Our opinion on the current state of PURPLE(PPE)Purple Group (PPE) is a trading platform and asset management company that is aimed mainly at the private investor and offers the cheapest costs of dealing in shares on the JSE.

The company has three divisions: (1) Easy Equities which enables investors to buy very small quantities of shares with very low dealing costs. For example, buying R100 worth of a share costs the investors just 64c. 95% of accounts opened are first-time investors and the company has 150 000 active investors. (2) Emperor Asset Management which manages funds on behalf of clients and (3) GT247, a derivatives trading platform.

On 18th May 2023 the company announced the finalisation of its rights issue to raise R105m and already had the support of more than 27% of its shareholders. Shareholders will be offered 10,20567 new shares for every 100 shares that they already hold at a price of 81c per share. The offer is at a 31,87% discount to the volume-weighted average price (VWAP) of the 7 days ending 16th May 2023.

In its results for the six months to 28th February 2025 the company reported revenue up 25,8% and headline earnings per share (HEPS) up 204,1%. The company's net asset value (NAV) increased by 9% to 45,35c per share. The company said, "Client deposits are rising, though not yet back at peak levels – signalling that further upside remains as clarity returns to global markets."

The share is well traded with an average with over R1m worth of shares changing hands daily on average. The share has made a "double top" formation at around 340c in the first half of 2022 and then fell until the beginning of March 2024. Since then it has been rallying.

We advised applying a 65-day exponentially smoothed moving average and waiting for an upward break – which occurred on 4th March 2024 at a price of 66c. It has since risen to 105c.

We believe it still has significant upside potential.

Our opinion on the current state of TREMATON(TMT)Trematon (TMT) is an investment holding company with subsidiaries, joint ventures and associate companies, mostly in the Western Cape. The company also invests in listed and unlisted shares.

Originally most investments were related to property, but its investments have moved outside that. The company owns Club Mykonos.

In a trading statement for the six months to 28th February 2025 the company estimated that HEPS would fall by between 17% and 25%. The company said, "INAV per share for the current period to be between 335 cents and 345 cents, which is between 18% and 15% lower than the previous interim period's 408 cents."

The share has only about R80 000 worth of shares changing hands each day – so it is marginal for private investors.

While this share is in a downward trend, we believe that it could become a worthwhile investment if it expands its growth in the education business and improves the volume traded, now that the pandemic is behind us.

Our opinion on the current state of PURPLE(PPE)Purple Group (PPE) is a trading platform and asset management company that is aimed mainly at the private investor and offers the cheapest costs of dealing in shares on the JSE.

The company has three divisions: (1) Easy Equities which enables investors to buy very small quantities of shares with very low dealing costs. For example, buying R100 worth of a share costs the investors just 64c. 95% of accounts opened are first-time investors and the company has 150 000 active investors. (2) Emperor Asset Management which manages funds on behalf of clients and (3) GT247, a derivatives trading platform.

On 18th May 2023 the company announced the finalisation of its rights issue to raise R105m and already had the support of more than 27% of its shareholders. Shareholders will be offered 10,20567 new shares for every 100 shares that they already hold at a price of 81c per share. The offer is at a 31,87% discount to the volume-weighted average price (VWAP) of the 7 days ending 16th May 2023.

In its results for the year to 31st August 2024 the company reported revenue up 45,1% and headline earnings per share (HEPS) of 1,77c compared with a loss of 2,05c in the previous year. The company said, "Year on year value added from August 2023 to August 2024: - Client assets increased by 24.8% to R58.2 billion (5 year CAGR: 45.4%) - Active retail clients increased by 10.4% to 991,320 (5 year CAGR: 66.4%) - Easy Group Revenue increased by 51.5% to 360.2 million (5 year CAGR: 54.6%)."

In a trading statement for the six months to 28th February 2025 the company estimated that HEPS will be between 2,29c and 2,44c compared with 0,78c in the previous period.

The share is well traded with an average with over R1m worth of shares changing hands daily on average. The share has made a "double top" formation at around 340c in the first half of 2022 and then fell until the beginning of March 2024. Since then it has been rallying.

We advised applying a 65-day exponentially smoothed moving average and waiting for an upward break – which occurred on 4th March 2024 at a price of 66c. It has since risen to 102c.

We believe it still has significant upside potential.

