#8 by Marketcap in France (Buy)$AI.PA ranked #8 in France with a 82.29B Market cap, engages in gas supply for large industry and health businesses has been ranging since late march.

1D chart is showing a bounce from the 20EMA and 0.236 Fibonacci level a possible sign of Bollinger band squeeze. The price might be taking a break at this point before continuing its upward trend.

4H chart is showing similar data, with a bounce from the 0.236 level and dipped briefly below the 20 and 50 EMA. It has now moving back to the top end of the range. RSI is increasing and broke through the 50% mark and MACD has also started to turn positive.

Buying today @ 165

Target price @195 (top of the current parallel channel)

Adyen EuropeSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

KBC Ancora Europe Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

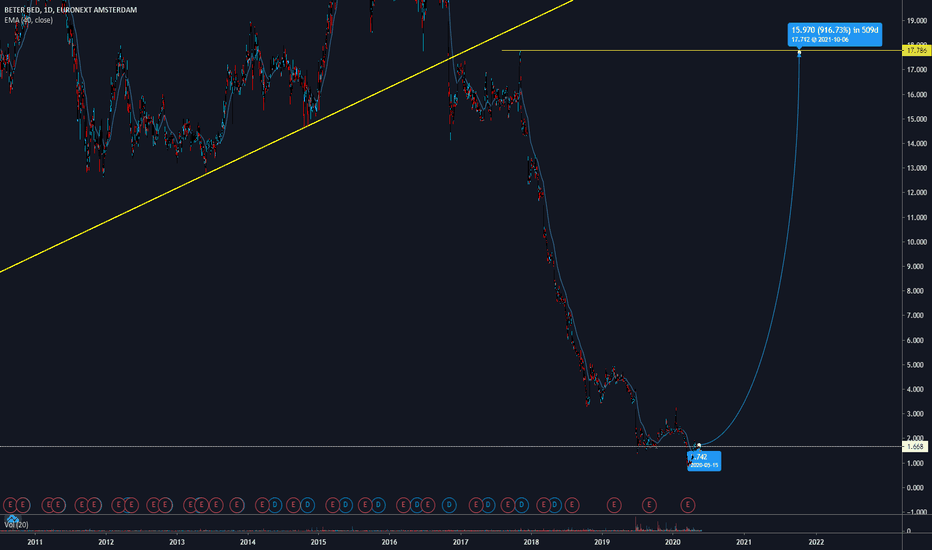

Retteketet naar Beter BedQ1 2020 sales increased by 8.0%,

Even in corana time many orders keep coming

BAM BAM BAM The construction sector has tremendous growth potential due to the large home shortage. BAM Group went through difficult times, but with a major reorganization and a new CEO Ruud Joosten who only seems to be making good choices at the moment. I see a bright future for BAM GROUP.

I have drawn two levels where I get into position.

ALERS Cup & Handle BOALERS EUROBIO SCIENTIFIC is a company on the French stock market in the vitro medical diagnostics and also producing CAVID19 tests. It made a nice CUP & Handle BO with volume

EURONEXT:ALERS EURONEXT:ALERS ://www.tradingview.com/x/Uw1WlyDV/]https://www.tradingview.com/x/Uw1WlyDV/

Is this the Solution to Your Problem? Solutions 30

Short Term - We look to Buy at 6.05 (stop at 5.71)

We look to buy dips. Previous support located at 6.00. A higher correction is expected. Although the anticipated move higher is corrective, it does offer ample risk/reward today.

Our profit targets will be 7.05 and 7.45

Resistance: 7.00 / 8.00 / 9.00

Support: 6.00 / 5.00 / 4.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Koninklijke BAM Groep NV. BAMNB. Cup & Handle. BAM has been in an uptrend since Feb 2021. However, in mid-February 2022 a nice dip from € 3.45 to € 2.07, but the uptrend has started again reasonably well.

If the price continues to rise in the coming weeks, we will see a cup & handle pattern and a test on the fibonacci golden pocket.

When this fibonacci is broken, the price can return to € 3.50. And that could be another selling point.

16-04-2022. My 2e TA.

MT: WATCH FOR BREAK OUTArcelorMittal, one of the major steel producers.

This is the weekly chart. After a big double bottom , MT is back at historical resistance around 30-31.

I would watch that level and enter a long swing trade if it breaks 31.

First target would be 40.

Most analysts rate this as a buy with a target at 50.

Trade safe.

ING Groep About to Drop? ING Groep

Short Term - We look to Sell at 9.90 (stop at 10.24)

Further downside is expected although we prefer to set shorts at our bespoke resistance levels at 10.00, resulting in improved risk/reward. Trading close to the psychological 10.00 level. Price action is forming a bearish flag which has a bias to break to the downside. There is scope for mild buying at the open but gains should be limited.

