INVITE-ONLY SCRIPT

Live Mini Terminal 4 : G10 Developed Countries Change Data

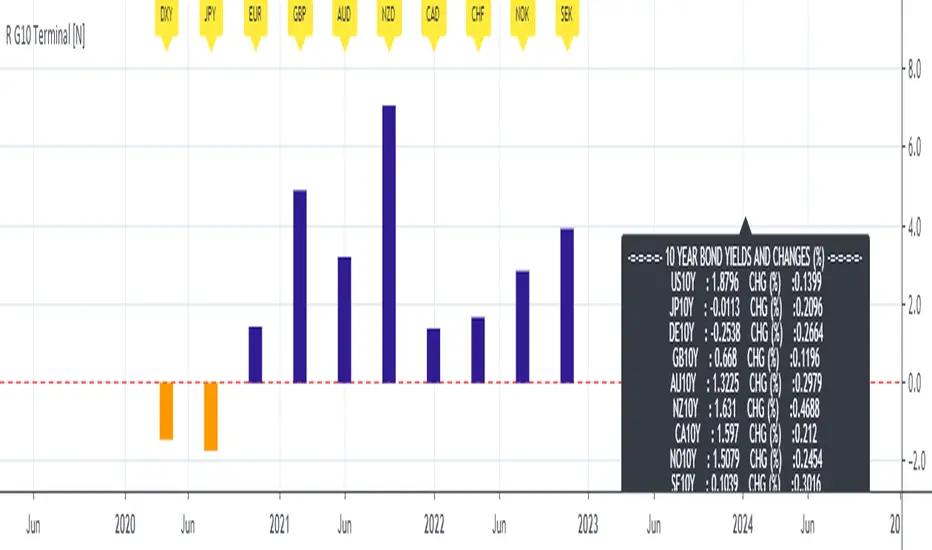

This script displays relative data changes occurring in the adjustable period and/or adaptive automatic period in G10 Developed Countries against U.S Dollar.

Concept and design were inspired by the data terminals used by commercial traders.

Period selection can be set in the menu.

This script uses the adaptive period algorithm used by Autonomous LSTM and Relativity scripts.

Or you can set the period manually from the menu.

For more information about adaptive period:

![Autonomous LSTM [Noldo]](https://s3.tradingview.com/e/ExPy48mQ_mid.png)

This script works only for 1 day (1D) and 1 week (1W) time frames.

The most efficient time frame is 1 week (1W) because of countries' different time-zones .

Features

INSTRUMENTS

Info Panel

NOTES :

* Germany was chosen because it had the most dominant and decisive economy for the Euro Zone.

* Swiss interests are generally not considered as they are minus and close to 0.

Info Panel List

USAGE

The script can be used as an indicator by putting it under the chart as shown above.

It is necessary to enlarge to see clearly.

Since it is not often looked at,

such use is the best method for healthy interpretation.

Concept and design were inspired by the data terminals used by commercial traders.

Period selection can be set in the menu.

This script uses the adaptive period algorithm used by Autonomous LSTM and Relativity scripts.

Or you can set the period manually from the menu.

For more information about adaptive period:

![Autonomous LSTM [Noldo]](https://s3.tradingview.com/e/ExPy48mQ_mid.png)

This script works only for 1 day (1D) and 1 week (1W) time frames.

The most efficient time frame is 1 week (1W) because of countries' different time-zones .

Features

- Value changes on a percentage basis (%)

- 10-year government bond yields of the countries are given in the information panel.

- In the information panel, the percentage values of the 10-year interest rates of the countries according to the adaptive period or the standard adjustable period are given.

INSTRUMENTS

- DXY : U.S Dollar Index

- JPY : Japanese Yen

- EUR : Euro

- GBP : British Pound

- AUD : Australian Dollar

- NZD : New Zealand Dollar

- CAD : Canadian Dollar

- CHF : Swiss Franc

- NOK : Norwegian Krone

- SEK : Swedish Krona

Info Panel

NOTES :

* Germany was chosen because it had the most dominant and decisive economy for the Euro Zone.

* Swiss interests are generally not considered as they are minus and close to 0.

Info Panel List

- US10Y : US Government Bonds 10 Year Yield (%) and percentage change over the specified period.

- JP10Y : Japan Government Bonds 10 Year Yield (%) and percentage change over the specified period.

- DE10Y : German Government Bonds 10 Year Yield (%) and percentage change over the specified period.

- GB10Y : UK Government Bonds 10 Year Yield (%) and percentage change over the specified period.

- AU10Y : Australia Government Bonds 10 Year Yield (%) and percentage change over the specified period.

- NZ10Y : New Zealand Government Bonds 10 Year Yield (%) and percentage change over the specified period.

- CA10Y : Canadian Government Bonds 10 Year Yield (%) and percentage change over the specified period.

- NO10Y : Norway Government Bonds 10 Year Yield (%) and percentage change over the specified period.

- SE10Y : Sweden Government Bonds 10 Year Yield (%) and percentage change over the specified period.

USAGE

The script can be used as an indicator by putting it under the chart as shown above.

It is necessary to enlarge to see clearly.

Since it is not often looked at,

such use is the best method for healthy interpretation.

Invite-only script

Access to this script is restricted to users authorized by the author and usually requires payment. You can add it to your favorites, but you will only be able to use it after requesting permission and obtaining it from its author. Contact Noldo for more information, or follow the author's instructions below.

TradingView does not suggest paying for a script and using it unless you 100% trust its author and understand how the script works. In many cases, you can find a good open-source alternative for free in our Community Scripts.

Want to use this script on a chart?

Warning: please read before requesting access.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.