UBS suffers a major setbackUBS suffers a major setback: regulatory pressure hits its share price and dims buyback expectations

By Ion Jauregui –ActivTrades Analyst

UBS Group AG (Ticker SWX: UBSG.CH), Switzerland’s largest bank, faces a fresh blow. The Swiss government has proposed demanding an additional $26 billion in top-tier regulatory capital following the historic takeover of Credit Suisse. The market reaction was swift, triggering a particularly volatile session yesterday: after a brief spike, UBS shares dropped more than 7%, marking their worst day in two months—just as the bank had announced plans to distribute dividends in the coming year. Despite strong earnings and a $3 billion dividend payout plan for 2025, the market is now pricing in a potential negative impact on share buybacks in 2026 and 2027. Global banks are watching closely.

A new scenario of "Swiss regulatory slap"

The so-called “Swiss regulatory slap” aims to strengthen the national financial system, raising the CET1 ratio to 17% and requiring all foreign subsidiaries to be fully capitalized. UBS has labeled the proposal “extreme and unnecessary,” though it acknowledges that implementation would not begin before 2028. Even so, the market fears that the regulatory cost may directly affect shareholder returns.

Fundamental analysis: strong results under pressure

The Swiss bank closed the first quarter of 2025 with a net profit of $1.7 billion, thanks largely to a strong performance in its wealth management division, which brought in $32 billion in new assets—pushing total assets under management past $6.2 trillion. Return on CET1 capital reached 11.3%, though the officially reported figure stands at 9.6%, a target criticized by the regulator. UBS forecasts EPS growth of more than 25% annually over the next five years.

However, pressure to boost capital threatens to slow share buybacks and dilute mid-term profitability—especially if economic conditions tighten further. This apparent strength could be constrained if UBS is forced to prioritize capital retention over shareholder distributions, as many in the market now anticipate.

Technical analysis: chart signals warning signs

Following the announcement of new requirements, UBS’s chart is showing signs of weakness. After reaching yearly highs, the stock lost momentum and broke through key support levels. Volatility has increased significantly, and although the long-term ascending channel remains intact, the coming days will be crucial in determining whether this is a technical pullback or the beginning of a bearish trend.

From a technical standpoint, this week’s drop has placed UBS at a critical juncture. Key support lies at the 20.01 CHF lows, while the 26.41–28.79 CHF range appears to offer some short-term stability. Below that, 23.40 and 21.87 CHF serve as additional buffers against further downside. A sustained close above current levels is needed to restore the bullish outlook, which currently appears to have stalled. RSI remains in neutral territory, with no clear oversold signals, while MACD has lost its bullish crossover. The previously bullish moving average crossover that began in mid-May is now fading, showing signs of trend exhaustion. On the bright side, price profile analysis reveals a potential point of control above the current range, near 29.30 CHF. If the price manages a weak upward continuation toward that area, a rebound from the current 26.49 CHF level could unfold.

Conclusion

UBS faces a delicate moment: Switzerland’s regulatory push sends a clear message about systemic prudence but also raises doubts about the bank’s short- and mid-term appeal to shareholders. Despite its strong fundamentals and global leadership, the market remains cautious. Technically, the stock is at a crossroads: a rebound from key support could reignite optimism, but a break below 25 CHF would open the door to a gloomier scenario.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

Roche Strengthens Its Bet Against the “Superbug”By Ion Jauregui – Analyst at ActivTrades

Zosurabalpin: A New Hope Against Antimicrobial Resistance

Swiss pharmaceutical giant Roche (SWX: ROG) has just taken a major step forward in the fight against bacterial resistance: its new antibiotic zosurabalpin is entering Phase 3 clinical trials. The compound targets acinetobacter baumannii, a highly resistant Gram-negative bacterium that causes serious infections such as pneumonia and sepsis, with mortality rates ranging from 40% to 60%, according to Larry Tsai, Chief Medical Officer at Genentech, Roche’s U.S. subsidiary.

