YILI: Its Tastes Good TooFundamental :

Another China Roaring 2020s stock called Inner Mongolia Yili. It is in in the consumer non-cyclical sector, involved in food processing. It processes and manufacturers milk products that I, personally, enjoy drinking. It tastes so good. In 2018, it was the world's best-performing food brands.

Not only are their products worth trying, but their company is stable and growing.

Technical :

The stock bounced from some long-term moving averages on large time frames. It also consolidated a bit and now it is breaking out. The stock's trend is a slow and steady rise over a long stretch of time, paying a dividend.

A Piece of China's Real Estate: Greenland Holdings: 600606This is another China Roaring 20s stock. I enjoyed the stay at one of this hotel's premium hotels. The price tag was $300 to $400 US dollars per night. It was the tallest building in a city called Nanjing. What's more, there company's bottom line is back after its stock took a hit from the 2015 slide from 40. Although this small investor cannot afford buying space or staying there for a month like other wealthy head-honchos, we can own a piece of this grand luxury.

Observing simple support and resistance on this chart, pit stops of technical and fundamental pause for me will be around 10, 20 and 40.

Qingdao HAIER: 600690Continuing on the theme of China and its coming "roaring 2020s," I also post about Qingdao Haier. I walked in several markets and found this company displayed on shelves. Also, I like the quality of its air conditioner, refrigerators, washing machines and other home appliance. It competes with GREE. Haier is more trustworthy than GREE among the circle that I know.

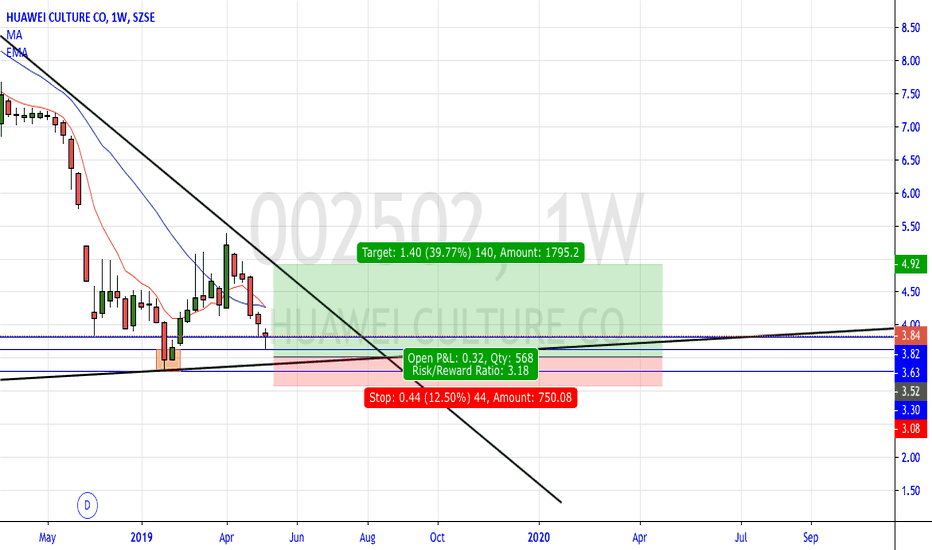

HUAWEI waiting for a bullish bounceThe price has made a significant drop in the past few days. We are expecting the price to reverse sooner or later, as all of the fundamental indicators show that. As we do not know when the big bullish bounce is going to happen we are waiting for a sign to form. Right now we can see that a small potential double bottom is being formed. That is why we are expecting a bullish move in the next few days.

Feel free to grab a copy of our Free Weekly Market Outlook here:

mailchi.mp

For more content follow us on Instagram and Facebook:

www.instagram.com

www.facebook.com

We wish you good luck with your trading!

