Options Screener [Pro] - IVRank, IVx, Deltas, Exp.move, Skew

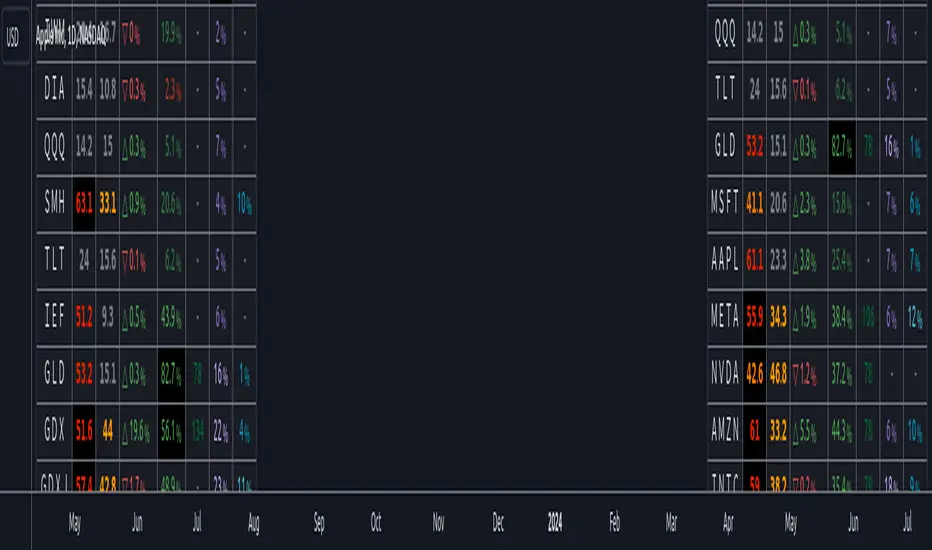

𝗢𝗽𝘁𝗶𝗼𝗻 𝘀𝗰𝗿𝗲𝗲𝗻𝗲𝗿 𝗼𝗻 𝗧𝗿𝗮𝗱𝗶𝗻𝗴𝗩𝗶𝗲𝘄 𝘄𝗶𝘁𝗵 𝗿𝗲𝗮𝗹 𝗱𝗮𝘁𝗮, 𝗮𝘃𝗮𝗶𝗹𝗮𝗯𝗹𝗲 𝗳𝗼𝗿 𝗼𝘃𝗲𝗿 𝟭𝟱𝟬+ 𝗹𝗶𝗾𝘂𝗶𝗱 𝗨𝗦 𝗺𝗮𝗿𝗸𝗲𝘁 𝘀𝘆𝗺𝗯𝗼𝗹𝘀!

𝗢𝘂𝗿 𝘀𝗰𝗿𝗲𝗲𝗻𝗲𝗿 𝗽𝗿𝗼𝘃𝗶𝗱𝗲𝘀 𝗲𝘀𝘀𝗲𝗻𝘁𝗶𝗮𝗹 𝗸𝗲𝘆 𝗺𝗲𝘁𝗿𝗶𝗰𝘀 𝘀𝘂𝗰𝗵 𝗮𝘀:

✅ IVRank

✅ IVx

✅ 5-Day IVx Change

✅ Vertical Pricing Skew

✅ Horizontal IVx Skew

✅ Delta Skew

like TastyTrade, TOS, IBKR etc.

Designed to help you assess option market conditions and make well-informed trading decisions, this tool is an essential addition for every serious options trader!

Ticker Information:

This screener is currently implemented for more than 150 liquid US market tickers and we are continuously expanding the list:

AMZN

AMZN How does the screener work and why is it unique?

This Pine Script screener is an expert tool created to provide various option metrics and visualization tools for options market traders. The screener extracts raw options data from an external data provider (ORATS), processes, and refines the delayed data package using pineseed, and sends it to TradingView. The data is calculated using specific formulas or interpolated values, such as delta distances. This method of integrating options data into a screener framework is unique and innovative on TradingView.

