Dollar General | DG | Long at $90.00Dollar General NYSE:DG took a massive hit this morning after revising their future earnings guidance. The economy is showing many signs of a recession, and this is a clear warning. From a technical analysis perspective, it has retouched my "crash" simple moving average and may dip further into the $80's in the near-term. But, like many overall strong companies that suddenly plummet, I view this as a future opportunity given the strength of NYSE:DG as a business (holistically). Dollar General is the only grocery and home goods store around in many rural locations. So, while there is doom and gloom in the near-term, Dollar General is in a personal buy zone at $90.00. I view this as a starter position, though, with the potential for future declines/opportunities for additional share accumulation in the near-term.

Target #1 = $100.00

Target #2 = $122.00

Target #3 = $200.00+ (very-long term outlook...)

GE Healthcare Technology | GEHC | Long at $62.25GE Healthcare Technology $NASDAQ:GEHC. An aging and unhealthy population will only create an increased need for healthcare imaging services. Add AI to the diagnostic mix, and imaging will be imperative for routine health maintenance and screening. With a P/E of 15x, debt-to equity of 1x, earnings forecast growth of 8.36% per year, and bullish analyst ratings, this could be a good value play for the patient.

Thus, at $62.25, NASDAQ:GEHC is in a personal buy zone. Further drops are possible if trade wars make imaging materials/technology difficult to obtain, but that general statement applies to the whole market at this time...

Targets:

$70.00

$78.00

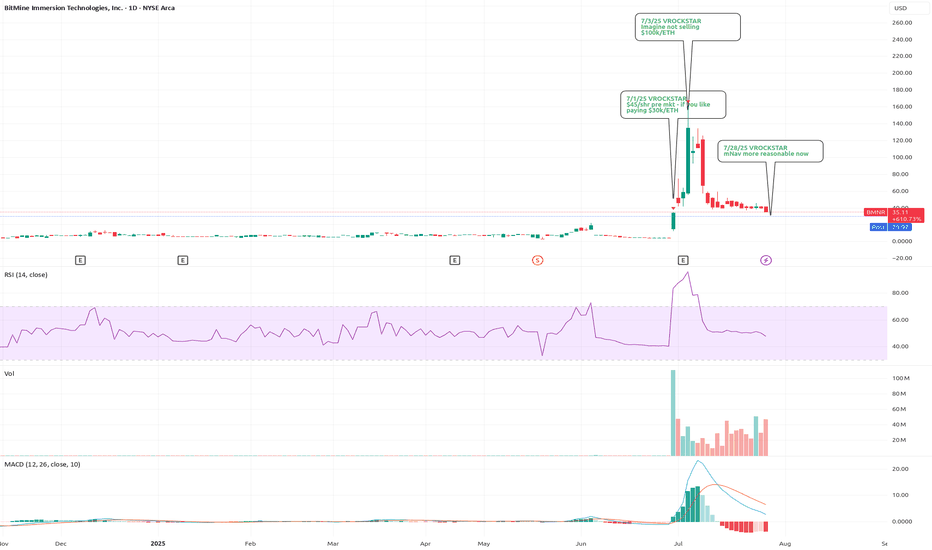

7/28/25 - $bmnr - mNav more reasonable now (1.3x at ~$30/shr)7/28/25 :: VROCKSTAR :: AMEX:BMNR

mNav more reasonable now (1.3x at ~$30/shr)

- i'd link the docs but tradingview wants you to do the digging and doesn't want me to "promote" doing your own DD. ironic.

- so here's how you get there

- go the sec dot gov website search edgar in google

- type in the ticker

- check out the latest 8K

- click presentation

- slide 30 shows "BMNR NAV Detail"

- about 23 bucks per share NAV on fully diluted shares

- AH this thing trading at $30 ish... so 1.3x mnav

- considering view that ETH becoming a captured/ "knighted" winner by the tradfi gremlins, $10k/eth or higher not unlikely this cycle

- this type of "ROE" on a Kc of probably 10-15% means a 3..4...5x mNAV at cycle top not unreasonabl

- so if ETH declines here 50% (also reasonable to expect the worst, you're at $10-15/shr assuming mnav toward 1)... and then a say 2x mnav on $10k/eth would mean shares (considering no additional moves/ accretion from here - also unlikely and conservative) would mean a 4x on the current share px so conservatively that's $100 again.

- does it get to ATH?

