Why FPT?Starting first looking at what the company is doing.

AI

The buzz word of most news headlines.

$200 Million Investment: FPT has committed to a landmark $200 million investment to build an AI Factory in partnership with global chip giant NVIDIA. The goal is to create a complete ecosystem for AI development, offering not just the raw computing power (GPU infrastructure) but also the software platforms (FPT AI Studio) and expert consulting needed to build and deploy AI solutions.

This one ties AI and chips together:

University Collaboration: FPT University is a strategic asset. They are working directly with NVIDIA and other institutions like the VNU University of Technology to incorporate AI into their curriculum, aiming to help train the 30,000 to 50,000 AI and semiconductor engineers Vietnam needs by 2030.

Chips

FPT is targeting the design aspect of making chips and there is a lot of international demand to cut into China's monopoly. FPT being in Vietnam is already in a strategically significant area. Samsung is Vietnam's single largest foreign investor and happens to be able to fabricate chips. They also have multiple existing partnerships with FPT and are no strangers to working together. Compute is hottest commodity of the modern age. Though compute is the final product I'll go over how we get there.

First stage mine it

Vietnam has an estimated 3.5 million metric tons Rare Earth Reserves. The world's sixth largest reserves. The key challenge is converting this immense potential into actual production and processed materials. In 2024 Vietnam produced 300 metric ton. So there is a lot of room to grow.

Why this matters:

This national ambition is backed by a new, aggressive legal framework. Key policies like Resolution 10-NQ/TW and the new Law on Geology and Minerals (effective July 1, 2025) mandate that raw ores must be processed in-country and explicitly push for Vietnamese companies and their partners to lead the charge. This strategy aims to prevent the export of raw minerals and build a complete high-value supply chain within Vietnam.

While FPT is not a mining company, these laws are designed to create a stable domestic supply of processed rare earths and high-value materials. This is a critical long-term advantage for a company like FPT aiming to build a world-class semiconductor design center, as it ensures future access to a secure, local supply chain.

Stage 2 is processing

Multiple countries are working on doing this. It's very complicated and the struggle seems to be making in cost effective outside of China.

Stage 3 Design

Conceptualizing the chip's architecture. (Fabless companies like NVIDIA do this). This is precisely the high-value role FPT is targeting.

Stage 4 Fabrication

This is mostly TSMC and Samsung. It's why Taiwan and chips is so related. Also worth mentioning Samsung not do fabrication in Vietnam. It does it in South Korea.

Stage 5 Assembly, Test, and Packaging (ATP)

Cutting the finished wafers into individual chips, assembling them into protective packages, and testing them to ensure they work. Companies like Intel and Samsung already do this in Vietnam.

Telecommunications Segment

While its growth is more modest (around +11.3% in 2024), it is highly profitable and provides consistent, predictable cash flow that helps fund the high-growth initiatives in the Technology segment.

Education & Other Investments

The education section has 1 simple con and that's birthrates in Vietnam. Currently below the replacement rate but effort is being made to change that. Other then that it's all good news. Over the last 50 years Vietnam has gone from it being common to have some elementary school education but no high school or university or English. To pumping out highly educated English and Vietnamese speaking students ready to take on global competition. This factory of new skilled workers means both proud parents and a nation about to steal the spotlight on a global stage. Vietnam while a small country by land mass makes up for it in a population of 100 million and a relentless work ethic. It's the definition of hard times make strong people and strong people make good times. The good times are coming. Why this matters to FPT Education? Good education costs money but it also makes $$$. With this new labor force they will be able to afford great education for the next generation. What else? Well when you got great education other people will use it. Looking forward, as Vietnam solidifies its status as a stable, high-tech hub, it's plausible that its top-tier educational institutions, like FPT University, will attract foreign students, creating an entirely new, high-margin revenue stream that is likely not on most investors' radar today.

