NASCON LONG IDEA UPDATEOn the 26th May, 2025, I shared my analysis that NASCON stock will appreciate up to N76.95. The price was at N56 then. Checking the stock performance, it has already done over 33% by appreciating up to N75 close to the target.

Will it actually meet the target?

Stay tuned!

Thanks.

Fatai Kareem Kof T Fx

BERGER LONG TARGET METOn the 26th May, 2025, I made an analysis that the price of BERGER stock will appreciate up to N30.80. As at that date, it was at N22.45. Checking the stock for its performance, the target has been met with a risk reward ratio of 2.51.

If you take advantage of this signal, you can share your thought under this post. If you would like me to post more of my analysis and recommendations, you can share your interest under this post.

Thanks.

Fatai Kareem Kof T Fx.

$MULTIVERSE Multiverse over 60% retracement from All time HighNSENG:MULTIVERSE Multiverse Mining & Exploration Plc focuses on quarrying solid minerals (granite, zinc, tin, tantalite, barite, columbite, gold, etc.) in Nigeria, with operations in Ogun and Nasarawa State.

Currently NSENG:MULTIVERSE has lost over 60% of its value from an all time high of 24.50/share and is in consolidation.

Current price: 9.85naira/share

Low risk Buy zone levels is between 6.8naira - 10naira/share

Expecting #Multiverse to retest previous resistances at 17naira/share and 24naira/share if price attempts a recovery.

📈 Key Levels

Breakout above ₦10.20 Breakout zone – key resistance turning into support if broken

₦17.1 TP1 – next major resistance (target)

₦24.5 TP2 – higher resistance / bull target

Invalidation of this idea is a weekly close under 6.8naira/share

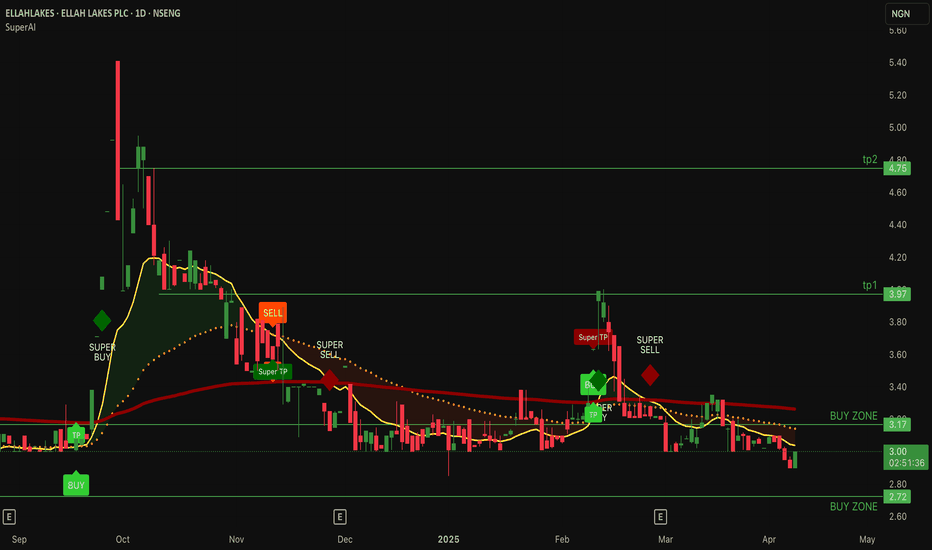

$ellahlakes Ellahlakes over 45% Retracement from 5.4naira/shareEllah Lakes Plc, established in 1980 and headquartered in Benin City, Nigeria, is an agribusiness company engaged in cultivating oil palm, cassava, soybean, maize, and rice. The company manages plantations across Edo, Ondo, and Enugu States.

NSENG:ELLAHLAKES all time high is 5.4naira/share in September 2024

Current price: 2.99naira/Share

#Ellahlakes is currently a low risk investment with possible heights of 3.9 and 4.7 per share.

Preferred buy zone is between: 2.7-3.1

Please Note: Idea Invalidation is Under 2.7

Indicator in use is the SuperAI: Check my Profile for more Information.

MTN Nigeria Stock Analysis and OutlookMTN Nigeria Stock Analysis and Outlook

MTN Nigeria has shown a strong recovery, breaking out of its prolonged downtrend in early December 2024. Since then, the stock has delivered an impressive rally, gaining nearly 70% in value.

As of the latest trading session, MTN Nigeria closed at ₦279. From a technical analysis standpoint, there is a possibility of a short-term pullback toward a key support zone (indicated in yellow on the chart). Should this level hold, the stock may continue its upward momentum with a potential push toward the ₦300 psychological resistance level.

