Triangle Breakout Watch | BUY SignalIntel is squeezing into a nice triangle pattern on the 4H chart, sitting above strong support at €18. Volume is calming down – a classic sign before a move.

Buy idea:

A breakout above €18.50 with strong volume could trigger a buy, aiming for €20–21.80.

Stop: Below €17.50 just in case it fakes out.

Looks like a solid setup if bulls step in. Watching closely!

Long Ceotronics for unfolding wave 5Log scale applied, Elliott waves analysis, as usual.

Not so good liquidity here compared to US stocks but very good setup in which I quite confident. Wave (v) with light blue color is going to unfold as consolidation in wave (iv), shaped as a triangle, comes to an end.

Bigger picture is quite interesting. Black (cycle) wave I shows up again as wave III with some contraction in wave (2) of smaller degree. I will leave big picture as a note. Nicely visible wave personality!

I do not have a clear target now but will see how wave 5 develops. Substantial price run is expected.

China Strikes Industrial Plastics SectorChina Imposes Harsh Tariffs on POM Plastics: Which Companies Are Hit the Hardest?

By Ion Jauregui – Analyst at ActivTrades

China has reignited trade tensions by announcing anti-dumping tariffs of up to 74.9% on imports of polyoxymethylene (POM) copolymers—a high-performance plastic widely used in the automotive, electronics, and consumer goods industries. The measure directly affects manufacturers from the United States, the European Union, Japan, and Taiwan, with varying degrees of severity.

U.S. exporters are the hardest hit, facing tariffs of up to 74.9%, followed by European companies at 34.5% and Japanese firms at 35.5%. Taiwanese exporters are also targeted, though with variable rates depending on the supplier.

Companies in the Crosshairs

Among the most affected are U.S. giants Celanese Corporation and DuPont de Nemours, both with strong exposure to China’s engineering plastics market. In Europe, BASF and Celanese’s German subsidiary Ticona GmbH could see their competitiveness eroded by higher costs. From Japan, firms like Mitsubishi Chemical and Asahi Kasei are also likely to feel the pinch due to their significant export volumes of POM to China.

BASF Pressured to Reinvent Itself

For BASF, the move comes at a critical time. The company is already under pressure from rising energy costs in Europe and weak industrial demand. Its share price has been volatile, influenced by macroeconomic factors and its significant exposure to China, where its engineering plastics division generates a major portion of revenue. These new tariffs may further hamper profitability in the region.

BASF is facing one of its most challenging periods in years. In addition to high energy costs and sluggish demand, the Chinese tariffs now threaten its position in Asia. The company has already launched a €2 billion cost-cutting program and is restructuring non-core assets. It also plans to reduce its annual dividend to €2.25 per share from 2025 to 2028, breaking with its long-standing stable payout policy. Shares are trading near €44, in a long-term downtrend. Still, analysts are watching the development of its new China chemical complex and upcoming divestitures, which could mark a turning point in future profitability.

Technically, BASF shares have been trading between a high of €52.33 in March and a low of €35.66 in April. Its current trading zone reflects a key support-resistance area, with the RSI currently neutral at 50%.

Impact on the Global Supply Chain

POM plays a vital role in manufacturing precision components such as gears, valves, electrical connectors, and automotive parts. With these tariffs in place, many Chinese firms may turn to domestic suppliers or regional alternatives like South Korea, reducing market share for Western and Japanese exporters that previously benefited from cost advantages.

A New Front in the Trade War

This decision emerges amid an already tense global environment, particularly between the U.S. and China. For investors, it adds a layer of geopolitical risk and raises the possibility of supply chain realignment in the medium term.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

Is that the bullish confirmation for 15€ TKA ?!Depending on how the market reacts to our green Overall Correction Level (OCL), we might actually see a net gain through Trump’s tariff war. Sure, the OCL has the potential to slam us down hard—but if we break through it...

Oh boy—there’ll be nothing stopping TKA from charging straight to €15–€16.

That zone, in my eyes, is a major key level, with the next high timeframe resistance sitting right there. That’s exactly where I’ll be looking to take massive profits on my spot buys.

So what’s it going to be—will the green OCL hold us back, or are we about to see a clean break and liftoff?

