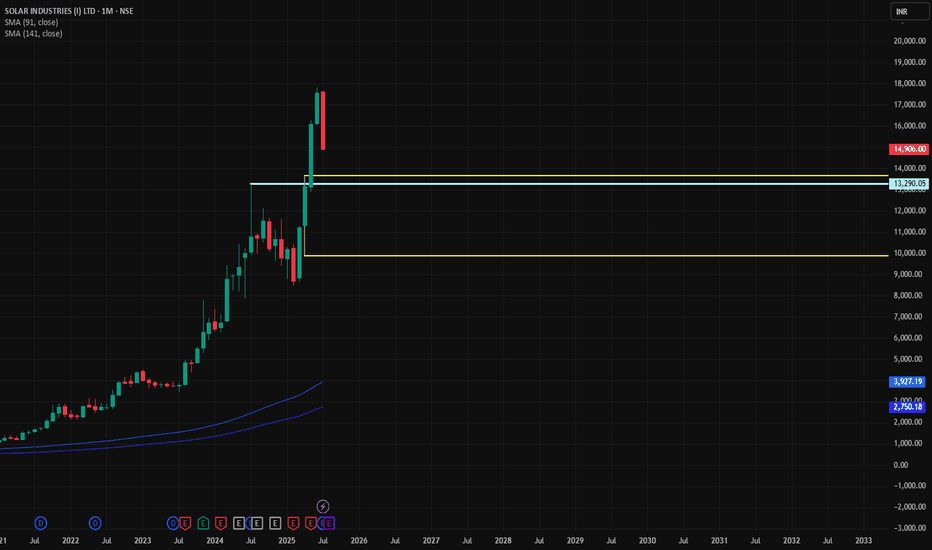

SOLAR IND🛒 Trade Plan: Buy Setup

Parameter Value

Entry 13,290

Stop Loss 11,278

Target 18,992

Risk 2,012 pts

Reward 5,702 pts

Risk-Reward 2.8 : 1

Last High 16,141

Last Low 13,290

Point Variance 2,851

🧠 Logic:

Entry is placed right at strong demand cluster on HTF & Weekly.

SL is just below the major Weekly/ITF zone.

Target is well above last swing high, offering strong RR.

DMIP (Demand Momentum Imbalance Points) on Daily & Intraday (60/180/240 mins) further supports bullish continuation.

✅ Verdict

High-conviction long trade supported by all major timeframes.

Strong demand confluence around 13,290 and below.

Maintain discipline at SL (11,278), and consider trail SL after price crosses 16,141 (previous high) for profit protection.

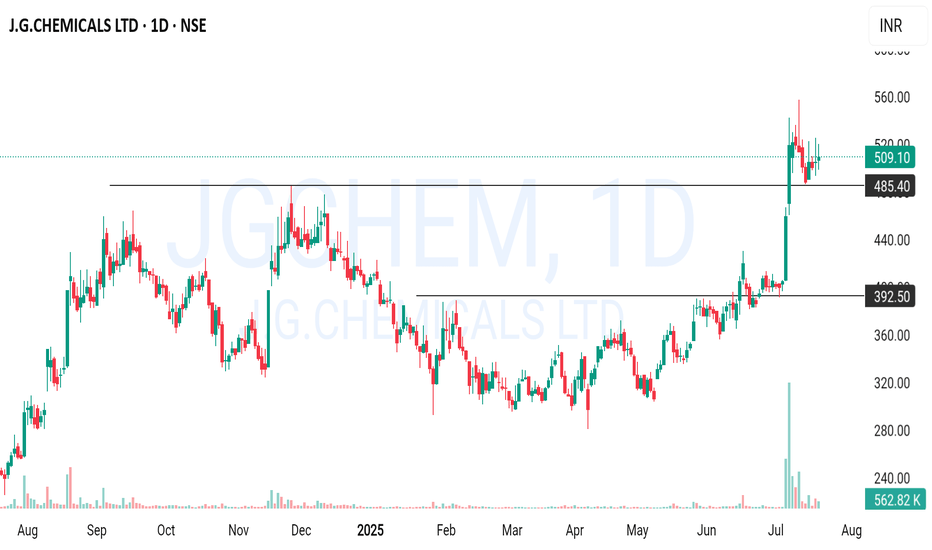

Amazing breakout on WEEKLY Timeframe - FLAIRCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

