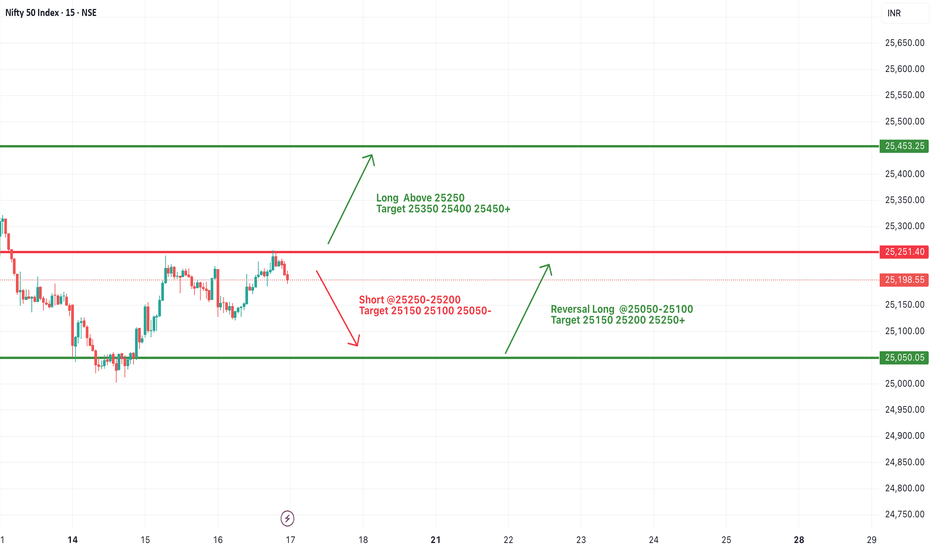

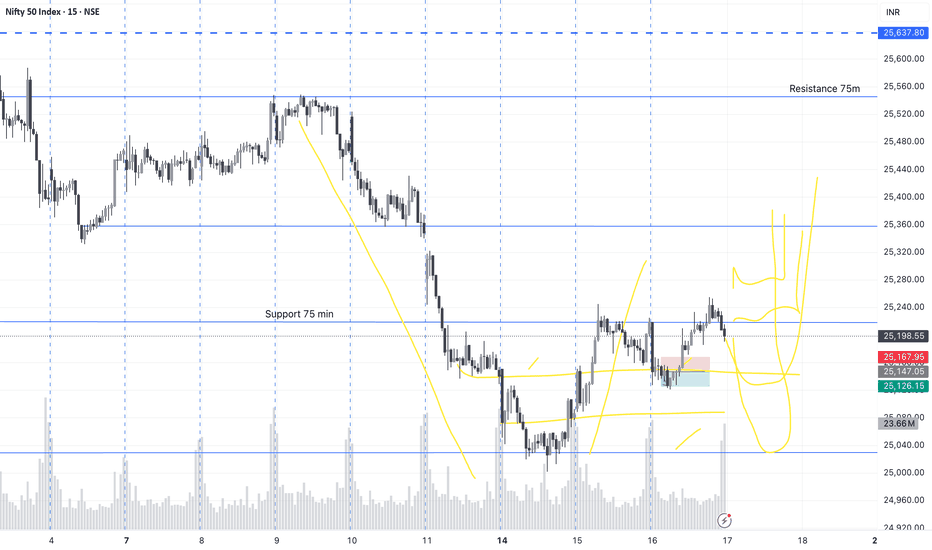

#NIFTY Intraday Support and Resistance Levels - 17/07/2025Opening Expectation: Slight Gap-Up Around 25200

Nifty is likely to open slightly gap-up near the 25200 level, showing early signs of strength. If the index manages to sustain above the 25250 level, we may see a continuation of the upward momentum with targets around 25350, 25400, and 25450+. This zone marks the upper resistance, and a breakout with strong volume could push prices into a bullish trend for the session.

On the other hand, if Nifty faces rejection around 25250–25200 and begins to slide, a short opportunity opens up with downside targets at 25150, 25100, and 25050. Sustained weakness below these levels could intensify selling pressure. However, in case the index reverses and bounces from the 25050–25100 zone, a quick intraday long trade can be considered toward 25150, 25200, and 25250+.

Today’s bias remains slightly positive, but the session may remain volatile between key levels. Traders should focus on price action around the 25250 resistance and use trailing stop losses with strict risk control.

