Market indices

DAX corrective pullback supported at 24085The DAX remains in a bullish trend, with recent price action showing signs of a resistance breakout within the broader uptrend.

Support Zone: 24085 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 24085 would confirm ongoing upside momentum, with potential targets at:

24650 – initial resistance

24880 – psychological and structural level

25000 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 24085 would weaken the bullish outlook and suggest deeper downside risk toward:

23970 – minor support

23800 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the DAX holds above 24085. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

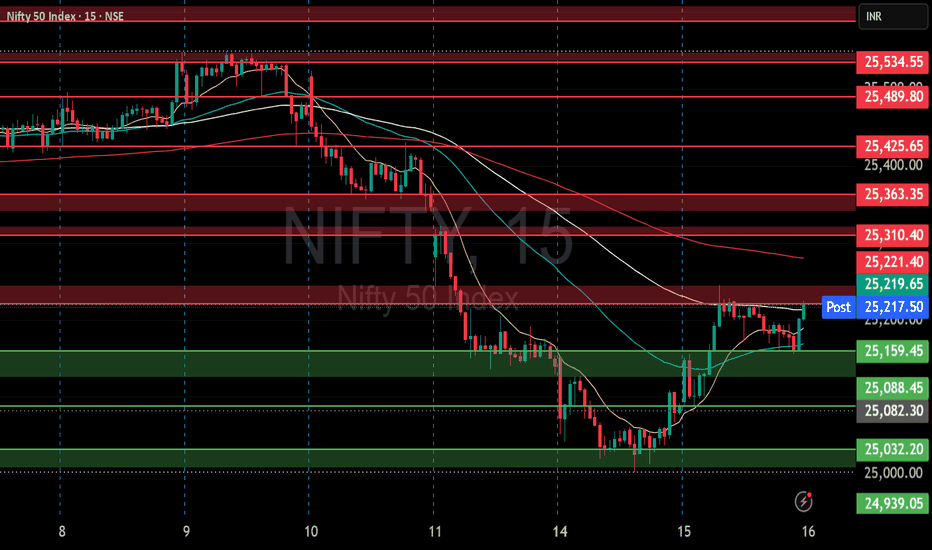

NIFTY S/R for 16/7/25Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Bit of a delay - New Falling Wedge ready to break upJapan like Hong Kong is showing strong signs of growth.

We first had the breakout above the Cup and Handle and now we are awaiting the breakout above the Falling Wedge...

There are some strong signs of upside fundamentally...

💼 1. Solid GDP & corporate profits

Japan’s economy grew about 2.7% annualized in Q1—beating estimates—and corporations are reporting stronger earnings growth

🌐 2. Foreign buying spree

Foreign investors have poured into Japanese stocks for weeks—13 of the last 14—with inflows fueled by attractive valuations and yen hedging

🤖 3. AI & chip boom

Tech and chip firms tied to AI are leading the charge, pushing market gains and drawing investor attention

💸 4. Cheap & reform-driven

Japanese equities trade at a discount (~15x forward P/E), and ongoing corporate governance reforms are boosting investor confidence

Here are the technicals

W Formation

Price>20 and 200

Target 42,153

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

(UPDATE) Hong Kong rally is evident to 26,944Hong Kong is shaping up nicely for upside.

We did this analysis in June and now it has broken above the breakout point and is showing signs of a rally.

🧧 1. Mainland Money Flood

Chinese investors are pouring cash into Hong Kong stocks, hitting record levels.

🚀 2. Big IPOs

Huge listings like Shein and CATL are reviving market excitement.

🤖 3. AI & Tech Buzz

Hong Kong’s tech giants are flying thanks to the global AI hype.

And technically it's looking great.

