near-term dollar behavior.

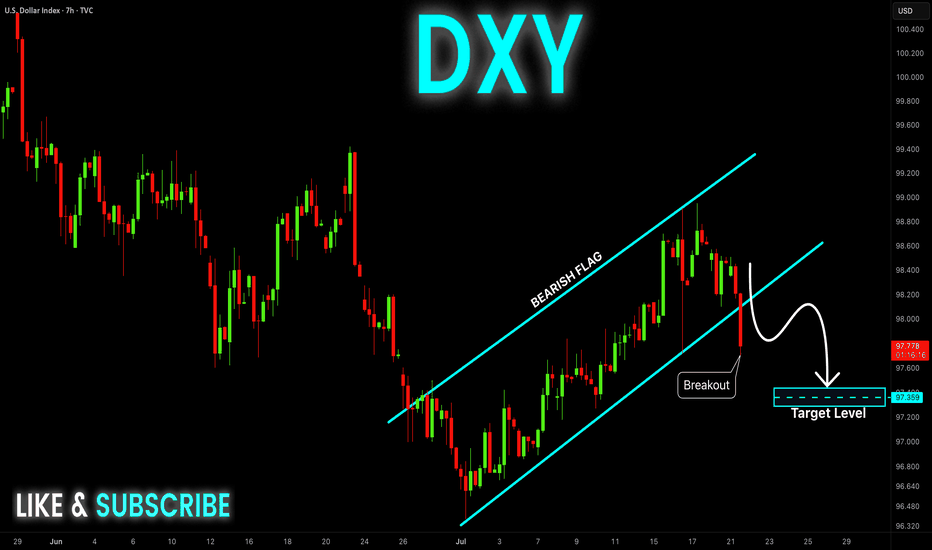

DXY Bearish Breakout! Sell!

Hello,Traders!

