OGKB 5M Investment Aggressive CounterTrend TradeAggressive CounterTrend Trade

- short impulse

+ biggest volume T1 level

+ biggest volume 2Sp-

+ weak test

+ first bullish bar close entry

Calculated affordable stop limit

1/2 yearly level take profit at 0.459

1H Counter Trend

"- short impulse

+ biggest volume TE / T1 level

+ support level

+ volumed 2Sp-"

1D Trend

"+ long impulse

+ JOC level

+ support level

+ 1/2 correction

+ volumed manipulation"

1M Trend

"+ long impulse (in 1d 4h)

+ neutral zone"

1Y CounterTrend

"""- short impulse

+ 2Sp-

+ perforated support level"""

GMKN Long 1D Investment Conservative Trend TradeConservative Trend Trade

+ long impulse

+ SOS test / T2 level

+ 1/2 correction

+ biggest volume Sp

Calculated stop limit

1 to 2 R/R take profit

Monthly Trend

"+ long impulse

- SOS reaction bar level

+ 1/2 weak correction"

Yearly Trend

"+ long impulse

- below SOS

+ 1/2 correction"

ALRS 1D Long Investment Aggressive CounterTrend TradeAggressive CounterTrend Trade

- short impulse

+ volumed T1

+ support level

+ biggest volume Sp

+ weak test

+ first bullish bar close entry

Calculated affordable stop limit

Take profit

1/3 - 1 to 2 R/R

1/3 - 1D T2 / 1M T2

1/3 - 1/2 of 1Y

Calculated affordable stop limit

Take profit

1/3 - 1 to 2 R/R

1/3 - 1D T2 / 1M T2

1/3 - 1/2 of 1Y

Monthly CounterTrend

"- short impulse

+ volumed TE / T1

+ support level

+ volumed Sp

+ test"

Yearly Trend

"+ long impulse

+ 1/2 correction

+ T2 level

+ support level

+ manipulation"

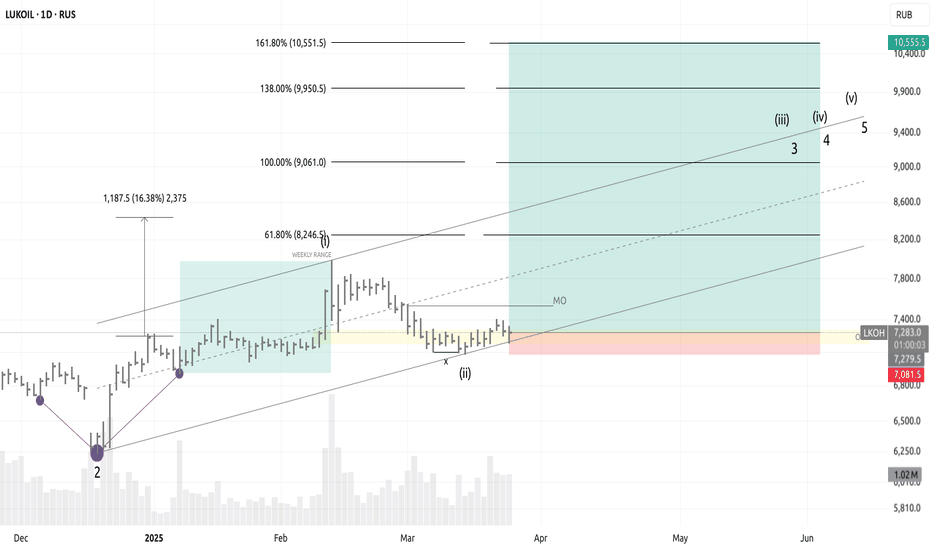

LKOH / LONG / 25.03.25⬆️ BUY LKOH 25.03.25

💰 Entry: 7279.5

🎯 Goal: 10555.5

⛔️ Stop: 7081.5

Entry reasons:

1) OSOK:

— Month minimum was set at the 2nd weekly

2) Eliott waves:

— 1D: 2th wave is formed, 3th is forming

3) Larry Williams:

— Long term point is formed

4) Range:

— Weekly bullish range, correction into OTE

5) Additional arguments:

— Divergence delta cluster

— Divergence delta oscillator

— Weekly liquidity is captured

Strategy: #osok #wave #larry #cluster

POSI 1H Investment Long Aggressive Trend TradeAggressive Trend Trade

- short impulse

+ exhaustion volume

- resistance level

+ long volume distribution

Calculated affordable stop limit

1/2 1M take profit

1D Trend

"+ long impulse

+ support level

+ T2 level?

