Arabian Cement has a potential to 24 then 25.61-hour chart,

the stock EGX:ARCC is trading in a channel, between support level at 22.4 and resistance level at 24.0

The technical indicators RSI, Stochastic are signalling a positive direction towards the upper line R.

Closing above 24.0 for 3 hours with high volume, the next target (TP - Take Profit) will be 25.6

(Fibonacci extension to 26.6)

Consider a stop loss below 22.2

GDWA_A Deeply Underrated Asset Investment Decision Analysis for GDWA holding company has shares as following:

1) 72.3% of Electro Cables (ELEC) market Cap 9.15B

2) 47.9% of Arab Dairy (ADPC) Market Cap 1.58B,

3) 73.9% of Universal for Paper &Packaging Materials (UNIP) Market Cap 621.74M

4) 74.7% Egyptian Integrated for Food Industries (EIFI) Market Cap 101.74M

Minimum Market Cap Estimate: If GDWA's value is purely based on its investments, the minimum estimate is 7.91B.

value-based price of EGP 7.54/share, you would gain approximately +28.0 % profit from your investment at the current price (EGP 5.8/share).

The fair value of GDWA's share price can be determined based on the valuation data provided in the reports and financial metrics. Here’s a detailed calculation and analysis:

A) Historically, GDWA's financial performance tends to be stronger in the second half of the year due to operational seasonality and project completions.

Q4 Financial Performance

B) EBIT for Q4: EGP 1.15 billion, up by +185.81% compared to previous periods. This indicates strong operational growth.

C) Net Income for Q4: EGP 430.05 million, up by +203.65%, suggesting solid profitability improvements in the company.

Gadwa is a leading industrial development and investment company that boasts holdings in the industrial sector, particularly high growth-potential consumer-related businesses, and defensive business models.

1. Projected Price by End of 2025: EGP 10.4/share

2. Projected Price by End of 2026: Refer stockanalysis.com the company The enterprise value

is 16.37 billion. what shou be prices of share DWA would be approximately

EGP 15.59 per share.

#RAYA Egyptian stock - great opportunity - great fundamental.#RAYA time frame 1 DAY

Created Gartley Bullish pattern , also there is positive diversion at RSI ( may that support our idea ) as follow :

Entry level around 2.70

Stop loss 2.55 ( estimated loss -5.50% )

First target at 3.00 ( with profit around 10% )

Second target 3.30 ( with profit around 20% )

Third target 3.50 ( with profit 28% )

NOTE : this data according to time frame I DAY , it`s may take period up to 3 months to achieve targets , you must study well the Alternative opportunities before invest in this stock .

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

#IEEC - Egyptian stock#IEEC time frame 1 DAY

Created a bearish Gartley pattern

Sell point around 0.359

Stop loss / reentry 0.368 ( estimated loss -2.5% )

First target at 0.338 ( estimated profit 5.80% )

Second target 0.32 ( estimated profit up to 11% )

also RSI made a negative diversion that may support our idea .

NOTE : this data according to time frame 1 DAY

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

#MOIL - Egyptian stock#MOIL time frame 1 hour

created a bullish Gartley pattern

Entry level around 0.338

Stop loss 0.334 ( estimated loss -1.10% )

First target at 0.346 ( estimated profit around 2.50% )

Second target 0.354( estimated profit around 4.80% )

Third target 0.363 ( estimated profit 7% )

Note : In addition there is positive diversion at RSI and MACD , that may be support our idea .

NOTE : this data according to time frame I hour

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

#KRDI - Egyptian stock#KRDI time frame 1 hour

created a bullish Gartley pattern

Entry level around 0.59

Stop loss 0.575 ( estimated loss -2% ) -5% from currant prices

First target at 0.611 ( estimated profit around 4% ) achieved

Second target 0.633( estimated profit around 8% )

Third target 0.659 ( estimated profit 12% )

Note : First target already achieved so it will be good chance if prices fall back into entry zone.

NOTE : this data according to time frame I hour

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

ISPH Short I think there is a valid short opportunity here.

Here is more fundamental analysis (done by ChatGPT).

///////////////////////////////////////////////////////////////////////////////

Ibnsina Pharma is a prominent pharmaceutical distribution company in Egypt, listed on the Egyptian Exchange under the ticker symbol ISPH. Established in 2001, the company distributes a wide range of pharmaceutical and cosmetic products to both private and public-sector clients, including pharmacies, hospitals, and healthcare institutions.