DXY is trading in a strong

Downtrend and the index

Made a bearish breakout

Out of the bearish flag pattern

So we are bearish biased

And we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

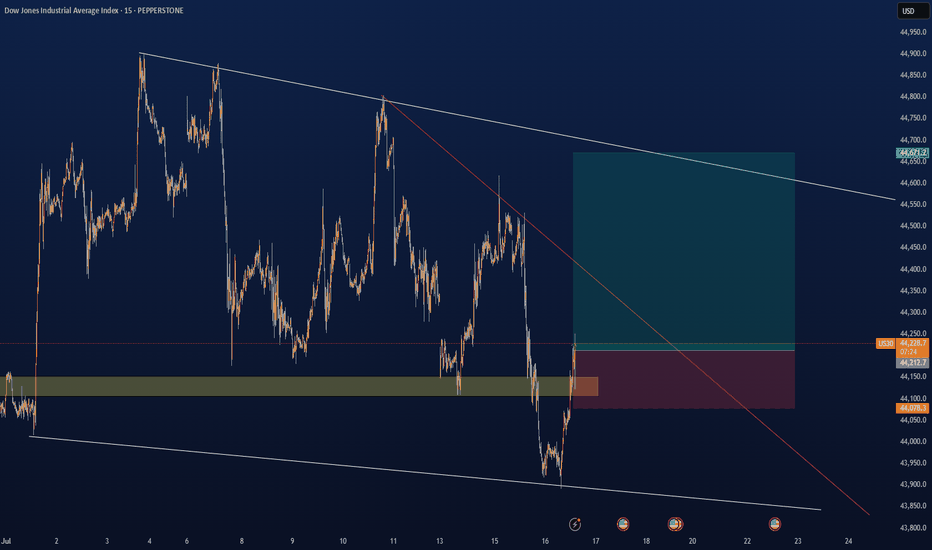

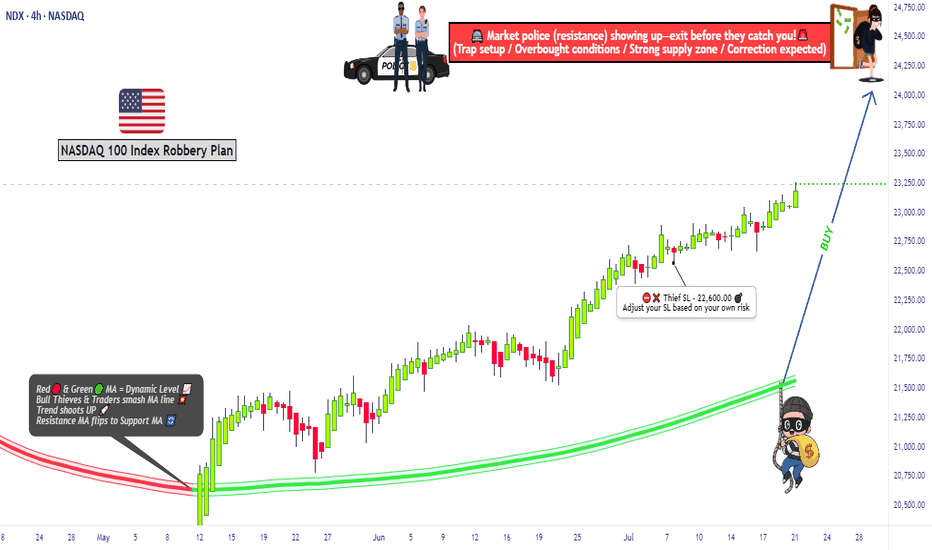

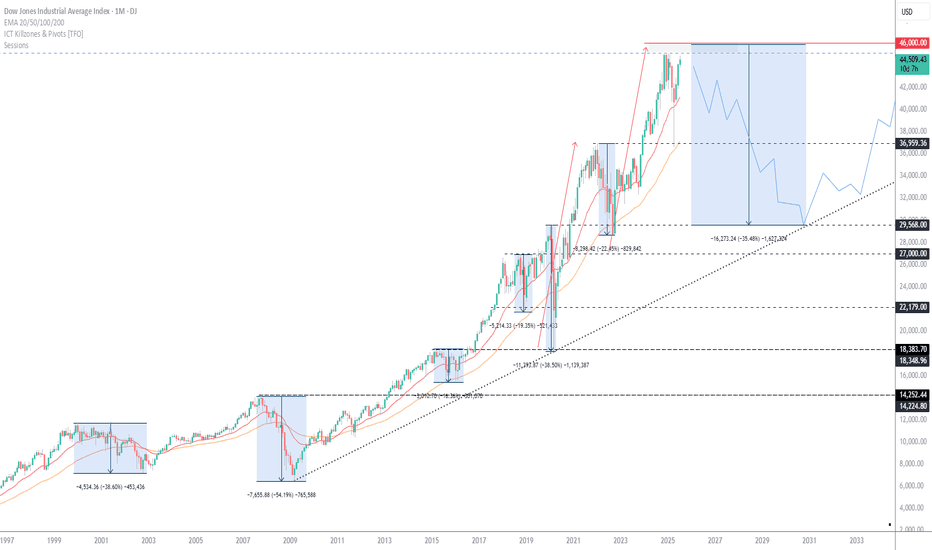

US30 Robbery Blueprint: Breakout, Pullback, Escape Setup💎 Dow Jones Robbery Blueprint: The US30 Vault Crack Plan 💎

(Maximized for reach — within TradingView title limit)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Robbers & Money Movers 🕵️♂️💰🚨

This ain't your average analysis — it’s a Thief Trader-style 🔥tactical mission🔥 aimed at the mighty "US30/DJI" (Dow Jones Industrial Average). We're talkin' about a precision heist with a full blueprint: entry zones, trap setups, and escape exits. Read carefully — this ain’t for the faint-hearted traders! 🧠🦾

🧠 Entry Zones (The Break-In) 📈

🛠 ENTRY 1: Crack the wall near 44700.00 – that’s the resistance gate. Wait for confirmation.

🎯 ENTRY 2: Sneak in at the Market Makers’ Trap around 43500.00 – a dirty zone where retailers get baited. Perfect time to strike long!

🧱 DCA/Layering strategy recommended. Stack those buy orders like a thief layering explosives on a safe. 💣💸

🛑 Risk Levels (Escape Routes/Stop Loss)

🔊 "Listen up, vault raiders! Never drop your SL until breakout is confirmed. If you jump early, you might land in a bear trap! 🪤"

🔐 Stop Zones (Based on Strategy):

📌 Swing Buy SL (2H TF): Place at 44100.00 for the stealth buy.

🏦 Institutional SL (Swing Zone): Drop it around 43000.00

🔐 Max Risk SL (3H TF): If you're deep, your last stand is at 39200.00

☝️ SL depends on your position sizing, number of entries, and risk appetite. Trade like a thief, not a gambler.

🎯 Heist Target (Profit Exit)

🏁 Escape Point: 46200.00 — or exit before heat rises! Don’t be greedy. Rob and vanish. 💨💰

🔥 Market Mood: Why the Heist Is On

"US30/DJI" is bullish AF — thanks to:

📊 Macro-Economic Wind at Our Back

📈 Institutional momentum

📰 Strong sentiment and intermarket flows

Check your chart radar: Fundamentals + technicals aligning = green light for robbery! 🟢

⚠️ Tactical Reminder: News Can Jam the Plan

📵 Avoid new entries during major economic releases

🛡 Use trailing SLs to protect running trades

Stay alert, stay alive. 💡

❤️ Support the Robbery Crew

Hit that 💥BOOST💥 — your love fuels our next mission.

