PROTECTED SOURCE SCRIPT

🔮 Mayer Multiple w/ MA Selection by Cryptorhythms

Updated

🔮 Mayer Multiple w/ MA Selection by Cryptorhythms

Description

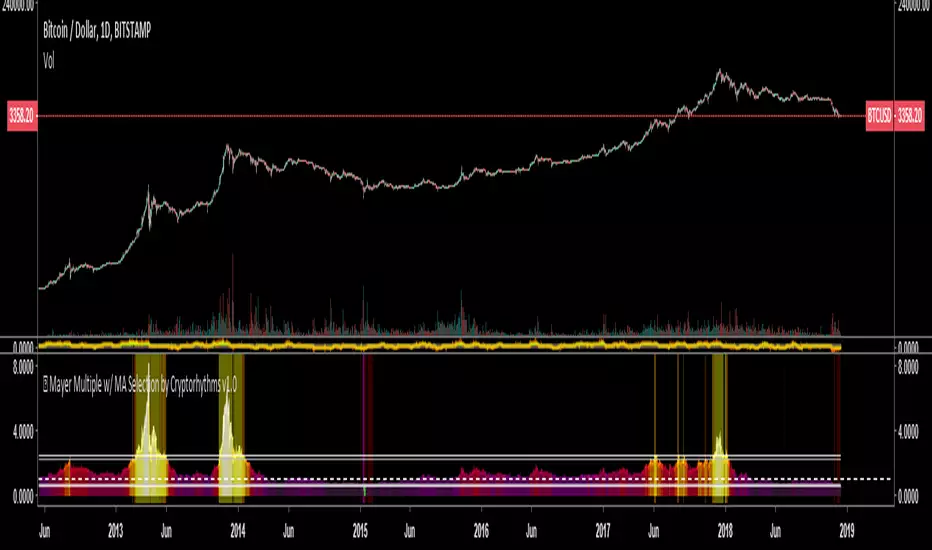

Introduced by Trace Mayer as a way to gauge the current price of Bitcoin against its long range historical price movements (200 day SMA by default), the Mayer Multiple highlights when Bitcoin is overbought or oversold in the context of longer time frames.

It`s worth noting as the market becomes larger and less volatile, the peaks are becoming less exaggerated. This is because a 200 day moving average baseline is a static yardstick against an ever growing, more stable, Bitcoin market. We should eventually recalibrate what constitutes the overbought/oversold extremes on this chart accordingly.

Additional Features

I added a heatmap based coloring and background highlighting of configurable overbought and oversold zones.

In my testing I observed anecdotal evidence that a value of >1 signaled bull market sentiment and a value of <1 signaled bear sentiment. So I added the dashed line at that value.

I also added secondary zones for experimentation on other timeframes or just plain tinkering.

Lastly I added the ability to substitute the SMA for a few different types of moving averages.

Default Settings

👍Enjoying this indicator or find it useful? Please give me a like and follow! I post crypto analysis, price action strategies and free indicators regularly.

💬Questions? Comments? Want to get access to an entire suite of proven trading indicators? Come visit us on telegram and chat, or just soak up some knowledge. We make timely posts about the market, news, and strategy everyday. Our community isnt open only to subscribers - everyone is welcome to join.

Description

Introduced by Trace Mayer as a way to gauge the current price of Bitcoin against its long range historical price movements (200 day SMA by default), the Mayer Multiple highlights when Bitcoin is overbought or oversold in the context of longer time frames.

It`s worth noting as the market becomes larger and less volatile, the peaks are becoming less exaggerated. This is because a 200 day moving average baseline is a static yardstick against an ever growing, more stable, Bitcoin market. We should eventually recalibrate what constitutes the overbought/oversold extremes on this chart accordingly.

Additional Features

I added a heatmap based coloring and background highlighting of configurable overbought and oversold zones.

In my testing I observed anecdotal evidence that a value of >1 signaled bull market sentiment and a value of <1 signaled bear sentiment. So I added the dashed line at that value.

I also added secondary zones for experimentation on other timeframes or just plain tinkering.

Lastly I added the ability to substitute the SMA for a few different types of moving averages.

Default Settings

- The defaults zones are > 2.4 is overvalued and < 0.5 is undervalued.

- Default timeframe is daily

- Default MA is SMA and default length is 200

- Suggested MA length for weekly chart is 28

👍Enjoying this indicator or find it useful? Please give me a like and follow! I post crypto analysis, price action strategies and free indicators regularly.

💬Questions? Comments? Want to get access to an entire suite of proven trading indicators? Come visit us on telegram and chat, or just soak up some knowledge. We make timely posts about the market, news, and strategy everyday. Our community isnt open only to subscribers - everyone is welcome to join.

Release Notes

Mayer Multiple will also work for other high volume coins with a long data history. - I used 12hr timeframe for LTC, and its currently in the buy zone...

- ETH also in buy zone

- For TRX with a relatively short data history I dropped down to 6 hour - no clear signals here yet

- ADA had even less data, so down to 4HR we go. No bottom here yet either:

- Seems to work nicely even on DOGE

- While it is not optimized by default settings for stocks it will work there too:

Even here with AMD where you dont get a clear sell signal, you can use crossing under the 1 value as a sell signal in that case. This will of course make you exit after the true top, but it will allow you to ride waves while still bullish. Vice versa is true, if the bottom doesnt signal but it crosses over 1 (but that could be a more risky buy signal).

Release Notes

Could be termed the "HODL" strategy since its signals are for the long term investor.Twitter - twitter.com/cryptorhythms

Cryptorhythms Group Chat - t.me/cryptorhythms

Cryptorhythms Group Chat - t.me/cryptorhythms

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.