NVDA📊 NVIDIA (NVDA) – Daily Chart Technical Analysis

Entry Point:

A long position is considered at $158, assuming the price holds above $157.78.

Resistance & Target:

The first target is set at $163, which is a clear resistance zone on the chart based on historical price reactions.

If momentum continues beyond that, higher targets could be considered in future analysis.

Stop Loss:

A tight stop-loss is placed just below key support at $157 to manage risk.

🔄 Weekly Bearish Scenario:

If the price closes below $157, this invalidates the bullish setup:

The first downside target would be $146, which is a previously established support zone.

A further drop could extend toward $115, especially if broader market weakness or sector rotation occurs.

📌 Key Technical Zones:

Support Zones: $157.78, $157.00 (critical for bullish continuation)

Resistance Zones: $158.12, $163.18

Multiple historical rejections and price consolidations are noted near these zones, highlighting their significance.

Summary:

As long as NVDA remains above $157.78, the outlook remains bullish targeting $163. However, a confirmed breakdown below $157 could shift the sentiment sharply bearish, targeting $146 and possibly $115.

Trade Idea: $HOOD – $106C by 7/25 | Bullish Setup🧠 Thesis:

After topping out at $100, NASDAQ:HOOD pulled back ~10%. I believe this recent pullback sets up a healthy base for a continuation move back toward $100+ in the coming sessions. If momentum kicks in, we could see a push toward the $106 level by expiration.

📊 Key Levels:

Resistance: $95.60 → $97.34 → $99.77 → $102 → $106

Support: $94.00 (uptrend line), $92.97 (higher low), $90.97 (must hold for bulls)

📌 Trade Strategy:

I'm scaling into the $106 Calls expiring 7/25.

Looking for:

A breakout above $97.34 to trigger upside momentum

Profit-taking zones around $99.77 and $102

Final target near $106 (ITM zone)

Risk is managed below $92.97.

🧭 Notes:

Watching broader market sentiment and NASDAQ:QQQ correlation closely. Volume confirmation will be key on any breakout attempts.