Join us and ride daily heist plans with Thief Trading Style 🏴☠️🚀💰

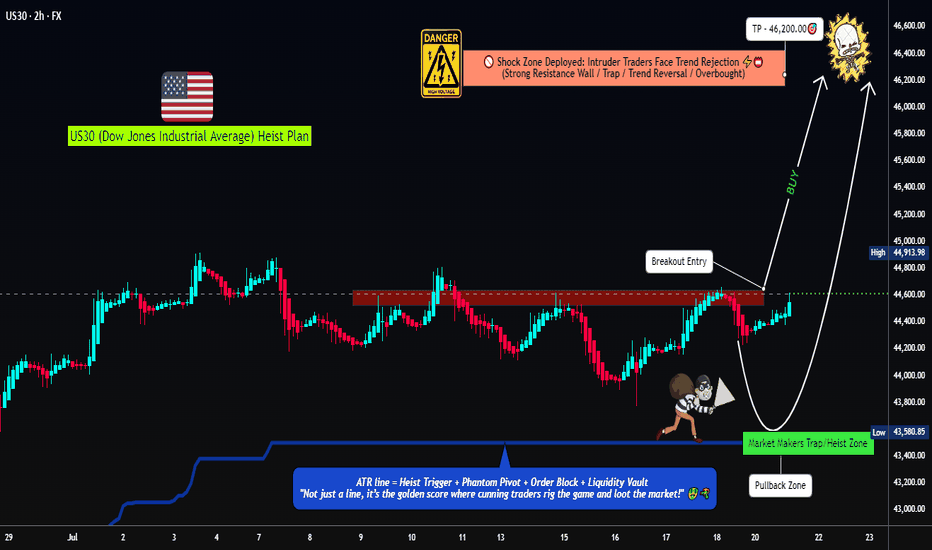

"NASDAQ 100 Heist – Scalp, Swing, or Hold? (Full Plan)🔥 NASDAQ 100 HEIST PLAN – BULLISH LOOT AWAITS! 🔥

🚨 Attention Market Robbers & Money Makers! 🚨

(Swing/Day Trade Strategy – High-Risk, High-Reward Play)

🎯 Mission Objective: Loot the NDX100/US100 (NASDAQ 100) Like a Pro!

Based on Thief Trading’s ruthless technical & fundamental analysis, we’re executing a bullish heist—targeting the Red Zone (high-risk, high-reward area).

⚠️ WARNING: Overbought market, consolidation zone, potential bear traps—weak bears may get slaughtered! Strong hands only!

🔐 ENTRY: The Vault is OPEN!

"SWIPE THE BULLISH LOOT!" – Any price is a steal, but smart thieves use:

Buy Limit Orders (15m-30m TF) near recent swing lows/highs.

DCA/Layering Strategy – Multiple limit orders for max loot.

Breakout Confirmation – Don’t jump in early; wait for the real move!

🛑 STOP LOSS: Protect Your Stash!

Thief’s SL Rule: Nearest 4H swing low (22,600) – WICK LEVEL ONLY!

DO NOT place SL before breakout! (Patience = Profit.)

Adjust SL based on risk, lot size, and number of orders.

🎯 TARGETS: Escape Before the Cops Arrive!

Main Take-Profit: 24,400 (or exit early if momentum fades).

Scalpers: Longs ONLY! Use trailing SL to lock in profits.

Swing Traders: Ride the wave like a true market pirate!

📰 FUNDAMENTAL BACKUP: Why This Heist Will Work

Bullish momentum in NDX100 driven by:

Macro trends (Fed, inflation, tech earnings).

COT Report & Institutional positioning.

Geopolitical & Sentiment Shifts.

Intermarket correlations (USD, Bonds, Tech Sector).

(Stay updated—markets change FAST!)

⚠️ TRADING ALERT: News = Danger Zone!

Avoid new trades during high-impact news.

Trailing SL = Your best friend.

Lock profits early if volatility spikes!

💥 BOOST THIS HEIST! 💥

👉 Hit LIKE & FOLLOW to strengthen our robbery crew!