- honestly the way that euphoria trades if we make a run for $100... probably yeah moar ATH, but that's unlikely to happen ST unless ETH has a monster run (and it already has)

- nevertheless... i'm finally (VERY) slowly adding this to my exposure, which for me means 50 bps at the AH px of $30.

V

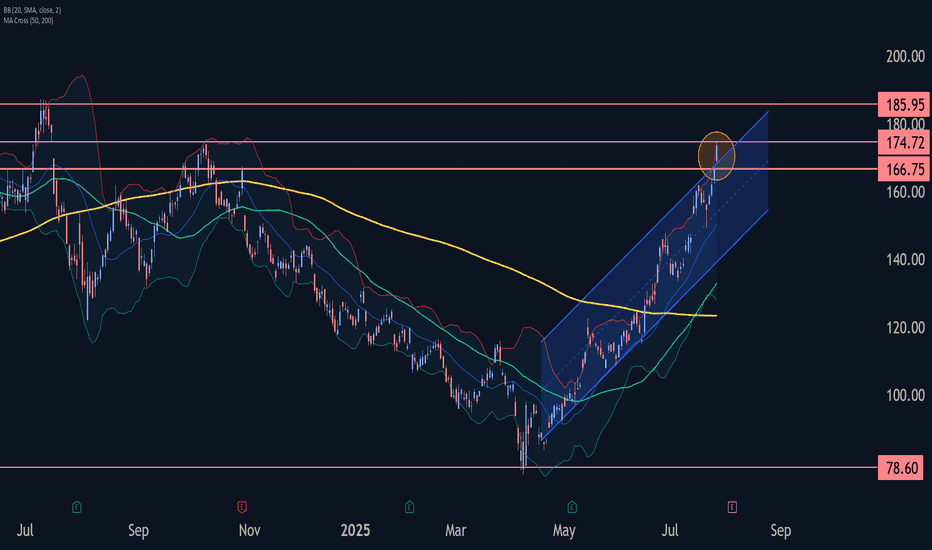

AMD Wave Analysis – 28 July 2025

- AMD broke resistance zone

- Likely to rise to resistance level 185.95

AMD recently broke the resistance zone between the resistance level 166.75 and the upper resistance trendline of the daily up channel from April.

The breakout of this resistance zone accelerated the active impulse waves 3 and (3).

Given the overriding daily uptrend, AMD can be expected to rise to the next resistance level 185.95 (former multi-month high from July of 2024).