Our opinion on the current state of ORIONMIN(ORN)Orion Minerals (ORN) is an Australian exploration company which is listed on the JSE (September 2017) and on the Australian Stock Exchange in Sydney. It is trying to find funding for its copper and zinc mine in Prieska.

The Prieska mine was previously operated by Anglovaal, but stopped operating in 1990 after 20 years during which it extracted more than 1 million tons of zinc and 430 000 tons of copper concentrate. The main problem with the mine is flooding. Orion hopes to exploit this resource with a mechanised approach and minimum labour.

Vedanta Resources, which runs the Gamsberg mine next to Orion's resource, is looking at building a smelter that could service all the mines in the area and even resources from Namibia. Once construction begins on the Prieska mine, they will need to pump out nearly 9 million cubic meters of water from the existing structure. Production is expected to begin in 2024.

Mining exploration is probably one of the riskiest investments on the JSE. At 30th September 2023 the company had $15,74m in cash.

On 17th April 2024 the company asked for a halt on the trading in its shares because of a "...material announcement on exploration results at Okiep copper mine." On 22nd April 2024 the company announced a "Spectacular High-Grade Copper Intercept at Okiep Copper Project, Flat Mines Area 49m at 4.89% Cu including 10.23m at 12.47% Cu." This caused the share price to jump from 19c to 24c.

Investors should be very careful of this loss-making penny stock and maintain a strict stop-loss level.

On 25th June 2024 the company requested an immediate stop to trading in its shares pending an announcement.

On 28th August 2024 the company announced that it had been granted a key water use licence for the Okiep copper mine.

In its results for the six months to 31st December 2024 the company reported a headline loss per share of 0,01c compared with 0,07c in the previous period (AUD). The company said, "The operating loss for the previous corresponding period reflected an unrealised foreign exchange loss of AUD0.51 million and exploration expenditure of AUD6.73 million."

In our view, this is a volatile penny stock engaged in a particularly risky venture.

On 3rd April 2025 the company announced that Errol Smart would step down as CEO and be replaced by Anthony Lennox with immediate effect.

Our opinion on the current state of SAIL(SGP)Previously Chrometco. Chrometco (CMO) is a company involved in the exploration and mining of chrome. Chrometco is obviously dependent on the international price of chrome and has all the risks associated with a mining company and a commodity share.

In its results for the six months to 31st August 2021 the company reported revenue down 43,6% and a headline loss per share of 2,02c compared with a loss of 2,95c in the previous period. The company said, "...the Group has been under severe financial pressure due to the prevailing chrome market as well as the ongoing impact of Covid-19 on operations. This resulted in Sail Contracting being placed in provisional liquidation on 5 July 2021 and the flagship operation, Black Chrome Mine, being put into care and maintenance soon thereafter. As at 31 August 2021, the Group’s current liabilities exceed its current assets by R922.3 million (28 February 2021: R540.3 million). There is however still a material uncertainty if the Group will be able to meet its obligations."

In addition, this share has very thin volumes traded which makes it relatively risky for the private investor. Essentially, it is a penny stock in a risky commodity which could easily fall into bankruptcy if the chrome price falls.

On 14th June 2022 the company announced that it had placed its Black Chrome Mine in business rescue.

On 1st July 2022 the JSE warned that CMO had missed the deadline to publish its financials within 4 months of its financial period end.

On 18th July 2022 Business Day reported that the JSE had suspended Chrometco shares. The shares were still suspended on 28th March 2024 pending the publication of the financial results.

In a suspension report on 28th June 2024 the company said, "In respect of the late publication of the Company's Provisional Report, the Company has been struggling in its appointment of new auditors due to three subsidiaries within the group, Black Chrome Mine Proprietary Limited ("Black Chrome Mine"), Sail Resources Proprietary Limited and Sail Minerals Proprietary Limited, being in Business Rescue."

In an update on 30th September 2024 the company said, "Trading in the Company's shares remain suspended due to the late publication of the annual financial statements for the years ended 28 February 2022, 28 February 2023 and 29 February 2024 ("Annual Results") and the subsequent interim results for the six months ended 31 August 2022 and 31 August 2023 ("Interim Reports")."

In an update on 3rd April 2025 the company said, "The Business rescue plan for the Company's subsidiary, Black Chrome Mine (Pty) Ltd ("BCM"), was approved and the Business Rescue Practitioner ("BRP") decided to proceed with a Mine Restart and Trade Out Plan ("Plan")."