INVESTING.COM

Financial Overview:

Revenue: In 2023, Ibnsina Pharma reported revenues of approximately EGP 33.95 billion.

BARRONS.COM

Net Income: The net income for the same period was EGP 173.14 million, resulting in a net profit margin of 0.51%.

BARRONS.COM

Total Assets and Liabilities: The company's total assets stood at EGP 18.55 billion, with total liabilities amounting to EGP 17.1 billion, indicating a debt-to-assets ratio of 92.19%.

BARRONS.COM

Shareholder Structure:

Ibnsina Pharma's ownership is diversified among prominent entities:

Free Float: 40.7%

Abdel Gawad Family: 15.0%

Faisal Islamic Bank: 14.0%

Mahgoub Family: 12.9%

European Bank for Reconstruction and Development (EBRD): 9.6%

Blom Investment: 7.8%

This diverse shareholder base has enhanced the company's corporate governance practices.

IR.IBNSINA-PHARMA.COM

Stock Performance:

As of January 29, 2025, the stock closed at EGP 7.02 per share, with a 52-week range between EGP 2.14 and EGP 7.59.

IR.IBNSINA-PHARMA.COM

Considerations for Investors:

While Ibnsina Pharma has demonstrated significant revenue generation, its net profit margin is relatively low, and the company operates with a high debt-to-assets ratio. Potential investors should weigh these factors carefully and consider consulting with a financial advisor to determine if this investment aligns with their risk tolerance and financial objectives.

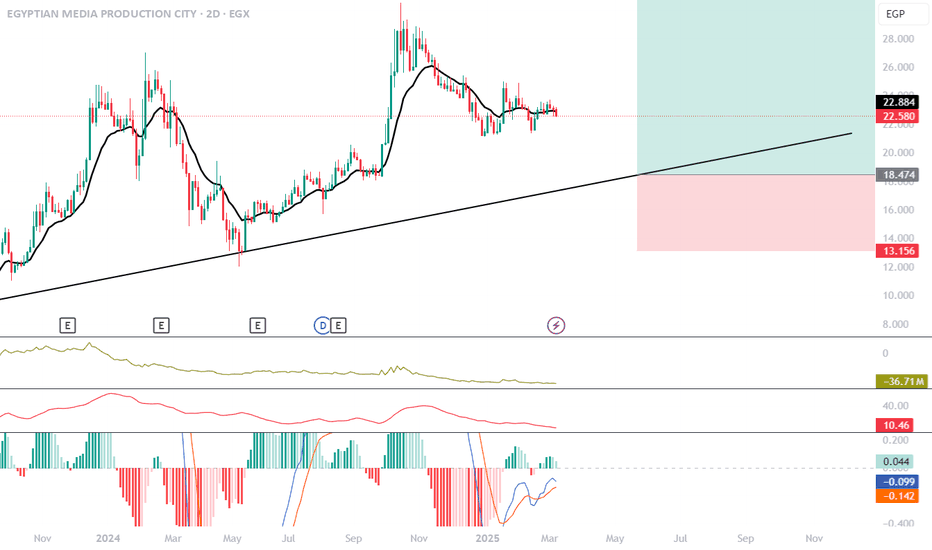

- **Entry Plan:** Expecting a **reversal from the trendlineBased on your chart analysis:

- **Entry Plan:** Expecting a **reversal from the trendline** and **60% Fibonacci level**, you plan to **start Dollar-Cost Averaging (DCA)** at current levels.

- **Stop Loss:** Placed at **13 EGP** to limit downside risk.

- **Take Profit:** Targeting **27 EGP** for a solid risk-reward ratio.

### **Additional Observations:**

1. **Trendline Support:** The price is near a long-term **ascending trendline**, which has acted as support before.

2. **Indicators:**

- The **moving average** (black line) shows a consolidation phase.

- **Momentum indicators** at the bottom suggest a potential reversal.

3. **Risk Management:**

- DCA is a good strategy if the price dips further before bouncing.

- The **stop loss at 13 EGP** is placed wisely below support to avoid unnecessary risk.

- The **profit target at 27 EGP** aligns with a previous resistance level.

Would you like a more detailed breakdown or adjustments to your trading plan? 🚀📈

Raya Holding (EGX) – Trendline Support with Upside PotentialHere’s a TradingView idea for your trendline approach setup with targets set to the previous top:

---

**Raya Holding (EGX) – Trendline Support with Upside Potential**

📉 **Technical Analysis:**

The stock is approaching a strong ascending trendline, acting as a dynamic support level. A potential bounce from this level could trigger a move towards previous resistance zones. The MACD is showing signs of bullish divergence, suggesting a possible reversal.