Market indices

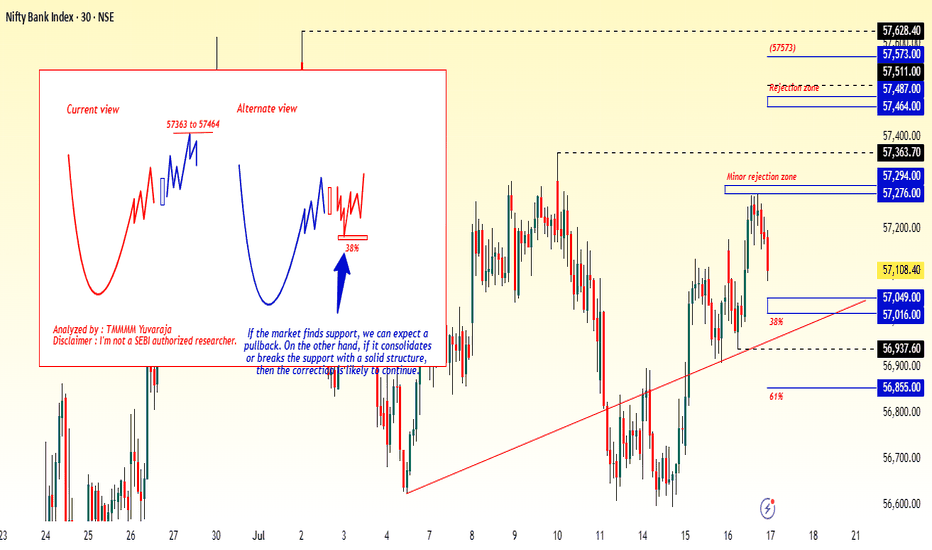

#Banknifty directions and levels for July 17thIn the previous session, both Nifty and Bank Nifty moved with ups and downs. Structurally, the sentiment still remains the same.

Even if the market opens with a gap-up, we can expect some rejection near immediate resistance.

So, my expectation is that the market may behave similarly to the previous session.

If it starts with a pullback, we may see rejection afterward.

On the other hand, if it starts with a decline, we can expect a pullback later.

The key point to note is that clear directional moves are likely only if a strong candle forms after consolidation.

[INTRADAY] #BANKNIFTY PE & CE Levels(17/07/2025)Bank Nifty is expected to open slightly gap-up near the 57100 zone. This level is a key intraday pivot. If the index sustains above 57100, it could trigger upward momentum toward the next resistance levels at 57250, 57350, and potentially 57450+. A move beyond 57550 will likely strengthen the bullish sentiment and may stretch the rally further toward 57750, 57850, and 57950+.

On the downside, if Bank Nifty fails to hold 57050–57100 and slips below 56950–56900, it may invite selling pressure, with potential downside targets at 56750, 56650, and 56550. This zone acts as short-term support, and failure to hold here could lead to further weakness.

Overall, Bank Nifty is currently in a range with bullish bias above 57100.

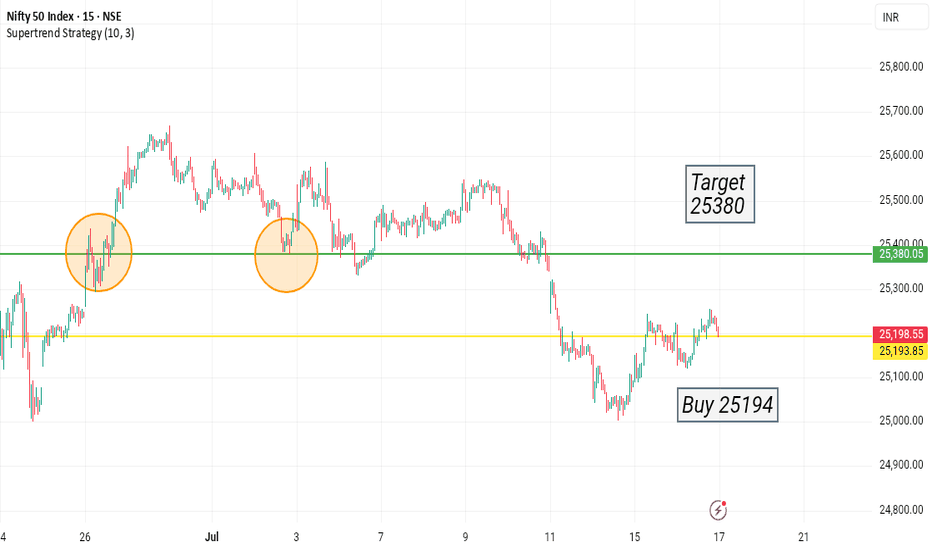

#Nifty directions and levels for July 17thGood morning, Friends! 🌞

Here are the market directions and levels for July 17th:

There have been no major changes in the global market; it continues to maintain a moderately bearish sentiment.

Meanwhile, our local market is showing a moderately bullish tone on the lower time frame. Today, Gift Nifty is indicating a neutral to slightly gap-up start.

So, what can we expect today?

In the previous session, both Nifty and Bank Nifty moved with ups and downs. Structurally, the sentiment still remains the same.