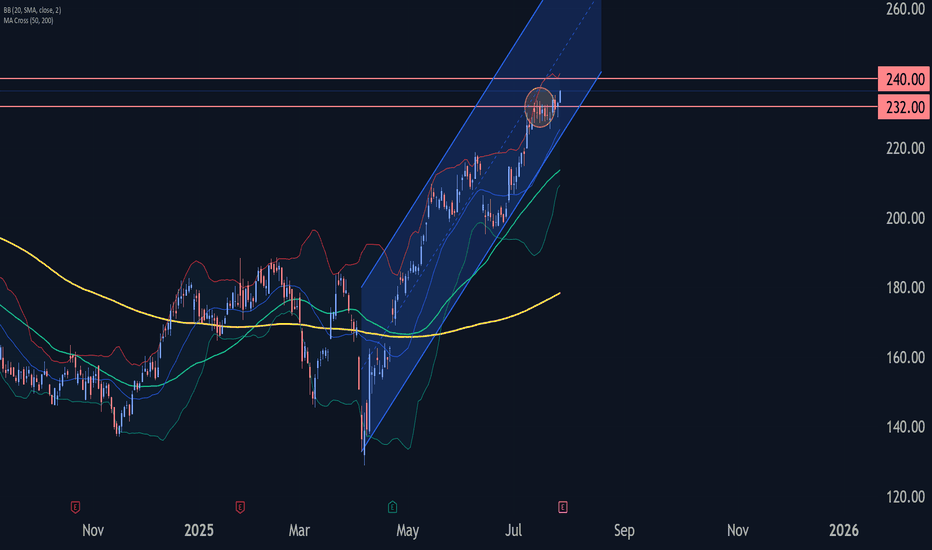

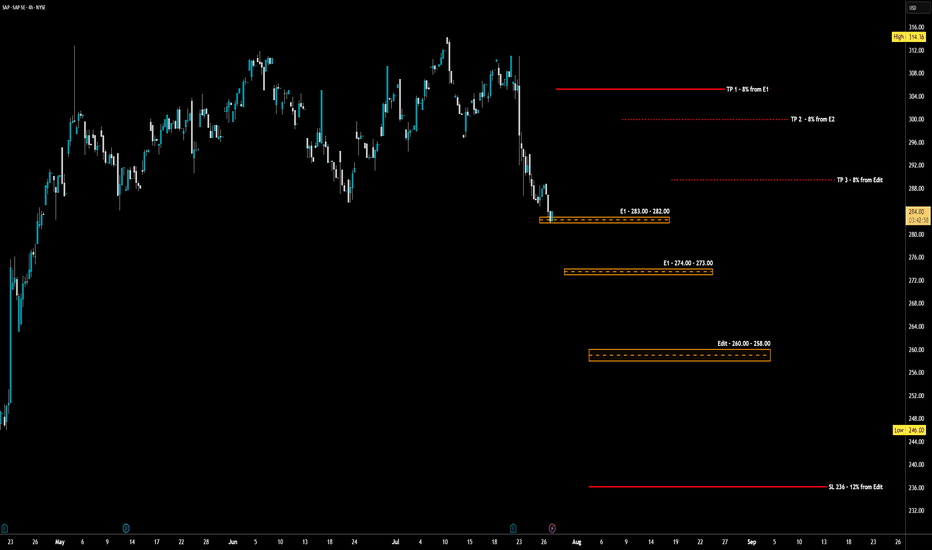

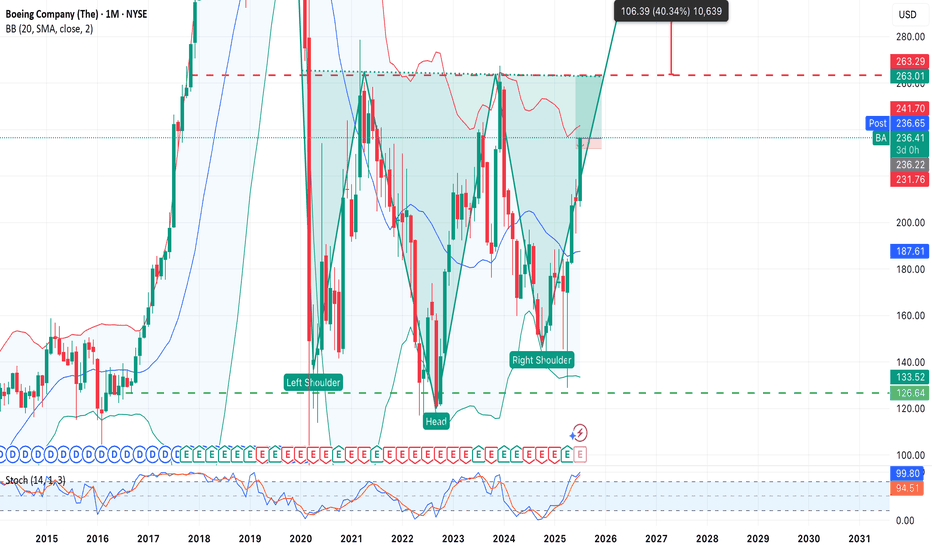

Boeing Wave Analysis – 28 July 2025- Boeing broke the resistance level 232.50

- Likely to rise to resistance level 240.00

Boeing recently broke the resistance level 232.50 (which stopped the previous minor impulse wave 3 in the middle of July, as can be seen below).

The breakout of the resistance level 232.50 continues the active short-term impulse wave 5 of the intermediate impulse wave (C) from June.

Given the clear daily uptrend, Boeing can be expected to rise further toward the next resistance level 240.00.

Cadence Design Systems (CDNS) – Keep an eye on tomorrow’s earninCadence ( NASDAQ:CDNS ) is reporting earnings tomorrow before the market opens, and honestly… this one might surprise.

Last quarter they not only beat expectations but also raised guidance — that’s no small thing. Since then, the stock has been consolidating nicely around the $160 zone. The chart looks solid: low volume pullbacks, RSI cooling off, and MACD looks ready to flip bullish.

If they deliver again (or just hold strong forward guidance), we could see a clean breakout toward $170+.

🟢 My game plan:

— Entry if it breaks $162 with volume

— Stop at $158

— Target $170–$175

Not financial advice — just what I’m seeing. The setup looks good and the risk is well-controlled.

What’s your take?

