Compelling BUY based on fundamentals + technicalsTECHNICALS:

Rovio has had a strong performance over the last 2 weeks, up 13%. Key support level at EUR 3.75 held. Volume also experienced a strong rebound. RSI has crossed the 30 mark, which is similar to the onset of the last bull trend in late 2018.

VPVR shows PoC at EUR 4.15, again with strong support to the downside. The path to EUR 5 is relatively sparsely filled, leaving room for a price breakout.

On the daily chart, 50MA turned from resistance to support.

Rovio repurchased 41.5k shares on 13 Nov sending the shares up by 5.5% on the day.

FUNDAMENTALS (as of Q3 2019):

Recent sell-off driven by profit warning and investor fears that Rovio turns ex-growth. However, this totally ignores the financial prowess of Rovio and tech assets. No balance sheet risk.

Adj EBITDA (LTM) = EUR 37.7m. EBITDA includes a EUR 10m charge for Hatch. If added back, EBITDA would have been EUR 47.7m

Operating CF (LTM) of EUR 26.6m (EUR 36.6m after Hatch add-back).

Market cap: EUR 348m

Net cash: EUR 112m (tons of strategic flexibility here: share buybacks, refinace; cash is earmarked for M&A which has been proven slow)

EV: EUR 235m

EBITDA multiple (LTM): 6.2x and 4.9x (adj for Hatch)

Op CF yield: 11.3% and 15.6% (adj for Hatch)

Based on FY 2018, P/E of 13.9x and Div yield of 2.1%

MAIN DRIVER: M&A (Hatch), EARNINGS SURPRISE

Rovio is currently in talks to sell a 30% stake in Hatch Entertainment, an internally incubated mobile cloud-gaming asset. Hatch is rolling out in 23 countries (18x EU, South Korea, US, Japan) with the likes of Samsung, Vodafone, NTT Docomo. The product is live and still free but started showing ads recently. The Hatch-CEO is a long-standing F2Play company builder with a strong vision. The existing product and partnerships show he can execute.

Hatch is not reflected in Rovio’s valuation at all. No revenues or value is attributed to the company valuation. A deal is expected to be announced by year-end (as per CEO’s comment on the CMD in Nov). Rovio's ownership expected to fall below 50%: Deconsolidate Hatch from Rovio's P&L + low to nil cash allocation to Hatch (expected to be injected by Hatch stake buyer) => Higher pro-forma EBITDA and no cash drain.

Rovio is rolling out a number of new games in Q4 2019. This should support earnings strength. The company has been transforming into more than just Angry Birds.

Nokia phones are back HMD Global is a recently-founded company headquartered in Helsinki, Finland, and run by former Nokia and Microsoft executive Arto Numella.

The company said on Wednesday it had signed a licensing agreement with Nokia Technologies – Nokia’s licensing unit – that gives HMD the sole use of the Nokia brand on mobile phones and tablets worldwide for the next decade, as well as key cellular patents.

Beautiful fall from NokiaNot only crypto can fall 20% in a couple of hours, tradiional stock market also love to surprise investors. Nokie, those undestroyable phones are already thing of the past, now everyone is focused on 5G and Internet of Things, but that's where the problem for nokia is. More competitors, more diffcult to earn new clients. As a result, new progft warning...

Nokia now sees 2019 underlying earnings per share (EPS) at 0.18 euros to 0.24 euros and 2020 EPS at 0.20 euros to 0.30 euros. It had earlier forecast 2019 EPS at 0.25 to 0.29 euros, and 2020 EPS in the range of 0.37 to 0.42 euros.” The reason for lower outlook is tougher competition in 5G and the need of further investments to compete.

Nokia’s board decided not to distribute the third and fourth quarterly instalments of the dividend for the financial year 2018 in order to increase 5G investments, investments in areas of growth like software and strengthen cash position.

Hopefully they achieve to solve the issue soon. Nevertheless, it can be a good opportunity to buy in a couple of days, as shares will finally stop falling.

