A Sleeping Giant in the Energy Sector?While everyone’s chasing the next hot AI stock, a quiet opportunity might be taking shape in the energy sector; and it could be a big one.

🔋 As AI data centers explode in size and number, the demand on our power grid is rising fast. Nuclear is still years away, and renewables are struggling to scal

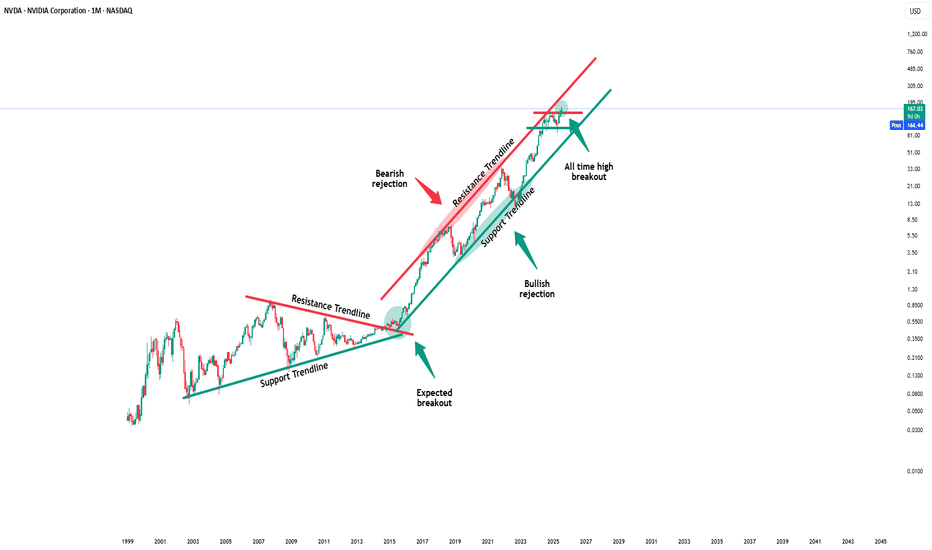

Nvidia - This is clearly not the end!📐Nvidia ( NASDAQ:NVDA ) will confirm the breakout:

🔎Analysis summary:

Over the past couple of months, Nvidia managed to rally about +100%, reaching top 1 of total market cap. Most of the time such bullish momentum just continues and new all time highs will follow. But in order for that to hap

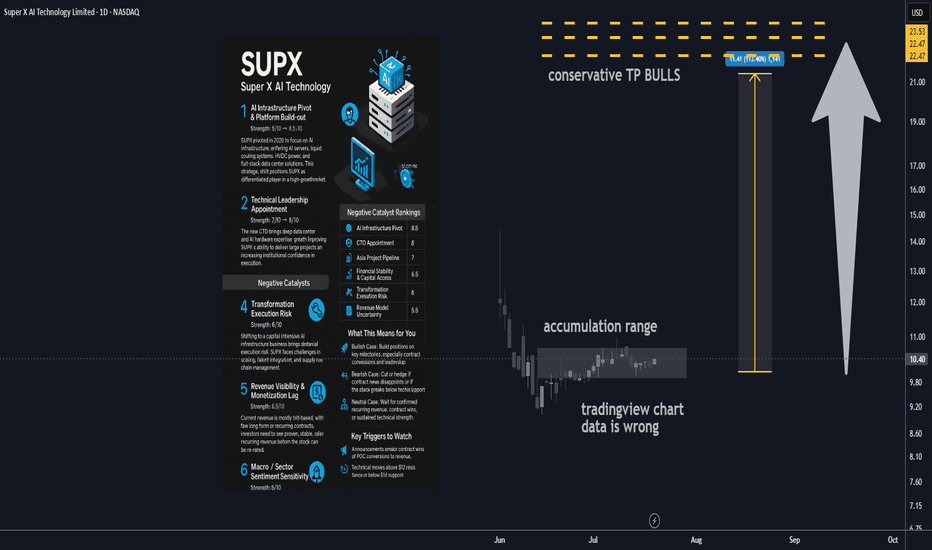

Super X AI Technology Ltd AI Infrastructure Stock 100% upside🔋 1. AI Infrastructure Pivot & Platform Build-out