The clinical trial is set to begin in late 2025 or early 2026, involving approximately 400 patients across more than 100 international sites. If successful, zosurabalpin would become the first new class of antibiotics targeting Gram-negative bacteria in over 50 years, marking a historic milestone in pharmaceutical development.

Strategic Return to the Antibiotics Arena

After stepping away from antibiotic research for several years, Roche re-entered the field in the past decade, just as the WHO warned of the growing threat of antimicrobial resistance, which could lead to up to 10 million deaths annually by 2050. This move underlines Roche’s renewed commitment to innovation in critical areas of global health.

Economic Context and Market Position

So far in 2025, Roche has delivered mixed financial results. In its first-quarter report, revenue grew 2% year-on-year, driven by its diagnostics division, while its oncology segment remains solid. However, margin pressures persist, and the biotech landscape remains fiercely competitive.

On the stock market, Roche shares have remained relatively stable around 250 Swiss francs, with investors showing caution toward the company’s pace of innovation in the post-pandemic era. The move to Phase 3 for zosurabalpin may shift that perception and position Roche as a pioneer in a long-overlooked segment of the pharmaceutical industry: next-generation antibiotics.

Technical Analysis

The stock has been trading within a range between 249.6 and 303.2 francs, peaking at 323.6 francs in late March, followed by a sharp correction that found support at 244 francs in early April. The current point of control lies slightly below the midpoint of the range at 263 francs. The RSI sits at 49.11%, indicating a relatively balanced momentum. Moving average crossovers suggest a potential price correction, as the 200-day average recently crossed below the 50-day average.

Conclusion

Roche’s latest advance could not only save thousands of lives but also restore the company’s leadership in the fight against infectious diseases. If all goes according to plan, zosurabalpin could be available before 2030, ushering in a new era in modern medicine.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

Nestlé Returns to Its Roots to Regain Lost GroundBy Ion Jauregui – Analyst at ActivTrades

Nestlé (SWX: NESN), one of the world’s food industry giants, has announced a major strategic shift: a renewed focus on what it does best. The company’s new CEO, Laurent Freixe, has made it clear that the era of forced diversification—particularly into areas like nutritional supplements—is over.

Since taking the helm in September, Freixe has been steering the company back to its traditional food and beverage business, acknowledging that moving away from this core was a mistake that undermined strategic clarity and market share, especially in the U.S. In his own words, mergers and acquisitions are no longer part of the plan: “they are not a strategy in themselves.”

This reorientation comes at a crucial time, as Nestlé seeks to regain momentum and reinforce its position in a challenging U.S. market, shaped by tariff pressures and increasingly specialized competitors. Still, early signs point to a gradual recovery, without the need to reinvent itself as a health or supplement company.

Recent Financial Results

In 2024, Nestlé posted sales of 91.354 billion Swiss francs, representing a 1.8% decline from the previous year. However, organic growth came in at 2.2%, driven by a 1.5% price increase and real internal growth (RIG) of 0.8%. Net profit stood at 10.884 billion Swiss francs, down 2.9% from 2023.

Regionally, sales in North America declined by 2.5% to 25.336 billion Swiss francs, while European sales dropped 1% to 18.910 billion. Sales in Asia and Oceania fell 4.1% to 16.793 billion, and Latin America saw a 2.2% contraction to 11.933 billion Swiss francs.

For the first half of 2025, Nestlé reported revenues of 45.045 billion Swiss francs, a 2.7% year-on-year decrease. Comparable sales grew by 2.1%, driven by a 2.0% price hike and 0.1% volume growth. Net profit reached 5.644 billion Swiss francs, slightly below market expectations.

Technical Analysis

Nestlé’s stock has been correcting since its May 2023 highs, reaching a low in January 2025 before rebounding toward a mid-range level between 78.50 and 98.28 Swiss francs per share. The current price of 88.64 is close to the average zone and the point of control at 86.75 francs. The RSI indicates mild overbought conditions at 60.35%, along with a long-term moving average crossover formed in late March that appears to signal a bullish extension continuing to reflect in the price action. A move up to the 0.5 Fibonacci level (89.60 francs) is plausible, and a further advance toward the next resistance at 94.15 francs (0.618 fibo) cannot be ruled out.

