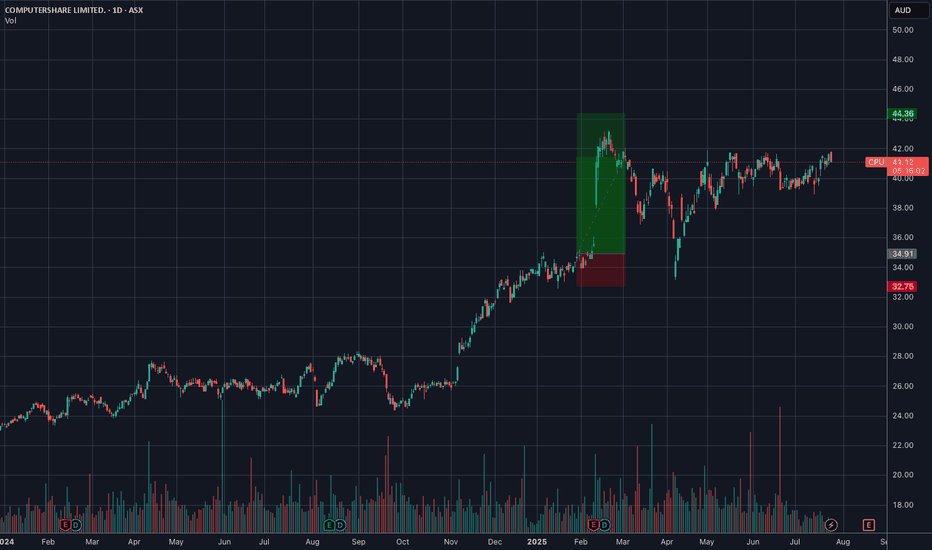

Buy Idea: CPU.ASX – Earnings Momentum PlayEarnings Date: 📅 19 August 2025

📊 Technical Setup

• CPU is forming a tight volatility contraction pattern (VCP) near highs, coiling above the 21EMA and 50MA.

• Strong bounce off support with increasing volume and bullish momentum crossover.

• Setup has clear risk-defined structure and is suppor

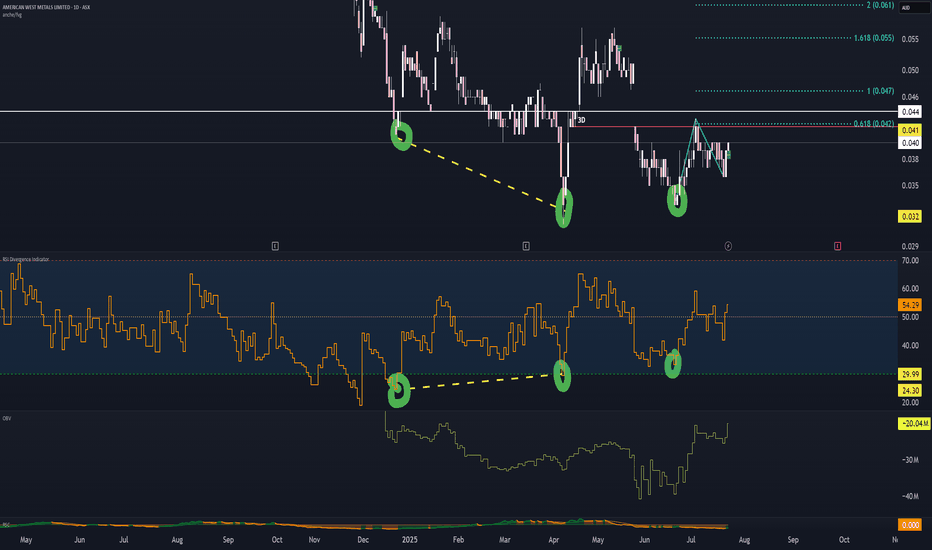

AW1 analysisIgnore the below write-up and watch the video.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has

