OPEN-SOURCE SCRIPT

Mean Reversion Channel - (fareid's MRI Variant)

Updated

Description :

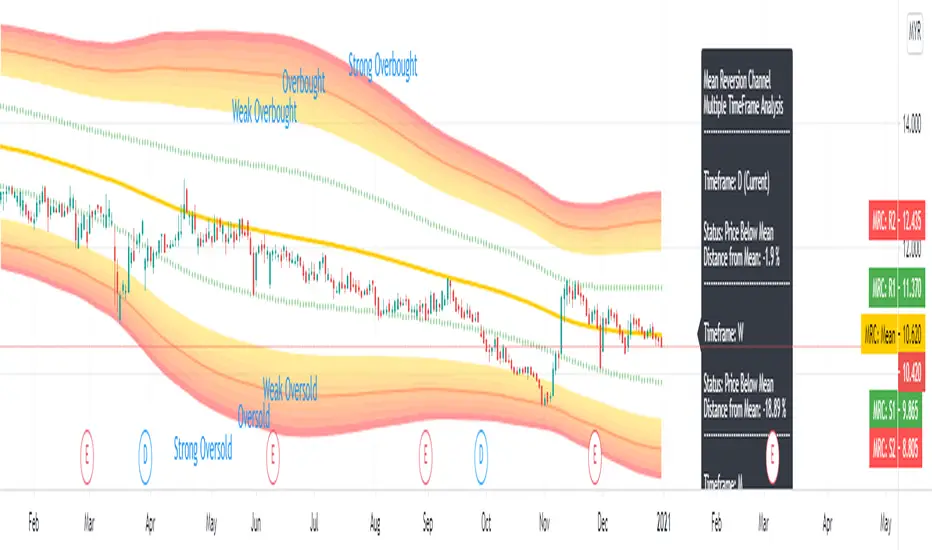

Mean Reversion Channel objective, based on Mean Reversion theory ( everything has a tendency to revert back to its mean), is to help visualizing:

Inner Channel -> Dynamic Support and Resistance

Outer Channel -> Overbought/Oversold Zone which may signal consolidation phase or potential reversal due to unsustainable move

Details on some of the filtering type used for mean calculation can be read in Ehlers Technical Papers: "Swiss Army Knife Indicator" and/or his book "Cybernetics Analysis for Stock and Futures"

Disclaimer:

These study scripts was built only to test/visualize an idea to see its viability and if it can be used to optimize existing strategy.

Any ideas to further improve this indicator are welcome :)

Mean Reversion Channel objective, based on Mean Reversion theory ( everything has a tendency to revert back to its mean), is to help visualizing:

Inner Channel -> Dynamic Support and Resistance

Outer Channel -> Overbought/Oversold Zone which may signal consolidation phase or potential reversal due to unsustainable move

Details on some of the filtering type used for mean calculation can be read in Ehlers Technical Papers: "Swiss Army Knife Indicator" and/or his book "Cybernetics Analysis for Stock and Futures"

Disclaimer:

These study scripts was built only to test/visualize an idea to see its viability and if it can be used to optimize existing strategy.

Any ideas to further improve this indicator are welcome :)

Release Notes

v2.0 Change log:1. Added Format Inherit

2. Added line extension with labels

Release Notes

v2.1 Change log:1. label position use bar_index instead of bar_time (bar_time doesn't work as expected approaching week end/week open)

Release Notes

- Added option to adjust the channel size- Added option to disable line extension and labels

- updated disclaimer in source code

- cleaning code

Notes: Screener for this indicator now available here.

Release Notes

Major Update█ New Features

1) Multiple Timeframe Analysis

- The script will scan up to 2 higher timeframes (HTF) for its status/condition

- User able to select HTF type (Auto or Custom)

- For Auto HTF, the script will automatically recommend HTF to be scanned

- For Custom HTF, the script will scan the user defined HTF based on the user input screen

- The MTF will also calculate the distance of last traded price from each TF's Mean, displayed as % of last traded price.

2) Display Mode

- Now user able to display/hide the channel

- HTF Status Label available in 2 display mode (Always Display / On Hover)

- For Always Display Mode, the HTF will always be displayed

- For On Hover Mode, the HTF will be displayed only when mouse hovered above the Check MTF label

- Notes: The script will override and always disabled the Line Extension if HTF is enabled and the mode is always displayed

Example:

On Hover Mode without Line Extension

Always Display Mode

MTF Disabled

█ Features Removed

1) Price label removed since TV's built-in price label offered better/cleaner label (To enable it, go to Setting > Chart Setting > Scales > Indicator Name Label)

Thanks to @combotrading for his feedback/idea on HTF

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.