INVITE-ONLY SCRIPT

(1) Genie Cycles VS-200

Updated

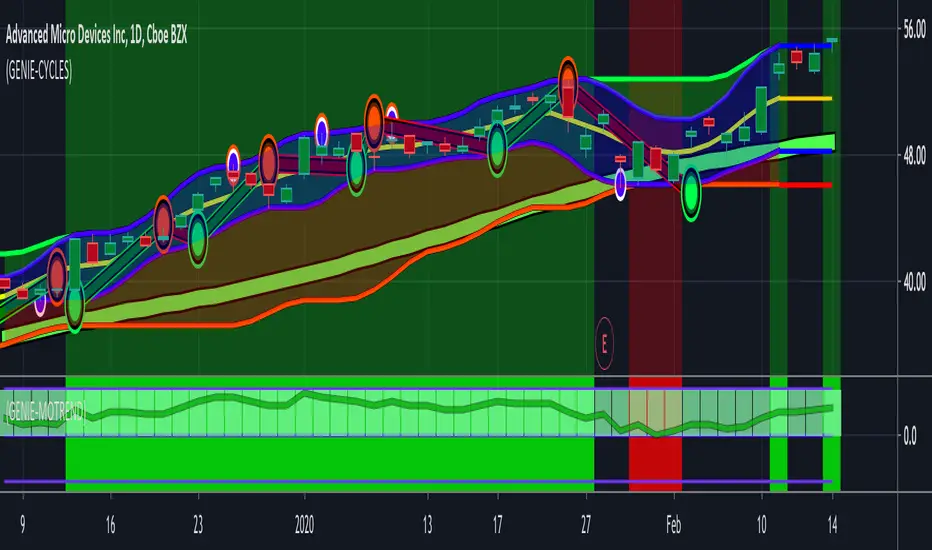

The Genie Cycles indicator contains two primary components. The first generates the primary turning-point Entry/Exit signals based on a hybrid algorithms that utilize multiple moving filters and oscillators, all working in concert. The second is our version of Hurst Cycles allowing the trader to view the harmonic convergence of short and long cycles.

The turning-point signals are generated by two Center of Gravity Oscillators (COG) originally developed by John Ehlers and published in Technical Analysis of Stocks and Commodities in its May 2002 issue.

COG produces a moving filter that heavily weights the most extreme and most current values in the stream of data within the window of the indicator. COG excels at determining and indicating where, within a parabolic path, tipping or turning points have occurred. Two COG indicators, each one set to a different length and different inputs are incorporated. The output of these two COG filters are them put through another Ehler’s filter, the Pass Band; July 2016 issue of TAOSAC. A pass band filter has the unique ability of removing the higher and lower frequencies from the signal, leaving behind only the core signal. Here we are taking a longer COG period of (10) days, utilizing the candles body size as it’s input and then subtracting a short period of (7) days utilizing only the close of the day. The result is an emphasis on the extreme values, i.e., the maximum apex and the minimum vertex of each parabolic swing. Finally, the Arnaud Legoux Moving Average (ALMA) is utilized as smoothing a filter to slightly shift the weighting from the COG Pass band filter, in a selective and adjustable manor to more current bars, not the most current bar. This is desirable because COG dramatically emphasizes the most current candle or bar as well as large candles and strong deviations from within the moving average.

This provides the trader with excellent responsiveness within a very smooth output signal with very few artifacts or whipsaws, producing highly reliable trading signals that indicate optimal entry and exit points with a high level of accuracy and very little lag.

The primary principals of Hurst cycles are price moves in waves that exhibit cyclic attributes based on their time scales. Genie Cycles incorporates Hurst cycles theories, but utilizes only two nested Laguerre moving filters. Laguerre moving filters have significantly less lag than traditional moving averages. These moving filters take as there inputs the highest high and the lowest lows for the two adjustable periods. The point of the indicator is to determine when a short-term swing cycle harmonizes or aligns with a long-term cycle, i.e., determining when the tops and bottoms of these cycles align.