📌 **Trade Plan:**

- **Entry:** Near the trendline support with confirmation of a bounce.

- **Stop Loss:** Below the trendline and recent lows to manage risk.

- **Target Levels:**

1️⃣ **First Target:** 2.478 – A key resistance level and volume cluster.

2️⃣ **Second Target:** 3.243 – A previous strong resistance zone.

3️⃣ **Final Target:** 3.752 – The previous high, where selling pressure might emerge.

📊 **Indicators & Confirmation:**

- MACD forming bullish divergence, signaling momentum shift.

- Price approaching a strong support level with high probability of a bounce.

- Volume profile suggests strong interest at higher levels.

🚀 **Final Thought:**

A well-structured trade with a favorable risk/reward ratio. A bounce from the trendline could lead to a strong upside move, aiming for previous highs. Monitor price action and volume for confirmation!

#Trading #StockMarket #TechnicalAnalysis #EGX

---

Not Financial Advice! 🚀

Golden Area Here’s an idea you can publish on TradingView based on the provided chart:

---

🚀 **Potential Trend Reversal & Fibonacci Golden Ratio Retest!** 🚀

We're approaching a key turning point in the market! 📉➡️📈

🔹 **Descending Wedge Breakout Incoming?**

The price has been consolidating within a descending wedge pattern, typically a strong bullish reversal signal. A breakout from this structure could indicate the beginning of a new impulsive move.

🔹 **Golden Ratio Confluence (0.618 - 0.705 Fibonacci Levels)**

The price is heading toward the **golden ratio zone (0.618 - 0.705 Fib retracement)**, a historically significant level for reversals. Buyers might step in, leading to a strong bullish push.

🔹 **Elliott Wave Structure in Play**

We're potentially forming the **(1)-(2)-(3)-(4)-(5) wave count**, with wave (2) likely completing near the golden ratio before the next impulsive leg (3) to the upside.

🔹 **Potential Targets 🎯**

If we confirm the breakout, our **first major resistance** lies around the **0.5 Fibonacci level (~36.96)**, followed by the **0.382 Fib (~43.06)**. Beyond that, wave (5) could aim even higher!

🔹 **Bullish Divergence on the MACD & RSI**

Momentum indicators are showing signs of reversal, further supporting the potential bullish scenario.

🚨 **What to Watch For:**

✔️ A clear breakout above resistance for confirmation

✔️ Volume increase to support the move

✔️ Retest of broken trendline as support

🔄 If the golden ratio doesn’t hold, deeper retracements to 0.79 Fib (~22.08) remain possible, but for now, bulls seem to be preparing for action!

What do you think? 🚀 Are we ready for the next leg up? Let me know in the comments! 👇

#Crypto #Trading #ElliottWave #Fibonacci #TrendReversal #PriceAction #TechnicalAnalysis

---

Let me know if you'd like any adjustments! 🚀📊its not financial advice

#ASCM - Egyptian stock - great opportunity, high financial risk#ASCM time frame 1 DAY

Note : before technical analysis the financial position of the company isn't in the best condition , there isn't any cash flows from operations activity , in anther hand the company work in MINING so that may cost the company lot of expenses and time before achieving any Mining discovery .

We have here a great Gartley Bullish pattern with 2 positive diversions at MACD and RSI in addition the prices in critical point ( stop loss of the pattern ) so :

Entry level at 34.00 ( price now is 32.85 ) so we can wait to close daily over 34.00 or start from this point ( consult your account manager )

Stop loss 32.70 ( estimated loss -4% ) or estimated loss from this point is 0.50 %

First target at 37.50 ( estimated profit around 14% )

Second target 40.70 ( estimated profit around 23% )

Third target 42.70 ( estimated profit 30% )

NOTE : this data according to time frame I DAY , it`s may take period up to 3 months to achieve targets , you must study well the Alternative opportunities before invest in this stock .

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

#ASCM - Egyptian stock / 1 hour#ASCM time frame 1 hour

Created 2 Bullish pattern ( Gartley and AB=CD ) ,

Entry level around 32.10

Stop loss 31.50 ( estimated loss -2% )

First target at 34.10 ( estimated profit around 6% )

Second target 35.50( estimated profit around 10% )

Third target 36.30 ( estimated profit 13% )

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

SDTI Target price is projected at 46.566 EGP/share withing 24 MSharm Dreams Co. for Touristic Investment S.A.E (SDTI) was founded in 1996 and specializes in the development of tourism, entertainment, and mixed-use real estate projects. The company’s property portfolio includes hotels, boutique hotels, resorts, vacation clubs, water parks, downtown areas, a spa island, real estate units, villas, and townhouses.

