OPEN-SOURCE SCRIPT

Grid Bot Parabolic [xxattaxx]

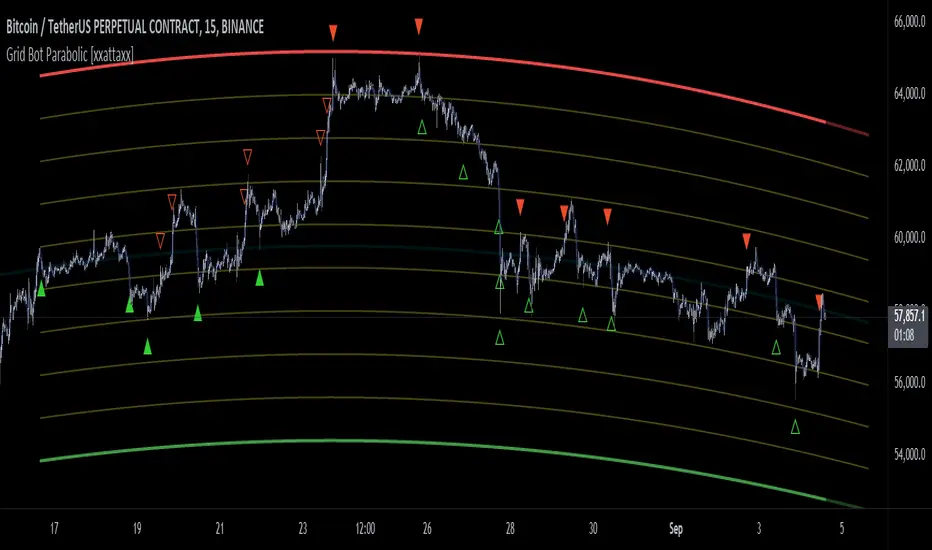

🟩 The Grid Bot Parabolic, a continuation of the Grid Bot Simulator Series, enhances traditional gridbot theory by employing a dynamic parabolic curve to visualize potential support and resistance levels. This adaptability is particularly useful in volatile or trending markets, enabling traders to explore grid-based strategies and gain deeper market insights. The grids are divided into customizable trade zones that trigger signals as prices move into new zones, empowering traders to gain deeper insights into market dynamics and potential turning points.

While traditional grid bots excel in ranging markets, the Grid Bot Parabolic’s introduction of acceleration and curvature adds new dimensions, enabling its use in trending markets as well. It can function as a traditional grid bot with horizontal lines, a tilted grid bot with linear slopes, or a fully parabolic grid with curves. This dynamic nature allows the indicator to adapt to various market conditions, providing traders with a versatile tool for visualizing dynamic support and resistance levels.

🔑 KEY FEATURES 🔑

📐 GRID STRUCTURES 📐

Beyond its core parabolic functionality, the Parabolic Grid Bot offers a range of grid configurations to suit different market conditions and trading preferences. By adjusting the "Acceleration" and "Curvature" parameters, you can transform the grid's structure:

⚙️ INITIAL SETUP ⚙️

1.Adding the Indicator to Your Chart

2. Setting Up the Grid

3. Configure Settings. In the dialog box, you can set the following:

If you choose to keep the default settings, with acceleration set to 0 and curve set to 0, the grid will display as traditional horizontal lines. The grid will align with your selected price point, and you can adjust the settings at any time through the indicator’s settings panel.

⚙️ CONFIGURATION AND SETTINGS ⚙️

Grid Settings

Chart Settings

Time/Price

Please note: Time and Price must be adjusted for each chart when switching assets. For example, a Start Price on BTCUSD of $60,000 will not work on an ETHUSD chart.

🤖 ALGORITHM AND CALCULATION 🤖

The Parabolic Function

At the core of the Parabolic Grid Bot lies the parabolic function, which calculates a dynamic curve that adapts to price action over time. This curve serves as the foundation for visualizing potential support and resistance levels.

The shape and behavior of the parabola are influenced by three key user-defined parameters:

Acceleration: This parameter controls the rate of change of the curve's slope, influencing its tilt or steepness. A higher acceleration value results in a more pronounced tilt, while a lower value leads to a gentler slope. This applies to both curved and linear grid configurations.