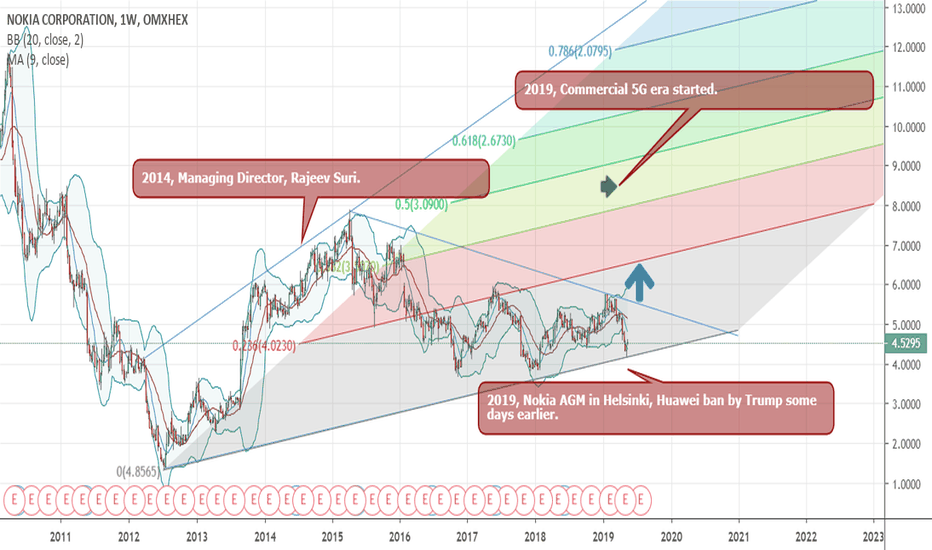

NOKIA potential long opportunityNokia is currently uptrending after completing a large bullish Cypher pattern that even appears on the weekly time scale. Now there is another opportunity for entry, as we are showing a lower low double bottom with daily bullish divergence. Price action (dragonfly doji followed by bullish continuation) indicates a trend reversal.

If entering a trade, one could play the double bottom, placing their stop loss just below the lower low. As price action continues to the upside, especially around the completion zone of the imperfect bearish Cypher (shown in red), one should look out for divergence on the oscillators and consider raising their stop loss if it starts to look bearish. Overall, I see this as a long opportunity with a very high reward/risk ratio.

Wartsila share are at the lowest price for several yearsWärtsilä, also spelled Wartsila and Waertsilae is a company based in Finland. The company's main business is fitting out the entire engine rooms of large ships.

Their website describes the activity as follows: Wärtsilä is a global leader in smart technologies and complete lifecycle solutions for the marine and energy markets. By emphasizing sustainable innovation, total efficiency and data analytics, Wärtsilä maximises the environmental and economic performance of the vessels and power plants of its customers. In 2018, Wärtsilä’s net sales totalled EUR 5.2 billion with approximately 19,000 employees. The company has operations in over 200 locations in more than 80 countries around the world. Wärtsilä is listed on Nasdaq Helsinki.

Today, 18/7/2019, the company announced their half year results. The results were worse than expected. Orders missed by 5% on both divisions. EBIT missed by 16%.

The outlook was far from bright. They wrote: "The demand for Wärtsilä’s services and solutions in the coming 12 months is expected to be somewhat below that of the previous 12 months (previously in-line)." Analysts are estimating about 5% worse. The shares are down around 11% this morning to EUR 11.15.

We can expect a series of analyst downgrades in the coming weeks. This means the share price could well head lower. Prior to the results the shares had already been under pressure, trending lower since March 2019. In fact the share have been a broad based down trend since September 2017, when they traded at a peak of EUR 20.25 now they are EUR 11.15. Prior to today's results the shares had been under pressure after another Finnish company (Fiskars Corporation), decided to distribute its 5% stake in Wartsila as a dividend to its investors. The share were distributed in June 2019. It seems that those investors sold the Wartsila shares, depressing the share price.

Whilst it will take quite some time for investors to change their view, and there is little prospect of a share price rise, there are some investors who think new shareholders are getting quite a bargain.

1) dividend yield 4.4%

2) P/e ratio 15X (forecast for 2018)

3) Prospects for refitting engines due to modern pollution controls.

