OPEN-SOURCE SCRIPT

Local Model Kalman Market Mode

Updated

Introduction

Heyo guys, I made a new (repainting) indicator called Local Model Kalman Market Mode.

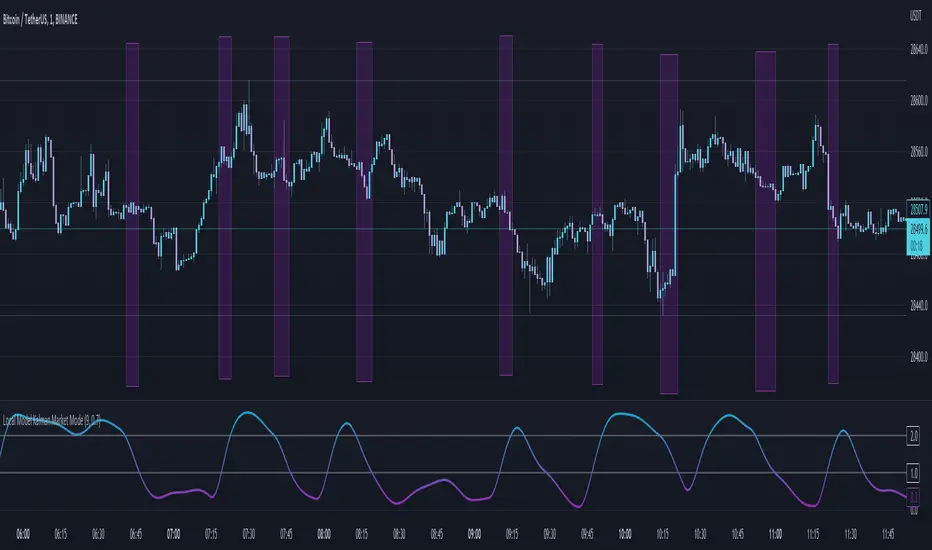

I created it, because I wanted a reliable market mode filter for a potential mean-reversion strategy (e. g. BB Scalping).

On the screenshot you can see an example of how to use it in a BB strategy.

E.g. you would enter long when you have bullish divergence, price is under lower BB, price is under PoC and this indicator here shows range-bound market phase.

You would exit long on cross of the middle band.

Description

The indicator attempts to model the underlying market using different local models (i.e., trending, range-bound, and choppy) and combines them using the T3 Six Pole Kalman Filter to generate an overall estimate of the market.

The Fisher Transform is applied on the price to reach a Gaussian distribution, which increases the accuracy of the indicator itself.

The script first defines state variables for each local model, which include trend direction, trend strength, upper and lower bounds of the range, volatility of the range, level of choppiness, and strength of noise.

Then, likelihood functions are defined for each local model based on the state variables.

Next, the script calculates weights for each local model based on their likelihoods and uses them to calculate state variables for the overall estimate.

Finally, the script combines the state variables using the T3 Six Pole Kalman Filter to generate the overall estimate of the market, which is plotted in blue.

Fundamental Knowledge

To understand the explanation of the indicator and the script, there are a few fundamental concepts that you need to know:

Market: A market is a place where buyers and sellers come together to exchange goods or services.

In the context of trading, the market refers to the exchange where financial instruments such as stocks, currencies, and commodities are bought and sold.

Local models: Local models are statistical models that attempt to capture the characteristics of a particular market regime.

For example, a trending market may have different characteristics than a range-bound market or a choppy market.

The indicator uses different local models to capture the different market regimes.

Trend direction and strength: The trend direction refers to the direction in which the market is moving, either up or down.

The trend strength refers to the magnitude of the trend and how likely it is to continue.

Range-bound market: A range-bound market is a market where prices are trading within a specific range, with a clear upper and lower bound.

Choppiness: Choppiness refers to the degree of irregularity in price movements, often seen in sideways or range-bound markets.

Volatility: Volatility refers to the degree of variation in the price of an asset over time. High volatility implies larger price swings, while low volatility implies smaller price swings.

Kalman filter: A Kalman filter is a mathematical algorithm used to estimate an unknown variable from a series of noisy measurements.

In the context of the indicator, the Kalman filter is used to generate an overall estimate of the market by combining the local models.

T3 Six Pole Kalman Filter: The T3 Six Pole Kalman Filter is a specific type of Kalman filter that is used to smooth and filter time-series data, such as the price data of a financial instrument.