The screener aims to offer a comprehensive view of the current state of options for the implemented instruments, including implied volatility index (IVx), IV rank (IVR), options skew, and expected market movements, which are objectively measured as detailed below.

The options metrics displayed may be familiar to options traders from various major brokerage platforms such as TastyTrade, IBKR, TOS, Tradier, TD Ameritrade, Schwab, etc.

🟨 𝗗𝗘𝗧𝗔𝗜𝗟𝗘𝗗 𝗗𝗢𝗖𝗨𝗠𝗘𝗡𝗧𝗔𝗧𝗜𝗢𝗡 🟨

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

🔶 Auto-Updating Option Metrics

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

🔹 IVR (IV Rank)

The Implied Volatility Rank (IVR) indicator helps options traders assess the current level of implied volatility (IV) in comparison to the past 52 weeks. IVR is a useful metric to determine whether options are relatively cheap or expensive. This can guide traders on whether to buy or sell options. We calculate IVrank, like TastyTrade does.

IVR Calculation: IV Rank = (current IV - 52 week IV low) / (52 week IV high - 52 week IV low)

IVR Levels and Interpretations:

- IVR 0-10 (Green): Very low implied volatility rank. Options might be "cheap," potentially a good time to buy options.

- IVR 10-35 (White): Normal implied volatility rank. Options pricing is relatively standard.

- IVR 35-50 (Orange): Almost high implied volatility rank.

- IVR 50-75 (Red): Definitely high implied volatility rank. Options might be "expensive," potentially a good time to sell options for higher premiums.

- IVR above 75 (Highlighted Red): Ultra high implied volatility rank. Indicates very high levels, suggesting a favorable time for selling options.

Extra: If the IVx value is also greater than 30, the background will be dark highlighted, because a high IVR alone doesn’t mean much without high IVx.

🔹IVx (Implied Volatility Index)

The Implied Volatility Index (IVx) displayed in the option chain is calculated similarly to the VIX. The Cboe employs standard and weekly SPX options to measure the expected volatility of the S&P 500. A similar method is utilized to calculate IVx for each option expiration cycle.

For our purposes, we aggregate the IVx values specifically for the 35-70 day monthly expiration cycle. This aggregated value is then presented in the screener and info panel, providing a clear and concise measure of implied volatility over this period.

We will display a warning if the option chain is heavily skewed and valid, symmetric 16 delta options are not found at optimal monthly expirations.

IVx Color coding:

- IVx above 30 is displayed in orange.

- IVx above 60 is displayed in red

Important Note: The IVx value alone does not provide sufficient context. There are stocks that inherently exhibit high IVx values. Therefore, it is crucial to consider IVx in conjunction with the Implied Volatility Rank (IVR), which measures the IVx relative to its own historical values. This combined view helps in accurately assessing the significance of the IVx in relation to the specific stock's typical volatility behavior.

This indicator offers traders a comprehensive view of implied volatility, assisting them in making informed decisions by highlighting both the absolute and relative volatility measures.

🔹IVx 5 days change %

We are displaying the five-day change of the IV Index (IVx value). The IV Index 5-Day Change column provides quick insight into recent expansions or decreases in implied volatility over the last five trading days.

Traders who expect the value of options to decrease might view a decrease in IVX as a positive signal. Strategies such as Strangle and Ratio Spread can benefit from this decrease.

On the other hand, traders anticipating further increases in IVX will focus on the rising IVX values. Strategies like Calendar Spread or Diagonal Spread can take advantage of increasing implied volatility.

This indicator helps traders quickly assess changes in implied volatility, enabling them to make informed decisions based on their trading strategies and market expectations.

🔹 Vertical Pricing Skew

At TanukiTrade, Vertical Pricing Skew refers to the difference in pricing between put and call options with the same expiration date at the same distance (at expected move). We analyze this skew to understand market sentiment. This is the same formula used by TastyTrade for calculations.