Curvature: This parameter introduces and controls the curvature or bend of the grid. A higher curvature value results in a more pronounced parabolic shape, while a lower value leads to a flatter curve or even a straight line (when set to zero).

Sensitivity: This setting fine-tunes the overall responsiveness of the grid, influencing how strongly the Acceleration and Curvature parameters affect its shape. Increasing sensitivity amplifies the impact of these parameters, making the grid more adaptable to price changes but potentially leading to more frequent adjustments. Decreasing sensitivity reduces their impact, resulting in a more stable grid structure with fewer adjustments. It may be necessary to adjust Sensitivity when switching between different assets or timeframes to ensure optimal scaling and responsiveness.

The parabolic function combines these parameters to generate a curve that visually represents the potential path of price movement. By understanding how these inputs influence the parabola's shape and behavior, traders can gain valuable insights into potential support and resistance areas, aiding in their decision-making process.

Sentiment

The Parabolic Grid Bot incorporates sentiment to enhance signal generation. The "Sentiment" input allows you to either:

Buy and Sell Signals

The Parabolic Grid Bot generates buy and sell signals based on the interaction between the price and the grid levels.

When the trigger condition is met within a buy zone and the confirmation criteria are satisfied, a buy signal is generated. Similarly, a sell signal is generated when the trigger and confirmation occur within a sell zone.

Secondary Signals

Secondary signals are generated when a regular buy or sell signal contradicts the prevailing sentiment. For example:

These secondary signals are visually represented on the chart using hollow triangles, differentiating them from regular signals (filled triangles).

While they can be interpreted as potential contrarian trade opportunities, secondary signals can also serve other purposes within a grid trading strategy:

Secondary signals should be interpreted with caution and considered in conjunction with other technical indicators and market context. They provide additional insights into potential market reversals or consolidation phases within a broader trend, aiding in adapting your grid trading strategy to the evolving market dynamics.

Examples

🧠THEORY AND RATIONALE🧠

The innovative approach of the Parabolic Grid Bot can be better understood by first examining the limitations of traditional grid trading strategies and exploring how this indicator addresses them by incorporating principles of market cycles and dynamic price behavior

Traditional Grid Bots: One-Dimensional and Static

Traditional grid bots operate on a simple premise: they divide the price chart into a series of equally spaced horizontal lines, creating a grid of trading zones. These bots excel in ranging markets where prices oscillate within a defined range. Buy and sell orders are placed at these grid levels, aiming to profit from mean reversion as prices bounce between the support and resistance zones.

However, traditional grid bots face challenges in trending markets. As the market moves in one direction, the bot continues to place orders in that direction, leading to a stacking of positions. If the market eventually reverses, these stacked trades can be profitable, amplifying gains. But the risk lies in the potential for the market to continue trending, leaving the trader with a series of losing trades on the wrong side of the market

The Parabolic Grid Bot: Adding Dimensions

The Parabolic Grid Bot addresses the limitations of traditional grid bots by introducing two additional dimensions:

Mean Reversion in Trending Markets

Even in trending markets, the Parabolic Grid Bot can help identify opportunities for mean reversion strategies. While the grid may be tilted to reflect the trend, the buy and sell zones can capture short-term price oscillations or consolidations within the broader trend. This allows traders to potentially pinpoint entry and exit points based on temporary pullbacks or reversals.

Visualize and Adapt

The Parabolic Grid Bot acts as a visual aid, enhancing your understanding of market dynamics. It allows you to "see the curve" by adapting the grid to the market's patterns. If the market shows a parabolic shape, like an upward curve followed by a peak and a downward turn (similar to a head and shoulders pattern), adjust the Accel and Curve to match. This highlights potential areas of interest for further analysis.

Beyond Straight Lines: Visualizing Market Cycle

Traditional technical analysis often employs straight lines, such as trend lines and support/resistance levels, to interpret market movements. However, many analysts, including Brian Millard, contend that these lines can be misleading. They propose that what might appear as a straight line could represent just a small part of a larger curve or cycle that's not fully visible on the chart.