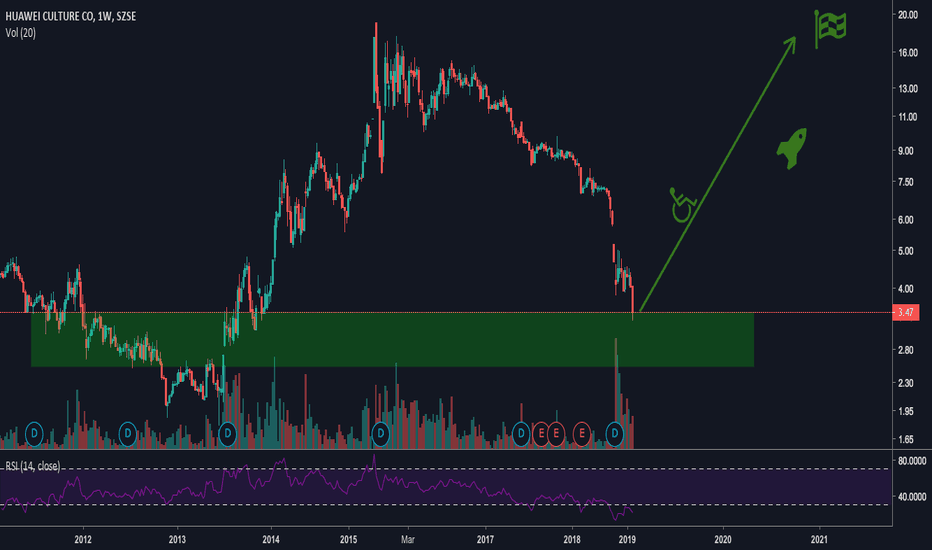

Acciones Huawei posible caida en el valor de las acciones de huawei por la guerra comercial entre eeuu y china ya que trump ha declarado situación de emergencia en eeuu para así poder regular las entradas de cualquier producto en este caso de huawei, aunque tambien veo una gran subida por el 5G la nueva tecnologia en la que huawei es uno de los cabecillas en este campo.

300324 Short Term Chart 04/10/2019 Bearish PatternLook at the daily chart, I originally thought 300324 will be rejected at a strong resistance level at around 8.6 when it had a strong bounce off from the low of 5.12. However bulls surprised me and pushed it up to 9.5 price range, and then hard rejected it back to 8.6, by forming a tweezer top pattern. Then 8.6 becomes a crucial price level that the price was actually bounced in a small range within the past couple of days. Bulls and bears are fighting to each other in order to form a more clear movement trend. Then bearish pattern formed when the price went to a lower high at 9.18.

One indicator is that volume is slowly declining, and the current price is bouncing between 12 and 26 exponential moving average, as showing green and red line in the chart. Fib also gives as a reference for the possible future downtrend movement if prices finally breaks down from 26 EMA. Fib 0.618 will become the first support, as the price bounced up couple of time at the previous timeframe. Then Fib 0.236 is another strong support line that price possible will have another strong bounce up.

Pattern will confirm once price breaks down 26 EMA, or Weekly closes at around 8.22 price range, by formed a weekly tweezer top. Keep an eye on the price movement in the following two days, and hope you will have a nice trade.

This is not financial advise for buy or sell. It is only for education purposes.

Late trend analysis of dongtu science and technology co., LTDThe east soil belongs to a concept of science and technology more rich mark, belongs to plate concept of Beijing 2025 plan 5 g plate edge calculated the gem big data industry 4.0 interconnected equity incentive domestic chip military deep deep into 500 shares male, smart grids, telecommunications industry through introducing the above it is not hard to see, this is a favor by main varieties, and from the trend before, did comply with this feature.

Ping an securities gives the view is

The company's revenue growth rate dropped sharply, and customer demand was not as good as expected, which may be the main reason: in the first three quarters of 2018, the company's revenue growth rate was only 7% compared with the same period of 2017, which was 23%, a sharp decline. We speculate that the main reasons are as follows: 1) the company's intelligent transportation solutions for the transportation industry and the intelligent substation integrated control server project for the electric power industry; the market promotion progress is not as expected, which makes the sales of the company's industrial Internet products fall short of expectations; 2. 2) in the first half of the year, the amount of newly added contract orders in the military industry was 120 million yuan, and the amount of orders to be executed was 150 million yuan, basically unchanged from the same period of the previous year, indicating that the growth of customer demand may be less than expected, making the sales volume less than expected.

These basic information you can see, I will not repeat, short - term trading, more look at the chart, the fundamentals can be referred to.

Say my logic, because April is the second anniversary of male security, and short term to see out of the stock brokerage funds, will look for the next target layout, then male security as a millennium plan, there is no possibility of speculation for a year, but should be repeatedly hyped the target. And in xiongan, science and technology, military, 5g and many other subjects intersection, the east soil is more prominent. We from the early trend and change hands to see, there is clearly a strong zhuang intervention, Friday market bearish, he still maintained a strong enough, intraday up more than 5%. This wave is unilateral pull up 100% trend, there should be a collation of the market, dressing the medium-term trend, and after the adjustment, there is a theoretical opportunity to rise, we suggest to stay focused.

Strategy: wait for the next day line level adjustment, bargain admission