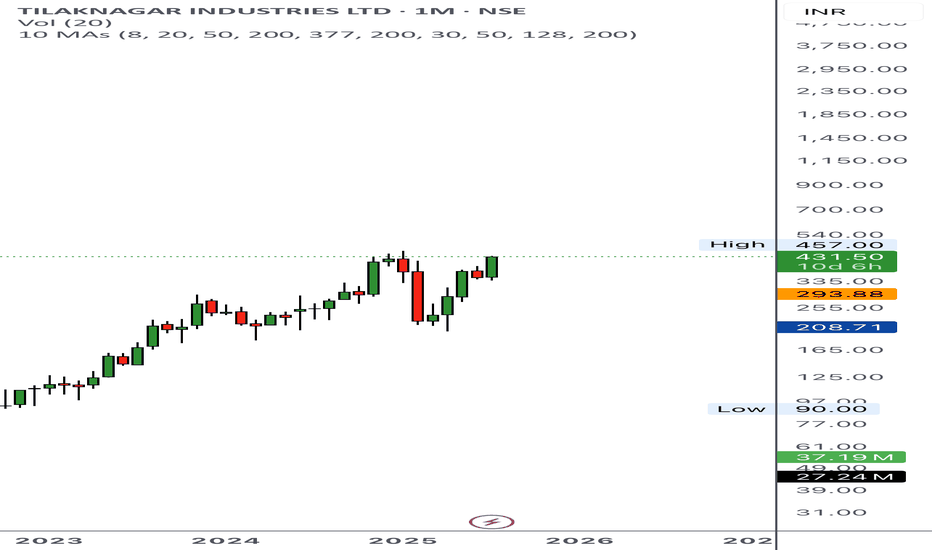

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

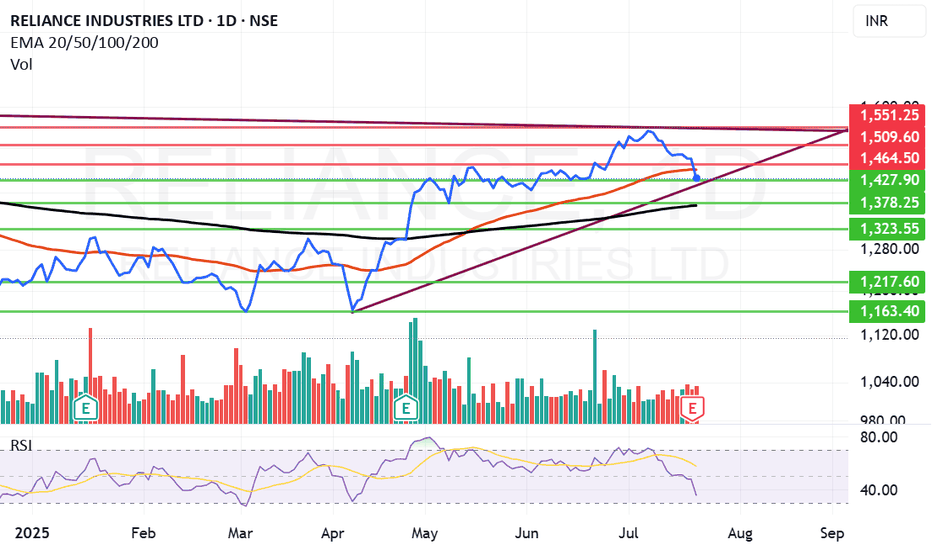

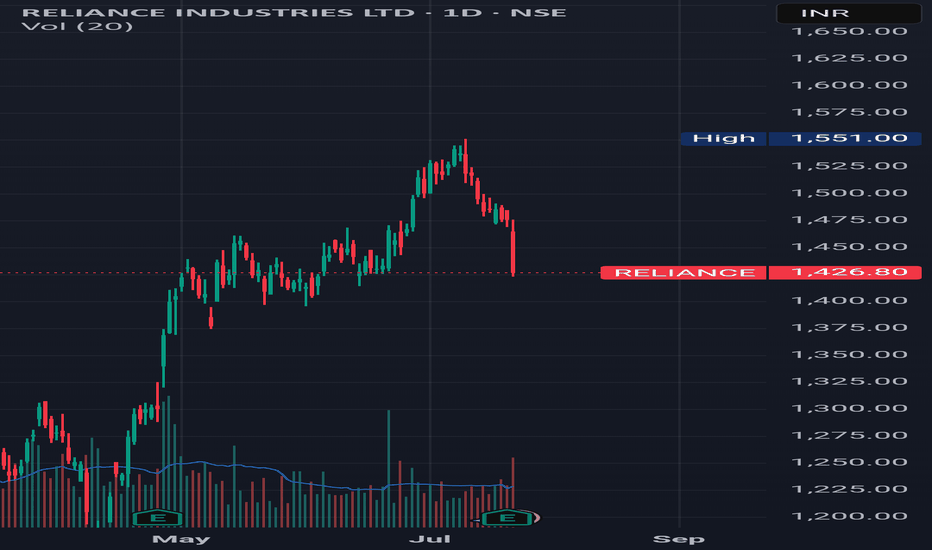

What to do with Reliance share after its drubbing today? Reliance looks weak post result however there is no spike in volume of sale that is a good point. The levels from which Reliance can recover seem to be 1427, 1370 or 1323. If we get a closing below 1323 the stock can fall to 1217 or even 1160 levels this is the reading as of now.

The result was looking good but on deeper scrutiny it was understood that major chunk was profit was due to sale of Reliance stake in Asian Paints business. This I think is not liked by the market specially the retail investors.

The stock has tanked close to 3% as of now but there is no huge selling seen from HNIs or MFs (As of now). (This is an assumption looking at the volume of sale) Volumes are similar to normal day of trade.