While the medium-term trend remains bullish, it is important to approach this with caution—particularly for short-term traders. Implementing a well-placed stop loss remains crucial to manage downside risks effectively in volatile market conditions.

Disclaimer:

This analysis is for informational purposes only and should not be construed as financial advice. Always conduct your own due diligence before making investment decisions.

Please:

Follow me, like, and share my analysis. Also let me know your viee

$INTBREW OVER 75% RETRACEMENT & 4-YEAR CONSOLIDATIONEven though NSENG:INTBREW International Breweries PLC has shown Market Leadership & Strong Brand Portfolio Owning popular brands like Trophy, Hero, Beta Malt, and Castle Lite it's share price has lost over 75% of its value across 4years.

#INTBREW Current Price: 5.4

In light of the value lost, Price action has also shown a 4year consolidation between 3.5 - 6.5 (termed Buy Zone) in the Charts.

A break out of price above 6.5 can lead to much higher prices.

Resistance above: 6.5, 9.6, 13.9

This idea is invalidates when price action loses support at 4.0

Want to know more about Nigerian shares? Also get my Share picks for 1st quarter of 2025?

Chat me up! Check the link on my profile. Cheers

WATCH OUT FOR VERITASKAPFrom around 0.83, VERITASKAP created an all-time high of around 1.81. This happened between August 2024 and September 2024. Then, price dropped into the discount level where is currently. The current price action shows that price is in a discount level, at a demand zone and within a falling wedge.

From a chart pattern perspective, falling wedge can be seen on the chart and a break out of the downtrend and resistance level around 1.06 with a bullish candle closing above these levels will serve as a strong indication that the stock is ready to rally up as much as the all-time high.

From a technical indicator perspective, awesome oscillator is below 0, showing that the stock is oversold. In addition, there is a bullish indication on the awesome oscillator as shown by its colour and upward movement. This is pointing to the fact that the value of the awesome oscillator is moving towards 0 and can cross over it which can be a good indication for a rise in price as well.

From a smart money concept perspective, a break of the last high (around 1.27) that led to the last bearish internal break of structure will as serve as indication of a bullish trend. Hence, the target will the all-time high.

Either way, the stock has a good potential. An aggressive trader or investor may buy at the current market price. While a conservative trader or investor may wait for a breakout.

Watch out for the confluences indicating potential rise in price so as to not miss out on the benefit.

ACCESSCORP LONG IDEAAccording to the Compendium of Broker's stock recommendation from May 26 to 30, 2025, a buy recommendation was made for ACCESSCORP. This caught my attention and I needed to see what made Bancorp Securities, Afrinvest and Lead Capital to make the buy recommendation.

In January, 2024, ACCESSCORP reached its all-time high, a value around 30.75. This rally started in September 2023 from a value of around 14.50. Then, there was a pullback into the discount in April, 2024 at a value of around 15.95. After which, price rose as high as 28.95 in February, 2025. This was also followed by a drop into the discount level in April, 2025. That time could have been a good long opportunity as price dropped into the discount level, mitigate a demand zone, support level and trend line; all lining at the area around 20.10.

Recently, bullish engulfing candlestick was formed around a key level and trend line. And this was a drop to the demand zone around 21.70. This is a good price to continue with the trend. At the current price, it is good to take a long position targeting the all-time high of 30.75.

Confluences for the long idea:

1. Price is respecting the uptrend.

2. Price is in discount level.

3. Trend line, support and demand zone converged at the same area.

4. Awesome oscillator is in oversold region.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. If you can't accept the risk, don't take the signal.

NEM SHORT IDEANEM Insurance stock is ready to have a drop. There's a bearish divergence signal from the awesome oscillator showing that there's a high tendency for the price of the stock to drop as much as to 11.65 and below that value. Any value below 11.50 is the discount level where there can be a potential for the next long opportunity.

Looking at the past data, some patterns were revealed. In September 2016, there was a bearish divergence signal and the price dropped from around 3.71 to around around 1.51. Likewise, in September 2022, there was a bearish divergence and the price dropped from around 5.65 to around 3.71. Similar pattern is what is repeating itself showing that there's a higher probability that the price dropped into the discount level. For an investor holding this stock, this maybe a signal to sell and wait for another long opportunity. For a trader, it's an opportunity to short the stock, targeting the discount price around 11.65.

Confluences for the short signal:

1. Price is showing higher high while awesome oscillator is showing lower high indicating bearish divergence.

2. When similar patterns occured in the past, price dropped into the discount level.

3. A bearish engulfing candlestick had been formed showing that price is likely going to drop further.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. If you can't accept the risk, don't take the signal.