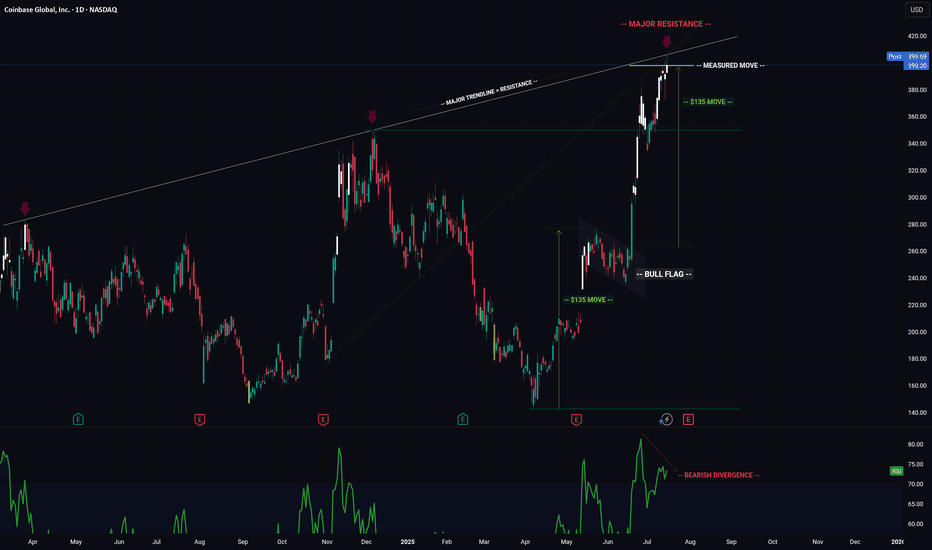

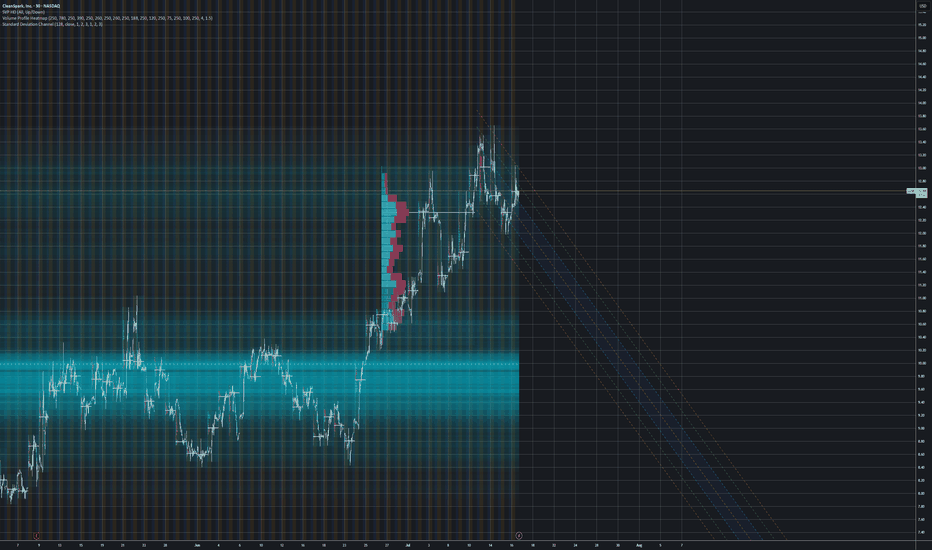

COIN -- Major Trendlines + Bearish Divergence = Breakdown?Hello Traders!

Today I have shared the chart of COINBASE. Of course we cant know for sure what price will do, however you can take clues and combine them to give you a high probability reading of the chart.

Here are the clues:

1) MAJOR TRENDLINE

2) TRENDLINE

3) BEARISH DIVERGENCE

4) BULL FLAG MEASURED MOVE

When we combine these clues, a very bearish picture is painted... This signals to me that there is a high probability price will likely reverse and trade to the downside in the near future.

I hope everyone enjoyed this post and is able to use it as an educational tool.

Thanks everyone and best of luck on your trading journey!

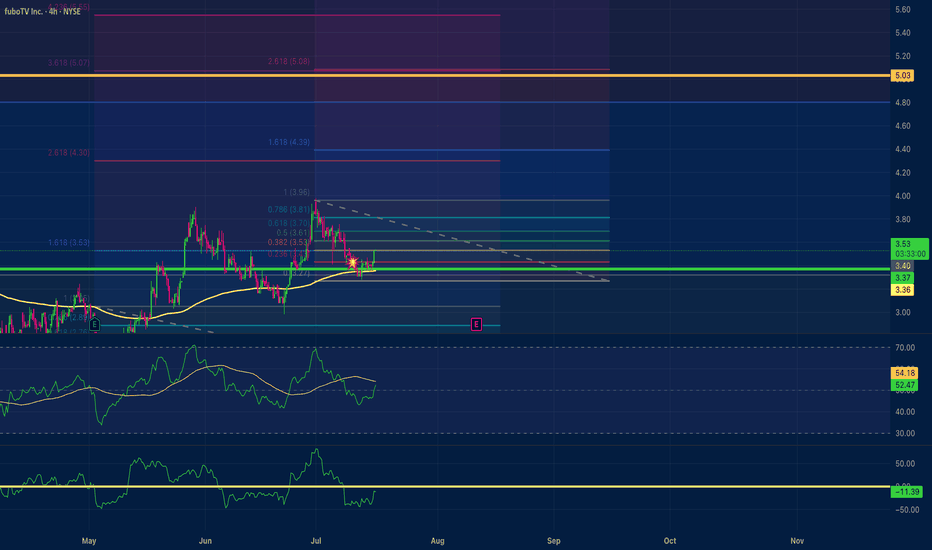

fuboTV $5.00 price target Positive Divergence Multi time frameMy trade on fuboTV has a $5.00 price target. With positive divergence multiple time frames 15,1hr, 4hr. An RSI scoop where the hrly RSI with a length setting of 36 shows upward momentum? The Chande momentum oscillator with a setting of 24 indicates the price may not stall at $4.50.