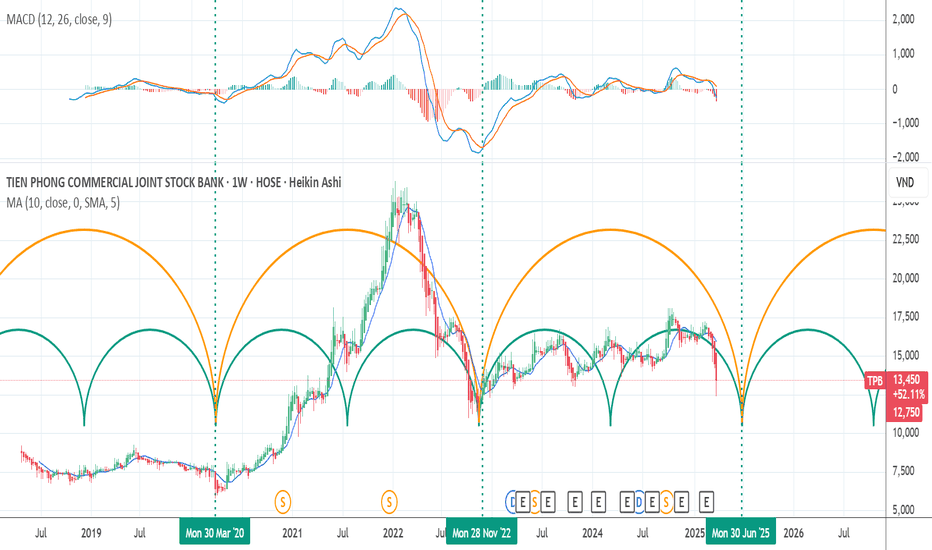

Price Chart

Price is sitting on the weekly 8 SMA. Waiting for a move above 122000 VND this is the next FIB retracement level. Right now we have a possible low at 106000 VND and possible higher low at 115000 VND . Stoploss at 110 000 VND means that upside potential is way bigger then the downside risk. To be clear the stoploss can't be at 114900 while this might work with low volatility stocks on larger US exchanges. The risk of getting wicked out of a position here on HOSE is way different. My optimistic target right now would be 190 000 VND and FIB retracement projection is 192 500 VND. Most likely I'll take profit before that.

MACD cross

MACD is still bearish there is a chance of a cross in the next few weeks.

Daily saw a nice move up. It's also very close to attempting a cross up. It's bearish but allows for an asymmetric trade when down side stop loss can be small. While upside can be huge. Lose small and win big. I opted for tight stoploss rather then waiting for signals to all line up. Some people might be less aggressive but not waiting here is about identifying in the price favorable conditions for minimal downside. Meaning it's clear where the position become invalid.

RSI

The daily RSI has a really nice double bottom. To me this increases the likelihood of a reversal substantially.

Stoch RSI

With Stochastic RSI continuing to move up we should know soon if this position is correct of not.

Disclaimer:

The information provided in this post is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. All investments involve risk, and the past performance of a security, market, or trading strategy does not guarantee future results. I am not a financial advisor. Please conduct your own thorough research and consult with a qualified financial professional before making any investment decisions. You are solely responsible for any investment decisions you make.

VIC hope you are watching it.---

### 🇻🇳 Vin Group (VIC): An On-the-Ground Perspective from Vietnam 📈

After first visiting Vietnam in 2022, it became clear Vin Group is doing a lot of interesting things in Vietnam. To me, Vin Group seemed like an obvious thing to get exposure to a lot of the growth in Vietnam.

* **Accessibility Note:** HOSE:VIC is not easily available outside Vietnam, other than within Vietnamese indexes.

---

### The NASDAQ:VFS Anomaly & Free Float Insights

While in 2023, NASDAQ:VFS (VinFast) went to prices that defied all logic on US markets, US media most likely had no idea about $VIC. All you needed to do was see that HOSE:VIC held most of the NASDAQ:VFS shares (I thought it was 80%, but some suggestions indicate it might have been closer to 99%).