Even if the market opens with a gap-up, we can expect some rejection near immediate resistance.

So, my expectation is that the market may behave similarly to the previous session.

If it starts with a pullback, we may see rejection afterward.

On the other hand, if it starts with a decline, we can expect a pullback later.

The key point to note is that clear directional moves are likely only if a strong candle forms after consolidation.

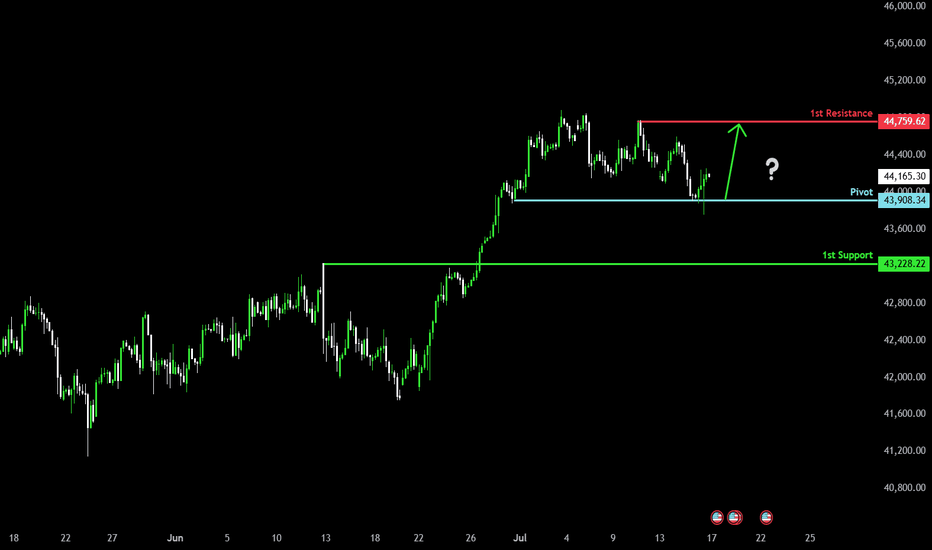

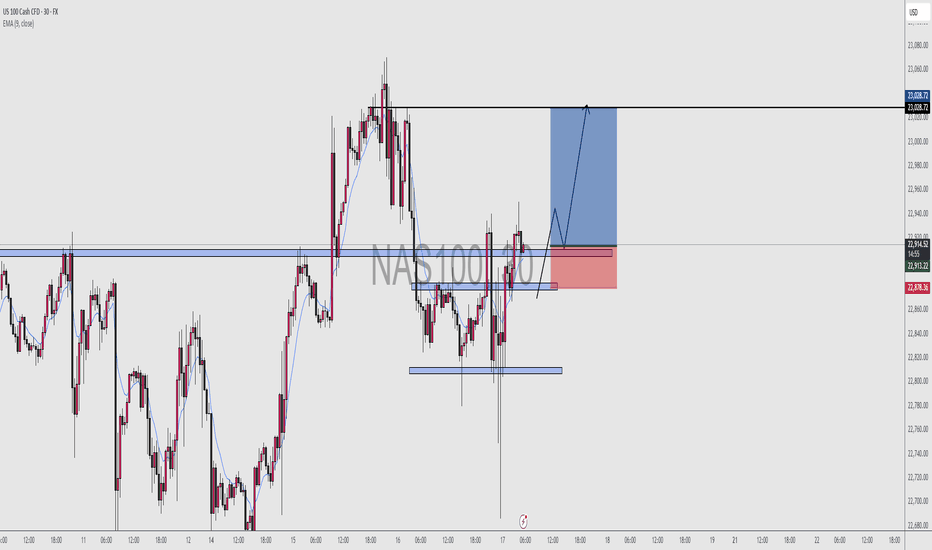

Could the price rise from here?Dow Jones (US30) has bounced off the pivot and could potentially rise to the 1st resistance which acts as a pullback resistance.