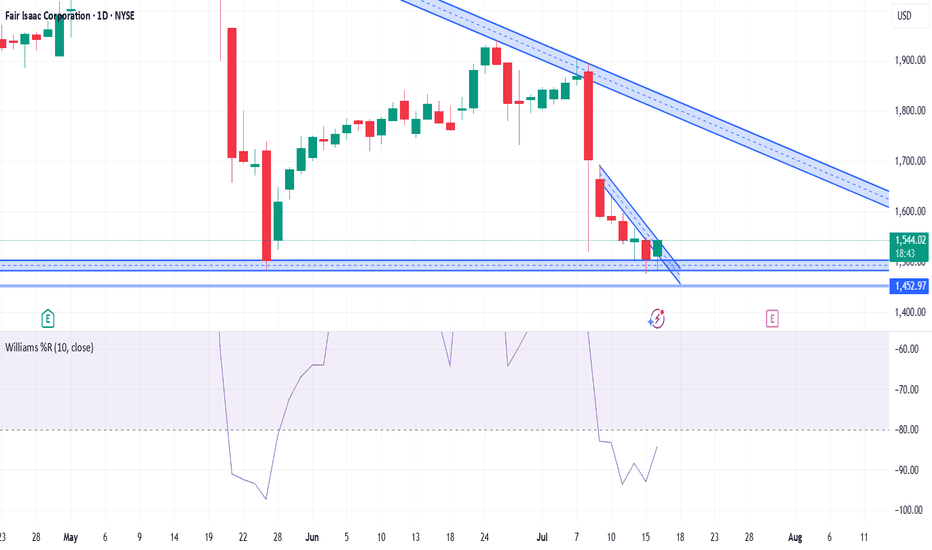

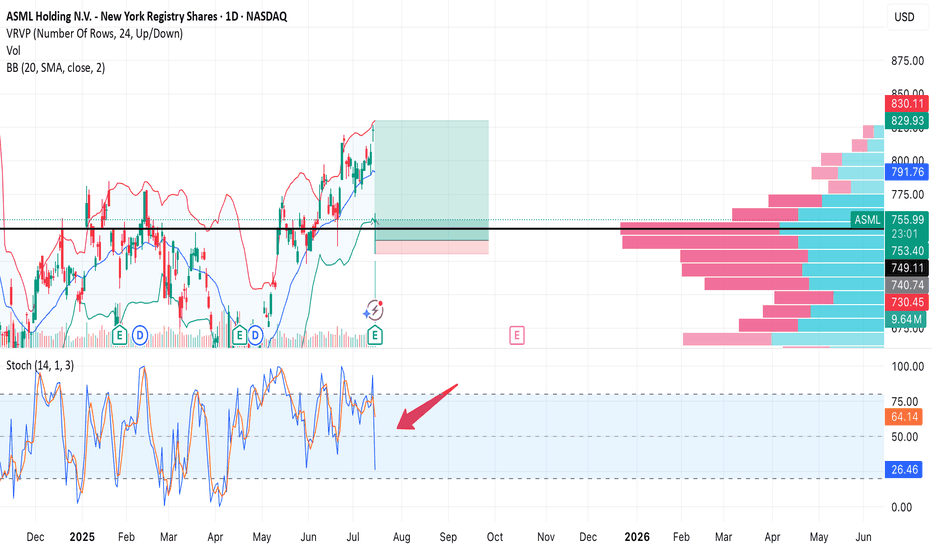

ASML — Strong earnings, sharp drop on profit-taking. Second chanAfter a strong quarterly report, NASDAQ:ASML stock initially surged, but then dropped -7.6% in a single session. Most likely due to profit-taking and a broader tech sector correction. Still, the key $754 support held, and the uptrend remains intact.

