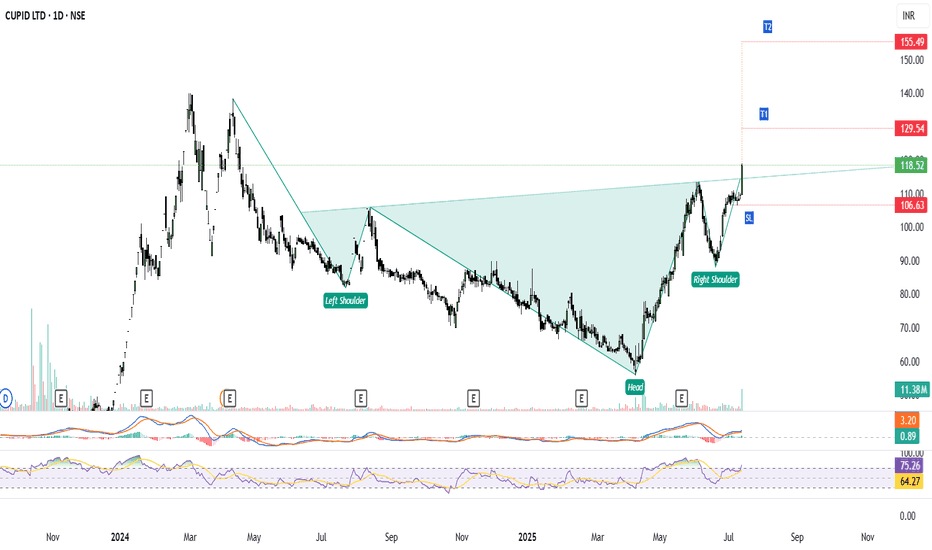

“CUPID LTD – Inverted Head & Shoulders Breakout | Swing TradePattern :- Inverted Head & Shoulders

Scrip :- CUPID LTD

Timeframe :- Daily (1D)

Breakout Confirmation :- Strong breakout above neckline with volume spike

Entry : ₹118.50 (after successful breakout)

SL :- ₹106.60 (below neckline support)

Target 1:- ₹129.50

Target 2 :- ₹160.00

Technical Analysis :-

- Volume spike confirms buying Pressure

- RSI above 65 = bullish momentum

- MACD crossover is the Confirmation

Disclaimer :- This analysis is shared for educational purposes only. Please do your own research or consult a financial advisor before making any trading decisions.

CUPID, breakout, inverted head and shoulders, NSE, swing trade, volume analysis, bullish setup

SYRMA Weekly Breakout | High Volume + 1.5-Year Base Structure🚨 Breakout Alert on SYRMA (Weekly)

After 1.5 years of sideways consolidation, SYRMA has finally broken out with strong conviction. The breakout is supported by the highest weekly volume seen in months — signaling smart money accumulation.

📊 Technical Setup:

🔹 1.5-year base formation now broken

🔹 Breakout candle closed above resistance with strength

🔹 Volume spike confirms breakout validity (HVE)

🔹 Structure resembles classic Stage 2 breakout

🟢 Ideal retest zone: ₹670–₹680

🛑 Support zone: ₹635–₹645

Fundamental Snapshot:

✅ Revenue: ₹2,000 Cr → ₹3,800 Cr in 2 years

✅ Net Profit up 50% YoY

✅ EPS (TTM): ₹9.57

✅ Promoter holding: ~46%

✅ Dominant player in EMS & IoT hardware

⚡Macro trend supports domestic electronics manufacturing — still early in the cycle.

Zydus Lifesciences Long_Support at 20 Daily EMAZydus Lifesciences Long:

- Clean Price action

- price takes support near 20 DEMA

- price test 20 DEMA for first time after Golden Crossover (50 > 200 DEMA)

- Hidden Bullish Divergence in action.

- Enter long when the prices are favorable

- SL: close below 20 DEMA

LTTS Weekly Trade Setup(14th-18th July 2025) – Parallel ChannelThis week, L&T Technology Services (LTTS) is showing a potential breakout opportunity that requires patience and precision. As the stock approaches a key resistance zone near ₹4445, traders should resist the urge to jump in early and instead wait for a breakout and confirmed re-test before entering any long positions.

Let’s break this down.