Pivot: 43,908.34

1st Support: 43,228.22

1st Resistance: 44,759.62

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

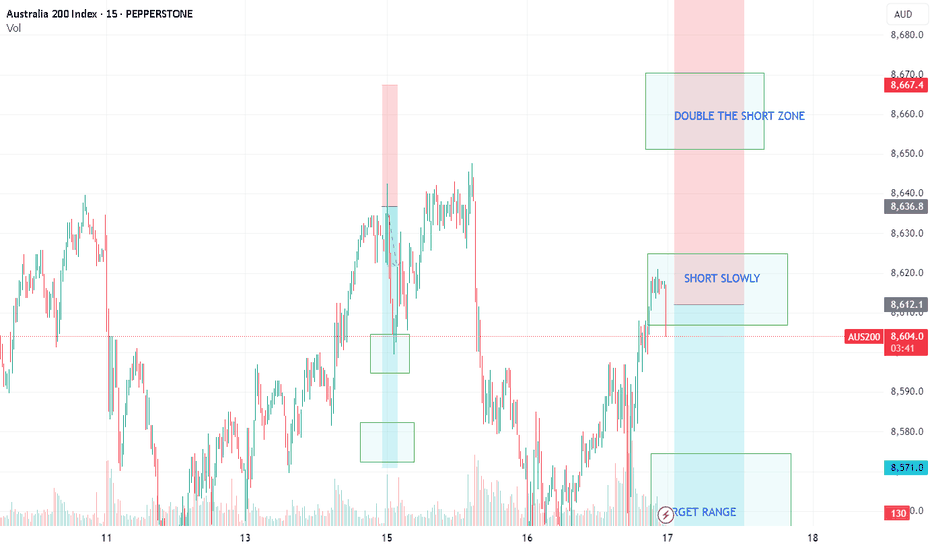

AUS200/ASX200 - ANOTHER DAY TO MAKE THEM PAYTeam, we have successfully SHORT AUS200 last week and kill them with our ACTIVE TRADER COMMUNITY.

Time to have another short at this current price level 8609-8626 ranges

DO NOT FEAR - DOUBLE THE SHORT AT 8642-56 - KILL them

Our first target range at 8586-72 - take 60% profit and bring stop loss to BE

2nd target at 8562-45

NOTE: Next week, we expect the market to be volatile, so be careful with your trade.

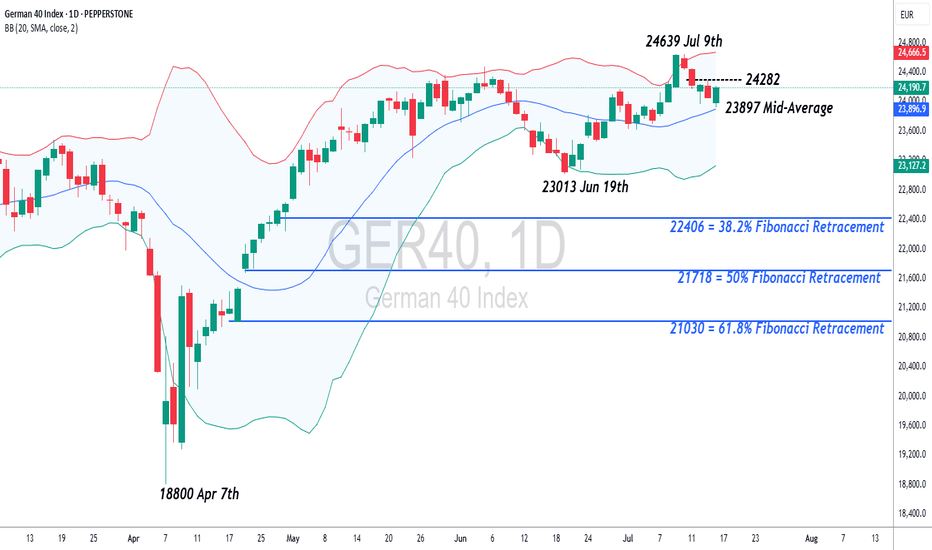

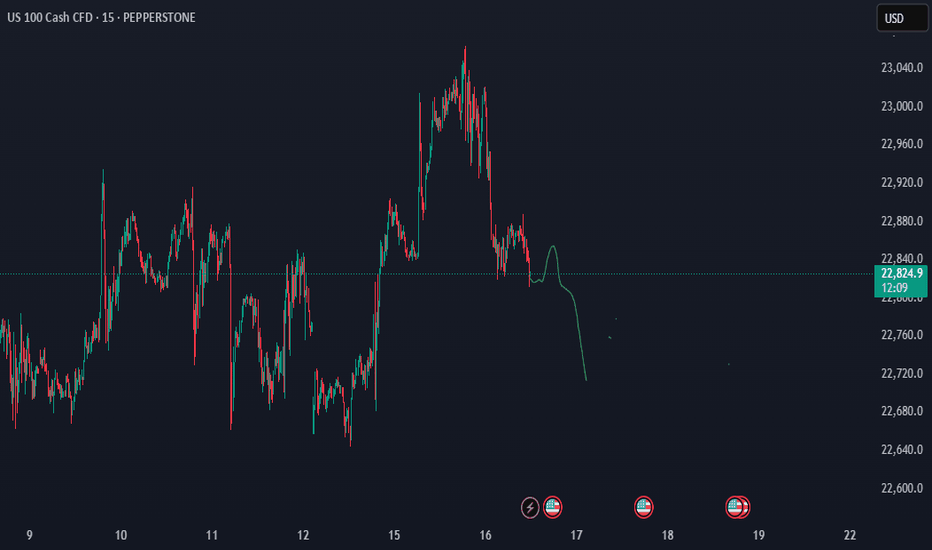

Germany 40 – Preparing For A Short Term Range BreakoutTariff worries, including new comments from President Trump stating that he is likely to impose fresh import charges on pharmaceuticals, have continued to dominate the thinking of Germany 40 traders this week, leading to some choppy price action for the index, which after opening on Monday at 24084, has bounced between a Tuesday high of 24293 and a Wednesday low of 23925, before settling back into the middle of that range.