Trade Setup:

• Buy Zone: $754–760 (on retest)

• Target: $849 (+12%)

• Stop Loss: $730 (below support and volume shelf)

• Risk/Reward: 1:8

Earnings were great, fundamentals are solid. This drop could be a shakeout before continuation. As long as $754 holds, bulls have a second chance.

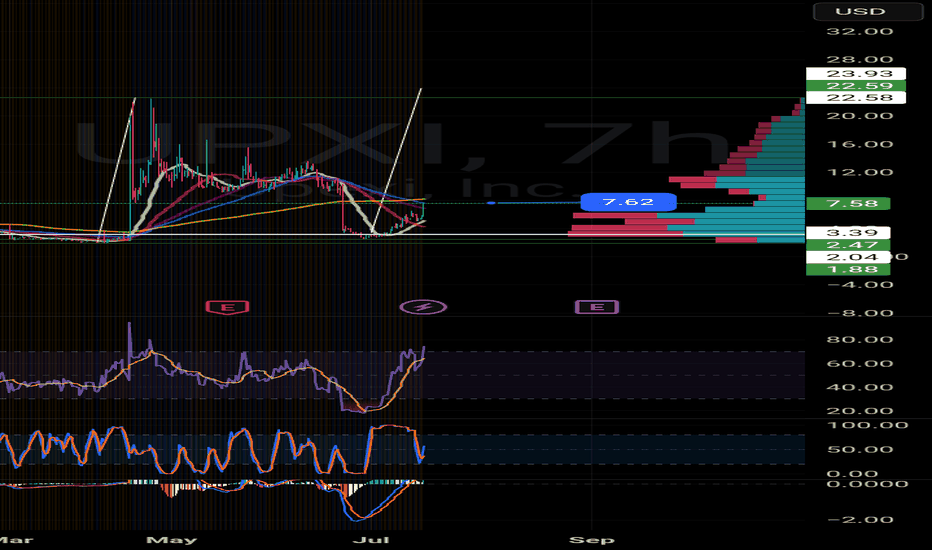

[$CLSK] CleanSpark Inc. - Farming [$BTC] LongNASDAQ:CLSK

no finanical advice

📑market outlook

+ Fed rate cut priced in --> short term risk-on environment

+ total FIAT-debasement in motion --> Precious &Crypto are poomping

- geo-political risk can drag down the 'weaker ANTI-Fiat' risk-on positions

💡idea

we want to farm BTC indirectly by selling covered-calls /placing cash secured puts

🧪approach

derivatives options with i.e. 0.1 BTC ~ 10,000 USD

🏁target

get 2% yield per month

⚠️ caution

Only weekly options: --> Crypto Cycle could take hits of -50% which would basically demolish your position

--> check weekly volume/sentiment on BTC

Don't forget:

⏳ Theta is our alley. Always have been!

[$CLSK] CleanSpark Inc. - Farming [$BTC] Long[ NASDAQ:CLSK ]

no finanical advice

📑market outlook

+ Fed rate cut priced in --> short term risk-on environment

+ total FIAT-debasement in motion --> Precious &Crypto are poomping

- geo-political risk can drag down the 'weaker ANTI-Fiat' risk-on positions

💡idea

we want to farm BTC indirectly by selling covered-calls /placing cash secured puts

🧪approach

derivatives options with i.e. 0.1 BTC ~ 10,000 USD

🏁target

get 2% yield per month

⚠️ caution

Only weekly options: --> Crypto Cycle could take hits of -50% which would basically demolish your position

--> check weekly volume/sentiment on BTC

Don't forget:

⏳ Theta is our alley. Always have been!

