OPEN-SOURCE SCRIPT

Fair Value Gaps Setup 01 [TradingFinder] FVG Absorption + CHoCH

🔵Introduction

🟣Market Structures

Market structures exhibit a fractal and nested nature, which leads us to classify them into internal (minor) and external (major) categories. Definitions of market structure vary, with different methodologies such as Smart Money and ICT offering distinct interpretations.

To identify market structure, the initial step involves examining key highs and lows. An uptrend is characterized by successive highs and lows that are higher than their predecessors. Conversely, a downtrend is marked by successive lows and highs that are lower than their previous counterparts.

🟣Market Trends and Movements

Market trends consist of two primary types of movements:

🟣Break of Structure (BOS)

In a downtrend, a Break of Structure (BOS) occurs when the price falls below the previous low and establishes a new low (LL). In an uptrend, a BOS, also known as a Market Structure Break (MSB), happens when the price rises above the last high.

To confirm a trend, at least one BOS is necessary, which requires the price to close at least one candle beyond the previous high or low.

🟣Change of Character (CHOCH)

Change of Character (CHOCH) is a crucial concept in market structure analysis, indicating a shift in trend. A trend concludes with a CHOCH, also referred to as a Market Structure Shift (MSS).

For example, in a downtrend, the price continues to drop with BOS, showcasing the trend's strength. However, when the price rises and exceeds the last high, a CHOCH occurs, signaling a potential transition from a downtrend to an uptrend.

It is essential to note that a CHOCH does not immediately indicate a buy trade. Instead, it is prudent to wait for a BOS in the upward direction to confirm the uptrend. Unlike BOS, a CHOCH confirmation does not require a candle to close; merely breaking the previous high or low with the candle's wick is sufficient.

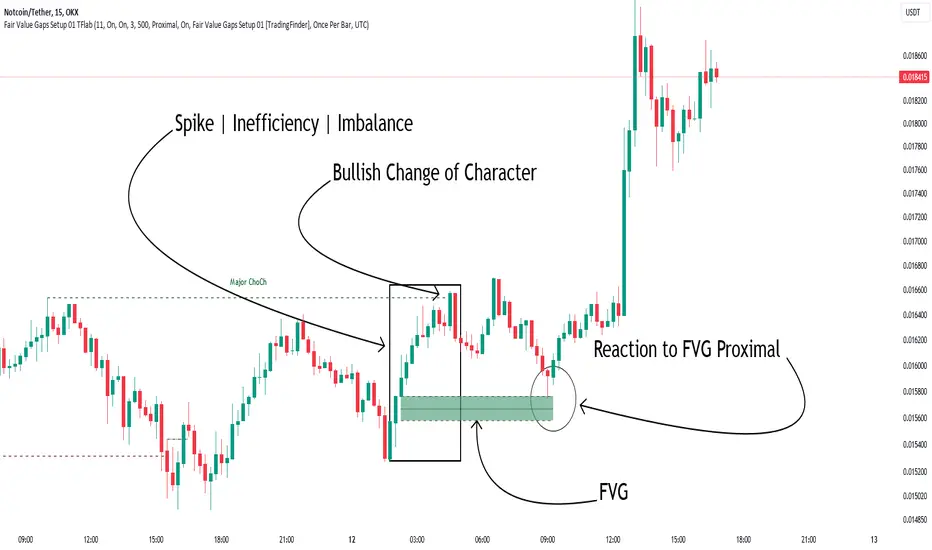

🟣Spike | Inefficiency | Imbalance

All these terms mean fast price movement in the shortest possible time.

🟣Fair Value Gap (FVG)

To pinpoint the "Fair Value Gap" (FVG) on a chart, a detailed candle-by-candle analysis is necessary. This process involves focusing on candles with substantial bodies and evaluating them in relation to the candles immediately before and after them.

Here are the steps:

This method helps in accurately identifying the Fair Value Gap, which is crucial for understanding market inefficiencies and potential price movements.