Throw into the mix, the start of Q2 earnings season for European corporates and an upcoming ECB interest rate decision in a week's time and you can see how price action could become increasingly volatile moving forward into the end of July.

Earnings season has so far got off to a slow start in Europe and Germany 40 traders may have to wait until SAP, the company carrying the highest market capitalisation ($352 billion) and index weighting (14.5%), reports its results next Tuesday (after the close) for further insight into where prices may move next.

In terms of the ECB rate decision next Thursday (July 24th), market expectations may currently be indicating that another rate cut is unlikely, although it could be a close call. Traders seem to be focusing on recent commentary from policymakers which suggests the balance of power for the time being has shifted to the more hawkish committee members, who have stated that with inflation sitting on the central bank's target of 2% there is no need to cut rates further. Choosing instead to wait for more clarity on the outcome of trade negotiations with the US, which could decide whether a trade war between the world's first and third biggest economies may be something they need to navigate.

Technical Update:

Having posted a new all-time high at 24639 on July 9th the German 40 index has entered a corrective period. However, while much will depend on future unknow market sentiment and price trends, traders may well be asking, if current price weakness can develop into a more extended phase of weakness, or if downside is just a limited move before buyers return to extend price strength.

Time will tell, but in the meantime, technical analysis may help pinpoint potential support and resistance levels, aiding us establish next potential trends and directional risks.

Potential Support:

Having recently posted a new all-time high at 24639, it might be argued this is still a possible positive trend, especially as the Bollinger mid-average is currently rising. This for Thursday stands at 23897, so may mark the first support focus for traders over coming sessions.

If closing breaks of this 23965 level materialise, it might lead towards a further phase of price weakness towards 23013, the June 19th session low, even 22406, the 38.2% Fibonacci retracement of April to July 2025 price strength.

Potential Resistance:

If the 23965 mid-average successfully holds the current price setback, it could possibly prompt further attempts to extend recent strength.

First resistance might then stand at 24282, equal to half latest weakness, with successful closing breaks possibly then opening scope back to the 24639 all-time high and maybe further, if this in turn gives way.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

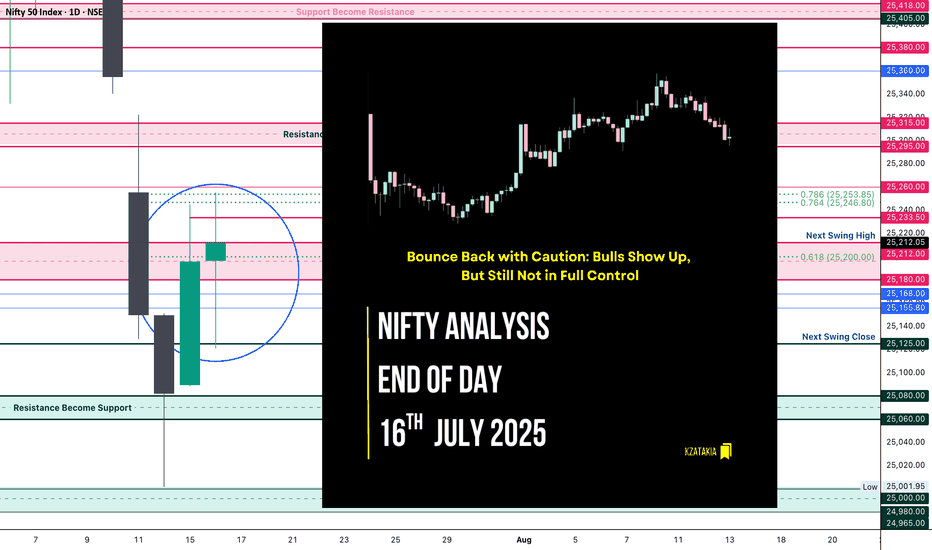

Nifty Analysis EOD – July 16, 2025 – Wednesday🟢 Nifty Analysis EOD – July 16, 2025 – Wednesday 🔴

"Bounce Back with Caution: Bulls Show Up, But Still Not in Full Control"

Nifty started the day on a flat note, but the opening candle turned out to be the day’s high, and from there, it quickly lost 91 points, marking the day’s low at 25,121 within the first hour. The early pressure gave a bearish opening tone, but bulls gradually stepped in.