1. Why the Breakout is Important

- LTTS has been consolidating within a parallel channel between ₹4280 (support) and ₹4445 (resistance). Breakouts from such structures often trigger significant moves — but only when confirmed.

- A false breakout can trap early traders. Hence, waiting for the price to break above ₹4445 and then re-test this level is critical.

2. The Strategy – Wait and React

📌 Step 1: Watch for Breakout

Monitor price action as it approaches and breaches the ₹4445 resistance.

Look for strong bullish candles with volume to validate the breakout.

📌 Step 2: Wait for Re-test

After breakout, price may pull back to test the previous resistance.

This re-test acts as a confirmation that bulls are defending the breakout.

📌 Step 3: Look for Confirmation

Enter only when you see a bullish candlestick pattern (like a bullish engulfing or hammer) near the re-test level on 15-min or 1-hour charts.

🛡️ Stop Loss:

Place your stop below the swing low of the re-test.

This protects you if the breakout fails.

🎯 Target:

Profit booking zone is near ₹4580–₹4600.

Risk/reward ratio: 1:2, 1:3, 1:4+

3. Why Re-test Entries are Powerful

They allow low-risk entries with a tight stop loss.

You avoid chasing price and reduce emotional trading.

Confirmation helps you filter out false breakouts.

4. Final Words

In trading, discipline often beats speed. This LTTS setup is all about timing and structure.

🔔 Watch for the breakout.

🧘♂️ Wait for the re-test.

🎯 Enter only with confirmation.

If executed properly, this trade offers a clean, high R:R opportunity with a clearly defined setup.

Nuvama Wealth 📈 Trade Setup:

Parameter Value

Entry Price ₹6,905

Stop Loss ₹6,643

Target ₹10,274

Risk ₹262

Reward ₹3,369

Risk:Reward 12.9x

Last High ₹8,551

Last Low ₹6,828

Point Variation ₹1,723

🧠 Interpretation:

Perfect Trend Alignment: UP across all HTFs, MTFs, and ITFs.

Entry is within weekly demand zone (6905–6374), giving a low-risk setup.

High R:R (12.9x) makes this a compelling swing trade opportunity.

Target of ₹10,274 implies a breakout beyond the previous high (₹8,551), anticipating new ATHs.

SL of ₹6,643 is below recent lows and strong demand zones—well positioned.

⚠️ Watchouts:

If 6828 breaks, revalidate strength — this is the last key support across multiple timeframes.

Monitor volumes and candle formations around 6900–7200 zone to confirm breakout momentum.

✅ Overall Trend: STRONG UPTREND

All timeframes — High Time Frame (HTF), Medium Time Frame (MTF), and Intraday Time Frame (ITF) — show consistent upward demand zones.

📊 Zone Summary:

Timeframe Trend Zone Type Proximal Distal Avg Zone

Yearly UP Support 5326 4454 4890

Half-Yearly UP Rally → Rally 5326 4454 4890

Quarterly UP Rally-Base-Rally 5326 4454 4890

Monthly UP BUFL 7241 6805 7023

Weekly UP BUFL 6905 6374 6640

Daily UP BUFL (DMIP) 7194 7034 7114

240M / 180M / 60M UP DMIP ~6882 ~6828 ~6941

Support zones are tightening as we move from higher to lower timeframes — showing strong buyer interest across levels.

RAMCOCEM

NSE:RAMCOCEM

Note :

1. One should go long with a Stop Loss, below the Trendline or the Previous Swing Low.

2. Risk :Reward ratio should be minimum 1:2.

3. Plan your trade as per the Money Mangement and Risk Appetite.

Disclamier :

>You are responsible for your profits and loss.

>The idea shared here is purely for Educational purpose.

>Follow back, for more ideas and their notifications on your email.

>Support and Like incase the idea works for you.

PEL !! PIRAMAL ENTERPRISES LTD appear to be in a Breakout phase This is the Daily Chart of PIRAMAL ENTERPRISES LTD.

PEL is trading above the midline of its ascending parallel channel, with strong support in the ₹1080–₹1150 zone. Historically, whenever it sustains above the midline, it tends to retest the upper boundary resistance of the channel near at 1500 -1540.

If this level is sustain then we may see higher prices in PEL.

Thank You !!