🟣Setup

This setup is based on Market Structure and FVG. After a change of character and the formation of FVG in the last lag of the price movement, we are looking for trading positions in the price pullback.

Bullish Setup:

Bearish Setup:

🔵How to Use

After forming the setup, you can enter the trade using a pending order or after receiving confirmation. To increase the probability of success, you can adjust the pivot period market structure settings or modify the market movement coefficient in the formation leg of the FVG.

Bullish Setup:

Bearish Setup:

🔵Setting

Pivot Period of Market Structure Detector:

This parameter allows you to configure the zigzag period based on pivots. Adjusting this helps in accurately detecting order blocks.

Show major Bullish ChoCh Lines:

You can toggle the visibility of the Demand Main Zone and "ChoCh" Origin, and customize their color as needed.

Show major Bearish ChoCh Lines:

Similar to the Demand Main Zone, you can control the visibility and color of the Supply Main Zone and "ChoCh" Origin.

FVG Detector Multiplier Factor:

This feature lets you adjust the size of the moves forming the Fair Value Gaps (FVGs) using the Average True Range (ATR). The default value is 1, suitable for identifying most setups. Adjust this value based on the specific symbol and market for optimal results.

FVG Validity Period:

This parameter defines the validity period of an FVG in terms of the number of candles. By default, an FVG remains valid for up to 15 candles, but you can adjust this period as needed.

Mitigation Level FVG:

This setting establishes the basic level of an FVG. When the price reaches this level, the FVG is considered mitigated.

Level in Low-Risk Zone:

This feature aims to reduce risk by dividing the FVG into two equal areas: "Premium" (upper area) and "Discount" (lower area). For lower risk, ensure that "Demand FVG" is in the "Discount" area and "Supply FVG" in the "Premium" area. This feature is off by default.

Show or Hide:

Given the potential abundance of setups, displaying all on the chart can be overwhelming. By default, only the last setup is shown, but you can enable the option to view all setups.

Alert Settings:

On / Off: Toggle alerts on or off.

Message Frequency: Determine how often alerts are triggered.

Options include:

Show Alert Time by Time Zone: Set the alert time based on your preferred time zone, such as "UTC-4" for New York time. The default is "UTC".

Display More Info: Optionally show additional details like the price range of the order blocks and the date, hour, and minute in the alert message. Set this to "Off" if you prefer not to receive this information.

🟣Market Structures

Market structures exhibit a fractal and nested nature, which leads us to classify them into internal (minor) and external (major) categories. Definitions of market structure vary, with different methodologies such as Smart Money and ICT offering distinct interpretations.

To identify market structure, the initial step involves examining key highs and lows. An uptrend is characterized by successive highs and lows that are higher than their predecessors. Conversely, a downtrend is marked by successive lows and highs that are lower than their previous counterparts.

🟣Market Trends and Movements

Market trends consist of two primary types of movements:

- Impulsive Movements: These movements align with the main trend and are characterized by high strength and momentum.

- Corrective Movements: These movements counter the main trend and are marked by lower strength and momentum.

🟣Break of Structure (BOS)

In a downtrend, a Break of Structure (BOS) occurs when the price falls below the previous low and establishes a new low (LL). In an uptrend, a BOS, also known as a Market Structure Break (MSB), happens when the price rises above the last high.

To confirm a trend, at least one BOS is necessary, which requires the price to close at least one candle beyond the previous high or low.

🟣Change of Character (CHOCH)

Change of Character (CHOCH) is a crucial concept in market structure analysis, indicating a shift in trend. A trend concludes with a CHOCH, also referred to as a Market Structure Shift (MSS).

For example, in a downtrend, the price continues to drop with BOS, showcasing the trend's strength. However, when the price rises and exceeds the last high, a CHOCH occurs, signaling a potential transition from a downtrend to an uptrend.