CMG entering a stage 4 downtrendCMG may have entered a stage 4 downtrend.The price has reflected sharply off the 200 daily moving average and busted rapidly on enormous volume to the low of the previous volume base formed from the week of March 10th to the week of June 9th. The 200 daily moving average has turned over and is sloping downward, alongside the 50 daily moving average. CMG has demonstrated poor relative strength (SPX). The consumer services sector remains in generally good condition, and there are large market caps that are showing strength and performing well in it. There are also many large market caps in the sector that have transitioned out of their respective stage 2 advances, and have started stage 3 distributions and stage 4 declines. Although MCD, the largest market cap in the restaurant industry, continues to perform very well- most of the stocks in the industry have begun to roll over into stage 3 distribution ranges and stage 4 declines. A short entry in CMG was made at ~$55, and more will be added to this position between $47.50 to $50 if the price corrects back to this level.

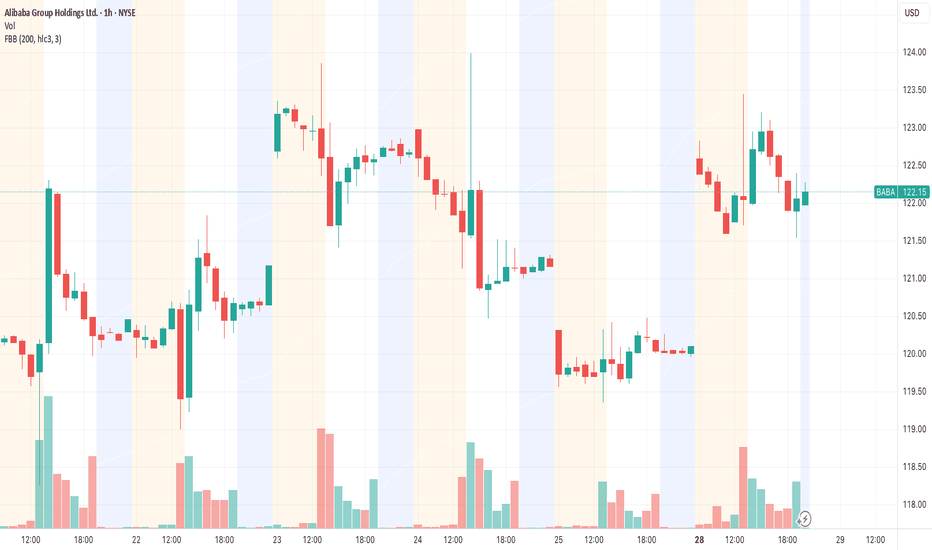

BABA looks ready to drop.It’s been hitting the $125 wall since May and just can’t break it. This last bounce? Weak volume. No real buyers stepping in. RSI is already stretched and there’s no accumulation from big players.

If it loses $120 with conviction, we might see $110 or lower.

And let’s be real — China’s still struggling and the narrative isn’t exciting anyone anymore.

I’m eyeing a PUT. If it breaks $125 clean, I’ll flip my view. Until then… watch out.

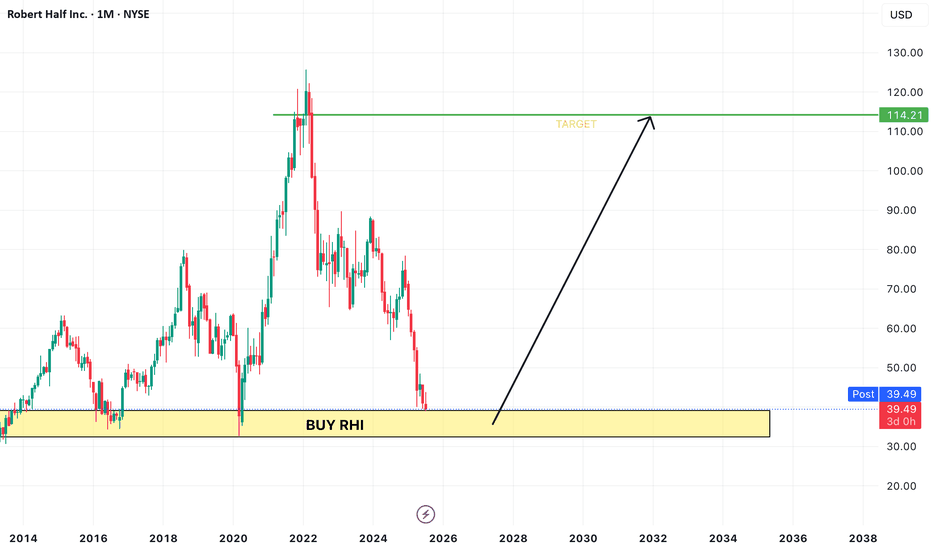

SAP - LONG Swing Entry PlanNYSE:SAP - LONG Swing Entry Plan

Entry Zone 1: $283.00 – $282.00

→ Open initial position targeting +8% from entry level.

