Walk This Way...This S. Korean company focuses on treatment of cystic fibrosis and chronic kidney disease, et al. Future Medicine, Limited.

Godspeed to this company as they search for cures for primary biliary cirrhosis; colorectal, prostate, and lung cancers and rheumatoid arthritis, et al. They target metabolic cancers, inflammatory and autoimmune diseases, to produce anticancer drugs, anti-fibrotics and antiviral remedies. Not only persistent, but painful diseases, as well. Who on earth wouldn't want this company to succeed ?

Selling Volume has completely Dried-up and the stock is in the process of setting Higher-Lows. MACD, StochasticsRSI, Rate-of-Change, and %r are all additive tenets of confirmation for the astute and intrepid investor.

Go Long.... it's at the 20... the 10... the 5... and Touchdown

The key is whether it can rise above 61800

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

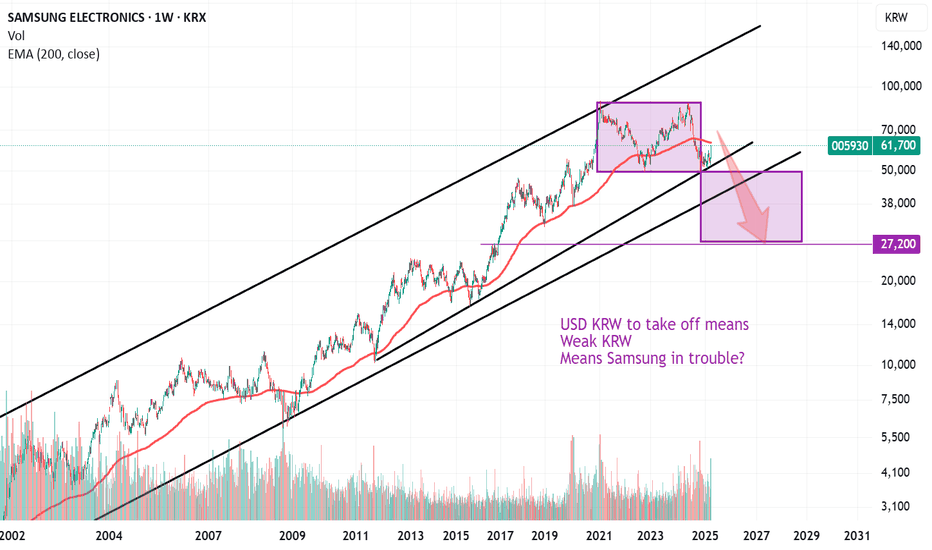

(Samsung Electronics 1D chart)

HA-Low indicator and HA-High indicator have begun to converge.

Accordingly, a trend is expected to occur soon.

Since the price is currently located below the M-Signal indicator on the 1M chart, it is possible that the rise is limited.

In addition, the PVT-MACD oscillator is showing signs of falling below the 0 point, so it is showing signs of switching to a selling trend.

Since the Low Line ~ High Line channel is showing signs of switching to a rising channel, if it rises above the High Line this time and is maintained, it is possible that it will switch to a buying trend again.

That is, when it shows support around 54100-58500, it is the first purchase period.

When it rises above the M-Signal indicator on the 1M chart and maintains the price, it is the second purchase period.

Accordingly, when it shows support around 61800 from the current price position, it is the second purchase period.

The expected target range is 77500-79400, which is near the current HA-High point.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

Breaking out if the falling wedge and uptrend is early!KRX:048910 is exhibiting a continued bullish uptrend and is still in its early stages after breaking out of the larger falling wedge. Currently, the stock has formed an early uptrend channel and strong bullish break out of the multi-tested resistance turned support 1t 11,630 has been broken.

Ichimoku is showing strong bullish signal and all three long to short-term momentum are showing strong bullish momentum (MACD, Stochastic Oscillator and ROC)

Extended double three corrective wave KRX:011790 is embarking on a double zig-zag wave and is likely at the next leg corrective wave B as price action shows a clear breakout of the consolidaitve range, which happens to be at the bottom of the descending channel.

Next up, Ichimoku has shown a bullish kumo twist and prices are trending above both the conversion+base line and the lagging span. Stochastic oscillator is oversold at the moment and should provide a support of a rally. Hence, we believe that SKC is likely to rally in the mid-term towards 138K and 160K

Good time to buy Samsung stocksIt went down a lot, and checked the floor.

It gave a fake rebound and fell back.

So, now it's ready for a go.

What do I mean?

Many individual investors entered thinking the price will go up, and they are losing hopes seeing a little minus %.

They will give up, and only after that process the price is ready to go up without the weaklings.

How cruel the market is, but that's what it is.

Buy till it falls to 49,900. Don't buy higher than 55,000 for the sake of your mentality.

Target is 99,000, which is about +99% profit in about 1 year.

See you in 1 year.

Mr.Million | My Kakao Position Update!Kakao bounced exactly where it should – on big volume! 🙏😊 I believe institutions are buying, and that’s always a great sign. 🍀

For full transparency:

My average cost: ₩ 36,000 (Korean Won)

Holding ~ ₩1,650,000,000 worth

How high could it go? I’m targeting ~ ₩52,000 per share 🤞

I’ll keep you updated on this holding – be sure to share & follow!

HANWHA Q CELLS Hanwha is the manufacturer of Teslas solar panels. With tesla set to expand its megapack production and increase its AI dataset training operations the focus will turn toward power production.

The chart is showing signs of accumulation with a 3 rising valleys on the weekly chart, first upside target is a 23% move to the next level. This asset has a lot of adversity ahead with multiple wick highs to contend with.

I think this chart provides a unique opportunity to get some long term exposure to solar operations without risking outsized downside like the rest of the solar sector.

Thanks!

: )

Price prediction of Hyundai E&C (2024.12.27)The price is right under the bottom line of falling wedge of 1M chart.

I recognized that there were bounce at the previous unbalanced volume zone on 1W volume foot print chart.

I think the price would go up to POC of long term trading zone which is seen on the chart.

I would take 6~12 months, that is over 2025.