🚀 More heists coming soon—stay tuned, thieves! 🚀

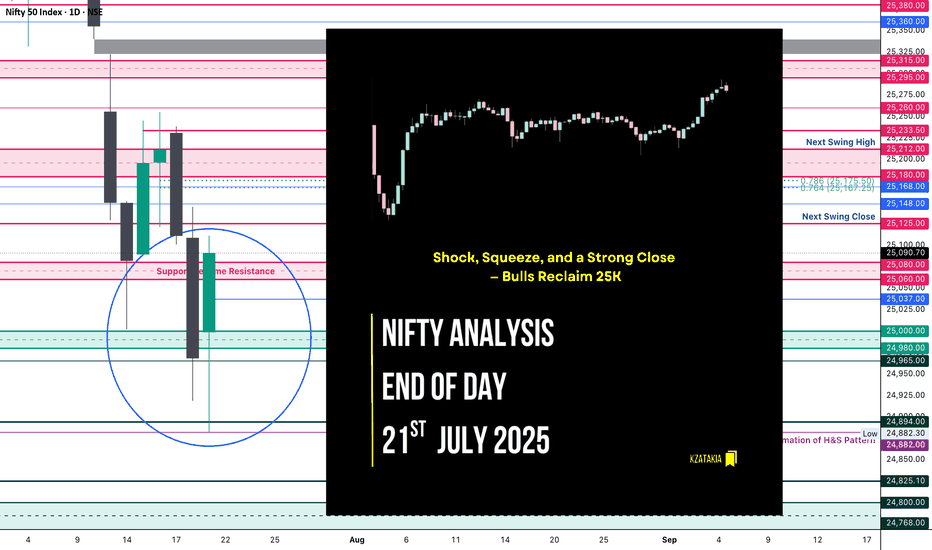

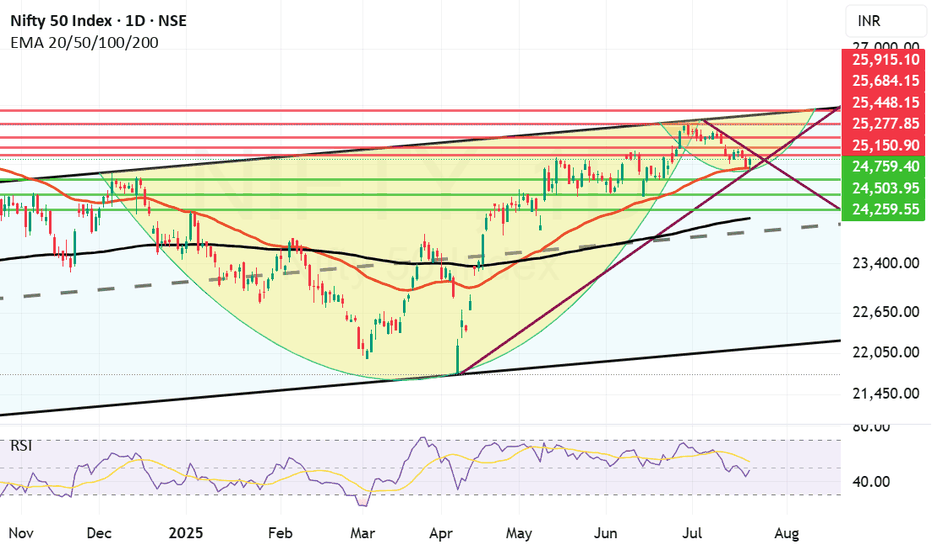

Nifty Analysis EOD – July 21, 2025 – Monday 🟢 Nifty Analysis EOD – July 21, 2025 – Monday 🔴

“Shock, Squeeze, and a Strong Close — Bulls Reclaim 25K”

Today’s move was nothing short of shocking. In the first 45 minutes, Nifty plunged more than 150 points, breaking through key levels and touching 24,882. But what followed was a V-shaped recovery that caught both Friday’s shorts and those who shorted below PDC/PDL completely off guard.

The index powered up to mark a day high of 25,080, and sustained above CPR and VWAP throughout most of the session. A final push came around 2:55 PM, breaking the intraday trendline and CDH, registering a fresh high before closing near the top at 25,090.70.

✅ Bulls not only held 25K — they dominated the battlefield all day, recovering almost everything lost during Friday’s drop.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,999.00

High: 25,111.40

Low: 24,882.30

Close: 25,090.70

Change: +122.30 (+0.49%)

📊 Candle Structure Breakdown

Real Body: 91.70 points → strong bullish body

Upper Wick: 20.70 points → slight hesitation near highs

Lower Wick: 116.70 points → deep intraday buying from the lows

🔍 Interpretation

Mildly negative open, followed by a sharp 150-point fall

Buyers stepped in strongly near 24,880, triggering a sharp reversal

V-shape recovery sustained above CPR & VWAP, closing near high

Close is not just above open — it’s above Friday’s close and 25K mark

🕯 Candle Type

Hammer-like Bullish Reversal Candle — Long lower wick with green body, signaling strong dip buying and possible short-term trend reversal

📌 Key Insight

Strong defense at 24,880–24,900 created the base for reversal

Close above 25,090 shifts near-term bias in favor of bulls

25,110–25,140 is the next resistance to watch

As long as we stay above 24,900, buyers hold the edge

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 186.31

IB Range: 166.8 → Wide IB

Market Structure: 🟡 Balanced

📉 Trades Triggered:

10:09 AM – Long Trade → ❌ SL Hit

📌 Support & Resistance Levels

Resistance Levels:

25,080 ~ 25,060

25,125

25,168

25,180 ~ 25,212

Support Levels:

25,037

25,000 ~ 24,980

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

💭 Final Thoughts

🧠 “Volatility doesn’t confuse the market — it reveals who’s in control.”Today’s V-shaped reversal erased all doubts from Friday’s fall. Buyers didn’t just defend — they counterattacked and reclaimed 25K with authority.Follow-through above 25,125 on Monday could confirm trend resumption.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