Cup and Handle

Price>20 and 200

Target 26,944

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

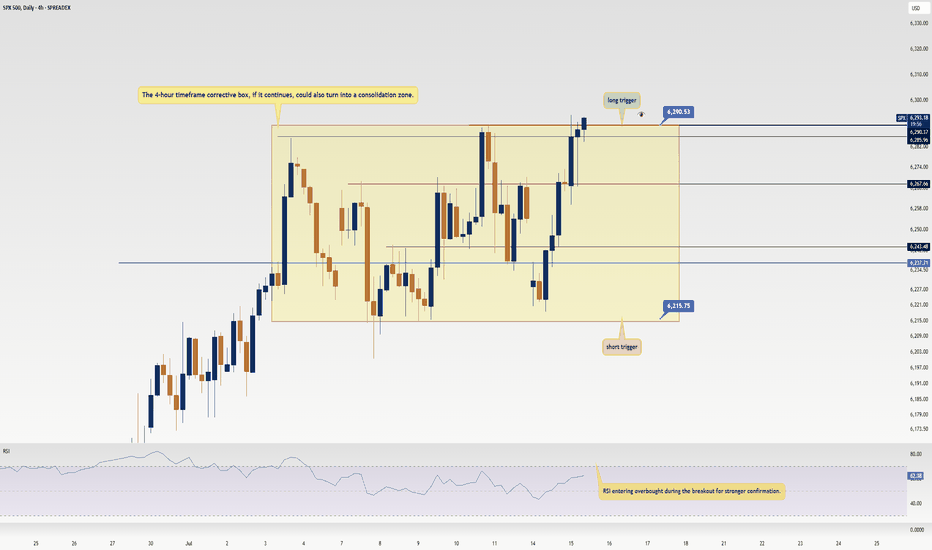

SPX500 Update: Monster Trigger Ready to Launch!Welcome back, traders, it’s Skeptic from Skeptic Lab! 😎 With news of the unemployment rate rising, stock and crypto markets have been surging hard, and right now, we’ve got a killer trigger on SPX500 you don’t want to miss. Its breakout could spark the next major bullish leg. Let’s dive into the Daily and 4-hour timeframes to unpack this setup. here’s the play:

✔️ Daily Timeframe:

After a strong rally, SPX500 hit an all-time high (ATH) at 5,249.14 before entering a deep correction. Here’s what many traders miss: support/resistance levels aren’t static—they shift over time. The resistance that was at 6,146.89 has now climbed to 6,290. Breaking 6,290 signals the start of a major bullish trend after 146 days of correction. This is our primary long trigger.

📊 4-Hour Timeframe (Futures Triggers):

Long Trigger: After a solid uptrend with strong momentum, we entered a time-based correction within a box pattern. Breaking the box ceiling at 6,290 is the long trigger, aligning with the Daily breakout.

Short Trigger: Breaking the box floor would trigger a short, but this goes against the trend, so stop-loss risk is higher, and your win rate could take a hit—stay cautious.

📉 Key Insight: The 6,290 breakout is the big move to watch, fueled by market momentum from the unemployment news. Shorts are riskier due to the bullish trend, so prioritize longs with volume confirmation.

🔔 Confirmation: For longs, confirm the 6,290 break with RSI entering overbought.Risk management is critical—cap risk at 1%–2% per trade to survive the market’s swings.

🔼 I’ll update if the structure shifts! Thanks for vibing with this analysis! <3

💬 Let’s Talk!

Which SPX500 trigger are you locked on? Hit the comments, and let’s crush it together! 😊 If this update lit your fire, smash that boost—it fuels my mission! ✌️

US30: Bears Are Winning! Short!

My dear friends,

Today we will analyse US30 together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 44,420.7 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 44,379.6..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

NAS100 Is Very Bullish! Long!

Take a look at our analysis for NAS100.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 23,006.9.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 23,667.5 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USNAS100 Outlook – CPI Data to Confirm Breakout or PullbackUSNAS100 – Bullish Momentum Holds Ahead of CPI

USNAS100 continues to show strong bullish momentum, trading above 22,905 and recently printing a new all-time high (ATH).

As long as price remains above this level, the next upside target is 23,170, followed by 23,300.

Market Focus – CPI Data Today:

• Expected: 2.6%

• Below 2.6% → bullish reaction likely

• Above 2.6% → bearish pressure expected

• Exactly 2.6% → could trigger a short-term bearish pullback

Key Risk Level:

A confirmed break below 22,905 would signal weakness and open the door for a correction toward 22,615.