NASCON LONG IDEA CONTINUATIONNASCON stock reached its all time high value of around 77 in January 2024. This happened after a bearish divergence signal from the awesome oscillator. Then, it dropped into the discount level. After which a bullish divergence signal was given, followed by a breakout. Since that breakout, price has been going up and rally for the all-time-high value. The first long opportunity could have been in November 2024 when the price was around 30. The next opportunity was when the price was around 44. Then the next opportunity was when price was around 54. Joining the rally now is not too late since the stock has a potential to hit 77.

Confluences for the long idea

1. Price was coming from the discount level.

2. Price broke out of a down trend line.

3. Price has been rally after a bullish divergence signal given by the awesome oscillator.

4. Bullish engulfing candlestick was formed recently after breaking a key level.

Disclaimer: this is not a financial advice. The outcome maybe different from the projection. If you can't accept the risk, don't take the signal.

Berger Paints PLC Berger Paints PLC stock is showing a bullish signal for appreciating in value. The price dropped into a discount level and broke a down trend line with a strong bullish candle, closing above the trendline. This happened when the price was also in an oversold region as indicated by Awesome Oscillator.

Currently, there has been a pull back with a rejection, showing more confidence in the bullish move. The stock can be bought at the current price while targeting 24, 26.60 and 30.80 as the final target based on the Fibonacci level.

Confluences for the long signal:

1. Price is coming from a discount level

2. Price was in oversold level before and it is showing more bullish signal

3. Price had broken out of a down trend line with a strong bullish candle

4. There was a strong rejection from last week candle.

Disclaimer: this is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you don't accept the risk.

RT BRISCOE PLC LONG IDEART BRISCOE PLC stock, after reaching its all time high, dropped to discount level. Currently, it has broken out of down trend line with a strong weekly bullish candle closing above a the down trend line and resistance level. The awesome oscillator is also in the oversold region with a bullish signal. An aggressive trader or investor can buy at the current price while a conservative trader or investor may wait for a drop to around 2.20 and 2.30 to place a buy. While you can also so spread your risk by buying at the current market price and add more positions when price drop towards the resistance turned support.

The entry is at the current market price or buy at 2.20 while the stop can be at 1.73 and the target can be around 2.90 and 4.30.

Confluences for the long signal:

1. Price is in discount level

2. Price broke out of a down trend line and resistance level with a strong bullish candle.

3. Awesome oscillator is in oversold region and showing bullish signal.

Disclaimer: this is not a financial advice. The outcome maybe different from the projection. If you can't accept the risk, don't take the signal.

MY BUY OUTLOOK FOR FIDELITY BANK NIGERIA stockMY BUY OUTLOOK FOR FIDELITY BANK NIGERIA stock.

This week has been a bleeding week for Fidelity stock despite a 64.2% year-on-year increase in gross earnings to N315.4 billion in Q1 2025.

I will patiently wait for entry at N16.5 zone and SL at N15.5 zone.

RR of 1:4

Trade with care.

Like, share,and follow me if you found this helpful

$Nestle PLC over 40% retracement in a Falling WedgeNestlé Nigeria Plc is a leading food and beverage company in Nigeria, manufacturing and marketing a variety of products under renowned brands such as Maggi, Milo, Nescafé, and Golden Morn.

MYX:NESTLE all time high is about 1600 Naira/share

Current price: 975 Naira/share - A 40% discount from all time high.

In the past, after #nestle price action broke out its falling wedge, it made over a 100% move upwards. IF HISTORY REPEATS, Nestle stands a chance to reclaim these resistances: 1026, 1253, 1553 and even higher.

This idea invalidates under 793.

My View on Nigerian Breweries PLC (NB)My View on Nigerian Breweries PLC (NB).

This asset has made a significant ride up from its recent low, which broke the previous N45 resistance zone, and hit a new resistance zone around N56 before dropping a bit.

If the N45 support continues to hold strong, we might see this asset rally towards the ALMIGHTY resistance level around N68.

Looking at the chart, the 68 level marked yellow is a critical level for all investors.

Trade with care.

Please, if you found this helpful, kindly follow me, like, share my chart and let me know your thoughts on the comment session

FBNH Stock Analysis and Technical OutlookFBNH Stock Analysis and Technical Outlook

First Bank Holding (FBNH) has experienced a consistent downtrend over the last four trading weeks, closing the most recent week at ₦38.25 per share. Based on current technical indicators and price action, there appears to be a strong likelihood that the stock may decline further, potentially reaching a key support zone around ₦26.65.