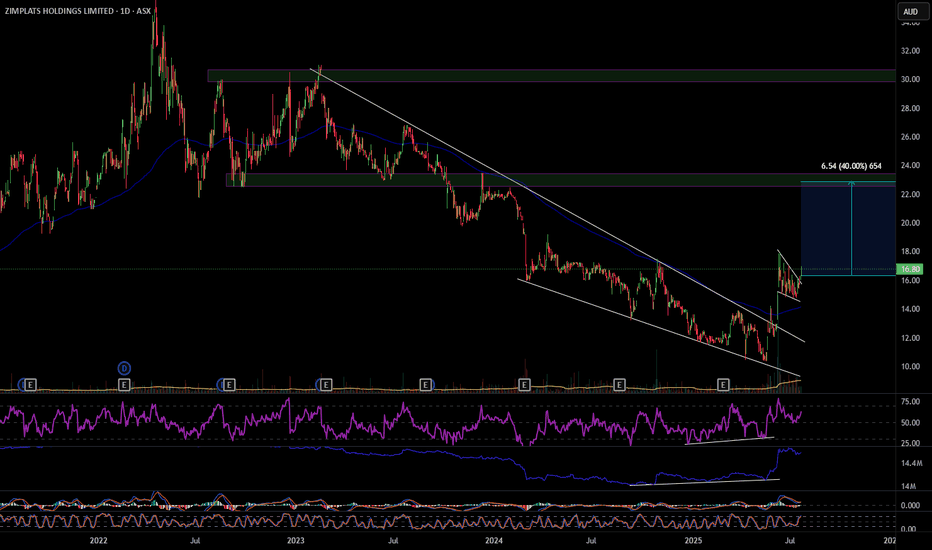

ZIM 40% move up

ZIM has broken out of a descending wedge with bullish RSI and OBV divergence, also multiple divergences on smaller time frames. On the hourly it's had a pull back and formed a bull flag that it has also broken out of. ZIM looks to have formed a change of structure forming higher highs and higher