Equity Markets Ahead of the US Inflation ReportEquity Markets Ahead of the US Inflation Report

Today at 15:30 GMT+3, the US inflation report (Consumer Price Index, or CPI) is scheduled for release. According to ForexFactory, analysts expect the inflation rate to rise from 2.4% to 2.6%.

The actual figures will provide market participants with grounds to debate not only the likelihood of a Federal Reserve rate cut, but also the evolving tensions between Donald Trump and Jerome Powell.

Should the report deliver any surprises, it will almost certainly trigger heightened volatility across the equity markets. For now, however, investors are seemingly optimistic about the upcoming fundamental data — especially given the commencement of Q2 earnings season, which lends additional weight to today’s macroeconomic indicators.

Technical Analysis of the S&P 500 Chart

The S&P 500 chart (US SPX 500 mini on FXOpen) shows the index fluctuating within a range defined by support at 6,222 and resistance at 6,290.

The upward impulses (as indicated by arrows) suggest that:

→ current market optimism, combined with the CPI release, may lead to a bullish breakout above resistance and the establishment of a new all-time high;

→ in a broader context, such a breakout could be interpreted as a continuation of the rally that began in April, following a period of consolidation between the aforementioned levels.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Technical Analysis Forecast for NIFTY50 (25,191) (UTC+4) 1:11PM

1. Candlestick Patterns

Recent Structure:

If NIFTY50 closed near 25,191 with a long upper wick (shooting star/gravestone doji), it signals rejection at higher levels → bearish reversal potential.

A bullish engulfing/marubozu candle would indicate strength → upside continuation.

Key Observation: Watch for confirmation candles. A close below 25,000 invalidates bullishness.

2. Harmonic Patterns

Potential Setups:

Bullish Bat Pattern: If 25,191 aligns with the 0.886 retracement of a prior up-move (e.g., 24,800 → 25,191), it suggests a reversal zone for longs.

Bearish Crab: If 25,191 is the 1.618 extension of a prior swing, expect resistance → pullback to 24,900-25,000.

Action: Validate with Fibonacci levels. Break above 25,250 negates bearish harmonics.

3. Elliott Wave Theory

Wave Count:

Scenario 1 (Bullish): If in Wave 3 (impulse), 25,191 could extend to 25,500 (Wave 3 = 1.618x Wave 1).

Scenario 2 (Bearish): If in Wave B (corrective), 25,191 may peak → Wave C drop to 24,600 (Wave A = Wave C).

Confirmation: A break below 24,950 supports Wave C; hold above 25,100 favors Wave 3.

4. Wyckoff Method

Phase Analysis:

Distribution?: If volume spiked at 25,191 without further upside, it suggests "upthrust" (smart money exiting) → downside to 24,700 (accumulation zone).

Re-accumulation?: If consolidating near 25,191 on low volume, expect breakout toward 25,400.

Key Sign: Watch for springs (false breakdowns) or upthrusts (false breakouts).

5. W.D. Gann Theory

Price & Time Squaring:

25,191 is near 25,200 (a Gann square number). Close above 25,200 opens 25,500 (next resistance).

Time Cycle: July 15–20 is a potential turning window (watch for reversals).

Gann Angle: Trade above 1x1 angle (e.g., 45° from June low) = bullish momentum.

6. Indicator Synthesis (RSI + BB + VWAP)

RSI (14-period):

>70: Overbought → pullback likely if diverging (e.g., price highs ↑, RSI ↓).

<50: Loss of momentum → risk of deeper correction.

Bollinger Bands (20,2):

Price near upper band → overextended → mean-reversion to middle band (25,000) possible.

"Squeeze" (narrow bands) → impending volatility breakout.

VWAP (Daily):

Price above VWAP = intraday bullish bias. A dip to VWAP (~24,950) is a buy opportunity.

Price below VWAP = bearish control → sell rallies.

Intraday/Swing Outlook

Bullish Case (Hold above 25,100):

Target: 25,400 (Elliott Wave 3 + Gann resistance).

