OPEN-SOURCE SCRIPT

Single Prints - Session Initial Balances

Updated

Disclaimer: Expose yourself to the knowledge of different trading methods. If you are unaware of what a Single Print is then do some research and broaden your knowledge.

This indicator has only been tested on BTCUSDT Binance pair. This indicator is meant to be used on the 30 minute timeframe to highlight Single Prints.

The calculations are base on 0000 UTC and what Single Prints are created during that day.

Single Prints

Single Prints are where prices moves to fast through an area (on a 30 minute timeframe), in the case of this indicator in $50 intervals, where the price has not yet cross back past, represented as orange lines. If you were viewing this on a Time Price Opportunity Chart (TPO) each $50 would be represented as a square with a letter in it. If price has only been through that area once, within that 24 hour period, then it is called a Single Print. If however the Single Print is on the lower wick of the candle it is called a Buying Tail and on the Upper Wick a Selling Tail.

Single Prints leave low volume nodes with liquidity gaps, these inefficient moves tend to get filled, and we can seek trading opportunities once they get filled, or we can also enter before they get filled and use these single prints as targets.

Single Prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there.

The endpoints of single print sections are considered to be potential support or resistance points and or get filled (like a CME gap).

The above is only a very short summary, to understand Single Prints, Buying Tails and Selling Tails more please do your own research (DYOR).

References:

Trading Riot Volume Profile - Website

TOROS TPO Charts Explained - Youtube

Session Boxes

Session Boxes are the high and low of that markets session before the new market session opens. I used the data from the website Trading Hours for the time input.

White box – Start of day UTC 0000 to Market Close UTC 2000

Purple box – Asia Start UTC 0130 to London Start UTC 0700

Yellow box – London Start UTC 0700 to New York Start UTC 1330

Blue box – New York Start UTC 1330 to Market Close UTC 2000

Red box – Market Close UTC 2000 to End of day UTC 2359

References:

Trading Hours - Website

Initial Balance

The Initial Balance is the market range between the high and low of the first hour of trading for the market. In the case of crypto when is the Initial Balance if it is 24/7.

Context of Initial Balance:

The Initial Balance is traditionally the range of prices transacted in the first hour of trade. Many regard the Initial Balance as a significant range because, especially for the index futures which are tied to the underlying stocks, orders entered overnight or before the open are typically executed prior to the end of the first hour of trade. Some use it to understand how the rest of the day may develop, while others use it as a span of time to avoid trading altogether because of its potential volatility.

For this indicator I have coded the Initial Balance time as below:

White Box - To appear for the first hour of the day 0000 to 0100 UTC .

Purple Box - To appear for the first hour of the day 0130 to 0230 UTC .

Yellow Box - To appear for the first hour of the day 0700 to 0800 UTC .

Blue Box - To appear for the first hour of the day 1330 to 1430 UTC .

Red Box - To appear for the first hour of the day 2000 to 2100 UTC .

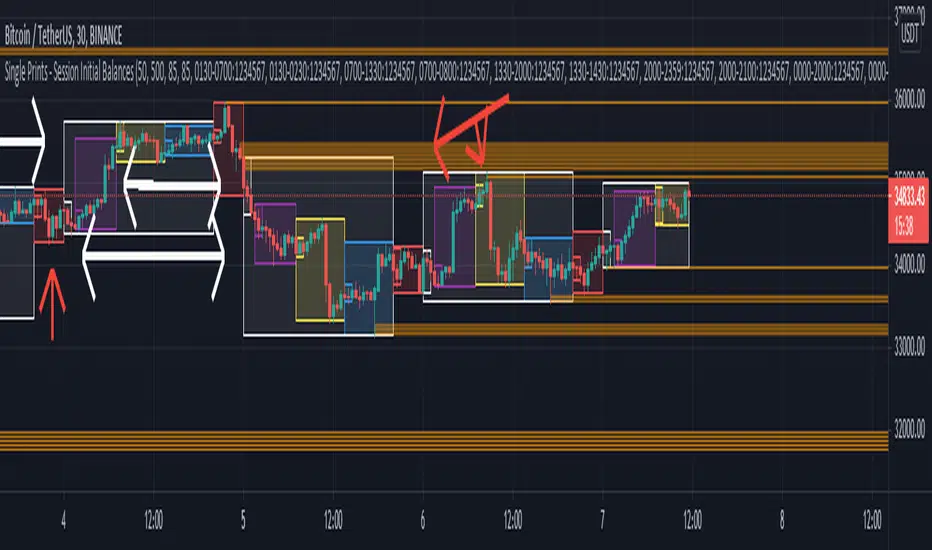

The diagram above shows some examples:

How price (white arrows) retraces the single prints.