Markets are inherently cyclical, marked by phases of expansion, contraction, and reversal. The Parabolic Grid Bot acknowledges this cyclical behavior by offering a dynamic, curved grid that adapts to these shifts. This approach helps traders move beyond the limitations of straight lines and visualize potential support and resistance levels in a way that better reflects the market's true nature

By capturing these cyclical patterns, whether subtle or pronounced, the Parabolic Grid Bot offers a nuanced understanding of market dynamics, potentially leading to more accurate interpretations of price action and informed trading decisions.

⚠️ DISCLAIMER⚠️

This indicator utilizes a parabolic curve fitting approach to visualize potential support and resistance levels. The mathematical formulas employed have been designed with adaptability and scalability in mind, aiming to accommodate various assets and price ranges. While the resulting curves may visually resemble parabolas, it's important to note that they might not strictly adhere to the precise mathematical definition of a parabola.

The indicator's calculations have been tested and generally produce reliable results. However, no guarantees are made regarding their absolute mathematical accuracy. Traders are encouraged to use this tool as part of their broader analysis and decision-making process, combining it with other technical indicators and market context.

Please remember that trading involves inherent risks, and past performance is not indicative of future results. It is always advisable to conduct your own research and exercise prudent risk management before making any trading decisions.

🧠 BEYOND THE CODE 🧠

The Parabolic Grid Bot, like the other grid bots in this series, is designed with education and community collaboration in mind. Its open-source nature encourages exploration, experimentation, and the development of new grid trading strategies. We hope this indicator serves as a framework and a starting point for future innovations in the field of grid trading.

Your comments, suggestions, and discussions are invaluable in shaping the future of this project. We welcome your feedback and look forward to seeing how you utilize and enhance the Parabolic Grid Bot.

While traditional grid bots excel in ranging markets, the Grid Bot Parabolic’s introduction of acceleration and curvature adds new dimensions, enabling its use in trending markets as well. It can function as a traditional grid bot with horizontal lines, a tilted grid bot with linear slopes, or a fully parabolic grid with curves. This dynamic nature allows the indicator to adapt to various market conditions, providing traders with a versatile tool for visualizing dynamic support and resistance levels.

🔑 KEY FEATURES 🔑

- Adaptable Grid Structures (Horizontal, Linear, Curved)

- Buy and Sell Signals with Multiple Trigger/Confirmation Conditions

- Secondary Buy and Secondary Sell Signals

- Projected Grid Lines

- Customizable Grid Spacing and Zones

- Acceleration and Curvature Control

- Sensitivity Adjustments

📐 GRID STRUCTURES 📐

Beyond its core parabolic functionality, the Parabolic Grid Bot offers a range of grid configurations to suit different market conditions and trading preferences. By adjusting the "Acceleration" and "Curvature" parameters, you can transform the grid's structure:

- Parabolic Grids

Setting both acceleration and curvature to non-zero values results in a parabolic grid.This configuration can be particularly useful for visualizing potential turning points and trend reversals. Example: Accel = 10, Curve = -10)

- Linear Grids

With a non-zero acceleration and zero curvature, the grid tilts to represent a linear trend, aiding in identifying potential support and resistance levels during trending phases. Example: Accel =1.75, Curve = 0

- Horizontal Grids

When both acceleration and curvature are set to zero, the indicator reverts to a traditional grid bot with horizontal lines, suitable for ranging markets. Example: Accel=0, Curve=0

⚙️ INITIAL SETUP ⚙️

1.Adding the Indicator to Your Chart

- Locate a Starting Point: To begin, visually identify a price point on your chart where you want the grid to start.This point will anchor your grid.

2. Setting Up the Grid

- Add the Grid Bot Parabolic Indicator to your chart. A “Start Time/Price” dialog will appear

- CLICK on the chart at your chosen start point. This will anchor the start point and open a "Confirm Inputs" dialog box.

3. Configure Settings. In the dialog box, you can set the following:

- Acceleration: Adjust how quickly the grid reacts to price changes.