May be as retail investors panic MFs, HNIs and others might gulp the stock. Cant say clearly. We might reanalyze by end of the day but caution: Do not sell Reliance in Panic. Result was average it was not bad even if we ignore the Asian paint factor so. Currently I am not selling Reliance I am holding on to it. Might add at lower levels.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

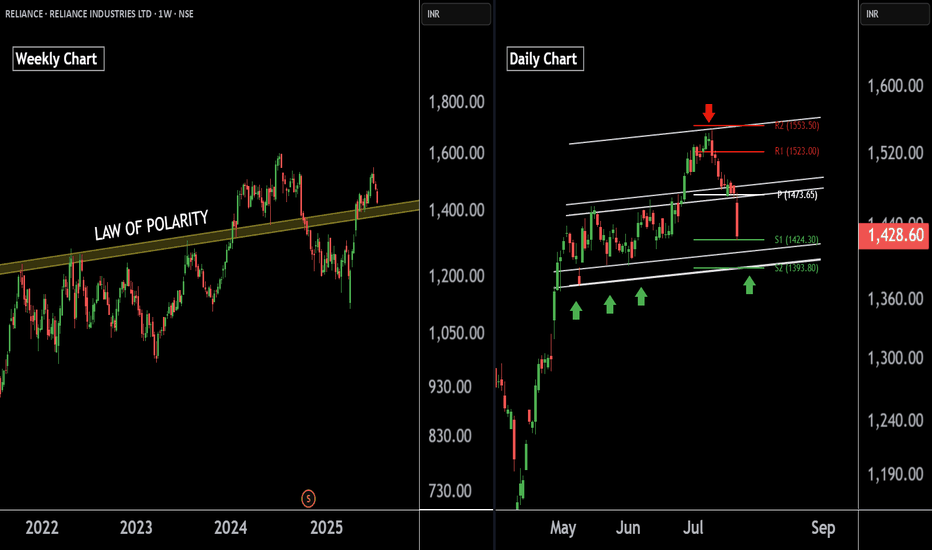

Reliance Industries — Preparing for the Next Bullish Leg !!There are two charts of Reliance Industries — one on the weekly timeframe and the other on the daily timeframe.

On the weekly timeframe:

Reliance industries is trading near (LOP), with a key support zone in the range of 1385–1400.

On the daily timeframe:

Reliance industries is moving in well defined parallel channel with support zone near at 1400-1410.the stock is also taking support at pivot levels S1 and S2, positioned between 1393 and 1422 levels.

If this level is sustain then we may see higher prices in Reliance industries.

Thank You !!