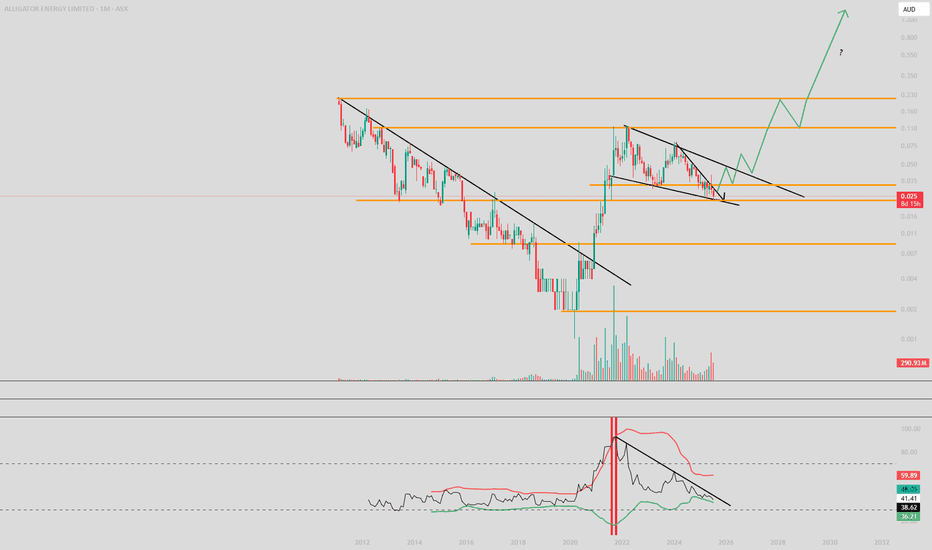

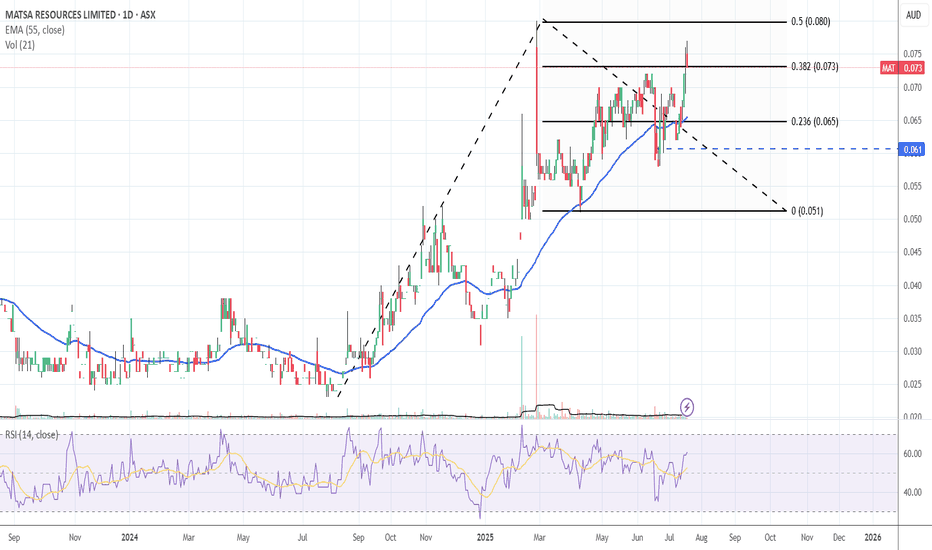

My Target for MATSA is 10x within 2 yearsHi, thanks for viewing. I just added another 12% to my MATSA position today. I'm not ruling out adding more at this stage, but for now I'm quite happy.

My valuation of Matsa is simply very different to the market presently, maybe I can get some comments and discussion going.

A few months they rele

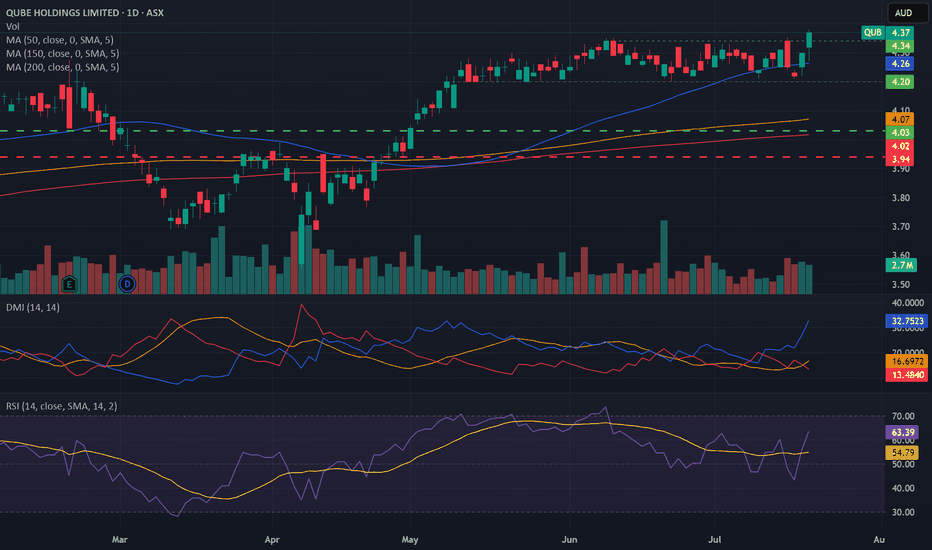

Bullish potential detected for QUBEntry conditions:

(i) higher share price for ASX:QUB along with swing up of indicators such as DMI/RSI.

Depending on risk tolerance, the stop loss for the trade would be:

(i) a close below the bottom of the formed channel (i.e.: below $4.20), or

(ii) below previous support of $4.11 from the open

FFM -- ASX – Breakout Consolidation in Focus

📝 Description

Firefly Metals is setting up a classic breakout continuation scenario after reclaiming the $1.00 psychological level and breaking the long-term trendline resistance.

🔹 Key Observations:

• Trendline Break: The descending trendline from the prior high was decisively breached, signaling

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Tomorrow

KOVKORVEST LTD

Actual

—

Estimate

0.59

AUD

Jul 28

PPLPUREPROFILE LTD

Actual

—

Estimate

0.00

AUD

Jul 29

FLNFREELANCER LIMITED

Actual

—

Estimate

—

Jul 29

BIOBIOME AUSTRALIA LIMITED

Actual

—

Estimate

—

Jul 30

CIACHAMPION IRON LIMITED

Actual

—

Estimate

0.04

AUD

Aug 5

CCPCREDIT CORP GROUP LIMITED

Actual

—

Estimate

0.72

AUD

Aug 6

REAREA GROUP LTD

Actual

—

Estimate

1.89

AUD

Aug 6

PNIPINNACLE INVESTMENT MANAGEMENT GROUP LIMITED

Actual

—

Estimate

0.23

AUD

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Finance | ||||||||

| Non-Energy Minerals | ||||||||

| Health Technology | ||||||||

| Retail Trade | ||||||||

| Technology Services | ||||||||

| Energy Minerals | ||||||||

| Commercial Services | ||||||||

| Transportation | ||||||||

| Consumer Services | ||||||||

| Communications |