INVITE-ONLY SCRIPT

MAutoFloorCeiling

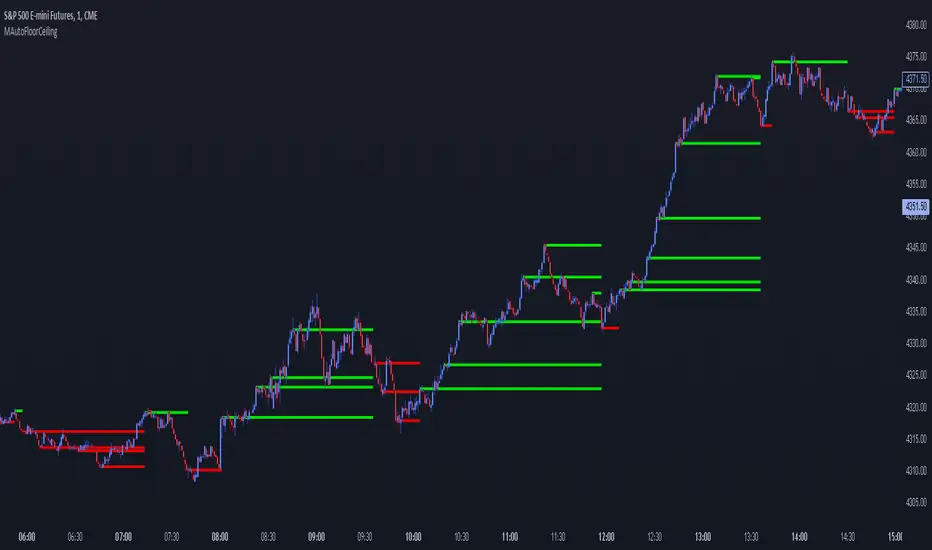

* MAutoFloorCeiling Indicator *

The MAutoFloorCeiling indicator is a powerful algorithm utilizing Wyckoffian concepts of Supply, Demand, and Volume Climaxes to determine and draw Support / Resistance levels automatically. It is the culmination of over 2 years of research. Drawing Support / Resistance lines automatically is a tremendous benefit to the trader as this provides structure to price and exposes market movement as well as which areas price is likely to respect or break out of.

* WHAT THE SCRIPT DOES *

The MAutoFloorCeiling algorithm draws Floor and Ceiling lines automatically. The price points at which these lines are drawn at are areas of increasing Supply, Demand, or Volume Climax respective to their Price Levels. Areas of Volume Climaxes are often respected by price, since price tends to return to them or break out of them, and hence form powerful Support / Resistance levels.

* HOW TO USE IT *

Floor and Ceiling lines correspond to Support and Resistance lines. When a line is draw consider the following questions

Is it a top / bottom?

Is it support / resistance?

Is it a breakout / breakdown?

Is it a pullback?

* HOW IT WORKS *

1. There are 2 types of lines: Floors and Ceilings

2. A Floor Line is drawn when there is a "Selling Volume Bias" (Volume Climaxes on downward price movement)

More Floor Lines get drawn if market continues to go lower combined with a "Selling Volume Bias"

3. A ceiling line is drawn when there is a "Buying Volume Bias" (Volume Climaxes on upward price movement)

More ceiling lines get drawn if market continues to go higher combined with a "Buying Volume Bias"

4. There is a 1 bar delay to confirm the creation of a new floor / ceiling line.

Once the new floor / ceiling is created, it draws forward with no delay.

* EXAMPLE AND USE CASES *

MAutoFloorCeiling draws lines that can be used as effective Support / Resistance Levels, Breakout Lines, and Pullback areas. Studying the Volume at these levels can provide insight as to where price is likely to go.

You can scan for Trend Like behavior such as

More Demand on Higher High = Increase in Volume on a Higher Ceiling

More Supply on Lower Low = Increase in Volume on a Lower Floor

You can scan for divergences such as

Less Demand on Higher High = Lower volume on a Higher Ceiling

Less Supply on on Lower Low = Lower volume on a Lower Floor

Pullbacks

A lower ceiling is representative of a pullback when price is going down.

