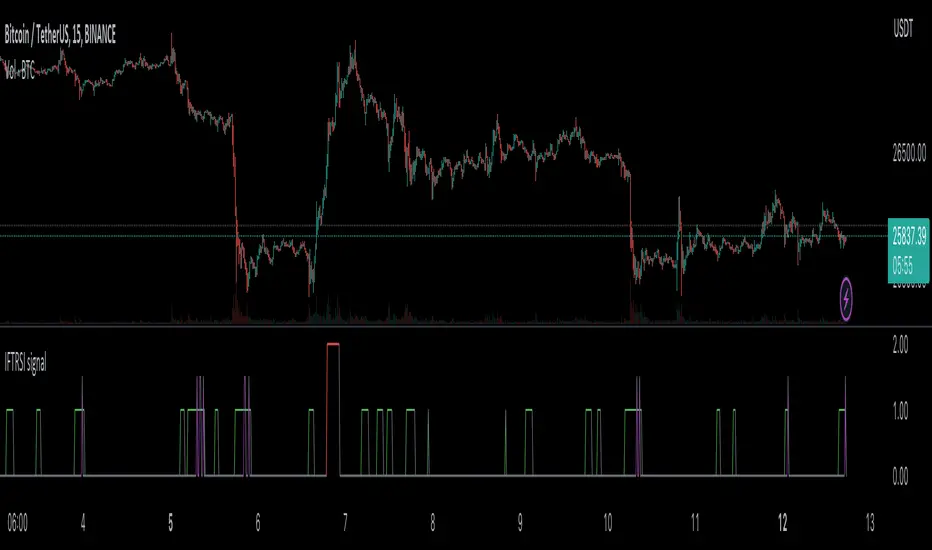

OPEN-SOURCE SCRIPT

Inverse Fisher Transform on RSI for backtest w/alerts

Updated

This version of the Inverse Fisher Transform on RSI comes with support for

1) Backtesting with Gavin's backtest script

2) Bypass, you can use another indicator to pause buy signals from this indicator. Just create another indicator that plots "1" whenever you want to activate the bypass on the IFTRSI signal.

3) Independent buy and sell level thresholds. Some tokens perform better with a higher sell level, even levels as high as 0.996, sometimes the buy level can also be relaxed to even 0.6 and get incredible results on the 5 minute chart.

4) alerts for Buy and Sell signals

Make sure you add Gavin's backtest and select external signal and this indicator as the source.

1) Backtesting with Gavin's backtest script

2) Bypass, you can use another indicator to pause buy signals from this indicator. Just create another indicator that plots "1" whenever you want to activate the bypass on the IFTRSI signal.

3) Independent buy and sell level thresholds. Some tokens perform better with a higher sell level, even levels as high as 0.996, sometimes the buy level can also be relaxed to even 0.6 and get incredible results on the 5 minute chart.

4) alerts for Buy and Sell signals

Make sure you add Gavin's backtest and select external signal and this indicator as the source.

Release Notes

remove unneeded codeRelease Notes

- built in QFL bypass - External bypass can work in conjunction with built in QFL bypass

- Support for second buy level. This is very useful, you can decide you want to enter a deal at -0.6 and then only fire another buy if the buy level reaches -0.99 and then take a more conservative second deal. This could be used as a way to average down using a second deal that got more oversold than the first one.

Release Notes

Now you can specify separated sell levels for when TV technical rating is buy or sell. This is pretty useful to

1) sell sooner when the market conditions are bearish. This can help reduce the size of losses

2) sell later when the market conditions are bullish. This can help increase the profits of wins.

Try different TV timeframes. 15 minutes gave me good results.

Some example of Sell levels:

0.999 and above will sell almost never

0.99 to 0.996 is a bit more frequent and sooner

0 and 0.5 will sell very often, maybe too often

Release Notes

repaint issue fixRelease Notes

color coded signalsRelease Notes

- Now support for TV technical rating based BUY and SELL levels.- Removed support for the second buy level as the TV technical rating seems to be a better option. This also helped making the code a bit more readable.

- Min candle age setting now also applies to TV rating levels

- Buy on reversal now also applies to TV rating BUY levels.

Release Notes

This version introduces a normalized volatility range filter.Pretty cool for those tokens with too much or too little volatility.

Decide when to enter by setting a min and max volatility.

Example:

- trade high volatile conditions with min 70 to max 100

- trade breakouts from low volatility conditions using 0 to 30

- trade moderate...you get the idea!

Release Notes

backtest "signal" typo fixedRelease Notes

- Upgraded to pine script 5- Added "new signal" which waits for extra confirmation than the original signal.

- Alerts now use the function "alert" so no more need to set 2 separated alerts for buy/sell.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Join our membership to gain access to the private scripts.

thetradingparrot.com

thetradingparrot.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.