- Curve: Define the shape of the parabola.

- Intervals: Determine the distance between grid levels.

If you choose to keep the default settings, with acceleration set to 0 and curve set to 0, the grid will display as traditional horizontal lines. The grid will align with your selected price point, and you can adjust the settings at any time through the indicator’s settings panel.

⚙️ CONFIGURATION AND SETTINGS ⚙️

Grid Settings

- Accel (Acceleration): Controls how quickly the price reacts to changes over time.

- Curve (Curvature): Defines the overall shape of the parabola.

- Intervals (Grid Spacing): Determines the vertical spacing between the grid lines.

- Sensitivity: Fine tunes the magnitude of Acceleration and Curve.

- Buy Zones & Sell Zones: Define the number of grid levels used for potential buy and sell signals.

* Each zone is represented on the chart with different colors:

* Green: Buy Zones

* Red: Sell Zones

* Yellow: Overlap (Buy and Sell Zones intersect)

* Gray: Neutral areas - Trigger: Chooses which part of the candlestick is used to trigger a signal.

* `Wick`: Uses the high or low of the candlestick

* `Close`: Uses the closing price of the candlestick

* `Midpoint`: Uses the middle point between the high and low of the candlestick

* `SWMA`: Uses the Symmetrical Weighted Moving Average - Confirm: Specifies how a signal is confirmed.

* `Reverse`: The signal is confirmed if the price moves in the opposite direction of the initial trigger

* `Touch`: The signal is confirmed when the price touches the specified level or zone - Sentiment: Determines the market sentiment, which can influence signal generation.

* `Slope`: Sentiment is based on the direction of the curve, reflecting the current trend

* `Long`: Sentiment is bullish, favoring buy signals

* `Short`: Sentiment is bearish, favoring sell signals

* `Neutral`: Sentiment is neutral. No secondary signals will be generated - Show Signals: Toggles the display of buy and sell signals on the chart

Chart Settings

- Grid Colors: These colors define the visual appearance of the grid lines

- Projected: These colors define the visual appearance of the projected lines

- Parabola/SWMA: Adjust colors as needed. These are disabled by default.

Time/Price

- Start Time & Start Price: These set the starting point for the parabolic curve.

* These fields are automatically populated when you add the indicator to the chart and click on an initial location

* These can be adjusted manually in the settings panel, but he easiest way to change these is by directly interacting with the start point on the chart

Please note: Time and Price must be adjusted for each chart when switching assets. For example, a Start Price on BTCUSD of $60,000 will not work on an ETHUSD chart.

🤖 ALGORITHM AND CALCULATION 🤖

The Parabolic Function

At the core of the Parabolic Grid Bot lies the parabolic function, which calculates a dynamic curve that adapts to price action over time. This curve serves as the foundation for visualizing potential support and resistance levels.

The shape and behavior of the parabola are influenced by three key user-defined parameters:

Acceleration: This parameter controls the rate of change of the curve's slope, influencing its tilt or steepness. A higher acceleration value results in a more pronounced tilt, while a lower value leads to a gentler slope. This applies to both curved and linear grid configurations.

Curvature: This parameter introduces and controls the curvature or bend of the grid. A higher curvature value results in a more pronounced parabolic shape, while a lower value leads to a flatter curve or even a straight line (when set to zero).

Sensitivity: This setting fine-tunes the overall responsiveness of the grid, influencing how strongly the Acceleration and Curvature parameters affect its shape. Increasing sensitivity amplifies the impact of these parameters, making the grid more adaptable to price changes but potentially leading to more frequent adjustments. Decreasing sensitivity reduces their impact, resulting in a more stable grid structure with fewer adjustments. It may be necessary to adjust Sensitivity when switching between different assets or timeframes to ensure optimal scaling and responsiveness.

The parabolic function combines these parameters to generate a curve that visually represents the potential path of price movement. By understanding how these inputs influence the parabola's shape and behavior, traders can gain valuable insights into potential support and resistance areas, aiding in their decision-making process.