Fisher Transform: The Fisher Transform is a mathematical formula used to transform any probability distribution into a Gaussian normal distribution. It is commonly used in technical analysis to transform non-Gaussian indicators into ones that are more suitable for statistical analysis.

By understanding these fundamental concepts, you should have a basic understanding of how the indicator works and how it generates an overall estimate of the market.

Usage

You can use this indicator on every timeframe.

Users can customize the parameters of the T3 Six Pole Kalman Filter (T3 length, alpha, beta, gamma, and delta) using input functions.

Try out different parameter combinations and use the one you like most.

Thank you for checking this out. Leave me a comment or boost the script, when you wanna support me! 👌

--

Credits to:

▪HPotter - Fisher Transform

▪loxx - T3

▪ChatGPT - Helped me to make the research for this indicator and helped to build the core algorithm.

Heyo guys, I made a new (repainting) indicator called Local Model Kalman Market Mode.

I created it, because I wanted a reliable market mode filter for a potential mean-reversion strategy (e. g. BB Scalping).

On the screenshot you can see an example of how to use it in a BB strategy.

E.g. you would enter long when you have bullish divergence, price is under lower BB, price is under PoC and this indicator here shows range-bound market phase.

You would exit long on cross of the middle band.

Description

The indicator attempts to model the underlying market using different local models (i.e., trending, range-bound, and choppy) and combines them using the T3 Six Pole Kalman Filter to generate an overall estimate of the market.

The Fisher Transform is applied on the price to reach a Gaussian distribution, which increases the accuracy of the indicator itself.

The script first defines state variables for each local model, which include trend direction, trend strength, upper and lower bounds of the range, volatility of the range, level of choppiness, and strength of noise.

Then, likelihood functions are defined for each local model based on the state variables.

Next, the script calculates weights for each local model based on their likelihoods and uses them to calculate state variables for the overall estimate.

Finally, the script combines the state variables using the T3 Six Pole Kalman Filter to generate the overall estimate of the market, which is plotted in blue.

Fundamental Knowledge

To understand the explanation of the indicator and the script, there are a few fundamental concepts that you need to know:

Market: A market is a place where buyers and sellers come together to exchange goods or services.

In the context of trading, the market refers to the exchange where financial instruments such as stocks, currencies, and commodities are bought and sold.

Local models: Local models are statistical models that attempt to capture the characteristics of a particular market regime.

For example, a trending market may have different characteristics than a range-bound market or a choppy market.

The indicator uses different local models to capture the different market regimes.

Trend direction and strength: The trend direction refers to the direction in which the market is moving, either up or down.

The trend strength refers to the magnitude of the trend and how likely it is to continue.

Range-bound market: A range-bound market is a market where prices are trading within a specific range, with a clear upper and lower bound.

Choppiness: Choppiness refers to the degree of irregularity in price movements, often seen in sideways or range-bound markets.

Volatility: Volatility refers to the degree of variation in the price of an asset over time. High volatility implies larger price swings, while low volatility implies smaller price swings.

Kalman filter: A Kalman filter is a mathematical algorithm used to estimate an unknown variable from a series of noisy measurements.

In the context of the indicator, the Kalman filter is used to generate an overall estimate of the market by combining the local models.

T3 Six Pole Kalman Filter: The T3 Six Pole Kalman Filter is a specific type of Kalman filter that is used to smooth and filter time-series data, such as the price data of a financial instrument.

Fisher Transform: The Fisher Transform is a mathematical formula used to transform any probability distribution into a Gaussian normal distribution. It is commonly used in technical analysis to transform non-Gaussian indicators into ones that are more suitable for statistical analysis.

By understanding these fundamental concepts, you should have a basic understanding of how the indicator works and how it generates an overall estimate of the market.

Usage

You can use this indicator on every timeframe.

Users can customize the parameters of the T3 Six Pole Kalman Filter (T3 length, alpha, beta, gamma, and delta) using input functions.

Try out different parameter combinations and use the one you like most.

Thank you for checking this out. Leave me a comment or boost the script, when you wanna support me! 👌

--

Credits to:

▪HPotter - Fisher Transform

▪loxx - T3

▪ChatGPT - Helped me to make the research for this indicator and helped to build the core algorithm.

Release Notes

Updated screenshotRelease Notes

Updated screenshotChanged " to '

Release Notes

Updated inputsAdded background colors to visualize the market phases

Release Notes

Removed wrong max_bars_backRelease Notes

Reworked T3 inputsRelease Notes

FIxed bug where label was not shownRelease Notes

Added option to toggle repaintingRelease Notes

Added data types and restructured inputsOpen-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.