The setup is there. Let’s see who blinks first.

Thyssenkrupp earnings coming. Tales of two rises?1. Fundamentals:

Thyssenkrupp have suffered a lot. In 7 years it lost 90% of the market cap!

Early 2018 the stock price was €26, and it fell under €3 in 2024.

Slowdown in European industry, especially car manufacturing, and the idea of 'green steel' did hurt the price.

A quick recovery happened to €11, as European spending picked up steam. Especially, defense spending and the recovery in the car industry give hope to the car industry. Continental delivered good earnings last week.

However, the defense part might not be help earnings as soon 2025 Q1, and the car industry alone don't justify the €11 price.

2. Technicals

The first rally in one month was fast, but had volume under it.

The price of €2.768 in 2024 september was clearly a nonsense, shorters exited the stock and accumulation started.

In one month, February to March it went bananas, +140%, then Liberation day came and it fell, like everything else.

It rose again, but this time, the volume is declining.

My hunch is, a spike to 10.9-11.6 on earnings (15. May), and then straight down under €6.

Can be a good long on long-term, but it's overbought now.

Can be a good short idea on earnings, if it opens green.

Indra and Rheinmetall Join Forces in Defense Alliance for IDVBy Ion Jauregui - ActivTrades Analyst

Indra has entered into a new strategic alliance with German defense giant Rheinmetall for the joint development of armored vehicles, expanding their existing cooperation beyond combat electronics for Leopard tanks. This move comes during the International Defence and Security Fair (Feindef 25) in Madrid and at a critical time: both companies are involved in the bidding process to acquire Iveco Defence Vehicles (IDV), the military subsidiary of Iveco, in a deal that could exceed €1.4 billion.

The operation has direct implications for Indra’s positioning as an industrial integrator in the land defense sector. Under the leadership of José Vicente de los Mozos, the Spanish firm is seeking to strengthen its capabilities through alliances and acquisitions, aiming to evolve from a primarily technological company into one with industrial production capacity—especially in small series manufacturing, which is vital in the NATO context.

From a stock market perspective, Indra currently trades around €29 per share, reaching an intraday high of €30.56 yesterday, with a market capitalization close to €5.1 billion. The company’s performance in recent years has been positive, driven by its shift toward the defense sector and key contracts in digitalization and military systems. However, the stock fell 1.72% following the announcement of the potential IDV acquisition, reflecting investor caution toward large-scale operations. The midpoint control area for the stock lies slightly lower, around €27.50, despite moving averages continuing to indicate bullish momentum and the RSI standing in clear overbought territory at 64%.

Rheinmetall, based in Düsseldorf, has been one of the major beneficiaries of the current geopolitical cycle. The stock traded at an all-time high of €1,744 per share yesterday, with a market capitalization exceeding €18 billion—doubling in value since 2022 due to the surge in European defense spending. However, following news of the IDV bid, its shares declined by 5.90%, closing the session at €1,594, reflecting market sensitivity to ambitious acquisitions. The midpoint control area for the stock stands just below at around €1,342, and once again, moving averages show no signs of trend reversal. The RSI remains clearly overbought at around 60%.

Both companies now aim to consolidate a European land defense hub capable of competing on a global scale, with support from Brussels and a strong commitment to integrating strategic industrial capabilities.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

SAP: Macro PotentialPolitical uncertainty and questionable economic policies from the U.S. administration are eroding investor confidence globally, prompting a search for more reliable investment opportunities outside the U.S.

Currently, the performance of European stock markets is outpacing that of the U.S. markets. For example, the ETF tracking major German stocks (ETF DAX) has been trading at historical highs for the second consecutive week, while

U.S. markets have merely recovered from their initial tariff-related declines.

One of the most promising medium-term investment ideas in the European equity market right now, in my opinion, is SAP ( XETR:SAP )

• Quarterly revenue and profit growth dynamics and forecasts

• Relative price strength

• Signs of accumulation by major funds

The macro trend structure of SAP also shows interesting potential

Weekly chart:

Monthly chart:

Thank you for your attention and I wish you successful trading decisions!