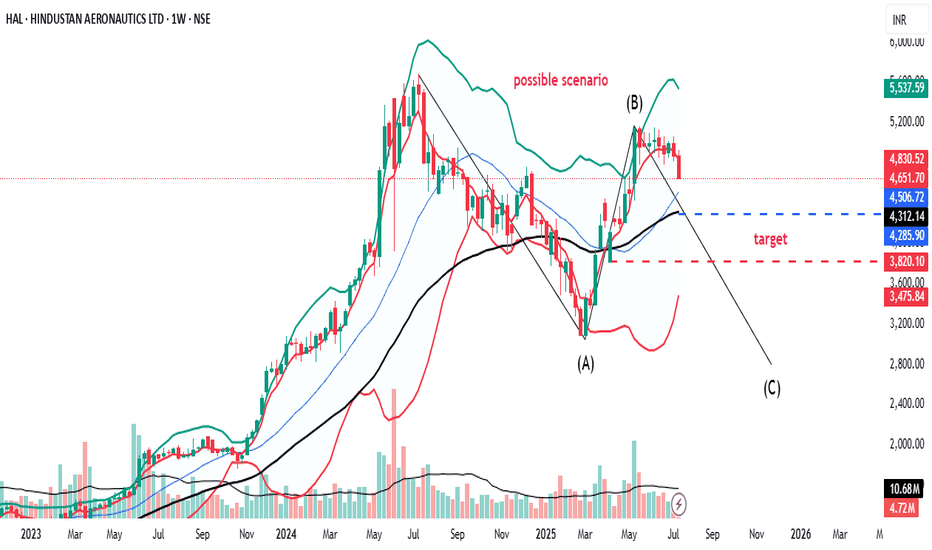

HAL bearish, Kindly do your own studyHAL is looking bearish on higher time frame.

Monthly price action is bearish

Monthly MACD is NCO stat

Weekly bearish price action. Price has broken last 8 weeks range. Looks like C wave is pending