+ 1/ 2 correction

+ weak approach"

1M Trend

"+ long impulse

+ 1/2 correction

+ biggest volume expanding T1

+ support level

+ biggest volume manipulation"

1Y Impulse

+ long impulse

POSI 1H Swing Long Conservative Trend TradeConservative Trend Trade

+ long impulse?

+ exhaustion volume

+ support level

+ long volume distribution

Calculated affordable stop limit

1/2 1M take profit

1D Trend

"+ long impulse

+ support level

+ T2 level?

+ 1/ 2 correction

+ weak approach"

1M Trend

"+ long impulse

+ 1/2 correction

+ biggest volume expanding T1

+ support level

+ biggest volume manipulation"

1Y Trend

+ long impulse

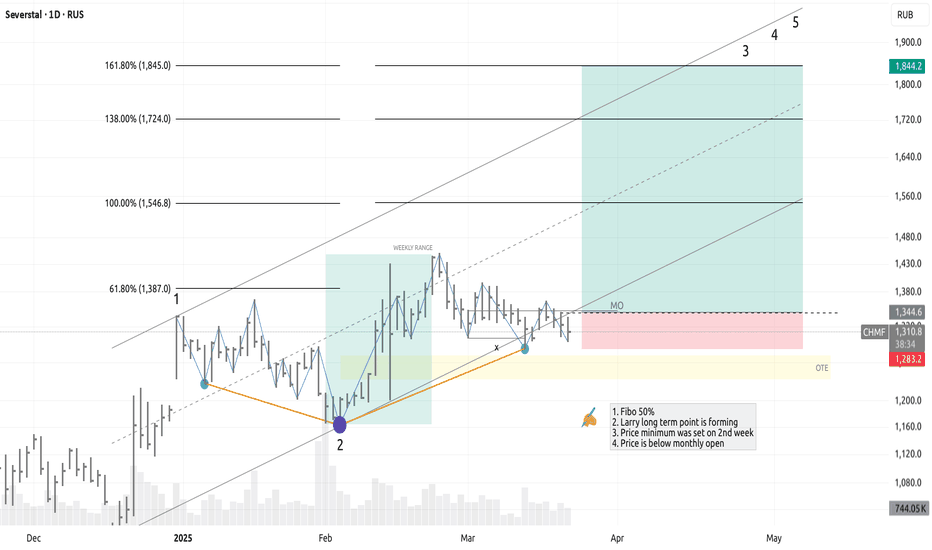

CHMF / LONG / 21.03.25⬆️ BUY CHMF 21.03.25

💰 Entry: 1344.6

🎯 Goal: 1844.2

⛔️ Stop: 1283.2

Entry reasons:

1) OSOK:

— Month minimum was set at the 2nd weekly

2) Eliott waves:

— 1D: 2th wave is formed, 3th is forming

3) Larry Williams:

— Long term point is forming

3) Range:

— Weekly bullish range, correction into discount zone

4) Additional arguments:

— Divergence delta cluster

— Weekly liquidity is captured

Strategy: #osok #wave #larry #cluster

MAGNIT / LONG / 21.03.25⬆️ BUY MAGNIT 21.03.25

💰 Entry: 4930.5

🎯 Goal: 6931.0

⛔️ Stop: 4526.0

Entry reasons:

1) OSOK:

— Month minimum was set at the 2nd weekly

2) Eliott waves:

— 1D: 2th wave is formed, 3th is forming

3) Larry Williams:

— Long term point is forming

3) Range:

— Monthly bullish range, correction into zone OTE

4) Additional arguments:

— Divergence delta cluster

— Divergence oscillator 1d

— Weekly liquidity is captured

Strategy: #osok #wave #larry #cluster

Unipro UPRO Stock Technical Analysis and Fundamental Analysis📊 Technical Analysis of Unipro ( RUS:UPRO ) Stock

Current Price: 2.043 RUB (+2.46%)

Trend: The stock is in a growth phase, but signs of overbought conditions are emerging.

RSI (14): 78.91 (overbought, possible correction ahead)

MACD (12,26,9): +0.13 (bullish signal, but a reversal is possible)

Support Levels: 1.95 RUB and 1.80 RUB

Resistance Levels: 2.10 RUB and 2.30 RUB

Entry Points:

A pullback to 1.95 RUB may be a good opportunity for long positions.