Due to Geo Political changes in Europe grow expected. These types of rates are always difficult (but fun) to analyze, because there is no history. This one has gone from always low to sky high. But I can still do something with it. You see again, classically according to the Fibonacci model, that the rate has shot up from 400 to 1280, from the blue area straight through the green and yellow. The red area is the outperformance, but you don't know that because you don't know where the rate ends.

You can put a reserve Fibonacci chart against that and then you suddenly see the purple area appear up to 2700. If I subdivide that again, resistance arises on:

1884

2064

2180

2313

2459

2700

The group was promoted to the DAX, Germany's main stock market index, in March 2023. It is the largest German and fifth-largest European arms manufacturer, and produces a variety of armored fighting vehicles and armored personnel carriers, both wheeled and tracked.

BMW: Stability, Innovation, and Opportunity in a Changing WorldIn times of market turbulence, great opportunities often lie hidden beneath temporary setbacks. Recent tariff-related ripples may have rattled BMW’s price, but for those looking to invest for the long haul, this dip is a golden opportunity to buy into one of the world’s most reliable automakers.

www.youtube.com

Resilient Amid Tariff Turbulence

Global trade frictions and tariff uncertainties have impacted many companies, and BMW is no exception. Yet, unlike many peers that retreat during such times, BMW remains steadfast—confident in its strategy and outlook. With industry insiders predicting that these tariffs are only temporary, BMW’s fundamentals remain ironclad. Its robust global presence and proactive planning have positioned it to weather these short-term shocks and bounce back stronger.

A Diverse, Future-Ready Product Lineup

While some high-profile names in the auto space chase trends with empty promises, BMW consistently delivers. Rather than focusing solely on electric vehicles like Tesla, BMW offers a balanced portfolio:

- Low-Emission Fossil Fuel Cars: Advanced, efficient engines that still serve a significant market segment.

- Hybrid and Electric Vehicles: Designed for the evolving demand for cleaner mobility, these models blend performance with environmental responsibility.

- Pioneering Hydrogen Technology: In collaboration with strategic partners, BMW is blazing a trail in hydrogen-powered vehicles—a potential game changer that ensures adaptability as the energy landscape shifts.

This diverse lineup not only meets current market needs but also positions BMW at the forefront of future mobility, delivering real, tangible products that work.

World-Class Manufacturing and Advanced Robotics

BMW’s reputation for engineering excellence isn’t just about beautiful design—it’s rooted in its state-of-the-art manufacturing. The company has embraced advanced robotics and automation, ensuring precision, efficiency, and consistent quality. With production facilities spanning the globe—including significant plants in the United States—BMW solidifies its stature as a truly international enterprise.

A Stable, Dividend-Paying Investment

In a market that often rewards volatile “meme” stocks and empty promises, BMW stands apart as a beacon of stability. Unlike Tesla, which currently pays no dividends, BMW offers a juicy dividend yield of over 5%, providing investors with regular, attractive returns. This dividend, coupled with its solid operational fundamentals, makes BMW a safe bet—one that rewards shareholders consistently even during turbulent times.

The Time to Invest Is Now

BMW is more than just a carmaker—it’s a symbol of resilience, innovation, and pragmatic progress. While market chatter may cast doubt amid temporary tariff-induced lows, the company’s diversified product mix, global manufacturing footprint, and commitment to delivering real, advanced technology create a compelling investment thesis.

For investors seeking stability, reliability, and the promise of long-term growth, BMW offers an opportunity to ride out the storm and benefit from a future where the company’s innovations in hybrids, electrics, and hydrogen continue to shape mobility worldwide. Now is the time to look beyond short-term market jitters and invest in a legacy built on quality, performance, and consistent returns.

Embrace the opportunity—BMW’s bright future is not just a promise; it’s already in motion.

XETR:BMW SIX:BMW NASDAQ:TSLA NYSE:GM NYSE:F

Flag Flutters Precariously: Navigating the Sky of Greed.The Siemens flag, once a symbol of ambition, now hovers in the sky of opportunistic buyers. Previously, it was plummeting toward the ground, but a swarm of butterfly-like buyers, armed with unwavering determination, managed to lift it back up using a sturdy candlestick.

