Unusual (1D1 - SGX) [1-3 weeks view]Long 1D1 with low conviction

Entry: $0.285

SL: $0.270

Market is forming a possible double bottom reversal pattern.

Only when price surpasses $0.330 will this reversal pattern be confirmed.

$0.330 is also a strong resistance level found twice via:

- Descending trendline resistance

- Double bottom neckline

Should market break above $0.330, we can expect to see price rise towards $0.395 which is both 0.618 retracement level and a probable wave 4 target.

TEE Intl (watch that region)View On TEE Intl (2 May 2019)

We are still in strong downtrend but pay attention to 0.115 to 0.125 regions.

If the level (only if) get broken up, the BULL may attack.

P.S. It is one ultra penny stock and it is not for faint-hearted. I did warn you.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Nam Cheong (Are we seeing some movement?)View On Nam Cheong (29 Apr 2019)

There is some bullish attempt at the strongly contested region of 0.01 - 0.012 regions.

We will need to see if would the attempt succeed?

If yes, (only if it can Break out), it can cruise to 0.020.

Be careful as always. BTW, it is the penny counter. Not for the faint-hearted. I warned ya.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Swing: Bearish trend is here to stay (16/04/19)Based on the charts, SGX looks pretty bearish in the coming weeks/months ahead. 7.32 will be a tough resistance level for price to breach and we expect the bearish sentiment to continue. The heavy sell down on 12 March 2019 indicates sellers are heavily in control. 7.17/7.09 will be the next support level, should buyers failed to support the mentioned levels, we can see price revisit 6.86.

Trade Set-up:

EP: 7.32

SL: 7.60

TP: 6.86

Best Regards,

Nour Capital - Tracking Smart Money Flow

Disclaimer:

The material (whether or not it states any opinions) is for educational purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Nour Capital or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

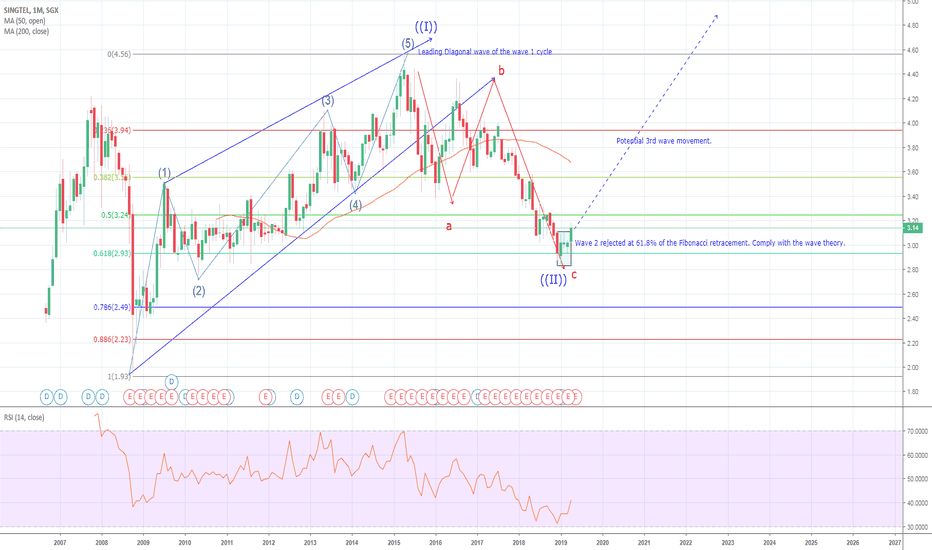

Starhub heading for a rebound. Base on the Cycle wave count of the Elliott wave, the market might be heading for an ABC correction. As such, I'm Bullish for now. But only for a short while. As you can see that the current 5 waves broke the low of the the previous bullish rally and as such, i believe that the current bearish 5 waves down are the leading waves.

Genting Singapore 618 tradeThe main reason that cause Genting Singapore gapped down when open today is due to the increase of casino tax. Good news is government allows expansion of its business.

Suggest to look for opportunity to long

around 0.96 will be a good area to long

SL : 0.84

TP : Follow arrow

Genting Sing (We may see a Bullish swing up soon)View On Genting Sing (10 Apr 2019)

Back Ground: We had a good GAP DOWn sell on Genting but I am seeing this move is a liquidity seeking mode. So it is risky to say but we may see a rebound soon. Do not buy it with the big lot but

you can tip top to see it it works.

Target(s): UP 1 (TP1), 1.1 (TP2), 1.125 (TP3)

SHTF: $0.80 is the last support.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Clearbridge heading for correction to stage a bull rallyClearbridge manage to breaks the previous high point towards the end of last week and although it had a correction at the start of this week, the market quickly rebound and attempt to reach for the high point last week. However, the market met some resistance and hence it might retreat to the zones highlighted. Remember to look out for any reversal pattern in these level and zones.