Why Does It Matter?

Because Nestlé serves as a bellwether for the global food sector. Its recent loss of strategic focus shows that even established brands can stumble when they stray too far from their core. This return to fundamentals could not only improve margins and operational efficiency, but also inspire other corporations to reevaluate their strategies. Nestlé is not innovating for the sake of it—it’s reconnecting with its essence: delivering quality products for everyday life.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

Inverse Cocoa?Keeping a close eye on this one. Whilst everyone tries to catch the bottom on an ever falling Nasdaq and tech stocks, the market has had far better trades to offer. I traded JDEP as my inverse Coffee play, now I bring to your attention one of the world's leading confectionery companies being affected by cocoa prices. This name is beared the brunt of a cocoa bull run, but as supply and demand equilibrium is at a better balance, this stock could outperform to the upside.

Keep an eye on cocoa, if price plummets I expect Barry Callebaut to outperform. There's no rush to buy this, we are sitting at historic level of support. I'd like to see some consolidation here before jumping into a trade.

Not financial advice.

UBS EXTREMELY OVERSOLD! BUY BUY BUY+ This is a unique opportunity to buy one of the largest asset managers in the world at a very low price. With AI, they can reduce headcount in the coming years, while shilling their products to naive customers who still have high trust in this institution.

+ The stock is clearly oversold due to Retail Investors running for the exit

+ Volume is very low, this is not even a real capitulation

Swatch (UHR.SW) Total Collapse – Heading to Zero?💀 "Swatch Freefall: A Stock on the Road to Oblivion?"

🚨 "Swatch: Management Watches as the Ship Sinks"

Swatch Group's recent performance has been nothing short of catastrophic, painting a grim picture of a company in freefall. In 2024, the company reported a staggering 70% drop in operating profit and a 14% decline in sales, with net income plummeting to 219 million Swiss francs from 890 million francs the previous year. This abysmal performance is largely attributed to a sharp downturn in China, a market that once accounted for a significant portion of Swatch's revenue.

The situation deteriorated further when UBS downgraded Swatch's stock to a 'Sell' rating, citing concerns over a prolonged downcycle and structural challenges to profitability. This downgrade was a direct result of Swatch's overexposure to underperforming markets, particularly in China and the United States.

In a desperate attempt to stay relevant, Swatch has resorted to gimmicky collaborations, such as the MoonSwatch series with Omega. While these releases, like the MoonSwatch 1965 and the Mission to Earthphase, have garnered media attention, they reek of a brand grasping at straws rather than innovating meaningfully.

The management's response to this crisis has been woefully inadequate. CEO Nick Hayek's decision to maintain production capacities and workforce levels, despite plummeting demand, demonstrates a blatant disregard for financial prudence.

This stubbornness not only exacerbates the company's financial woes but also signals to investors that Swatch is unwilling or incapable of adapting to harsh market realities.

In light of these developments, it's evident that Swatch is on a trajectory towards irrelevance and financial ruin. The company's inability to navigate market challenges, coupled with ineffective leadership and uninspired product strategies, suggests that its stock is well on its way to becoming worthless. Investors would be wise to divest before Swatch's value erodes entirely.

Swatch ? you are a POS !!!