4) The company's leading position in a cyclical market could mean a strong price recovery when the economy improves.

The company's recent dividend isn't too bad, being more than 4% of the share price. The company paid a dividend of EUR 0.48 for 2018.

Is the dividend sustainable? Wärtsilä's says its target is to pay a dividend of at least 50% of operational earnings over the cycle. In the first half of 2019 the company had earnings per share of EUR 0.22 vs EUR 0.21 in the previous year. Usually the company earns more in the second half than the first half. With an EPS estimate for the full year of EUR 0.60 to EUR 0.80, it looks like the dividend for 2019 might be under threat.

At the end of the day, it looks like the shares are going to stay in the doldrums for quite some time until there are concrete signs of recovery. Looking at the chart, I reckon the downtrend can continue for a while. I would stay away.

Buy This Pick-and-Shovel 5G Stock Before It Takes OffWireless technology has come a long way.

The first generation of wireless known as 1G was rolled out in the 1980s. The only thing a user could do with 1G was make a phone call.

At times, the call quality could rival that of two tin cans connected by a string.

But wireless tech has made huge advances since those early days.

About every 10 years we’ve seen a new generation of wireless—1G, 2G, 3G, and today’s 4G. Each was faster and more reliable than the previous generation.

As you may already know, we are about to see the next generation of wireless. It’s the new 5G technology, which is slated to hit the market this year.

And that creates a big opportunity for investors.

Why 5G Is So Important

To understand why 5G is such a big deal, you must understand one thing: latency.

Latency is delays in sending information from one point to the next. This is different than bandwidth, which is the volume of data being transferred, not the speed of the transfer.

The lower the latency, the faster information can race across a network.

And the 5G network has very, very, very low latency. This core attribute of 5G will revolutionize many industries.

Remote medical procedures are just one example. Low latency will enable remotely located robots to instantly mimic human movements.

This will give doctors the real-time response they need to perform surgery on a patient located anywhere in the world.

The next era of self-driving cars will also depend on 5G. The new technology will allow cars to “talk” to each other in real time.

5G will even change farming. Farm equipment company John Deere is developing 5G technology that promises to radically boost crop yields.

5G is a gamechanger. And there’s been a ton of money flowing into 5G-related companies.

Major Investment in 5G Is Already Underway

Companies have already spent over $200 billion on 5G infrastructure.

Most of this money has gone toward building 5G-ready cell towers.

That’s a lot of money, but there is much more to come. Research firm Moor Insights & Strategy expects that 5G-related IT hardware spending will reach $326 billion by 2025.

See, to achieve the speed and reliability of 5G requires lots of cell towers.

Today, the 4G network uses 25,000 cell towers across the US. Each one is 100 feet (or more) tall, and they are spaced several miles apart.

The 5G network will need 200,000 cell towers that are much smaller and spaced in a much tighter web across the US.

So in the near term, almost all 5G spending will go to building out the cell tower grid.

When it’s ready, 5G speeds will be 20 gigabytes per second. That’s 1000x faster than today’s 4G technology.

5G will make wireless bandwidth seem infinite. And the companies building the infrastructure for this new technology will be the first to profit.

Picking the Right Horse in the Race to 5G

There are a few ways to invest in the evolution to 5G.

You could buy the stock of companies that maintain and operate 5G infrastructure. These would be stable dividend companies like AT&T, Verizon, and China Mobil.

These are low-risk, limited-upside investments that will take time to bear fruit.

Things work slowly in the telecom space. We saw this play out when 4G was introduced.

To gain the benefits of the 4G network, users had to replace their 3G phones. Phones aren’t cheap, and 3G phone owners had to first be convinced that the new phones and features were worth the money. That took some time.

Instead, I recommend going the “picks and shovels” route. This means companies who build the infrastructure that supports 5G technology.

These companies are making money from their 5G investments right now.

I like to buy companies that sell the “picks and shovels” that industries need… like investing in farm machinery companies rather than agricultural businesses.

In the 5G space, this would be companies that sell the hardware, software, and services to telecom companies.

And we can leverage our bet by owning a company with exposure to the international adoption of 5G technology.

There’s only one company that fits these criteria.