If the price consolidates above 2.10 RUB, further growth toward 2.30 RUB is likely.

Stop-Loss: 1.85 RUB (if breached, the trend could reverse downward)

📈 Fundamental Analysis

Financial Performance:

Revenue remains stable, but growth rates are slowing.

Net profit declined in 2024 due to rising operating expenses.

Debt burden is low, ensuring resilience to macroeconomic shocks.

Impact of the Russian Central Bank:

The high key interest rate is limiting market capitalization growth.

Investors are waiting for rate decisions—any cuts could accelerate stock growth.

Dividends:

Expected to remain at 6 RUB per share.

Dividend yield remains attractive for long-term investors.

Macroeconomic Factors:

External sanctions and political risks may influence business growth.

A potential IPO of RTK-DPC (a Unipro subsidiary) could strengthen the company’s financial position.

🔍 Conclusion

Short-term: The stock may experience a correction due to overbought conditions. The best entry point is around 1.95 RUB.

Mid-term: If the price consolidates above 2.10 RUB, growth toward 2.30 RUB is likely.

Long-term: Unipro remains attractive for investors focused on dividends and stability.

❗ Keep an eye on Russian Central Bank decisions and overall market sentiment.

MGNT 1H Long Investment Conservative Trend TradeConservative Trend Trade

+ long impulse

+ SOS level

+ 1/2 correction

+ volumed 2Sp-

- day will close without test

Calculated affordable stop limit

1/2 1M take profit

Daily Trend

"+ long impulse

+ SOS test / T2 level

+ support level

- strong approach from volume zone

+ biggest volume manipulation"

Monthly Trend

+ long impulse

+ expanding biggest volume T2

+ support level

+ 1/2 correction

+ unvolumed 2Sp-

+ strong buying bars

+ weak selling bar / test

Yearly no context

POSI 1H Investment Aggressive Trend TradeAggressive Trend Trade

- short impulse

+ volumed T1 level / SOS test level

+ volumed 2Sp-

+ weak test

Calculated affordable stop limit

1/2 Monthly wave take profit

Daily Trend

"+ long impulse?

- resistance level

- short volume distribution"

Monthly Trend

"+ long impulse

+ 1/2 correction

+ volumed expanding T1

+ support level

+ biggest volume manipulation"

Yearly Trend

+ long impulse

Weird set up. Market is strong and Monthly look a lot like exhaustion!

FLOT 1D Long Investment Trend TradeTrend Trade

+ long impulse

+ T2 level

+ support level

+ 1/2 correction

+ biggest volume 2Sp+?

Calculated affordable stop limit

1 to 2 R/R take profit

Monthly countertrend

"- short impulse

+ volumed T1

+ 2Sp+

+ bigger volume on test"

Yearly context

"+ long impulse

- correction"

ALROSA PJSC $ALRS: CAN IT WEATHER THE STORM?💎 ALROSA PJSC (ALRS.ME): CAN IT WEATHER THE STORM?

Russia’s diamond giant, Alrosa, is under pressure from global sanctions and weak demand. Can this dominant player maintain its shine ✨ or will it get buried under geopolitical and market risks? Let's dig in! 👇

1/ Revenue Hits:

Alrosa's diamond sales halted in Sept-Oct 2024, reflecting a tough market.

This move was part of a strategic response to sluggish demand 📉 and efforts to stabilize earnings.

The diamond industry isn't sparkling like it used to. 💎

2/ Market Stabilization Efforts: 🛑

No recent earnings reports were mentioned, but the sales halt highlights how volatile the market has become.

Alrosa is bracing for financial pressure while keeping reserves intact for better conditions.

Is this a smart move, or just delaying the pain? 🤔

3/ Major Threat: G7 Sanctions ⚠️

The G7 plans to ban Russian diamond imports, a major blow to Alrosa's access to key markets.

Sanctions could severely disrupt revenue and global sales channels. 🌍

This geopolitical chess match might redefine the company's future moves. ♟️

4/ How's Alrosa Valued? 💲

The last known analysis suggested a 25% undervaluation (based on a DCF model in 2019).

However, without updated data, it's unclear if this still holds true under current conditions.

Alrosa's financial outlook hinges on lifting or navigating around sanctions.

5/ Comparing Alrosa to Peers:

Alrosa’s dominance in diamonds is clear, but sector-wide data remains limited.

Compared to precious metals miners, Alrosa’s reliance on one commodity increases its risk exposure.