Sentiment

The Parabolic Grid Bot incorporates sentiment to enhance signal generation. The "Sentiment" input allows you to either:

- Manually specify the market sentiment: Choose between 'Long' (bullish), 'Short' (bearish), or 'Neutral'.

- Let the script determine sentiment based on the slope of the parabolic curve: If 'Slope' is selected, the sentiment will be considered 'Long' when the curve is sloping upwards, 'Short' when it's sloping downwards, and 'Neutral' when it's flat.

Buy and Sell Signals

The Parabolic Grid Bot generates buy and sell signals based on the interaction between the price and the grid levels.

- Trigger: The "Trigger" input determines which part of the candlestick is used to trigger a signal (wick, close, midpoint, or SWMA).

- Confirmation: The "Confirm" input specifies how a signal is confirmed ('Reverse' or 'Touch').

- Zones: The number of "Buy Zones" and "Sell Zones" determines the areas on the grid where buy and sell signals can be generated.

When the trigger condition is met within a buy zone and the confirmation criteria are satisfied, a buy signal is generated. Similarly, a sell signal is generated when the trigger and confirmation occur within a sell zone.

Secondary Signals

Secondary signals are generated when a regular buy or sell signal contradicts the prevailing sentiment. For example:

- A buy signal in a bearish market (Sentiment = 'Short') would be considered a "secondary buy" signal.

- A sell signal in a bullish market (Sentiment = 'Long') would be considered a "secondary sell" signal.

These secondary signals are visually represented on the chart using hollow triangles, differentiating them from regular signals (filled triangles).

While they can be interpreted as potential contrarian trade opportunities, secondary signals can also serve other purposes within a grid trading strategy:

- Exit Signals: A secondary signal can suggest a potential shift in market sentiment or a weakening trend. This could be a cue to consider exiting an existing position, even if it's currently profitable, to lock in gains before a potential reversal

- Risk Management: In a strong trend, secondary signals might offer opportunities for cautious counter-trend trades with controlled risk. These trades could utilize smaller position sizes or tighter stop-losses to manage potential downside if the main trend continues

- Dollar-Cost Averaging (DCA): During a prolonged trend, the parabolic curve might generate multiple secondary signals in the opposite direction. These signals could be used to implement a DCA strategy, gradually accumulating a position at potentially favorable prices as the market retraces or consolidates within the larger trend

Secondary signals should be interpreted with caution and considered in conjunction with other technical indicators and market context. They provide additional insights into potential market reversals or consolidation phases within a broader trend, aiding in adapting your grid trading strategy to the evolving market dynamics.

Examples

- Trigger=Wick, Confirm=Touch. Signals are generated when the wick touches the next gridline.

- Trigger=Close, Confirm=Touch. Signals require the close to touch the next gridline.

- Trigger=SWMA, Confirm=Reverse. Signals are triggered when the Symmetrically Weighted Moving Average reverse crosses the next gridline.

🧠THEORY AND RATIONALE🧠

The innovative approach of the Parabolic Grid Bot can be better understood by first examining the limitations of traditional grid trading strategies and exploring how this indicator addresses them by incorporating principles of market cycles and dynamic price behavior

Traditional Grid Bots: One-Dimensional and Static

Traditional grid bots operate on a simple premise: they divide the price chart into a series of equally spaced horizontal lines, creating a grid of trading zones. These bots excel in ranging markets where prices oscillate within a defined range. Buy and sell orders are placed at these grid levels, aiming to profit from mean reversion as prices bounce between the support and resistance zones.