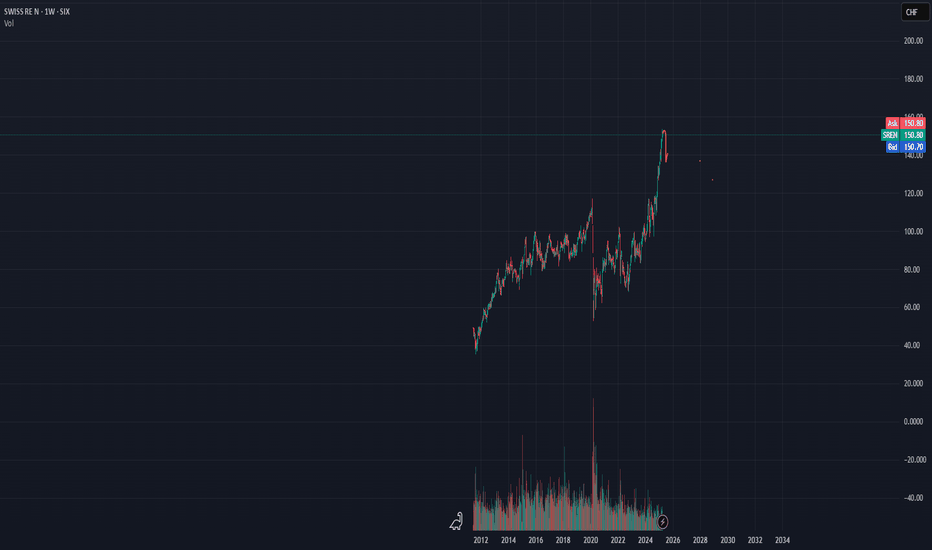

Swiss RE Crash ahead?+low volume

+MACD overbought

+RSI overbought

+increase in dividends

+Divested insurance company stake

+Thailand & Myanmar earthquake uncertainty

+Trump tariff unceartainty

+Most shares are in the hands of baby boomers, who are on the brink of retirement

+I really don't see how the next generation will buy into this stock, as most millenials, GenZ etc.

have no freaking idea what this company is doing

+ITS TIME TO PANIC

Flight to Safety?It looks like Wave 5 could be in and we are getting the bounce of the Fibonacci Speed Fan and POC level. The Swiss Franc is also crowded short, keep an eye on this stock as it has bounced perfectly from the expected levels. One to keep an eye on, as the market looks to derisk from tech after the expected sell off.

CFR - Compagnie Financière Richemont SAAs the brand includes many watch brands, I think the index it has affects the prices of the watch market in general.

In my opinion, the love of watches has turned into populism, and market prices are a bit inflated.

It is possible to see a decrease in prices (in the market prices of watches) in the future.

Kennedy and Nestlé: The Beginning of a New Era for the Industry?Nestlé (Ticker AT: NESN.US) is looking to calm market fears following criticism from Robert F. Kennedy Jr. appointed by Donald Trump as the new U.S. health chief. Kennedy, known for his stance against packaged foods, has used his platform to question products such as Kellogg's (Ticker AT: K.US) Fruit Loops cereals as part of his “Make America Healthy Again” campaign. However, Nestlé says it shares principles with Kennedy, particularly in terms of improving agriculture and nutrition.

Steve Presley, president of Nestlé in North America, clarified that Kennedy's concern is more about regenerative and clean agriculture, an approach that Nestlé has supported for years. This stance highlights the company's commitment to innovation in health, an effort that began in 2019 when it started ranking its products by nutritional value.

Technical & Fundamental Aspect

Looking at the monthly chart it is palpable the steady fall in value over the last 2 years from 129 francs to 76.64 francs where it is currently trading. It is important to note that like all companies listed on the Swiss index, it has suffered from the strength of the franc in its conversion of foreign earnings. Looking at quarterly results its data has been relatively stable except for the post-pandemic earnings period in 2021 which was arguably one of the best for companies in the food and beverage sector. Subsequently the net has remained relatively stable despite criticism and economic sanctions.

Looking at the chart you can see a bearish channel started in 2022 to date. At the moment it is located at the bottom of this channel. A bearish oversold signal was marked on November 13. Currently the POC is around 83-84 francs. It is currently at the bottom of the channel touching the low of 76.04 francs. Looking at the average crossover it has been advancing since February 1 with the 200 average below the 100 average and the 50 average below the 100 average. In other words, the extension of this volatility from the end of October has extended the stock's downward slide very sharply.

Why is it relevant?

Nestlé's focus on health innovation and sustainable agriculture aligns with Kennedy's concerns, which could soften the relationship between the two parties, despite previous criticism of processed products.