- PUT Skew (red): Put options are more expensive than call options, indicating the market expects a downward move (▽). If put options are more expensive by more than 20% at the same expected move distance, we color it lighter red.

- CALL Skew (green): Call options are more expensive than put options, indicating the market expects an upward move (△). If call options are priced more than 30% higher at the examined expiration, we color it lighter green.

We focus on options with 35-70 days to expiration (DTE) for optimal analysis. We always evaluate the skew at the expected move using linear interpolation to determine the theoretical pricing of options. If the pricing have more than C50%/P35% we are highlighting the cell.

This approach helps us gauge market expectations accurately, providing insights into potential price movements.

🔹 Horizontal IVx Skew

In options pricing, it is typically expected that the implied volatility (IVx) increases for options with later expiration dates. This means that options further out in time are generally more expensive. At TanukiTrade, we refer to the phenomenon where this expectation is reversed—when the IVx decreases between two consecutive expirations—as Horizontal Skew or IVx Skew.

Horizontal IVx Skew occurs when: Front Month IVx < Back Month IVx

This scenario can create opportunities for traders who prefer diagonal or calendar strategies. Based on our experience, we categorize Horizontal Skew into two types:

Weekly Horizontal Skew: When IVx skew is observed between two consecutive non-monthly expirations, the displayed value is the rounded-up percentage difference. On hover, the approximate location of this skew is also displayed. The precise location can be seen on the Overlay indicator.

Monthly Horizontal Skew: When IVx skew is observed between two consecutive monthly expirations, the displayed value is the rounded-up percentage difference. On hover, the approximate location of this skew is also displayed. The precise location can be seen on the Overlay indicator.

The Monthly Vertical IVx skew is consistently stronger (more liquid) on average symbols than the weekly vertical IVx skew. Weekly Horizontal IVx Skew may not carry relevant information for symbols not included in the 'Weeklies & Volume Masters' preset.

If the options chain follows the normal IVx pattern, no skew value is displayed.

Additionally, if the Implied Volatility Rank (IVR) is low (indicated by green), the Horizontal Skew background turns black, because this environment is good for Calendar+Diagonal.

Additionally, if the % of the skew is greater than 10, the Horizontal Skew font color turns lighter.

🔹 Delta Skew 🌪️ (Twist)

We have a metric that examines which monthly expiration indicates a "Delta Skew Twist" where the 16 delta deviates from the monthly STD. This is important because, under normal circumstances, the 16 delta is positioned between the expected move and the standard deviation (STD1) line. However, if the interpolated 16 delta line exceeds the STD1 line either upwards or downwards, it represents a special case of vertical skew.

Normal case : exp.move < delta16 < std1

Delta Skew Twist: exp.move < std1 < delta16

If the Days to Expiration of the twist is less than 75, we use a lighter color.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

🔶 HOW WE CALCULATE

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

🔹 Expected Move

The expected move is the predicted dollar change in the underlying stock's price by a given option's expiration date, with 68% certainty. It is calculated using the expiration's pricing and implied volatility levels.

[u]Expected Move Calculation

[/u]Expected Move = (ATM straddle price x 0.6) + (1st OTM strangle price x 0.3) + (2nd OTM strangle price x 0.1)

[u]For example[/u], if stock XYZ is trading at 121 and the ATM straddle is 4.40, the 120/122 strangle is 3.46, and the 119/123 strangle is 2.66, the expected move is calculated as follows: 4.40 x 0.60 = 2.64; 3.46 x 0.30 = 1.04; 2.66 x 0.10 = 0.27; Expected move = 2.64 + 1.04 + 0.27 = ±3.9

🔹 Standard deviation

One standard deviation of a stock encompasses approximately 68.2% of outcomes in a distribution of occurrences based on current implied volatility.