Standard Bank outperforming the market and showing strong upsideHere is the update with Standard Bank.

The price broke up and out of the Brim level of the Cup and Handle.

The price is also above the 20 and 200 MA - Bullish by nature.

It then rocketed up which I said, the target was on the way to R251.68.

It's an unusual situation as the general JSE has been coming down as of late, and yet banks signal a bit of a foretelling notion that the index is soon set to fly.

Is that the case or will there be a fakeout of note.

We will have to see.

Anheuser Busch InBev preparing for MAJOR upside!Inv Head and Shoulders formed on Anheuser Busch Inbev and now we are waiting for a SOLID break to the upside above the Neckline.

We also see bullish signs with the Moving Averages.

Price> 20 and 200

So we can expect the first target at R1,384.54

But remember, Neckline needs to break first.

POSSIBILITY OF AN UPSIDE PROJECTION (CONTINUATION)FSR is very much bullish but we had sideways movement (accumulation of orders) from March 2022 to July 2024 finally we took liquidity and we had an impulse movement to the upside (Elephant stepped in the pool). The market after breaking the structure it maintained above external high showing intention of a bullish bias, Ey I would be unreasonable to think the market will just push up without a retracement making the price efficient before the bull run..... The back bone of the setup is momentum the correction down to my point of interest is something I could wish for -this is textbook- the concept "sprint & recovery" fits this to perfection. My stops will be around R56.50 stop loss represents where your setup is no longer valid

ABG...... I AM STILL MAINTAINING MY LONGSI was studying the momentum to the upside I am pretty much convinced that the elephant stepped in the pool(liquidity) and the corrective move to the downside it solidifies my long position and I have my heat wave entry instrument I would be looking to take more positions

Our opinion on the current state of ARCINVEST(AIL)African Rainbow Capital (AIL) is a BEE investment company that was formed in 2015 and listed on the JSE in September 2017. Since its formation, AIL has invested in more than forty listed and unlisted investments across a wide range of industries, including telecommunications, mining, construction, energy, property, agriculture, insurance, asset management, and banking.

ARC Investments is 44.4% effectively owned by African Rainbow Capital Proprietary Limited (ARC), which in turn is 100% owned by Ubuntu-Botha Investments Proprietary Limited (UBI). UBI effectively owns 51.2% of ARC Investments. AIL is thus owned through Ubuntu-Botha Investments by the Motsepe family through their trusts.

In the South African context, AIL has a significant advantage in finding suitable companies in which to invest because it can offer them a solid, reliable BEE shareholder. AIL has benefited from an investment by Sanlam and owns a stake in the Sanlam subsidiary, Santam. The company acquired 100% of TymeDigital, which has launched a digital bank in partnership with Pick 'n Pay. It offers digital banking, especially for those who cannot afford normal banking, via their phones, and had the distinction of being the only bank in South Africa not to charge transaction fees. It competes with other new banks in South Africa like Discovery Bank and Bank Zero.

AIL has taken a hit on its investment in EOH (which may now be improving) but has done well in most other areas. Roughly half of the AIL portfolio is in what it describes as "early lifestyle stage businesses" such as Tymebank, Rain, and Kropz. These investments are seen as disruptive in their sectors but will take time to mature. It also owns 7% of Afrimat, having reduced its stake from 18.4%.

If there is a criticism of this investment holding company, it must be its lack of focus. It appears to be invested in a very diverse range of industries without significant synergies or economies of scale. The need for most South African companies to have a stable BEE partner gives it an edge in finding and negotiating good deals, but its lack of focus may eventually become a problem.

The share trades at a fraction of its intrinsic NAV. It was 59% of its NAV after falling about 25% in the last six months to 2023. The discount makes it good value and may result in "unbundling" some of that value into the hands of shareholders in due course. The directors have said that they will consider delisting from the JSE if the discount persists because the listing cannot be used to raise further capital at current share prices.

On 21st November 2023, the company announced a rights issue to raise R742.35m. Shareholders will get 11.06579 new shares for every 100 shares they hold at a 7.32% discount to the volume-weighted average price on 10th November 2023.

In its results for the six months to 31st December 2024, the company reported net asset value (NAV) up 3.2% to 1278c per share. The company said, "Rain - strong performance of rainOne and Rain mobile offerings. TymeBank – 10.7 million customers and increased activity per customer. Tyme Global – GOtyme customer base has more than doubled to 5 million. Alexforbes – strong share price performance on the back of solid results and a positive outlook."