Around 11:45 AM, Nifty broke above the VWAP–Day Low range, crossed the CPR zone, and then pushed toward PDH. It did make one attempt to break PDH, but failed, resulting in a slow drift downward toward VWAP and CPR into the close. The day ended at 25,212.05, nearly at CPR — a zone of indecision.

📉 The structure shows sharp reversal from the lows, but also clear hesitation near resistance zones. The session was volatile, forming a typical pre-expiry pattern with mixed sentiment. Bulls must take charge tomorrow by crossing the 25,250–25,260 zone to regain strength.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,196.60

High: 25,255.30

Low: 25,121.05

Close: 25,212.05

Change: +16.25 (+0.06%)

📊 Candle Structure Breakdown

Real Body: 15.45 points → small green body

Upper Wick: 43.25 points

Lower Wick: 75.55 points → significant downside recovery

🔍 Interpretation

Market opened flat, dropped quickly to test 25,120 zone

Strong buying emerged after initial fall

Buyers lifted the index above CPR, but failed to hold breakout above PDH

Candle closes with long lower wick → buyers defended dip, but lacked closing dominance

🕯 Candle TypeSpinning Top with Long Lower Wick — often a neutral to mildly bullish candle, suggesting buying interest at lower levels, but with uncertain momentum.

📌 Key Insight

Bulls clearly defended the 25,120–25,125 support zone

Momentum will only resume above 25,250–25,260, leading to targets around 25,300–25,315

Failure to hold 25,120 could reopen downside toward 25,000–25,050

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 180.99

IB Range: 91.20 → Medium IB

Market Structure: 🟡 Balanced

Trades Triggered

11:34 AM – Long Trade → ✅ Target Achieved, Trailed SL Hit (R:R 1:2.42)

📌 Support & Resistance Zones

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

“Structure is forming — but conviction is lacking. Let expiry day bring clarity. Above 25,260 we fly, below 25,120 we fall.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