Strength: 8/10 → 8.5/10

SUPX has made a major pivot in 2025, transitioning from a legacy business into next-gen AI infrastructure. The new focus includes AI servers, liquid cooling systems, HVDC power, and full-stack data center offerings targeting t

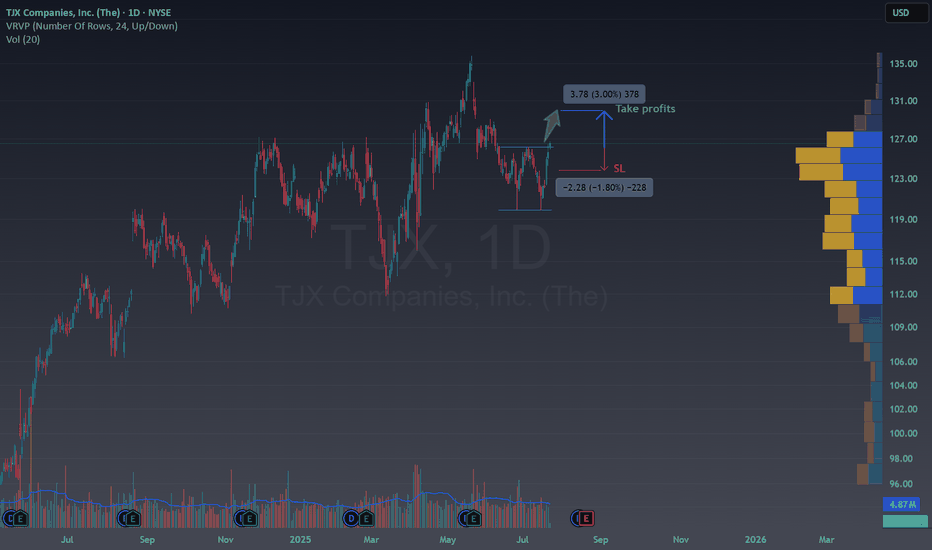

Easy double bottom in TJXTechnical Overview

NYSE:TJX is currently trading around $126.72 and is forming a double bottom.

Breaking the 126$ activates the double bottom in the middle of a bull trend , which is a bull pattern inside another bull pattern, could you imagine a better moment to buy?

Fundamental Arguments

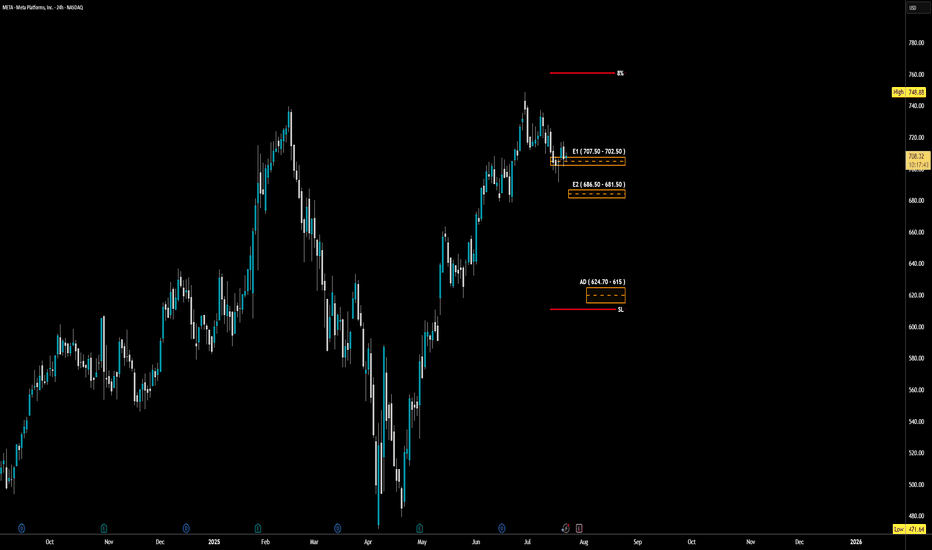

META - LONG Swing Entry PlanNASDAQ:META - LONG Swing Entry Plan

Entry Zone 1: $707.50 – $702.50

→ Open initial position targeting +8% from entry level.