The company announced that it will be delisting from the JSE, and shareholders are offered 975c per share, which is a 22.8% discount to the NAV.

Technically, the share was falling since March 2023. We recommended applying a 200-day moving average and waiting for a clear upside break before investigating further. That break came on 26th April 2024 at 544c per share. The delisting offer means that anyone who acted on that suggestion made a capital gain of 79% in just under one year.

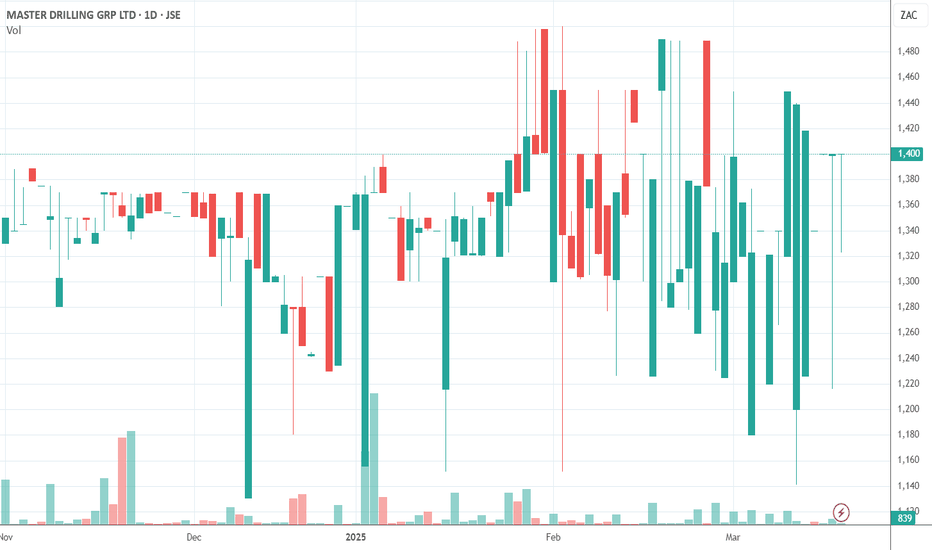

Our opinion on the current state of MASTDRILL(MDI)Master Drilling (MDI) is a South African company that specialises in drilling exploration and other holes for the mining industry. It has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the South African mining industry and now provides services in North and South America, Europe, and elsewhere.

Master Drilling has developed a new horizontal drilling technology, or tunnel boring machine, which could revolutionise the mining industry worldwide. This technology enables the drilling of horizontal tunnels or tunnels inclined up or down by 12 degrees. It is much quicker and cheaper than the traditional blast-and-clear methods currently in use. At the moment, it requires three operators, but the company is working on a completely automated, remote-controlled version.

In its results for the six months to 30th June 2024, the company reported revenue up 17.3% and headline earnings per share (HEPS) down 3.2% (in US dollars). The company's net asset value (NAV) increased 8% to 135c per share. The company said, "...operating profit decreased by 67.6% to USD6.9 million due to impairment losses recognised on reverse circulation and mobile tunnel-boring equipment."

In a trading statement for the year to 31st December 2024, the company estimated that HEPS would increase by between 16.4% and 26.4%. It is now trading at about 62% of its net asset value (NAV) and on a price:earnings (P:E) multiple of 5.25 - which looks like good value.

We regard the company's horizontal drilling technology as a potentially disruptive technology in the mining industry. It extends the life of some mines and makes others viable again. While this is a risky share due to its link to the commodities markets, it has the potential to offer strong growth because of its new technologies. These innovations could revolutionise the mining industry.

In our view, this is an interesting company with the potential to perform well as its new horizontal boring machine gains traction.

Our opinion on the current state of REMGRO(REM)Johann Rupert's Remgro (REM) is an investment holding company that owns 28.2% of Rand Merchant Bank Holdings (RMH) and 3.9% of FirstRand. However, Remgro's investments extend beyond banking. It also owns Mediclinic, an international healthcare company with operations in Switzerland, Southern Africa, and the United Arab Emirates, which has now been delisted from the JSE.

Remgro recently sold its 25.8% stake in the London-listed Unilever Group for R4.9bn in cash, along with the Unilever spreads business in Southern Africa. This acquisition gave it ownership of brands like Flora and Rama. In its food division, Remgro owns 31.8% of Distell and 77.2% of RCL Foods, where the Unilever spreads division may be housed in a new subsidiary called "Silver 2017."