However, in this latest turn of events, the flag now hangs precariously between two vast voids, abandoned by the overconfident grip of greedy crab buyers. Their hold appears too weak to keep the flag aloft, and it seems destined to fall from the lofty height of 214 euros—ironically referred to as the "golden level of the crab." It seems that gravity, much like the harsh reality of the market, inevitably prevails.

Deutsche Bank AG to 21 EuroDespite the chaos with Credit Suisse European banks in General are printing some excellent setups. What is the reason for this? No idea.

On the above 2-month chart:

1) A strong buy signal (not shown) prints with price action breakout from resistance that has been active since 2007.

2) Regular bullish divergence. No less than eight oscillators this time. Four to five oscillators printing on this time frame is incredibly powerful but eight?!

3) Inverse head and shoulders pattern. Confirmation is price action closing above 10.50 and staying there or above for a week or two. On confirmation a target of 21 euro should be expected.

4) The yellow line is the 21/2-month EMA. Notice the first attempt to hold as support has failed? (Orange arrow). This was the first attempt to hold as support since July 2005. Confirmation of support is price action at 10.50 and above by the month of May.

5) Almost EVERY idea on tradingview is 'short' / Bearish! Ww is the 5%. What in?

Is it possible price action falls further? Sure.

Is it probable? No.

Ww

Type: Investment

Risk: <=6% of portfolio

Timeframe: Don’t know.

Return: 110%

Stop loss: 7.20

Late cycle. Medicine ++In November 2023, it was reported that German chemical concern Bayer AG was considering options for splitting the business due to weak financial performance.

Management considered several options:

spinning off the health products or agricultural fertilizer businesses into a separate company;

maintaining a three-division structure but getting rid of non-core assets;

successive splits into three independent companies, each retaining its own divisions.

In January 2024, it was reported that Bayer announced a business restructuring and job cuts. The plan was to simplify the management model, eliminate bureaucracy and speed up decision-making processes. The job cuts were expected to begin in the coming months and should be completed by the end of 2025.

This company could go the same way as deutsche bank.

Get up off your knees and grow a few times over. =)

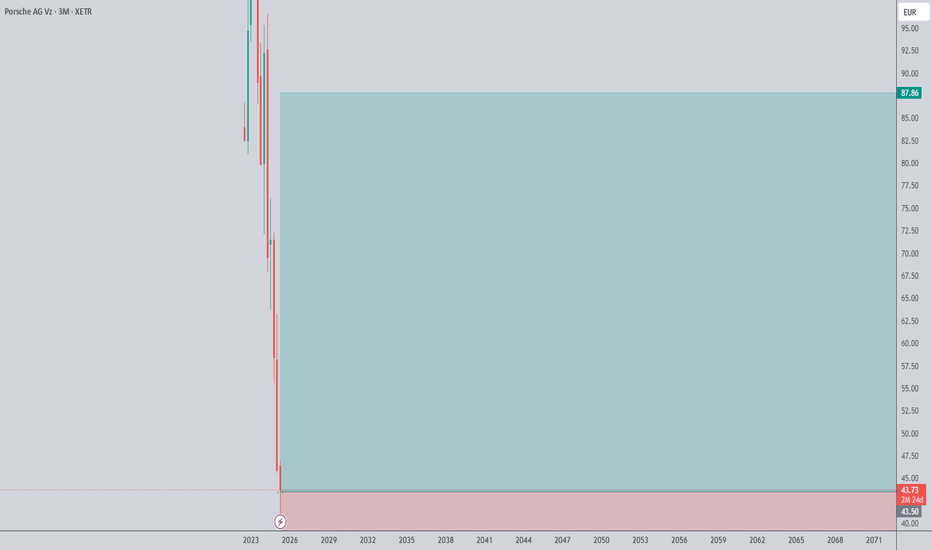

Why It’s a Good Idea to Buy Porsche Stock During a Market CrashStrong Brand with Loyal Customers

Porsche is a premium brand with global recognition. Even during downturns, demand for luxury products like Porsche remains relatively resilient.

Fundamentally Solid Company

Porsche has strong revenue, high profit margins (some models generate over 15–20% margin), and a reputation for financial discipline.

Undervalued During Crashes

In a market crash, even high-quality companies are sold off irrationally. This creates a rare opportunity to buy at a discount to intrinsic value.

