Thai SET impact from covid19 delta and omicron bad omensBBL ; price plummetted after fear started , when situation got to the worst, price already go up for days, as many can speculate the end of delta wave

at a point, price open gap up, which favor strategy of short and DCA buy back over weeks

gap up 23 aug , dropdown wks=... not quite gap down, more gradual price downtrend, downswing = 9, upswing= 11

kbank ; gap up 23 aug , dropdown wks=4, downswing = 9, upswing= 13

TMB bank (TTB) ; gap up 23 aug , dropdown wks=4, downswing = 17, upswing= 20+ up to now(jan22)

siam cement company (SCC) ; same time gap up but last only 2-3 wks then down for 14 wks, now on uptrend for 4 wks but will see extent of omicron impact

siam cement's paper&packaging company (SCGP) since ipo in 2020 it soared up and up, its theme of online shopping play important role in covid-era. So contradicting price fall

when others went up in late august & start 6 wks downtrend. jan 2022 might start another down trend, as we already had 13 uptrend candles (TD sequential 13)

but will SCGP be seen as covid-defensive stock might limit its downside

From my humble, non-expert, nooby personal opinion, Thai's bluechip stocks could be in danger of omicron impact.

Fundamentally ; afternoon of 5th Jan 2022, SET start falling, without apparent drop but retrospectively ,we guessed insider who seen omicron rising selling a chunk. 6th is public awareness of both us interest rate amped up & earning yield gap in downtrend, Thailand’s institutional side sells twice as much as foreign investor with 3x local investor buying the SET at 1660.

growth of income/profit from SET100/SET50 depends on both domestic economy & tourism alike which both of which would be crippled by this covid19's wave

Technically ' Thai's SET50 index plummetted 8 of last 8 times it hit resistance/support of 979- 999.

AWC and WTZ1 SetupBefore expecting WTZ1 trade Setup, we could take this opportunity to speculate AWC testing the upper range due to closing above POC of VP with gained volume. I made the 1st plan for trading preparation. If it can break out the upper range, we will make another plan for this stock. Good Luck

TRC | Bull Trap Beware | Anti Shark Bearish Harmonic | DowntrendTRC | Thailand SET Index | Construction Sector | Chart Pattern Trading

Chart Pattern: Anti Shark Harmonic Bearish Pattern - Bull Trap

Price Action: Short Entry @ low breakout recommendation - Target Downtrend at the Shark tail

Good Luck

DP

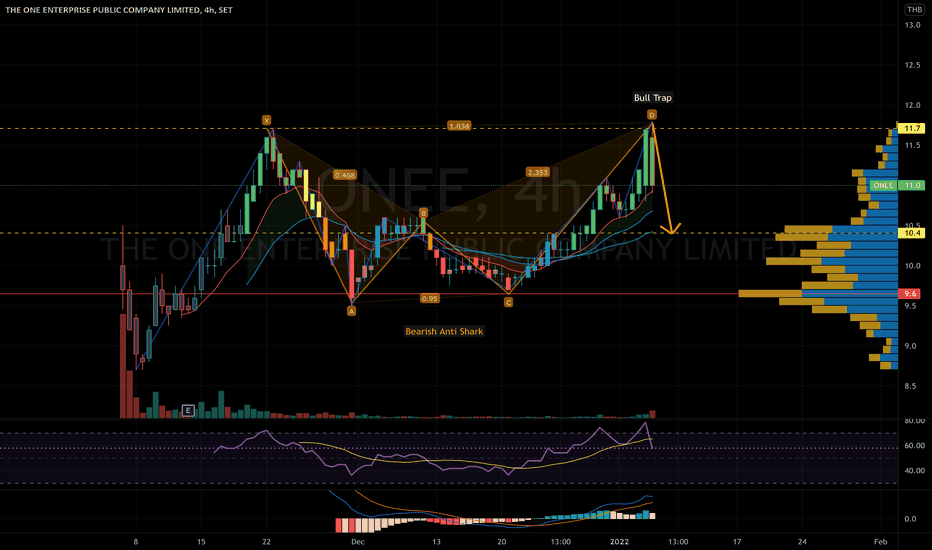

ONEE | Bearish Anti Shark Harmonic | Bull Trap | Entry@Pullback?ONEE | Thailand SET Index | Media Sector | Price Action & Chart Pattern Trading

Chart Pattern: Anti Shark Bearish Harmonic

Price Action: Short Entry @ Breakout avoid Bull Trap and could be entry @ pullback position for speculative buy

Indicator:

> RSI down dead cross MA line still on high bullish side above 50.

> MACD remains upside above baseline 0

Stop-loss @ Shark’s tail position - target at shark’s head until further new pattern changes

Trade with affordable risk ratio 3:1

Always respect your stoploss

Good Luck

DP

MDX | Bearish ABCD Harmonic Pattern | Completed 5th Elliott WaveMDX | Thailand SET Index | Energy Sector | Price Action & Chart Pattern Trading

Chart Pattern: Bearish ABCD Harmonic Pattern

Price Action: Short Entry @ Low Breakout Channel

Completed Elliott 5th Wave correction ABC phase. What do you think? let me know

WIN | Strong Momentum Rising Window Candle- Triangle Breakout WIN | Thailand MAI Index | Price Action & Chart Pattern Trading

Chart Pattern: Symmetrical Triangle Strong Momentum Breakout - possible new high Elliott 5th Wave Extension

