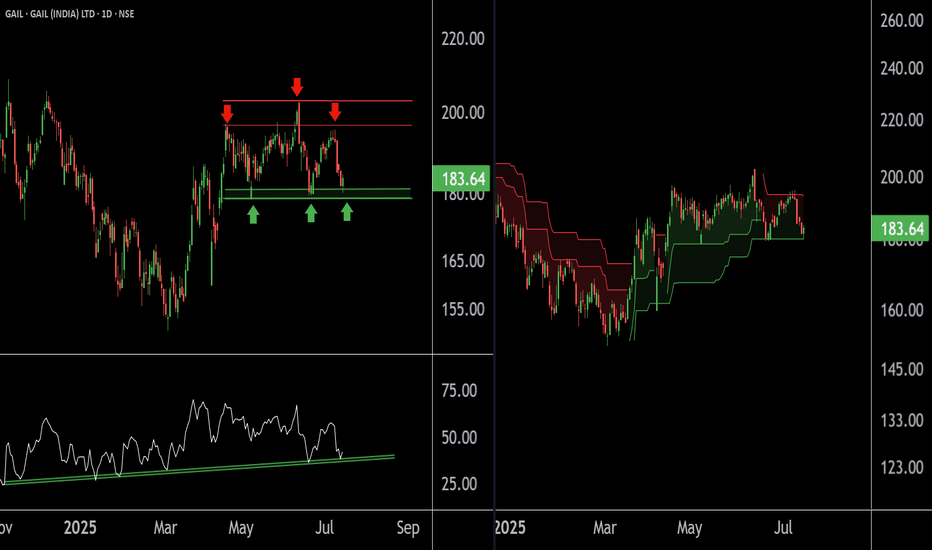

GAIL at Best Support zone !! There are two chart of Gail on Daily timeframe.

On the first chart Gail is moving in well defined parallel channel with support near at 178-180 zone.

Daily RSI is also taking support and bouncing back, indicating a revival in short-term momentum and strengthening the overall bullish setup.

On the second chart , the stock is bouncing from the supertrend support around ₹180, reinforcing bullish sentiment. However, on the shorter timeframe, the supertrend indicator is acting as resistance near ₹192, which needs to be breached for further upside continuation.

Thank You !!

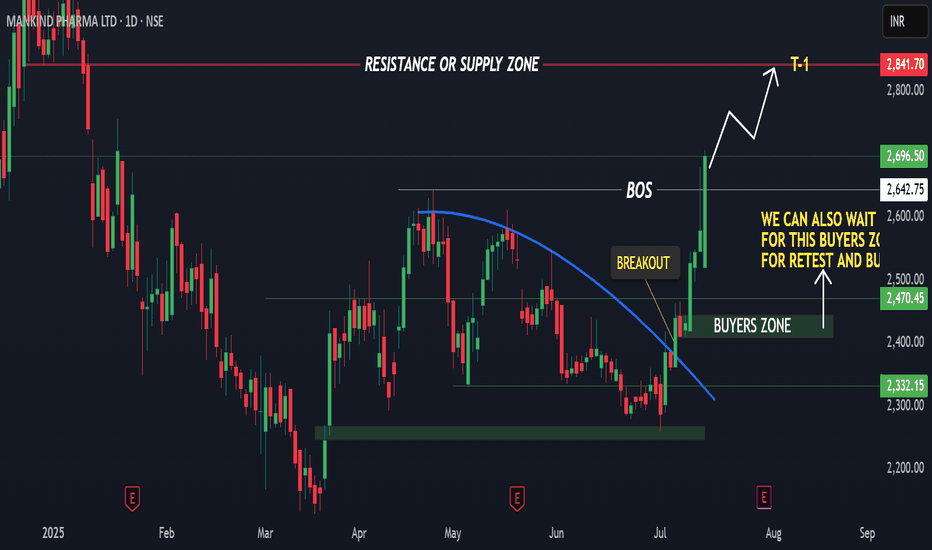

MANKIND PHARMA - For swing Trade1. In monthly time frame price is looking very bullish.

2. In weekly time frame price has given a breakout of double bottom pattern which is also showing bullish sign. And also from last 4 weeks price is making a good bullish move upside.

3. In daily time frame price has given a curve line breakout and make a good bullish move upside today.

4. Current price is 2696

2642 was the breakout level and also a break of structure(BOS)

5. Next Target can be 2840 to 2940

NOTE -

2445 to 2410 is the Bullish reversal zone.

Neuland Lab - Trendline BreakoutNEULAND LABORATORIES LTD.

Breakout from trendline resistance on daily timeframe.

Breakout with heavy volume.

Close crossing last week high.

Increasing relative strength.

Disclaimer:

For educational purpose only.

Please do your own research before taking any trades.

Happy Trading!

MAP MY INDIAC.E. Info Systems Ltd., operating under the brand MapmyIndia, is a leading geospatial SaaS and digital mapping company offering AI-powered mobility platforms, navigation tools, and automotive-grade telematics solutions. It serves marquee clients in automotive, logistics, government, and e-commerce verticals. The stock is currently trading at ₹1,804.40 and is forming a base post-correction, with early signs of trend reemergence supported by volume and Fibonacci alignment.