Weekly MACD has given downtick

Weekly RSI is below 60

Daily price has challenged lowe bollinger band with good volume

Daily MACD is in NCO stat and below zero line

Daily RSI is below 40

Daily ADX is strong

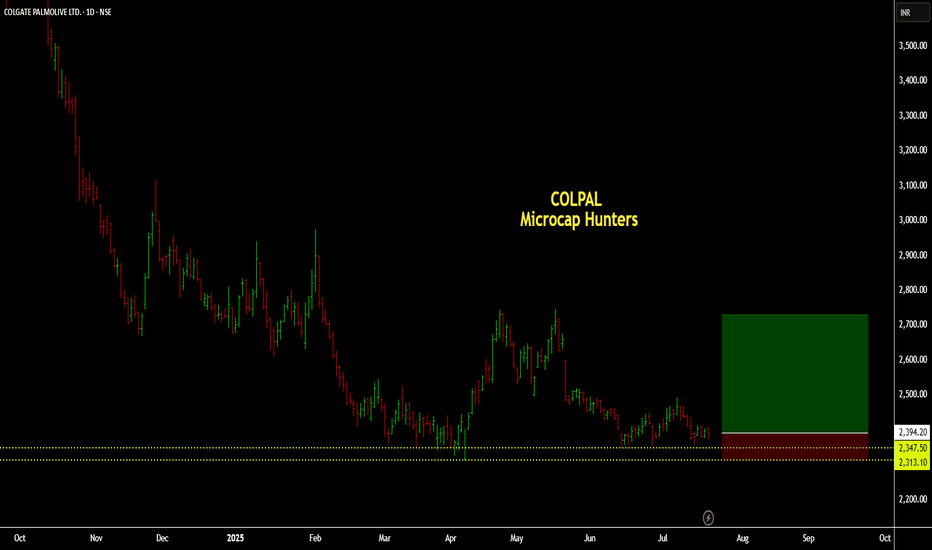

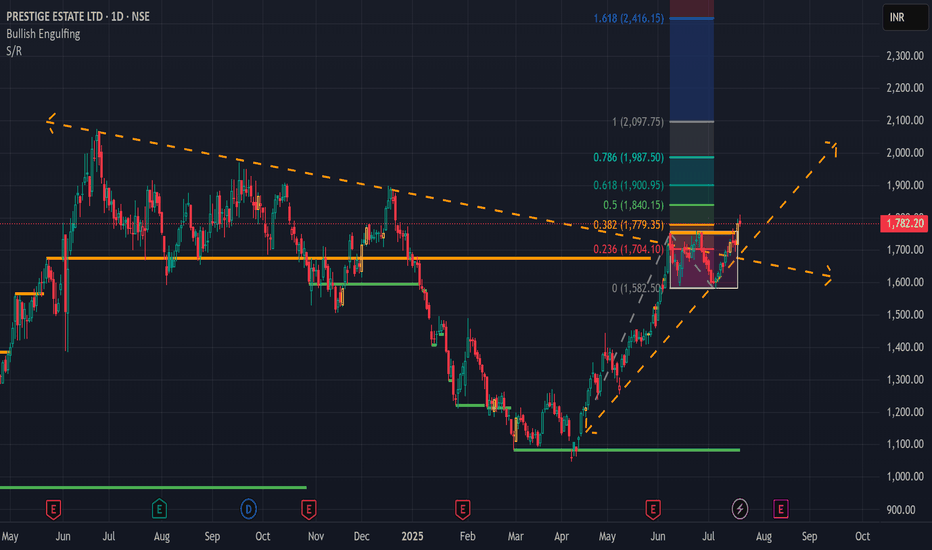

COLPAL (Swing):COLPAL (Swing):

COLPAL is getting ready for an reversal up move by breaking the past supply levels.

Script has consolidated and formed a strong base near the demand zone.

Trade offers a RR of more than 1:4.

Check out my earlier views for a better understanding.

Note: Do your own due diligence before taking any action.

Reliance Entry done @ 1425Reliance Industries Ltd (RIL) shares are experiencing a decline, currently trading around ₹1424-1425. This recent dip comes despite the company reporting robust Q1 FY26 results with a significant 78% year-on-year rise in consolidated net profit to ₹26,994 crore, largely driven by a one-time gain from the stake sale in Asian Paints.

Current Scenario and Key Observations:

* Falling Price: The stock has seen a considerable fall in the past few days, with reports indicating a crash of around 2.7% on BSE today, and a drop of over 6% in July so far.

* Q1 FY26 Performance:

* Net Profit: RIL reported its highest-ever consolidated net profit of ₹26,994 crore for Q1 FY26, significantly beating market estimates.

* Revenue: Revenue from operations increased by 5.3% to ₹2,48,660 crore.

* EBITDA: Consolidated EBITDA jumped 36% to ₹58,024 crore, with EBITDA margin improving to 21.2%.

* Segmental Performance:

* Jio Platforms: Reported a strong 23.9% YoY increase in EBITDA, driven by ARPU growth and operational efficiency. Jio has also surpassed 200 million 5G subscribers.

* Reliance Retail: Posted an 11.3% YoY increase in revenue, though some reports indicate a slowdown in consumer electronics sales and space addition lagging expectations.

* Oil-to-Chemicals (O2C): Saw a slight revenue decline due to weaker crude prices and planned maintenance, but EBITDA climbed due to improved transportation fuel margins.

* Analyst Outlook: Despite the recent fall, many major brokerages have maintained "Buy" or "Overweight" ratings on RIL, with target prices generally ranging from ₹1500 to ₹1767. They remain sanguine about RIL's long-term growth prospects, especially in the New Energy segment, Jio, and Retail.

* Growth Drivers:

* New Energy: RIL is heavily investing in the new energy sector, with plans to commission giga-factories for solar PV, fuel cells, and batteries over the next 4-6 quarters, aiming for a self-funded platform and perpetual growth.

* Digital Services: Continued expansion and growth in Jio Platforms, including 5G deployment and broadband connections.

* Retail Expansion: Ongoing growth and diversification within the retail segment.

* Debt: While the net profit was record-breaking, net debt has slightly increased, reflecting capex intensity in digital infrastructure, new energy, and retail expansion.

Investment Consideration with Stop Loss:

Given the current falling price at ₹1424 and your stated stop loss limit of not more than 5% of your total portfolio, this indicates a cautious approach. While the stock has corrected, many analysts see this as a potential buying opportunity due to strong fundamentals and future growth drivers, especially in the New Energy and Digital segments.

However, it is crucial to consider:

* Volatility: RIL stock is currently exhibiting some volatility.

* Market Sentiment: The broader market conditions and immediate investor reaction to the Q1 results seem to be weighing on the stock despite the strong underlying performance.

* Risk Management: Adhering to your 5% portfolio stop loss is a prudent strategy to mitigate potential downside risk in a volatile market.