Entry Zone 2: $274.00 – $273.00

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

Edit Zone : $260.00 – $258.00

→ If reached, enter with double the initial size to lower the overall cost basis.

→ Profit target remains +8% from the new average across all three entries.

Risk Management:

Stop Loss:

Risk is capped at 12% below the average entry price (calculated across all executed positions including the Edit Zone).

Position Sizing Approach:

Entry 1: 1x

Entry 2: 1x

Edit Zone: 2x

→ Total exposure: 4x

→ Weighted average determines final TP and SL calculations.

______________________________________

Legal Disclaimer

The information provided in this content is intended for educational and informational purposes only and does not constitute financial, investment, or legal advice or recommendations of any kind. The provider of this content assumes no legal or financial responsibility for any investment decisions made based on this information. Users are strongly advised to conduct their own due diligence and consult with licensed financial advisors before making any financial or investment decisions.

Sharia Compliance Disclaimer: The provider makes no guarantees that the stocks or financial instruments mentioned herein comply with Islamic (Sharia) principles. It is the user’s responsibility to verify Sharia compliance, and consultation with a qualified Sharia advisor is strongly recommended before making any investment decisions

An adventure? Yes. But technically — beautiful. Boeing.Adventure Idea: The Return of Boeing NYSE:BA

An inverted “Head and Shoulders” pattern is forming on the BA (Boeing) chart — one of the most reliable bullish formations in technical analysis. The price is confidently approaching the neckline around $235–241, and a breakout above this level could mark the beginning of a new upward momentum.

Pattern Parameters:

• Left Shoulder: ~$126

• Head: ~$99

• Right Shoulder: ~$126

• Neckline: ~$235

• Breakout Target:

➤ $235 + $136 = $371 (long-term)

➤ Nearest resistance: $263

Action Plan (if entering long):

• Entry: On breakout above $241 or on a retest of $235

• Stop: Below the right shoulder — $126–133 (depending on risk tolerance)

• Targets:

1. $263 — first technical target

2. $280+ — if the trend develops

3. $371 — full target based on the pattern (textbook scenario)😄

EBAY watch $75.76-76.26: Key Support zone to launch next Leg UP EBAY trying to get back above its ATH from 2021.

Now testing a key support zone at $75.76-76.26.

Good but late long entry with StopLoss just below.

.

See "Related Pubications" for previous charts such as THE BOTTOM call:

Hit the BOOST and FOLLOW for more PRECISE and TIMELY charts.

=========================================================

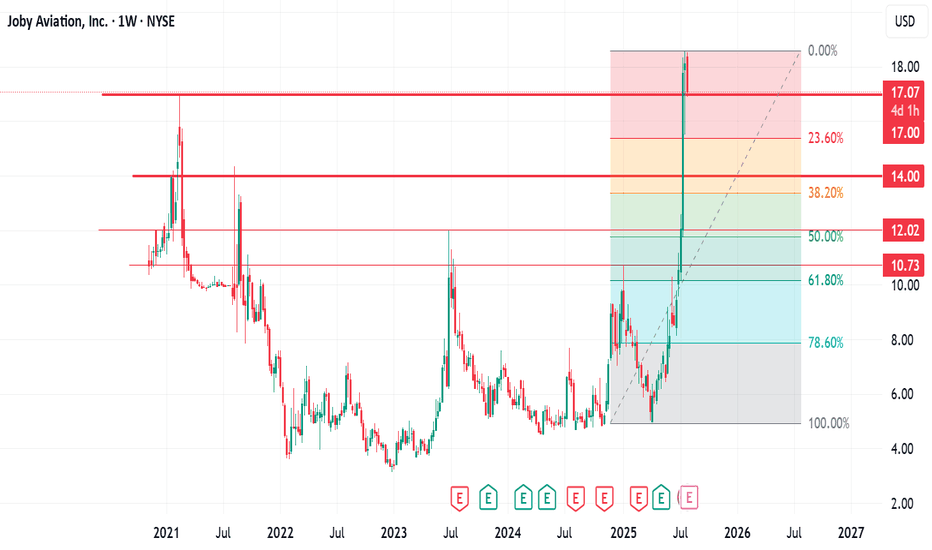

JOBy Aviation (JOBY) Price Action and Accumulation OutlookJOBy Aviation (JOBY) Price Action and Accumulation Outlook.