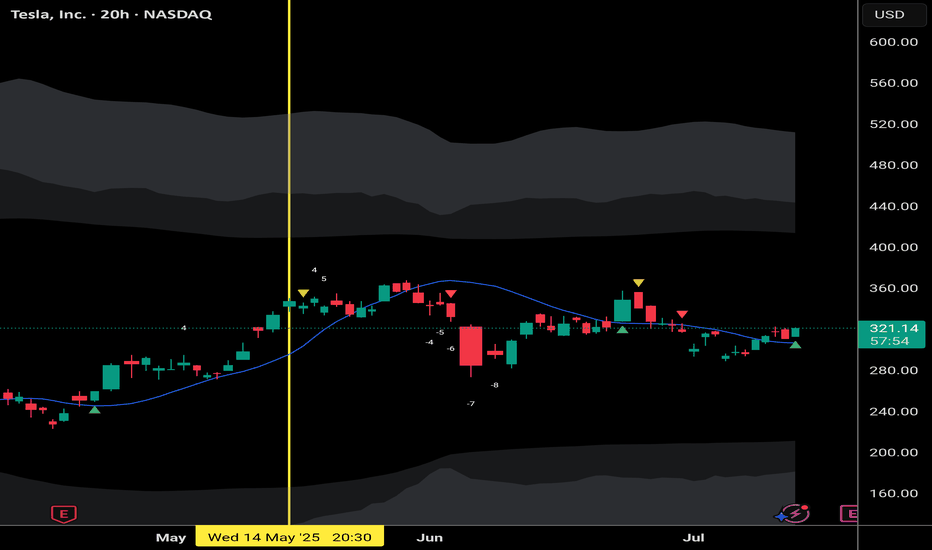

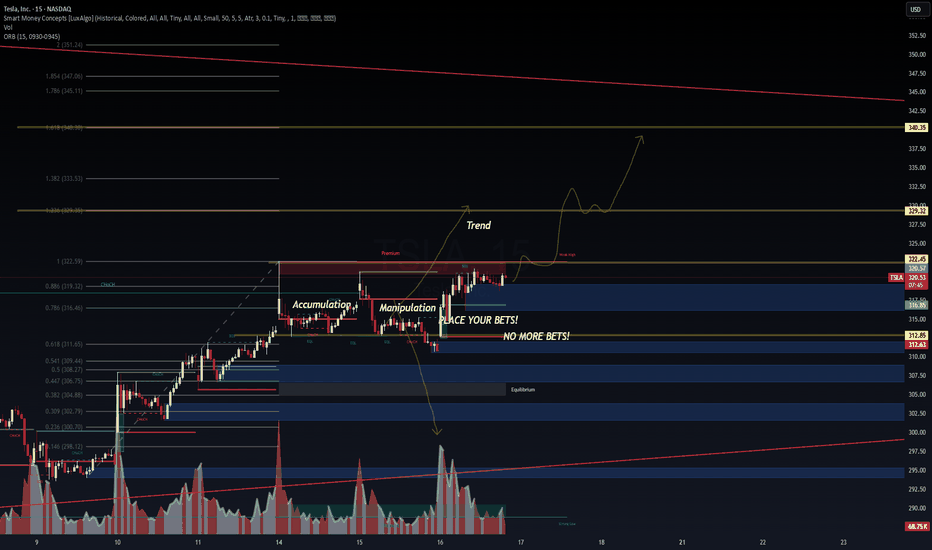

TSLA UPDATE: Trend Initiation in Play – WaverVanir SMC ModelPosted July 16, 2025 – 15m Chart

🚨 "PLACE YOUR BETS!" triggered bullish confirmation.

After textbook accumulation → manipulation → expansion, TSLA is attempting a breakout above premium zone. We're entering trend territory now.