Entry Zone 2: $686.50 – $681.50

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

Edi

NIO Setting Up for a Big Move!🚨 NIO ALERT 🚨

Looks like a buy & fly setup is loading! 📈💥

📊 Technicals aligning beautifully with macro cycle support.

🔥 Volume picking up. The structure looks explosive.

📍 A clean breakout could send this EV beast soaring!

I'm watching closely for confirmation...

This could get FAST. ⚡

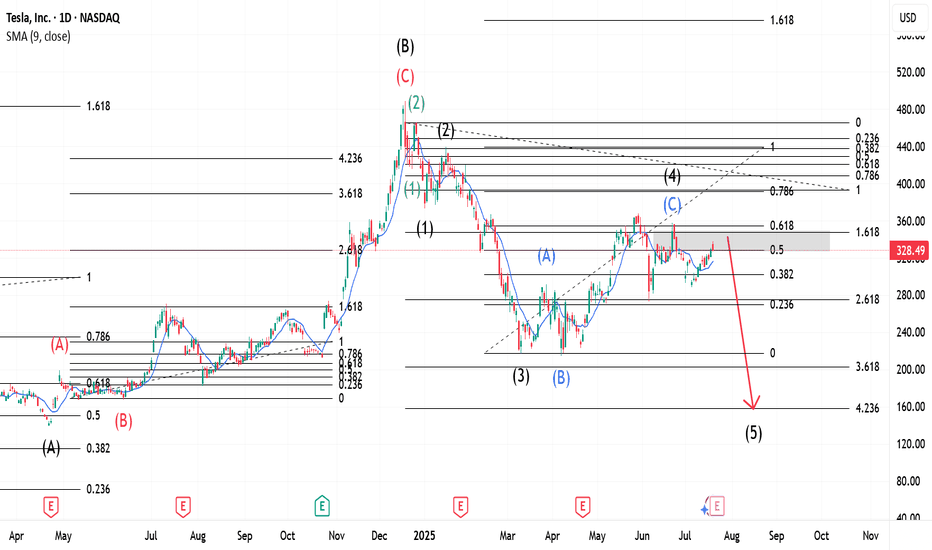

TESLA and the Elliott Wave Theory.This Chart shows a large Flat correction with Wave A and B(Black) completed. Wave B(Black) expressed itself in 3 waves namely A,B,C and are shown in Red. After B(Black) completed, a Wave C(Black) began so as to round off the Flat correction. A Wave 1(Green) formed, followed by a Zigzag correction an

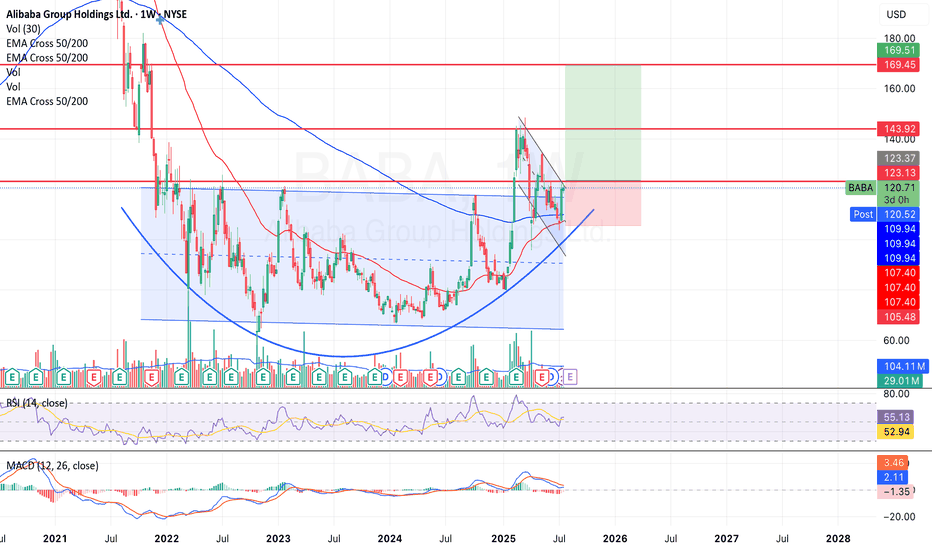

Much needed break for $BABA on the horizonI took a much needed break but not as long as NYSE:BABA has taken since 2021; swinging between ~$70 and ~$120 over the past six years.