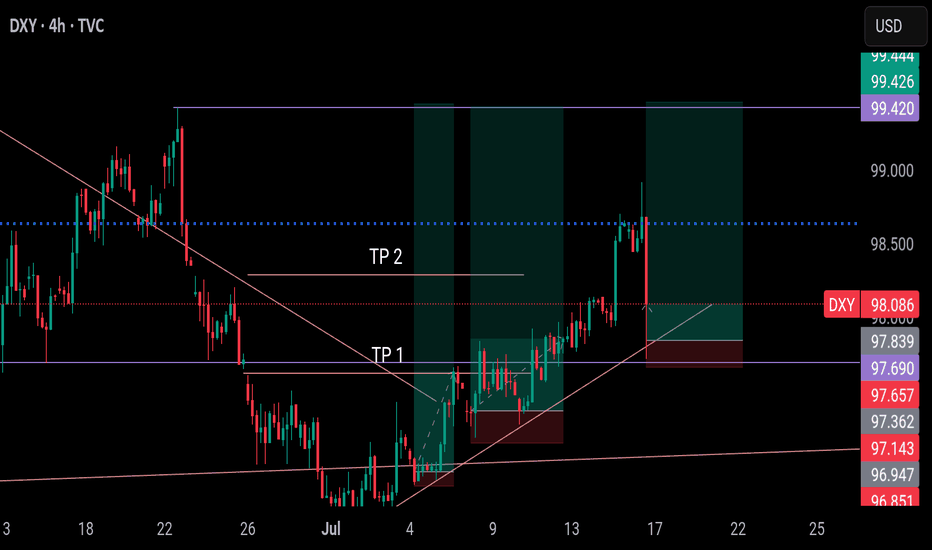

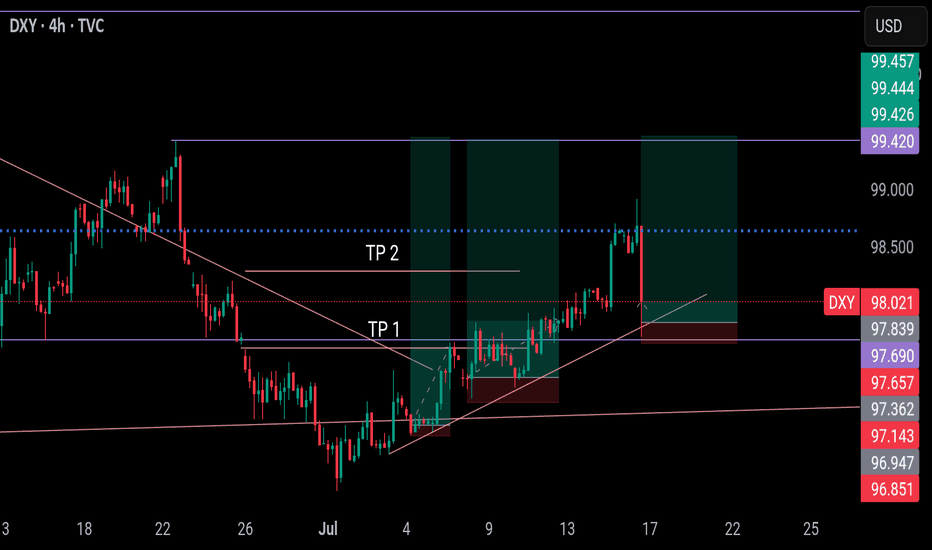

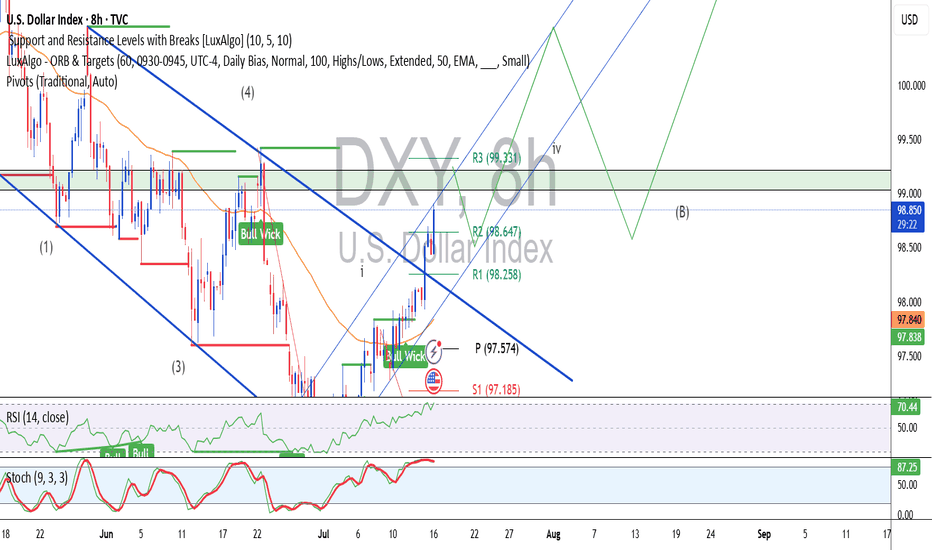

Sometimes, it can be this easy. DXY BULLISH continuationAs I'm trying to give reason, the market is running away.

I've guided you from the low till now, stop doubting my analysis please.

This is a discount price, DXY is still bullish till 99.42. Dont be caught on the sideline. EURUSD and other pairs are bearish. Trade accordingly

Follow me as my trades are market orders, so you will see them on time and enter the trade on time

Enjoy

Sometimes, it is this simple. DXY BULLISH I'm selling EURUSD and other pairs. DXY is still bullish till 99.42. Once price reach there, we will recheck and let price tip its hand.

This is discount price, dont miss out

Follow me as my trades are market order, so you will see it on time and enter on time