It is essential to note that a CHOCH does not immediately indicate a buy trade. Instead, it is prudent to wait for a BOS in the upward direction to confirm the uptrend. Unlike BOS, a CHOCH confirmation does not require a candle to close; merely breaking the previous high or low with the candle's wick is sufficient.

🟣Spike | Inefficiency | Imbalance

All these terms mean fast price movement in the shortest possible time.

🟣Fair Value Gap (FVG)

To pinpoint the "Fair Value Gap" (FVG) on a chart, a detailed candle-by-candle analysis is necessary. This process involves focusing on candles with substantial bodies and evaluating them in relation to the candles immediately before and after them.

Here are the steps:

- Identify the Central Candle: Look for a candle with a large body.

- Examine Adjacent Candles: The candles before and after this central candle should have long shadows, and their bodies must not overlap with the body of the central candle.

- Determine the FVG Range: The distance between the shadows of the first and third candles defines the FVG range.

This method helps in accurately identifying the Fair Value Gap, which is crucial for understanding market inefficiencies and potential price movements.

🟣Setup

This setup is based on Market Structure and FVG. After a change of character and the formation of FVG in the last lag of the price movement, we are looking for trading positions in the price pullback.

Bullish Setup:

Bearish Setup:

🔵How to Use

After forming the setup, you can enter the trade using a pending order or after receiving confirmation. To increase the probability of success, you can adjust the pivot period market structure settings or modify the market movement coefficient in the formation leg of the FVG.

Bullish Setup:

Bearish Setup:

🔵Setting

Pivot Period of Market Structure Detector:

This parameter allows you to configure the zigzag period based on pivots. Adjusting this helps in accurately detecting order blocks.

Show major Bullish ChoCh Lines:

You can toggle the visibility of the Demand Main Zone and "ChoCh" Origin, and customize their color as needed.

Show major Bearish ChoCh Lines:

Similar to the Demand Main Zone, you can control the visibility and color of the Supply Main Zone and "ChoCh" Origin.

FVG Detector Multiplier Factor:

This feature lets you adjust the size of the moves forming the Fair Value Gaps (FVGs) using the Average True Range (ATR). The default value is 1, suitable for identifying most setups. Adjust this value based on the specific symbol and market for optimal results.

FVG Validity Period:

This parameter defines the validity period of an FVG in terms of the number of candles. By default, an FVG remains valid for up to 15 candles, but you can adjust this period as needed.

Mitigation Level FVG:

This setting establishes the basic level of an FVG. When the price reaches this level, the FVG is considered mitigated.

Level in Low-Risk Zone:

This feature aims to reduce risk by dividing the FVG into two equal areas: "Premium" (upper area) and "Discount" (lower area). For lower risk, ensure that "Demand FVG" is in the "Discount" area and "Supply FVG" in the "Premium" area. This feature is off by default.

Show or Hide:

Given the potential abundance of setups, displaying all on the chart can be overwhelming. By default, only the last setup is shown, but you can enable the option to view all setups.

Alert Settings:

On / Off: Toggle alerts on or off.

Message Frequency: Determine how often alerts are triggered.

Options include:

- "All" (alerts every time the function is called)

- "Once Per Bar" (alerts only on the first call within the bar)

- "Once Per Bar Close" (alerts only at the last script execution of the real-time bar upon closing)

- The default setting is "Once Per Bar".

Show Alert Time by Time Zone: Set the alert time based on your preferred time zone, such as "UTC-4" for New York time. The default is "UTC".

Display More Info: Optionally show additional details like the price range of the order blocks and the date, hour, and minute in the alert message. Set this to "Off" if you prefer not to receive this information.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Get Access to TradingFinder indicators and Education for FREE: tradingFinder.com/

Forex, Crypto, Stocks, Futures & Index informational materials and Trading Tools in Turkish language: tradingFinder.com/tr/

Forex, Crypto, Stocks, Futures & Index informational materials and Trading Tools in Turkish language: tradingFinder.com/tr/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.