OPEN-SOURCE SCRIPT

Dynamic Order Blocks [LuxAlgo]

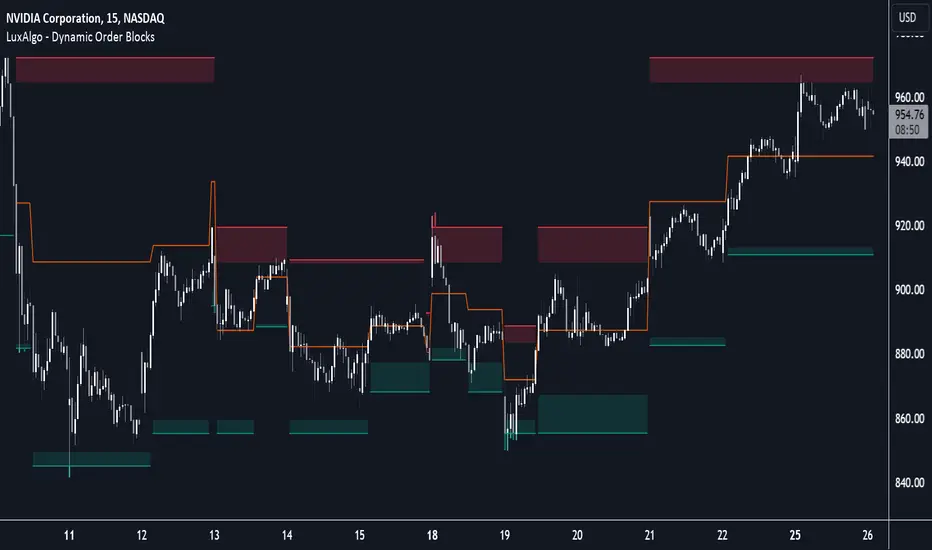

The Dynamic Order Blocks indicator displays the most recent unmitigated bullish and bearish order blocks on the chart, providing dynamic support/resistance areas.

When price sweeps an order block, this is highlighted by the script indicating a potential reversal.

The average between the displayed order blocks is also displayed.

🔶 USAGE

Order blocks are a popular method of price action analysis, representing price areas where more significant market participants accumulate their orders.

Displaying order blocks dynamically allows obtaining relevant areas of support/resistance. Users can obtain longer-term order blocks using a higher "Swing Lookback" setting.

Users can also use mitigation events to assess the current trend direction, with price mitigating a bearish order block (breaking above the upper extremity) indicating an uptrend, and price mitigating a bullish order block (breaking below the lower extremity) indicating a downtrend.

🔹Average Level

An average level obtained from the displayed bullish and bearish order blocks is included in the indicator and offers an additional polyvalent dynamic support/resistance level.

The change of direction of the average line can also be indicative of the current trend direction.

🔹Dynamic Sweeps

Price sweeping the mitigation level of an order block is highlighted on the chart using bordered rectangles. These highlight a breakout failure and can be indicative of a potential reversal.

🔶 SETTINGS

When price sweeps an order block, this is highlighted by the script indicating a potential reversal.

The average between the displayed order blocks is also displayed.

🔶 USAGE

Order blocks are a popular method of price action analysis, representing price areas where more significant market participants accumulate their orders.

Displaying order blocks dynamically allows obtaining relevant areas of support/resistance. Users can obtain longer-term order blocks using a higher "Swing Lookback" setting.

Users can also use mitigation events to assess the current trend direction, with price mitigating a bearish order block (breaking above the upper extremity) indicating an uptrend, and price mitigating a bullish order block (breaking below the lower extremity) indicating a downtrend.

🔹Average Level

An average level obtained from the displayed bullish and bearish order blocks is included in the indicator and offers an additional polyvalent dynamic support/resistance level.

The change of direction of the average line can also be indicative of the current trend direction.

🔹Dynamic Sweeps

Price sweeping the mitigation level of an order block is highlighted on the chart using bordered rectangles. These highlight a breakout failure and can be indicative of a potential reversal.

🔶 SETTINGS

- Swing Lookback: Period of the swing detection used to construct order blocks. Higher values will return longer-term order blocks.

- Use Candle Body: Use the candle body as the order block area instead of the candle full range.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Get access to our exclusive tools: luxalgo.com

Join our 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Join our 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.