Diversifying might be crucial for long-term resilience. 🏗️

6/ Key Risks to Watch: 🚨

Geopolitical Tensions:

Sanctions are the biggest risk threatening Alrosa's market access.

Market Demand Slump:

Global demand for natural diamonds is weakening as lab-grown diamonds gain popularity. 🧪

Regulatory Risks:

Changes to mining laws in Russia could further complicate operations.

Currency Volatility:

The ruble's instability 💱 may distort reported earnings and profitability.

7/ SWOT Analysis: 🔍

Strengths:

✅ Global leader with significant diamond reserves

✅ State-backed, offering some political protection

Weaknesses:

⚠️ Heavy reliance on a struggling market

⚠️ Susceptible to international sanctions

8/ SWOT Continued:

Opportunities:

🚀 Recovery potential in the diamond market post-sanctions

🚀 Diversification into other minerals or industries

Threats:

🌍 Sanction risks from Western nations

🌍 Rising competition from lab-grown diamonds

Alrosa will need bold strategies to capitalize on any opportunities ahead.

9/ Investment Thesis: 💡

Alrosa’s future remains uncertain due to sanctions and weak market conditions. However, significant reserves and state support could provide resilience if market demand recovers. Investors must weigh the high geopolitical risk against potential recovery gains.

10/ What do YOU think? 💬

📈 Bullish: Alrosa can weather this storm.

🔄 Hold: Let’s see how sanctions evolve.

🚫 Bearish: Too risky, no recovery in sight.

Material gain. Big brother is watching you.While the lion's share of investors are tense and outraged by the calculation of material benefits, we would like to add the final touches to the reasons why the government decided to reinstate this provision in the tax code.

Undoubtedly, investors who will now have to pay for material benefits did not anticipate that blocked foreign securities would have the same status as assets available for free trading. Some investors point to delayed calculations by the broker, while others defend themselves by arguing that they were not properly informed. Determining who is right and who is wrong has become so complicated that it seems this task should be resolved exclusively by the government. The Russian stock market is constantly under pressure, making negative forms and reactions an absolute norm in such a stressful environment.

However, we are less interested in analyzing what has happened and more focused on why material benefits were reinstated specifically in 2024 and why they now apply to blocked foreign securities, even though, in theory, these assets could be blocked indefinitely.

📃Background 2022-2023

As a result of the massive sanctions imposed by Western countries against Russia's financial sector, a significant number of assets were blocked both within Russia and abroad. The sanctions paralyzed all interaction chains. Trading operations were disrupted. Shares of Russian issuers were partially blocked and sold at a significant discount. Instruments such as RUS:SBER , RUS:MDMG , $HHRU, RUS:YDEX , RUS:LKOH , and RUS:QIWI were trading at a 70-90% discount to their real value. The majority of these discounted assets of Russian issuers were held in several European banks. The effect triggered by the geopolitical conflict was one of the most dramatic, reminiscent of the U.S. stock market crash during the dot-com bubble.

📃Unexpected Outcome Amid High Risk

Unpredictability, fear, and concerns that the assets would drop to zero forced many foreign holders to sell highly valuable shares of Russian companies. It was at this moment that those engaged in purchasing discounted securities had the opportunity to earn extra profits, similar to those that could arise from buying blocked foreign securities.

Those who think this type of over-the-counter transaction was available to everyone and free of charge are mistaken. The fees for buying back discounted shares were comparable to what material benefit implies today.

At the initial stage, it was indeed possible to buy Sberbank shares for 35-45 cents, but this period was limited. Liquid securities were fully bought out by early 2023 and ended up in the hands of those waiting for their moment to sell them on the open market.

📃Lessons Learned

Unfortunately, we do not have information about who took the initiative to introduce material benefit into the Tax Code regarding blocked foreign securities, but their actions were based on a thorough analysis of processes occurring outside Russia's jurisdiction.

If EU tax authorities could go back and make appropriate adjustments, they would do the same with blocked Russian securities. Thus, in our view, material benefit essentially serves as a combined taxation tool for blocked foreign securities in scenarios where assets are withdrawn using an individual OFAC license beyond the perimeter without paying taxes in Russia.

SMLT 1D Aggressive Investment CounterTrend TradeAggressive CounterTrend Trade

- short impulse

+ biggest volume T1

+ support level

+ biggest volume 2Sp+

+ weak test

+ first bullish bar closed entry

Calculated affordable stop limit

1 to 2 R/R take profit

CounterTrend 1M

"+ short impulse

+ biggest volume TE / T1 level

+ support level

+ biggest manipulation?"