C.E. Info Systems Ltd. – FY22–FY25 Snapshot Sales – ₹215 Cr → ₹264 Cr → ₹314 Cr → ₹360 Cr – Consistent growth driven by SaaS subscriptions and automotive partnerships Net Profit – ₹89.3 Cr → ₹103.5 Cr → ₹116.2 Cr → ₹129.4 Cr – Steady margin profile with scalable revenue mix Company Order Book – Moderate → Strong → Strong → Strong – Expanding pipeline in mobility platforms and GIS services Dividend Yield (%) – 0.00% → 0.00% → 0.00% → 0.00% – No payouts, focused on reinvestment Operating Performance – Moderate → Strong → Strong → Strong – SaaS leverage driving operating margins Equity Capital – ₹10.71 Cr (constant) – Lean and efficient capital structure Total Debt – ₹0 Cr (debt-free) – Conservative balance sheet Total Liabilities – ₹185 Cr → ₹192 Cr → ₹204 Cr → ₹217 Cr – Stable, aligned with business scale Fixed Assets – ₹62 Cr → ₹68 Cr → ₹72 Cr → ₹78 Cr – Light capex structure supporting software stack

Latest Highlights FY25 net profit rose 11.4% YoY to ₹129.4 Cr; revenue increased 14.6% to ₹360 Cr EPS: ₹12.08 | EBITDA Margin: 31.2% | Net Margin: 35.94% Return on Equity: 25.28% | Return on Assets: 19.67% Promoter holding: 53.78% | Dividend Yield: 0.00% New deployments in EV navigation, autonomous mapping, and smart city platforms OEM integrations with leading automotive brands extending platform reach

Institutional Interest & Ownership Trends Promoter holding remains healthy at 53.78%, with no dilution or pledging. Recent quarterly filings show marginal uptick in FII interest, while mutual fund holdings remained steady. Delivery volume trends suggest accumulation by small-cap institutional trackers and thematic tech-focused portfolios.

Business Growth Verdict Yes, C.E. Info Systems is scaling sustainably with differentiated geospatial offerings Margins remain robust across product lines Zero debt and high ROE underscore financial discipline Asset-light model supports scalable growth with minimal capex needs

Company Guidance Management expects continued double-digit revenue growth in FY26, driven by expansion in automotive-grade maps, IoT platforms, and SaaS contracts. Profit margins are projected to stay above 30%.

Final Investment Verdict C.E. Info Systems Ltd. offers a unique play in India’s emerging deep-tech and mobility infrastructure ecosystem. With strong profitability metrics, zero debt, and expanding adoption across automotive and government platforms, the company is positioned for long-term value creation. Despite modest topline scale, its consistent margin profile and differentiated IP stack make it suitable for staggered accumulation by investors seeking niche tech exposure with high capital efficiency.

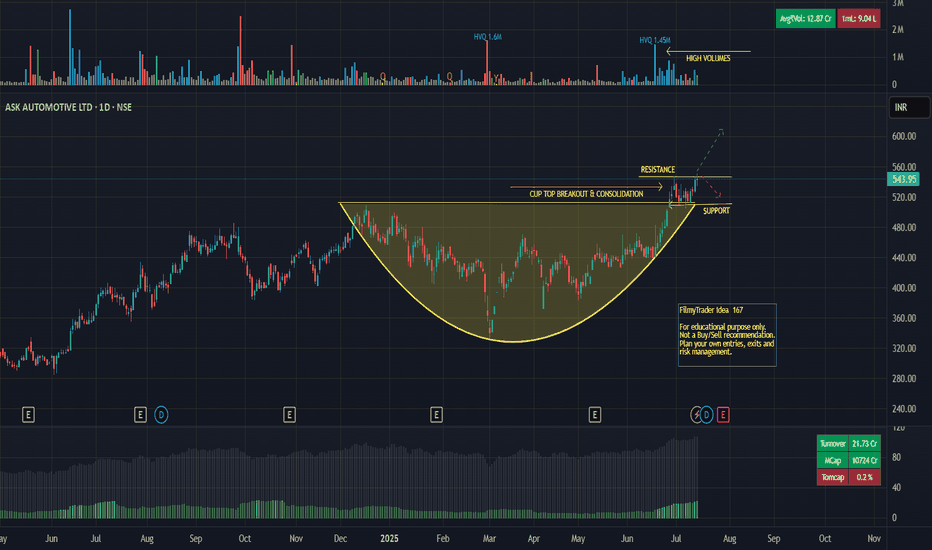

ASKAUTOLTD - Strong Technicals + Strong Fundamentals Should be a long term play, looks strong from the medium term. Beautiful Chart. MCap less than 10K Cr, poised for growth, strong fundamentals, strong technicals.

How to build Positions - Gradual scale in is your answer. Do not put in money blindly at open, good thinks take time to build and so should your portfolio.

SL - 480 (roughly 11% away, slow accumulation should help get your average price less than 7% away from this SL)

Long above 13960Nonstop move after the breakout of 10,350, stock is moving in a upward channel respecting upper and lower bend as resistance and support, out of 3 past sessions, stock formed 2 weak candles, today's low at 13,620 can act as immediate support (Not marked), below that stock may find next support at 13,285, 12,720 and zone at 12,010 - 12,210 can be the good support to hold the price from further fall, above 13,960 stock may chase for 14,775, 15,385 and 15,920. (On a weekly TF stock looks quite week so far.) CMP: 13,705

#DIXON - 4000 Pts move coming? 18246 or 9842.00?Date: 24-05-2025

#Dixon

Current Price: 14473

Pivot Point: 14044.00 Support: 13213.60 Resistance: 14882.04

Upside Targets:

Target 1: 15991.02

Target 2: 17100.00

Target 3: 18246.00

Target 4: 19392.00

Downside Targets:

Target 1: 12100.80

Target 2: 10988.00

Target 3: 9842.00

Target 4: 8696.00