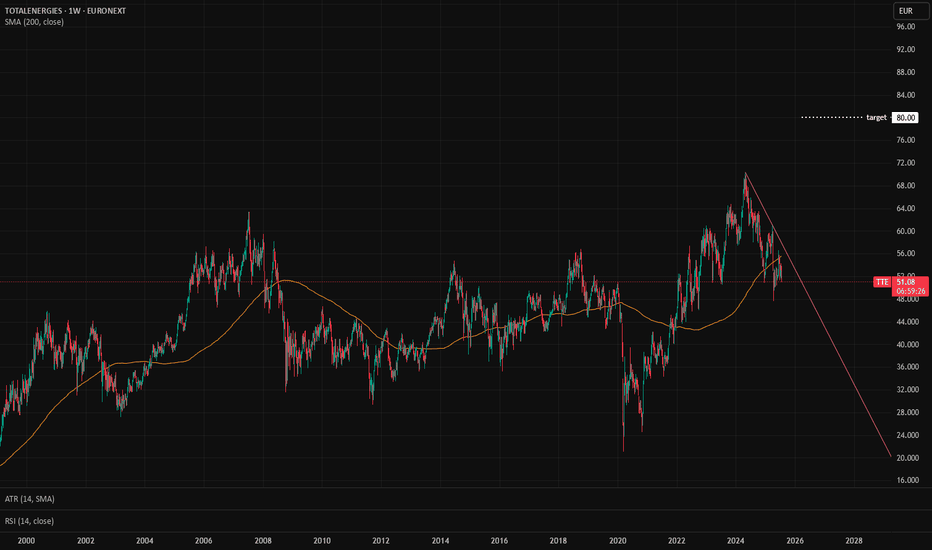

TTE: Fundamental Analysis +56 %With 2024 revenue of 195,6 billions €, Total Energies ranks among the top 10 largest energy companies in the world. EverStock identifies a fundamental revaluation potential of + 56 %.

Valuation at 7.3x net earnings

Currently valued at 115,7 billions € in market capitalization, Total Energies post

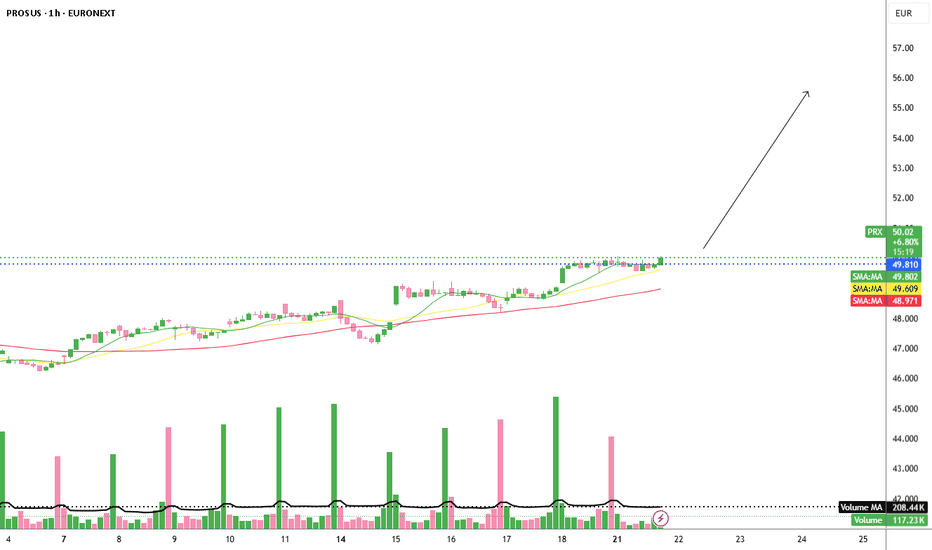

Prosus N.V. – Hidden Giant with Breakout PotentiaFollowing a strong bullish trend in July, Prosus N.V. is already up 8% month-to-date, and things are heating up. The company is reportedly in talks to acquire Just Eat Takeaway.

However, since Prosus already holds a 24% stake in Delivery Hero, the EU antitrust body has pushed back. Prosus has resp

Exail Technologies European Drone Warfare and Robotics. Exail Technologies (previously Groupe Gorge S.A.) is a French tech company specializing in drones, robotics, and maritime autonomous systems, with growing exposure to defense and industrial markets.

It’s on a clear uptrend, sitting well above its 50 and 200-day EMAs with momentum firmly in play.

Airbus Wave Analysis – 10 July 2025- Airbus broke resistance zone

- Likely to rise to resistance level 190.00

Airbus recently broke the resistance zone lying between the resistance level 175.00 (which started the earlier sharp downward correction in March, as can be seen from the Airbus chart below) and the resistance trendline of t

SOLB | Confirmed Descending Triangle Breakout – 32% Target📍 Ticker:

SOLB (Solvay SA – Euronext Brussels)

📆 Timeframe: 1D (Daily)

📉 Price: €30.14

📈 Pattern: Descending triangle breakout confirmed on daily close

📊 Breakout Probability estimation: ~73% (short-term triangle breakout upward)

🔍 Technical Setup (Updated on Daily Chart):

Solvay has now confirmed

ASMLASML Holding

ASML closed at $671.6 on July 7, 2025.

Market Capitalization:

ASML's market cap is approximately $302–$314 billion as of early July 2025, making it one of the world’s 30 most valuable companies.

Key Financials and Outlook

Next Earnings Release:

Scheduled for July 16, 2025. The consens

AEDIFICA - Alternative Medium Timeframe Elliot Wave analysisIn this scenario, I’m interpreting the larger Wave 1 as a potential leading contracting diagonal, where each subwave is unfolding as a zigzag (3-3-3-3-3) rather than the typical 5-3-5-3-5 structure.Currently, we appear to be in Wave 4 (Pink) of this diagonal, which seems to be in the final stages of

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Aug 7

KBCKBC GROEP NV

Actual

—

Estimate

2.30

EUR

Aug 7

XIORXIOR STUDENT HOUSI

Actual

—

Estimate

—

Aug 7

JENJENSEN-GROUP

Actual

—

Estimate

2.70

EUR

Aug 8

BPOSTBPOST

Actual

—

Estimate

0.16

EUR

Aug 8

LOTBLOTUS BAKERIES

Actual

—

Estimate

98.75

EUR

Aug 13

NEXTANEXTENSA

Actual

—

Estimate

—

Aug 14

SHURSHURGARD

Actual

—

Estimate

0.81

EUR

Aug 14

MONTMONTEA NV

Actual

—

Estimate

—

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Consumer Non-Durables | ||||||||

| Finance | ||||||||

| Health Technology | ||||||||

| Process Industries | ||||||||

| Utilities | ||||||||

| Consumer Services | ||||||||

| Industrial Services | ||||||||

| Non-Energy Minerals | ||||||||

| Distribution Services | ||||||||

| Producer Manufacturing |