PROTECTED SOURCE SCRIPT

Liquidation Levels v2 [LG]

Updated

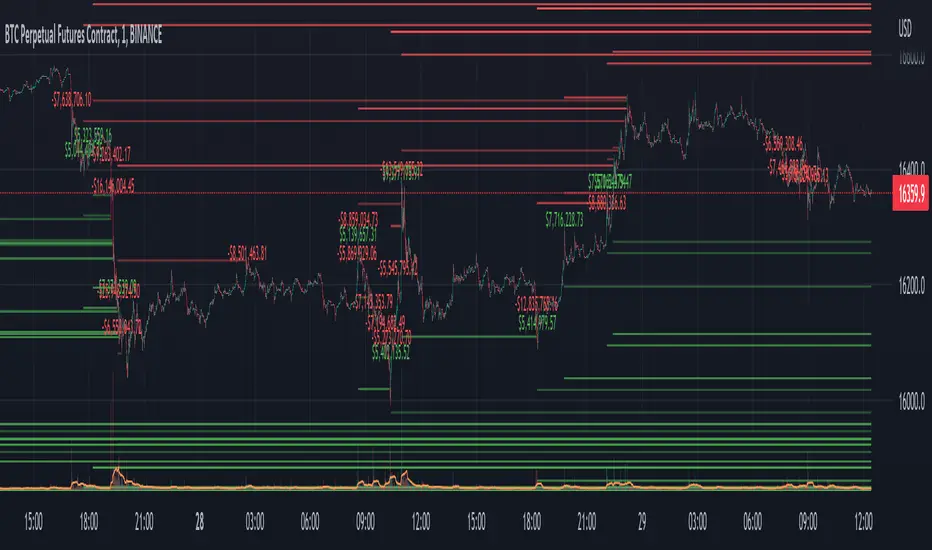

The main premise of this indicator is to identify when large cryptocurrency futures positions are opened, and then plot the liquidation levels of those positions. Market makers know this data and tend to push price towards these levels, as there is guaranteed liquidity at or approaching those levels.

Remember, we want to buy when others are forced to sell, not when they want to sell, and vice versa. Whales want to position, but need to do so in areas of larger liquidity, as they want to minimize slippage and detection as much as possible.

This indicator is very useful during times of chop, when the market is taking liquidity anywhere it exists as whales are forcing retail players out of their positions.

This indicator will also plot where positions with a total value in excess of the user-defined threshold are opened or closed, so you are able to better gauge how market participants are reacting to price levels.

Commonly used leverage levels are 100x, 50x, and 25x, but can be adjusted by the user depending on what they are noticing is attracting price levels.

This indicator is recommended for use on the 1 minute chart of the Binance BTCUSD perpetual contract pair. This will allow for as much precision as possible for the majority of users. Note: The only supported coin at this point is BTC - other coins to follow soon.

SUMMARY

1) View liquidation levels of large positions opened

2) View exact moments where large positions are opened or closed

3) Gauge available liquidity to upside or downside to better assist in determining longer term reversal points

COMING SOON

1) Additional coins

2) VPVR inspired vertical histogram or other visualization tool summarizing total available liquidity at specific price level

3) Total delta of available long and short liquidity

4) Push notifications when price takes liquidity

5) Requests as outlined in the comments

This indicator was inspired by the Hyblock Capital liquidation levels and offers an improvement upon the popular existing Liquidation Levels indicator by mlapplications.

Remember, we want to buy when others are forced to sell, not when they want to sell, and vice versa. Whales want to position, but need to do so in areas of larger liquidity, as they want to minimize slippage and detection as much as possible.

This indicator is very useful during times of chop, when the market is taking liquidity anywhere it exists as whales are forcing retail players out of their positions.

This indicator will also plot where positions with a total value in excess of the user-defined threshold are opened or closed, so you are able to better gauge how market participants are reacting to price levels.

Commonly used leverage levels are 100x, 50x, and 25x, but can be adjusted by the user depending on what they are noticing is attracting price levels.

This indicator is recommended for use on the 1 minute chart of the Binance BTCUSD perpetual contract pair. This will allow for as much precision as possible for the majority of users. Note: The only supported coin at this point is BTC - other coins to follow soon.

SUMMARY

1) View liquidation levels of large positions opened

2) View exact moments where large positions are opened or closed

3) Gauge available liquidity to upside or downside to better assist in determining longer term reversal points

COMING SOON

1) Additional coins

2) VPVR inspired vertical histogram or other visualization tool summarizing total available liquidity at specific price level

3) Total delta of available long and short liquidity

4) Push notifications when price takes liquidity

5) Requests as outlined in the comments

This indicator was inspired by the Hyblock Capital liquidation levels and offers an improvement upon the popular existing Liquidation Levels indicator by mlapplications.

Release Notes

Performance updatesRelease Notes

SUNSETTING - Locking position liquidation values at 5m USD for BTCUSD pairs only - Indicator will remain up and functional, but future upgraded versions will continue to be optimized elsewhere. Please DM for full access.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.