Under insurance, Remgro holds 29.9% of RMI. Additionally, it owns a number of other investments, including a 23.1% stake in Grindrod and a 30% stake in Seacom. The Competition Tribunal has approved the acquisition by Community Investment Ventures Holdings (CIVH), a Remgro subsidiary, of Vumatel, a "last mile" fibre infrastructure company. As part of the approval, Vumatel must supply free uncapped fibre services to schools near its networks for the next 10 years.

On 2nd December 2020, Remgro announced plans to increase its stake in RCL Foods at a cost of R805m. The company also intends to enter the electricity generation business to supply its own businesses, citing concerns over Eskom's reliability.

In its results for the year to 30th June 2024, Remgro reported revenue of R50.4bn, up from R48.1bn, while headline earnings per share (HEPS) declined by 18.8%. The company stated, "A significant driver of the decline in headline earnings relates to the effect of the corporate actions implemented in the recent past, the majority of which are non-recurring items. Remgro's intrinsic net asset value per share increased by 1.0% from R248.47 at 30 June 2023 to R251.01 at 30 June 2024."

In a trading statement for the six months to 31st December 2024, Remgro estimated that HEPS would rise by between 33% and 43%. The company explained, "The increase in headline earnings is driven by improved operational performances from the majority of Remgro's investee companies, lower finance costs, as well as the negative impact of significant corporate actions in the comparative period."

Technically, the share made a low at 8388c on 7th September 2020 and has been in a rising trend. It is currently trading at 15048c on a P:E of 14.78. We recommended applying a 65-day exponential moving average and waiting for a clear upside break before investigating further. That break came on 12th June 2024 at 13000c. We see further upside potential in the share.

Our opinion on the current state of SUPRGRP(SPG)Super Group (SPG) is a large international logistics group offering transportation to the industrial sector. The company has a policy of not paying dividends, preferring to undertake share buy-backs and investing in organic and acquisitive growth. Its policy of diversifying outside South Africa has paid off with as much as 51% of operating profit now coming from non-South African sources. This reduces the company's exposure to the strength of the rand and to the relatively depressed economic conditions which exist in SA at the moment.

The company may have lost as much as R100m during the civil unrest. This is usually a profitable company which generates strong free cash flows. On 19th July 2023, the company announced that it had acquired 78,82% of CBW Group in the UK for GBP30,3m (R700m).

In its results for the six months to 31st December 2024, the company reported revenue down 7,6% and headline earnings per share (HEPS) down 24,2%. The company said the fall was, "...primarily due to weaker performance in the UK Dealerships and Supply Chain Africa Commodity businesses. Operating profit fell by 13.0% to R959.8 million, with the overall operating margin decreasing slightly to 4.1% from 4.3%. This was largely attributed to margin pressure in the Supply Chain Africa Commodity businesses and UK Dealerships. Fleet Africa, however, saw an improvement in operating profit margins."

At the current price of 2760c and on a P:E of 7,8, it looks reasonably valued. It has strong support at around 2500c per share and may bounce off this lower level. On 25th November 2025, the company published a cautionary announcement which caused the share price to jump. An Australian company offered A$3.50 per share for all the shares of Supergroup Fleet. This caused the share price to jump.