A higher floor is representative of a pullback when price is going up.

You can inspect instances where the thrust of price is shortened, which means the distance between Ceiling or Floor lines becomes less as price struggles to continue in the direction it was moving. Or conversely the thrust of price as shown by the Floor / Ceiling lines can expand, which is indicative of a trend forming.

* AUTHOR *

This script is published by MBoxWave LLC

The MAutoFloorCeiling indicator is a powerful algorithm utilizing Wyckoffian concepts of Supply, Demand, and Volume Climaxes to determine and draw Support / Resistance levels automatically. It is the culmination of over 2 years of research. Drawing Support / Resistance lines automatically is a tremendous benefit to the trader as this provides structure to price and exposes market movement as well as which areas price is likely to respect or break out of.

* WHAT THE SCRIPT DOES *

The MAutoFloorCeiling algorithm draws Floor and Ceiling lines automatically. The price points at which these lines are drawn at are areas of increasing Supply, Demand, or Volume Climax respective to their Price Levels. Areas of Volume Climaxes are often respected by price, since price tends to return to them or break out of them, and hence form powerful Support / Resistance levels.

* HOW TO USE IT *

Floor and Ceiling lines correspond to Support and Resistance lines. When a line is draw consider the following questions

Is it a top / bottom?

Is it support / resistance?

Is it a breakout / breakdown?

Is it a pullback?

* HOW IT WORKS *

1. There are 2 types of lines: Floors and Ceilings

2. A Floor Line is drawn when there is a "Selling Volume Bias" (Volume Climaxes on downward price movement)

More Floor Lines get drawn if market continues to go lower combined with a "Selling Volume Bias"

3. A ceiling line is drawn when there is a "Buying Volume Bias" (Volume Climaxes on upward price movement)

More ceiling lines get drawn if market continues to go higher combined with a "Buying Volume Bias"

4. There is a 1 bar delay to confirm the creation of a new floor / ceiling line.

Once the new floor / ceiling is created, it draws forward with no delay.

* EXAMPLE AND USE CASES *

MAutoFloorCeiling draws lines that can be used as effective Support / Resistance Levels, Breakout Lines, and Pullback areas. Studying the Volume at these levels can provide insight as to where price is likely to go.

You can scan for Trend Like behavior such as

More Demand on Higher High = Increase in Volume on a Higher Ceiling

More Supply on Lower Low = Increase in Volume on a Lower Floor

You can scan for divergences such as

Less Demand on Higher High = Lower volume on a Higher Ceiling

Less Supply on on Lower Low = Lower volume on a Lower Floor

Pullbacks

A lower ceiling is representative of a pullback when price is going down.

A higher floor is representative of a pullback when price is going up.

You can inspect instances where the thrust of price is shortened, which means the distance between Ceiling or Floor lines becomes less as price struggles to continue in the direction it was moving. Or conversely the thrust of price as shown by the Floor / Ceiling lines can expand, which is indicative of a trend forming.

* AUTHOR *

This script is published by MBoxWave LLC

Invite-only script

Access to this script is restricted to users authorized by the author and usually requires payment. You can add it to your favorites, but you will only be able to use it after requesting permission and obtaining it from its author. Contact mboxwave for more information, or follow the author's instructions below.

TradingView does not suggest paying for a script and using it unless you 100% trust its author and understand how the script works. In many cases, you can find a good open-source alternative for free in our Community Scripts.

Author's instructions

″Purchase / Additional information about MBoxWave TradingView Indicators on this page

https://mboxwave.com/tradingview

Get in contact with me via the contact form

https://mboxwave.com/contact-form

Want to use this script on a chart?

Warning: please read before requesting access.

Purchase / Additional information about MBoxWave TradingView Indicators on this page

mboxwave.com/tradingview

Get in contact with me via the contact form

mboxwave.com/contact-form

mboxwave.com/tradingview

Get in contact with me via the contact form

mboxwave.com/contact-form

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.