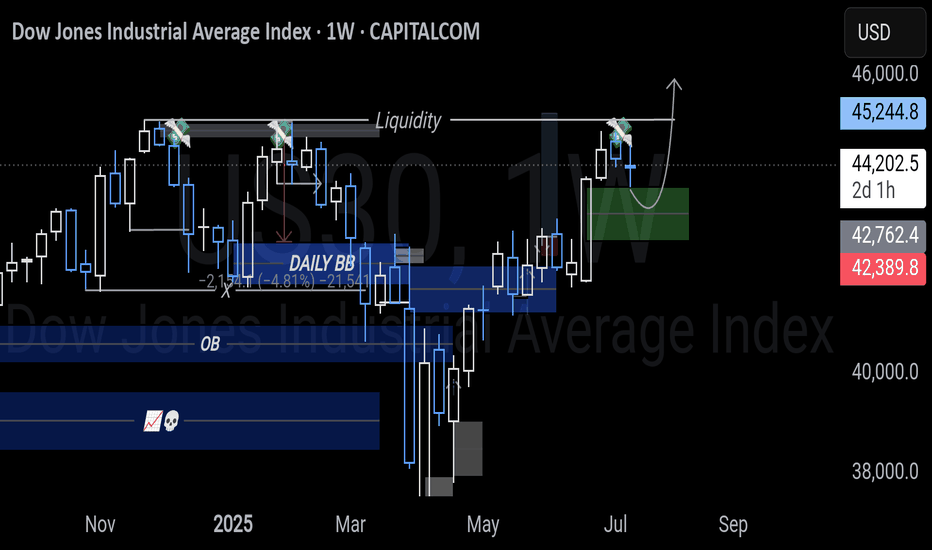

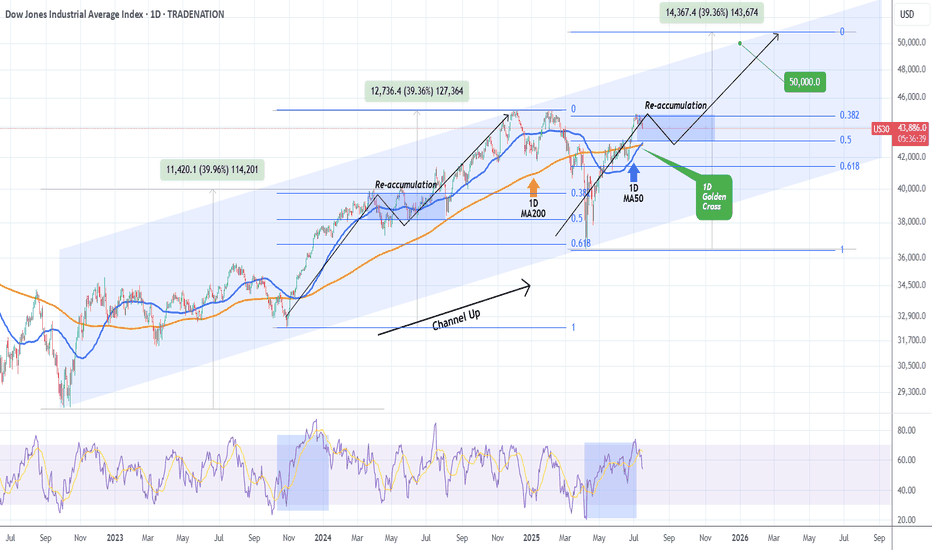

DOW JONES formed 1st 1D Golden Cross since 2022!Dow Jones (DJIA) completed on Monday its 1st Golden Cross on the 1D time-frame since December 12 2022! This powerful bullish pattern comes with the price close to its All Time High (ATH).

Being inside almost a 3-year Channel Up, the current rise is the pattern's latest Bullish Leg following the April 07 2025 bottom (Higher Low). Both previous Bullish Legs rose by +39.96% before forming a Higher High.

Based on the Fibonacci retracement levels, last time the previous Bullish Leg was within the 0.382 - 0.5 Fibonacci Zone, it formed a Re-accumulation Phase for 3 months. As a result, we shouldn't dismiss the fact of trading sideways for the rest of the Summer and then picking up the pace. Our end-of-year Target remains 50000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

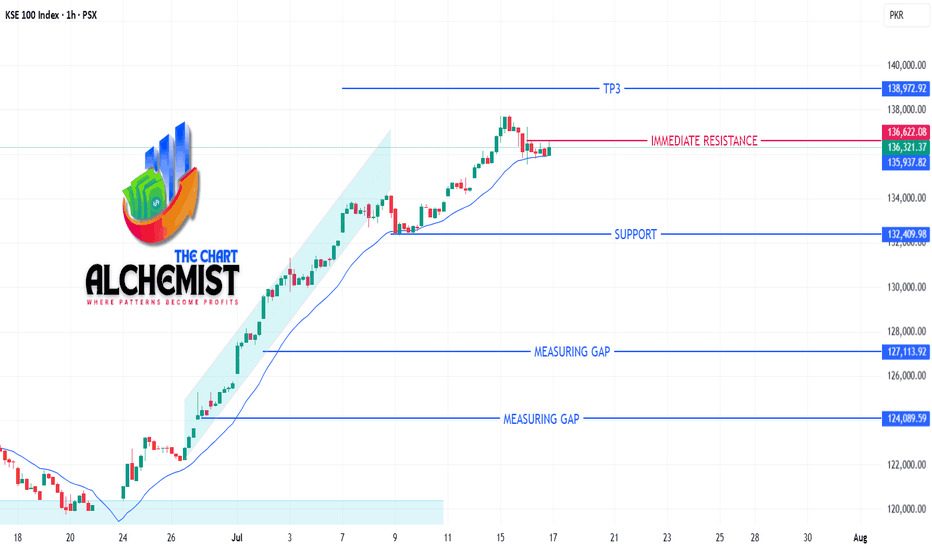

KSE-100 ANALYSIS | 16 JULY 2025📊 KSE-100 ANALYSIS | 16 JULY 2025

As previously mentioned, KSE-100 completed its spike phase, marking a high of 134,240. The uptrend is now transitioning into a channel phase, with deeper pullbacks expected in the short term.

KEY LEVELS:

Support: 20 EMA (1-hour timeframe)

Immediate Resistance: 136,620

OUTLOOK:

Expected to take support from the 20 EMA and resume the uptrend

A break above 136,620 will confirm another leg upward

Targets: 138,970 (TP3) and 151,600 (Final Target)

Let’s keep an eye on the market!