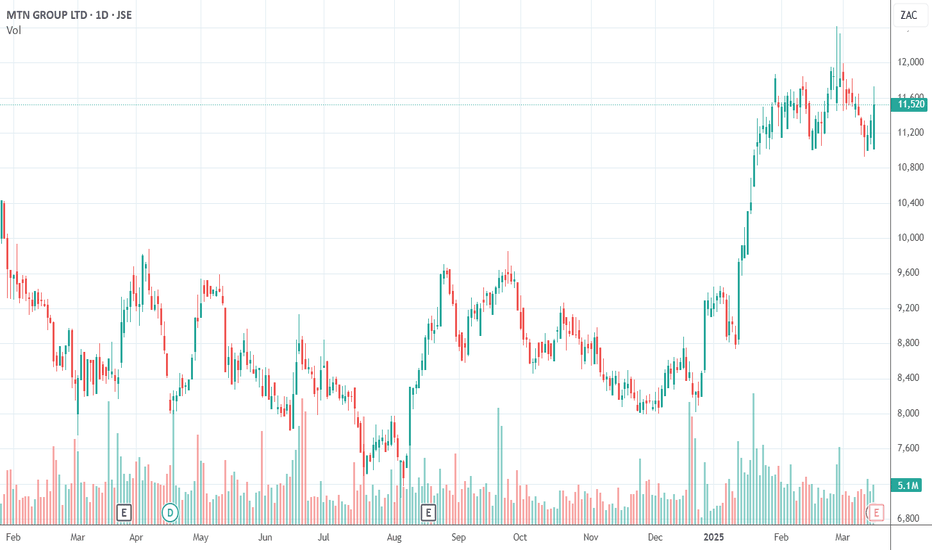

Our opinion on the current state of MTN-GROUP(MTN)MTN is a leading emerging market mobile operator, serving 290 million people (including 29 million in South Africa) in 19 countries across Africa and the Middle East. MTN's three largest subscriber bases are in Iran, Nigeria, and South Africa. Generally, companies supplying a mobile service have faced very stiff competition and declining voice revenue. The sharp increase in data usage has, to some extent, mitigated this change, but these companies remain quite risky. MTN is especially risky because of the political risk in Iran and Nigeria.

MTN is working with Sanlam to offer insurance products to its clients in the hopes that "fintech" will become a major part of its business. The goal is to turn MTN into a "...digital operator with a major focus on the fintech, digital, enterprise, and wholesale business areas." MTN has rolled out its mobile money services in both Nigeria and South Africa. It is currently offering these services in 14 out of the 21 countries where it operates, and it has 41.8 million mobile money customers. It is trying to increase that number to 60 million. MTN has now listed on the Nigerian stock exchange.

On 13th January 2023, MTN received an assessment from the Ghanaian tax authorities that it owed $773 million (about R13.3 billion). This is seen as a "shakedown" of a wealthy international company by a cash-strapped national government—similar to what happened in Nigeria. The company announced that Mastercard would take a R100 billion stake in its fintech business and partner with it to expand that business.

In its results for the six months to 31st December 2024, the company reported data revenue up 21.9% and fintech revenue up by 28.5% in constant currencies. Headline earnings per share (HEPS) fell by 68.9% and total subscribers increased by 2.2% to 290.9 million. The company said, "Active data subscribers increased by 7.7% to 157.8 million - Mobile Money (MoMo) monthly active users (MAU) increased by 0.9% to 63.1 million - Data traffic increased by 32.6% to 19 459 Petabytes (PB) - Fintech transaction volumes increased by 15.3% to 20.3 billion."

Clearly, the company is being impacted by the volatility in the Nigerian economy, which has been a large part of its business. The share was falling from its cycle high in March 2022. We recommend applying a downward trendline from that peak and waiting for a clear upside break before investigating further. That break came on 7th December 2024 at a price of 9289c, and the share has since moved up to 11519c. It was added to the Winning Shares List (WSL) on 14-1-25 at 9729c.

Our opinion on the current state of RHODES(RFG)Rhodes (RFG) is a Western Cape manufacturer of convenience foods—started by Cecil John Rhodes in 1896. It has several well-known South African brands like Bisto, Bull Brand, and Hinds. The company operates 15 manufacturing plants in South Africa and a fruit processing plant in Swaziland.

In its results for the year to 29th September 2024, the company reported revenue up 1,5% and headline earnings per share (HEPS) up 18,6%. The company's debt-to-equity ratio improved from 21,3% to 11,9%. The company said, "The regional segment delivered resilient revenue growth in an environment of sustained pressure on consumer spending. However, the rate of volume decline and price inflation have slowed considerably relative to the prior year as consumer confidence started to show signs of improvement."

In a trading update for the 5 months to 28th February 2025, the company reported revenue up 2,1%. The company said, "Regional revenue increased by 5.6%, driven by volume growth of 8.7% (prior comparative period: volume decline of 5.7%) and price deflation of 0.6% (prior comparative period: price inflation of 10.8%)."

Technically, the share fell from a high of 2900c in October 2016 in a bear trend. We suggested waiting for it to break up through its long-term downward trendline—which happened on 13th November 2023 at a share price of 1220c. It has since moved up to 1895c and is on a P:E of 8,53— which looks reasonably priced, even cheap. We believe that the share will continue to recover over time as the economy and rand improve.