The resulting nested channels produce natural bounding boxes. This dramatically highlights likely support and resistance levels as they often occur at prior highs or lows that this indicator is drawing. Convergence of the different cycle lengths can indicate strong trends that make excellent trading opportunities. Decoupling of the cycles indicates the end of the trend.

The turning-point signals are generated by two Center of Gravity Oscillators (COG) originally developed by John Ehlers and published in Technical Analysis of Stocks and Commodities in its May 2002 issue.

COG produces a moving filter that heavily weights the most extreme and most current values in the stream of data within the window of the indicator. COG excels at determining and indicating where, within a parabolic path, tipping or turning points have occurred. Two COG indicators, each one set to a different length and different inputs are incorporated. The output of these two COG filters are them put through another Ehler’s filter, the Pass Band; July 2016 issue of TAOSAC. A pass band filter has the unique ability of removing the higher and lower frequencies from the signal, leaving behind only the core signal. Here we are taking a longer COG period of (10) days, utilizing the candles body size as it’s input and then subtracting a short period of (7) days utilizing only the close of the day. The result is an emphasis on the extreme values, i.e., the maximum apex and the minimum vertex of each parabolic swing. Finally, the Arnaud Legoux Moving Average (ALMA) is utilized as smoothing a filter to slightly shift the weighting from the COG Pass band filter, in a selective and adjustable manor to more current bars, not the most current bar. This is desirable because COG dramatically emphasizes the most current candle or bar as well as large candles and strong deviations from within the moving average.

This provides the trader with excellent responsiveness within a very smooth output signal with very few artifacts or whipsaws, producing highly reliable trading signals that indicate optimal entry and exit points with a high level of accuracy and very little lag.

The primary principals of Hurst cycles are price moves in waves that exhibit cyclic attributes based on their time scales. Genie Cycles incorporates Hurst cycles theories, but utilizes only two nested Laguerre moving filters. Laguerre moving filters have significantly less lag than traditional moving averages. These moving filters take as there inputs the highest high and the lowest lows for the two adjustable periods. The point of the indicator is to determine when a short-term swing cycle harmonizes or aligns with a long-term cycle, i.e., determining when the tops and bottoms of these cycles align.

The resulting nested channels produce natural bounding boxes. This dramatically highlights likely support and resistance levels as they often occur at prior highs or lows that this indicator is drawing. Convergence of the different cycle lengths can indicate strong trends that make excellent trading opportunities. Decoupling of the cycles indicates the end of the trend.

Release Notes

VS-226: Revised Hurst Cycles to turn off entire plot. Release Notes

This update adds two new alerts. When the tops of the short term Hurst Cycles merge with the tops of the long term Hurst Cycles a Green alert can be set for this condition. A Red alert can be set when the bottoms of the two cycles lengths merge. This alert is triggered by the conditions that produces the same colored, merge indication dots, on the charts. The MoTREND indicator is shown below the Genie Cycles indicator because it dramatically signals the same condition these new alerts settings indicate. MoTRREND was designed to be used in tandem with Genie Cycles to clearly signal Trend Trading opportunities and keep you in the trade through short term deviations of the prevailing trend by using the stiffness indicator included within MoTREND.

Invite-only script

Access to this script is restricted to users authorized by the author and usually requires payment. You can add it to your favorites, but you will only be able to use it after requesting permission and obtaining it from its author. Contact StockSwinger for more information, or follow the author's instructions below.

TradingView does not suggest paying for a script and using it unless you 100% trust its author and understand how the script works. In many cases, you can find a good open-source alternative for free in our Community Scripts.

Want to use this script on a chart?

Warning: please read before requesting access.

NO EMOTION ~ Plan Your Trade and Trade Your Plan

HODL+ Managed Risk Bitcoin Trades

Bitcoin-Trend-Trader.com/

stockdotgenie.com/

crypto-trend-trader.com

HODL+ Managed Risk Bitcoin Trades

Bitcoin-Trend-Trader.com/

stockdotgenie.com/

crypto-trend-trader.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.