Healthy Balance Sheet with Low Debt

The company maintains a solid financial position, making it more capable of weathering economic storms.

Attractive Dividend Yield

Porsche pays dividends, and when the stock price drops, the dividend yield becomes more attractive to long-term investors.

Backed by Volkswagen Group

As part of the VW Group, Porsche benefits from shared technology, resources, and strategic support, adding an extra layer of stability.

📈 Why Porsche Is Likely to Recover After a Crash:

Strong Demand for Luxury Vehicles

The premium segment tends to recover faster post-crisis, as high-net-worth individuals are less impacted and quicker to resume spending.

Innovation & EV Leadership

Models like the Taycan prove that Porsche is a frontrunner in high-performance electric vehicles, well-positioned for the EV revolution.

Global Presence

Porsche operates across major markets—Europe, the U.S., and Asia—offering multiple growth channels once global recovery begins.

Limited Shares – High Demand Potential

After Porsche AG’s IPO, only a portion of shares are publicly traded, meaning limited supply. Once demand returns, this can drive the price up sharply.

Long-Term Vision & Prestige

Investors see Porsche not just as a carmaker but as a long-term luxury mobility brand with staying power and vision, which boosts confidence in its recovery.

Why Invest in RheinmetallWhy Invest in Rheinmetall

Rheinmetall’s defense segment accounts for a significant portion of its revenue and profits, providing a stable and growing revenue stream due to increased global defense budgets. In recent years, global defense spending has risen, driven by geopolitical tensions and security concerns, particularly in Europe and NATO countries. Rheinmetall benefits from this trend with a focus on:

• Military vehicles: The company produces combat vehicles, armored trucks, and defense platforms, which are in high demand due to modernization efforts in several global defense forces.

• Ammunition: Rheinmetall is a leader in supplying ammunition for land, air, and naval forces, with long-term contracts in place to supply NATO forces.

• Defense electronics: The company produces advanced radars, communication systems, and sensor technologies for military and security applications.

Rheinmetall has a strong order backlog, which is a positive indicator for long-term growth. With long-term defense contracts with governments in Germany, NATO, and other international defense forces, Rheinmetall enjoys visibility and stability for the coming years. This gives investors confidence in sustained revenue streams, particularly in the defense sector, which is typically less sensitive to economic cycles.

In addition to its defense business, Rheinmetall is a key supplier in the automotive sector, particularly in areas such as electrification and safety technologies. The company’s automotive division produces components for electric vehicles (EVs), hybrid vehicles, and safety systems such as braking systems and collision sensors. This diversification makes Rheinmetall a dual-sector play, giving investors exposure to both the defense and automotive industries, both of which are poised for growth.

• Automotive Safety Systems: Increasing demand for active safety and driver assistance systems in the automotive sector provides Rheinmetall with solid growth prospects.

• Electrification: The company is expanding its presence in the electric vehicle market, benefitting from the global shift toward sustainable transportation.

Rheinmetall is highly focused on research and development (R&D), ensuring that it remains competitive in both the defense and automotive markets. The company continues to develop next-generation technologies such as cybersecurity solutions, autonomous military systems, and electric propulsion systems for vehicles. This commitment to innovation ensures that Rheinmetall remains at the cutting edge of both its sectors.

Rheinmetall offers a relatively attractive valuation compared to its peers in the defense sector, with a P/E ratio of 18x. The company's strong operating margins and high return on equity highlight its strong financial health, making it an appealing option for value-oriented investors. Additionally, the company’s low debt-to-equity ratio ensures financial flexibility, further enhancing its attractiveness.

Strong Buy Recommendation

In conclusion, Rheinmetall AG represents a strong investment opportunity, offering investors a diversified portfolio with strong exposure to both defense and automotive markets. The company benefits from long-term defense contracts, a growing order backlog, and strong positions in military vehicles, ammunition, and automotive safety systems. Its commitment to innovation and technological advancement, coupled with a strong balance sheet, makes it an attractive option for those seeking exposure to the growing global defense and automotive technology markets.

With solid revenue growth, high margins, and a relatively attractive valuation, we recommend Rheinmetall AG as a strong buy for investors seeking a balance of growth potential, stability, and defensive characteristics in both defense and automotive sectors.