A shift towards sustainability

Nestlé has been the subject of much criticism in the past, especially for its involvement in controversial practices, such as the marketing of milk powder in developing countries, the exploitation of natural resources and the use of unhealthy products in its offerings. However, its current focus on sustainability and health innovation reflects a clear strategy of adaptation to social and market demands. Consumers are increasingly aware of the environmental and nutritional impacts of the products they consume, and Nestlé appears to be responding to this trend.

By aligning itself with Kennedy, who promotes public health and regenerative agriculture, Nestlé may be trying to improve its image and demonstrate its commitment to more responsible practices. This strategic move seeks to mitigate past criticism and position the company as a more positive player in the food industry.

However, the real test will be in how the company implements its commitments and whether its actions actually match the ideals it is promoting. Nestlé's challenge remains to maintain this narrative over the long term, as its history is marked by controversy.

Ion Jauregui - ActivTrades Analyst

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

Long-term bottom in place; BUCKLE UP! WE ARE GOING TO THE MOONIn my wave count, we are in the midst of an impulsive move upwards.

We should see the end of this impulsive move at around $300.

To enter, I would wait for the (b) to occur. The target zone for the end of (b) is $118 to $120.

There will be many possibilities to enter after this, though.

Nestlé SA: A stock to keep foreverCompany Overview

Nestlé S.A., established in 1866 and headquartered in Vevey, Switzerland, is the world’s largest food and beverage conglomerate. Known for its extensive portfolio of iconic brands like Nescafé, KitKat, Maggi, and Perrier, Nestlé has maintained a strong presence in North America and Europe, which together account for 59% of its revenue. In addition, it is a global leader in pet food products through brands like Purina, a sector which has shown resilience and growth. While Nestlé’s stock has faced challenges recently, it continues to be a staple in long-term portfolios.

Recent Stock Performance

Nestlé's share price has declined by over 35% since its peak in 2021-2022. This underperformance relative to the market has presented a potential entry point for long-term investors. This decline in share price is attributed to external factors such as increased competition from new weight-loss products, currency exchange fluctuations, and rising global interest rates. Despite these challenges, the company’s enduring market position, particularly in emerging markets, underscores its resilience and potential for long-term growth.

Business Segments and Revenue Breakdown

1. Beverages: Revenue of $25 billion, featuring globally recognized brands like Nescafé and Nespresso.

2. Pet Care: Nestlé leads the pet food industry with brands like Purina, generating approximately $17 billion annually. The pet sector is growing as consumers increasingly seek premium products.

3. Nutrition and Health: Generating $15.3 billion, this segment includes specialized nutrition products for infants and adults.

4. Prepared Meals and Cooking Aids: With approximately $12 billion in revenue, this segment includes Maggi and other ready-to-eat meal products.

5. Dairy Products and Ice Cream: A significant segment with $11 billion in revenue, including well-known dairy brands.

6. Confectionery: With brands like KitKat, this segment contributes over $9 billion.

Investment Thesis

Nestlé stands out as a “forever stock” for several reasons:

1. Dividend Aristocrat: Nestlé has increased its dividend for 29 consecutive years, offering a current yield of approximately 3.8%. Since 2009, the company has returned CHF 181 billion to shareholders through dividends and share buybacks, a healthy mix that demonstrates Nestlé’s commitment to rewarding shareholders.

2. Global Presence and Market Share: Approximately 41% of Nestlé's revenue originates from emerging markets (Asia, Africa, South America), where there is strong demand for premium products, a growing middle class, and solid organic growth. In these regions, Nestlé continues to gain market share and expand its brand presence.

3. Pet Sector Growth: Premiumization in the pet care market offers a robust growth driver, particularly as pet owners show a high willingness to spend on quality food. This sector remains resilient, with consumers even prioritizing their pets’ needs over their own during economic downturns.