Trend 12M

"+ SOS test level

- far below 1/2 correction

+ support level

+ biggest volume manipulation?"

They say company is going to bankruptcy, but why would it concern technical analysis?!

PIKK 1H Swing Long Conservative Trend TradeConservative Trend Trade

+ long impulse

+ 1/2 correction

+ T2 level ? (new spread)

+ support level

+ biggest volume Sp

+ weak test

Calculated affordable stop limit

1 to 2 R/R take profit

Daily context

"+ long impulse

+ 1/2 correction

- SOS level above JOC

+ support level

+ volumed Sp

+ weak test"

Monthly context

"- short impulse

+ volumed T1

+ support level

+ biggest volume 2Sp+ in 4d"

Yearly context

"- no trend

- context direction short"

#TRNFP - Strategic company.Good day, dear investors.

We continue to look positively at assets and enterprises located in the Russian Federation, especially those with the characteristic of "natural monopoly".

Transneft is the world's largest oil pipeline company, the owner of the oil transportation system of the Soviet Union. 68 thousand kilometers of main pipelines, more than 500 pumping stations, 24 million cubic meters of storage capacity. The company transports 83% of the oil produced and 30% of oil products in Russia. Owner of port infrastructure: Port Primorsk, Port Ust-Luga, Port Novorossiysk, Port Kozmino.

Before us is an infrastructure company of strategic importance, the profit of which does not depend on fluctuations in energy prices.

The company's net profit continues to grow from year to year, the debt is decreasing, despite the growth of capital expenditures, the growth of Cash on the balance sheet is positive in the context of high CBR rates. Transneft indexes the cost of its services annually by the amount of inflation + 0.3%.

The average dividend yield for 10 years is: 94.44 ₽, for 5 years: 117 ₽.

The Russian government owns 78% of voting shares. Which is both a plus and a minus. The minuses include the direction of the company's profits for purposes not related to commercialization. This includes an increase in taxes from 20 to 40%, which was approved on December 2. The plus is protection from takeovers and splitting of the company, and in the event of a decrease in the state's share to 50% + 1 share, there will be an increase in the value of both ordinary and preferred shares. We consider this scenario probable in the current conditions.

The technical picture remains bearish, the company is in a downward trend, the range of which is 1831-699, which is 70% lower than the ATX. The current movement that is forming at the moment shows signs of a double bottom.

Given the dividend yield, financial indicators and strategic importance of the company, we have a positive view of these shares.

Levels that we consider acceptable for forming a position: 969-790.

Levels at which it is possible to increase positions above standard risks are 493-308.

With respect to you,

Daniel Drozdov.

CIS Market Analyst VokCapital

Disclaimer:

The information above is not an investment recommendation.

#GMKN - Option x2/x2.5 with 14% annual yield. Good day, dear investors.

We continue to bet on the normalization of relations between the Russian Federation and the United States and Europe, one of the recipients of these events will be Norilsk Nickel.

GMKN is a producer of nickel, copper, platinum, palladium, the list is much wider, but this is the main thing. An export company, it has a full production cycle: mining, enrichment, production, logistics and sales. In connection with foreign economic activity, the devaluation risks of the national currency are less aggressively distributed.

Financial indicators are stable. Under the influence of restrictions, net profit and revenue are decreasing, but net assets remain in surplus and are growing despite the rising cost of servicing debt obligations.

The average dividend yield over the past 10 years is 14.3 ₽ per 1 share, which at the time of writing is 13.6%.

The technical picture is bearish. The stock has dropped to the range of 123-77, where trading is taking place below the lower boundary of the ascending channel. The target of this bearish cycle may be marks near the lower boundary of the range.

Possible scenarios:

- Direct fall to 77

- Growth to 139 - 149 and fall to 77

- End of the bearish cycle.

Our team believes that at the moment the company's quotes are at historically low price levels, especially considering the quotes of precious metals and the growth of the money supply in Russia. At the same time, if our expectations for the normalization of external relations are not met, the shares will still be able to grow and neutralize currency risks, according to the scenario of Iran or Turkey and their stock markets. Therefore, despite the bearish view from technical analysts, we are considering this company for addition to our portfolio on the Russian market.

With respect to you,

Daniel Drozdov.

CIS Market Analyst VokCapital