* **Key Takeaway:** A lot of retail investors won't understand free float risks. Starting my investing journey in the crypto space, I am well versed in dealing with assets with low float.

**(Image 1: VFS Marketcap)**

` `

*VFS Marketcap*

**(Image 2: VIC Marketcap & The Disconnect)**

` `

*VIC Marketcap – Note: VIC is in VND, VFS in USD. At one point, HOSE:VIC (approx. $12B USD) held VFS shares valued vastly higher, highlighting a significant market disconnect.*

> Needless to say, I wanted exposure to the things Vin Group was doing but chose to wait rather than join that insanity.

---

### An Expat's View: Seeing Vietnam's Transformation zmiany

As of Q4 2023, I moved to Vietnam. Living here, I get to see what's going on. Though I am still a foreigner, I get a different perspective.

> You see, when you look in the mirror every day, it's hard to see the changes. Then you see that family member you haven't seen in a while who still thinks you're 6, but you're actually 16. This is the case in Vietnam; many people came years ago and think it's the same or worse, or perhaps just watched a movie.

---

### Understanding Vietnam's Economic DNA: Đổi Mới and its People 🚀

To understand economics in Vietnam, you must first understand **Đổi Mới** – those changes are the start of economic success in Vietnam.

* **Human Capital:**

* First-generation university/college-educated individuals are very common.

* First-generation English, Chinese, or Korean speakers are gaining more access to markets outside Vietnam. (Korean is significant for FDI and cultural influence like movies/TV).

* **The Vietnamese Grit:** Many Vietnamese had very rough younger lives, and grit is a character trait they could win prizes for. It's seen in an extreme you don't find in other places. They just won't quit.

* **International Relations:** International business requires friendliness, and they choose to be friendly with everyone.

> Investing is about backing winners so that you can win with them.

---

### Navigating Vin Group's Diverse Portfolio:

**1. Real Estate Market & HOSE:VIC :**

The real estate market has struggled after the incident with Truong My Lan. A lot of stuff is empty and unsold. I have no clue when Vietnamese housing will top or bottom. While HOSE:VIC is largely made up of real estate, I believe that with lower mortgage rates now, they will sell properties they have and don't want, moving debt and assets off the balance sheet.

**2. VinFast ( NASDAQ:VFS ) & Xanh SM 🚕:**

* **Indonesian Expansion:** Watch for expansion into Indonesia – a massive, often underestimated market. (Unless it's someone who follows National GDP rankings globally and other macroeconomics.)

* **Path to Profitability:** VinFast just needs to reach a point where it's no longer cash-flow negative.

* **Long-Term Value:** The money will come from the Vision training they are doing.

* **Xanh SM (Taxi Service):**

* Now the largest taxi company in Vietnam.

* Creates organic demand (buy pressure) for VinFast cars.

* **A Better "Green" Product:** Unlike my experience in Canada where "green" options often felt forced and uncompetitive, Xanh SM is something you take because it's simply a *better product*. Smart, innovative people can make something "Green" AND better for the consumer. If you haven't tried it, just try it – it's better in every way (specifically the VinFast cars).

* **Scooter Critique:** The VinFast scooter needs a very simple change. The handle to hold onto the scooter located on the back is really bad. If I had one request, it would be to change that handle; it's awful. Put a large man in the front and try it.

**3. Vin Bus 🚌:**

Wow, the bus is the same quality as the newest buses I have seen in Canada, with one huge change: They are *extremely clean*. I have never been on a dirty VinBus.

**4. Vin Homes 🏡:**

Truly amazing, with great amenities. Lots of people run or play sports in the early morning. Mall access, VinBus access.

**5. Other Ventures:**

* **VinSchool & VinMec:** I've heard a lot of great stuff, but I haven't used them personally.

* **VinWonders Theme Park:** Also a lot of fun.

* **Vin Group Hotels:** Can also be really great.