Our profit targets will be 8.24 and 7.45

Resistance: 10.00 / 11.00 / 13.50

Support: 9.00 / 8.00 / 7.25

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Euronav NV (EURN)Euronav is an international shipping enterprise which focuses on oil transport by sea. On 7 April 2022 there was announced a merger between Euronav and Frontline Ltd. pending regulatory approval and ironing out of the last details. The combination would be based on an exchange ratio of 1.45 shares in Frontline for every Euronav share. Euronav shareholders would own 59% of the merged entity and Frontline shareholders 41%. The merged company would have a market cap of $4.2bn based on 6 April market values and a fleet of 69 VLCC and 57 Suezmax vessels, and 20 LR2/Aframax vessels.

Danone S.A (BN.pa) bullish scenario:The technical figure Triangle can be found in the French company Danone S.A (BN.pa) at daily chart. Danone S.A. is a multinational food-products corporation based in Paris and founded in Barcelona, Spain. It is listed on Euronext Paris where it is a component of the CAC 40 stock market index. Some of the company's products are branded Dannon in the United States. As of 2018, Danone sold products in 120 markets, and had sales in 2018 of €24.65 billion. In the first half of 2018, 29% of sales came from specialized nutritional preparations, 19% came from branded bottled water, and 52% came from dairy and plant-based products. The Triangle has broken through the resistance line on 08/04/2022, if the price holds above this level you can have a possible bullish price movement with a forecast for the next 10 days towards 53.75 EUR. Your stop-loss order according to experts should be placed at 49.47 EUR if you decide to enter this position.

French food group Danone said on Tuesday that "all options are on the table" regarding its business in Russia and that there was no decision at this stage to exit the country. This was after a source close to the matter said Danone was looking at possible ways of withdrawing from Russia, as the West prepared new sanctions on Moscow after dead civilians were found lining the streets of a Ukrainian town seized from Russian invaders.The company earned about 5% of its revenues in Russia in 2021 and less than 1% in Ukraine.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

BNP Paribas Bounce? BNP Paribas

Short Term - We look to Buy at 46.81 (stop at 45.50)

We look to buy dips. Although we remain bearish overall, a correction is possible without impacting the trend lower. Previous support located at 47.00. We look for a temporary move higher.

Our profit targets will be 50.19 and 53.18

Resistance: 55.00 / 60.00 / 68.00

Support: 47.00 / 38.00 / 30.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

GLPG.BR completing 3rd wave up off the Dec lowTLDR: targeting 80 if next pull back holds 56.

--

Galapagos has gained more than 50% nominally off the Dec '21 low, in a three waves structure.

While running into the 1.618 extension of the green circle i-ii, the technicals are becoming overbought.

With the next earning report within a month, it seems wise to take some profits off the tabel.

Further more, the 65 region also happens to be near:

- an important volume wedge on the weekly ~68 EUR;

- the orange 2.0-2.618 extension, a typical target range for the impulsive subwave v of circle iii;

- the 0.236 retracement of the higher degree correction started in Feb 2020, before the covid crash;

Therefor resistance is expected, a pull back could be starting soon.

Assuming we are topping somewhere between the green 1.618-1.764 extension, ideally the pull back holds above 57-58 region as circle iv to jump start circle v targeting 80 region.

A drop under 56 will be the first warning that this rally is topped in three waves, while dropping under 52 will have me reconsider whether there is any bullish potential left in the near term.

Bigger picture (monthly chart: )

Off the ATH struct in Feb '20, GLPG has corrected more than 80% nominally, but when putting it in logarithmic perspective, it was merely a 0.382 retracement after a phenomenal run from 2.74 to 250.9, almost 100x in 12 years. The long term trend line has never been violated, and the monthly technicals are trying to turn upward again.

Now that we are back to a make-or-break level like the dips in 2011 and 2014, the stop limit to the down side is clearly defined while the potential upside is still beyond imagination.

A hard stop should be placed just under 44, as given the tiny volume in between, the next long term support will likely not be found until 0.618 retracement ~15 EUR.

Conclusion: with 0.382 retracement from ATH ~45 EUR as long term support, maintaining immediate bullish bias as long as next pull back holds above 56.

Takeaway (TKWY) bullish scenario:The technical figure Triangle can be found in the Dutch company Just Eat Takeaway.com N.V. (TKWY.as) at daily chart. Just Eat Takeaway.com N.V. is a Dutch multinational online food ordering and delivery company based in Amsterdam, Netherlands. It is the parent company of brands including Takeaway.com, Just Eat, SkipTheDishes, Grubhub, and Menulog. Just Eat Takeaway operate various food ordering and delivery platforms, where customers can order food online from restaurants’ menus, and have it delivered by restaurant or company couriers directly to their home or workplace using an app or website. The Triangle has broken through the resistance line on 02/04/2022, if the price holds above this level you can have a possible bullish price movement with a forecast for the next 7 days towards 40.000 EUR. Your stop-loss order according to experts should be placed at 30.705 EUR if you decide to enter this position.

Just Eat Takeaway.com N.V. and McDonald's Corp have entered into a global strategic partnership to support the McDelivery business. The financial terms of the arrangement were not disclosed. Just Eat Takeaway.com's geographic coverage, food-delivery marketplace, and 500,000 couriers worldwide support its delivery partners, such as McDonald's. The partnership will elevate local partnerships between the parties, reducing complexity to innovate at scale and improve operational efficiency.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.