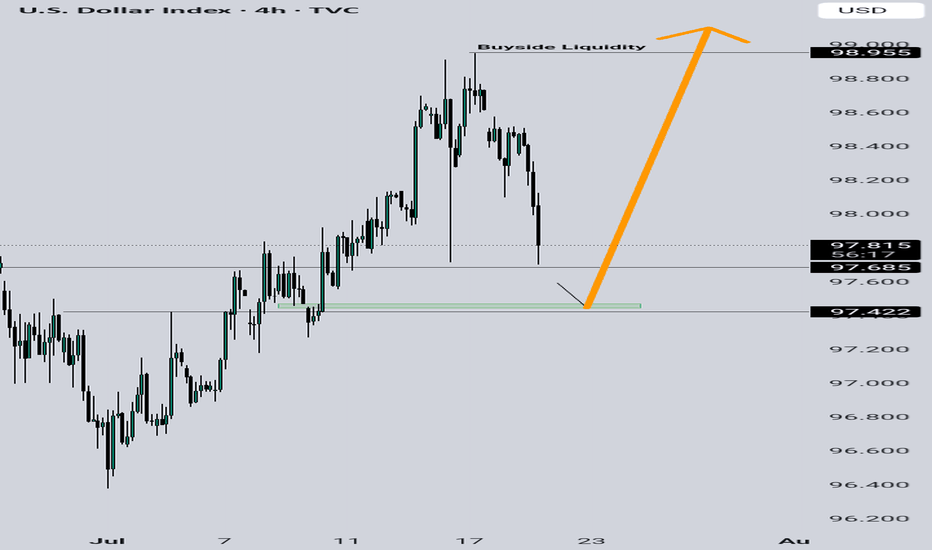

US Dollar Index (DXY) - 4 Hour Chart4-hour performance of the US Dollar Index (DXY) from CAPITALCOM, showing a current value of 98.040 with a 0.23% increase (+0.222). The chart includes recent buy and sell signals at 98.094 and 98.040, respectively, with a highlighted resistance zone around 98.706-99.000 and a support zone around 97.291-98.040. The timeframe covers data from early July to mid-August 2025.