---

### My Investment Journey with HOSE:VIC charted

**(Image 3: My Entry Point)**

` `

*So when did I actually get into Vin Group? In 2024.*

**(Image 4: Weekly MACD Signal)**

` `

*To me, this weekly MACD made it really obvious downside momentum was done. It was a matter of time to buy it up.*

* **Stop-Loss:** Having a stop-loss was also pretty obvious with the 2023 low.

* **Sentiment:** Sentiment was also really low.

* **Conviction:** Yet, I kept using the products of HOSE:VIC subsidiary companies, thinking the only way I see this company not doing better is if it goes bankrupt. The products are definitely amazing.

* **Debt vs. Rates:** If you looked at the company balance sheets, debt was a risk, but Vietnam changed its rates, and eventually, most nations will change their rates.

---

### Price Targets & Risk Management for HOSE:VIC 📈📉

**(Image 5: Long-Term View & Current RSI)**

` `

* **Long-Term Target:** I think this Company could go well over **200k VND**.

* **Short-Term Caution:** Price going straight up is risky. With 2024 buying, you could have a narrow stop-loss. In 2025, with this price movement, a simple weekly reversion to the mean would be very rough.

* **Overbought RSI:** The RSI hit 97 – not a number that makes me think, "Wow, lots of room to grow immediately."

> For me, I want to hold enough stock that I am okay if, before going to 200k VND, we first go back to 60k VND.

---

**Disclaimer:**

*The information provided in this post is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. All investments involve risk, and the past performance of a security, market, or trading strategy does not guarantee future results. I am not a financial advisor. Please conduct your own thorough research and consult with a qualified financial professional before making any investment decisions. You are solely responsible for any investment decisions you make.*

FPT Thought:

One of the key FPT leaders practice his strategy by implementation the teaching from the book "The Diamond Cutter" Geshe Michael Roach.

It seems the organisation not only focusing on their skilled & talented engineers/ mangers but also M&A to expand global.

Can next generation and young FPT leaderships continue its mission and growing?

fpt.com.vn

Vinamilk: VNM (Fair value & slow growth)● Vietnam Dairy Products Joint Stock Company (VNM) was established in 1976. The Company has its main business in processing, production, trade, import and export of dairy products and other nutritious ones, under the model of a joint stock company since 2003. VNM is the biggest dairy company with a market share of over 50% in Vietnam dairy industry. VNM's products are exported to 57 countries.

● Milk consumption per capita in Vietnam was only 28 liters in 2021, lower than Thailand (35 liters) and Singapore (45 liters). VS each person in Vietnam consumes around 42.5 liters of beer annually.

● I believe every VNM investor should hold a glass of vinamilk instead glass of beer or soft drink to have a better life.

Sun 10/03/2024

MSN - Vietnam's No.1 Consumer Goods Group - Entering the Growth Today, we would like to introduce our valued customers at Hưng Đạo Investment to the next strategic investment opportunity: MSN - Masan Group Corporation.

Criterion 1: Leadership Team Assessment

“Quang Masan” – full name Nguyễn Đăng Quang, Chairman of the Board of Directors.

Danny Le – CEO of Masan Group Corporation.

Masan’s leadership team is a refined combination of finance, strategic vision, and technology—a blend of experience and innovation, tradition and modernity. Sometimes, their strategy resembles that of a business mafia—why do I say this? Read on to understand their product and service approach below.

Leadership ownership:

45% of publicly traded shares are in the hands of the Board of Directors.

25% is held by foreign investors and institutions.

Around 30% of free-floating shares are available for market making.

The concentrated ownership of MSN is at a moderate level, which may impact the company’s growth acceleration in the future. Particularly, after the 73-80 range, a significant stock transaction has already been executed.

Criterion 2: Masan’s Products and Services – Market Utilization & Competitive Advantage

MasanAuth follows these core values:

Masan's two golden eggs:

Consumer Goods (Masan Consumer)

Retail (WinCommerce)

These two core business segments contribute nearly 80% of Masan Group’s revenue and profit and are its key growth drivers in the coming years.