Our opinion on the current state of SUNINT(SUI)Sun International (SUI) is a casino and hotel operator with interests in South Africa, Chile, Peru, and recently, Argentina. The depressed economy in South Africa impacted the performance of South African casinos and hotels even before COVID-19. The company increased its stake in Sun Dreams in Peru by 10% to 65%. It also bought a hotel and casino in Argentina for $25,5m.

The company invested R4bn in the Time Square casino near Pretoria, which was beginning to perform before COVID-19. The group also owns well-known South African casino/hotel operations like Sun City, Carnival City, and Grand West. The share has fallen from a high of R142 in February 2015 to current levels around R40. At this level, its debt was close to double its market capitalisation.

The company plans to sell its Nigerian interests and has received a number of offers. It has not paid any dividends in the past two years and only expects to resume dividends in a further two years or so. The company retrenched 2,195 staff, and its debt fell sharply.

In its results for the year to 31st December 2024, the company reported income up 5,1% and headline earnings per share (HEPS) up 17,4%. The company said, "Sunbet maintained its impressive upward trend, with income increasing by 60.6%, once again exceeding its ambitious growth targets. The rapid expansion of online gaming, fuelled by technological advancements, evolving social attitudes, and several other challenges, necessitates enhanced compliance monitoring."

Technically, the share has been in a volatile upward trend since its low point in May 2020. It should continue to recover.

Our opinion on the current state of THUNGELA(TGA)Thungela (TGA) is Anglo American's coal assets which have been unbundled into the hands of Anglo shareholders and separately listed on the JSE and the LSE because of Anglo's policy of moving away from carbon-based fossil fuels like coal. Anglo sold its last 8% of Thungela on 25th March 2022 for R1,67bn.

Thungela is a major thermal coal exporter in South Africa. It has over 7500 employees and exports coal to Asia, India, Southeast Asia, and East and North African countries. The company owns 50% of Phola, which operates a coal processing plant, and it has a 23,22% interest in the Richards Bay Coal Terminal (RBCT). The company has the capacity to produce over 90 million tons of coal per annum. It operates seven mines in South Africa, four open cast and three underground.

The share began trading on the JSE on 7th June 2021 and immediately fell to 2190c from 2600c. It was originally estimated to be worth a minimum of 4400c but reached a high of 37752c on 16th September 2022. Since then, it has been moving sideways and downwards with lower coal prices and problems with Transnet. Obviously, it is also subject to the volatility of being a single commodity share and dependent on Transnet to get its product to port. The company has committed to paying out at least 30% of "...adjusted operating free cash flow" in the form of a dividend.

In its results for the year to 31st December 2024, the company reported revenue up 16% and headline earnings per share (HEPS) down 27%. The company said, "Adjusted operating free cash flow* of R3.6 billion for the year and net cash* of R8.7 billion at 31 December 2024, after capital expenditure of R3.4 billion. Declaration of a final cash dividend of R11 per share, taking full-year dividend to R13 per share. Share buyback announced of up to R300 million."

Thungela will drift sideways until the price of coal increases—if it ever does. On 21st January 2025, the company announced that its CEO, July Ndlovu, will retire in July 2025 and be replaced by Moses Madondo on 1st August 2025.

Our opinion on the current state of OUTSURE(OUT)OUTsurance (OUT) took over the listing of Rand Merchant Insurance (RMI) with effect from 7th December 2022. RMI unbundled its stakes in Discovery (DSY) and Momentum (MTM) and sold its 30% stake in Hastings Plc for R14,6bn. By March 2023, all that was left was the insurance business of OUTsurance.

In its results for the six months to 31st December 2024, the company reported gross written premiums up 17,4% and new business up 17,9%. Embedded value rose by 6,8% to 1969c per share. The company said, "In response to the lower inflationary environment, interest rates and our investment income generation will be adversely impacted. These macroeconomic trends will, however, support a more favourable real growth outlook for the South African and Australian operations."

Technically, the share has been climbing steadily since the unbundling, and we believe it will continue to perform. We added it to the Winning Shares List (WSL) on 15th June 2024 at a price of 4457c. It has since risen to 6364c, but it is looking "toppish" now and may be in for a downward trend.

Our opinion on the current state of ASTORIA(ARA)Astoria (ARA) is an investment company that was formed to give investors exposure to an international selection of equities in developed economies.