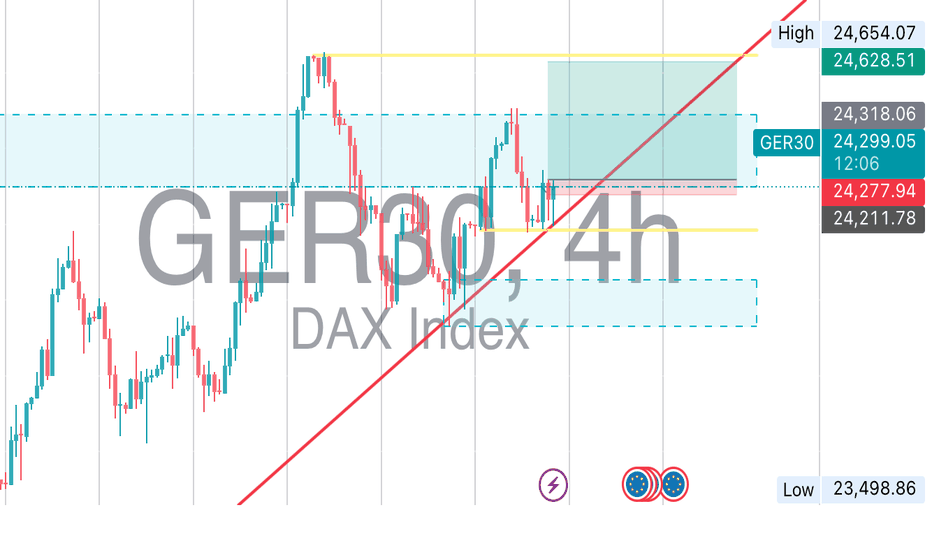

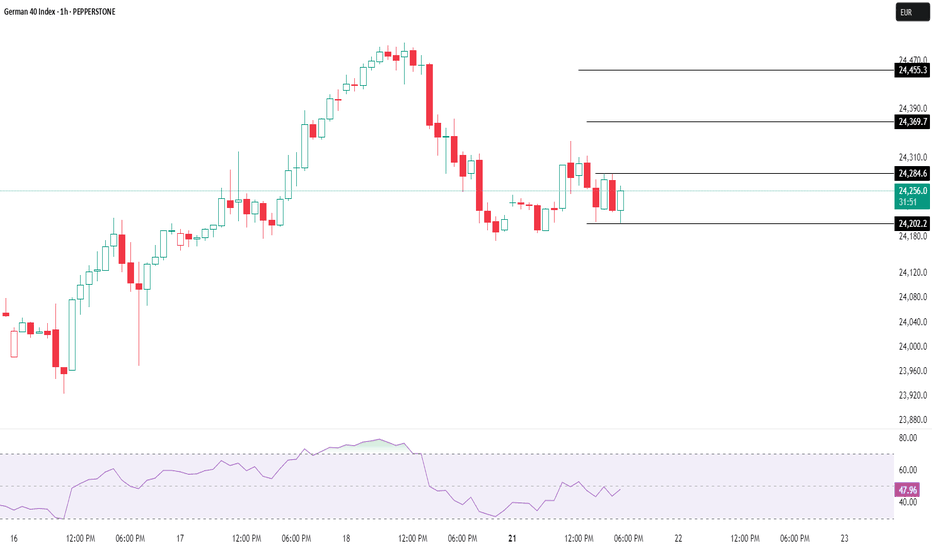

Technical Weekly AnalysisGermany 40 remains in a bullish trend but has entered a pullback phase. It is trading at 24,239, slightly above its VWAP of 24,180. The RSI at 55 suggests a neutral momentum with potential for a continuation of the uptrend. Support is found at 23,631 and resistance at 24,604

U K 100 continues its bullish trend in an impulsive phase, trading at 8,984, above its VWAP of 8,886 but still below the key 9k level. This shows underlying strength. The RSI at 61 reflects continued buying interest. Support lies at 8,708 and resistance at 9,064.

Wall Street remains bullish but is experiencing a pullback just under the March highs, trading at 44,429 just above the VWAP of 44,400. The RSI at 58 suggests moderate bullish momentum. Support is at 43,894, and resistance is at 44,788.

Brent Crude is in a neutral trend, currently in a tight range which fits inside a bigger range - with price at 6,849 and VWAP at 6,847. The RSI at 49 indicates balanced sentiment. Key support lies at 6,637, with resistance at 7,054.

Gold is in a neutral range phase, trading at 3,364 and below the VWAP of 3,332. The RSI of 55 shows slight bullish bias. Support is at 3,283, with resistance at 3,391.

EUR/USD continues in a bullish trend but is correcting, with price at 1.1643 below its VWAP of 1.1704. The RSI at 50 implies neutral momentum. Support stands at 1.1571, and resistance is at 1.1837

GBP/USD remains in a bullish trend but is undergoing a correction. Price is at 1.3455, slightly below the VWAP of 1.3559. RSI at 42 shows weakening momentum. Support is at 1.3316 and resistance at 1.3802.

USD/JPY is in a neutral trend and ranging as it tests the upper limits of the range for a possible breakout. It trades at 147.78, above the VWAP of 146.25. The RSI at 59 suggests slightly bullish momentum. Support is at 142.57, and resistance is at 149.94.

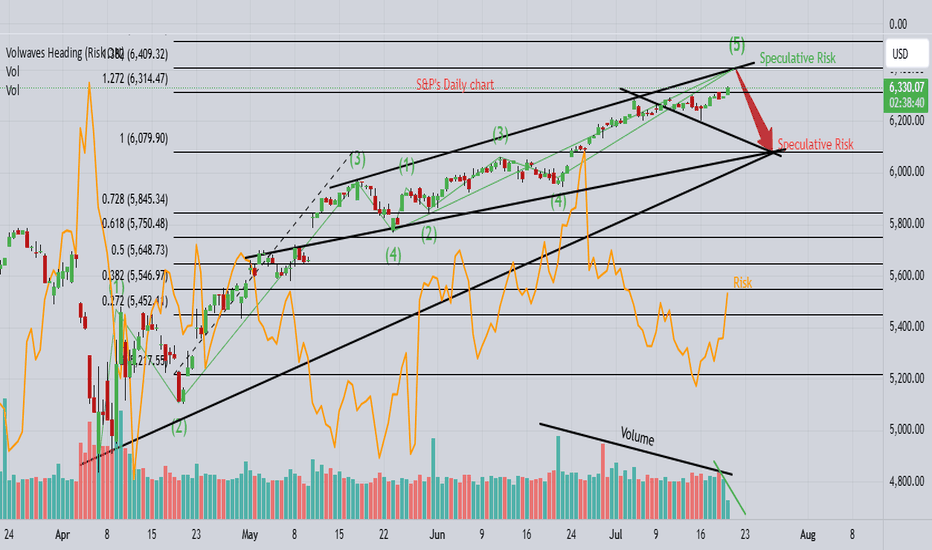

S&P's "hugely overbought" towards 6375!1). Position Volume dropping! 2). Big institutions (Banks & Insurance) have backed off on higher Risk positions! 3). Huge resistance at .728 fib & trend! 4). Trump tariff talk is likely adding to a fall as well! 5). We're looking for a "SELL" trade @ 6375, since buying is too risky at the moment...Good Luck!