In the quarter ending September 30, 2024, SDTI reported revenue of 75.37 million EGP, reflecting 66.25% growth. Over the past twelve months, the company’s total revenue reached 197.36 million EGP, marking a 54.04% year-over-year increase. In 2023, SDTI achieved annual revenue of 116.58 million EGP, with a growth rate of 80.78%.

EBIT Performance (Last 5 Years):

2019: -13.07 million EGP

2020: -25.71 million EGP

2021: -12.3 million EGP

2022: 13.28 million EGP

2023: 54.41 million EGP

2024: 120.94 million EGP

The fair value, as estimated by Ostoul Capital, is 16.51 EGP/share in Feb.2024

SDTI (EGX:SDTI) has a market capitalization (net worth) of 829.22 million EGP, while its enterprise value stands at 2.48 billion EGP.

The target price is projected at 46.566 EGP/share.

Return on investment (ROI): 195.7% within 2 years

This means your investment would nearly triple in value if the target price of 46.566 EGP/share is reached. 🚀

#EMFD - Egyptian stock#EMFD time frame 1 DAY

Created Gartley Bullish pattern ,

Entry level around 6.45

Stop loss 5.90 ( estimated loss - 8% )

First target at 7.35 ( estimated profit 13% )

Second target 7.85 ( estimated profit 22% )

Third target 8.25 ( with profit 27% )

MACD and RSI show positive diversion that is may support our idea

NOTE : this data according to time frame I DAY , it`s may take period up to 3 months to achieve targets , you must study well the Alternative opportunities before invest in this stock .

In addition EGX30 is negative.

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

Go Green Egypt: To be Monitored for Rebound!1-hour chart

The stock EGX:GGRN was recently rolled out in the EGX stock market, and fell sharply since then.

It should be monitored for the rebound confirmation signals; to grab the new bullish wave.

Above 1.25 will be a good entry.

However, for higher profit/risk, buy in parts down to 1.15,

then the first sell target will be 1.35

Closing above 1.35 for 3 bars with high volume, the next target will be 1.60

Consider a near profit protection / stop loss level, as this stock is volatile.

long Stock Performance & Valuation

Current Price: 5.9 EGP/share (🔼 +10.8% gain so far)

Fair Value: 7.1 EGP/share (🔼 20.3% undervalued)

P/E Ratio: 4.1X (very low, strong value play)

Market Cap: 5.48B EGP

Price Target: 8.1~9.5 EGP (+37% upside potential)

Holding Period: 12 months

Financial Performance (1H 2024)

📈 Revenue Growth: +80% YoY → Strong top-line expansion

📈 Gross Profit Growth: +110% YoY → Higher profitability efficiency

📈 Operating Profit Growth: +123% YoY → Improved operational execution

📈 Net Profit Growth: +115% YoY → Bottom-line strength

📈 Net Profit Margin: 13% (up from 11%) → Profitability improving

📌 EPS Growth: 0.81 EGP vs 0.38 EGP (YoY) → +113% growth in earnings per share

💡 Sector Strength:

Cable product revenue: +79% YoY (65% of total revenue)

Dairy product revenue: +60% YoY (16% of total revenue)

Real estate & contracting revenue: +166% YoY (8% of total revenue)

Investment Outlook & Strategy

✅ Bullish Signals:

✔ P/E ratio of 4.1X → Stock is undervalued relative to earnings

✔ Strong revenue & profit growth → +115% net profit YoY is a major positive

✔ Fair value (7.1 EGP) & TP1=price target (8.1 EGP) → Stock has a potential 37% upside

✔ Higher profitability margins (13% net profit margin)

❌ Bearish Signals & Risks:

⚠ Finance expenses surged (+176%) → Higher debt burden

⚠ Currency translation differences (-91%) → FX risk exposure

⚠ Lower gains on asset sales → One-time earnings boost may not be repeated

longKey Financial Metrics

Fair Value: 4.3 EGP (close to current levels, undervaluation is limited)

P/E Ratio: 5.1X (very low, indicating potential undervaluation)

Market Cap: 10.75B EGP

Price Target: 5.1 EGP (~18.6% upside from fair value)

