OPEN-SOURCE SCRIPT

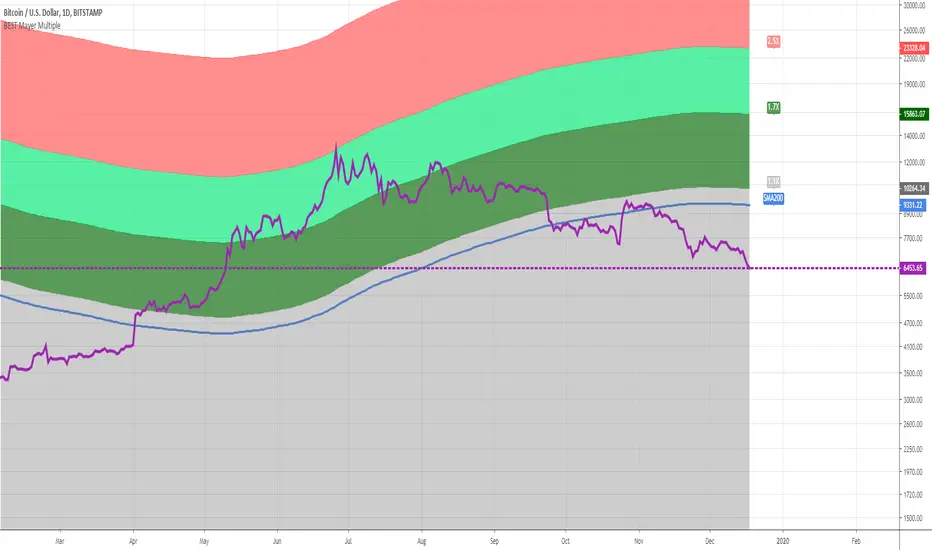

BEST Mayer Multiple

Hello traders

I'm not a HODLer by any means. I know when to sell (or I think I know....) when an asset starts going against me too much.

Even if it's a "long-term" investment.

My mentor used to telling me this: "If a short-term trade becomes a long-term investment, then you're in for a hell of a ride".

I have no clue if Bitcoin/BTC will go back up or not - I don't even care because I'm an intraday trader.

What if BTC was actually a way to accumulate more fiat? Satoshi fooled us

I coded this Mayer Multiple according to the specifications below. By the way, I'm a big fan of Willy Woo. I've been monitoring all his work since I learned about crypto (10 minutes ago.... it's a joke come on)

https://charts.woobull.com/bitcoin-mayer-multiple/

Scaling

To respect the Mayer's multiple model, I recommend to select the Logarithmic scaling as shown below

imgur.com/a/zSI71tE

What Mayer's model says

Using the reference below, the model says we're in the oversold zone. But, we can be in that zone for months/years...

When a model says an asset could bounce in a 1000-7000 USD range... well... I don't know how I would be able to perform optimally with that insight. This is very subjective and not a recommendation.

Mayer's Multiple model reference

All the BEST

Dave

I'm not a HODLer by any means. I know when to sell (or I think I know....) when an asset starts going against me too much.

Even if it's a "long-term" investment.

My mentor used to telling me this: "If a short-term trade becomes a long-term investment, then you're in for a hell of a ride".

I have no clue if Bitcoin/BTC will go back up or not - I don't even care because I'm an intraday trader.

What if BTC was actually a way to accumulate more fiat? Satoshi fooled us

I coded this Mayer Multiple according to the specifications below. By the way, I'm a big fan of Willy Woo. I've been monitoring all his work since I learned about crypto (10 minutes ago.... it's a joke come on)

https://charts.woobull.com/bitcoin-mayer-multiple/

Scaling

To respect the Mayer's multiple model, I recommend to select the Logarithmic scaling as shown below

imgur.com/a/zSI71tE

What Mayer's model says

Using the reference below, the model says we're in the oversold zone. But, we can be in that zone for months/years...

When a model says an asset could bounce in a 1000-7000 USD range... well... I don't know how I would be able to perform optimally with that insight. This is very subjective and not a recommendation.

Mayer's Multiple model reference

All the BEST

Dave

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

⭐️ Listed as TradingView Trusted Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator

Telegram: Daveatt

⏩ Course: best-trading-indicator.com

Twitter: twitter.com/bti_trading

📧 Coding/Consulting Inquiries: dave@best-trading-indicator

Telegram: Daveatt

⏩ Course: best-trading-indicator.com

Twitter: twitter.com/bti_trading

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.