Trigger: Bullish candle close + RSI holding 60.

Bearish Case (Break below 25,000):

Target: 24,700 (Wyckoff accumulation + BB lower band).

Trigger: Bearish harmonic confirmation + RSI divergence.

Key Levels

Type Level Significance

Support 25,000 Psychological + BB middle band

24,700 Wyckoff accumulation zone

Resistance 25,191-25,200 Current price + Gann square

25,400 Elliott Wave 3 target

Trading Strategy

Intraday:

Long if holds 25,050-25,100 with RSI >50. Stop loss: 24,950. Target: 25,250.

Short if breaks 25,000 on high volume. Stop loss: 25,150. Target: 24,800.

Swing:

Wait for daily close above 25,200 (bullish) or below 24,950 (bearish).

Hedge with options: Buy 25,200 Calls + 25,000 Puts for volatility breakout.

Conclusion

25,191 is a pivotal level. The confluence of:

Harmonic resistance + Gann square at 25,200,

RSI near overbought territory,

Price testing BB upper band,

suggests short-term consolidation/pullback is likely. However, a daily close above 25,200 ignites bullish momentum toward 25,500. Trade the breakout/breakdown with confirmation.

*Disclaimer: This analysis is time-sensitive (as of July 15, 2025). Monitor real-time volume/price action for validation.*

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

SPX500 Outlook – CPI Data in Focus, Key Pivot at 6282SPX500 – Market Outlook

U.S. futures are climbing as Nvidia plans to resume chip sales to China, fueling positive momentum across tech and growth sectors.

However, investor caution remains ahead of key events:

Major banks ( NYSE:JPM , NYSE:WFC Wells Fargo, NYSE:C Citigroup) will report earnings, offering insights into the financial sector.

All eyes are on the June CPI report, expected at 2.6%. A higher reading could reinforce bearish pressure, while a softer print would support continued bullish momentum.

Technical Outlook:

SPX500 has bounced from the demand zone and is now trading above the pivot at 6282, which keeps the bullish trend in play.

As long as the price holds above this level, we expect continuation toward 6341, and if broken, extended upside toward 6394.

To shift bearish, price must break and close below 6223, which would open the path toward 6142.

Pivot: 6282

Resistance: 6341 – 6394

Support: 6225 – 6191 – 6142

Event Watch : CPI data release today – anything above 2.6% may trigger downside; below 2.6% could support further upside.

Previous idea:

Nas100 Long We Currently Have an Ascending triangle (bullish continuation pattern) Forming After Asian Session & Price is consolidating just below the resistance level, forming higher lows.

We Have a Clearly defined demand zone below current price (gray box), Which also marks out our Bullish Order Block Formed Yesterday Which Price Should Come Retest Before Continuing Upwards.

Pro Tip for CPI Events

Expect increased volatility and fakeouts within the first few minutes.

Wait for a 5–15 min candle close for confirmation before entry.

Use lower timeframes (1m–5m) for entries, but keep higher timeframe structure in mind.

Remember To Like & Subscribe For More A+ Setups✅

deepseek→→U.S. Dollar Index (DXY) Recent Analysis and Outlookchina deepseek↓↓

### **U.S. Dollar Index (DXY) Recent Analysis and Outlook**

#### **1. Current Market Trends and Driving Factors**

- **Trade Policies Boost the Dollar**: U.S. President Trump recently announced new tariffs on Canada (35%), the EU, and Mexico (30%), triggering risk-off sentiment and pushing the Dollar Index (DXY) from 97.20 to around 98.00.

- **CPI Data as a Key Variable**: The U.S. June CPI data, released today (July 15), will influence market expectations for Fed rate cuts. Stronger-than-expected inflation could reinforce the dollar's rally, while weak data may weaken it.

- **Shift in Market Sentiment**: Unlike the "dollar sell-off" trend in early 2025, recent market reactions have leaned toward treating the dollar as a "safe-haven asset" rather than selling it solely due to trade war concerns.