Should the price action confirm a reversal from this support area, a rebound towards the ₦33 and ₦38 levels may occur. These levels represent potential profit targets 1 and 2, respectively, for swing traders and medium-term investors.

From a fundamental perspective, FBNH appears undervalued at current levels, especially when considering its Price-to-Earnings (P/E) ratio of approximately 1.5. This suggests that the stock may be trading below its intrinsic value, which could attract long-term investors seeking undervalued opportunities in the Nigerian banking sector.

Caution is advised, however, as overall market sentiment and macroeconomic factors could influence short-term price movements. Investors and traders are encouraged to apply risk management strategies and conduct further due diligence before taking any position.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always consult with a certified financial advisor before making trading decisions.

Update! 1st Quarter Nigerian Share Picks for 2025 (DEC30-JAN30)Between the two given dates (DEC30 - JAN30), stock prices have shown a positive overall trend, with an average percentage change of approximately 16.29% across all listed stocks.

Key observations:

Significant Gainers: Some stocks like SCOA(+97.5%). MULTIVERSE(+50%) MTNN (+20.31%) and UPDC (+26.58%), experienced notable growth.

Moderate Increases: Stocks such as FBNH (+3.72%), FTNCOCOA (+5.00%), and GUINNESS (+9.61%) saw steady increases.

Broad Market Growth: Most stocks had a price increase, indicating a general upward trend in our 1st quarter share picks for 2025.

Overall, our portfolio appears to have performed well over the period, with most stocks appreciating in value. Let me know what you think!

Nigerian Share Picks for Second Quarter 2025 (APRIL - JUNE 2025)My share choice for Second Quarter 2025

ELLAHLAKE 2.90 (low risk) Active trading, small-cap stock with growing momentum.

INTBREW 5.05 (low risk) High volume, possible interest buildup despite recent dips.

NASCON 43.95(medium risk)Strong performance; good short- to mid-term growth potential.

NB 32.00(low risk) Stable, consumer-facing; may need a catalyst for price movement.

MTNN 245.00(medium risk)Defensive blue-chip; solid for long-term holding and dividends.

GUINNESS 80.00(medium risk) Resilient FMCG stock; consistent but currently flat.

NESTLE 1,020.00 (low risk) Premium stock, strong fundamentals; long-term value hold.

DANGCEM 480.00 (medium risk)Cement giant, good for infrastructure-focused portfolios.

MULTIVERSI 8.65 (low risk)Low activity; speculative with limited liquidity.

ALEX 7.15 (low risk) Very low volume; watchlist-only unless volume improves.

Real time monitoring: www.tradingview.com

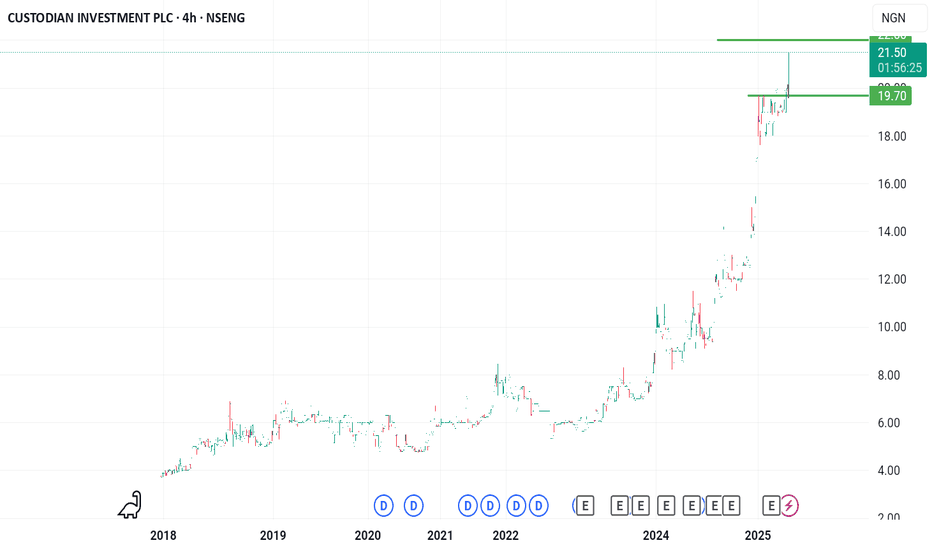

CUSTODIAN stock on Nigeria Exchange to likely hit N21 soon.CUSTODIAN stock on Nigeria Exchange to likely hit N21 soon.

This stock made it to the position of 3rd best performing stock on the NGX gainers table.

The move from N19.6 to N21.5 was a rapid one.

I will be looking at N22 as a likely resistance to the upward move.