JOBy Aviation (NASDAQ: JOBY) has experienced a notable upward trend since its reversal on April 7, 2025, when it was trading around $4.96. The stock reached an all-time high of approximately $18.60 on July 25, 2025.

However, in today’s trading session, the stock declined by over 8%, testing a key support level at $17.00. From a technical standpoint, if this support level fails to hold, the next potential downside target could be around $14.00.

At this level, I plan to begin accumulating shares using a dollar-cost averaging (DCA) strategy. Should Fibonacci retracement levels become relevant in the correction, we may see the price retrace to the 50% level, which lies around $12.00 per share — a zone that could offer an attractive long-term entry point.

Given JOBY’s position as a frontrunner in the eVTOL (electric Vertical Takeoff and Landing) sector, this may represent a long-term investment opportunity worth considering.

I look forward to connecting with you.

Let's keep winning together

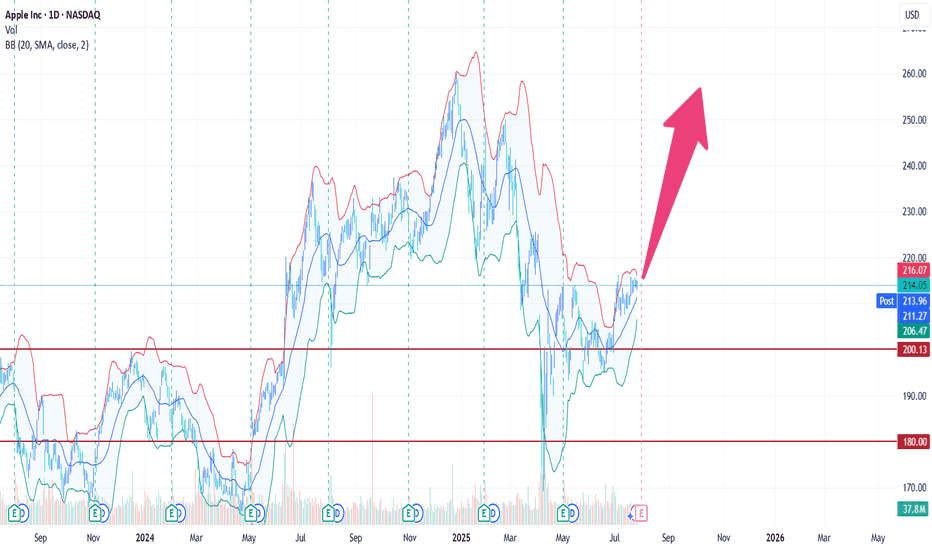

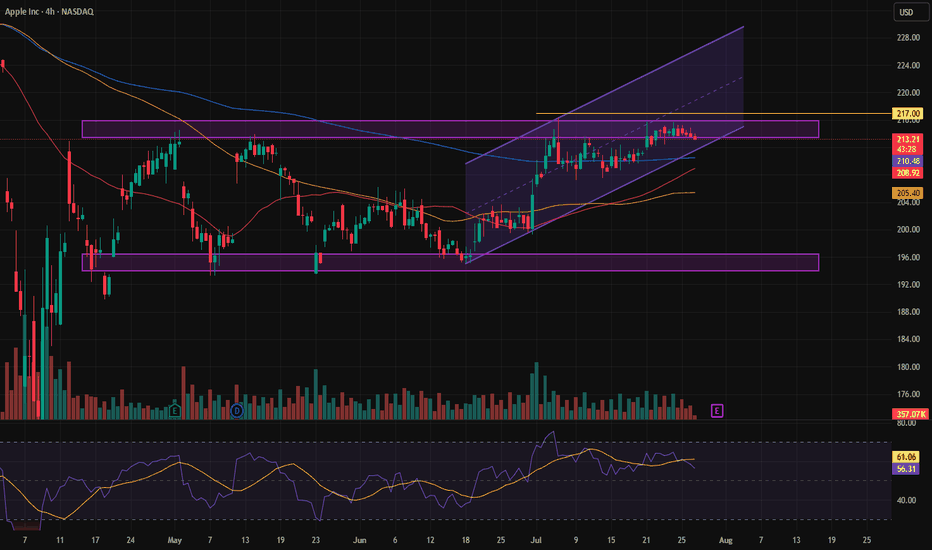

End of correction or a drop?In the long-term trend of Apple stock, we all know it's clearly bullish. However, it has been going through a correction for a while now, and signs are starting to suggest that the correction may be ending. Once a trigger is confirmed, we can consider trading this stock and going for a buy.