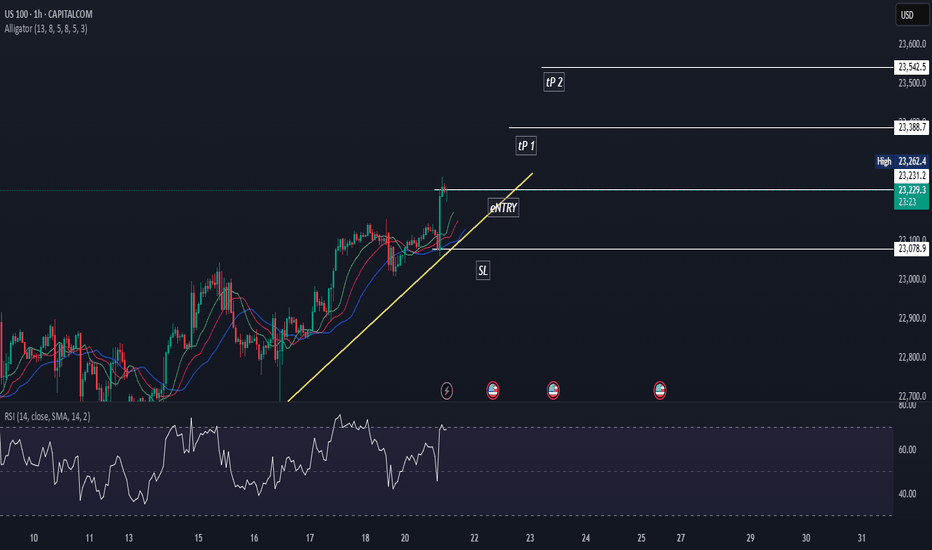

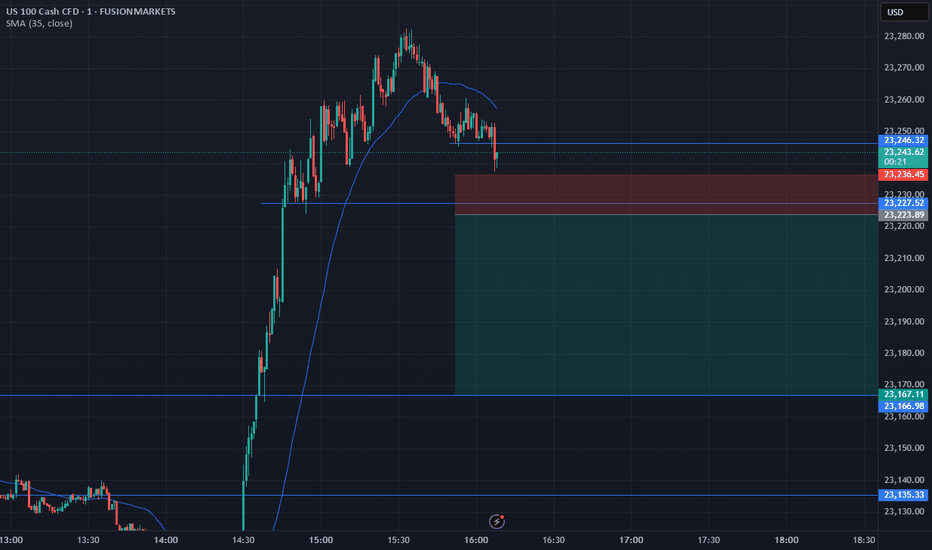

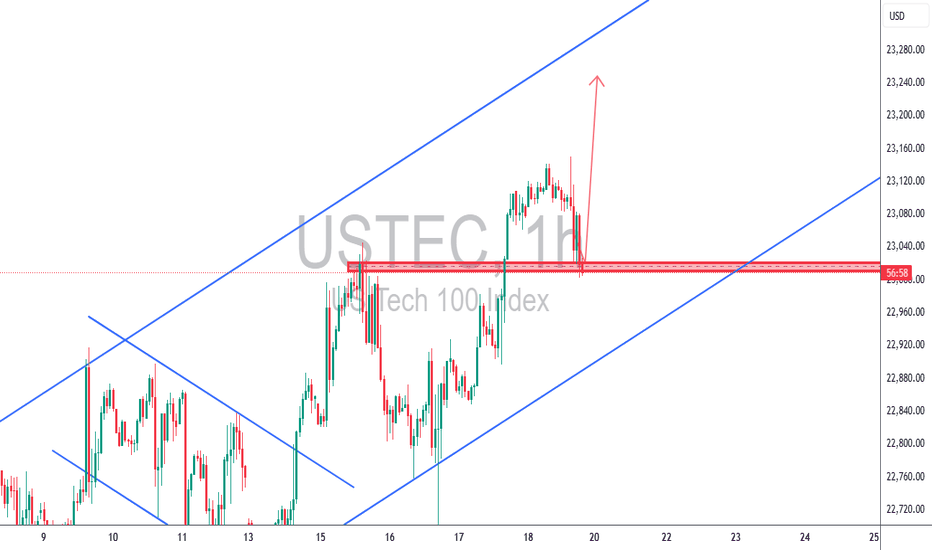

USTEC 1H – Bullish Continuation Play🔥 USTEC 1H – Bullish Continuation Play

Price pulled back into a strong demand zone and ascending channel support. We're in a clear bullish trend, and this retest offers a high-probability continuation setup.