🔍 Highlights:

🔄 Accumulation held above the 0.5–0.618 Fib + SMC EQ zones

💥 Manipulation sweep faked below $312.63 before reclaiming

🎯 Target zones:

▫️ $322.45 reclaim confirms

▫️ $329.32 → $340.35 are projected liquidity zones

🔊 Volume is climbing as trend unfolds

🧠 WaverVanir DSS Notes:

Our ORB model detected a valid launch from $316.85 (0.786 Fib)

This is Trend Phase 1, with volatility expected to increase

No More Bets! = stop hunting complete

Smart money likely positioned → now comes the markup

youtu.be

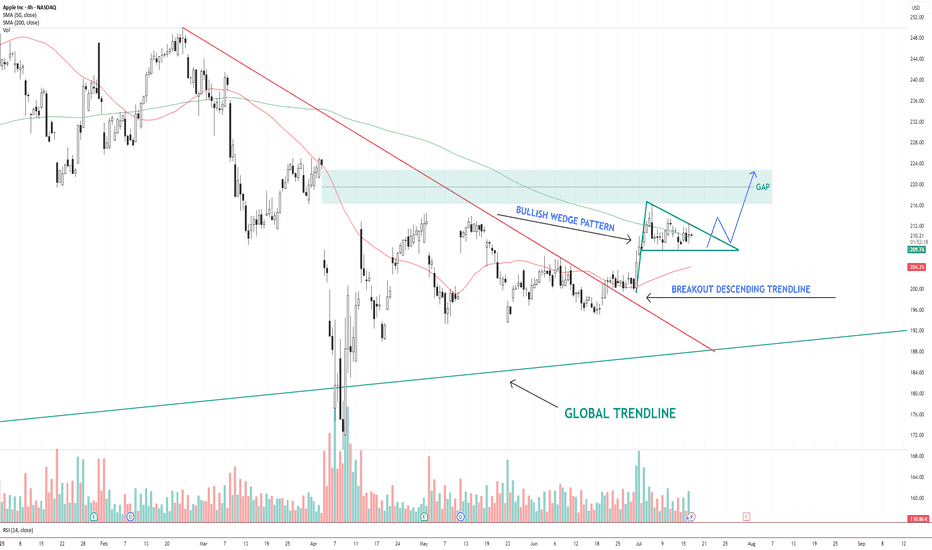

AAPL – Bullish Wedge Breakout Setup Toward Gap FillAAPL NASDAQ:AAPL has broken out of a descending trendline and is now consolidating inside a bullish wedge pattern . Price is holding above the 200 SMA and hovering near the 50 SMA.

The structure suggests a potential breakout above the wedge, with a clear gap area between $216–$224 acting as the next upside target.

Key levels:

Support: $206 (wedge base / 50 SMA)

Resistance: $216–$224 (gap zone)

Trend structure: Bullish consolidation after breakout

A clean breakout from the wedge with volume could trigger a continuation move toward the gap zone.

📌 Watching for confirmation and potential entry on a breakout + retest.

This is not financial advice. Always do your own research.

$LAC up from here: support, elliot wave, price actionI believe LAC may have begun its 3rd elliot wave, with a bottom at $2.33. There also appears to be nice recent strong base support around $2.80. In addition, there appears to be a deviation between price and money flow, as shown with the green arrows - with a potential correction available to push price beyond $3.30 very soon.

I have entered and will watch its daily action and volume with an upside expectation limit around $9-10, then a 4th wave down, etc. Of course, I am not a financial advisor and I have been wrong before and will be wrong again. I trade within this reality and control my risk.