We use the expected move formula to calculate the one standard deviation range of a stock. This calculation is based on the days-to-expiration (DTE) of our option contract, the stock price, and the implied volatility of a stock:

[u]Calculation:[/u]

Standard Deviation = Closing Price * Implied Volatility * sqrt(Days to Expiration / 365)

According to options literature, there is a 68% probability that the underlying asset will fall within this one standard deviation range at expiration.

∑ Quant Observation: The values of the expected move and the 1st standard deviation (1STD) will not match because they use different calculation methods, even though both are referred to as representing 68% of the underlying asset's movement in options literature. The expected move is based on direct market pricing of ATM options. The 1STD, on the other hand, uses the averaged implied volatility (IVX) for the given expiration to determine its value. Based on our experience, it is better to consider the area between the expected move and the 1STD as the true representation of the original 68% rule.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

🔶 USAGE

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

🔹 Create a new empty layout for the screener!

You can access this from the dropdown menu in the upper right corner. In the popup window, name it as you like, for example, "Option Screener."

🔹 Hide the candlestick chart

Make the chart invisible using the "Hide" option from the three-dot dropdown menu located in the upper left corner.

🔹 Other Unwanted Elements

If other unnecessary elements are distracting you (e.g., economic data, volume, default grid), you can easily remove them from the layout. Right-click on the empty chart area. Here, click on the gear (Settings) icon and remove everything from the "Events" tab, as well as from the "Trading" tab. Under the "Canvas" tab, it is recommended to set the "Grid lines" setting to "None."

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

🔶 Screener Settings

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Naturally, the font size and position can be easily adjusted.

Additionally, there are two basic usage modes: manual input or using the preset list.

🔹If you selected “Manual Below” in the preset dropdown, the tickers you chose from the dropdown (up to a maximum of 40) will be displayed. The panel name will be the one you specified.

🔹If you selected a pre-assembled list, the manually entered list will be ignored, and the preset list will be displayed. (In the future, we will expand the preset list based on your feedback!).

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

🔶 Best Practices for TanukiTrade Option Screener:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

🔹 Every Preset on a New Layout:

If you following the steps above, you easy can setup this screener in one window with one split layout:

🔹 Split Layout:

- Left Side: The underlying asset with our Options IV Overlay (IVR, Deltas, Expected Move, STD1, Skew visualized) along with the Enhanced Murrey Math Indicator and Option Expiry.

- Right Side: Searching for opportunities using our Options Screener.

Opportunities Search

🔹 Everything in One Layout + One Window:

This is the all-in-one view:

- The underlying asset with our Options IV Overlay (IVR, Deltas, Expected Move, STD1, Skew visualized)

- Enhanced Murrey Math Indicator and Option Expiry

- Options Screener on the left

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

🔶 ADDITIONAL IMPORTANT COMMENTS

- U.S. market only:

Since we only deal with liquid option chains: this option indicator only works for the USA options market and do not include future contracts; we have implemented each selected symbol individually.

- Why is there a slight difference between the displayed data and my live brokerage data? There are two reasons for this, and one is beyond our control.

- Brokerage Calculation Differences:

Every brokerage has slight differences in how they calculate metrics like IV and IVx. If you open three windows for TOS, TastyTrade, and IBKR side by side, you will notice that the values are minimally different. We had to choose a standard, so we use the formulas and mathematical models described by TastyTrade when analyzing the options chain and drawing conclusions.

- Option-data update frequency:

According to TradingView's regulations and guidelines, we can update external data a maximum of 5 times per day. We strive to use these updates in the most optimal way:

(1st update) 15 minutes after U.S. market open

(2nd, 3rd, 4th updates) 1.5–3 hours during U.S. market open hours

(5th update) 10 minutes before market close.

You don’t need to refresh your window, our last refreshed data-pack is always automatically applied to your indicator, and you can see the time elapsed since the last update at the bottom of your indicator.

- Weekly illiquid expiries:

The Weekly Horizontal IVx Skew may not carry relevant information for instruments not included in the 'Weeklies & Volume Masters' preset package.