Nearly 99% of households in Hanoi currently use Masan’s products, such as:

Fish sauce, seasoning, instant noodles, chili sauce, detergent, bottled water, beer, soft drinks, etc.

Shopping at WinMart and WinMart+ stores, despite slightly higher prices compared to traditional markets.

Masan dominates five key product categories with annual revenue of $150-250 million each:

Kokomi, Omachi, Chinsu, Nam Ngư, Wake-up 247, contributing 80% of Masan’s total dollar revenue.

Even those who previously had no preference for Masan’s products have unknowingly become loyal customers. The company has successfully infiltrated consumer habits by:

Owning thousands of WinMart stores, strategically located near residential areas, schools, and commercial hubs.

Optimizing shelf space, ensuring Masan products are always available while competitors’ products gradually disappear.

Masan’s products may not be the best, but they have successfully shaped consumer behavior. This is a competitive advantage that Mobile World (Thế Giới Di Động) cannot replicate in retail—they can only follow or play catch-up.

Criterion 3: Financials, Assets, Debt, Profit Margins

Masan’s revenue has doubled compared to the 2015-2019 period (VND 31,000-45,000 billion), reaching VND 77,000-88,000 billion in the past 5 years.

In 2024, Masan achieved VND 83,456 billion in revenue.

Hưng Đạo Investment projects a 40-50% revenue growth from 2025-2029, reaching VND 130,000-140,000 billion.

Key financial highlights:

Debt: Masan’s total debt stands at VND 65,000 billion, representing 44% of total assets (VND 147,000 billion). Although not a risk, high debt levels impact short-term profits due to VND 2,400 billion in annual interest expenses.

Liquidity: Cash and cash equivalents are VND 16,000 billion, a strong indicator of healthy business operations.

Selling expenses: Increased to VND 14,500 billion in 2024, up from VND 11,500-12,500 billion in previous years, signaling strong sales expansion.

Profit margins: Improved for three consecutive years, reaching 29.6% in 2024 (vs. 28.3% in 2023).

With Vietnam’s GDP growth target of 8% in 2025 and at least 10% in 2026, Masan is well-positioned to capitalize on macroeconomic expansion.

Criterion 4: Market Outlook, Valuation, and Investment Strategy

What’s next for MSN’s stock price? How should individual investors position their investments?

📌 Follow our updates for Masan’s 2024 Annual Report, set to be released in Q1 2025, for more details on upcoming strategic growth opportunities.

chiến lược đơn giảnThe example strategy is a simple moving average crossover system designed to identify potential buy and sell signals. It calculates a 50-period simple moving average (SMA) and monitors the price movements relative to this indicator. When the closing price crosses above the SMA, the strategy enters a long position. Conversely, when the closing price crosses below the SMA, it closes the long position. This approach aims to capture trends by following the price momentum. The strategy is implemented using Pine Script in TradingView and can be optimized by adjusting the SMA period or adding risk management parameters.

VinHomes (VHM)- Long runVinHomes (VHM) stock has entered Phase C of the accumulation process, indicating a pivotal moment in the Wyckoff method. This phase is crucial as it often precedes a shift towards a renewed uptrend. During Phase C, investors might observe signs of strength as the stock begins to assert its readiness to move out of the consolidation zone. This stage is characterized by a test of support levels, without new lows being made, suggesting that selling pressure is diminishing and demand is starting to dominate. For traders and investors following the Wyckoff method, this transition signals an opportune moment to consider positions in anticipation of the next growth phase. It's a time when the market forces align, showcasing the potential for VHM to embark on an upward trajectory as it moves into the markup phase.

TNH Thai Nguyen Hospital - PositionEnd of Aug - Sep 3 2024

**Monitoring Price Target for TNH

if it is wave III, price will be >> 38,550 (161.8% => 50,400)

if it is any corrective form wave forming triangle in the middle

TNH price >> 31,500 61.8%A

TNH price >> 38,550 100%A

TNH price >> 43,100 127%A

TNH price >> 45,850 138.2%A