OPEN-SOURCE SCRIPT

Arms Index TRIN [DM]

Updated

Hello colleagues""

Here I share today Arms Index!!!

-Avalilables settings and options:

- Switcheable Index NASDAQ and S&P

- Switcheable Alerts "crossover, crossunder, change and main ones"

-Fill Color Customizables

-Signal Color Customizables

-Signal Smooth Customizable

Enjoy!!!

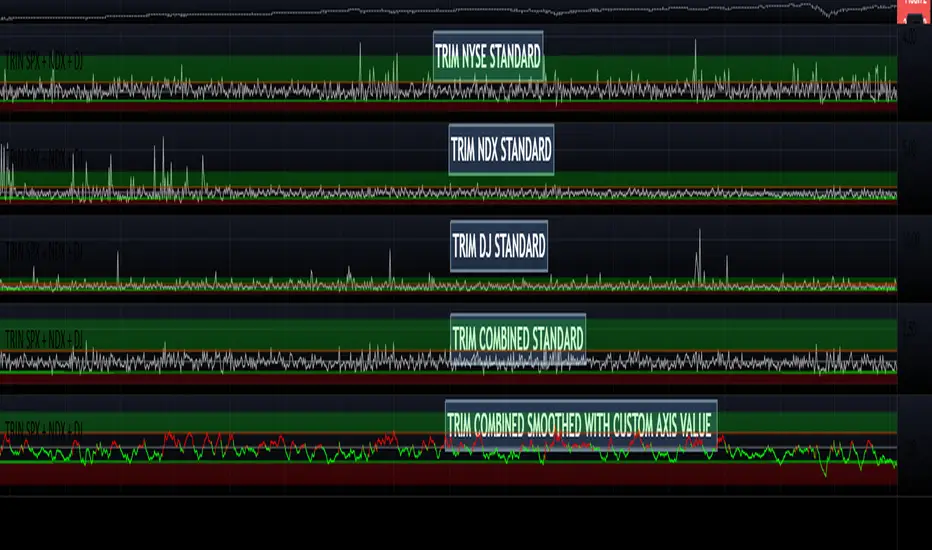

Arms Index (TRIN)

The Arms Index (TRIN) is a market breadth oscillator that was developed by Richard Arms. It is also known as the Trading Index, hence the abbreviation TRIN. It relates advancing and declining stocks to their respective volume flows by dividing the Advance/Decline Ratio by the volume ratio. When it rises the market is said to be weak and vice versa. The value 1 is key and crossing it generates a signal. A value above 1 indicates declining stocks have the upperhand in the volume flow and vice versa. The indicator can be used to spot overbought and oversold situations and is best used in combination with other analysis techniques.

Here I share today Arms Index!!!

-Avalilables settings and options:

- Switcheable Index NASDAQ and S&P

- Switcheable Alerts "crossover, crossunder, change and main ones"

-Fill Color Customizables

-Signal Color Customizables

-Signal Smooth Customizable

Enjoy!!!

Arms Index (TRIN)

The Arms Index (TRIN) is a market breadth oscillator that was developed by Richard Arms. It is also known as the Trading Index, hence the abbreviation TRIN. It relates advancing and declining stocks to their respective volume flows by dividing the Advance/Decline Ratio by the volume ratio. When it rises the market is said to be weak and vice versa. The value 1 is key and crossing it generates a signal. A value above 1 indicates declining stocks have the upperhand in the volume flow and vice versa. The indicator can be used to spot overbought and oversold situations and is best used in combination with other analysis techniques.

Release Notes

Minor changesRelease Notes

Change Title (Fix error advancing and declining main sources it's from NYSE New York Stock Exchange)

Added DJ Advancing and declining Values

Added combine function

Note: for smooth signals recommend set the axis with the following values +-

*1'5 upper line for fill oversell zone

*1'2 upper oversell line "for oversell alert"

*1'0 axis line ==

*0'8 lower line overbought "for overbought alert"

*0'5 lower line for fill overbought zone

Release Notes

Fix signal colorAdd axis tooltips notes

Release Notes

Minor changesRelease Notes

Added ability to toggle signal between columns and lines Added background color when signal cross ob os lines

Release Notes

Adder Comparaison TickerAmlifier signals *100 and *5000

Fix some notes

Fix Toggle alerts

Release Notes

Minor changesNew visual options =

https://www.tradingview.com/x/xrhNPPzp/

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.