4. Currency Challenges and Inflation Resistance: Nestlé reports in Swiss Francs, making it susceptible to currency fluctuations. In 2023, for instance, North American revenue grew by 5.3% in local currencies but showed a slight decline when converted to Swiss Francs. This effect, while impacting short-term results, does not detract from the company’s overall growth potential. Nestlé’s long-standing pricing power and ability to adjust prices to maintain margins further solidify its resilience against inflation and currency volatility.

5. Resilient Business Model: Nestlé’s predictable cash flows and low-risk business model make it an attractive investment, particularly as interest rates rise. While the recent preference for high-growth tech stocks has contributed to Nestlé's undervaluation, the company’s defensive nature remains appealing in a volatile market.

Valuation and Pricing

Nestlé currently trades at a P/E ratio of approximately 18-19, reflecting its steady but unspectacular growth profile. This valuation, while fair, does not fully capture Nestlé’s strong brand portfolio, market position, or growth potential in emerging markets. The company’s ROIC has been trending upward, indicating that management is effectively deploying capital to generate returns above the cost of capital.

Nestlé’s organic growth is targeted at 4% for 2024, with EPS growth projected at 6-10% in the medium term. Should the stock price fall to a P/E ratio of 15, it could present a compelling buying opportunity for building a substantial position.

Risks and Considerations

1. Competition from Weight-Loss Drugs: Nestlé’s food business faces an emerging threat from weight-loss drugs like Ozempic, which could reduce demand for certain products. In response, the company is developing new health products to mitigate muscle loss, which may offer a future growth opportunity.

2. Currency Exchange Effects: The appreciation of the Swiss Franc against other major currencies negatively impacts reported revenue and earnings. While a short-term challenge, this effect does not impact the company’s fundamental business model.

3. Rising Interest Rates: Defensive stocks like Nestlé become relatively less attractive as interest rates rise. However, given the company’s stable cash flows and dividends, Nestlé remains a reliable choice for income-focused investors. Additionaly interest rates have been going down over the past months, so that is good.

Conclusion and Recommendation

Nestlé is a high-quality, defensive stock with a stable growth outlook and an attractive dividend profile. Its diversified product line, strong presence in emerging markets, and growth in the pet food sector make it a reliable, long-term investment option. For investors seeking stable returns and consistent dividends, Nestlé remains a strong addition to any portfolio, particularly as a counterbalance to higher-risk, growth-oriented stocks.

In conclusion, Nestlé I think is fairly valued at its current P/E ratio. Long-term investors can consider building a position gradually, potentially increasing their stake if the P/E ratio declines. While competitors like Coca-Cola and Unilever also offer stable income, Nestlé’s broader global reach, particularly in emerging markets, provides a competitive edge that may lead to superior returns over the next decade.

This information is for informational purposes only and does not constitute financial or investment advice. Always do your own research or consult a financial professional before making investment decisions.

Nestle Approaching Buy ZoneWe have taken out the Covid lows and we could enter the X phase of the WXY correction. In the longer term I do expect one last flush to the downside, but the downside does appears to be exhausted here as we are in the final phase of the 5 wave move to the downside. I'm playing this as a short term bounce of 15-25%.

Nestlé is known for its defensive qualities. In times of broader market volatility (elections and geopolitical issues) investors flock to high quality, consumer staples companies with strong brands and a reliable revenue stream. Nestlé's portfolio of well-established products in food, beverages, and health-related categories (such as its coffee brands, bottled water, and baby nutrition products) can appeal to investors looking for stability amid uncertainty.

Nestlé is known for its reliable and growing dividend, making it attractive to yield-seeking investors, especially in the approaching lower-interest-rate environments. A stable dividend yield can support the stock price, and as more investors focus on cash flow from dividends, increased buying pressure could lead to a short-term bounce.

Do what's best for you, do not copy what I am doing!

Nestlé (consumer goods): A stable company with a strong global pNestlé (consumer goods): A stable company with a strong global presence in consumer goods. It’s a defensive choice, less subject to economic fluctuations.