Holding Period: 12 months

Financial Performance (9M 2024)

📈 Revenue Growth: +42.4% YoY (Strong top-line expansion)

📈 Net Profit Growth: +161% YoY (Impressive earnings surge)

📈 Quarterly Revenue Growth: +49.6% YoY

📈 Quarterly Net Profit Growth: +270% YoY

These numbers indicate strong operational efficiency, and the net profit margin of 4% is stable.

investment Outlook

✅ Bullish Signals:

✔ Low P/E (5.1X) → Indicates the stock is cheap compared to earnings

✔ Strong Revenue & Profit Growth → 42.4% revenue and 161% net profit growth YoY show business expansion

✔ Solid Quarterly Performance → 270% net profit growth YoY is a strong indicator of continued momentum

❌ Bearish Signals:

Market conditions & liquidity low

long _ fundamental investorYour latest update provides some positive catalysts for EFIH:

Strong Earnings Growth:

Net income for 9M 2024: 1.39495B EGP, which is 3.5% of market cap

+21% Y-o-Y growth → Indicates strong business expansion

Strategic Partnership with Visa:

Focus on digital payments, merchant solutions, and financial inclusion

Aligns with Egypt’s Vision 2030 → Government support is a plus

Expansion of Tap-on-Phone technology and digital payment services

Government-Backed Health Collaboration:

Partnership with eHealth & Egypt's UHIA → Supports long-term revenue stability

Digitalization of healthcare payments → Increases EFIH’s presence in essential services

Updated Investment Strategy:

Bullish Factors:

✅ Strong earnings growth (+21%)

✅ Visa partnership increases digital finance reach

✅ Government-backed health project adds long-term value

Bearish Factors:

❌ Still overvalued (P/E 32.64X)

❌ Short-term volatility remains a risk

If you're a momentum/speculative investor, the price target of 29 EGP could present an opportunity if market sentiment improves within year 2025

#UEGC - Egyptian stock#UEGC time frame 1 DAY

Created a bearish Gartley pattern

Sell point at 1.029

Stop loss / rebuy 1.055 ( estimated loss - loss of additional profit -2.30% )

First target at 0.973 ( estimated profit - avoid capital loss or Realized gains - 5.50% )

Second target 0.924 ( estimated profit - avoid capital loss or Realized gains - 10.50% )

Third target 0.889 ( estimated profit - avoid capital loss or Realized gains - 14% )

NOTE : this data according to time frame 1 DAY

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

MFPC Short Hello Everyone,

Have checked this stock for a shorter term opportunity on the 4h tf. The stock seems was way way way over valued and made a huge run to the upside, then now is on the way down. This downtrend only tells that buyers are not that interested on this stock at those prices, along side those who made profits from the initial run up to the upside, which now closing their positions.

Now there are entities and individuals who would love to buy this stock at lower prices, thus it only means that the stock in itself is worth the money (based on the chart and not any fundamentals, as i dont read enough about companies nowadays).

The chart this time shows two different opportunities. The first one is long and the second one is short.

The long opportunity comes as poison in honey (as we Egyptians say), its a reversal trade and going against the trend thus the stoploss is so tight and the target is marked by the yellow arrow.

Now the short opportunity comes as free money laying around, waiting to be taken. There is a short price gap, which likely to be filled, then there will be a liquidity sweep @ 50.9. Then its on.

Do your own research, and find out if the company has any upcoming news that might move the price up or down, also remember to DYOR. This is a lucrative opportunity i think, but without reading about the fundamentals then its not worth it.

#ORHD - Egyptian stock . weekly ( may loss go to 40% ) #ORHD time frame 1 WEEK

Created a 2 bearish pattern ( Gartley and AB=CD ) .

In addition there is SHARK 32 from ( 17.00 to 20.00 ) if prices close weekly higher 20.00 may still rises to 23.00 , in anther hand if prices closes under 17.00 weekly may still down to 14.00 achieved first target for the 2 bearish pattern as follow :

Sell point around 19.00 to 18.00 and wait for action .

Stop loss / reentry 20.00 ( estimated loss -6.80% ) weekly close .

First target at 15.50 to 14.00 ( estimated profit or saving invest 20% ) .

Second target 13.00 ( estimated profit or saving invest 30% )

Third target 11.00 ( estimated profit or saving invest 43% )

the profit in this case is saving your invest from losses up to 40% .

NOTE : this data according to time frame 1 week .

So i think if prices closed weekly under 17.00 , stock will go in downtrend for medium-term .

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck