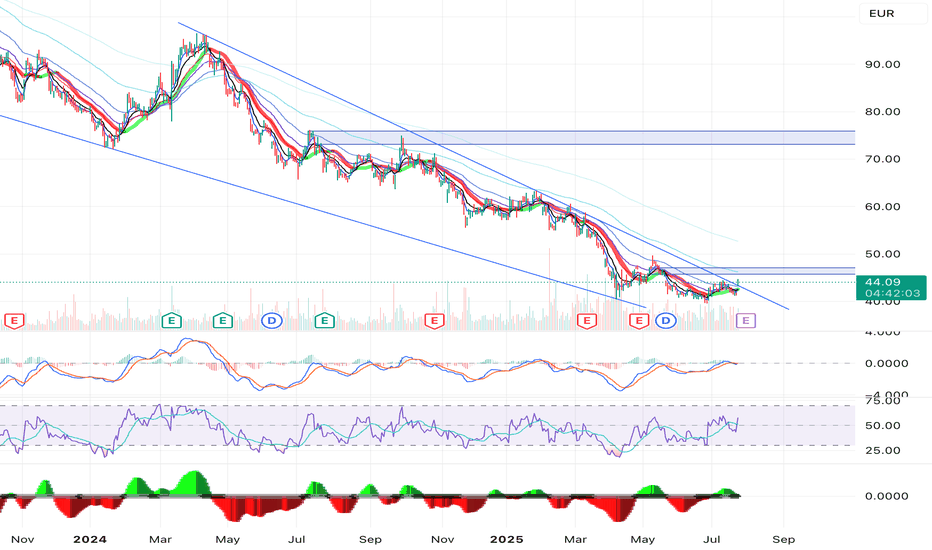

Fib resistance + RSI bullish reversal After the bearish news earlier today, it seems like Novo has had its final capitulation.

There's a fib resistance + historical resistance dating back to '21-'22.

On the weekly, the RSI is also presenting a bullish divergence - although we may want to await the closing of this week to confirm this.

T

SAP Gann-Method... down potential📈 SAP SE – Gann Projection Signals Major Downside Risk

📅 July 30, 2025 | TF: Daily | Ticker: SAP.XETR

🧠 Concept

Using a historical correction (orange line) from SAP’s past — projected into the future using Gann symmetry — we might be witnessing a repeating time-price pattern. This method suggests t

Retro Editors' picks 2022Going further in our retro EP selection , we present to you the third collection of additional scripts that have earned a spot in our Editors' picks, now from 2022.

These retrospective selections reflect our continued commitment to honoring outstanding contributions in our community, regardless o

Rheinmetall now faces a crucial testWill it continue to dominate as Germany’s biggest defence player—or is the soaring rally over, giving smaller names in the sector a chance to gain strength?

🟢 The green scenario outlines what I see as the healthiest outcome: a controlled correction to absorb parts of the massive rally, allowing the

$DHER to $40- XETR:DHER i.e Delivery Hero is working towards profitability and exiting markets where it doesn't want to burn on operations.

- Company is becoming leaner, meaner and strategic in areas where it operates and dominates.

- Region MENA is growing (31% YoY)

- It has nice free cash flow per share g

LVMH BUYLVMH is trading at around €468, well below its 2023 highs and at a significant discount to historical valuation multiples. The forward P/E is approximately 17x, versus a 5-year average of 24x. EV/EBITDA is under 10x, and the dividend yield is near 3%.

Fundamentals remain strong. LVMH continues to g

Rheinmetall Ag - Micro Timeframe EW-analysisI have two possible short-term scenarios for Rheinmetall. Both share the same structure on the higher degrees, but they differ slightly in the short term. Despite the difference in micro-counts, both scenarios remain bullish in the near term. As shown here, in this scenario, Wave 5 (yellow) is unfol

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Today

HAGHENSOLDT AG

Actual

—

Estimate

0.19

EUR

Today

KBXKNORR BREMSE AG

Actual

—

Estimate

0.94

EUR

Today

NEMNEMETSCHEK SE

Actual

—

Estimate

0.38

EUR

Today

LHALUFTHANSA AG VNA O.N.

Actual

—

Estimate

0.39

EUR

Today

FPEFUCHS SE

Actual

—

Estimate

0.59

EUR

Today

BMWBAY.MOTOREN WERKE AG ST

Actual

—

Estimate

3.28

EUR

Today

AIXAAIXTRON SE

Actual

—

Estimate

0.15

EUR

Today

PUMPUMA SE

Actual

—

Estimate

−0.83

EUR

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Technology Services | ||||||||

| Electronic Technology | ||||||||

| Finance | ||||||||

| Health Technology | ||||||||

| Retail Trade | ||||||||

| Consumer Non-Durables | ||||||||

| Producer Manufacturing | ||||||||

| Consumer Durables | ||||||||

| Energy Minerals | ||||||||

| Communications |