✅ Demand zone confluence

✅ Previous resistance turned support

✅ Trendline + bullish wick rejection

✅ Clean structure with 1:3+ potential

🎯 Targeting 23,250+ while SL remains below 22,990

Strategy: TCB – Trend Phase (Pullback Entry)

Checklist Score: 100% ✅ A+ setup

Bias: Bullish – continuation expected

#USTEC #NASDAQ100 #US100 #TechnicalAnalysis #TCBStrategy #PriceAction #ForexTrading #IndicesTrading #SmartMoney #BreakoutTrading #TrendTrading #ChartAnalysis #BullishSetup #TradeIdeas #TradingView

Let me know if you want custom hashtags for XAUUSD, BTCUSD, USDCAD, or others.

NIFTY SUPPORT & RESISTANCE ZONES FOR 22-07-2025Nifty Support & Resistance Zones for Tomorrow 22-07-2025

Based on price cluster analysis and recent market structure, the following key support and resistance levels have been identified for the upcoming session:

Resistance Zones:

25438.25 – 25454.15

25363.45 – 25374.55

25257.60 – 25287.05

25178.00 – 25194.70

25089.70 – 25111.15

Support Zones:

25012.50 – 25030.00

24901.90 – 24931.35

24800.00 – 24825.50

24725.20 – 24733.20

24642.45 – 24651.20

These levels are derived from high-probability zones where price has shown repeated interaction in the recent past. Watch how Nifty reacts at these zones for potential breakout, reversal, or pullback setups.

Nifty has taken support at Mother line as expected.Despite poor showing by Reliance post result and TCS continuing to fall Nifty staged a remarkable comeback on the back of Pvt Sector banking which did well. Bank Nifty came back strongly posting 1.19% gains today which enabled Nifty to rise 122 points or 0.49%. Capital Goods, Finance and Metals indices also gained more than 1% each.

Resistances for Nifty now remain at: 25150, 25277 (Trend line resistance), 25448, 25684 and finally channel top resistance at 25915.

Supports for Nifty remain at: 24938 (Mother Line Support of Daily Chart), 24759, 24503, 24259 and finally 24116 (Father Line support of Daily chart).

Shadow of the candle right now is neutral to positive and RSI is 47.63 with median RSI resistance at 54.09.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

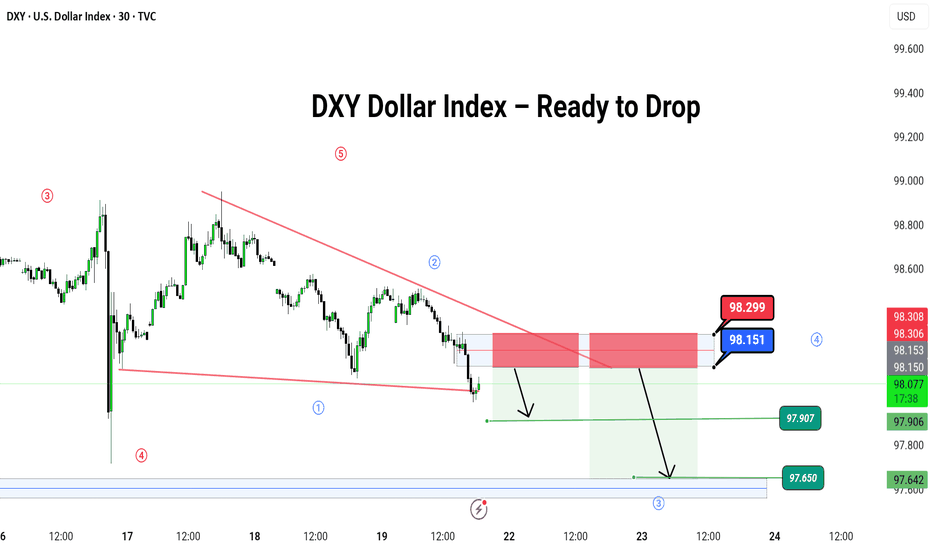

DXY Dollar Index – Ready to Drop

🌪️ DXY Dollar Index – Ready to Drop Like a Hot Potato? 💸

Hey traders! 🎯

The DXY (U.S. Dollar Index) is dancing inside a falling wedge 🔻, and it just hit the top of the party zone (red box 🎁).

📍 We're watching for a bounce up to this red zone near 98.151–98.299, then expecting a big slide down like a rollercoaster 🎢 toward:

🎯 Target 1: 97.907

🎯 Target 2: 97.650

🛑 Stop if it jumps over: 98.299

🌀 Pattern: Ending Diagonal / Wave 5 Setup

🧠 Logic: Smart money might be setting up the final wave before a major fall. Let it pop, then drop!

💡 It’s like the last spark before the fireworks go out 🎆

---

#DXY #USDIndex #ForexTrading #Wave5 #PriceAction #ChartPattern #SimpleTrading #DollarDrop

---

Let me know if you have ant suggestion ,