How price (red arrows) uses the single prints as S/R.

References:

Not Hard Trading – Website

My Pivots Initial Balance - Website

Thanks go to:

StackOverFlow Bjorn Mistiaen

Trading View user mvs1231

Please message me if you have any feedback/questions.

I am looking at developing this indicator further in the future.

This indicator has only been tested on BTCUSDT Binance pair. This indicator is meant to be used on the 30 minute timeframe to highlight Single Prints.

The calculations are base on 0000 UTC and what Single Prints are created during that day.

Single Prints

Single Prints are where prices moves to fast through an area (on a 30 minute timeframe), in the case of this indicator in $50 intervals, where the price has not yet cross back past, represented as orange lines. If you were viewing this on a Time Price Opportunity Chart (TPO) each $50 would be represented as a square with a letter in it. If price has only been through that area once, within that 24 hour period, then it is called a Single Print. If however the Single Print is on the lower wick of the candle it is called a Buying Tail and on the Upper Wick a Selling Tail.

Single Prints leave low volume nodes with liquidity gaps, these inefficient moves tend to get filled, and we can seek trading opportunities once they get filled, or we can also enter before they get filled and use these single prints as targets.

Single Prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there.

The endpoints of single print sections are considered to be potential support or resistance points and or get filled (like a CME gap).

The above is only a very short summary, to understand Single Prints, Buying Tails and Selling Tails more please do your own research (DYOR).

References:

Trading Riot Volume Profile - Website

TOROS TPO Charts Explained - Youtube

Session Boxes

Session Boxes are the high and low of that markets session before the new market session opens. I used the data from the website Trading Hours for the time input.

White box – Start of day UTC 0000 to Market Close UTC 2000

Purple box – Asia Start UTC 0130 to London Start UTC 0700

Yellow box – London Start UTC 0700 to New York Start UTC 1330

Blue box – New York Start UTC 1330 to Market Close UTC 2000

Red box – Market Close UTC 2000 to End of day UTC 2359

References:

Trading Hours - Website

Initial Balance

The Initial Balance is the market range between the high and low of the first hour of trading for the market. In the case of crypto when is the Initial Balance if it is 24/7.

Context of Initial Balance:

The Initial Balance is traditionally the range of prices transacted in the first hour of trade. Many regard the Initial Balance as a significant range because, especially for the index futures which are tied to the underlying stocks, orders entered overnight or before the open are typically executed prior to the end of the first hour of trade. Some use it to understand how the rest of the day may develop, while others use it as a span of time to avoid trading altogether because of its potential volatility.

For this indicator I have coded the Initial Balance time as below:

White Box - To appear for the first hour of the day 0000 to 0100 UTC .

Purple Box - To appear for the first hour of the day 0130 to 0230 UTC .

Yellow Box - To appear for the first hour of the day 0700 to 0800 UTC .

Blue Box - To appear for the first hour of the day 1330 to 1430 UTC .

Red Box - To appear for the first hour of the day 2000 to 2100 UTC .

The diagram above shows some examples:

How price (white arrows) retraces the single prints.

How price (red arrows) uses the single prints as S/R.

References:

Not Hard Trading – Website

My Pivots Initial Balance - Website

Thanks go to:

StackOverFlow Bjorn Mistiaen

Trading View user mvs1231

Please message me if you have any feedback/questions.

I am looking at developing this indicator further in the future.

Release Notes

Updated functionalityShow Daily Single Prints with Extended Lines - This now will extend all Daily Single Prints where price has not crossed.

Show Daily Single Prints - I have left this option so that you can kind of back test and see what happened to other daily Single Prints.

Release Notes

User request to be able to change the color of the Session Boxes.This is now available with the settings.

Release Notes

User reported that when they changed the timings for sessions that weekend session boxes would not show up. Code updated to rectify this issue.

Release Notes

User update request. User requested the functionality to be able to turn on and off the session boxes.

Aim to be able to look back at particular individual session and their Initial Balances to see how that market opening affected price action.

Release Notes

User request for Initial Balance extension to only be for today and yesterday. Code modified.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.