Price Action: Entry @ New High Breakout supported with strong momentum with Rising Window Bullish Candlestick

Indicator:

> RSI: Bullish signal cross up MA line

> MACD: Golden cross way above baseline 0 - indicating strong bullish

OSP | Bull Trap | Falling Channel Harmonic Pattern | Tight StopOSP | Thailand SET Index | Food Sector | Chart Pattern Trading

Chart Pattern: Falling Channel Bearish Harmonic Pattern

Price Action: Watch out for BULLISH TRAP and FLASE REVERSAL BREAKOUT or Make ENTRY with tighter STOP-LOSS

Indicator:

> RSI & MACD Bullish Trap

Trade with affordable risk

Trust in your system indicator

Always respect STOP-LOSS

Good Luck

DP

INTUCH | Bull Trap | Bearish Butterfly Harmonic PatternINTUCH | Thailand SET Index | ICT Sector | Chart Pattern Trading

> Chart Pattern: Bearish NEN STAR and BUTTERFLY in PARALLEL CHANNEL - Bull trap

> Price Action: Beware of BULLISH TRAP | Entry Position@Breakout with tighter stop-loss

> Indicator: BULLISH TRAP

Trade with AFFORDABLE RISK

Trust in your SYSTEM

Always respect STOPLOSS

Good Luck

IP | Falling Wedge Reversal| MFI Divergence | Elliott 4th Wave?IP | Thailand SET Market | Price Action Trading | Elliott Wave Tracing

Chart Pattern: entering Falling Wedge Reversal Pattern

Price Action: Downtrend area of consolidation

Entry Position: Buy on BREAKOUT of FALLING WEDGE

Indicator:

> MFI - Money Flow Divergence - Banker accumulation phase

> RSI - Sideway up below 50

> MACD - Golden cross below baseline 0

Trust SYSTEM & INDICATOR | Never panic trade

Trade affordable RISK | Ratio 3:1

Always respect STOP-LOSS

Good Luck

WORK | Harmonic ABCD | Entry @ Pullback |Gravestone DOJIWORK | Thailand SET Index | Media Sector | Price Action Trading

Chart Pattern: Harmonic ABCD Bullish Pattern

Price Action: Entry @ Pullback from bullish breakout with Gravestone DOJI candlestick

Stop-loss Position - 3 - 5% below Volume Profile POINT OF CONTROL

Risk Ratio: 3:1 minimum

Indicator:

> RSI bullish divergent crossover

> MACD golden crossing over baseline 0

Always respect your stop-loss

Good Luck

HNY 2022

ITEL | Bullish Flag Breakout | Entry PositionITEL | Thailand SET Index | ICT Sector | Price Action Trading

Chart Pattern: Falling Wedge Reversal

Price Action: Bullish Breakout with Breakaway Candle

Indicator:

> RSI & MACD golden cross above baseline

Placing your stop-loss 5-7% below the entry, there may be some pullback

Risk ratio: 3:1 minimum

Always respect your stop-loss

Good Luck

SUN | Possible Powerful 3-Drive Harmonic Pattern |Entry@BreakoutSUN | Thailand SET Index | Food Sector | Chart Pattern Trading

Chart Pattern: Possible a powerful THREE-DRIVE HARMONIC REVERSAL

Price Action: Entry@Breakout and Retest Area of Support

Indicator: RSI Bullish Divergence

Always respect your stop-loss

Good Luck

CPF | Week Timeframe | Bullish Wedge Breakout | Entry & Target CPF | Thailand SET Index | Food Sector | Price Action Trading

Price Action | Bullish Engulfing candlestick strong momentum

Chart Pattern | Falling Wedge Bullish Breakout

Indicator:

> Banker Smart Money & Chip Volume Support

> BBD Banker divergent signal

> Fund Flow uptrend bottom signal

> KDJ STO on the uptrend channel

Place your stop-loss zone 5-7% below ENTRY

Recommended Risk Ratio minimum 3:1

Always respect your stop-loss

Good Luck

IRPC | Bullish Wedge Breakout | Target for uptrendIRPC |Thailand SET Index | Energy Sector | Price Action Trading

Price Action | Bullish Breakout

Chart Pattern | Reversal Wedge

Indicator:

> MFI - Money Flow-in support

> RSI Bullish Signal

> MACD golden cross - crossing up 0

Fundamental Factor: Oil price bullish trend

Risk Ratio: 3:1 minimum

Always respect your stop-loss

Good Luck

OR | Pennant Triangle Breakout | OR | Thailand SET Index | Energy Sector

Price Action:

> Strong BREAKAWAY CANDLESTICK

> Trend reversal BULLISH BREAKOUT

Chart Pattern:

> Inverted Head & Shoulders on daily timeframe

> Pennant Triangle BREAKOUT

Indicators:

> MFI - Money Flow-In cross above 60

> RSI - Bullish Power Move

> MACD - GOLDEN CROSS about to cross up 0

Minimum Risk Ratio: 3:1

Always respect your stop-loss,

Good Luck

BBL | Weekly TF Inverted Head&Shoulders Target BBL | Thailand SET Index | Banking Sector

Chart Pattern Trading: Inverted Head & Shoulder weekly timeframe

Price Action Trigger: BUY ON BREAKOUT Neckline 129 Baht

Risk Ratio 3:1 minimum

Stop placement 5-10% below ENTRY POSITION

Always respect your stoploss

Good Luck