OPEN-SOURCE SCRIPT

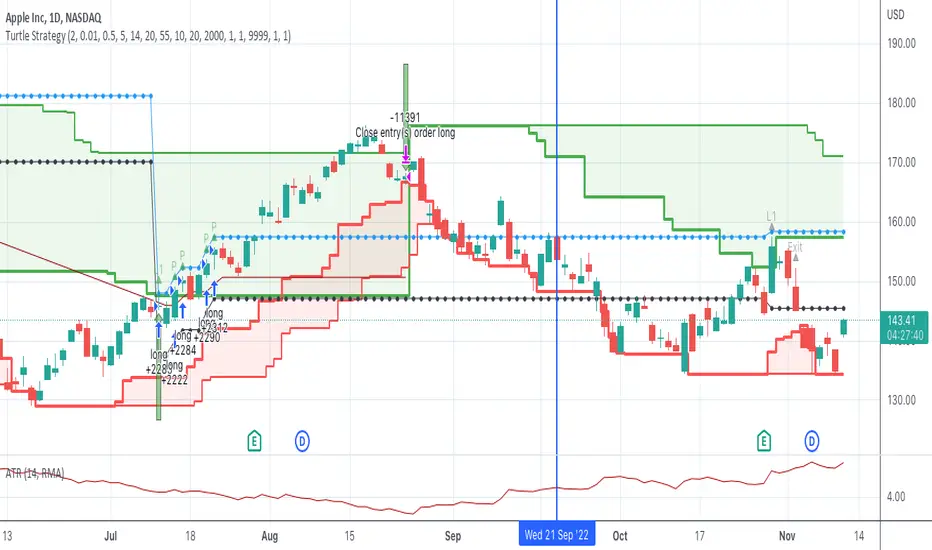

Updated Turtle System

First pinescript strategy I've ever written so still learning what is possible.

This strategy is based on the famous turtle system and tried to stay true

to the rules within the confines of what pinescript will allow me to do.

Features:

Green lines represents the 20/55 day highs (configurable)

Red lines represent the 10/20 day lows (configurable)

Purple line represents stop (defaults to 2N away configurable)

Pyramids up to 5 long positions (each 1N away configurable).

Arrows:

Up Arrow Green - 20 day long position entered

Up Arrow Purple - 55 day long position entered

Down Arrow Green - Winning trade exited out.

Down Arrow Red - Losing Trade either stopped out or exited out.

Code tracks successful wins as it is only allowed to enter positions if the last trade was not a wining trade.

One limitation, only supports Long trades although wouldn't be a lot of work to also make it support Short. AAPL

AAPL

Love to hear feedback on improvements, particularly to make it more robust.

This strategy is based on the famous turtle system and tried to stay true

to the rules within the confines of what pinescript will allow me to do.

Features:

Green lines represents the 20/55 day highs (configurable)

Red lines represent the 10/20 day lows (configurable)

Purple line represents stop (defaults to 2N away configurable)

Pyramids up to 5 long positions (each 1N away configurable).

Arrows:

Up Arrow Green - 20 day long position entered

Up Arrow Purple - 55 day long position entered

Down Arrow Green - Winning trade exited out.

Down Arrow Red - Losing Trade either stopped out or exited out.

Code tracks successful wins as it is only allowed to enter positions if the last trade was not a wining trade.

One limitation, only supports Long trades although wouldn't be a lot of work to also make it support Short.

Love to hear feedback on improvements, particularly to make it more robust.

Release Notes

Small change to update the way the labels present for each trade.Release Notes

Removed some unnecessary code.Release Notes

Documented the system and added comments to the logic.Release Notes

Fixed one minor logic bug.Release Notes

Updated the chart.Release Notes

Fixed a couple more logic issues.Release Notes

Fixed bug was adding 6 units max, should only add 5.Release Notes

Rewrite to consolidate rules and improved the aesthetics to make it easier to visually see breakouts.Release Notes

Breakouts now occur when the bar moves into the green. One of the rules of turtle system is to not take trades where the last trade was a winning trade, rather skip the next trade. Logic is implemented and you can visually see the trades skipped because the labels are greyed out (L1 labels). If the trade keeps going, it will take the L2 trade as according to the rules.Release Notes

Fixed issue of code not adhering to the dates used.Release Notes

More cleanup and now uses next day market order to close position rather that an exit order. exit orders were somewhat unpredictable in terms of when they were filled.Release Notes

little more cleanup.Release Notes

Fixed bug in calculating avg price.Release Notes

1) Fixed bug not always taking L2 trades in strategy tester (visually could see them but strategy entry would not always take it)2) Added lines to show next buy price as well as the stop price (these are the dashed lines).

Couple things to note about this script so far, which vary slightly from the original turtle rules.

a) All entries to positions are triggered if the close > L1 or L2, NOT the high. This has an interesting side effect. If high crosses over the L1 or L2, but doesn't close above it, this extreme point (high of day) must be crossed in subsequent days to generate a trade. Backtesting, I like this as it forces the trade to really stretch and be bullish, also helps reduce some of the noise in this day to day trading.

b) The actually buy in trading view occurs at the open the next day.

Release Notes

Fixed issue that L2 trades take precedence.Release Notes

Minor changes.Release Notes

Fixed issue where L2 trades where using L1 stop.Release Notes

The latest version handles position sizing based on N. It computes position size as follows # of shares=(risk/n), where risk=capital*riskPercent and n=ATR14.

Release Notes

Improvements to calculating position size.Release Notes

Figured out a way to have pine script tell me capital left for determining position sizing.Release Notes

Entry points are taken on close instead of next day's open. Strategy takes entry based on high/lows > L1 or L2 rather than close.Release Notes

More updates. Added max units configuration. Cleaned up code a bit. Added alerts. Uses new functionality in strategy to determine cost basis, position sizing based on turtle rules, etc. Release Notes

More improvements.Release Notes

Updated versionRelease Notes

Make ATR period configurable (defaults to 14)Release Notes

Someone reported the last version had a bug and wouldn't load, so hopefully this fixes it.Release Notes

Bug fix.Release Notes

Fixed issue with position sizing. Fixed crash in 5 minute time frame. Fixed crash in some futures charts.Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.