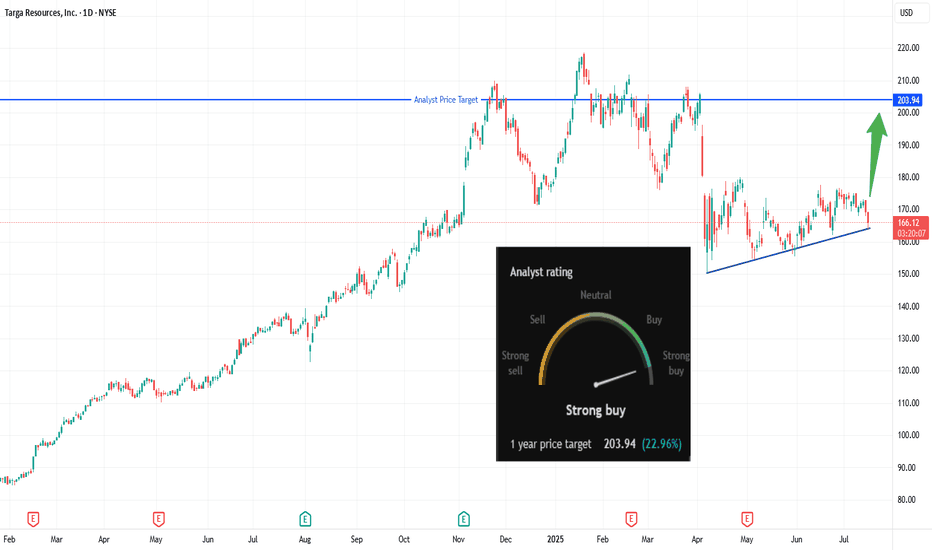

Breakout Brewing: Is TRGP About to Explode?🔹 Trade Summary

Setup:

Ascending triangle forming over several months

Price consolidating near major resistance

Strong analyst buy rating with 1-year target at $203.94

Entry:

Buy on daily close above $169.42 (breakout trigger)

Stop-loss:

Below $159 (invalidate the setup)

Targets:

$203.94 (analyst target / recent highs)

Risk/Reward:

Approx. 1:3.5 (risking ~$10 for ~$34 gain)

🔹 Technical Rationale

🔹 Ascending triangle pattern suggests bullish continuation

🔹 Flat resistance at $169.42 now being challenged

🔹 Daily timeframe, recent higher lows showing building pressure

🔹 Catalysts & Context

🚦 Analyst “Strong Buy” rating with 1-year upside potential of +22.96%

🛢️ Energy sector momentum, especially in midstream & LNG plays

📰 Potential earnings/corporate updates could drive breakout

🔹 Trade Management Plan

Entry: Buy only on daily close above $169.42

Stop-loss: Below $159 — trail up if price closes above $180

Scaling: Take partial profits at $185, remainder at $203.94 (target)

What’s your view? Are you watching NYSE:TRGP ? Comment below or vote:

🔼 Bullish

🔽 Bearish

🔄 Waiting for confirmation

🔹 Disclaimer

Not financial advice. Trade at your own risk.

*** Don't forget to follow us for more trade setups ***

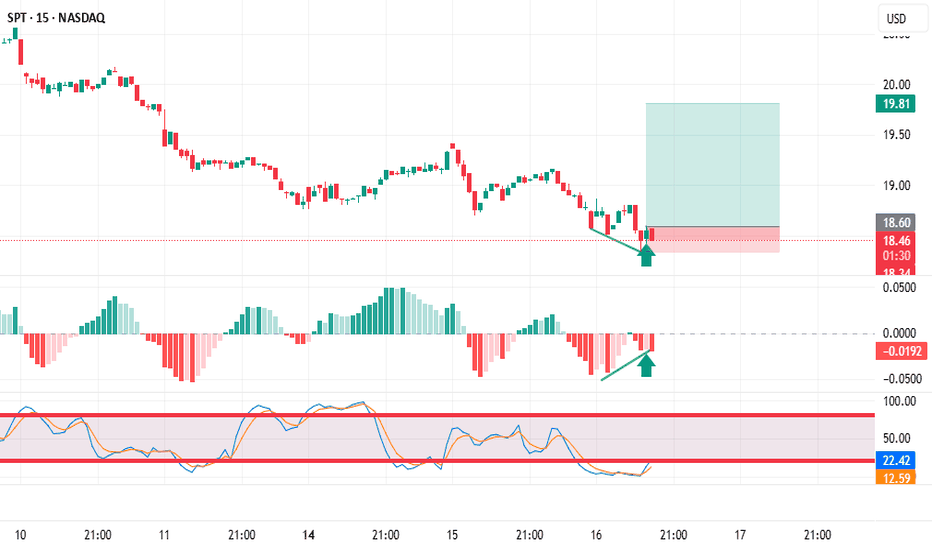

Trading stocks using Dr. Elder's "Three Screens" methodI found a great divergence on the weekly chart

Then I looked at the daily chart of this stock, and here I also found divergence.

