OPEN-SOURCE SCRIPT

MA_FibBand_MTF

Updated

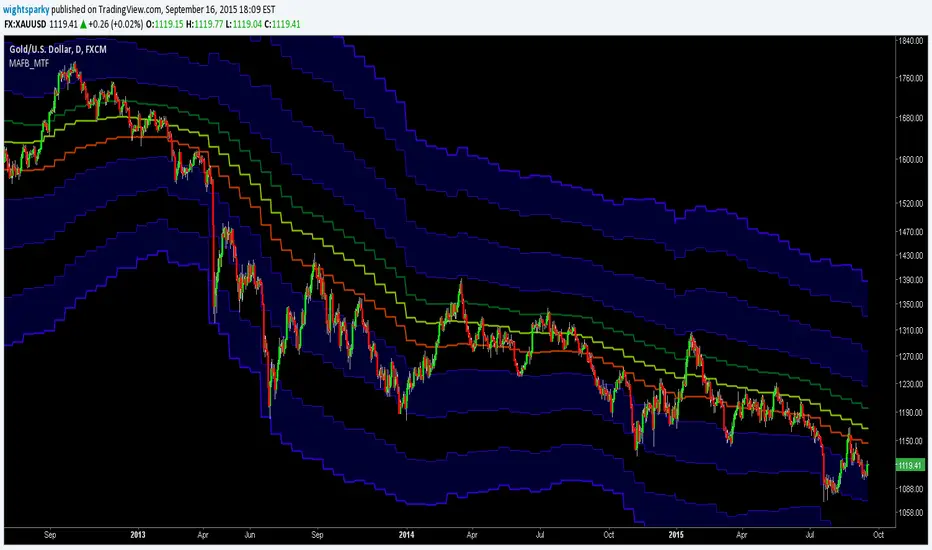

Moving average of High, Low & Close with Fibonacci bands calculated from the average high and low. Four upper levels are to the power of 1.618, 2.618, 3.618 & 4.618. Four lower levels are to the power of 0.618, 1.618, 2.618 & 3.618. Included are a choice of time frames either current, semi-custom or fully custom allowing freedom to set any period you like which makes it great for historical averages. Adapted and expanded from Clarke Moody's MA_MTF i have tidied the script and included all CM's formulas although should be used in SMA or EMA i kept the other MA formulas for curiosity.

My preferred usage is to stick with 20ma and adjust the legnth of the period. Shown here is 20ema of 10day period.

More information can be learnt from 'endlessmountain' on youtube but only the very top and bottom levels are used with the High, Low & Close. Also i am not aware if this originates from any other source.

Thankyou to Clarke Moody and endlessmountain. Hope you like this tool.

My preferred usage is to stick with 20ma and adjust the legnth of the period. Shown here is 20ema of 10day period.

More information can be learnt from 'endlessmountain' on youtube but only the very top and bottom levels are used with the High, Low & Close. Also i am not aware if this originates from any other source.

Thankyou to Clarke Moody and endlessmountain. Hope you like this tool.

Release Notes

Moving average of High, Low & Close with Fibonacci bands calculated from the average high and low. Upper and lower levels are to the power of Fibonacci percentages. Included are a choice of time frames either current, semi-custom or fully custom allowing freedom to set any period you like which makes it great for historical averages. Hope you like this tool.Update: With interest gaining from the community i have decided to publish what is in my opinion a better version.

Upper and lower levels are now multiplications of 1.272 (square root of 1.618). See script for the percentages.

High and low shaded bands shows the average candle to wick range.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.