I strongly suspect that this might have something to do with Jack Ma's speech in late 2024 that made him go 'missing' from public view

- www.wired.com .

The s

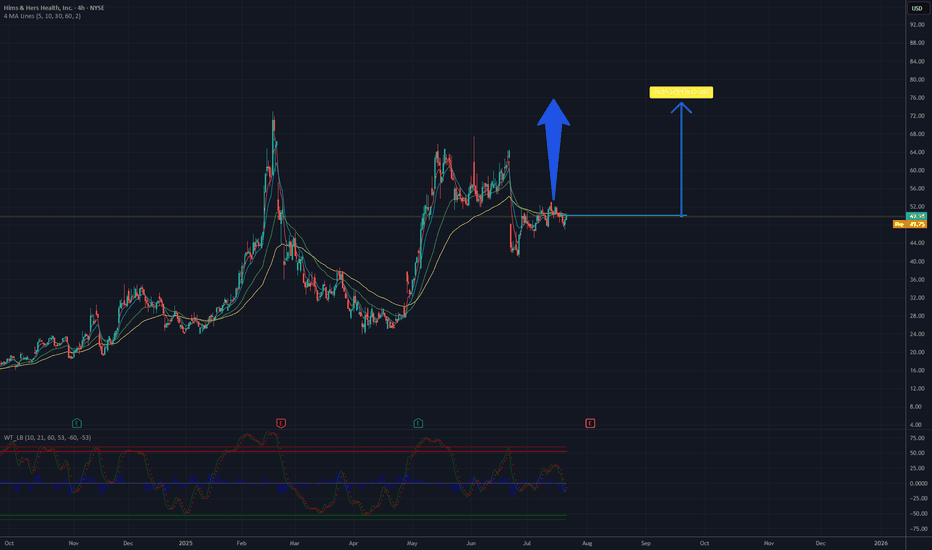

Is it a time for HIMS? Potential 50%,target 75USD.The company has announced plans to introduce comprehensive at-home lab tests, leveraging the acquisition of Trybe Labs, which could enhance service personalization and attract new customers. Additionally, expansion into markets such as Canada and Europe (through the acquisition of Zava) opens new re

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activePre-market gainersPre-market losersPre-market most activePre-market gapAfter-hours gainersAfter-hours losersAfter-hours most activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksPink sheetOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Jul 23

TNLTravel Leisure Co.

Actual

1.65

USD

Estimate

1.65

USD

Jul 23

HLTHilton Worldwide Holdings Inc.

Actual

2.20

USD

Estimate

2.05

USD

Jul 23

TELTE Connectivity plc

Actual

2.27

USD

Estimate

2.08

USD

Jul 23

TMOThermo Fisher Scientific Inc

Actual

5.36

USD

Estimate

5.23

USD

Jul 23

OTISOtis Worldwide Corporation

Actual

1.05

USD

Estimate

1.03

USD

Jul 23

TMHCTaylor Morrison Home Corporation

Actual

1.92

USD

Estimate

1.93

USD

Jul 23

HASHasbro, Inc.

Actual

1.30

USD

Estimate

0.78

USD

Jul 23

BSXBoston Scientific Corporation

Actual

0.75

USD

Estimate

0.73

USD

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Technology Services | ||||||||

| Electronic Technology | ||||||||

| Finance | ||||||||

| Health Technology | ||||||||

| Retail Trade | ||||||||

| Consumer Non-Durables | ||||||||

| Producer Manufacturing | ||||||||

| Energy Minerals | ||||||||

| Consumer Services | ||||||||

| Consumer Durables |