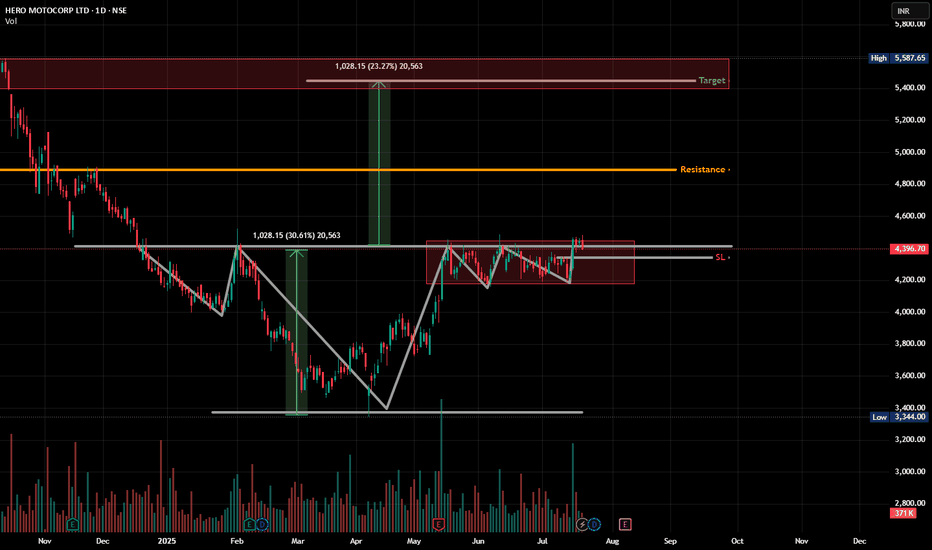

HEROMOTOCO - Multi-Right Shoulder H&S (it works out too much)Pattern Watchers!👀

We usually get one head, one left shoulder, and one right shoulder, right?

But this chart said: "Why stop at one? Let’s bulk up the right side!" 😂

🧠 Head & Shoulders spotted –

✔️ Classic neckline around ₹4390

✔️ Multiple failed breakouts but price holding above range

✔️ Right shoulder has been gymming, forming a clean range

📏 Potential breakout target = ~₹5400

🧱 Resistance zone above (highlighted in red) may act as the next boss level

🎯 Watch for:

Break and hold above ₹4450–₹4480

Volume confirmation

Avoid fakeouts — price needs to STAY above neckline

💡 Bonus thought: This could also be interpreted as an Inverse H&S breakout from March, and this range is just a healthy consolidation.

Amazing breakout on WEEKLY Timeframe - DCMSHRIRAMCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