Nokia Corp. (NOK)

Nokia is a Finnish multinational telecommunications company. It is the world’s third-largest telecom equipment manufacturer after Huawei and Cisco.

The company is split into two segments:

• Nokia Networks (90% of sales) : provides systems and software to build high capacity network infrastructure.

• Nokia Technologies (10% of sales) : develops consumer products and licenses technology for the Nokia brand.

Almost all of Nokia’s business comes from selling data networking and telecom equipment. That’s just what we want, because I expect those types of sales will see big growth as 5G investment ramps up.

The build out of the 5G network will be global, and Nokia is a truly international company.

Even better, two of Nokia’s biggest rivals—ZTE and Huawei, were blacklisted by the US government. This will shrink NOK’s competition in this US market to pretty much just one company—Ericsson.

The investment flow into 5G from the major telecom companies has already started to climb.

In July, Nokia received a $3.5 billion contract from T-Mobile US, which was reportedly the largest 5G deal ever.

T-Mobile has about a 17% share of the US wireless market, making this a major win for NOK.

This Play Will Take Time… Be Patient

The flow of investment will not, however, hit the 5G market like a giant wave.

It will be more like a steadily rising tide. In fact, NOK management expects 5G investment to be soft in the first half of 2019.

But that’s perfect for investors. It gives us an opening to get in before the tide of money starts to rise.

The multibillion-dollar contract from T-Mobile looks like a sign of some early pump priming for more 5G spending.

The other major wireless carriers in the US aren’t going to let themselves lag behind in the race to 5G.

I think we will soon see more big 5G contracts make the headlines. As a major player in a market with limited competition, Nokia will almost certainly win a lot more US sales by the end of 2019.

Nokia potentially oversold on the alcatel lucent newsFundamentals:

Nokia took a big hit after stating that they are starting an internal investigation on alcatel lucent which they have bought. Investors reacted pretty hard to this and the stock was diving more that -8% during that day. It of course could be that there will be some negative facts to be found and in the worst case even some fines to be had. So there is of course a risk associated with longing the stock at this point.

However, let's consider this from a different perspective. The company decided willingly to start investigation and they contacted officials by themselves and they do not expect any concrete consequences on the company itself based on the investigation results. Of course this is their own statement and view on the matter and they would ideally always want to make it look like a minor thing even if it weren't. However, considering the other possibility that there won't be anything significant to be found on the investigations and there won't be any fines. The stock has dived more that -5% based on these news and the fear of the potential results. If nothing will be found this would suggest the stock was significantly oversold and should be looking to recover.

Techical side:

The technical side is quite simplistic. RSI9 shows that the stock is on the edge of being oversold and looking at the previous behavior the level 30 has often provided support and the price has bounced up. Sometimes of course this has been violated and can be the case here as well. However just considering the option that after the stock has been up and being valuated at the previous levels 5.25 - 5.6 after Q4 report it would be quite hard to believe the proper value would be below 5€ which is of course a very important support level.

Considering the both sides on this price crash I would suggest that Nokia is currently oversold and will be recovering when the investigations continue and if they show no concrete results suggesting significant fines to be had. I'd be looking to long Nokia now or at the fibonacci support at 5.065 which has been already tested briefly once. Stop loss should be placed below 5.065 support or 5.00 depending on your risk tolerance and personal view on how confident you are on these news.

Lastly considering the option that the investigations bring up skeletons in the closet and significant fines are had then the stop loss is still quite small and the potential reward in my opinion clearly out weights the risk.

OMXH - Dovre - Cent-stocksCompany in bad finance for a couple of years. Seems to be soon at it's last legs.

Common pattern: Company stock drops to downtrend channel and bounces in average 26% up from there to commence yet another new drop to the abyss (average drops +-28-33%).

It's a risky stock, but if charts are true, when oversold hits and price touches downtrend channel there is a possibility to get 25-30% gains.

Average downtrend length: 308d

Average uptrend impulse length: x+2 aka. 6, 8, 10, 12...

Traditional 3-descending peaks, so remember, very risky in case no positive news heard after 3rd peak.

Not trading advice. Just observations.