Rewards

Trading at 49.4% below estimate of its fair value

Earnings are forecast to grow 5.74% per year

Earnings grew by 15.8% over the past year

Pays a reliable dividend of 3.62%

Risk Analysis

Has a high level of debt

Kuehne + Nagel (logistics): An interesting position as logisticsKuehne + Nagel (logistics): An interesting position as logistics are essential to international trade, but performance is sensitive to global economic cycles.

Rewards

Trading at 46% below estimate of its fair value

Earnings are forecast to grow 4.74% per year

Risk Analysis

Dividend of 4.32% is not well covered by earnings or free cash flows

Swatch (watchmaking): Highly exposed to luxury and discretionarySwatch (watchmaking): Highly exposed to luxury and discretionary consumer spending, it will depend on the demand for high-end watches.

Trading at 32.4% below estimate of its fair value

Earnings are forecast to grow 16.62% per year

Dividend of 4.29% is not well covered by free cash flows

Profit margins (7.1%) are lower than last year (12.4%)

NESTLE: Is a rebound incoming?The Nestle stock is undergoing a correction phase, with the possibility of further declines into the green marked support zones. This level is marked as a strong long-term buy opportunity for investors, and price recovery is expected from this zone. Should this correction unfold as anticipated, the stock could rally to CHF107 and beyond, with potential targets at CHF115 and CHF130 in the longer term.

The CHF70-85 zone represents a key area of interest for long-term positions. This zone is supported by the 0.618 Fibonacci retracement and historical price action, making it a high-probability level where buyers are likely to step in.

This area is highlighted as the "Best Long-Term Buy Zone", offering an ideal entry point for those looking to accumulate Nestle shares for a potential rebound.

Thank you for taking the time to read my analysis.

I look forward to hearing your thoughts.

Best regards,

Mattner

No investment advice

Roche vs. Novo Nordisk: Who will suffer the Weight Loss?Roche (ticker: ROG.SW) is losing ground on the stock due to the side effects of its new weight loss pill, CT-996, which is still in the testing phase. After a rally that boosted its shares 40% between May and September, the Swiss drugmaker has seen an 11% drop in its shares in September alone, including a decline of up to 6.75% on the U.S. stock market.

The weight-loss drug market, driven by the success of Novo Nordisk's Ozempic (ticker: NVO), is projected to reach $130 billion annually by the end of the decade. However, Roche faces challenges following trials of CT-996, where five out of six patients suffered nausea and one in six had “chronic reflux,” which has affected its competitiveness. Despite these adverse results, Manu Chakravarthy, director of product development for Roche's cardiovascular, renal and metabolism division, believes the trials are still encouraging and plans to continue with larger clinical studies to determine tolerability and improve the drug's profile.

Comparing the two companies' charts, Roche showed significant progress versus Novo Nordisk through July 31. However, after a failed attempt to break above its highs on September 2, Roche is currently in a support zone, having broken downward from the bullish channel it had held since May. In contrast, Novo Nordisk lost positions from June 24 until August 7, at which point it began to recover towards the middle of its long-term range. Currently, Roche could pull back to 214 Swiss francs if its downtrend continues. On the other hand, Novo Nordisk remains in an intermediate trading zone around $134, with a possible uptrend in the short term.

Ion Jauregui - ActivTrades Analyst

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

UBS (UBSG): Too Big to Fail?Remember this analysis from over four months ago? We didn't place a limit order at that time (which is why it's greyed out), but if you followed our setup during the livestream back then, congratulations! The chart reacted beautifully at the desired level, just as we anticipated.

In my opinion, this is a great-looking chart, showing a strong reaction at a key level. I'm now looking for some long plays on UBS to gain some exposure to the Swiss market. UBS is a relatively safe stock, which is a good thing to have during phases of uncertainty.

The worst-case scenario would be a banking crash, but we believe UBS is still too big to fail. As long as it maintains this status, we like it. I'll send out a limit order once I find a good setup. For now, I wouldn't recommend any FOMO into this stock, as it could be a dead cat bounce, but we'll closely monitor it for you.