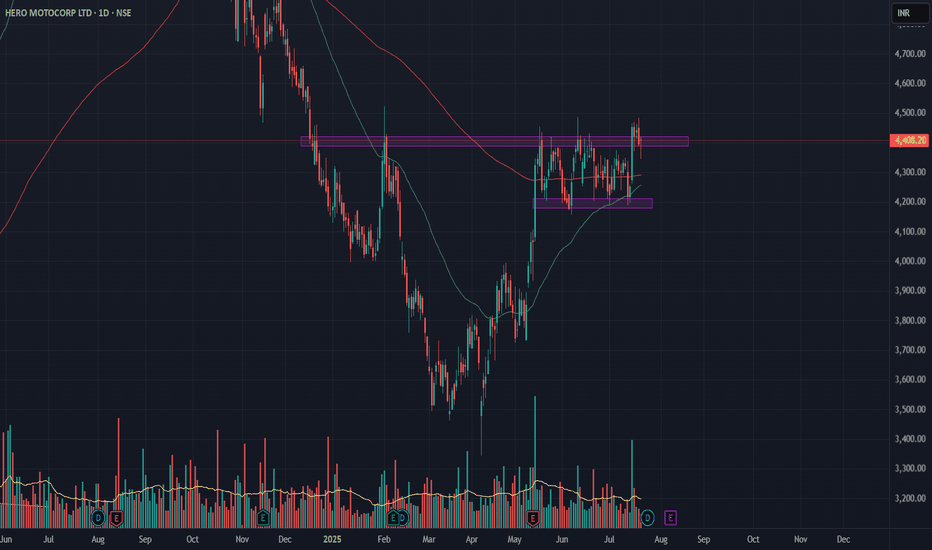

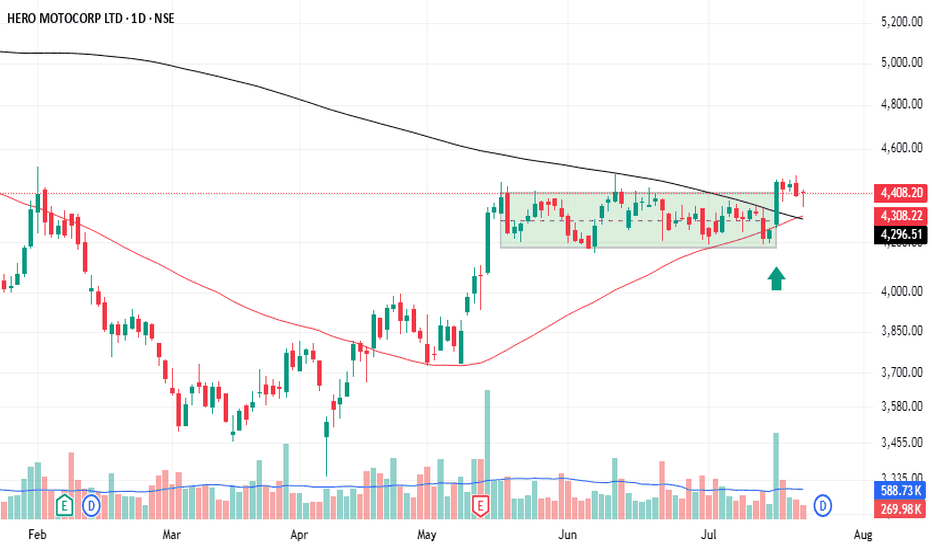

HEROMOTOCO is ready for big breakoutHEROMOTOCO is making inverted Head & Shoulder pattern. Making Pole & Flag pattern on weekly timeframe. Possibility of golden cross over on daily timeframe. Spent more than 2 months within short range and now spending time near high end of the range. Very high chances of break out. 4410 SL 4295 T 4810

Hero Moto Co - Darvas Box Breakout - No AdviceHero Motocorp's stock has shown period of consolidation, forming potential Darvas Box. A breakout above the box on 15 th july. Price movement was also accompanied by increased volume and then followed by golden cross over - showing a good opportunity to long. Warning - Investing in the stock market involves risks. It's essential to conduct thorough research, set clear goals, and consider multiple perspectives before making investment decisions.

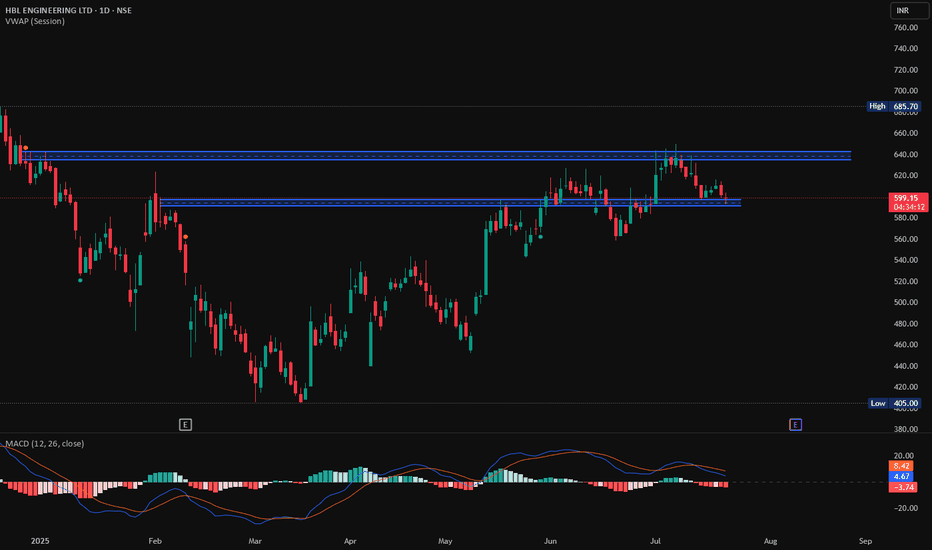

HBL Engineering at support, Long, 1DHBL Engineering is at its support, if it breaks and sustains 600 level then we may see it upward move in it for 620 and 645. Enter in the trade if it show any Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami above 600.