Then I looked at the hourly chart of this stock, and here I also found divergence.

And even on the 15-minute chart I saw price divergence towards the indicators. This will be an excellent entry into a long position.

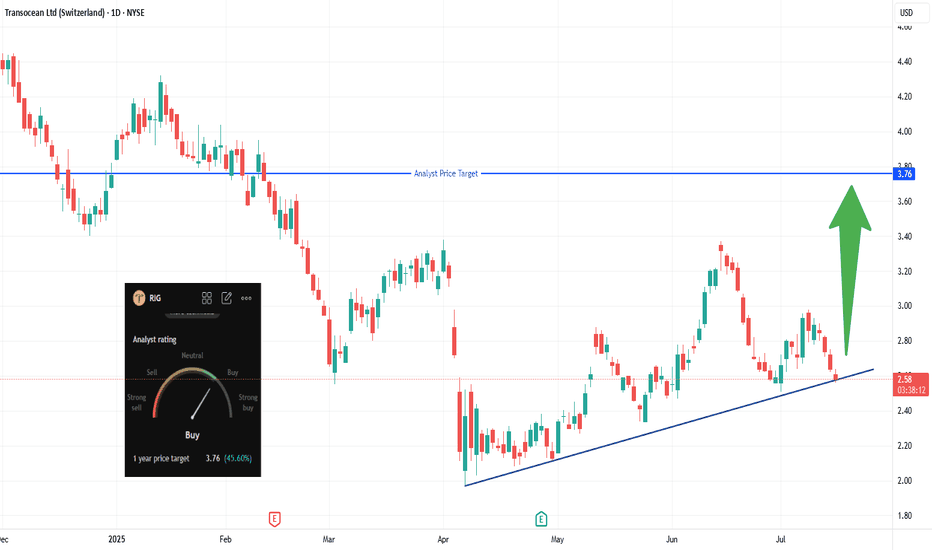

Hidden Support on RIG: Next Big Move?🔹 Trade Summary

Setup:

Price pulling back to ascending trendline support

Testing major support near $2.58

Analyst 1-year target: $3.76

Entry:

Above today's high of $2.64 (on confirmation of bounce from trendline)

Stop-loss:

Below $2.40 (clear break of trendline)

Targets:

$3.76 (analyst price target / major resistance)

Risk/Reward:

Approx. 1:4 (risking ~$0.25 for ~$1.10 gain)

🔹 Technical Rationale

🔹 Ascending trendline holding as key support since April

🔹 Oversold bounce potential at this zone

🔹 Daily timeframe shows structure for a trend reversal if support holds

🔹 Catalysts & Context

🏦 Strong analyst “Buy” rating; 1-year target at $3.76 (+45%)

🛢️ Oil sector volatility—any rally could boost offshore drillers

🌍 Macro: Global energy demand headlines could trigger momentum

🔹 Trade Management Plan

Entry: Wait for daily close above $2.65 to confirm support

Stop-loss: Move to breakeven if price closes above $3.00

Scaling: Trim partial at $3.20, rest at $3.76 (analyst target)

What’s your view? Are you watching NYSE:RIG ? Comment below:

🔼 Bullish

🔽 Bearish

🔄 Waiting for confirmation

🔹 Disclaimer

Not financial advice. Trade at your own risk.

*** Don't forget to follow us for more trade setups ***