However, traditional grid bots face challenges in trending markets. As the market moves in one direction, the bot continues to place orders in that direction, leading to a stacking of positions. If the market eventually reverses, these stacked trades can be profitable, amplifying gains. But the risk lies in the potential for the market to continue trending, leaving the trader with a series of losing trades on the wrong side of the market

The Parabolic Grid Bot: Adding Dimensions

The Parabolic Grid Bot addresses the limitations of traditional grid bots by introducing two additional dimensions:

- Acceleration (Second Dimension): This parameter introduces a second dimension to the grid, allowing it to tilt upwards or downwards to align with the prevailing market trend. A positive acceleration creates an upward-sloping grid, suitable for uptrends, while a negative acceleration results in a downward-sloping grid, ideal for downtrends. The magnitude of acceleration controls the steepness of the tilt, enabling you to fine-tune the grid's responsiveness to the trend's strength

- Curvature (Third Dimension): This parameter adds a third dimension to the grid by introducing a parabolic curve. The curve's shape, ranging from gentle bends to sharp turns, is controlled by the curvature value. This flexibility allows the grid to closely mirror the market's evolving structure, potentially identifying turning points and trend reversals.

Mean Reversion in Trending Markets

Even in trending markets, the Parabolic Grid Bot can help identify opportunities for mean reversion strategies. While the grid may be tilted to reflect the trend, the buy and sell zones can capture short-term price oscillations or consolidations within the broader trend. This allows traders to potentially pinpoint entry and exit points based on temporary pullbacks or reversals.

Visualize and Adapt

The Parabolic Grid Bot acts as a visual aid, enhancing your understanding of market dynamics. It allows you to "see the curve" by adapting the grid to the market's patterns. If the market shows a parabolic shape, like an upward curve followed by a peak and a downward turn (similar to a head and shoulders pattern), adjust the Accel and Curve to match. This highlights potential areas of interest for further analysis.

Beyond Straight Lines: Visualizing Market Cycle

Traditional technical analysis often employs straight lines, such as trend lines and support/resistance levels, to interpret market movements. However, many analysts, including Brian Millard, contend that these lines can be misleading. They propose that what might appear as a straight line could represent just a small part of a larger curve or cycle that's not fully visible on the chart.

Markets are inherently cyclical, marked by phases of expansion, contraction, and reversal. The Parabolic Grid Bot acknowledges this cyclical behavior by offering a dynamic, curved grid that adapts to these shifts. This approach helps traders move beyond the limitations of straight lines and visualize potential support and resistance levels in a way that better reflects the market's true nature

By capturing these cyclical patterns, whether subtle or pronounced, the Parabolic Grid Bot offers a nuanced understanding of market dynamics, potentially leading to more accurate interpretations of price action and informed trading decisions.

⚠️ DISCLAIMER⚠️

This indicator utilizes a parabolic curve fitting approach to visualize potential support and resistance levels. The mathematical formulas employed have been designed with adaptability and scalability in mind, aiming to accommodate various assets and price ranges. While the resulting curves may visually resemble parabolas, it's important to note that they might not strictly adhere to the precise mathematical definition of a parabola.

The indicator's calculations have been tested and generally produce reliable results. However, no guarantees are made regarding their absolute mathematical accuracy. Traders are encouraged to use this tool as part of their broader analysis and decision-making process, combining it with other technical indicators and market context.

Please remember that trading involves inherent risks, and past performance is not indicative of future results. It is always advisable to conduct your own research and exercise prudent risk management before making any trading decisions.

🧠 BEYOND THE CODE 🧠

The Parabolic Grid Bot, like the other grid bots in this series, is designed with education and community collaboration in mind. Its open-source nature encourages exploration, experimentation, and the development of new grid trading strategies. We hope this indicator serves as a framework and a starting point for future innovations in the field of grid trading.

Your comments, suggestions, and discussions are invaluable in shaping the future of this project. We welcome your feedback and look forward to seeing how you utilize and enhance the Parabolic Grid Bot.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

USDT(ERC20):0x89c1ada92d53e88a06131a28693fd46101bdbecb

LTC:LWx9nAqbfZcWB5GBxUuBEpdBCFyVAmSFjm

ETH(ERC20):0x89c1ada92d53e88a06131a28693fd46101bdbecb

BTC:113pXq5Lxdp3UUgTpRng24sxX7YRE9dR61p

LTC:LWx9nAqbfZcWB5GBxUuBEpdBCFyVAmSFjm

ETH(ERC20):0x89c1ada92d53e88a06131a28693fd46101bdbecb

BTC:113pXq5Lxdp3UUgTpRng24sxX7YRE9dR61p

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.