#### **2. Technical Analysis**

- **Key Resistance and Support Levels**:

- **Resistance**: 97.80-98.00 (short-term critical range). A breakout could test 98.50 or even 99.00.

- **Support**: 97.50 (50-day moving average). A drop below may target 96.38 (June low).

- **Technical Indicators**:

- **MACD**: A golden cross has formed on the daily chart, but it remains below the zero line, suggesting the current rebound may still be corrective.

- **RSI**: Near the 50 neutral zone, not yet overbought, indicating room for further upside.

#### **3. Short-Term and Long-Term Outlook**

- **Short-Term (1-2 Weeks)**:

- **Bullish Scenario**: If CPI data is strong and DXY breaks above 98.20, it could challenge 98.50-99.00.

- **Bearish Scenario**: Weak CPI data or progress in trade talks may push DXY back to 97.30-96.50.

- **Long-Term (Second Half of 2025)**:

- **Structural Pressures Remain**: Despite the short-term rebound, the dollar still faces long-term challenges, including widening U.S. fiscal deficits, de-dollarization trends, and concerns over Fed independence.

- **Historical Trend**: After falling over 10% in the first half of 2025, DXY may continue its downtrend in the second half, though the pace of decline could slow.

#### **4. Key Risk Factors**

- **Fed Policy**: If CPI data reinforces a "higher-for-longer" rate outlook, the dollar may strengthen further. Conversely, rising rate-cut expectations could weigh on the dollar.

- **Geopolitics and Trade Talks**: Compromises from the EU or Mexico could reduce safe-haven demand, while failed negotiations may fuel further dollar gains due to risk aversion.

### **Conclusion**

The DXY is at a critical juncture, with short-term direction hinging on CPI data and trade policy developments. Technicals lean bullish, but long-term fundamentals remain challenging. Traders should closely monitor the 98.00 breakout and today’s CPI data impact.

The best strategies if the US dollar rebounds this summerFor several months now, the US dollar (DXY) has been under pressure against the major currencies, falling by over 11% since the start of the year. However, technical and fundamental signals suggest that a low point could be reached this summer. In this scenario, it is essential to measure the possible consequences on the markets and anticipate the best strategies to protect or boost your portfolio.

At this stage, the US dollar has not confirmed a major low, but it will eventually happen, so it's important to anticipate the consequences for all asset classes, and identify the best strategies to implement at an early stage, particularly on Forex.

In this new analysis in the TradingView columns, we ask a number of questions, including the impact on gold, the price of bitcoin and Forex vehicles for exposure to a possible rebound in the US dollar.

1) On the technical front, many of the bearish targets have been made

The first point to watch is the technical configuration. The DXY is now evolving on long-term support levels, with divergences indicating that the downtrend is running out of steam. Indicators such as the RSI and MACD show that selling pressure is weakening on the weekly timeframe. The monthly uptrend line is still active, although the signal varies according to the scale chosen. It's still too early to say that the US dollar has made its final low, but it's worth bearing in mind that most of the bearish technical targets in Elliott waves have been made.

2) If the US dollar were to rebound this summer, what impact would this have on gold and the bitcoin price?

Secondly, a rebound in the dollar would have a direct impact on other asset classes. Gold is influenced by several fundamental factors, notably its inverse correlation with the US dollar and the impact of GOLD ETFs, which are themselves closely linked to the underlying trend in the US dollar. Overall, we believe that if the US dollar were to rebound, gold would lose a good third of its bullish fundamentals. The table below summarizes the factors influencing gold's underlying trend.

Crypto-currencies, and Bitcoin in particular, could also be penalized by a stronger dollar and a contraction in global liquidity (M2). The US dollar plays a very direct role in the calculation of M2 global liquidity, and the bitcoin price is highly correlated with the underlying trend in M2 global liquidity. This indicator, which aggregates the money supply of the major economies converted into US dollars, generally acts on bitcoin with an average lag of around 12 weeks. The latest statistics show a new all-time high for this global liquidity.

This factor is helping to sustain the upward trend observed since April, despite a complex fundamental context marked by a Federal Reserve determined to maintain a restrictive monetary policy in the short term.

