Ideas on the SGXTrend :Bullish

Formation : Bull Flag

Breakout : 9.10

Please look for a breakout before you enter. Always have your own trading plan , please take a look at my entry and TP . Set your own stop loss

Feel free to post any comment/question. I am more than willingly to reply you back :)

Quotes "The key to trading success is emotional discipline"

DBS (The Sell down momentum is slowing down)View On DBS (24 May 2019)

We were in the fast and furious pull back mode in the recent week.

Now, it has approached some decent support levels. It may take some time to around but as long as it is above the price level of $24, we shall see the rise up on the price again..

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice.

We may (or) We may not take the trade. The risk of trading in securities markets can be substantial.

You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Free Telegram FX/Stock analysis at your fingertip @ t.me/sonictraders

Follow our Trading View, @ bit.ly

Visit our Webby @ bit.ly

Like our FB @ bit.ly

Looking for a good broker? Go to cmc.mk

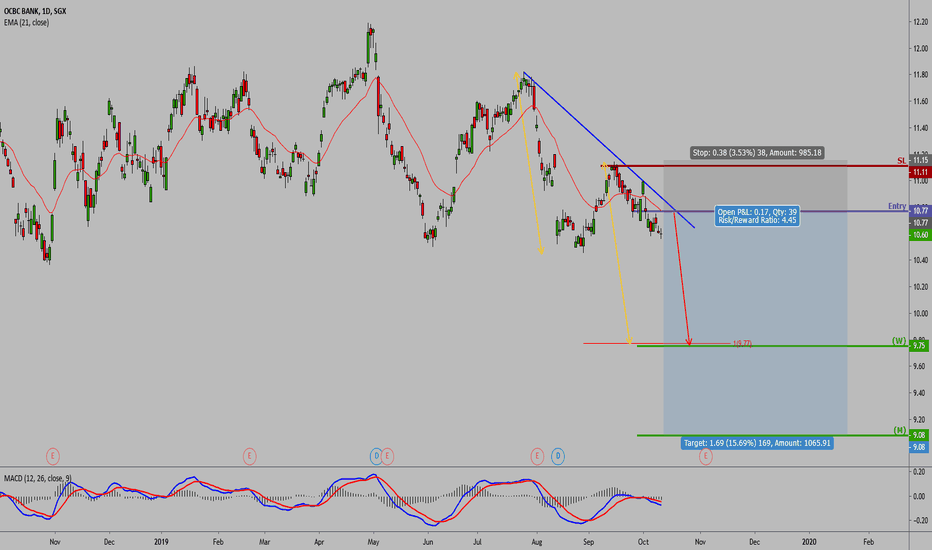

OCBC [1-3 weeks view]SHORT OCBC

Entry: 10.77

TP1: 9.75

TP2: 9.08

SL: 11.15

Market holding below natural moving average and descending trendline resistance.

MACD in bearish territory

Trade safe guys! Feel free to reach out to me if anything!

Cheers

**Trading is a high risk activity. Follow my personal calls at your own discretion. Always do your own due diligence and analysis. I do not take any responsibility for your losses**

Venture Corp [1-3 weeks view]SHORT Venture Corp

Entry: 15.42

TP1: 14.85

TP2: 12.93

SL: 16.10

Market reacting below descending trendline resistance.

Trade safe guys!

**Trading is a high risk activity. Follow my personal calls at your own discretion. Always do your own due diligence and analysis. I do not take any responsibility for your losses**

Another 3% in 20 days?I personally do not like this stock but it is close to all time low, good value.

Enter 17/09/19 at $1.08

Exit at 1.12 in 20 days?

Past trades

Singapore airlines (Live trade)

Entered: 22/08/19 8.92

Exit: 13/09/19 9.19

Spotted but never managed to buy in

City Development (did not managed to enter)

Enter: 05/09/19 $9.42

Exit: 13/09/19 $9.70

Yangzijiang Shipbuilding

Enter: 17/09/19 $1.08

Exit: When price hit $1.12

M04 Mandarin Oriental International Limited Enter at $1.54Yesterday 18/9/19

M04 Mandarin Oriental International Limited signal was triggered.

Enter at $1.54 and exit at $1.59

I have yet to enter into this trade but this looks a promising trade. Great hotel chain which now operates 32 hotels and six residences in 23 countries and territories.

The Group’s global reputation continues to be reflected in numerous awards from respected associations – Group restaurant outlets across the portfolio currently hold 23 Michelin stars, more than any other hotel brand in the world.

I am abit unfamiliar with this name, might need more research before deciding to enter!

Spotted 4 stocks on 17/09/19 did not entered any of them. OUE actually took profit today at $1.53.

Spotted but never managed to buy in

City Development (Done TP 9 days)

Enter: 05/09/19 $9.42

Exit: 13/09/19 $9.70

Yangzijiang Shipbuilding

Enter: 17/09/19 $1.08

Exit: When price hit $1.12

OUE (Done TP 2 days)

Enter: 17/09/19 $1.48

Exit: When price hit $1.53

Sembcorp Marine

Enter: 17/09/19 $1.3

Exit: When price hit $1.34

Singtel

Enter: 17/09/19 $3.21

Exit: When price hit $3.31

Multiple stocks was flagged out today... OUE Never entered this trade as the money from the SIA trade still not back in account.

If price stay at $1.48 when money is in account, will have a go at it. Will be choosing between, Yangzijiang, OUE, Sembcorp Marine, Singtel, UOB Kayhian.

Past trades

Singapore airlines (Live trade)

Entered: 22/08/19 8.92

Exit: 13/09/19 9.19

Spotted but never managed to buy in

City Development (did not managed to enter)

Enter: 05/09/19 $9.42

Exit: 13/09/19 $9.70

Yangzijiang Shipbuilding

Enter: 17/09/19 $1.08

Exit: When price hit $1.12

OUE

Enter: 17/09/19 $1.48

Exit: When price hit $1.53

3rd stock flagged out for investment opportunity Sembcorp MarineMany stocks were flagged out for investing opportunities today but the money is still not in from the SIA trade.

Past trades

Singapore airlines (Live trade)

Entered: 22/08/19 8.92

Exit: 13/09/19 9.19

Spotted but never managed to buy in

City Development (did not managed to enter)

Enter: 05/09/19 $9.42

Exit: 13/09/19 $9.70

Yangzijiang Shipbuilding

Enter: 17/09/19 $1.08

Exit: When price hit $1.12

OUE

Enter: 17/09/19 $1.48

Exit: When price hit $1.53

Sembcorp Marine

Enter: 17/09/19 $1.3

Exit: When price hit $1.34

The best stock among the rest that was flagged out todayThis is the best stock flagged out today. Hopefully price will still be there when our money comes back!

Singtel

Enter: 17/09/19 $3.21

Exit: When price hit $3.31

Past trades

Singapore airlines (Live trade)

Entered: 22/08/19 8.92

Exit: 13/09/19 9.19

Spotted but never managed to buy in

City Development (did not managed to enter)

Enter: 05/09/19 $9.42

Exit: 13/09/19 $9.70

Yangzijiang Shipbuilding

Enter: 17/09/19 $1.08

Exit: When price hit $1.12

OUE

Enter: 17/09/19 $1.48

Exit: When price hit $1.53

Sembcorp Marine

Enter: 17/09/19 $1.3

Exit: When price hit $1.34

Singtel

Enter: 17/09/19 $3.21

Exit: When price hit $3.31