-Timeframe Issues:

Our option indicator visualizes relevant data on a daily resolution. If you see strange or incorrect data (e.g., when the options data was last updated), always switch to a daily (1D) timeframe. If you still see strange data, please contact us.

Disclaimer:

Our option indicator uses approximately 15min-3 hour delayed option market snapshot data to calculate the main option metrics. Exact realtime option contract prices are never displayed; only derived metrics and interpolated delta are shown to ensure accurate and consistent visualization. Due to the above, this indicator can only be used for decision support; exclusive decisions cannot be made based on this indicator. We reserve the right to make errors.This indicator is designed for options traders who understand what they are doing. It assumes that they are familiar with options and can make well-informed, independent decisions. We work with public data and are not a data provider; therefore, we do not bear any financial or other liability.

* some naming issues

* symbol preset enhancement

* Adding XXL size for Screener

* Based on your votes and feedback, we have expanded our list with the following 13 USA market tickers:

EEM: iShares MSCI Emerging Markets ETF

UNH: UnitedHealth Group Incorporated

SCHW: The Charles Schwab Corporation

PNC: The PNC Financial Services Group, Inc.

USB: U.S. Bancorp

AXP: American Express Company

HAL: Halliburton Company

TFC: Truist Financial Corporation

CLF: Cleveland-Cliffs Inc.

ENPH: Enphase Energy, Inc.

STX: Seagate Technology Holdings PLC

VRT: Vertiv Holdings Co

CMG: Chipotle Mexican Grill, Inc.

Now we have more than 160+ US market symbols in our Option Screener[Pro].

Thank you for your participation and valuable input!

Driven by our weekly Reddit community poll, the following symbols have been added to the TanukiTrade Options Screener indicator:

For now, we have 165 U.S. market symbols implemented in our watchlist: https://www.tradingview.com/watchlists/156511666/

🔶 NEW SUPPORTED SYMBOLS

Driven by the needs of our members, the following symbols have been added to the TanukiTrade Options Indicators:

New symbol updates will be arrive at monday market open if you've updated your script in tradingview.

🔶 New Symbols Supported:

We’ve added the following symbols to the indicator:

This brings the total number of supported symbols to over 175.

Full compatible list is here: https://www.tradingview.com/watchlists/156511666/

Enjoy the updates, and thank you for your continued feedback and support!

We’ve added the Magnificent 7 (“MAG7+FAANG”)—plus QQQ, which is driven by these seven major tech stocks—to the preset list. The MAG7&FAANG merged includes:

AAPL, AMZN, GOOG, META, MSFT, NVDA, TSLA, NFLX + QQQ as bonus

🟨 Preparing for GEX screening - Coming soon

We've prepared the script for recieving GEX data too, in the next script update (in~14 days) you will able to see that.

🔶𝗦𝘂𝗽𝗽𝗼𝗿𝘁𝗲𝗱 𝗦𝘆𝗺𝗯𝗼𝗹 𝗟𝗶𝘀𝘁 𝗠𝗼𝗱𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀

- XYZ → Formerly SQ Block, which changed its ticker from SQ to XYZ in January 2025.

- Added 9 new symbols: UVXY, VST, MBLY, ACHR, HUM, ANET, APP, NDX, and FSLR.

- Removed JWN due to inactivity (we don’t think it will be missed).

With these updates, we now support 186 liquid option symbols in the U.S. options market. You can save the current watchlist to TradingView a single click or download it as a CSV file:

tradingview.com/watchlists/156511666/

Starting today, these new symbols are available alongside the existing ones.

You can find the full list of symbols supported by our indicators here:

tradingview.com/watchlists/156511666/

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact TanukiTrade directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

Warning: please read our guide for invite-only scripts before requesting access.

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

Disclaimer

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact TanukiTrade directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

Warning: please read our guide for invite-only scripts before requesting access.

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com