The share trades well below its NAV and has only recently begun trading after being suspended from September 2020 to April 2021. The company benefited from the sale of "non-lethal self-defence" products during the period as a result of the civil unrest. It owns one-third of Outdoor Investment Holdings, a 35.7% stake in Trans Hex, and has sold its stake in CNA.

On 19th April 2021, the company announced that following the distribution of 51.15m shares, trading in the company's shares had resumed.

In its results for the six months to 30th June 2024, the company reported headline earnings per share (HEPS) of 79.29c compared with a loss of 18.32c in the previous period. The company's net asset value (NAV) rose from 74.76c (US) per share to 77.2c.

In an update on the 3 months to 30th September 2024, the company reported headline earnings per share of 70.62c compared with a loss of 7.3c in the previous period. The company's net asset value (NAV) was slightly higher at 1407.67c per share.

In a trading statement for the year to 31st December 2024, the company estimated that its NAV would be between 59.6c (US) and 63.58c—a decrease of between 20% and 25%.

Volume traded on the share has increased to R131,000 worth of shares per day on average, with some days without any trades. It remains in a downward trend.

Our opinion on the current state of MC-MINING(MCZ)MC Mining (previously "Coal of Africa") (MCZ) is a small metallurgical coal-mining company with a single producing mine, Uitkomst.

Aside from Uitkomst, the company is developing the Makhado project, the Vele colliery, and MbeuYashu. The Makhado project is the company's flagship operation in the Limpopo province. It is an opencast mine with a life of 16 years and the potential to be extended. In January 2019, the company announced the acquisition of surface rights, which will make the Makhado project viable. Production was initially expected to commence at the end of 2020, and the mine was projected to produce 800,000 tons of hard coking coal and 1 million tons of export thermal coal. The Makhado purchase improves the risks substantially and makes this into a viable investment.

The IDC has provided R245m for the project, but a further R530m is still needed. The company owns 69% of Baobab Mining and Exploration, which owns the Makhado project.

On 8th April 2024, Business Day reported that Goldway Capital had received acceptances from shareholders amounting to 83.67% of the issued shares—more than the 82.15% required for the takeover to proceed. On 24th June 2024, the company announced that Godfrey Gomwe would resign with effect from 30th June 2024.

In its results for the six months to 31st December 2024, the company reported an after-tax loss of $8.4m—up 40% from the previous period—with revenue down 67%. Administrative expenses rose by 55%, and finance costs increased by 19%. The headline loss per share was 1.83c compared with 1.45c in the previous period.

The company said, "Cash and cash equivalents of $3.9 million compared to cash and cash equivalents of $0.2 million at 30 June 2024. Net asset value increased slightly to $75.6 million from $75.4 million in 30 June 2024."

This remains a volatile commodity share with only about R20,000 worth of shares changing hands on average each day, high debt levels, and all the risks of mining exploration and development.

Our opinion on the current state of RENERGEN(REN)Renergen (REN) describes itself as an "...integrated alternative energy business..." which invests in renewable energy projects in Africa. The company listed on the JSE in June 2015 and has been losing money every year since. This is reflected in its falling share price.

Renergen is investing in liquified natural gas (LNG) and helium. The R125m rights issue was fully underwritten and enabled it to access a R218m loan facility. Its initial public offer (IPO) on the Australian Stock Exchange (ASX) was more than two times over-subscribed. It claims to have proven helium reserves of over 6bn cubic feet. On 18th May 2018, the US government identified helium as critical to national security, causing the price to rise by 135%.

On 7th June 2023, the company announced that it had received $750m in further funding from Standard Bank and the International Development Finance Corporation for its Virginia Gas project.

In its results for the six months to 31st August 2024, the company reported revenue of R25,6m, up from R23,8m, and a headline loss of 45,73c compared to a loss of 29,87c in the previous period. The company said the loss was "...broadly as a result of the reduction in gross profit contribution, higher operating costs1 (employee costs, depreciation and amortization, professional fees, insurance cost and repairs and maintenance expenses), higher interest expenses1, lower deferred tax credit, which were offset by a higher other operating income mainly consisting of foreign exchange gains and lower share-based payment expenses."

The share may be a speculative opportunity, but it is making losses and is very risky and volatile. We advised at least waiting for the share price to break up through its long-term downward trendline before investigating further, which happened on 14-3-25 when the company announced its first commercial sales of helium. The announcement caused the share price to jump.

We advise caution, at least in the short term.