The US dollar, by strengthening or weakening, directly modifies the total value of M2 expressed in dollars.

This contributes to the extent of global liquidity and, consequently, to the evolution of bitcoin. Consequently, if the US dollar rebounds this summer, expect a bearish impact on BTC from this autumn onwards.

3) If the US dollar rebounds this summer, what are the best Forex strategies to consider?

Finally, on a practical level, there are several strategies to consider. On Forex, a dollar rebound scenario calls for monitoring major pairs such as EUR/USD, in order to identify selling entry points if a top is confirmed.

But the most direct and unleveraged way to gain exposure to the US dollar (DXY) is through ETFs. Should the US dollar rebound, then exposure to a US dollar (DXY) ETF may be a good strategy. Unlike futures and CFDs, there's no leverage, so it allows for better risk management.

We also suggest that you keep a close eye on the USD/CAD, USD/JPY and GBP/USD currency pairs in the event of a summer rebound scenario for the US dollar against a basket of major currencies.

We will continue to bring you regular analysis on the US dollar to determine whether or not a major low will emerge this summer.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

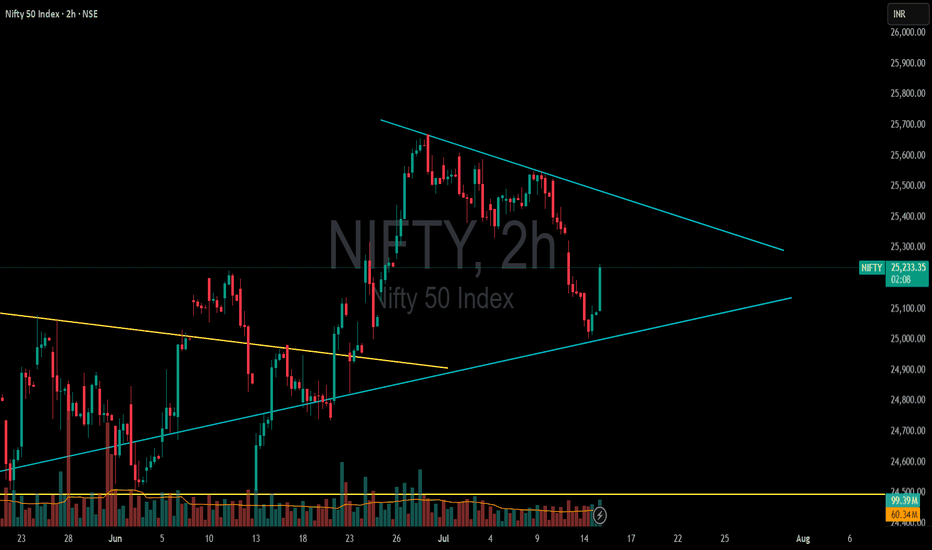

NIFTY 2HNifty is currently trading around the 25,200 level and has formed a symmetrical triangle pattern on the chart, which typically indicates a period of consolidation before a major move. This pattern reflects a balance between buyers and sellers, with price making lower highs and higher lows, gradually converging towards the apex. A breakout from this triangle, especially with strong volume, signals the potential start of a new trend. In this case, if the breakout sustains and is followed by a successful retest of the breakout zone as support, it strengthens the bullish outlook. Based on technical projections, there is a strong possibility that Nifty could rally towards the 28,000 level, marking a significant upside move from the current range. However, traders should monitor volume and price action closely to confirm the breakout's strength.

Disclaimer: The information provided is for educational and informational purposes only and should not be considered as financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Please consult with a certified financial advisor or conduct your own research before making any investment decisions. We are not responsible for any losses incurred as a result of using this information. Stock market investments are subject to market risks; read all related documents carefully.

Dow Jones H4 | Rising into a multi-swing-high resistanceThe Dow Jones (US30) is rising towards a multi-swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 44,845.48 which is a multi-swing-high resistance.

Stop loss is at 45,240.47 which is a level that aligns with the 127.2% Fibonacci extension.

Take profit is at 44,124.85 which is an overlap support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.