Entry: 600 (only at Bullish candlestick patterns)

Target1: 620

Target2: 645

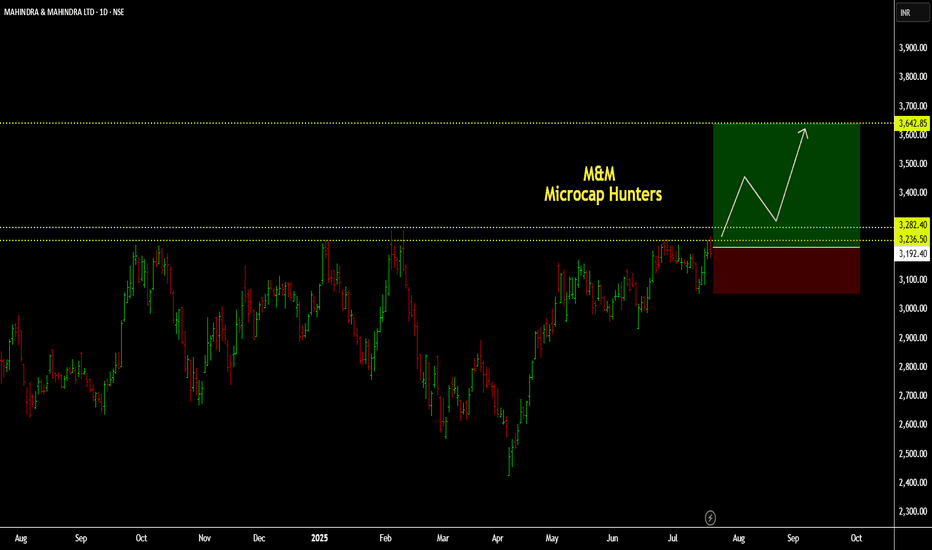

M&M (Breakout/Swing):M&M (Breakout/Swing):

M&M is getting ready to pass through the last 1 year's supply zone.

Signs of significant base formation is evident.

Trade offers a RR of more than 1:3.

Check out my earlier views for a better understanding.

Note: Do your own due diligence before taking any action.

ashokkleyNSE:ASHOKLEY

One Can Enter Now !

Or Wait for Retest of the Trendline (BO) !

Or wait For better R:R ratio !

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low.

2. R:R ratio should be 1 :2 minimum

3. Plan as per your RISK appetite and Money Management.

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose

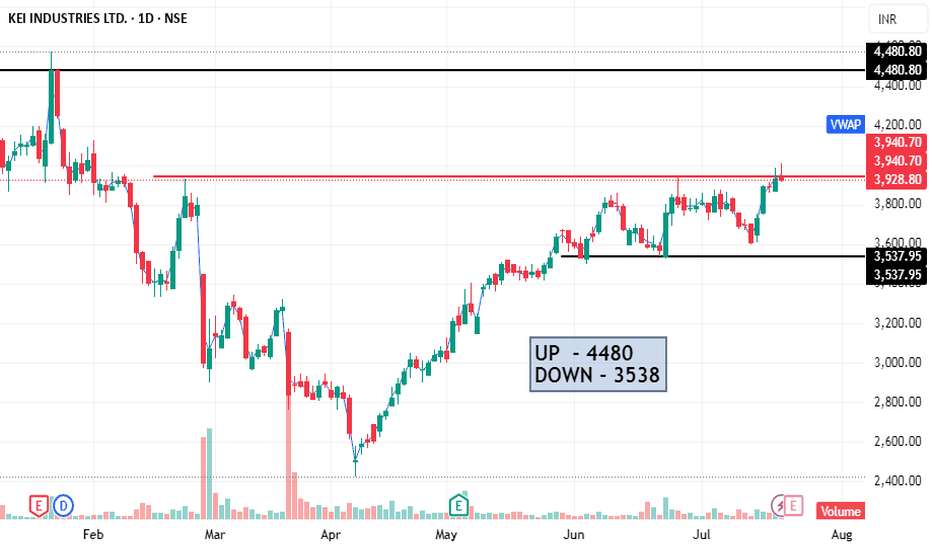

KEI is upside trend Bullish.Sharing the chart of KEI in deatil research as my opinion Trend is Bullish, if market close above 3950. TG open - 4480- 4500 with in 1 month etc.

I AM NOT A SEBI REGISTER,

Before invest or trade please consult with financial advisor.

SO This is not TIPS, SUGGESTIONS. Just Sharing my Experience.

Reliance Industries Stock(India) - {11/07/2025}Educational Analysis says that Reliance Industries (Indian Stock) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFITS OR LOSS,

Happy Trading,

Stocks & Commodities TradeAnalysis.

My Analysis is:-

Short term trend may be go to the external demand zone.

Long term trend breaks the new high after going from discount zone.

Short trade idea analysis (Education Purpose)

Confirmation - fractal CHOch

2 trades:- Market and sell limit order

Both Stop loss same @1554.55

Both Target Same @1104

Please check the comment section to see how this turned out.