Swing: Long ComfortDelgro as it approaches Demand Zone Reasons:

1. Prior consolidation before strong up move, shows hidden buying activities at this region – buyers will be likely to defend their positions at this level

2. Prior support turned resistance level

3. Broke out of major downtrend line, will only be keen to take long positions

Our Trade Setup will be:

EP: 2.42

SL: 2.35

TP: TBD

Best Regards,

Nour Capital - Tracking Smart Money Flow

Disclaimer:

The material (whether or not it states any opinions) is for educational purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Nour Capital or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Best World (DOWN DOWN DOWN)View On Best World (5 Mar 2019)

The recent selldown has already spooked out the investors.

Now, most of the investors must be in SOS mode with Hope and Hold.

We are seeing the counter shall go a lot lower from now on.

-------------

Our Analysis

-------------

Short (entry is valid as long as the price is 'below' $3.3)

SL $3.7

TP1 $2.1

TP2 $1.9

TP3 $1.6

Do not trade with contra!

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

SingPost - Bullish Inverted Head & Shoulders formedSingpost formed a bullish head and shoulders and also gapped up on a strong volume today. A strong gap at the low end of the chart is usually a sign that the trend has turned up. While it is possible that Singpost could pull back to fill the gap at 1.01 in the near future, the odds have greatly increased for higher prices in the coming weeks.

I am bullish with a stop at 0.99 (a couple of ticks beow the gap) and will trail my profit and scale out between 1.14 to 1.20.

Hope for the best!

<TradeVSA> OUE (SGX) continue on the mark-up stageStrength in the chart:

1. Confirmation on the accumulation

2. Gap up and formed support

3. Continuation on Mark-Up stage

Send us your preference stock to review based on TradeVSA chart by comment at below.

Disclaimer

This information only serves as reference information and does not constitute a buy or sell call. Conduct your own research and assessment before deciding to buy or sell any stock

Swing: $26 easily achievable with potential for further upsideAfter a period of consolidation at $24.30 level, DBS has moved further in line with the bullish sentiment. Price has closed above both the 50D and 200D MA which spells potential further up-move ahead. It is currently sitting at prior support turned resistance zone. Should price stay above $25.19, we can see the next target at $26.06 before the next level of resistance at $29. A break below $24.30 will invalidate our analysis.

Best Regards,

Nour Capital - Tracking Smart Money Flow

Disclaimer:

The material (whether or not it states any opinions) is for educational purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Nour Capital or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Swing: Bearish view on Genting Singapore Ltd (G13.SI) (04/03/19)Genting Singapore Limited (G13.SI) seems to be unable to break the resistance level at $1.07. Overall trend is leaning towards the bears with a potential trend line resistance at $1.12. Both the EMA 50 and 200 is also acting as resistance which slows a few key confluence levels. A break above $1.19 will invalidate our trade idea.

We are looking for a short set-up as follows:

EP: $1.07

SL: $1.19

TP: $0.94

Best Regards,

Nour Capital - Tracking Smart Money Flow

Disclaimer:

The material (whether or not it states any opinions) is for educational purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Nour Capital or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Hong Fok (A pull back is overdue)View On Hong Fok (25 Mar 2019)

We had a BIG UP recently and I expect we had a lot of retail traders are on board.

And it might be in for a pull back.

It should go to 0.9 to 0.92 range "easily" first.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

SGX - bullish divergent on weekly chartThere is a bullish divergence on the weekly chart (price made a higher low while stochastic made a lower low). This increased the odds of a rebound soon. I will look to trail my stops along fib levels from 50% to 61%, ie a small target about 5% over the next few weeks. I will place my initial stop loss a few cts below the recent low of 7.22

Swing: Bullish view on Golden Agri (E5H) (01/04/19)Golden Agri-Resources Ltd (E5H) exhibits healthy volume during the up-move from the recent low at 0.225. As long as the zone is holding, price will look to retest the next resistance level at 0.31/0.345. A break below 0.26 will see price go back to the previous support zone at 0.245.

Trade Set-up:

EP: 0.280

TP: 0.345

SL: 0.255

Best Regards,

Nour Capital - Tracking Smart Money Flow

Disclaimer:

The material (whether or not it states any opinions) is for educational purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Nour Capital or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Best World (This time it is going to get bloody)View On Best World (25 Mar 2019)

We had made a decent killing from this counter in last Feb and we are seeing there will be another round of selling is to come in.

-------------

Our Analysis

-------------

Short (entry is valid as long as the price is 'below' $2.9)

SL $3.7

TP1 $2.34

TP2 $2.27

TP3 $2

Do not trade with contra!

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.